Ingestible Sensor Market by Component (Sensor, Data Recorder, & Software), Type (Temperature, Pressure, pH, & Image sensor), Vertical (Medical and Sports & Fitness), and Geography - Global Forecast to 2022

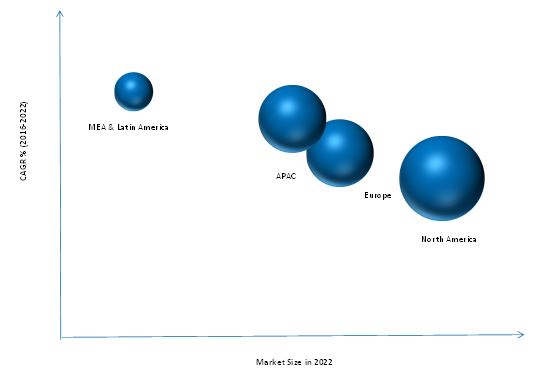

The ingestible sensor market is expected to grow from USD 198.2 Million in 2015 to USD 678.2 Million by 2022, at a CAGR of 20.2% between 2016 and 2022. The medical vertical dominated the market, and the use of ingestible sensors has revolutionized this vertical. Ingestible sensor defines the first phase of developing a digital medicine platform. In the medical sector, ingestible sensors are used in capsule endoscopy, patient monitoring, and controlled drug delivery applications. This report aims at estimating the current market size and future growth potential of the ingestible sensor market. The base year considered for this study is 2015, and the market forecast is given for the period between 2016 and 2022. The key drivers for market are real-time patient monitoring, medication adherence, rising number of cases of chronic diseases, and accuracy in performing invasive diagnosis tests. In mature markets such as North America and Europe, the growing number of gastroparesis cases, government policies controlling the healthcare expenditure, and awareness toward ensuring medication adherence play a vital role in driving the demand for ingestible sensor.

The ingestible sensor market size is expected to grow from USD 198.2 Million in 2015 to USD 678.2 Million by 2022, at a CAGR of 20.2% between 2016 and 2022. The growing need for medication adherence, increasing rate of chronic diseases, and demand for real-time monitoring create a huge demand for ingestible sensors across the world. The growing complexities in diagnosing and managing chronic diseases and other biomedical activities are creating opportunities for the market. The expansion of ingestible sensors in novel medical applications such as customized drug delivery is also responsible for contributing to the overall market. Patients are found to be comfortable and prefer minimally invasive techniques for diagnosis and monitoring. Moreover, ingestible sensors are more accurate than the traditional medical equipment. Therefore, these sensors are in high demand in the medical vertical. In other verticals such as sports, astronauts, animal care, mining, fire-fighting, and military, ingestible sensors are used to signify the core body temperature changes in relation with the extreme working environment. Thus, this market has a great scope for growth in the next five years.

The scope of this report covers the market on the basis of component, sensor type, vertical, and geography. Temperature sensors are expected to hold the largest market share between 2016 and 2022. The image sensor market is expected to grow at the highest CAGR between 2016 and 2022. Using image sensors, doctors can view clear images of different target areas inside the patient’s body to diagnose critical diseases.

Pressure sensor have also contributed to the overall market. These sensors are used in smart pills and capsule endoscopes to determine the biomedical changes in various target areas. In emerging markets such as APAC and RoW, the growth of capsule endoscopy is expected to be more than that in North America and Europe due to the large population base and government support.

In the medical vertical, the diagnosis application dominated the market. Other emerging applications such as drug delivery and monitoring are also gaining a significant market size owing to their contribution in providing accurate healthcare to the patients. Patient monitoring using ingestible sensors helps in enhancing the effectiveness of disease management for both patients and physicians. These sensors determine the condition of a patient’s gastrointestinal tract and track pH and temperature, enabling physicians to understand the main cause of the disease.

North America currently dominates the ingestible sensors market. As treatment procedures using ingestible electronic pills are highly effective and minimally invasive, physicians prefer the use of ingestible sensor technology. In North America, the field of endoscopy has witnessed significant technological advancements over the past few years such as the development of advanced wireless minimally invasive capsule endoscopes.

The Asian market is characterized by the presence of a large population base and high incidence of target diseases. In the APAC ingestible sensors market, established players from various product segments are following the push strategy, which enables them to make their ingestible electronic pills available in this region. Japan, China, and India represent the next promising hubs for the development of ingestible sensors technology-based devices.

The major challenges faced by the market include complex circuit designing and regulatory mandates & standards. Circuit designing for these sensors is the major obstacle faced by companies. The ingestible sensors are miniaturized microelectronics and designing such complex structures needs sophisticated technology and high investment in R&D.

