Intelligent Platform Management Interface (IPMI) Market by Component (Hardware: Baseboard Management Controller (BMC), Sensors & Controls, Memory Devices, and Software), End-Use Application, Vertical, and Geography - Global Forecast to 2022

The intelligent platform management interface market was valued at USD 1.20 Billion in 2015 and is expected to reach USD 3.10 Billion by 2022, at a CAGR of 13.2% between 2016 and 2022. The most significant factor driving the intelligent platform management interface market is the rising demand for enhanced server management, along with the reduced cost of ownership, increase in ICT spending, growing trend to adopting data center by organizations, and rising need for standardized server management platform. For the study, the base year considered is 2015, and the market forecast provided is between 2016 and 2022.

The prime objectives of this report can be summarized in the following points.

- To define, describe, and forecast the global IPMI market, segmented on the basis of components, end-use applications, and vertical.

- To forecast the market size of various segments, in terms of value, with respect to four main regions: North America, Europe, APAC, and RoW.

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the IPMI market.

- To use the Porter’s five forces model to gauge the entry barriers to this market, along with the value chain analysis and market roadmaps to study the evolution of the intelligent platform management interface market.

- To analyze the opportunities in the market for stakeholders and detail the competitive landscape for key players.

The intelligent platform management interface market was valued at USD 1.20 Billion in 2015 and is expected to reach USD 3.10 Billion by 2022, at a CAGR of 13.2% between 2016 and 2022. The most significant factor driving the IPMI market is the rising demand for enhanced the server management, along with the reduced cost of ownership; also, increase in ICT spending and rising need for standardized server management platform act as drivers for the growth of the intelligent platform management interface market. Similarly, the increasing trend of adoption of data centers by small and medium business is likely to create opportunities for the market to grow.

The intelligent platform management interface (IPMI) architecture consists of several hardware and software components that enable proper monitoring of server and other hardware devices. The hardware components consist of baseboard management controller (BMC), sensors and controls, memory devices, LAN controllers, serial connectors, and transceivers, among others. Sensors hold the largest share of the intelligent platform management interface market for the hardware component and BMC is expected is grow at a higher rate.

The intelligent platform management interface market based on end-use application is segmented into servers, storage devices, and telecommunication equipment. Servers hold the largest market share, and the market for the same is also expected to grow at the highest CAGR during the forecast period. Intelligent platform management interface was mainly designed for the sever management by Intel (U.S.), Dell (U.S.), HPE (U.S.), and NEC (Japan). The growing demand for servers across the geography because of a wide deployment of data centers is driving the market for IPMI.

Furthermore, the intelligent platform management interface (IPMI) has its applications in various vertical such as banking, financial services, and insurance (BFSI); healthcare; IT and telecom; education and research; manufacturing; public sector; retail; and other verticals. Other verticals include automotive, logistics, and transportation. BFSI sector held the largest market share in 2015, and the healthcare sector is expected to grow at a higher rate during the forecast period. The BFSI industry vertical comprises mainly banks, insurance companies, and stockbrokers, and deals with large workforce, assets in different locations, and diverse customer profiles. In today’s scenario, the economic and financial sector reform has strengthened the automation and expansion of IT infrastructure, which transformed not only the operating environment of banks and financial institutions but has also played a significant role in structuring and strengthening economies of countries such as Brazil, India, and the UAE. Thus, this market is being adopted in the BFSI industry.

The Americas region accounted for the largest share of the total intelligent platform management interface market in 2016 though APAC is expected to grow at the highest CAGR between 2016 and 2022. The IPMI market in China and Japan is increasing because of the influx and growth of the IT and telecommunication sector. The surge in growth is attributed to the technological advancements, along with mandatory regulations imposed by government regulatory entities to adopt the best-in-class technology and standards. The U.S. is one of the major markets for the IT hardware and software sector. The increase in demand for computer and servers in major industries has given rise to the market of IPMI systems. The U.S. contributes to the major portion of the revenue of the market in North America. The U.S. has been the early adopters of IPMI technology and majority of IPMI provider companies are based in this country. Hence, consumers are benefitted because of the competition that exists in this region as they have easy access to the latest IPMI services. Some of the major companies in IPMI systems in the U.S. are Emerson Electric Company (U.S.), HP Inc. (U.S.), Dell Inc. (U.S.), and Cisco Systems.

