Infrared Search & Track (IRST) System Market by End User (Civil & Defense), Component (Scanning Head, Processing & Control Electronics, Display), Platform (Airborne, Naval, Land & Others) and Region - Global Forecast to 2022

The Infrared Search & Track system market is projected to grow from an estimated USD 4.47 Billion in 2017 to USD 5.95 Billion by 2022, at a CAGR of 5.88% from 2017 to 2022. The objective of this study is to analyze, define, describe, and forecast the IRST system market based on end user, platform, component, and region. The report also focuses on the competitive landscape of this market by profiling companies based on their financial positions, product portfolios, growth strategies, and analyzing their core competencies and market shares to anticipate the degree of competition prevailing in the market. This report also tracks and analyzes competitive developments, such as partnerships, mergers & acquisitions, new product developments, and Research & Development (R&D) activities in the IRST system market. The base year considered for this study is 2016 and the forecast period is from 2017 to 2022.

The IRST system market is estimated to be USD 4.47 Billion in 2017 and is projected to reach USD 5.95 Billion by 2022, at a CAGR of 5.88% during the forecast period. Increasing need for enhanced situational awareness and enhanced security and immunity over radars are the major factors expected to drive the market in the coming years.

On the basis of end user, the IRST system market has been segmented into civil and defense. The defense segment leads the market in terms of market size, and is expected to continue to lead over the next five years. The use of passive situation awareness system by defense forces is growing at a rapid pace across the globe. Growth of the defense segment is mainly attributed to the rising number of aircraft modernization programs, increasing procurement of military equipment, and rise in defense budgets globally.

On the basis of platform, the IRST system market has been segmented into airborne, naval, land, and others. The airborne segment leads the market in terms of market size, is expected to continue to lead over the next five years, and is projected to grow at the highest CAGR during the forecast period. The growth of the airborne segment at a high rate is attributed to increase in defense aircraft modernization programs and use of better passive systems to search and detect in airborne platforms.

On the basis of component, the IRST system market has been segmented into scanning head, processing & control electronics, control & display. The scanning head segment leads the market in terms of market size, and is expected to continue to lead over the next five years. However, the processing & control electronics segment is projected to grow at the highest CAGR during the forecast period. There has been an increasing demand for infrared based devices for aircraft, so better processing electronics are required to sense and get better feedback out of each and every IR signature emitted from aircraft.

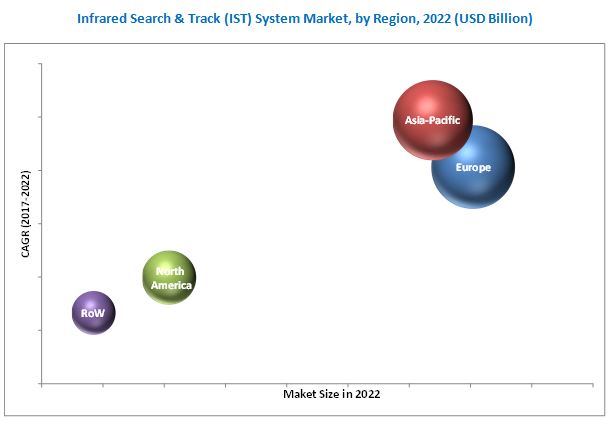

Europe is estimated to lead the IRST system market in 2017. Countries in this region include the U.K., France, Germany, Russia, Sweden and Rest of Europe. Factors contributing to the leading position are defense aircraft modernization programs and increasing demand for situational awareness.

Restricted defense budgets of developed countries is a major restraint for the growth of the IRST system market. The life cycle of the IRST system is 15-20 years; these systems are upgraded post the mentioned timeframe. Therefore, the market is prone to remain stagnant in terms of technology for a long time.

