Insecticides Market by Type (Pyrethroids, Organophosphorus, Carbamates, Organochlorine, Botanicals), Crop Type, Mode of Application, Formulation (WP, EC, SC, EW, ME, GR), and Region - Global Forecast to 2022

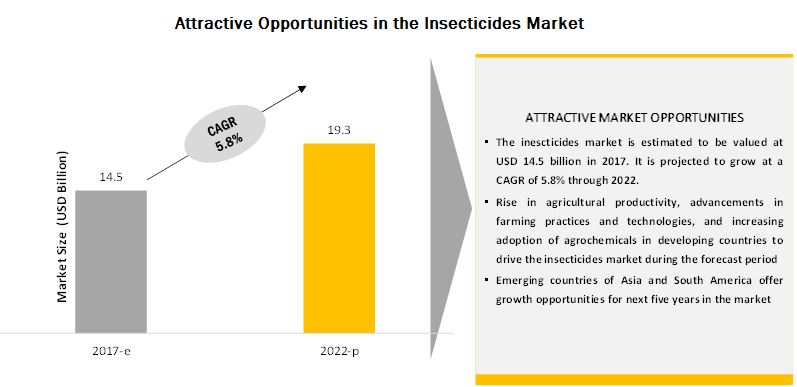

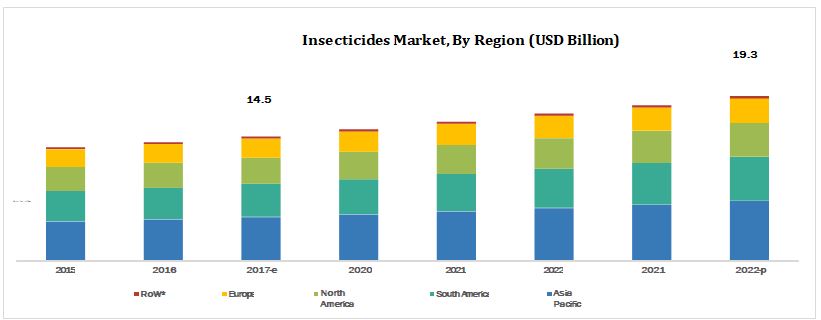

The insecticides market is estimated to be valued at USD 14.5 billion in 2017; it is projected to grow at a CAGR of 5.8%, to reach USD 19.3 billion by 2022. The key factors that are projected to drive the insecticides market during the forecast period are; fall in the per capita arable land, increasing crop losses due to insect attacks, and advancement in farming practices & techniques. Also, increasing global exports and rise in instances of crop losses due to insect infestation are resulting in an increased market for insecticides, globally. The basic objective of the report is to define, segment, and project the global market size for insecticides on the basis of type, crop type, mode of application, and formulation.

Source: Investor Presentation, Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

By crop type, the cereals & grains segment is projected to dominate the insecticides market during the forecast period.

Corn, rice, and wheat are the major crops that are treated with insecticides in the cereals & grains segment. Since cereals are grown in almost all countries, the global demand for insecticides is high, and this trend is expected to continue over the next five years. On a global level, the total cereal production has been increasing, and with the growth in cereal production and consumption, it has become important for producers to focus more on its yield and quality by using effective insecticides. The cereals & grains market is witnessing growth as they are a rich source of vitamins and minerals, and are used in large amounts in animal feed.

By type, the organophosphate segment is projected to dominate the insecticides market during the forecast period.

Organophosphates are the most widely used insecticides as they is cheaper than other alternatives. Currently, organophosphates still find use in agriculture, homes, gardens, and veterinary practices; however, several organophosphates have been discontinued for use in the past decade. Though the market for orgaophosphates as insecticides is growing steadily, there are high risk factors associated with the production of the same. Stringent government rules on usage of chemical insecticides, coupled with the advent of bioinsecticides as a potent substitute, are the key factors restraining the growth of organophosphate insecticides market.

By formulation, the emulsifyable concentrates segment is projected to dominate the insecticides market during the forecast period.

An emulsifiable concentrate formulation usually contains an oil-soluble liquid active ingredient, one or more petroleum-based solvents, and a mixing agent. Emulsifiable concentrates are a widely used formulation for insecticides across the globe, mainly because of their versatility for use in agricultural as well as non-agricultural applications. They are adaptable to any type of sprayer, ranging from portable sprayers to hydraulic spraying machines. They are relatively easier to handle for treating large areas, which is the main reason for emulsifyable concentrates dominating the insecticides market.