The report profiles the major players in ingestible sensors along with their SWOT analysis. The market has witnessed a series of new product launches along with investments and collaboration among the industry players across the value chain. The major players in the ingestible sensors market are Proteus Digital Health, Inc. (U.S.), HQ, Inc. (U.S.), Given Imaging Ltd. (Israel), Medimetrics Personalized Drug Delivery B.V. (Netherlands), and CapsoVision (U.S.)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Market Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 26)

4.1 Attractive Market Opportunities in the Global Ingestible Sensors Market

4.2 Ingestible Sensors Market Growth, By Sensor Type

4.3 Ingestible Sensors Market in APAC, 2015

4.4 Ingestible Sensors Market Growth (2016–2022)

4.5 Ingestible Sensors Market, By Vertical, USD Million (2016–2022)

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Component

5.2.2 By Type

5.2.3 By Vertical

5.2.4 By Geography

5.3 Market Dynamics: Ingestible Sensors Market

5.4 Drivers

5.4.1 Aging Population and Growing Lifestyle-Related Diseases

5.4.2 Medication Adherence

5.4.3 Better Visualization and Favorable Reimbursement

5.5 Restraints

5.5.1 Technical and Clinical Issues

5.5.2 High Cost of Technology

5.6 Opportunities

5.6.1 Emerging Markets and Modernization of Healthcare Infrastructure

5.7 Challenges

5.7.1 Need for Need for Advancement in Healthcare Informatics

5.7.2 Complex Circuit Designing

5.7.3 Regulatory Mandates & Standards

6 Industry Trends (Page No. - 38)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Industry Trends

6.4 Porter’s Five Forces Analysis

6.4.1 Bargaining Power of Suppliers

6.4.2 Bargaining Power of Buyers

6.4.3 Threat of New Entrants

6.4.4 Threat of Substitutes

6.4.5 Intensity of Rivalry

7 Ingestible Sensors Market, By Component (Page No. - 45)

7.1 Introduction

7.1.1 Sensor

7.1.2 Wearable Patch/Data Recorder

7.1.3 Software

8 Ingestible Sensors Market, By Sensor Type (Page No. - 49)

8.1 Introduction

8.2 Temperature Sensor

8.3 Pressure Sensor

8.4 PH Sensor

8.5 Image Sensor

9 Ingestible Sensors Market, By Vertical (Page No. - 55)

9.1 Introduction

9.1.1 Medical Vertical

9.1.1.1 Medical Vertical Applications.

9.1.1.1.1 Diagnosis Application

9.1.1.1.2 Patient Monitoring

9.1.1.1.3 Drug Delivery Application

9.1.2 Sports & Fitness

9.1.3 Others

10 Geographical Analysis (Page No. - 65)

10.1 Introduction

10.1.1 North America

10.1.1.1 North America to Hold the Largest Market Share During the Forecast Period

10.1.1.2 U.S.

10.1.1.2.1 The Presence of Major Players Makes the U.S. A Prominent Market for Ingestible Sensors

10.1.1.3 Canada

10.1.1.3.1 Aging Population and Need for Remote Patient Monitoring are the Key Drivers for the Canadian Market

10.1.1.4 Mexico

10.1.1.4.1 Being the Third-Largest Medical Device Importer in the Americas, Mexico Offers Untapped Market Opportunities for the Companies

10.1.2 Europe

10.1.2.1 Growing Cases of Gastroparesis Driving the Ingestible Sensors Market in Europe

10.1.2.2 U.K.

10.1.2.2.1 Government Initiatives to Implement Capsule Endoscopy Facilities Supporting the Growth of Ingestible Sensors in the U.K.

10.1.2.3 France

10.1.2.3.1 Favorable Reimbursement Scenario for Capsule Endoscopy Procedures Drives Demand for Ingestible Sensors in France

10.1.2.4 Germany

10.1.2.4.1 Remote Patient Monitoring has A Growing Scope in Germany During the Forecast Period

10.1.2.5 Rest of Europe

10.1.3 APAC

10.1.3.1 Japan

10.1.3.1.1 Government Recommendations for Insurance Reimbursement SPUR Demand for Ingestible Sensors in Japan

10.1.3.2 China

10.1.3.2.1 China, the Second-Largest Medical Device Market in the World, Presents Lucrative Opportunities for Expansion

10.1.3.3 Rest of APAC

10.1.4 Middle East & Africa and Latin America

10.1.4.1 MEA & Latin America are Among the Major Regions Contributing to the Research and Design of Ingestible Sensors

11 Competitive Landscape (Page No. - 82)

11.1 Overview

11.2 Market Ranking Analysis for the Players in the Ingestible Sensors Market, 2015

11.3 Competitive Scenario

11.4 New Product Launches

11.5 Agreements & Collaborations

11.6 Investment & Funding

12 Company Profiles (Page No. - 87)

12.1 Proteus Digital Health, Inc.

(Overview, Products and Services, Financials, Strategy & Development)*

12.2 Capsovision Inc.

12.3 Given Imaging Ltd

12.4 Olympus Corporation

12.5 Medimetrics Personalized Drug Delivery B.V.

12.6 HQ, Inc.

12.7 MC10, Inc.

12.8 Microchips Biotech, Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 99)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (35 Tables)

