Integrated Cloud Management Platform Market by Component (Solutions and Services), Organization Size, Vertical (BFSI, IT & Telecom, Government & Public Sector) and Region - Global Forecast to 2027

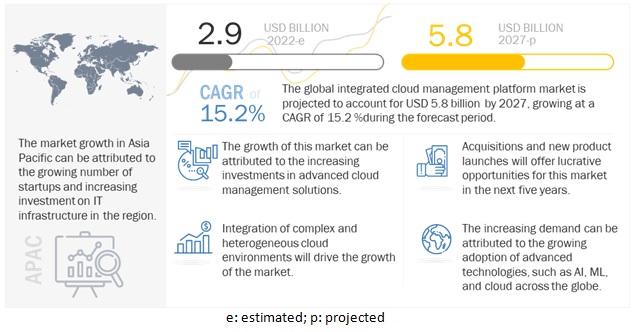

[233 Pages Report] The global Integrated cloud management platform market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 15.2% during the forecast period, to reach USD 5.8 billion by 2027 from USD 2.9 billion in 2022. Key factors that are expected to drive the growth of the market are increased mobility, shifting workload toward cloud environments, and growing trend to bring your own device, facilitating simplified management of complex and heterogenous cloud environments, growing adoption of hybrid cloud and multi-cloud strategies, across enterprises of different industry verticals, rising adoption of cloud-based business utility solutions and services due to COVID-19, increased savings and workforce productivity, and emergence of AI-enabled tools in IT operations.

The integrated cloud management platform market is growing due the presence of global and emerging players in the market. The major factors that are driving the adoption of ICMP solutions among the enterprises as well as SMEs across various verticals including BFSI, IT and telecom, government and public sector, manufacturing, retail and consumer goods, healthcare and lifesciences, energy and utilities and others. Due to significant adoption of cloud services and security infrastructure. Developing countries across APAC and MEA are expected to offer more opportunities for vendors in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The impact of the COVID-19 pandemic on the market is covered throughout the report. The pandemic has had a positive impact on the integrated cloud management platform market. Corporates are increasingly adopting technology-aided tools that can be leveraged remotely and can ensure hiring as well as business continuity amid disruptions. Due to this, the demand for the SaaS platform is continuously growing. Top companies, such as Microsoft, are witnessing a high number of subscribers during this period. This is driving the growth of integrated cloud management platforms amid the ongoing COVID-19 pandemic to cater to the growing adoption of multi-cloud and hybrid cloud models, with the growing adoption of remote working models. The COVID-19 pandemic has created an enormous challenge for businesses globally in continuing operations despite the massive shutdown of offices and other facilities. The increasing use of technologies, especially in the pandemic situation, to stay connected and efficiently operate businesses, is expected to drive the market during COVID-19.

Market Dynamics

Driver: Facilitating simplified management of complex and heterogenous cloud environment

The integrated cloud management platform solutions enable enterprises to combine software and technologies in a design that manages cloud environments. The solution enables easy and efficient integration of cloud infrastructure across different environments, which is driving the global cloud system management market. Multi-cloud management software allows reliable provisioning, configuration, monitoring, analytics, and cost management across a diverse set of cloud resources.

When business requirements exceed the capacity of private cloud, services are procured from public cloud service providers. This creates complications in the integration of private and public clouds, leading to the emergence of hybrid cloud infrastructure. In addition, enterprises with large-scale cloud implementations require a more robust cloud management that can manage multiple platforms from some central reference and intelligent analytics to automate processes, such as application lifecycle management. Cloud management tools and solutions help organizations manage all types of cloud activities, including resource deployment, use tracking, data integration, and disaster recovery. They also offer administrative control over infrastructure, platforms, applications, and data. Major integrated cloud management platform vendors are collaborating with cloud service providers, delivering customized computing solutions, and providing innovative and efficient solutions to end-users, which is also driving the market growth.