Several major players are present in the IRST system market. Some of these players are Lockheed Martin Corporation (U.S.), Thales Group (France), Safran S.A. (France), Rheinmetall AG. (Germany), Aselsan A.S. (Turkey), Leonardo S.p.A. (Italy), Northrop Grumman Corporation (U.S.), and HGH Systemes Infrarouges SAS (France), among others. Contracts has been the key growth strategy adopted by the major players in the IRST system market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

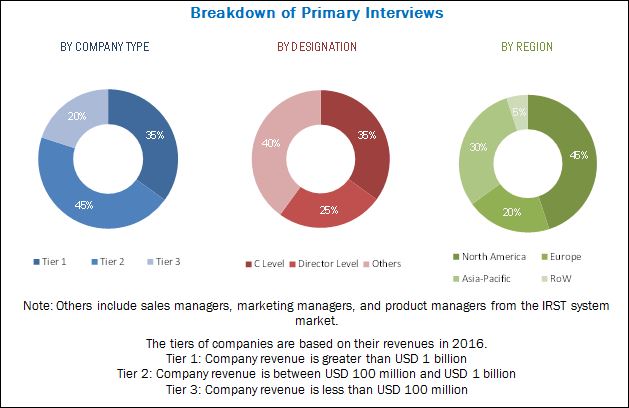

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increase in Military Spending of Emerging Countries

2.2.2.2 Global Militarization Index

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Infrared Search & Track (IRST) System Market

4.2 Market, By End User

4.3 Market, By Component

4.4 Market, By Platform

4.5 Scanning Head Component Segment, By Subsegment

4.6 Market Share and Growth Analysis, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Platform

5.2.2 By End User

5.2.3 By Component

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Need for Enhanced Situational Awareness