Insufficient management tools for modern data centers is the factor inhibiting the growth of this market. Furthermore, for the total intelligent platform management interface (IPMI) market, evolution of new server management standard—Redfish is not only a challenge but expected to make a huge impact on the market in the near future. However, increase in adoption of data centers by small and medium business can generate huge opportunities for this market in the near future.

Some of the major players include Intel Corporation (U.S.), NEC Corporation (Japan), ARM Holdings Inc. (U.K.), Dell, Inc. (U.S.), HPE (U.S.), Microsoft (U.S.), Softlayer Technologies, Inc. (U.S.), Emerson (U.S.), Super Micro Computer, Inc. (U.S.), and Cisco (U.S.), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Global IPMI Market

4.2 IPMI Market Size, By Vertical and Country, 2015

4.3 IPMI Market Size, By Component, 2016–2022

4.4 IPMI Component Market Size, By Hardware, 2016–2022

4.5 IPMI Market Size, By End-Use Application, 2016–2022

4.6 IPMI Market Size, By Vertical, 2016–2022

4.7 IPMI Market Size, By Geography

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Component

5.3.2 By End-Use Application

5.3.3 By Vertical

5.3.4 Geographic Analysis

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increase in Ict Spending and Growing Trend Among Organizations to Set Up Data Centers

5.4.1.2 Rising Demand for Enhanced Server Management Platform, Along With Reduced Total Cost of Ownership

5.4.1.3 Need for Standardized Server Management Platforms

5.4.2 Restraints

5.4.2.1 Insufficient Management Tools for Modern Data Centers

5.4.3 Opportunities

5.4.3.1 High Adoption Rate of Data Centers in Small and Medium Businesses (SMBs)

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Threat of New Entrants

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Bargaining Power of Suppliers

7 Intelligent Platform Management Interface (IPMI) Market, By Component (Page No. - 50)

7.1 Introduction

7.2 Hardware

7.2.1 Baseboard Management Controllers (BMCs)

7.2.2 Sensors & Controls

7.2.3 Memory Devices

7.2.4 Others

7.3 Software

8 Intelligent Platform Management Interface (IPMI) Market, By End-Use Application (Page No. - 57)

8.1 Introduction

8.2 Servers

8.2.1 Rack Servers

8.2.2 Blade Servers

8.2.3 Tower Servers

8.3 Storage Devices

8.4 Telecommunication Equipment

9 Intelligent Platform Management Interface (IPMI) Market, By Vertical (Page No. - 76)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance (BFSI)

9.3 Healthcare

9.4 Education & Research

9.5 It & Telecom

9.6 Manufacturing

9.7 Retail

9.8 Public Sector

9.9 Others

10 Geographical Analysis (Page No. - 86)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Others

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 Rest of APAC

10.5 Rest of the World

10.5.1 Middle East and Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 105)

11.1 Introduction

11.2 Market Ranking Analysis for the IPMI Market, 2015

11.3 Competitive Situations and Trends

11.3.1 New Product Launches and Developments

11.3.2 Partnerships

12 Company Profiles (Page No. - 109)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

12.2 Hewlett Packard Enterprise (HPE) Company

12.3 Intel Corporation

12.4 NEC Corporation

12.5 Super Micro Computer, Inc.

12.6 Dell Inc.

12.7 ARM Holdings PLC

12.8 Cisco Systems, Inc.

12.9 Emerson Electric Company

12.10 Microsoft Corporation

12.11 Softlayer Technologies, Inc.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 131)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (62 Tables)

Table 1 IPMI Market Size, By Component, 2013–2022 (USD Million)

Table 2 IPMI Market Size for Components, By Hardware, 2013–2022 (USD Million)

Table 3 IPMI Market Size for Hardware Components, By End-Use Application, 2013–2022 (USD Million)