Restraint: Concerns about cyber-attacks and data breaches

In recent years, business requirements and regulatory standards are constantly changing. The compliance need is versatile due to the business environment. Also, the concerns of cyber-attacks and data breaches are immense for enterprises. The rising security requirements make it essential to follow compliance standards. The integrated cloud management platform market requires complying with the regulatory standards of the organization. These standards are certain that can lead to difficulties in deployment. The compliance standards prevent damages, losses, cyber-attacks on an organization. However, when deploying the cloud management platform, all these factors can delay the process. Also, more time and energy are required for deployment. Cloud management platform solutions help enterprises to improve businesses by providing several benefits, such as cost optimization, reliability, manageability, agility, and strategic edge. Moreover, maintaining the privacy and confidentiality of enterprise data is one of the challenges faced by enterprises; hence, companies are reluctant to move their data to cloud and prefer on-premises infrastructure to store sensitive data. Although there have been various advancements and developments related to cloud technologies, achieving high levels of security and interoperability have been major hurdles. According to the 2020 Trustwave Global Security Report, cloud services are the third most-targeted environment by cybercriminals. Another research study report by Cybersecurity Insiders mentions that the major cloud security threats are unauthorized access, insecure interfaces/APIs, and misconfiguration of the cloud platform. These hurdles are affecting the growth of cloud solutions. The amount of data that is hosted over the cloud infrastructure has grown exponentially. This has increased the risk of data being accessed by an unauthorized external entity. Thus, the growth of the market may be challenged by the rising threat of security breaches in cloud systems

Opportunity: Emergence of hybrid cloud infrastructure

Technological advancements are expected to raise the integrated cloud management platform market growth opportunities. The launch of a hybrid cloud infrastructure will provide exceptional benefits to the market. The adoption rate of the hybrid cloud platform will be immense during the forecast period. The low initial cost is one of the crucial aspects that increase the hybrid cloud adoption rate. SMEs are expected to have demand for the hybrid cloud infrastructure. The flexibility, scalability, efficiency, and high-end features will attract a wider customer base. The set-up and maintenance costs are much lower for hybrid cloud management.

The hybrid cloud comes with workload management. The security standards are high in the new-age cloud infrastructure. DevOps integration is one of the featured developments in a hybrid infrastructure. With high growth opportunities, the profitability of the market will be massive in the forecast period. More than the launch, the adoption of cloud management will be advantageous to the overall market growth. Large enterprises, IT companies, healthcare, and retail are the key end-users expected to adopt the hybrid cloud platforms.

Challenge: Complexity in designing the network for cloud and security concerns

High-security issues and distributed denial of service attacks are the major challenges for cloud management platforms. The lack of visibility pushes public security cloud and can lead to unauthorized access to data, improper handling, and duplication of data leading to the deletion of confidential data from infrastructure. In addition to these, the designing of networks from on-premises to the cloud needs high investment, which is one of the major challenges mainly for small and medium-sized enterprises that have small budgets. Complexity in designing the cloud platforms is hindering the growth of the integrated cloud management platform market.

Services segment to grow at a higher CAGR during the forecast period.

Based on the component, the market is segmented into two categories: solutions, and services. The services segment is expected to grow at a higher CAGR during the forecast period. Services, including consulting, integration and implementation, training and education, and support and maintenance, are required at various stages, from pre-sales requirement assessment to post-sales product deployment and execution, thus enabling the client to get maximum RoI. Services constitute an integral part in deploying the solution onboard, imparting training, and handling and maintaining the software solution. Companies offering these services encompass consultants, solution experts, and dedicated project management teams specializing in designing and delivering critical decision support software, tools, and services.

SMEs segment to grow at a higher CAGR during the forecast period.

The integrated cloud management platform market is segmented by organization size is segmented into SMEs and large enterprises. The SMEs segment is expected to grow at a higher CAGR during the forecast period. Cost-effectiveness is an important factor for SMEs, as they always have a tight budget, leaving them with limited ways to market themselves and gain visibility. The implementation of cloud storage is expected to result in increased revenues, desired outcomes, and improved business efficiency for SMEs. SMEs adopt the pay-as-you-go model, which offers flexibility to manage their IT infrastructure according to their requirements. SMEs face intense competition from large enterprises; thus, to gain a competitive edge, they are adopting integrated cloud management platforms, which would enable quick responses, timely decisions, and overall enhanced business productivity.

Consumer goods and retail vertical to grow at a higher CAGR during the forecast period.