5.3.1.2 Enhanced Security and Immunity Over Radars

5.3.2 Restraints

5.3.2.1 Restricted Defense Budget of Developed Countries

5.3.3 Opportunities

5.3.3.1 Increased Focus on Military Modernization

5.3.4 Challenges

5.3.4.1 Limited Operational Range of IRST System

5.3.4.2 Proven Capability and Fidelity of Radars

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Future Trends

6.3 Technology Trends

6.3.1 Infrared Technologies

6.3.2 Thermally Cooled Infrared Devices

6.3.3 Forward Looking Infrared Technology

6.3.4 Multispectral and Hyperspectral Infrared Technology

6.4 Patent/ Patent Applications

7 Infrared Search and Track (IRST) System Market, By End User (Page No. - 43)

7.1 Introduction

7.2 Defense

7.3 Civil

8 Infrared Search & Track (IRST) System Market, By Component (Page No. - 46)

8.1 Introduction

8.2 Scanning Head

8.2.1 Infrared (IR) Module

8.2.2 Laser Range Finder (LRF)

8.2.3 Optics

8.3 Processing & Control Electronics

8.4 Display

9 Infrared Search & Track (IRST) System Market, By Platform (Page No. - 50)

9.1 Introduction

9.2 Airborne

9.2.1 Military Aircraft

9.2.1.1 Trainer Aircraft

9.2.1.2 Combat Aircraft

9.2.1.3 Special Mission Aircraft

9.2.2 Unmanned Aerial Vehicle (UAV)

9.2.2.1 Tactical UAV

9.2.2.2 Strategic UAV

9.2.2.3 Special Purpose UAV

9.3 Naval

9.3.1 Offshore Patrol Vessel (OPV)

9.3.2 Destroyers

9.3.3 Frigates

9.3.4 Amphibious Warships

9.3.5 Corvettes

9.3.6 Fast Attack Craft (FAC)

9.3.7 Cruisers

9.3.8 Aircraft Carriers

9.4 Land

9.5 Others

10 Regional Analysis (Page No. - 59)

10.1 Introduction

10.2 By Region

10.3 Europe

10.3.1 By Platform

10.3.2 By End User

10.3.3 By Component

10.3.4 By Country

10.3.4.1 Russia

10.3.4.1.1 By Platform

10.3.4.1.2 By End User

10.3.4.1.3 By Component

10.3.4.2 France

10.3.4.2.1 By Platform

10.3.4.2.2 By End User

10.3.4.2.3 By Component

10.3.4.3 Germany

10.3.4.3.1 By Platform

10.3.4.3.2 By End User

10.3.4.3.3 By Component

10.3.4.4 Sweden

10.3.4.4.1 By Platform

10.3.4.4.2 By End User

10.3.4.4.3 By Component

10.3.4.5 Rest of Europe

10.3.4.5.1 By Platform

10.3.4.5.2 By End User

10.3.4.5.3 By Component

10.4 Asia-Pacific

10.4.1 By Platform

10.4.2 By End User

10.4.3 By Component

10.4.4 By Country

10.4.4.1 China

10.4.4.1.1 By Platform

10.4.4.1.2 By End User

10.4.4.1.3 By Component

10.4.4.2 India

10.4.4.2.1 By Platform

10.4.4.2.2 By End User

10.4.4.2.3 By Component

10.4.4.3 Japan

10.4.4.3.1 By Platform

10.4.4.3.2 By End User

10.4.4.3.3 By Component

10.4.4.4 Rest of Asia-Pacific

10.4.4.4.1 By Platform

10.4.4.4.2 By End User

10.4.4.4.3 By Component

10.5 North America

10.5.1 By Platform

10.5.2 By End User

10.5.3 By Component

10.5.4 By Country

10.5.4.1 U.S.

10.5.4.1.1 By Platform

10.5.4.1.2 By End User

10.5.4.1.3 By Component

10.5.4.2 Canada

10.5.4.2.1 By Platform

10.5.4.2.2 By End User

10.5.4.2.3 By Component

10.6 Rest of the World (RoW)

10.6.1 By Platform

10.6.2 By End User

10.6.3 By Component

10.6.4 By Country

10.6.4.1 Saudi Arabia

10.6.4.1.1 By Platform

10.6.4.1.2 By End User

10.6.4.1.3 By Component

10.6.4.2 Brazil

10.6.4.2.1 By Platform

10.6.4.2.2 By End User

10.6.4.2.3 By Component

10.6.4.3 Others

11 Competitive Landscape (Page No. - 88)

11.1 Introduction

11.1.1 Vanguards

11.1.2 Innovator

11.1.3 Dynamic

11.1.4 Emerging

11.2 Competitive Benchmarking

11.2.1 Analysis of Product Portfolio of Major Players in the Market

11.2.2 Business Strategies Adopted By Major Players in the Market

12 Company Profiles (Page No. - 92)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

12.1 Leonardo S.P.A.

12.2 Thales Group

12.3 Rheinmetall AG

12.4 Aselsan A.S.

12.5 Safran S.A.

12.6 Lockheed Martin Corporation

12.7 Northrop Grumman Corporation

12.8 HGH Systèmes Infrarouges

12.9 Tonbo Imaging Private Limited

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 115)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (70 Tables)

Table 1 Segment Definition, By Platform

Table 2 Segment Definition, By End User

Table 3 Segment Definition, By Component

Table 4 Innovation & Patent Registrations, 2000-2017

Table 5 IRST System Market Size, By End User, 2015-2022 (USD Million)

Table 6 Defense Segment, By Region, 2015-2022 (USD Million)

Table 7 Civil Segment, By Region, 2015-2022 (USD Million)

Table 8 IRST System Market Size, By Component, 2015-2022 (USD Million)

Table 9 Scanning Head Segment, By Subsegment, 2015–2022 (USD Million)

Table 10 IRST System Market Size, By Platform, 2015-2022 (USD Million)

Table 11 Airborne Segment, By Subsegment, 2015-2022 (USD Million)

Table 12 Military Aircraft Subsegment, By Aircraft Type, 2015-2022 (USD Million)

Table 13 UAV Segment, By Type, 2015-2022 (USD Million)

Table 14 Naval Segment, By Subsegment, 2015-2022 (USD Million)

Table 15 IRST System Market Size, By Region, 2015-2022 (USD Million)

Table 16 Europe IRST System Market Size, By Platform, 2015-2022 (USD Million)

Table 17 Europe Market Size, By End User, 2015-2022 (USD Million)

Table 18 Europe Market Size, By Component, 2015-2022 (USD Million)

Table 19 Europe Market Size, By Country, 2015-2022 (USD Million)

Table 20 Russia Market Size, By Platform, 2015-2022 (USD Million)

Table 21 Russia Market Size, By End User, 2015-2022 (USD Million)

Table 22 Russia Market Size, By Component, 2015-2022 (USD Million)

Table 23 France Market Size, By Platform, 2015-2022 (USD Million)

Table 24 France Market Size, By End User, 2015-2022 (USD Million)