Table 4 IPMI Market Size for Baseboard Management Controllers, By End-Use Application, 2013–2022 (USD Million)

Table 5 IPMI Market Size for Sensors & Controls , By End-Use Application, 2013–2022 (USD Million)

Table 6 IPMI Market Size for Memory Devices, By End-Use Application, 2013–2022 (USD Million)

Table 7 IPMI Market Size for Other Components, By End-Use Application, 2013–2022 (USD Million)

Table 8 IPMI Market Size for Software, By End-Use Application 2013–2022 (USD Million)

Table 9 IPMI Market Size, By End-Use Application, 2013–2022 (USD Million)

Table 10 IPMI Server Market Size, By Server Type, 2013–2022 (USD Million)

Table 11 IPMI Market Size for Servers, By Vertical, 2013–2022 (USD Million)

Table 12 IPMI Server Market Size for BFSI, By Region, 2013–2022 (USD Million)

Table 13 IPMI Server Market Size for Healthcare, By Region, 2013–2022 (USD Million)

Table 14 IPMI Server Market Size for Education & Research, By Region, 2013–2022 (USD Million)

Table 15 IPMI Server Market Size for It & Telecom, By Region, 2013–2022 (USD Million)

Table 16 IPMI Server Market Size for Manufacturing, By Region, 2013–2022 (USD Million)

Table 17 IPMI Server Market Size for Retail, By Region, 2013–2022 (USD Million)

Table 18 IPMI Server Market Size for Public Sector, By Region, 2013–2022 (USD Million)

Table 19 IPMI Server Market Size for Other Verticals, By Region, 2013–2022 (USD Million)

Table 20 IPMI Market Size for Storage Devices , By Vertical, 2013–2022 (USD Million)

Table 21 IPMI Storage Device Market Size for BFSI, By Region, 2013–2022 (USD Million)

Table 22 IPMI Storage Device Market Size for Healthcare, By Region, 2013–2022 (USD Million)

Table 23 IPMI Storage Device Market Size for Education & Research, By Region, 2013–2022 (USD Million)

Table 24 IPMI Storage Device Market Size for It & Telecom, By Region, 2013–2022 (USD Million)

Table 25 IPMI Storage Device Market Size for Manufacturing, By Region, 2013–2022 (USD Million)

Table 26 IPMI Storage Device Market Size for Retail, By Region, 2013–2022 (USD Million)

Table 27 IPMI Storage Device Market Size for Public Sector, By Region, 2013–2022 (USD Million)

Table 28 IPMI Storage Device Market Size for Other Verticals, By Region, 2013–2022 (USD Million)

Table 29 IPMI Telecommunication Equipment Market Size, By Vertical, 2013–2022 (USD Million)

Table 30 IPMI Telecommunication Equipment Market Size for BFSI, By Region, 2013–2022 (USD Million)

Table 31 IPMI Telecommunication Equipment Market Size for Healthcare, By Region, 2013–2022 (USD Million)

Table 32 IPMI Telecommunication Equipment Market Size for Education & Research, By Region, 2013–2022 (USD Million)

Table 33 IPMI Telecommunication Equipment Market Size for It & Telecom, By Region, 2013–2022 (USD Million)

Table 34 IPMI Telecommunication Equipment Market Size for Manufacturing, By Region, 2013–2022 (USD Million)

Table 35 IPMI Telecommunication Equipment Market Size for Retail, By Region, 2013–2022 (USD Million)

Table 36 IPMI Telecommunication Equipment Market Size for Public Sector, By Region, 2013–2022 (USD Million)

Table 37 IPMI Telecommunication Equipment Market Size for Other Verticals, By Region, 2013–2022 (USD Million)

Table 38 IPMI Market Size, By Vertical, 2013–2022 (USD Million)

Table 39 IPMI Market Size for BFSI, By End-Use Application, 2013–2022 (USD Million)

Table 40 IPMI Market Size for Healthcare, By End-Use Application, 2013–2022 (USD Million)

Table 41 IPMI Market Size for Education & Research, By End-Use Application, 2013–2022 (USD Million)

