Integrated Microwave Assembly Market Size, Share, Statistics and Industry Growth Analysis Report by Product (Amplifiers, Frequency Synthesizers, Oscillators), Frequency, Vertical (Avionics, Communication, Military & Defense) and Geography (2022-2027)

Updated on : Oct 23, 2024

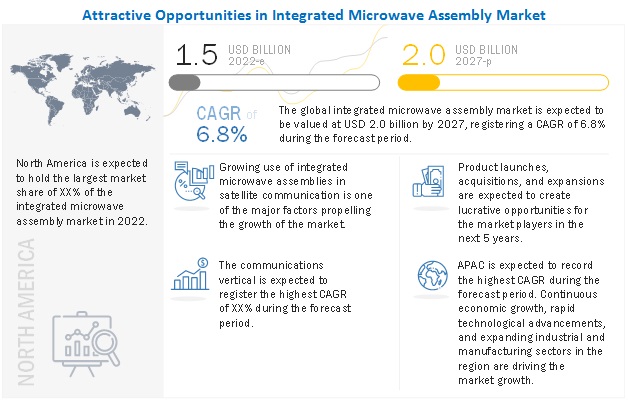

The Integrated Microwave Assembly Market Size is expected to grow from USD 1.5 Billion in 2022 to USD 2.0 Billion by 2027; it is expected to grow at a CAGR of 6.8 % during the forecast period.

The growth of the integrated microwave assembly industry is expected to be driven by the rising defense expenditure globally to design advanced warfare equipment, including secure communication products and military radars. Likewise, with technological advancements and rapid growth in the adoption of 5G, the demand for integrated microwave assembly-based RF modules has increased significantly, creating lucrative opportunities for the market players.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increasing expenditure in military & defense sector

The global political situation is likely to remain uncertain for a long period owing to the increasing disagreements between two or more nations, for instance, the oil price war between Saudi Arabia and Russia and the drawdown of the US military forces in Afghanistan, among others. To tackle this situation, the regulatory bodies of various countries are seeking higher budgets from respective governments. Although the defense budgets across the globe declined during the COVID-19 pandemic period as the governments highly focused on curbing the spread of the virus and providing emergency relief, they may foresee a substantial rise in the post-pandemic period. As the global military & defense sector is focusing on developing state-of-the-art warfare infrastructure for defense purposes in the current uncertain geopolitical conditions, the demand for integrated microwave assembly devices is increasing significantly.

Restraint: High development costs associated with integrated microwave assembly

The development costs of integrated microwave assemblies are high. The production volume of integrated microwave assembly is also substantially low, leading to high manufacturing costs. Materials used in integrated microwave assembly, including GaAs, GaN, and indium phosphate, are scarce. Besides, the limited availability of materials used in the development of integrated microwave assemblies, the use of integrated microwave assemblies in most commercial and defense applications is expensive, increasing the cost of the complete supply chain. Hence, cost acts as a major restraint for market growth.

Opportunity: Growing adoption of gallium nitride (GaN) in microwave module

Gallium Nitride (GaN) is an emerging alternative for pure silicon in the field of semiconductors and electronics due to its high brightness emission and intensity in opto-semiconductors, high-power efficiency, high-frequency handling capacity, and flexibility to be used alongside various substrates such as silicon, sapphire, and silicon carbide (SiC). Gallium nitride is a hard and mechanically stable semiconductor material with a wide bandgap and high heat capacity and thermal conductivity. With the constant developments in 5G, the adoption of GaN over silicon-based RF devices is expected to increase in different verticals, including communications, military & defense, and radar. GaN provides high efficiency in long-range communication and is power efficient.

Challenge: Device complexity

The integrated microwave assembly is a combination of active components, including transistors and tubes, and passive components, such as isolators, resistors, and filters, in electronic circuitry. Thus, design complexity makes it difficult to understand the working of the microwave products, leading to inefficient end results. Furthermore, bulky electronic circuits require high energy for efficient working and exhibit slow operations. With the rapid developments in smartphone designs, increasing cellular network requirements, and rising deployment of modern warfare infrastructure, device complexity is expected to be a major barrier in the adoption of integrated microwave assembly.