By mode of application, the foliar spray segment is projected to dominate the insecticides market during the forecast period.

Usage of foliar spray is the highest for insecticides due to its ease of application and high effectiveness. Foliar spraying is a technique of treating plants with liquid insecticides directly to their leaves. It is an excellent solution for plants experiencing pest attacks. Foliar spray is also recommended when environmental conditions limit the uptake of nutrients through roots. Such conditions may include high or low soil pH, temperature stress, too low or too high soil moisture, root disease, the presence of pests that affect nutrient uptake, and nutrient imbalances in the soil. Formulations such as wettable powders, liquid concentrates, and emulsions can be used by this mode of application.

Emerging markets for insecticides in Asia Pacific

Agricultural expansion for livelihood security in countries such as China and India, are the major factors contributing to the increasing sales of insecticides in this region. The developing economy in this region and inconsistent regulations on pesticides usage across different countries are the major factors contributing to the exponential growth of the Asia Pacific insecticides market as compared to other regions. Asia Pacific has wide climatic variations and a high degree of plant diversity. Hence, the use of insecticides is widespread throughout the region. The increasing awareness about pesticides and continuous technological advancements are factors contributing to the growth of this market. In addition to this, the growing demand for crops and rising cultivation in the countries of Asia Pacific have forced agribusiness companies to expand their supplier and manufacturing base in the region.

See how this study impacted revenues for other players in Insecticides Market

Clients Problem Statement

MnMs client was interested in assessing market for housefly control insecticides in the US and Canada. Key objectives of the study was to understand market potential, supply chain patterns, scenario (current & projected), end-use segments (such as public and animal health), and market share of key players.

MnM Approach

Insights were provided to devise better planning and strategy for new product development/launch, supply chain patterns, and distribution, especially in livestock health sector, against their competitors with respect to the regional divisions of the US and Canada.

- Based on our insights, the company identified key market areas at livestock and state level for their product Agita, an insecticide for housefly and darkling beetles.

- https://www.feedstuffs.com/story-elanco-adds-insecticide-poultry-houses-122-143096

Revenue Impact (RI)

The study was completed in Feb 2016 and the client did not have this category. The revenue from this stream was nil.

Post our research study, the client launched this category in June 2016. We estimate the revenue impact as a result of entering into this category to be in a range of 3-5% of their total revenues. The CAGR for this category was estimated at 9%.

e-estimated; p-projected

*RoW includes the Middle East & Africa

Source: Investor Presentation, Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

Market Dynamics

Rise in agricultural productivity

Rise in agricultural productivity is achieved by the use of high-yield varieties of seeds, advanced irrigation technologies, and agricultural chemicals such as insecticides. Output and productivity have increased significantly in most countries; for example, wheat yield in the UK and corn yields in the US Insecticides have been an integral part of the process by reducing losses from diseases and insects that result in reduced amount of harvestable produce. According to the FAO, there would be a considerable economic loss globally, without the use of insecticides. Severe infestation of insects, particularly in the early stage of crop establishment, ultimately accounts for a yield reduction. Insecticides are helpful in providing both economic and labor benefits, thereby resulting in a lower crop loss.

Advancements in farming practices and technologies

Traditional farming is being replaced by commercial farming with technologically advanced machinery and high-quality pesticides for crop yield enhancement and protection. This evolving technology and advancements in agricultural chemistry have enabled farmers to adopt effective pest management. Increasing awareness regarding the use of pesticides has not only increased their demand, but also has increased awareness regarding potential crop savings in developing nations. The table below shows the degree of use of crop protection chemicals. Corn has accounted for the highest use of insecticides, whereas cotton, rice, and sunflower recorded moderate usage of insecticides.

Integrated Pest Management (IPM)

Integrated Pest Management (IPM) is a sustainable approach to pest management by a combination of biological, mechanical, physical, and chemical methods. These methods are performed in three stages prevention, observation and intervention. It is an ecological approach and strives for eliminating or significantly reducing the use of pesticides and at the same time containing pest growth at acceptable levels. As the importance of IPM is increasing all over the world, new opportunities are being created for natural crop protection chemical products. Leading players in the crop protection chemicals market such as Bayer AG (Germany) and Syngenta (Switzerland) have developed a product range of crop protection chemicals such as insecticides, herbicides, and fungicides to meet the increasing demand for natural crop protection products for usage in IPM.