Table 42 IPMI Market Size for It & Telecom, By End-Use Application, 2013–2022 (USD Million)

Table 43 IPMI Market Size for Manufacturing, By End-Use Application, 2013–2022 (USD Million)

Table 44 IPMI Market Size for Retail, By End-Use Application, 2013–2022 (USD Million)

Table 45 IPMI Market Size for Public Sector, By End-Use Application, 2013–2022 (USD Million)

Table 46 IPMI Market Size for Other Verticals, By End-Use Application, 2013–2022 (USD Million)

Table 47 IPMI Market Size, By Region, 2013–2022 (USD Million)

Table 48 IPMI Market Size in North America, By Vertical, 2013–2022 (USD Million)

Table 49 IPMI Market Size in North America, By Country, 2013–2022 (USD Million)

Table 50 IPMI Market Size in North America, By End-Use Application, 2013–2022 (USD Million)

Table 51 IPMI Market Size in Europe, By Vertical, 2013–2022 (USD Million)

Table 52 IPMI Market Size in Europe, By Country, 2013–2022 (USD Million)

Table 53 IPMI Market Size in Europe, By End-Use Application, 2013–2022 (USD Million)

Table 54 IPMI Market Size in APAC, By Vertical, 2013–2022 (USD Million)

Table 55 IPMI Market Size in APAC, By Country, 2013–2022 (USD Million)

Table 56 IPMI Market Size in APAC, By End-Use Application, 2013–2022 (USD Million)

Table 57 IPMI Market Size in RoW, By Vertical, 2013–2022 (USD Million)

Table 58 IPMI Market Size in RoW, By Region, 2013–2022 (USD Million)

Table 59 IPMI Market Size in RoW, By End-Use Application, 2013–2022 (USD Million)

Table 60 Market Ranking Analysis for the IPMI Market, 2015

Table 61 Most Significant New Product Launches and Development in the IPMI Market, 20o4–2016

Table 62 Most Significant Partnerships in the IPMI Market in 2015

List of Figures (79 Figures)

Figure 1 IPMI Market Segmentation

Figure 2 IPMI Market: Research Design

Figure 3 Research Flow

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Intelligent Platform Management Interface, Market Size, 2013–2022 (USD Million)

Figure 8 Software Market Expected to Grow at A Higher Rate Between 2016 and 2022

Figure 9 Sensors and Controls Expected to Hold the Largest Size of the Market By 2022

Figure 10 BFSI Sector Expected to Hold the Largest Market Size By 2022

Figure 11 IPMI Market for Servers Expected to Grow at the Highest Rate During the Forecast Period

Figure 12 North America Held the Largest Market Share in 2015, While APAC Expected to Grow at the Highest Rate During the Forecast Period

Figure 13 Rising Demand for Enhanced Server Management Platform, Along With Reduced Total Cost of Ownership Drives the Market

Figure 14 The BFSI Vertical Held the Largest Share of the IPMI Market in 2015

Figure 15 IPMI Market for Software Expected to Grow at A Higher Rate During the Forecast Period

Figure 16 IPMI Market for Baseboard Management Controllers Expected to Grow at the Highest Rate During the Forecast Period

Figure 17 The Market for Servers Expected to Grow at the Highest Rate During the Forecast Period

Figure 18 The IPMI Market for the Healthcare Vertical Expected to Grow at the Highest Rate During the Forecast Period

Figure 19 North America Held the Largest Market Share in 2015, While Market in APAC Would Grow at the Highest Rate During the Forecast Period

Figure 20 Evolution of Intelligent Platform Management Interface

Figure 21 Intelligent Management Platform Interface (IPMI) Market, By Geography

Figure 22 Rising Demand for Enhanced Server Management Platform, Along With Reduced Total Cost of Ownership Drives the IPMI Market

Figure 23 Global Data Center Ip Traffic Per Year, 2014–2022

Figure 24 Value Chain Analysis: Major Value Addition Between Component Manufacturing and System Integration Phases