Table 25 France Market Size, By Component, 2015-2022 (USD Million)

Table 26 Germany Market Size, By Platform, 2015-2022 (USD Million)

Table 27 Germany Market Size, By End User, 2015-2022 (USD Million)

Table 28 Germany Market Size, By Component, 2015-2022 (USD Million)

Table 29 Sweden Market Size, By Platform, 2015-2022 (USD Million)

Table 30 Sweden Market Size, By End User, 2015-2022 (USD Million)

Table 31 Sweden Market Size, By Component, 2015-2022 (USD Million)

Table 32 Rest of Europe Market Size, By Platform, 2015-2022 (USD Million)

Table 33 Rest of Europe Market Size, By End User, 2015-2022 (USD Million)

Table 34 Rest of Europe Market Size, By Component, 2015-2022 (USD Million)

Table 35 Asia-Pacific Market Size, By Platform, 2015-2022 (USD Million)

Table 36 Asia-Pacific Market Size, By End User, 2015-2022 (USD Million)

Table 37 Asia-Pacific Market Size, By Component, 2015-2022 (USD Million)

Table 38 Asia-Pacific Market Size, By Country, 2015-2022 (USD Million)

Table 39 China IRST System Market Size, By Platform, 2015-2022 (USD Million)

Table 40 China IRST System Market Size, By End User, 2015-2022 (USD Million)

Table 41 China IRST System Market Size, By Component, 2015-2022 (USD Million)

Table 42 India IRST System Market Size, By Platform, 2015-2022 (USD Million)

Table 43 India IRST System Market Size, By End User, 2015-2022 (USD Million)

Table 44 India IRST System Market Size, By Component, 2015-2022 (USD Million)

Table 45 Japan IRST System Market Size, By Platform, 2015-2022 (USD Million)

Table 46 Japan IRST System Market Size, By End User, 2015-2022 (USD Million)

Table 47 Japan IRST System Market Size, By Component, 2015-2022 (USD Million)

Table 48 Rest of Asia-Pacific IRST System Market Size, By Platform, 2015-2022 (USD Million)

Table 49 Rest of Asia-Pacific IRST System Market Size, By End User, 2015-2022 (USD Million)

Table 50 Rest of Asia-Pacific IRST System Market Size, By Component, 2015-2022 (USD Million)

Table 51 North America IRST System Market Size, By Platform, 2015-2022 (USD Million)

Table 52 North America IRST System Market Size, By End User, 2015-2022 (USD Million)

Table 53 North America IRST System Market Size, By Component, 2015-2022 (USD Million)

Table 54 North America IRST System Market Size, By Country, 2015-2022 (USD Million)

Table 55 U.S. IRST System Market Size, By Platform, 2015-2022 (USD Million)

Table 56 U.S. IRST System Market Size, By End User, 2015-2022 (USD Million)

Table 57 U.S. IRST System Market Size, By Component, 2015-2022 (USD Million)

Table 58 Canada IRST System Market Size, By Platform, 2015-2022 (USD Million)

Table 59 Canada IRST System Market Size, By End User, 2015-2022 (USD Million)

Table 60 Canada IRST System Market Size, By Component, 2015-2022 (USD Million)

Table 61 RoW IRST System Market Size, By Platform, 2015-2022 (USD Million)

Table 62 RoW IRST System Market Size, By End User, 2015-2022 (USD Million)

Table 63 RoW IRST System Market Size, By Component, 2015-2022 (USD Million)

Table 64 RoW IRST System Market Size, By Country, 2015-2022 (USD Million)

Table 65 Saudi Arabia IRST System Market Size, By Platform, 2015-2022 (USD Million)

Table 66 Saudi Arabia IRST System Market Size, By End User, 2015-2022 (USD Million)

Table 67 Saudi Arabia IRST System Market Size, By Component, 2015-2022 (USD Million)

Table 68 Brazil IRST System Market Size, By Platform, 2015-2022 (USD Million)

Table 69 Brazil IRST System Market Size, By End User, 2015-2022 (USD Million)

Table 70 Brazil IRST System Market Size, By Component, 2015-2022 (USD Million)

List of Figures (37 Figures)