The consumer goods and retail industry vertical is expected to grow at the highest CAGR during the forecast period. The world of retail is changing rapidly, not just in terms of the stores we buy from, but how we shop, when how we pay for goods and the way in which those goods move through the supply chain. The impact of this has redefined the perception of customer experience and the standards retailers today are expected to reach and exceed. Multi-cloud platforms provide retailers with flexibility and allow them to do storage and computing at a lower cost. Examples of this are the UK’s retailing giant, Sainsbury’s and Argos. The merger of the two companies was facilitated by the adoption of a multi-cloud platform because combining the operational requirements of both businesses would have been impossible on-premises. Through multi-cloud, the businesses were able to blend their business processes and maximized reach. Retailers use data to connect the e-commerce and in-store shopping experiences, and the only way they can do this accurately and efficiently is through flexible, scalable technology. The rise of selling on social media platforms also means integrating payment into the user experience, bringing security and protection of customers’ data to the forefront of retailers’ minds. The hybrid cloud provides the portability and control needed to bring retailers into the new era of customer experience.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

North America and Europe are the largest revenue contributors to the integrated cloud management platform market, as the growth in these regions is driven by the increasing instances of digitalization among enterprises and the growing use of cost-effective cloud-based recruitment solutions. The other three regions: APAC, MEA, and Latin America, are expected to grow at a high rate as the adoption of advanced hiring solutions in these regions was slow in the past, but now traction is observed across these regions due to an increase in the digitalization of the enterprises. APAC is expected to grow at a higher CAGR during the forecast period. The Asia Pacific region comprises emerging economies including China, Japan, Australia and New Zealand and the rest of APAC. The APAC market is gaining huge traction among global businesses. Moreover, the business relationship of APAC countries has increased drastically with the US in the past decade. This has led to the increased adoption of ICMP software and services in the APAC region. Due to the region's high population, there are many applications for every job post, which has become a major challenge for recruiters in the APAC region. To overcome this challenge, APAC enterprises are being made aware of the benefits offered by ICMP since the region includes countries such as Singapore, India, Sri Lanka, Malaysia, and Hong Kong, which focuses more on such parameters. Moreover, the advanced benefits of automation and analytic metrics are a few other factors compelling APAC companies to adopt ICMP.

Integrated Cloud Management Platform Companies

The ICMP solution vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The integrated cloud management platform market comprises major providers, such as Microsoft(US), IBM(US), VMware (US), Dynatrace(US), MicroFocus (England), Snow Software (Sweden), Cognizant (US), BMC Software (US), Lumen Technologies(US), Splunk (US), Oracle(US), Cisco (US), HPE (US), NetApp(US), Nutanix(US), Flexera (US), Datadog(US), Red Hat (US), New Relic (US), Service Now (US), HashiCorp (US), Turbonomic(US), Abiquo(US), HyperGrid(US), Rafey Systems(US), Centilytics(US), Stacklet (US), RackWare(US), Cirrusform(UK), Corestack(US), Morpheus Data(US), and CloudBolt(US).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Component,Organization Size (SMEs, Large Enterprises), Vertical(BFSI, IT & Telecom, Government & Public Sector) and Region |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

List of Companies in Integrated Cloud Management Platform |

Microsoft(US), IBM(US), VMware (US), Dynatrace(US), MicroFocus (England), Snow Software (Sweden), Cognizant (US), BMC Software (US), Lumen Technologies(US), Splunk (US), Oracle(US), Cisco (US), HPE (US), NetApp(US), Nutanix(US), Flexera (US), Datadog(US), Red Hat (US), New Relic (US), Service Now (US), HashiCorp (US), Turbonomic(US), Abiquo(US), HyperGrid(US), Rafey Systems(US), Centilytics(US), Stacklet (US), RackWare(US),Cirrusform(UK), Corestack(US), Morpheus Data(US), and CloudBolt(US) |

This research report of integrated cloud management platform market based on component, organization size, vertical, and region.

Based on the Component:

- Solutions

- Services

Based on the organization size:

- SMEs

- Large Enterprises

Based on the vertical:

- BFSI

- IT and Telecom

- Government and Public Sector

- Manufacturing

- Retail and Consumer Goods

- Healthcare and Lifesciences

- Energy and Utilities

- Others

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Australia and New Zealand

- Rest of APAC

-

MEA

- UAE

- KSA

- Rest of MEA

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In November 2021, Microsoft Azure Arc has announced new functionality in public preview. It is getting additional machine learning functionality. Using this, users can train anywhere. New functionality has also been added for Azure Arc-enabled data services. These updates enhance Azure Arc capabilities for servers, Kubernetes, app services, and data services anywhere.

- In December 2021, Airtel Business, the B2B unit of Bharti Airtel (Airtel), and IBM, collaborated to deploy a hybrid cloud solution for a group of Milk Producer Companies (MPCs) created by NDDB Dairy Services. The hybrid cloud solution that leverages Airtel Cloud and IBM Power servers, will host the ERP and other key applications to accelerate the digital transformation of the MPCs. These five large MPCs include Paayas in Rajasthan, Maahi in Gujarat, Shreeja in Andhra Pradesh, Baani in Punjab, and Saahaj in Uttar Pradesh. The transition to the Airtel-IBM hybrid cloud platform along with advanced IT infrastructure will enable these MPCs to strengthen the support provided to member milk farmers. It will enable these producer companies to securely record and access key information of members, the quantum of milk procured from the farmers, milk products made & sold, etc.