Table 1 Ingestible Sensor Market, By Component, 2013–2022 (USD Million)

Table 2 Market, By Sensor Type, 2013–2022 (USD Million)

Table 3 Temperature Sensors Market, By Vertical, 2013–2022 (USD Million)

Table 4 Temperature Sensor Market, By Medical Application, 2013–2022, (USD Million)

Table 5 Pressure Sensor Market, By Medical Application, 2013–2022 (USD Million)

Table 6 PH Sensor Market, By Medical Application, 2013–2022 (USD Million)

Table 7 Image Sensor Market, By Medical Application, 2013–2022 (USD Million)

Table 8 Market, By Vertical, 2013–2022 (USD Million)

Table 9 Market in Medical Vertical, By Sensor Type, 2013–2022 (USD Million)

Table 10 Market in Medical Vertical, By Region, 2013–2022 (USD Million)

Table 11 Market in Medical Vertical, By Application, 2013–2022 (USD Million)

Table 12 Market for Diagnosis Application, By Region, 2013–2022 (USD Million)

Table 13 Market for Diagnosis Application, By Sensor Type, 2013–2022 (USD Million)

Table 14 Market for Patient Monitoring Application, By Region, 2013–2022 (USD Million)

Table 15 Market for Patient Monitoring Application, By Sensor Type, 2013–2022 (USD Million)

Table 16 Market for Drug Delivery Application, By Region, 2013–2022 (USD Million)

Table 17 Market for Drug Delivery Application, By Sensor Type, 2013–2022 (USD Million)

Table 18 Market for Sports & Fitness Vertical, By Region, 2013–2022 (USD Million)

Table 19 Market in Other Verticals, By Region, 2013–2022 (USD Million)

Table 20 Market, By Region, 2013–2022 (USD Million)

Table 21 Market in North America, By Country, 2013–2022 (USD Million)

Table 22 Market in North America, By Vertical, 2013–2022 (USD Million)

Table 23 Market in North America, By Medical Application, 2013–2022 (USD Million)

Table 24 Ingestible Sensors Market in Europe, By Country, 2013–2022 (USD Million)

Table 25 Market in Europe, By Vertical, 2013–2022 (USD Million)

Table 26 Market in Europe, By Medical Application, 2013–2022 (USD Million)

Table 27 Market in APAC, By Country, 2013–2022 (USD Million)

Table 28 Market in APAC, By Vertical, 2013–2022 (USD Million)

Table 29 Market in APAC, By Medical Application, 2013–2022 (USD Million)

Table 30 Market in MEA & Latin America, By Region, 2013–2022 (USD Million)

Table 31 Market in MEA & Latin America, By Vertical, 2013–2022 (USD Million)

Table 32 Market in MEA & Latin America, By Medical Application, 2013–2022 (USD Million)

Table 33 New Product Launches

Table 34 Agreements & Collaborations

Table 35 Investment & Funding

List of Figures (49 Figures)

Figure 1 Ingestible Sensors Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Market Breakdown & Data Triangulation

Figure 5 Ingestible Sensors Market, By Sensor Type, 2016 and 2022 (USD Million)

Figure 6 Medical Vertical to Offer Lucrative Growth Opportunities During the Forecast Period

Figure 7 Market, By Medical Application, 2016 vs 2022

Figure 8 Market, Geographic Snapshot, 2015

Figure 9 Medication Adherence is the Key Factor Driving the Ingestible Sensors Market During the Forecast Period

Figure 10 Temperature Sensor to Hold Largest Market Share During the Forecast Period

Figure 11 Japan Held the Largest Share of the Ingestible Sensors Market in APAC

Figure 12 MEA & Latin America to Grow at the Highest CAGR During the Forecast Period

Figure 13 Medical Vertical to Dominate the Ingestible Sensor Market During the Forecast Period

Figure 14 Aging Population, Lifestyle Diseases, and Medical Tourism Would SPUR the Demand for Ingestible Sensors

Figure 15 Percentage of World Population of Major Countries, 2014

Figure 16 Per Capita Healthcare Expenditure of Major Countries, 2011–2013, (USD)