Advent of bioinsecticides as substitutes

Bioinsecticides are insecticides produced with natural inputs. With the growth in environmental considerations and health hazards from many synthetic insecticides, the demand for bioinsecticides has been rising steadily in all parts of the world. Bioinsecticides are growing in popularity, due to their less or non-toxic nature as compared to synthetic counterparts. Moreover, bioinsecticides provide a more targeted activity towards desired insects, unlike conventional insecticides that often affect a broad spectrum of species. Further, bioinsecticides can be very effective in small quantities; thus, they offer lower exposure and are quickly decomposable, leaving virtually no harmful residue after application

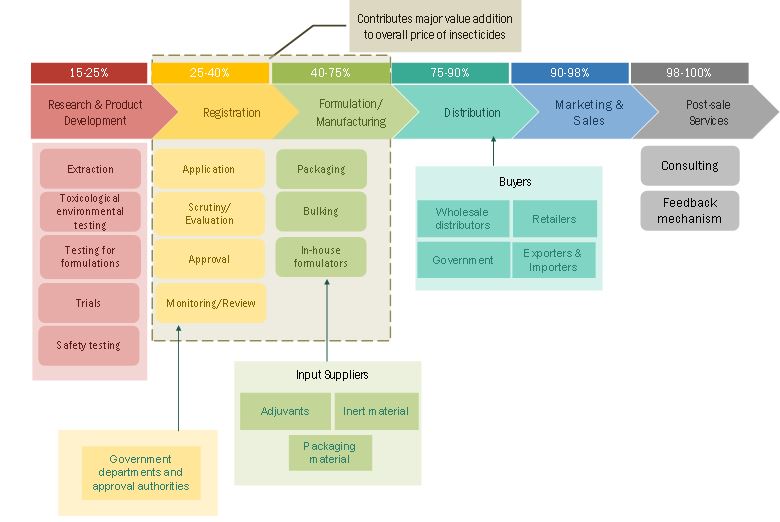

Market Ecosystem:

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD), Volume (Tons) |

|

Segments covered |

Type, Crop Type, Mode of Application, Formulation, Form and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America and Rest of the World (RoW) |

|

Companies covered |

BASF, Bayer Cropscience, ChemChina, FMC Corporation, Corteva Agriscience, Nufarm Limited, UPL Limited, Sumitomo Chemical Co., Ltd., Adama Agricultural Solutions, American Vanguard Corporation, Syngenta International AG, Cheminova A/S, Monsanto, Makhteshim Agan Industries, Shandong Weifang Rainbow Chemical Co., Ltd., Nanjing Red Sun Co., Ltd., Oxon Italia S.p.A, Nissan Chemical Corporation, Arysta Lifesciences, Marrone Bio Innovations. |

The research report categorizes the insecticides to forecast the revenues and analyze the trends in each of the following sub-segments:

On the basis of type, the insecticides market has been segmented as follows:

- Pyrethroids

- Organophosphorus

- Carbamates

- Organochlorine

- Botanicals

- Other types

On the basis of crop type, the insecticides market has been segmented as follows:

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

- Other crop types

On the basis of formulation, the insecticides market has been segmented as follows:

- Wettable powder

- Emulsifiable concentrate

- Suspension concentrate

- Oil emulsion in water

- Microencapsulated suspension

- Granules

- Other formulations

On the basis of form, the insecticides market has been segmented as follows:

- Sprays

- Baits

- Strips

On the basis of region, the insecticides market has been segmented as follows:

- North America

- US

- Canada

- Mexico

- Europe

- Spain

- UK

- Italy

- France

- Germany

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Rest of World (RoW)*

- Africa

- Middle East

Key Market Players

Key players identified in the global insecticides market include BASF SE (Germany), Corteva Agriscience (US), FMC Corporation (US), ChemChina (China), Bayer CropScience (Germany), which are among the key players of the insecticides market as these are well-established and financially stable players that have been operating in the industry for several years. Most key participants have been exploring new regions through expansions, investments, new product launches, and acquisitions across the globe to avail a competitive advantage through combined synergies.

Recent Developments

- In June 2019, Corteva Agriscience has separated from DowDuPont, and the remaining entity is being recast as DuPont. Corteva Agriscience has separated from DowDuPont, and the remaining entity is being recast as DuPont.

- In March 2019, BASF introduced Vebtigra insecticide, an excellent resistance management tool for nursery and greenhouse growers, providing precision-targeted pest management of piercing-sucking insects like whiteflies, aphids, mealybugs and scales.