- In April 2020, VMware launched vRealize Operations Cloud. vRealize Operations Cloud is a unified operations platform to manage VMware Cloud and multi-clouds. It will offer benefits, such as reducing unplanned downtime, lowering costs, delivering faster time to value, and mitigating risks. It is intended to provide capabilities, such as continuous performance optimization, efficient capacity and cost management, and integrated compliance. The solution will enable customers to optimize, plan, and scale their cloud deployments.

- In September 2020, Dynatrace announced that it has joined the ServiceNow® Service Graph Connector Program, a new designation within the Technology Partner Program, enhancing the integration between Dynatrace® and ServiceNow.

Frequently Asked Questions (FAQ):

What is the projected market value of the global integrated cloud management platform market?

The global integrated cloud management platform market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 15.2% during the forecast period, to reach USD 5.8 billion by 2027 from USD 2.9 billion in 2022.

Which region has the highest market share in the integrated cloud management platform market?

North America and Europe hold the highest market share of the global integrated cloud management platform market in 2022.

Who are the major vendors in the integrated cloud management platform market?

Despite the presence of a large number of vendors, the market is dominated mainly by vendors such as Microsoft(US), IBM(US), VMware (US), Dynatrace(US), MicroFocus (England), Snow Software (Sweden), Cognizant (US), BMC Software (US), Lumen Technologies(US), Splunk (US), Oracle(US), Cisco (US), HPE (US), NetApp(US), Nutanix(US), Flexera (US), Datadog(US), Red Hat (US), New Relic (US), Service Now (US), HashiCorp (US), Turbonomic(US), Abiquo(US), HyperGrid(US), Rafey Systems(US), Centilytics(US), Stacklet (US), RackWare(US), Cirrusform(UK), Corestack(US), Morpheus Data(US), and CloudBolt(US).

What are some of the latest trends that will shape the integrated cloud management platform market in the future?

Emergence of AI and cloud enabled offerings, ML, which significantly improve the integrated cloud management platform market is expected to shape the market in the coming years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

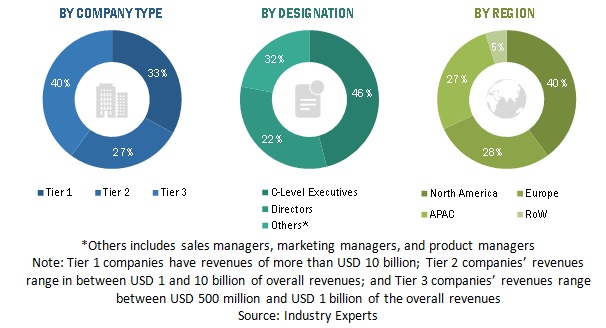

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY-SIDE): REVENUE OF INTEGRATED CLOUD MANAGEMENT PLATFORM FROM VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF INTEGRATED CLOUD MANAGEMENT PLATFORM VENDORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND-SIDE): INTEGRATED MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY-SIDE): ILLUSTRATION OF VENDOR-REVENUE ESTIMATION

2.4 MARKET FORECAST

TABLE 1 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 9 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 10 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 11 MARKET: GLOBAL SNAPSHOT, 2019-2027

FIGURE 12 TOP-GROWING SEGMENTS IN THE INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET

FIGURE 13 SOLUTIONS SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 14 SMALL AND MEDIUM-SIZED SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 15 RETAIL AND CONSUMER GOODS VERTICAL EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 16 NORTH AMERICA EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 BRIEF OVERVIEW OF THE INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET

FIGURE 17 INCREASING DEMAND FOR MULTI-CLOUD AND HYBRID CLOUD ENVIRONMENTS DRIVING THE GROWTH OF THE MARKET

4.2 MARKET, BY COMPONENT, 2022 VS. 2027

FIGURE 18 SOLUTIONS SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SHARE BY 2027

4.3 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027

FIGURE 19 LARGE ENTERPRISES SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SHARE BY 2027

4.4 MARKET, BY VERTICAL, 2022 VS. 2027

FIGURE 20 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2027

4.5 MARKET - INVESTMENT SCENARIO

FIGURE 21 ASIA PACIFIC EXPECTED TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET

5.2.1 DRIVERS

5.2.1.1 Increased mobility, shifting workload toward cloud environments, and growing trend of bring your own device

5.2.1.2 Facilitating simplified management of complex and heterogeneous cloud environments

5.2.1.3 Growing adoption of hybrid cloud and multi-cloud strategies across enterprises of different industry verticals

5.2.1.4 Rising adoption of cloud-based business utility solutions and services due to COVID-19

5.2.1.5 Increased savings and workforce productivity

5.2.1.6 Emergence of AI-enabled tools in IT operations

5.2.2 RESTRAINTS

5.2.2.1 Concerns about cyber-attacks and data breaches

5.2.2.2 Difficulties involved in application portability

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of hybrid cloud infrastructure

5.2.3.2 Increasing investments in AIOps technology

5.2.3.3 Proactive investments by enterprises in cloud-based models

5.2.3.4 COVID-19 outbreak to foster adoption of cloud-based solutions

5.2.4 CHALLENGES

5.2.4.1 Complexity in designing the network for cloud and security concerns

5.2.4.2 Limited expertise among enterprises to utilize cloud system management solutions

5.2.4.3 Increasing number of changes in IT operations

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: AZURE ARC-ENABLED DATA SERVICES ARE POWERING A FASTER APP PIPELINE AND HELPING RBC TO DELIVER ON A LONG-DESIRED ON-PREMISES DATABASE AS A SERVICE (DBAAS)

5.3.2 CASE STUDY 2: EMPOWERING BUSINESSES WITH CISCO WORKLOAD OPTIMIZATION MANAGER

5.3.3 CASE STUDY 3: WITH VMWARE VREALIZE SUITE, COGNIZANT REALIZED ITS VISION OF A HYBRID CLOUD ENVIRONMENT WITH ‘ANY CLOUD, ANY APPLICATION’ CAPABILITY

5.3.4 CASE STUDY 4: CLOUDBOLT'S CLOUD MANAGEMENT PLATFORM ENABLES HAMBURG SÜD TO PROVIDE A WIDE RANGE OF CLOUD SERVICES FROM VMS, STORAGE, AND DATABASES AUTOMATICALLY WITHIN MINUTES

5.4 ECOSYSTEM

FIGURE 23 MARKET: ECOSYSTEM

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 24 MARKET: SUPPLY CHAIN

5.6 PRICING ANALYSIS

TABLE 2 DYNATRACE: PRICING ANALYSIS OF VENDORS IN THE INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET

5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

5.7.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

TABLE 3 KEY STAKEHOLDERS IN THE BUYING PROCESS BY TOP THREE INDUSTRY VERTICALS

5.7.2 BUYING CRITERIA

TABLE 4 INTEGRATED CLOUD MANAGEMENT PLATFORM VENDORS SELECTION CRITERIA

5.8 PATENT ANALYSIS

FIGURE 25 NUMBER OF PATENT DOCUMENTS PUBLISHED OVER THE LAST 10 YEARS

FIGURE 26 TOP FIVE PATENT OWNERS (GLOBAL)

TABLE 5 TOP TEN PATENT APPLICANTS

TABLE 6 PATENTS GRANTED TO VENDORS IN THE INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET

5.9 TECHNOLOGICAL ANALYSIS

5.9.1 ARTIFICIAL INTELLIGENCE

5.9.2 DATA ANALYTICS

5.10 KEY CONFERENCES AND EVENTS IN 2022-2023

TABLE 7 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.11 COVID-19 DRIVEN MARKET DYNAMICS

5.11.1 DRIVERS AND OPPORTUNITIES

5.11.2 RESTRAINTS AND CHALLENGES

5.12 PORTERS FIVE FORCES ANALYSIS

FIGURE 27 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 8 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF NEW ENTRANTS

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 TARIFF AND REGULATORY LANDSCAPE

5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.2 REGULATIONS

5.13.2.1 North America

5.13.2.2 Europe

5.13.2.3 Asia Pacific

5.13.2.4 Middle East and South Africa

5.13.2.5 Latin America

6 MARKET, BY COMPONENT (Page No. - 81)

6.1 INTRODUCTION

FIGURE 28 SERVICES SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 13 MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 14 MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 15 COMPONENT: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 16 COMPONENT: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

