Inert Gas Generator System (IGGS) Market by Type (Marine, Aviation, Industrial), Component (Aviation IGGS Component, Marine IGGS Component, Industrial IGGS component), End User (Aviation, Marine, Industrial), Fit (OEM Fit, Retrofit), and Region - Global Forecast to 2022

[129 Pages Report] The Inert Gas Generator System (IGGS) market was valued at USD 606.0 Million in 2016 and is projected to reach USD 2,121.0 Million by 2022, at a CAGR of 23.22% during the forecast period. Factors such increasing commercial aircraft & military cargo aircraft procurement as well as retrofitting of IGGS on existing aircraft across the world, as well as the increasing military & commercial aircraft procurement by various countries have led to an increase in the demand for aircraft-based IGGS systems. The growth of the market can also be attributed to factors such as the increasing fleet size of marine cargo ships. The increasing cargo ship fleet size due to the growing trade via sea routes has led to a rise in the demand for marine-based IGGS systems. This report forecasts the IGGS market and its dynamics over the next five years. It also identifies the market application gaps, recent developments in the market, and high potential countries. The objectives of the report are to study the factors influencing the market, map major industry players, and provide vendor analysis and competitor landscape. The base year considered is 2016 and the forecast period is from 2017 to 2022.

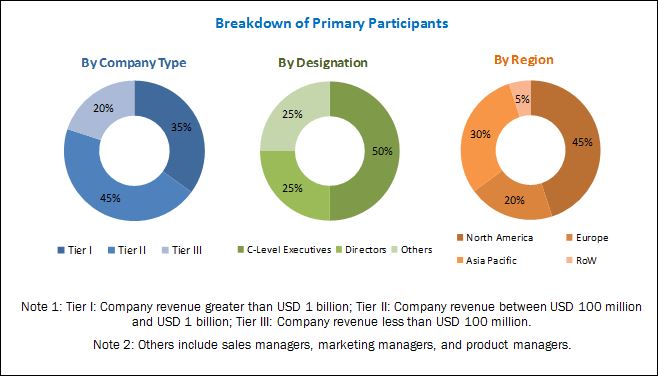

Market size estimations for various segments and subsegments of the IGGS market were arrived at through extensive secondary research and government sources (Federal Aviation Authority, International Air Transport Association, Airport Authority of India, and International Civil Aviation Organization); company websites; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations, among others. Corroboration with primaries and further market triangulation with the help of statistical techniques using econometric tools were carried out. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the IGGS market comprises manufacturers, component suppliers, raw material suppliers, distributors, service providers, and end users. The key end users of the IGGS market are aviation, marine, and industrial sectors. Key manufacturers in the IGGS market include Parker Hannifin (US), Honeywell (US), and Air Liquide (France).

“This study answers several questions for stakeholders, primarily, which segments they need to focus upon over the next five years to prioritize their efforts and investments.”

Target Audience

- IGGS Manufacturers

- Component Manufacturers

- Aircraft Manufacturers

- Ship Manufacturers

- Oil & Gas Industry

- Food & Beverages Industry

- Chemical Industry

- Electronics Industry (Semiconductor Fabrication Plants)

- Metallurgical Industry

Scope of the report

This research report categorizes the IGGS market into the following segments and subsegments:

- IGGS Market, By Type

- Marine IGGS Type

- Aviation IGGS Type

- Industrial IGGS Type

- IGGS Market, By Component

- Aviation IGGS Component

- Marine IGGS Component

- Industrial IGSS Component

- IGGS Market, By Fit

- OEM Fit

- Retrofit

- IGGS Market, By End User

- Aviation

- Marine

- Industrial

- IGGS Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Customizations available for the report

With the given market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

- Country-level Analysis

- Comprehensive market projections for countries categorized under the Rest of Europe, Rest of Asia Pacific, and Rest of the World

- Company Information

- Detailed analysis and profiles of additional market players (up to five)

The Inert Gas Generator Systems (IGGS) market is estimated to be USD 746.7 Million in 2017 and projected to reach USD 2,121.0 Million by 2022, at a CAGR of 23.22% during the forecast period. The growth of the IGGS market can be attributed to the increasing demand for new commercial aircraft & military cargo aircraft as well as retrofitting of IGGS on existing aircraft across the world. The growth of the market is also attributed to the increasing fleet size of marine cargo ships. The increasing cargo ship size due to the growing trade via sea routes has led to a rise in the demand for marine-based IGGS systems. Increasing application of inert gases in industries such as oil & gas, electronics, pharmaceuticals, metallurgy, and food & beverages is increasing the demand for IGGS system as more companies are installing N2 gas generators.