Amplifier to account for the largest market share of the integrated microwave assembly market by 2027

Amplifier is expected to hold a larger share of the integrated microwave assembly market in 2027. Amplifiers are in huge demand due to the radical developments in telecom infrastructure as the industry is shifting towards 5G technology along with the increasing penetration of 4G/LTE technology. More cell sites are required for the penetration of advanced technologies such as 5G and LTE, which leads to increased demand for base stations and backhaul equipment to service these sites. This is expected to propel the demand for amplifiers during the forecast period.

APAC to witness the highest CAGR in the integrated microwave assembly market during the forecast period

APAC is expected to witness the highest CAGR during the forecast period. The growth of the regional market can be attributed to the high adoption rate of smartphones, growing preference for high-speed mobile technologies (5G), increased use of social media and e-commerce platforms, and rising military expenditures by countries such as China, India, Japan, and South Korea.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Analog Devices(US), Teledyne Technologies(US), MACOM(US), Qorvo(US), CAES(US), CPI International (US), APITech (US), National Instruments (US), Narda-MITEQ (US), and Integrated Microwave Corporation (US) are among the key players operating in the integrated microwave assembly companies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, Frequency, Vertical, and Region |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Analog Devices (US), Teledyne Technologies (US), Qorvo (US), MACOM (US), CAES (US), CPI International (US), APITech (US), National Instruments (US), Narda-MITEQ (US), and Integrated Microwave Corporation (US) are among the key players operating in the integrated microwave assembly market. |

This research report categorizes the integrated microwave assembly market based on Product, Frequency, Vertical and Region

Integrated Microwave Assembly Market, by Product

- Frequency Converters

- Frequency Synthesizers

- Amplifiers

- Oscillators

- Transceivers

- Others

Integrated Microwave Assembly Market, by Frequency

- Ku-Band

- C-Band

- Ka-Band

- L-Band

- X-Band

- S-Band

- Other-Bands

Integrated Microwave Assembly Market, by Vertical

- Avionics

- Military & Defense

- Communication

- Others

Integrated Microwave Assembly Market, by Region

- North America

- Europe

- APAC

- RoW

Recent Developments

- In December 2021, CAES announced the launch of a wideband Gallium Nitride (GaN)-based high-power RF amplifier. It has a high output power-to-weight ratio and enables long-distance standoff jamming. The amplifier is used in the military & defense and avionics verticals.

- In July 2021, Teledyne Technologies acquired FLIR Systems Inc. for a deal of USD 8 billion. This acquisition has helped Teledyne Technologies to expand its imaging sensors portfolio that is based on different semiconductor technologies for various wavelengths.

- In June 2021, CAES launched a new millimeter wave (mmW) Active Electronically Scanned Array AESA for providing early missile attack warning information in aircraft, radars, and surveillance applications.

Frequently Asked Questions (FAQ):

What are the key strategies adopted by key companies in the integrated microwave assembly market?

The product launch, agreements and partnership has been and continues to be some of the major strategies adopted by the key players to grow in the integrated microwave assembly market.

What region dominates integrated microwave assembly market?

APAC region will dominate integrated microwave assembly market

Who are the major companies in the integrated microwave assembly market?

Analog Devices (US), Teledyne Technologies (US), Qorvo (US), MACOM (US), CAES (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 INTEGRATED MICROWAVE ASSEMBLY MARKET: SEGMENTATION

FIGURE 2 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 3 PROCESS FLOW: MARKET SIZE ESTIMATION

FIGURE 4 INTEGRATED MICROWAVE ASSEMBLY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.2.2 Key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.1.3.2 Key industry insights

2.1.3.3 Primary interviews with experts

2.1.3.4 List of key primary respondents

2.1.3.5 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis

FIGURE 5 INTEGRATED MICROWAVE ASSEMBLY MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for calculating market size by top-down analysis

FIGURE 6 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 8 IMPACT OF COVID-19 ON INTEGRATED MICROWAVE ASSEMBLY MARKET

3.1 POST-COVID-19 SCENARIO

TABLE 2 POST-COVID-19 SCENARIO: MARKET, 2022–2027 (USD MILLION)

3.2 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 3 OPTIMISTIC SCENARIO (POST-COVID-19): MARKET, 2022–2027 (USD MILLION)

3.3 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 4 PESSIMISTIC SCENARIO (POST-COVID-19): MARKET, 2022–2027 (USD MILLION)

FIGURE 9 AMPLIFIERS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 10 KU-BAND SEGMENT TO WITNESS FASTEST GROWTH IN MARKET FROM 2022 TO 2027