- In March 2019, Bayer launched Fludora Fusion, the worlds first combination indoor residual spray insecticide in Africa to help fight insecticide-resistant strains of malaria.

- In March 2018, Bayer CropScience acquired Monsanto (US). Through this acquisition, Bayer aimed to enhance its business verticals as well as consumer base, globally.

- In January 2018, Adama Agricultural Solutions acquired Hubei Sanonda Co., Ltd. (China) to increase its presence in the Asian market.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the insecticides market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Units Considered

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in the Insecticides Market

4.2 Asia Pacific Insecticides Market, By Country and Type

4.3 Insecticides Markets: Key Countries

4.4 Insecticides Market, By Crop Type & Region

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise in Agricultural Productivity

5.2.1.2 Increase in Crop Losses Due To Insect Infestation

5.2.1.3 Advancements in Farming Practices And Technologies

5.2.2 Restraints

5.2.2.1 Stringent Government Regulations

5.2.2.2 Increase in Resistance Among Insects

5.2.3 Opportunities

5.2.3.1 Integrated Pest Management (IPM)

5.2.3.2 Greater Opportunities in Developing Countries

5.2.4 Challenges

5.2.4.1 Advent of Bioinsecticides as Substitutes

5.3 Supply Chain Analysis

5.4 Regulatory Framework

5.4.1 North America

5.4.2 Europe

5.4.3 Asia Pacific

5.4.4 South America

6 Insecticides Market, By Crop Type

6.1 Introduction

6.2 Cereals & Grains

6.2.1 The Cereals & Grains Market is Witnessing Growth as They Are a Rich Source of Vitamins And Minerals, And Are Used in Large Amounts in Animal Feed

6.3 Oilseeds & Pulses

6.3.1 The Demand for High-Yielding and Premium Quality of Cereals & Grains Drives the Insecticides Market Globally

6.4 Fruits & Vegetables

6.4.1 Recently, the Use Of Insecticides Has Been Increasing On Fruits And Vegetables, And Hence, This Segment Is Projected To Be The Fastest-Growing During The Forecast Period

6.5 Other Crop Types

7 Insecticides Market, By Type

7.1 Introduction

7.2 Pyrethroids

7.2.1 Widely Used Pyrethroids Include Bifenthrin, Cypermethrin, Deltamethrin, Fenavalerate, Sumithrin, and Permethrin

7.3 Organophosphates

7.3.1 Organophosphates Are the Most Commonly Used Insecticides Across the World, And Were Introduced Mainly as Substitutes to Organochlorine

7.4 Carbamates

7.4.1 A Number Of Carbamates Are Used In Plants, For The Reason That They Have High Water Solubility, Which Makes Them Easy To Be Absorbed By The Roots And Leaves Of The Plant.

7.5 Organochlorides

7.5.1 Owing to This High Toxicity Levels and Restrictions Laid By the Government, This Class of Insecticides Are a Declining Market in Developed Countries

7.6 Botanical Insecticides

7.6.1 Botanical Insecticides Are Increasingly Becoming Popular Being Naturally Occurring Toxins Derived From Plants, Are Generally Environment Friendly

7.7 Other Types

8 Insecticides Market, By Mode of Application

8.1 Introduction

8.2 Foliar Spray

8.2.1 Foliar Spray Segment Is Used As an Excellent Short-Term Solution for Plants Experiencing Pest Attacks

8.3 Soil Treatment

8.3.1 Soil Treatment Is A Cheaper And More Widely Accepted Mode Of Insecticide Application Compared To Foliar Sprays

8.4 Post Harvest

8.4.1 Stringent Regulations Posed By Governments On The Chemicals Used For Post-Harvest Applications is One Of The Major Factor Restraining The Demand For This Mode Of Application.