Figure 25 Porter’s Five Forces Analysis, 2015

Figure 26 Threat of Substitutes Witnessed Maximum Impact in 2015

Figure 27 Impact of Intensity of Competitive Rivalry Remained Medium in the IPMI Market in 2015

Figure 28 Impact of Threat of New Entrants Remained Low in the IPMI Market in 2015

Figure 29 Impact of Threat of Substitutes Remained High in the IPMI Market in 2015

Figure 30 Impact of Bargaining Power of Buyers Remained Medium in the IPMI Market in 2015

Figure 31 Impact of Bargaining Power of Suppliers Remained Medium in the IPMI Market in 2015

Figure 32 IPMI Market, By Component

Figure 33 Hardware Component Expected to Hold the Largest Size of the IPMI Market in 2016

Figure 34 Servers Expected to Dominate the IPMI Market Based on End-Use Application During the Forecast Period

Figure 35 IPMI Market, By End-Use Application

Figure 36 Servers Expected to Lead the IPMI Market During the Forecast Period

Figure 37 Types of Servers

Figure 38 BFSI Expected to Hold the Largest Market Size, While Healthcare Expected to Grow at the Highest Rate During the Forecast Period

Figure 39 IPMI Storage Device Market for Healthcare Vertical Expected to Grow at the Highest Rate During the Forecast Period

Figure 40 It & Telecom Sector Expected to Hold the Largest Size of the IPMI Market for Telecommunication Equipment in 2016

Figure 41 Intelligent Platform Management Interface (IPMI) Market Segmentation, By Vertical

Figure 42 Market for Telecommunication Equipment Application for BFSI Industry Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 43 Servers Expected to Hold the Largest Size of the IPMI Market for the Healthcare Vertical By 2022

Figure 44 Servers Expected to Lead the IPMI Market for the Education & Research Vertical During the Forecast Period

Figure 45 Servers Expected to Grow at the Fastest Rate for It & Telecom Industry During the Forecast Period

Figure 46 Servers Expected to Lead the IPMI Market for Manufacturing Industry During the Forecast Period

Figure 47 Servers Expected to Dominate the IPMI Market for Retail Sector During the Forecast Period

Figure 48 Servers Expected to Dominate the IPMI Market for Public Sector During the Forecast Period

Figure 49 Server Expected to Be the Fastest-Growing Segment in Other Verticals During the Forecast Period

Figure 50 Geographic Snapshot: the IPMI Market in China to Grow at the Highest Rate During the Forecast Period

Figure 51 IPMI Market in APAC is Expected to Grow at the Highest Rate During the Forecast Period

Figure 52 IPMI Market Snapshot in North America

Figure 53 BFSI Industry Expected to Hold the Largest Size of the IPMI Market in North America During the Forecast Period

Figure 54 U.S. to Lead the North American IPMI Market Between 2016 and 2022

Figure 55 IPMI Market Snapshot in Europe

Figure 56 IPMI Market for Healthcare Industry in Europe Expected to Grow at the Highest Rate During the Forecast Period

Figure 57 Germany Expected to Lead the IPMI Market in Europe Till 2022

Figure 58 IPMI Market Snapshot in APAC

Figure 59 IPMI Market in China Expected to Grow at the Highest Rate During the Forecast Period

Figure 60 IPMI Market Snapshot in Rest of the World

Figure 61 BFSI Vertical Expected to Hold the Largest Size of the IPMI Market in the RoW Region During the Forecast Period

Figure 62 Companies Adopted New Product Launches and Developments as A Key Strategy to Grow in the IPMI Market, 2014–2016

Figure 63 Market Evaluation Framework

Figure 64 Battle for Market Share: New Product Launches and Developments Had Been the Key Strategies

Figure 65 Geographic Revenue Mix for the Top Three Players in the IPMI Market in 2015