FIGURE 11 COMMUNICATIONS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN INTEGRATED MICROWAVE ASSEMBLY MARKET

FIGURE 13 GROWING USE OF INTEGRATED MICROWAVE ASSEMBLIES IN SATELLITE COMMUNICATION TO FUEL MARKET GROWTH FROM 2022 TO 2027

4.2 MARKET, BY FREQUENCY

FIGURE 14 KU-BAND SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 INTEGRATED MICROWAVE ASSEMBLY MARKET, BY PRODUCT

FIGURE 15 AMPLIFIERS SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.4 MARKET FOR MILITARY & DEFENSE VERTICAL, BY APPLICATION AND REGION

FIGURE 16 ELECTRONIC WARFARE APPLICATION AND NORTH AMERICA TO HOLD LARGEST SHARES OF MARKET FOR MILITARY & DEFENSE VERTICAL DURING FORECAST PERIOD

4.5 INTEGRATED MICROWAVE ASSEMBLY MARKET, BY REGION (2027)

FIGURE 17 APAC MARKET TO RECORD HIGHEST CAGR DURING 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 MARKET: DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing expenditure in military & defense sector

FIGURE 19 MILITARY & DEFENSE EXPENDITURES IN TOP REGIONS BETWEEN 2019 AND 2020

5.2.1.2 Rising penetration of radio frequency (RF) module assembly for 5G and telecommunications verticals

5.2.1.3 Growing adoption of next-generation warfare techniques

5.2.2 RESTRAINTS

5.2.2.1 High development costs associated with integrated microwave assembly

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for secure and fast satellite communication

5.2.3.2 Growing adoption of gallium nitride (GaN) in microwave modules

5.2.4 CHALLENGES

5.2.4.1 Device complexity

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 MARKET: VALUE CHAIN

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5 INTEGRATED MICROWAVE ASSEMBLY ECOSYSTEM ANALYSIS

FIGURE 21 INTEGRATED MICROWAVE ASSEMBLY ECOSYSTEM

TABLE 6 INTEGRATED MICROWAVE ASSEMBLY MARKET: ECOSYSTEM

5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR INTEGRATED MICROWAVE ASSEMBLY MANUFACTURERS

FIGURE 22 REVENUE SHIFT FOR INTEGRATED MICROWAVE ASSEMBLY PROVIDERS

5.7 CASE STUDY ANALYSIS

TABLE 7 USE CASE 1: CUSTOM MONOLITHIC MICROWAVE INTEGRATED CIRCUIT-BASED INTEGRATED MICROWAVE ASSEMBLY FOR DEFENSE OEMS

TABLE 8 USE CASE 2: NASA SELECTED INTEGRATED MICROWAVE ASSEMBLY COMPONENTS FROM QORVO, INC. FOR ITS MARS EXPLORATION INITIATIVES

5.8 TECHNOLOGY ANALYSIS

5.8.1 ADVANCEMENTS IN FREQUENCY BANDS

5.8.2 5G IN SPACE AND COMMUNICATION VERTICAL

5.8.3 ADVANCEMENTS IN WARFARE TECHNOLOGY

5.9 PATENT ANALYSIS

FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 9 TOP 10 PATENT OWNERS IN US IN LAST 10 YEARS

FIGURE 24 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2021

TABLE 10 LIST OF PATENTS

5.10 REGULATORY LANDSCAPE

5.10.1 UTILIZATION OF RADIO FREQUENCIES BY INTERNATIONAL TELECOMMUNICATION UNION

5.10.2 FEDERAL COMMUNICATIONS COMMISSION (FCC) REGULATIONS

5.10.3 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS) AND WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE)

5.11 TRADE ANALYSIS AND TARIFF ANALYSIS

5.11.1 TRADE ANALYSIS

5.11.1.1 Trade data for HS code 854079

FIGURE 25 IMPORT DATA FOR HS CODE 854079, BY COUNTRY, 2016−2020 (USD MILLION)

FIGURE 26 EXPORT DATA HS CODE 854079, BY COUNTRY, 2016−2020 (USD MILLION)

5.11.1.2 Trade data for HS code 854081

FIGURE 27 IMPORT DATA HS CODE 854081, BY COUNTRY, 2016−2020 (USD MILLION)

FIGURE 28 EXPORT DATA HS CODE 854081, BY COUNTRY, 2016−2020 (USD MILLION)