8.5 Seed Treatment

8.5.1 The Seed Treatment Application Is Gaining Importance In The Insecticides Industry Mainly Due To Its High Effectiveness And Rising Demand From Farmers

9 Insecticides Market, By Formulation

9.1 Introduction

9.2 Wettable Powders

9.2.1 Safer To Handle, Easy To Apply, Easy To Store and Transport are Some of the Factors Contributing To The Growth Of Wettable Powders

9.3 Emulsifiable Concentrates

9.3.1 Emulsifiable Concentrates Are A Widely Used Formulation For Insecticides Across The Globe, Mainly Because Of Their Versatility For Use In Agricultural As Well As Non-Agricultural Applications

9.4 Suspension Concentrates

9.4.1 Preferred For Their Excellent Residual Activity and Low Likeliness to Harm Treated Plants as Compared to Other Insecticides

9.5 Oil Emulsions in Water

9.5.1 The Utilization of Oil Emulsions in Water Has Decreased to a Considerable Extent in Recent Times but Still Sees Demand In Developing Countries

9.6 Microencapsulated Suspensions

9.6.1 The Market for Microencapsulated Suspension Insecticides Is Niche Due To Its Recent Introduction into the Market

9.7 Granules

9.7.1 Granule-Formulated Insecticides Are Ready-To-Use Formulations That Are Water Insoluble And Applied As A Spray By Mixing In Water Preferred For Their Ease Of Application

10 Insecticides Market, By Form

10.1 Introduction

10.2 Sprays

10.2.1 Sprays Are the Most Conventional and Widely Accepted Form of Insecticides Across The Globe Due To Their Ease Of Handling And Portability

10.3 Baits

10.3.1 Most Widely Used To Exterminate Ants And Crickets, Also Used To Control Termites And Rodents.

10.4 Strips

10.4.1 Strips Are Not Widely Used In Agricultural Practices; However, There Are a Few Products Available In the Market for Low-Scale Insecticidal Effect

11 Insecticides Market, By Region

11.1 North America

11.1.1 US

11.1.1.1 High Awareness Related to the Efficient Use of Insecticides Drives the Market in the US

11.1.2 Canada

11.1.2.1 High Demand for Crops Such As Corn is the Major Growth Factor for Insecticides in Canada

11.1.3 Mexico

11.1.3.1 Increase in the Commercialization of Agriculture is the Main Driving Force for the Market in Mexico

11.2 Europe

11.2.1 Germany

11.2.1.1 High Production of Field Crops Such As Grains and Cereals, a Major Application Area For Insecticides In Germany, Is Driving The Market

11.2.2 France

11.2.2.1 The Countrys Strong Agricultural Sector Is Fueling The Demand For Insecticides In The Country

11.2.3 Italy

11.2.3.1 Italian Insecticides Market Is A High-Growth-Potential Market, As The Agricultural Sector Is Yet To Reach Its Complete Commercial Potential In The Country

11.2.4 UK

11.2.4.1 Presence Of Major Players In The Region Is A Key Driving Factor For Insecticides In The UK

11.2.5 Spain

11.2.5.1 High Demand For Crops Such As Corn Is The Major Growth Factor For Insecticides

11.2.6 Rest Of Europe

11.2.6.1 The Production Of Corn And Soy is A Major Application Of Insecticides In The Region

11.3 Asia Pacific

11.3.1 China

11.3.1.1 Presence of A Large Number Of Chemical Insecticide Manufactures And Distributors Is A Key Factor For The Growth Of The Market

11.3.2 Japan

11.3.2.1 Rice Production is the Main Factor Behind the Growth of The Market in Japan

11.3.3 India

11.3.3.1 India is a Potential Market for Chemical Insecticides, With High Demand For Biological Insecticides

11.3.4 Australia & New Zealand

11.3.4.1 Growth of Horticulture Crops in Australia is the Major Reason for the Growth of Insecticides Market In The Country

11.3.5 Rest of Asia Pacific

11.3.5.1 Domination of Wet Rice Cultivation to Drive the Market in the Region

11.4 South America

11.4.1 Brazil

11.4.1.1 Growing Demand for Soybean Crop to Drive the Demand for Insecticides

11.4.2 Argentina

11.4.2.1 Need to Increase the Crop Yield is the Major Driver for Pesticides in the Country

11.4.3 Rest of South America

11.4.3.1 The Insecticides Market is a High-Growth-Potential Market Yet to Reach Its Complete Commercial Potential in the Region