The IGGS market has been segmented based on type, component, end user, and fit. Based on type, the market has been further segmented into marine IGGS, aviation IGGS, and industrial IGGS. The industrial IGGS segment is projected to lead the market during the forecast period. The increasing installation of on-site inert gas generator systems for industrial N2 gas requirements, along with retrofitting of industrial IGGS, is driving the growth of the industrial IGGS type segment.

Based on component, the IGGS market has been segmented into aviation IGGS components, marine IGGS components, and industrial IGGS components. The industrial IGGS components segment is projected to lead the market during the forecast period owing to the increase in the demand for onsite generated N2 gas via industrial IGGS.

Based on end user, the IGGS market has been segmented into aviation, marine, and industrial. The industrial segment is projected to lead the market during the forecast period owing to the increase in spending on factory-installed nitrogen generators in existing industrial installations and new industrial installations, especially for decreasing dependence on external N2 gas supplier. On the other hand, the marine segment is projected to witness the highest CAGR during the forecast period owing to the increasing demand for new cargo ships worldwide.

Based on fit, the IGGS market has been segmented into OEM fit and retrofit. The OEM fit segment is projected to lead the market during the forecast period owing to the increasing demand for new commercial aircraft in countries such as India and China. Increasing demand for new cargo ships is also fueling the high growth of OEM fit segment.

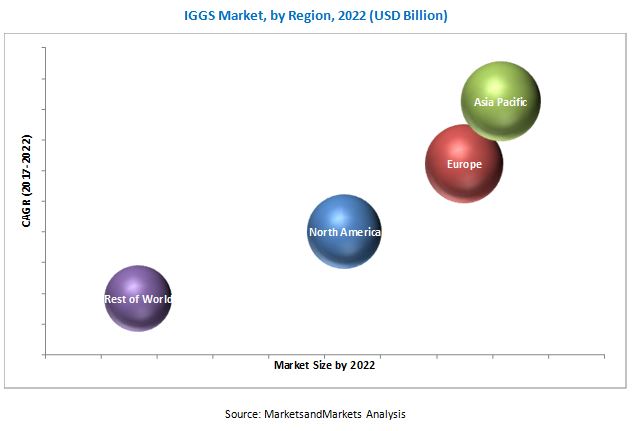

Asia Pacific accounted for the largest share of the IGGS market in 2017, followed by Europe and North America and Rest of World. APAC’s large share can be attributed to the increasing industrialization within the region coupled with the increasing procurement of military cargo & commercial aircraft. China is estimated to be the leading market for IGGS in Asia Pacific in 2017. The reason for China’s dominance over the Asia Pacific IGGS market can be attributed to the country’s increasing development in industrial sector along with the increasing demand for aircraft and shipping cargo vessels.

Major challenges faced by the manufacturers of IGGS are mostly related to the technical aspects of the IGGS. At present, manufacturing an IGGS that works optimally while completely adhering to safety standards and providing purity of nitrogen gas is a challenge for the IGGS providers.

The major players in the IGGS market include Parker Hannifin (US), Honeywell (US), and Air Liquide (France). These manufacturers are mostly focused on acquiring long-term contracts to grow in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the IGGS Market

4.2 IGGS Market, By Type

4.3 IGGS Market, By Component

4.4 Industrial End User Segment, By Subsegment

4.5 IGGS Market, By Fit

4.6 IGGS Market Share and Growth Analysis, By Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Commercial and Military Aircraft Fleet