5.11.2 TARIFF ANALYSIS

TABLE 11 TARIFFS DATA FOR HS 854081

5.12 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 12 INTEGRATED MICROWAVE ASSEMBLIES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VERTICALS

TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VERTIALS (%)

6 INTEGRATED MICROWAVE ASSEMBLY MARKET, BY PRODUCT (Page No. - 71)

6.1 INTRODUCTION

FIGURE 30 MARKET, BY PRODUCT

FIGURE 31 AMPLIFIERS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 14 MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 15 MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

6.2 FREQUENCY CONVERTERS

6.2.1 APAC TO REGISTER HIGHEST CAGR IN MARKET FOR FREQUENCY CONVERTERS

TABLE 16 MARKET FOR FREQUENCY CONVERTERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 MARKET FOR FREQUENCY CONVERTERS, BY REGION, 2022–2027 (USD MILLION)

6.3 FREQUENCY SYNTHESIZERS

6.3.1 NORTH AMERICA TO HOLD LARGEST SHARE OF MARKET FOR FREQUENCY SYNTHESIZERS

TABLE 18 MARKET FOR FREQUENCY SYNTHESIZERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 MARKET FOR FREQUENCY SYNTHESIZERS, BY REGION, 2022–2027 (USD MILLION)

6.4 AMPLIFIERS

6.4.1 POWER AMPLIFIERS

6.4.1.1 High adoption of Power amplifiers in military and advanced communication applications to drive market growth

6.4.2 LOW NOISE AMPLIFIERS (LNAS)

6.4.2.1 Increased demand for high-speed communication to fuel growth of low noise amplifiers sub-segment

TABLE 20 MARKET FOR AMPLIFIERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 MARKET FOR AMPLIFIERS, BY REGION, 2022–2027 (USD MILLION)

6.5 OSCILLATORS

6.5.1 EASE OF INTEGRATION WITH OTHER RECEIVERS AND TRANSMITTERS TO DRIVE MARKET GROWTH

TABLE 22 MARKET FOR OSCILLATORS, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 MARKET FOR OSCILLATOR, BY REGION, 2022–2027 (USD MILLION)

6.6 TRANSCEIVERS

6.6.1 INCREASING INSTALLATION OF TRANSCEIVERS IN COMMUNICATIONS INDUSTRY TO DRIVE MARKET GROWTH

FIGURE 32 APAC TO REGISTER HIGHEST CAGR IN MARKET FOR TRANSCEIVERS DURING FORECAST PERIOD

TABLE 24 MARKET FOR TRANSCEIVERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 MARKET FOR TRANSCEIVERS, BY REGION, 2022–2027 (USD MILLION)

6.7 OTHERS

6.7.1 ATTENUATORS

6.7.1.1 Growing demand for attenuators in electronic warfare applications to drive market growth

6.7.2 COUPLERS

6.7.2.1 Growing use of couplers to optimize performance of integrated microwave assembly devices to drive market growth

6.7.3 MIXERS

6.7.3.1 Best-in-class isolation and conversion losses with low input power function of mixers to increase their demand in communication applications

6.7.4 SWITCHES

6.7.4.1 Low insertion loss and high port-to-port isolation features to fuel demand for switches

6.7.5 FILTERS

6.7.5.1 Increasing shift toward 5G technology to fuel demand for filters

TABLE 26 MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 MARKET FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

7 INTEGRATED MICROWAVE ASSEMBLY MARKET, BY FREQUENCY (Page No. - 83)

7.1 INTRODUCTION

TABLE 28 MICROWAVE FREQUENCY BANDS AND CORRESPONDING RANGES

FIGURE 33 MARKET, BY FREQUENCY

FIGURE 34 KU-BAND SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 29 MARKET, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 30 MARKET, BY FREQUENCY, 2022–2027 (USD MILLION)

7.2 KU-BAND

7.2.1 KU-BAND SEGMENT HELD LARGEST MARKET SHARE IN 2021

TABLE 31 MARKET FOR KU-BAND, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 MARKET FOR KU-BAND, BY REGION, 2022–2027 (USD MILLION)

7.3 C-BAND

7.3.1 C-BAND SEGMENT ACCOUNTED FOR SIGNIFICANT MARKET SHARE IN 2021

TABLE 33 MARKET FOR C-BAND, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 MARKET FOR C-BAND, BY REGION, 2022–2027 (USD MILLION)

7.4 KA-BAND

7.4.1 KA-BAND SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 35 MARKET FOR KA-BAND, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 MARKET FOR KA-BAND, BY REGION, 2022–2027 (USD MILLION)