6.2 SOLUTIONS

6.2.1 CLOUD AUTOMATION AND ORCHESTRATION

6.2.2 GOVERNANCE AND COMPLIANCE

6.2.3 PERFORMANCE MONITORING

6.2.4 SECURITY SOLUTIONS

6.2.5 COST MANAGEMENT SOLUTIONS

TABLE 17 SOLUTIONS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 SOLUTIONS: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.2 MANAGED SERVICES

TABLE 19 SERVICES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 20 SERVICES: MARKET, BY REGION, 2021–2027 (USD MILLION)

7 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY ORGANIZATION SIZE (Page No. - 87)

7.1 INTRODUCTION

FIGURE 29 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 21 MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 22 MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

7.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 23 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3 LARGE ENTERPRISES

TABLE 25 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2020(USD MILLION)

TABLE 26 LARGE ENTERPRISES: MARKET, BY REGION, 2021–2027 (USD MILLION)

8 MARKET, BY VERTICAL (Page No. - 92)

8.1 INTRODUCTION

FIGURE 30 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 27 MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 28 MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

8.1.1 VERTICAL: MARKET DRIVERS

8.1.2 VERTICAL: COVID-19 IMPACT

8.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 29 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.3 IT AND TELECOM

TABLE 31 IT AND TELECOM: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 IT AND TELECOM: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.4 GOVERNMENT AND PUBLIC SECTOR

TABLE 33 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.5 MANUFACTURING

TABLE 35 MANUFACTURING: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 36 MANUFACTURING: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.6 RETAIL AND CONSUMER GOODS

TABLE 37 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 38 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.7 HEALTHCARE AND LIFE SCIENCES

TABLE 39 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 HEALTHCARE: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.8 ENERGY AND UTILITIES

TABLE 41 ENERGY AND UTILITIES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 ENERGY AND UTILITIES: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.9 OTHER VERTICALS

TABLE 43 OTHER VERTICALS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY REGION (Page No. - 104)

9.1 INTRODUCTION

FIGURE 31 ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 45 MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 MARKET, BY REGION, 2021–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

TABLE 47 NORTH AMERICA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

9.2.1 NORTH AMERICA: MARKET DRIVERS

9.2.2 NORTH AMERICA: COVID-19 IMPACT

9.2.3 UNITED STATES

TABLE 55 UNITED STATES:MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 56 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

9.2.4 CANADA

TABLE 57 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 58 CANADA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

9.3 EUROPE

TABLE 59 EUROPE: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 60 EUROPE: MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 61 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 62 EUROPE: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 63 EUROPE: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 64 EUROPE: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

9.3.1 EUROPE: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET DRIVERS

9.3.2 EUROPE: COVID-19 IMPACT

9.3.3 UNITED KINGDOM

TABLE 67 UNITED KINGDOM: PLATFORM MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 68 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

9.3.4 GERMANY

TABLE 69 GERMANY: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 70 GERMANY: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

9.3.5 FRANCE

TABLE 71 FRANCE: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 72 FRANCE: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 73 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 74 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET DRIVERS

9.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 75 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 77 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

9.4.3 CHINA

TABLE 83 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 84 CHINA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

9.4.4 JAPAN

TABLE 85 JAPAN: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 86 JAPAN: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

9.4.5 AUSTRALIA AND NEW ZEALAND

TABLE 87 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 88 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC

TABLE 89 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 90 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

9.5.1 MIDDLE EAST & AFRICA: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET DRIVERS

9.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

TABLE 91 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 92 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 93 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 96 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

9.5.3 KINGDOM OF SAUDI ARABIA

TABLE 99 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 100 KINGDOM OF SAUDI ARABIA: MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

9.5.4 UNITED ARAB EMIRATES

TABLE 101 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 102 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

9.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 103 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 104 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET DRIVERS

9.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 105 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 106 LATIN AMERICA: MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 107 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 108 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 109 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 110 LATIN AMERICA: MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 111 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 112 LATIN AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

9.6.3 BRAZIL

TABLE 113 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 114 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

9.6.4 REST OF LATIN AMERICA

TABLE 115 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 116 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 137)

10.1 INTRODUCTION

FIGURE 34 MARKET EVALUATION FRAMEWORK, 2019-2022

10.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN

10.2.1 OVERVIEW OF STRATEGIES BY KEY INTEGRATED CLOUD MANAGEMENT PLATFORM VENDORS

10.3 MARKET SHARE OF TOP VENDORS

FIGURE 35 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET: VENDOR SHARE ANALYSIS