5.2.1.2 Mandatory Installation of IGGS in Cargo Ships

5.2.2 Restraints

5.2.2.1 Existing Long-Term Contracts With Nitrogen Gas Suppliers

5.2.3 Opportunities

5.2.3.1 Increasing IGGS Adoption in the Industrial Sector

5.2.4 Challenges

5.2.4.1 Low Efficiency of IGGS Systems and Strict Safety Standards

5.2.4.2 Proven Capability of External Industrial Gas Suppliers

5.3 Future Trends

5.4 Technology Trends

5.4.1 Catalytic Inerting Systems for Aircraft

6 Inert Gas Generator Systems (IGGS) Market, By Type (Page No. - 39)

6.1 Introduction

6.2 Industrial IGGS Type

6.3 Aviation IGGS Type

6.4 Marine IGGS Type

6.4.1 Flex Inert System

6.4.2 Dual Fuel Inert Gas Generator

6.4.3 Inert Gas Generator

6.4.4 Inert Gas Deck House Module

7 Inert Gas Generator Systems (IGGS) Market, By Component (Page No. - 43)

7.1 Introduction

7.2 Industrial IGGS Component

7.2.1 Air Separation Module (ASM)

7.2.2 Air Compressor

7.2.3 After Cooler

7.2.4 Surge Tank

7.2.5 Others

7.3 Aviation IGGS Component

7.3.1 Air Separation Module (ASM)

7.3.2 Pressure & Temperature Controller

7.3.3 Filtration Chain

7.3.4 Oxygen Sensor

7.4 Marine IGGS Component

7.4.1 Scrubber

7.4.2 Combustion Chamber

7.4.3 Burner (Main & Auxiliary)

7.4.4 Fuel/Oil Pump

7.4.5 Monitoring Device

7.4.6 Filter (Demister)

8 Inert Gas Generator Systems (IGGS) Market, By Fit (Page No. - 51)

8.1 Introduction

8.2 OEM Fit

8.2.1 Industrial

8.2.2 Aviation

8.2.3 Marine

8.3 Retrofit

8.3.1 Industrial

8.3.2 Aviation

8.3.3 Marine

9 Inert Gas Generator Systems (IGGS) Market, By End User (Page No. - 57)

9.1 Introduction

9.2 Industrial

9.2.1 Oil & Gas Industry

9.2.2 Metallurgical Industry

9.2.3 Chemical Industry

9.2.4 Electronics Industry

9.2.5 Food & Beverages Industry

9.3 Aviation

9.3.1 Commercial Aircraft

9.3.1.1 Narrow Body Aircraft

9.3.1.2 Wide Body Aircraft

9.3.1.2.3 Very Large Aircraft

9.3.1.2.4 Business Jets

9.3.1.2.5 Regional Transport Aircraft

9.3.1.2.6 Light Aircraft

9.3.2 Military Aircraft

9.3.2.1 Rotary Wing

9.3.2.2 Fixed Wing

9.4 Marine

9.4.1 Oil/Chemical Tankers

9.4.2 Product Tankers

9.4.3 Crude Oil Tankers

9.4.4 LPG Tankers

9.4.5 LNG Tankers

10 Regional Analysis (Page No. - 68)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 UK

10.3.2 France

10.3.3 Germany

10.3.4 Russia

10.3.5 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 Rest of Asia Pacific

10.5 Rest of the World

10.5.1 Rest of the World

10.5.2 Brazil

10.5.3 Middle East

11 Company Profiles (Page No. - 101)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Rank Analysis, 2017

11.2 Honeywell International

11.3 Cobham

11.4 Eaton Corporation

11.5 Parker Hannifin Corporation

11.6 Air Liquide

11.7 Onsite Gas Systems

11.8 Wartsila

11.9 Coldharbour Marine

11.10 Novair

11.11 Alfa Laval

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 122)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing KS: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (91 Tables)

Table 1 IGGS Market, By Type, 2015-2022 (USD Million)

Table 2 Marine IGGS Type Segment, By Subtype, 2015-2022 (USD Million)

Table 3 IGGS Market Size, By Component, 2015-2022 (USD Million)

Table 4 Industrial IGGS Component Segment, By Subcomponent, 2015-2022 (USD Million)

Table 5 Aviation IGGS Component Segment, By Subcomponent, 2015-2022 (USD Million)

Table 6 Marine IGGS Component Segment, By Subcomponent, 2015-2022 (USD Million)

Table 7 IGGS Market Size, By Fit, 2015-2022 (USD Million)

Table 8 OEM Fit Segment, By End User 2015-2022 (USD Million)

Table 9 Retrofit Segment, By End User, 2015-2022 (USD Million)

Table 10 IGGS Market Size, By End User, 2015-2022 (USD Million)

Table 11 Industrial Segment, By Industry Type, 2015-2022 (USD Million)

Table 12 Aviation Segment, By Aircraft Type 2015-2022 (USD Million)

Table 13 Commercial Aircraft Subsegment, By Subtype , 2015-2022 (USD Million)

Table 14 Military Aircraft Type Subsegment, By Subtype, 2015-2022 (USD Million)

Table 15 Marine Segment, By Vessel Type, 2015-2022 (USD Billion)

Table 16 IGGS Market Size, By Region, 2015-2022 (USD Million)

Table 17 North America IGGS Market Size, By Type, 2015-2022 (USD Million)

Table 18 North America IGGS Market Size, By End User, 2015-2022 (USD Million)

Table 19 North America IGGS Market Size, By Fit, 2015-2022 (USD Million)

Table 20 North America IGGS Market Size, By Component, 2015-2022 (USD Million)

Table 21 North America IGGS Market Size, By Country, 2015-2022 (USD Million)

Table 22 US IGGS Market Size, By Type, 2015-2022 (USD Million)

Table 23 US IGGS Market Size, By End User, 2015-2022 (USD Million)

Table 24 US IGGS Market Size, By Fit, 2015-2022 (USD Million)

Table 25 US IGGS Market Size, By Component, 2015-2022 (USD Million)

Table 26 Canada IGGS Market Size, By Type, 2015-2022 (USD Million)

Table 27 Canada IGGS Market Size, By End User, 2015-2022 (USD Million)

Table 28 Canada IGGS Market Size, By Fit, 2015-2022 (USD Million)

Table 29 Canada IGGS Market Size, By Component, 2015-2022 (USD Million)