Figure 66 Hewlett Packard Enterprise Co (HPE): Company Snapshot

Figure 67 Hewlett Packard Enterprise Co: Sw0t Analysis

Figure 68 Intel Corporation: Company Snapshot

Figure 69 Intel Corporation: SWOT Analysis

Figure 70 NEC Corporation: Company Snapshot

Figure 71 NEC Corporation: SWOT Analysis

Figure 72 Super Micro Computer, Inc.: Company Snapshot

Figure 73 Super Micro Computer, Inc.: SWOT Analysis

Figure 74 Dell Inc.: SWOT Analysis

Figure 75 ARM Holdings PLC: Company Snapshot

Figure 76 Cisco Systems, Inc.: Company Snapshot

Figure 77 Emerson Electric Company: Company Snapshot

Figure 78 Microsoft Corporation: Company Snapshot

Figure 79 Softlayer Technologies, Inc.: Company Snapshot

The sizing of the IPMI market has been done by top-down and bottom-up method. The bottom-up approach has been employed to arrive at the overall size of the intelligent platform management interface market from the revenues of key players (companies) and their share in the market. Calculations based on the number of IPMI goes in each type of application, which is further multiplied by the production of various application products for all major countries and finally the volume is multiplied by the average selling price of each IPMI to arrive the overall market size. In top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation), through percentage splits from secondary sources such as ITWorld, Factiva, and Thomas-Krenn-WiKi among others and primary researches. For the calculation of specific market segments, the most appropriate parent market size has been used to implement the top-down approach.

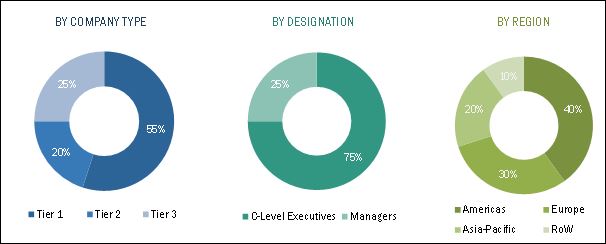

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key opinion leaders. The break-up of the profiles of primary participants is given in the chart below.

To know about the assumptions considered for the study, download the pdf brochure

The IPMI ecosystem comprises major chipset manufacturers such Intel Corporation (U.S.), ARM Holdings Inc. (U.K.), Emerson (U.S.); server vendors NEC Corporation (Japan), Super Micro Computer, Inc. (U.S.), and Cisco (U.S.), Dell, Inc. (U.S.), HPE (U.S.); and software providers Microsoft (U.S.), and Softlayer Technologies, Inc. (U.S.), among others.

All these companies have their own R&D facilities and extensive sales offices and distribution channels. The products of these companies can be used across various industries for respective applications. The report provides the competitive landscape of the key players which indicates their growth strategies in terms of the intelligent platform management interface market.

Target Audience:

- IPMI product and device manufacturers

- Original technology designers and suppliers

- Raw material suppliers

- Integrated device manufacturers (IDMs)

- Original device manufacturers (ODMs) (discrete and chip manufacturers)

- Original equipment manufacturers (OEMs)

- System integrators

- Electronic hardware equipment manufacturers

- Technical universities

- Government space research agencies and private research organizations

- Research institutes and organizations

- Market research and consulting firms

- IPMI forums, alliances, and associations

“Study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years (depends on range of forecast period) for prioritizing the efforts and investments.”

Scope of the Report:

The market covered in this report has been segmented as follows:

IPMI Market, by Component:

-

Hardware

- Baseboard management controller

- Sensors & controls

- Memory devices

- Others (LAN controller, serial connectors)

IPMI Market, by End-Use Application:

- Server

- Storage devices

- Telecommunication equipment

IPMI Market, by Vertical:

- Banking, Financial services, and Insurance (BFSI)

- Healthcare

- Education & research

- Retail

- Manufacturing

- Public sector

- IT & telecom

- Others (Automotive, logistics and transportation)

IPMI Market, by Geography:

-

Americas

- U.S.

- Canada

- Rest of North America

-

Europe

- Germany

- France

- U.K.

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- Rest of APAC

-

Rest of the World

- Middle East & Africa

- South America

Available Customizations:

- Detailed analysis and profiling of additional market players (up to 5)

- Product matrix which gives a detailed comparison of product portfolio of each company

Growth opportunities and latent adjacency in Intelligent Platform Management Interface (IPMI) Market