7.5 L-BAND

7.5.1 L-BAND SEGMENT HELD SIGNIFICANT REVENUE SHARE OF OVERALL MARKET IN 2021

TABLE 37 MARKET FOR L-BAND, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 MARKET FOR L-BAND, BY REGION, 2022–2027 (USD MILLION)

7.6 X-BAND

7.6.1 X-BAND SEGMENT TO WITNESS HEALTHY GROWTH DURING FORECAST PERIOD

TABLE 39 MARKET FOR X-BAND, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 MARKET FOR X-BAND, BY REGION, 2022–2027 (USD MILLION)

7.7 S-BAND

7.7.1 S-BAND SEGMENT TO GROW AT SUBSTANTIAL CAGR FROM 2022 TO 2027

TABLE 41 MARKET FOR S-BAND, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 MARKET FOR S-BAND, BY REGION, 2022–2027 (USD MILLION)

7.8 OTHER BANDS

TABLE 43 MARKET FOR OTHER BANDS, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 MARKET FOR OTHER BANDS, BY REGION, 2022–2027 (USD MILLION)

8 INTEGRATED MICROWAVE ASSEMBLY MARKET, BY VERTICAL (Page No. - 95)

8.1 INTRODUCTION

FIGURE 35 MARKET, BY VERTICAL

FIGURE 36 MILITARY & DEFENSE SEGMENT TO LEAD MARKET FROM 2022 TO 2027

TABLE 45 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 46 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

8.2 AVIONICS

8.2.1 INCREASED DEMAND FOR FAST DATA TRANSFER TO DRIVE MARKET GROWTH

TABLE 47 MARKET FOR AVIONICS, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 MARKET FOR AVIONICS, BY REGION, 2022–2027 (USD MILLION)

8.3 MILITARY & DEFENSE

8.3.1 MILITARY & DEFENSE SEGMENT TO HOLD SIGNIFICANT MARKET SHARE IN 2022

TABLE 49 MARKET FOR MILITARY & DEFENSE, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 MARKET FOR MILITARY & DEFENSE, BY REGION, 2022–2027 (USD MILLION)

FIGURE 37 ELECTRONIC WARFARE APPLICATION SUB-SEGMENT TO LEAD MARKET FOR MILITARY & DEFENSE VERTICAL FROM 2022 TO 2027

TABLE 51 MARKET FOR MILITARY & DEFENSE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 52 MARKET FOR MILITARY & DEFENSE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 53 MILITARY & DEFENSE: MARKET FOR ELECTRONIC WARFARE, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 MILITARY & DEFENSE: MARKET FOR ELECTRONIC WARFARE, BY REGION, 2022–2027(USD MILLION)

TABLE 55 MILITARY & DEFENSE: MARKET FOR RADAR, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 MILITARY & DEFENSE: MARKET FOR RADAR, BY REGION, 2022–2027(USD MILLION)

TABLE 57 MILITARY & DEFENSE: MARKET FOR MILITARY COMMUNICATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 MILITARY & DEFENSE: MARKET FOR MILITARY COMMUNICATION, BY REGION, 2022–2027 (USD MILLION)

8.4 COMMUNICATIONS

8.4.1 DEVELOPMENTS IN 5G COMMUNICATION TO BOOST MARKET GROWTH

TABLE 59 MARKET FOR COMMUNICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 MARKET FOR COMMUNICATIONS, BY REGION, 2022–2027 (USD MILLION)

8.5 OTHERS

TABLE 61 MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 MARKET FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

9 INTEGRATED MICROWAVE ASSEMBLY MARKET, BY REGION (Page No. - 105)

9.1 INTRODUCTION

FIGURE 38 MARKET IN INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 63 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

TABLE 65 MARKET IN NORTH AMERICA, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 66 MARKET IN NORTH AMERICA, BY FREQUENCY, 2022–2027 (USD MILLION)

TABLE 67 MARKET IN NORTH AMERICA, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 68 MARKET IN NORTH AMERICA, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 69 MARKET IN NORTH AMERICA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 70 MARKET IN NORTH AMERICA, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 71 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 72 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Government-led investments in developing cutting-edge military warfare equipment to create lucrative opportunities for market