11.5 RoW

11.5.1 Middle East

11.5.1.1 Scope for the Growth of the Insecticide Industry in the Region is Limited Due to Climatic Conditions

11.5.2 Africa

11.5.2.1 Production of the Grains and Cereals is a Major Factor For The Growth of Insecticides

12 Competitive Landscape

12.1 Introduction

12.2 Competitive Leadership Mapping

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

12.3 Market Share Analysis

12.4 Competitive Scenario

12.4.1 Expansions & Investments

12.4.2 Mergers & Acquisitions

12.4.3 New Product Launches

12.4.4 Agreements, Joint Ventures, Partnerships & Collaborations

13 Company Profiles

13.1 BASF SE

13.1.1 Business Overview

13.1.2 Product Portfolio

13.1.3 Recent Developments

13.1.4 SWOT Analysis

13.1.5 Right to Win

13.2 Bayer Cropscience

13.2.1 Business Overview

13.2.2 Product Portfolio

13.2.3 Recent Developments

13.2.4 SWOT Analysis

13.2.5 Right to Win

13.3 Chemchina

13.3.1 Business Overview

13.3.2 Product Portfolio

13.3.3 Recent Developments

13.3.4 SWOT Analysis

13.3.5 Right to Win

13.4 FMC Corporation

13.4.1 Business Overview

13.4.2 Product Portfolio

13.4.3 Recent Developments

13.4.4 SWOT Analysis

13.4.5 Right to Win

13.5 Corteva Agriscience

13.5.1 Business Overview

13.5.2 Product Portfolio

13.5.3 Recent Developments

13.5.4 SWOT Analysis

13.5.5 Right to Win

13.6 Nufarm Limited

13.7 UPL Limited

13.8 Sumitomo Chemical Co., Ltd.

13.9 Adama Agriculture Solutions Ltd.

13.10 American Vanguard Corporation

13.11 Syngenta

13.12 Cheminova A/S

13.13 Monsanto

13.14 Makhteshim Agan Industries

13.15 Shandong Weifang Rainbow Chemical Co., Ltd.

13.16 Nanjing Red Sun Co., Ltd.

13.17 Oxon Italia S.P.A

13.18 Marrone Bio Innovations

13.19 Nissan Chemical Corporation

13.20 Arysta Lifesciences

Note: This Section Covers 15-20 Key Company Profiles Which Include Business Overview, Recent Financials, Product Offerings, Key Strategies, And SWOT Analysis.

14 Appendix

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: MarketsandMarkets Subscription Portal

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables

Table 1 Degree of Usage of Crop Protection Chemicals

Table 2 List of Banned Insecticides

Table 3 Insecticides Market Size, By Type, 20152022 (USD Million)

Table 4 Insecticides Market Size, By Type, 20152022 (KT)

Table 5 Pyrethroids Market Size, By Region, 20152022 (USD Million)

Table 6 Pyrethroids Market Size, By Region, 20152022 (KT)

Table 6 Organophosphates Insecticides Market Size, By Region, 20152022 (USD Million)

Table 7 Organophosphates Insecticides Market Size, By Region, 20152022 (KT)

Table 8 Carbamate Insecticides Market Size, By Region, 20152022 (USD Million)

Table 9 Carbamate Insecticides Market Size, By Region, 20152022 (KT)

Table 10 Organochlorine Insecticides Market Size, By Region, 20152022 (USD Million)

Table 11 Organochlorine Insecticides Market Size, By Region, 20152022 (KT)

Table 12 Botanicals Market Size, By Region, 20152022 (USD Million)

Table 13 Botanicals Market Size, By Region, 20152022 (KT)

Table 14 Other Insecticide Types Market Size, By Region, 20152022 (USD Million)

Table 15 Other Insecticide Types Market Size, By Region, 20152022 (KT)

Table 16 Insecticides Market Size, By Crop Type, 20152022 (USD Million)

Table 17 Insecticides Market Size, By Crop Type, 20152022 (KT)

Table 18 Cereals & Grains: Insecticides Market Size, By Region, 20152022 (USD Million)

Table 19 Oilseeds & Pulses: Insecticides Market Size, By Region, 20152022 (USD Million)

Table 20 Fruits & Vegetables: Insecticides Market Size, By Region, 20152022 (USD Million)

Table 21 Other Crop Types: Insecticides Market Size, By Region, 20152022 (USD Million)

Table 22 Insecticides Market Size, By Mode Of Application, 20152022 (USD Million)

Table 23 Insecticides Market Size, By Mode Of Application, 20152022 (KT)

Table 24 Foliar Spray: Insecticides Market Size, By Region, 20152022 (USD Million)

Table 25 Foliar Spray: Insecticides Market Size, By Region, 20152022 (KT)

Table 26 Post-Harvest: Insecticides Market Size, By Region, 20152022 (USD Million)

Table 27 Post Harvest: Insecticides Market Size, By Region, 20152022 (KT)

Table 28 Foliar Spray: Insecticides Market Size, By Region, 20152022 (USD Million)