Figure 1 Research Process Flow

Figure 2 Infrared Search & Track (IRST) System Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Increasing Defense Budgets of Emerging Countries, 2005 & 2016 (USD Billion, %)

Figure 5 Global Militarization Index Score, By Country, 2016

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 Assumptions of the Research Study

Figure 10 Europe is Estimated to Account for the Largest Share of the IRST System Market in 2017

Figure 11 Based on Platform, the Airborne Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Based on End User, the Defense Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 13 Based on Component, the Processing & Control Electronics Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Need for Enhanced Situational Awareness, and Improved Security and Immunity Against Radars are Expected to Drive the IRST System Market During the Forecast Period

Figure 15 Defense End User Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Based on Component, the Scanning Head Segment is Projected to Lead the IRST System Market During the Forecast Period

Figure 17 Based on Platform, the Airborne Segment is Projected to Lead the IRST System Market During the Forecast Period

Figure 18 The Infrared (IR) Module Subsegment is Projected to Lead the Scanning Head Component Segment During the Forecast Period

Figure 19 Asia-Pacific is Projected to Be the Fastest-Growing Market for IRST System During the Forecast Period

Figure 20 Infrared Search & Track (IRST) System Market Segmentation, By Platform

Figure 21 Infrared Search & Track (IRST) System Market Segmentation, By End User

Figure 22 Infrared Search & Track (IRST) System Market Segmentation, By Component

Figure 23 Market Dynamics for Infrared Search & Track (IRST) System Market

Figure 24 Defense Segment Projected to Grow at A Higher CAGR During the Forecast Period

Figure 25 Airborne Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Europe Estimated to Account for the Largest Share of the IRST System Market in 2017

Figure 27 Europe IRST System Market Snapshot

Figure 28 Asia-Pacific IRST System Market Snapshot

Figure 29 North America IRST System Market Snapshot

Figure 30 Dive Chart

Figure 31 Leonardo S.P.A.: Company Snapshot

Figure 32 Thales Group: Company Snapshot

Figure 33 Rheinmetall AG: Company Snapshot

Figure 34 Aselsan A.S.: Company Snapshot

Figure 35 Safran S.A.: Company Snapshot

Figure 36 Lockheed Martin Corporation: Company Snapshot

Figure 37 Northrop Grumman Corporation: Company Snapshot

The research methodology used to estimate and forecast the IRST system market includes the study of data and revenues of key market players through secondary resources, such as annual reports, Yahoo Finance, Federal Aviation Administration (FAA), International Civil Aviation Organization (ICAO), International Air Transport Association (IATA), and Stockholm International Peace Research Institute (SIPRI). The bottom-up procedure was employed to arrive at the overall size of the IRST system market from the revenues of key players in the market. After arriving at the overall market size, the IRST system market was split into several segments and sub segments, which were then verified through primary research by conducting extensive interviews with key industry experts, such as CEOs, VPs, directors, executives, and engineers. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primaries is shown in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The ecosystem of the IRST system market has been segmented based on end user, platform, component and region. The key players operating in the IRST system market include component suppliers, Leonardo S.p.A. (Italy), Thales Group (France), Rheinmetall AG. (Germany), Lockheed Martin Corporation (U.S.), and Northrop Grumman Corporation (U.S.), among others. Contracts, new product launches, agreements, and acquisitions are the major strategies adopted by key players in the IRST system market.

Target Audience for this Report

- Manufacturers of IRST systems

- Original Equipment Manufacturers (OEMs)

- Sub-component Manufacturers

- Technology Support Providers

- Government and Certification Bodies

“This study answers several questions for stakeholders, primarily, which market segments they need to focus upon during the next two to five years to prioritize their efforts and investments.”

Scope of the Report:

IRST System Market, By End User

- Civil

- Defense

Market, By Platform

- Airborne

- Naval

- Land

- Others

Market, By Component

- Scanning Head

- Processing Unit

- Control & Display Unit

Market, By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for this report:

-

Geographic analysis

- Further breakdown of the Rest of the World market

-

Company information

- Detailed analysis and profiles of additional market players (up to five)

- Additional level segmentation

Growth opportunities and latent adjacency in Infrared Search & Track (IRST) System Market