9.2.2 CANADA

9.2.2.1 Increasing investments in communications vertical to drive market growth in Canada

9.2.3 MEXICO

9.2.3.1 Rising defense expenditure to fuel demand for integrated microwave assemblies in Mexico

FIGURE 40 IMPACT OF COVID-19 ON NORTH AMERICAN MARKET

TABLE 73 PRE-COVID-19 & POST-COVID19: MARKET IN NORTH AMERICA, 2018–2027 (USD MILLION)

9.3 EUROPE

FIGURE 41 EUROPE: SNAPSHOT OF MARKET

TABLE 74 MARKET IN EUROPE, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 75 MARKET IN EUROPE, BY FREQUENCY, 2022–2027 (USD MILLION)

TABLE 76 MARKET IN EUROPE, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 77 MARKET IN EUROPE, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 78 MARKET IN EUROPE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 79 MARKET IN EUROPE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 80 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 81 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Increasing demand for radar systems to create growth opportunities for market

9.3.2 FRANCE

9.3.2.1 Presence of major aerospace companies to boost growth of market in France

9.3.3 UK

9.3.3.1 Increased military spending in post-Brexit period to drive market growth

9.3.4 REST OF EUROPE

FIGURE 42 IMPACT OF COVID-19 ON EUROPEAN MARKET

TABLE 82 PRE-COVID-19 & POST-COVID19: MARKET IN EUROPE, 2018–2027 (USD MILLION)

9.4 APAC

FIGURE 43 APAC: SNAPSHOT OF MARKET

TABLE 83 MARKET IN APAC, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 84 MARKET IN APAC, BY FREQUENCY, 2022–2027 (USD MILLION)

TABLE 85 MARKET IN APAC, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 86 MARKET IN APAC BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 87 MARKET IN APAC, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 88 MARKET IN APAC, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 89 MARKET IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 90 MARKET IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Rising military and defense equipment manufacturing to fuel demand for integrated microwave assemblies

9.4.2 JAPAN

9.4.2.1 New geopolitical and defense tie-ups with India, Australia, and US to drive market growth

9.4.3 INDIA

9.4.3.1 Make in India initiative to fuel demand for Integrated microwave assemblies and drive market growth

9.4.4 SOUTH KOREA

9.4.4.1 Significant developments in manufacturing sector to drive market growth in South Korea

9.4.5 REST OF APAC

FIGURE 44 IMPACT OF COVID-19 ON APAC MARKET

TABLE 91 PRE-COVID-19 & POST-COVID19: MARKET IN APAC, 2018–2027 (USD MILLION)

9.5 ROW

FIGURE 45 ROW: SNAPSHOT OF MARKET

TABLE 92 MARKET IN ROW, BY FREQUENCY, 2018–2021 (USD MILLION)

TABLE 93 MARKET IN ROW, BY FREQUENCY, 2022–2027 (USD MILLION)

TABLE 94 MARKET IN ROW, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 95 MARKET IN ROW, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 96 MARKET IN ROW, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 97 MARKET IN ROW, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 98 MARKET IN ROW, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 99 MARKET IN ROW, BY COUNTRY, 2022–2027 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 Rising use of integrated microwave assemblies in satellite communication application to drive market growth

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Favorable government initiatives and high military investments to drive market growth

FIGURE 46 IMPACT OF COVID-19 ON ROW MARKET

TABLE 100 PRE-COVID-19 & POST-COVID19: MARKET IN ROW, 2018–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 133)

10.1 OVERVIEW

10.2 TOP 4 PLAYERS–3-YEAR COMPANY REVENUE ANALYSIS

FIGURE 47 REVENUE ANALYSIS (USD BILLION), 2019–2021

10.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 101 KEY STRATEGIES OF TOP PLAYERS IN MARKET

10.4 MARKET SHARE ANALYSIS (2021)

TABLE 102 MARKET: MARKET SHARE ANALYSIS

FIGURE 48 MARKET SHARE ANALYSIS: MARKET, 2021

10.5 COMPANY EVALUATION QUADRANT, 2021

10.5.1 STAR

10.5.2 PERVASIVE

10.5.3 EMERGING LEADER

10.5.4 PARTICIPANT

FIGURE 49 MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2021

10.5.5 COMPANY FOOTPRINT

TABLE 103 COMPANY FOOTPRINT: MARKET

TABLE 104 COMPANY VERTICAL FOOTPRINT: MARKET

TABLE 105 COMPANY PRODUCT FOOTPRINT: MARKET

TABLE 106 COMPANY REGIONAL FOOTPRINT: MARKET

10.6 SMALL AND MEDIUM ENTERPRISE (SME) EVALUATION QUADRANT, 2021

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 50MARKET (GLOBAL), SME EVALUATION QUADRANT, 2021