Table 29 Foliar Spray: Insecticides Market Size, By Region, 20152022 (KT)

Table 30 Seed Treatment: Insecticides Market Size, By Region, 20152022 (USD Million)

Table 31 Seed Treatment: Insecticides Market Size, By Region, 20152022 (KT)

Table 32 Insecticide Formulations And Abbreviations

Table 33 Insecticides Market Size, By Formulation, 20152022 (USD Million)

Table 34 Insecticides Market Size, By Formulation, 20152022 (KT)

Table 35 Wettable Powders Market Size, By Region, 20152022 (USD Million)

Table 36 Wettable Powders Market Size, By Region, 20152022 (KT)

Table 37 Emulsifiable Concentrates Market Size, By Region, 20152022 (USD Million)

Table 38 Emulsifiable Concentrates Market Size, By Region, 20152022 (KT)

Table 39 Suspension Concentrates Market Size, By Region, 20152022 (USD Million)

Table 40 Suspension Concentrates Market Size, By Region, 20152022 (KT)

Table 41 Oil Emulsions In Water Market Size, By Region, 20152022 (USD Million)

Table 42 Oil Emulsions In Water Market Size, By Region, 20152022 (KT)

Table 43 Microencapsulated Suspensions Market Size, By Region, 20152022 (USD Million)

Table 44 Microencapsulated Suspensions Market Size, By Region, 20152022 (KT)

Table 45 Granular Formulations Market Size, By Region, 20152022 (USD Million)

Table 46 Granular Formulations Market Size, By Region, 20152022 (KT)

Table 47 Other Formulations Market Size, By Region, 20152022 (USD Million)

Table 48 Other Formulations Market Size, By Region, 20152022 (KT)

Table 49 Insecticides Market Size, By Region, 20152022 (USD Million)

Table 50 Insecticides Market Size, By Region, 20152022 (KT)

Table 51 North America: Insecticides Market Size, By Country, 20152022 (USD Million)

Table 52 North America: By Market Size, By Type, 20152022 (USD Million)

Table 53 North America: By Market Size, By Crop Type, 20152022 (USD Million)

Table 54 North America: By Market Size, By Application, 20152022 (USD Million)

Table 55 North America: Insecticides Market Size, By Formulation, 20152022 (USD Million)

Table 56 Us: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 57 Canada: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 58 Mexico: By Market Size, By Type, 20152022 (USD Million)

Table 59 Europe: Insecticides Market Size, By Country, 20152022 (USD Million)

Table 60 Europe: By Market Size, By Type, 20152022 (USD Million)

Table 61 Europe: Insecticides Market Size, By Crop Type, 20152022 (USD Million)

Table 62 Europe: By Market Size, By Application, 20152022 (USD Million)

Table 63 Europe: Insecticides Market Size, By Formulation, 20152022 (USD Million)

Table 64 Spain: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 65 Uk: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 66 Italy: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 67 France: By Market Size, By Type, 20152022 (USD Million)

Table 68 Germany: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 69 Rest Of Europe: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 70 Asia-Pacific: Insecticides Market Size, By Country, 20152022 (USD Million)

Table 71 Asia-Pacific: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 72 Asia Pacific: Insecticides Market Size, By Crop Type, 20152022 (USD Million)

Table 73 Asia Pacific: Insecticides Market Size, By Application, 20152022 (USD Million)

Table 74 Asia Pacific: Insecticides Market Size, By Formulation, 20152022 (USD Million)

Table 75 China: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 76 Japan: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 77 India: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 78 Australia & New Zealand: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 79 Rest Of Asia Pacific: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 80 South America: Insecticides Market Size, By Country, 20152022 (USD Million)

Table 81 South America: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 82 South America: Insecticides Market Size, By Crop Type, 20152022 (USD Million)

Table 83 South America: Insecticides Market Size, By Application, 20152022 (USD Million)

Table 84 South America: Insecticides Market Size, By Formulation, 20152022 (USD Million)

Table 85 Brazil: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 86 Argentina: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 87 Rest Of South America: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 88 Row: Insecticides Market Size, By Country, 20152022 (USD Million)

Table 89 Row: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 90 Row: Insecticides Market Size, By Crop Type, 20152022 (USD Million)

Table 91 Row: Insecticides Market Size, By Application, 20152022 (USD Million)

Table 92 Row: Insecticides Market Size, By Formulation, 20152022 (USD Million)