10.4 HISTORICAL REVENUE ANALYSIS OF TOP FIVE VENDORS

FIGURE 36 HISTORICAL REVENUE ANALYSIS, 2017-2021

10.5 KEY MARKET DEVELOPMENTS

10.5.1 NEW LAUNCHES

TABLE 117 NEW LAUNCHES, 2021-2022

10.5.2 DEALS

TABLE 118 DEALS, 2019-2021

10.5.3 OTHERS

TABLE 119 OTHERS, 2019-2021

10.6 COMPANY EVALUATION QUADRANT

10.6.1 STARS

10.6.2 EMERGING LEADERS

10.6.3 PERVASIVE PLAYERS

10.6.4 PARTICIPANTS

FIGURE 37 INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

TABLE 120 COMPANY SOLUTIONS FOOTPRINT

TABLE 121 COMPANY VERTICAL FOOTPRINT

TABLE 122 COMPANY REGIONAL FOOTPRINT

TABLE 123 COMPANY FOOTPRINT

10.7 SME EVALUATION QUADRANT

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 38 MARKET: SME EVALUATION QUADRANT, 2021

10.7.5 COMPETITIVE BENCHMARKING

TABLE 124 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 125 SME/STARTUP SOLUTIONS FOOTPRINT

TABLE 126 SME/STARTUP VERTICAL FOOTPRINT

TABLE 127 SME/STARTUP REGION FOOTPRINT

TABLE 128 SME/STARTUP FOOTPRINT

11 COMPANY PROFILES (Page No. - 154)

11.1 INTRODUCTION

11.2 KEY PLAYERS

(Business and Financial overview, Products/Services/Solution Offered, Recent Developments, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

11.2.1 MICROSOFT

TABLE 129 MICROSOFT: BUSINESS OVERVIEW

FIGURE 39 MICROSOFT: COMPANY SNAPSHOT

TABLE 130 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 131 MICROSOFT: PRODUCT LAUNCHES

TABLE 132 MICROSOFT: DEALS

11.2.2 IBM

TABLE 133 IBM: BUSINESS OVERVIEW

FIGURE 40 IBM: COMPANY SNAPSHOT

TABLE 134 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 135 IBM: PRODUCT LAUNCHES

TABLE 136 IBM: DEALS

11.2.3 VMWARE

TABLE 137 VMWARE: BUSINESS OVERVIEW

FIGURE 41 VMWARE: COMPANY SNAPSHOT

TABLE 138 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 139 VMWARE: PRODUCT LAUNCHES

TABLE 140 VMWARE: DEALS

11.2.4 DYNATRACE

TABLE 141 DYNATRACE: BUSINESS OVERVIEW

FIGURE 42 DYNATRACE: COMPANY SNAPSHOT

TABLE 142 DYNATRACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 143 DYNATRACE: PRODUCT LAUNCHES

TABLE 144 DYNATRACE: DEALS

11.2.5 MICROFOCUS

TABLE 145 MICROFOCUS: BUSINESS OVERIVEW

FIGURE 43 MICROFOCUS: COMPANY SNAPSHOT

TABLE 146 MICROFOCUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 147 MICROFOCUS: PRODUCT LAUNCHES

TABLE 148 MICROFOCUS: DEALS

11.2.6 SNOW SOFTWARE

TABLE 149 SNOW SOFTWARE: BUSINESS OVERVIEW

TABLE 150 SNOW SOFTWARE: PRODUCT LAUNCHES

TABLE 151 SNOW SOFTWARE: DEALS

11.2.7 COGNIZANT

TABLE 152 COGNIZANT: BUSINESS OVERVIEW

FIGURE 44 COGNIZANT: COMPANY SNAPSHOT

TABLE 153 COGNIZANT: PRODUCTS OFFERED

TABLE 154 COGNIZANT: DEALS

TABLE 155 COGNIZANT: OTHER DEALS

11.2.8 BMC SOFTWARE

TABLE 156 BMC SOFTWARE: BUSINESS OVERVIEW

TABLE 157 BMC SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 158 BMC SOFTWARE: PRODUCT LAUNCHES

TABLE 159 BMC SOFTWARE: DEALS

11.2.9 LUMEN TECHNOLOGIES

TABLE 160 LUMEN TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 45 LUMEN TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 161 LUMEN TECHNOLOGIES: SOLUTIONS OFFERED

TABLE 162 LUMEN TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 163 LUMEN TECHNOLOGIES: DEALS