TABLE 107 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

10.7 COMPETITIVE SCENARIO

TABLE 108 MARKET: PRODUCT LAUNCHES, JANUARY 2020 TO JANUARY 2022

TABLE 109 MARKET: DEALS, JANUARY 2020 TO JANUARY 2022

11 COMPANY PROFILES (Page No. - 148)

11.1 INTRODUCTION

11.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

11.2.1 ANALOG DEVICES

TABLE 110 ANALOG DEVICES: COMPANY SNAPSHOT

FIGURE 51 ANALOG DEVICES: COMPANY SNAPSHOT

11.2.2 TELEDYNE TECHNOLOGIES

TABLE 111 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 52 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

11.2.3 QORVO

TABLE 112 QORVO: COMPANY SNAPSHOT

FIGURE 53 QORVO: COMPANY SNAPSHOT

11.2.4 MACOM

TABLE 113 MACOM: COMPANY SNAPSHOT

FIGURE 54 MACOM: COMPANY SNAPSHOT

11.2.5 COBHAM ADVANCED ELECTRONIC SOLUTIONS (CAES)

TABLE 114 COBHAM ADVANCED ELECTRONICS SOLUTIONS (CAES): COMPANY SNAPSHOT

11.2.6 NATIONAL INSTRUMENTS

TABLE 115 NATIONAL INSTRUMENTS: COMPANY SNAPSHOT

FIGURE 55 NATIONAL INSTRUMENTS: COMPANY SNAPSHOT

11.2.7 CPI INTERNATIONAL

TABLE 116 CPI INTERNATIONAL: COMPANY SNAPSHOT

11.2.8 NARDA-MITEQ

TABLE 117 NARDA-MITEQ: COMPANY SNAPSHOT

11.2.9 APITECH

TABLE 118 APITECH: COMPANY SNAPSHOT

11.2.10 INTEGRATED MICROWAVE CORPORATION

TABLE 119 INTEGRATED MICROWAVE CORPORATION: COMPANY SNAPSHOT

Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.3 OTHER KEY PLAYERS

11.3.1 KRATOS DEFENSE AND SECURITY SOLUTION

11.3.2 MERCURY SYSTEMS

11.3.3 WENZEL ASSOCIATES

11.3.4 TTM TECHNOLOGIES

11.3.5 AKON

11.3.6 MICROWAVE DYNAMICS (MD)

11.3.7 RAPIDTEK

11.3.8 LINWAVE TECHNOLOGY

11.3.9 EM RESEARCH

11.3.10 SYLATECH

11.3.11 ERZIA TECHNOLOGIES

11.3.12 TRITON SERVICES

11.3.13 WOLFSPEED

11.3.14 ARRALIS

11.3.15 VECTRAWAVE

12 APPENDIX (Page No. - 186)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATION

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the integrated microwave assembly market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include integrated microwave assembly journals and magazines, annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

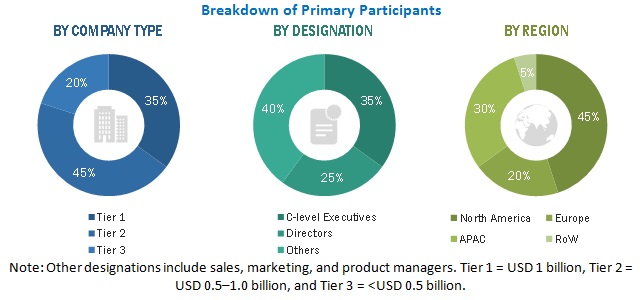

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the integrated microwave assembly market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the integrated microwave assembly market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Integrated Microwave Assembly Market: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides.

Report Objectives

The following are the primary objectives of the study.

- To define, describe, and forecast the integrated microwave assembly market, in terms of product, frequency, vertical and region.

- To provide the market size estimation for North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence market growth.

- To provide a detailed overview of the integrated microwave assembly market value chain

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To profile key players and comprehensively analyze their ranking based on their revenues and core competencies.

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market.

- To analyze competitive developments in the market, such as expansion, agreements, partnerships, contracts, product developments, and research and development (R&D)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Integrated Microwave Assembly Market