Table 93 Middle East: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 94 Africa: Insecticides Market Size, By Type, 20152022 (USD Million)

Table 95 List of Banned Insecticides in the EU

Table 96 Investments & Expansions

Table 97 Agreements, Partnerships, and Collaborations

Table 98 Acquisitions

Table 99 New Product Launches

Table 100 Mergers & Acquisitions

List Of Figures

Figure 1 Insecticides Market Segmentation

Figure 2 Research Design: Insecticides Market

Figure 3 Breakdown Of Primary Interviews, By Company Type, Designation, And Region

Figure 4 Global Population, 19552050 (Billion)

Figure 5 Arable Land, 19502020 (Hectares/Person)

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 Assumptions of the Study

Figure 10 Limitations of the Study

Figure 11 Insecticides Market, By Type (2017 Vs 2022)

Figure 12 Insecticides Market, By Type (2017 Vs 2022)

Figure 13 Insecticides Market, By Crop Type (2017 Vs 2022)

Figure 14 Insecticides Market, By Formulation (2017 Vs 2022)

Figure 15 Insecticides Market: Geographic Snapshot

Figure 16 An Emerging Market With Promising Potential, 2017-2022

Figure 17 Organophosphates Dominated the Market In 2016

Figure 18 India And China to Be the Fastest-Growing Markets for Insecticides, From 2017 To 2022

Figure 19 India Emerging As the Most Attractive Market for Insecticides During The Forecast Period

Figure 20 Asia Pacific Accounted for the Largest Share Across All Crop Types In 2016

Figure 21 Insecticides Market: Drivers, Restrains, Opportunities & Challenges

Figure 22 Annual Food Loss/ Wastage Is The Highest In Fruits & Vegetables

Figure 23 Basic Components of Integrated Pest Management

Figure 24 Value Chain Analysis of Insecticides (2016): A Major Contribution From The Registration & Formulation/ Manufacturing Phase

Figure 25 Supply Chain Analysis For The Insecticides Market

Figure 26 Insecticides Market Size, By Type, 2017 Vs 2022 (USD Million)

Figure 27 Insecticides Market Size, By Crop Type, 2017 Vs 2022 (USD Million)

Figure 28 Insecticides Market Size, By Mode of Application, 2017 Vs 2022

Figure 29 Insecticides Market in Japan Is Projected To Grow at the Highest CAGR

Figure 30 Mexico Was the Largest Market for Insecticides in North America

Figure 31 Asia Pacific Accounted for the Highest Growth Rate

Figure 32 Investments and Expansions Were Preferred By Companies In The Insecticides Market In The Last Five Years

Figure 33 Strengthening Market Presence Through Investments And Expansions

Figure 34 Investments & Expansions: The Key Strategy Adopted by the Companies

Figure 35 Insecticides Market (Global): Competitive Leadership Mapping

Figure 36 BASF SE: Company Snapshot

Figure 37 BASF SE: SWOT Analysis

Figure 38 Bayer Cropscience Ag: Company Snapshot

Figure 39 Bayer AG: SWOT Analysis

Figure 40 Corteva Agriscience: Company Snapshot

Figure 41 Corteva Agriscience: SWOT Analysis

Figure 42 Chemchina: Company Snapshot

Figure 43 Chemchina (Syngenta AG): SWOT Analysis

Figure 44 FMC Corporation: Company Snapshot

Figure 45 FMC Corporation: SWOT Analysis

Figure 46 American Vanguard Corporation: Company Snapshot

Figure 47 Nufarm Limited: Company Snapshot

Figure 48 UPL Limited: Company Snapshot

Figure 49 Sumitomo Chemical Co., Ltd: Company Snapshot

Figure 50 Adama Agricultural Solutions Ltd.: Company Snapshot

Figure 51 Syngenta: Company Snapshot

Figure 52 Cheminova A/S: Company Snapshot

Figure 53 Monsanto: Company Snapshot

Figure 54 Makhteshim Agan Industries: Company Snapshot

Figure 55 Shandong Weifang Rainbow Chemical Co., Ltd.: Company Snapshot

Figure 56 Ninjang Red Sun Co., Ltd.: Company Snapshot

Figure 57 Oxon Italia: Company Snapshot

Figure 58 Nissan Chemical Corporation: Company Snapshot

Figure 59 Arysta Lifesciences: Company Snapshot

Figure 60 Marrone Bio Innovations: Company Snapshot

Growth opportunities and latent adjacency in Insecticides Market