Figure 17 Ingestible Sensors: Vale Chain Analysis

Figure 18 Digital Medicine is the Key Trend Among Industry Players

Figure 19 Porter’s Five Forces Analysis

Figure 20 Porter’s Five Forces Impact Analysis, 2015

Figure 21 Bargaining Power of Suppliers in Ingestible Sensors Market, 2015

Figure 22 Bargaining Power of Buyers in Ingestible Sensor Market, 2015

Figure 23 Threat of New Entrants in Ingestible Sensor Market, 2015

Figure 24 Threat of Substitutes in Ingestible Sensor Market, 2015

Figure 25 Intensity of Rivalry in Ingestible Sensors Market, 2015

Figure 26 Ingestible Sensors Market, By Component

Figure 27 Market, By Component, (2016–2020)

Figure 28 Ingestible Sensors Market, By Sensor Type

Figure 29 Growing Demand for Capsule Endoscopy to Drive the Image Sensor Market During the Forecast Period

Figure 30 Diagnosis Application to Dominate the PH Sensor Market During the Forecast Period

Figure 31 Ingestible Sensors Market, By Vertical

Figure 32 Temperature Sensors to Dominate the Medical Vertical During the Forecast Period

Figure 33 Drug Delivery Application to Grow at the Highest CAGR Between 2016 and 2022

Figure 34 Temperature Sensors to Hold the Largest Market Size for Drug Delivery Application During the Forecast Period

Figure 35 Market, By Geography

Figure 36 Ingestible Sensors Market: Geographical Snapshot (2016–2022)

Figure 37 North America: Geographic Snapshot

Figure 38 Europe: Geographical Snapshot

Figure 39 APAC Ingestible Sensors Market Driven By Large Population Base & Government’s Economy Modernization Initiatives APAC

Figure 40 MEA & Latin America: Geographic Snapshot

Figure 41 Companies Adopted New Product Launches as the Key Growth Stratgy in the Ingestible Sensors Market

Figure 42 Market Evaluation Framework: New Product Launches Fuelled Growth & Innovation in 2015

Figure 43 Battle for Market Share: New Products Launches & Partnerships Were the Key Strategy

Figure 44 Proteus Digital Health, Inc.: SWOT Analysis

Figure 45 Capsovision Inc.: SWOT Analysis

Figure 46 Olympus Corporation: Company Snapshot

Figure 47 Olympus Corporation: SWOT Analysis

Figure 48 Marketsandmarkets Knowledge Store Snapshot

Figure 49 Marketsandmarkets Knowledge Store: Semiconductor & Electronics Industry Snapshot

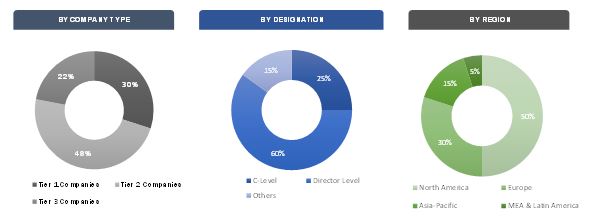

The research methodology used to estimate and forecast the ingestible sensor market begins with capturing the data on key ingestible sensor manufacturers through secondary research. The vendors’ offering and their current product portfolio are also considered for this estimation. The final estimation has been made by identifying the percentage share of ingestible sensors in the miniaturized biosensors market for medical, sports and fitness, and other verticals including firefighting, military, animal care, astronautics, and mining, using the bottom-up approach. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting interviews with key experts such as CEOs, VPs, directors, product managers, and others. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in this industry are HQ, Inc. (U.S.) and Proteus Digital Health, Inc. (U.S.). System integrators such as CapsoVision, Inc. (U.S.), Given Imaging, Ltd. (Israel), Medimetrics Personalized Drug Delivery B.V. (Netherlands), and Olympus Corporation (Japan).

Key Target Audience

- Pharmaceutical companies

- Healthcare providers (diagnosis centre, clinics, healthcare researchers)

- Government bodies

- Medical councils

- Sports & physical fitness research institutions

“The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next two to five years for prioritizing the efforts and investments.”

Scope of the Report

The research report segments the ingestible sensor market into the following submarkets:

By Component:

- Sensor

- Data recorder

- Software

By Sensor Type:

- Temperature sensor

- Pressure sensor

- pH sensor

- Image sensor

By Vertical:

- Medical/healthcare

- Sports & fitness

- Others

By Geography:

- North America

- Europe

- APAC

- MEA & Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Ingestible Sensor Market

Conducting a project for people with autism in gallery spaces using sensors to create and gather data. Could you provide data for different sensors in this market?