11.2.10 SPLUNK

TABLE 164 SPLUNK: BUSINESS OVERIVEW

FIGURE 46 SPLUNK: COMPANY SNAPSHOT

TABLE 165 SPLUNK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 166 SPLUNK: PRODUCT LAUNCHES

TABLE 167 SPLUNK: DEALS

11.2.11 ORACLE

TABLE 168 ORACLE: BUSINESS OVERVIEW

FIGURE 47 ORACLE: COMPANY SNAPSHOT

TABLE 169 ORACLE: PRODUCTS OFFERED

TABLE 170 ORACLE: PRODUCT LAUNCHES

TABLE 171 ORACLE: DEALS

TABLE 172 ORACLE: OTHER DEALS

11.2.12 CISCO

TABLE 173 CISCO: BUSINESS OVERVIEW

FIGURE 48 CISCO: COMPANY SNAPSHOT

TABLE 174 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 175 CISCO: PRODUCT LAUNCHES

TABLE 176 CISCO: DEALS

11.2.13 HEWLETT PACKARD ENTERPRISE

TABLE 177 HEWLETT PACKARD ENTERPRISE: BUSINESS OVERIVEW

FIGURE 49 HEWLETT PACKARD ENTERPRISE: COMPANY SNAPSHOT

TABLE 178 HEWLETT PACKARD ENTERPRISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 179 HEWLETT PACKARD ENTERPRISE: PRODUCT LAUNCHES

TABLE 180 HEWLETT PACKARD ENTERPRISE: DEALS

11.2.14 NETAPP

TABLE 181 NETAPP: BUSINESS OVERIVEW

FIGURE 50 NETAPP: COMPANY SNAPSHOT

TABLE 182 NETAPP: SOLUTIONS OFFERED

TABLE 183 NETAPP: PRODUCT LAUNCHES

TABLE 184 NETAPP: DEALS

11.2.15 NUTANIX

TABLE 185 NUTANIX: BUSINESS OVERIVEW

FIGURE 51 NUTANIX: COMPANY SNAPSHOT

TABLE 186 NUTANIX: SOLUTIONS OFFERED

TABLE 187 NUTANIX: PRODUCT LAUNCHES

TABLE 188 NUTANIX: DEALS

11.2.16 FLEXERA

11.2.17 DATADOG

11.2.18 RED HAT

11.2.19 NEW RELIC

11.2.20 SERVICENOW

11.2.21 HASHICORP

11.2.22 TURBONOMIC

11.3 STARTUPS

11.3.1 ABIQUO

11.3.2 HYPERGRID

11.3.3 RAFEY SYSTEMS

11.3.4 CENTILYTICS

11.3.5 STACKLET

11.3.6 RACKWARE

11.3.7 CIRRUSFORM

11.3.8 CORESTACK

11.3.9 MORPHEUS DATA

11.3.10 CLOUDBOLT

*Details on Business and Financial overview, Products/Services/Solution Offered, Recent Developments, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 ADJACENT MARKET (Page No. - 221)

12.1 INTRODUCTION

12.1.1 RELATED MARKET

12.2 CLOUD SYSTEM MANAGEMENT MARKET

TABLE 189 CLOUD SYSTEM MANAGEMENT MARKET, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 190 CLOUD SYSTEM MANAGEMENT MARKET, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 191 CLOUD SYSTEM MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2016–2019 (USD MILLION)

TABLE 192 CLOUD SYSTEM MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2020–2025 (USD MILLION)

TABLE 193 CLOUD SYSTEM MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 194 CLOUD SYSTEM MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 195 CLOUD SYSTEM MANAGEMENT MARKET, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 196 CLOUD SYSTEM MANAGEMENT MARKET, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 197 CLOUD SYSTEM MANAGEMENT MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 198 CLOUD SYSTEM MANAGEMENT MARKET, BY REGION, 2020–2025 (USD MILLION)

13 APPENDIX (Page No. - 226)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the global integrated cloud management platform market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total Integrated cloud management platform market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including chief experience officers (CXOs); vice presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from ICMP solution vendors, industry associations, and independent consultants; and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the Integrated cloud management platform market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the integrated cloud management platform market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the Integrated cloud management platform market based on component, organization size, vertical, and region.

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the impact of COVID-19 on components, verticals, organization size, and regions across the globe.

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To profile key players in the market and comprehensively analyze their core competencies in each microsegment

- To analyze key players based on pricing models, technology analysis, and their market shares

- To analyze competitive developments, such as new product launches, product enhancements, partnerships, and mergers and acquisitions, in the integrated cloud management platform market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Integrated Cloud Management Platform Market