Table 30 Europe IGGS Market, By Type, 2015-2022 (USD Million)

Table 31 Europe IGGS Market Size, By End User, 2015-2022 (USD Million)

Table 32 Europe IGGS Market Size, By Fit, 2015-2022 (USD Million)

Table 33 Europe IGGS Market Size, By Component, 2015-2022 (USD Million)

Table 34 Europe IGGS Market Size, By Country, 2015-2022 (USD Million)

Table 35 UK IGGS Market Size, By Type, 2015-2022 (USD Million)

Table 36 UK IGGS Market Size, By End User, 2015-2022 (USD Million)

Table 37 UK IGGS Market Size, By Fit, 2015-2022 (USD Million)

Table 38 UK IGGS Market Size, By Component, 2015-2022 (USD Million)

Table 39 France IGGS Market Size, By Type, 2015-2022 (USD Million)

Table 40 France IGGS Market Size, By End User, 2015-2022 (USD Million)

Table 41 France IGGS Market Size, By Fit, 2015-2022 (USD Million)

Table 42 France IGGS Market Size, By Component, 2015-2022 (USD Million)

Table 43 Germany IGGS Market Size, By Type, 2015-2022 (USD Million)

Table 44 Germany IGGS market Size, By End User, 2015-2022 (USD Million)

Table 45 Germany IGGS market Size, By Fit, 2015-2022 (USD Million)

Table 46 Germany IGGS market Size, By Component, 2015-2022 (USD Million)

Table 47 Russia IGGS market Size, By Type, 2015-2022 (USD Million)

Table 48 Russia IGGS market Size, By End User, 2015-2022 (USD Million)

Table 49 Russia IGGS market Size, By Fit, 2015-2022 (USD Million)

Table 50 Russia IGGS market Size, By Component, 2015-2022 (USD Million)

Table 51 Rest of Europe IGGS market Size, By Type, 2015-2022 (USD Million)

Table 52 Rest of Europe IGGS market Size, By End User, 2015-2022 (USD Million)

Table 53 Rest of Europe IGGS market Size, By Fit, 2015-2022 (USD Million)

Table 54 Rest of Europe IGGS market Size, By Component, 2015-2022 (USD Million)

Table 55 Asia Pacific IGGS market, By Type, 2015-2022 (USD Million)

Table 56 Asia Pacific IGGS market Size, By End User, 2015-2022 (USD Million)

Table 57 Asia Pacific IGGS market Size, By Fit, 2015-2022 (USD Million)

Table 58 Asia Pacific IGGS market Size, By Component, 2015-2022 (USD Million)

Table 59 Asia Pacific IGGS market Size, By Country, 2015-2022 (USD Million)

Table 60 China IGGS Market Size, By Type, 2015-2022 (USD Million)

Table 61 China IGGS Market Size, By End User, 2015-2022 (USD Million)

Table 62 China IGGS Market Size, By Fit, 2015-2022 (USD Million)

Table 63 China IGGS Market Size, By Component, 2015-2022 (USD Million)

Table 64 India IGGS Market Size, By Type, 2015-2022 (USD Million)

Table 65 India IGGS Market Size, By End User, 2015-2022 (USD Million)

Table 66 India IGGS Market Size, By Fit, 2015-2022 (USD Million)

Table 67 India IGGS Market Size, By Component, 2015-2022 (USD Million)

Table 68 Japan IGGS Market Size, By Type, 2015-2022 (USD Million)

Table 69 Japan IGGS Market Size, By End User, 2015-2022 (USD Million)

Table 70 Japan IGGS Market Size, By Fit, 2015-2022 (USD Million)

Table 71 Japan IGGS Market Size, By Component, 2015-2022 (USD Million)

Table 72 Rest of Asia Pacific Market Size, By Type, 2015-2022 (USD Million)

Table 73 Rest of Asia Pacific Market Size, By End User, 2015-2022 (USD Million)

Table 74 Rest of Asia Pacific Market Size, By Fit, 2015-2022 (USD Million)

Table 75 Rest of Asia Pacific Market Size, By Component, 2015-2022 (USD Million)

Table 76 Rest of the World Market Size, By Type, 2015-2022 (USD Million)

Table 77 Rest of the World Market Size, By End User, 2015-2022 (USD Million)

Table 78 Rest of the World Market Size, By Fit, 2015-2022 (USD Million)

Table 79 Rest of the World Market Size, By Component, 2015-2022 (USD Million)

Table 80 Brazil Market Size, By Type, 2015-2022 (USD Million)

Table 81 Brazil Market Size, By End User, 2015-2022 (USD Million)

Table 82 Brazil Market Size, By Fit, 2015-2022 (USD Million)

Table 83 Brazil Market Size, By Component, 2015-2022 (USD Million)

Table 84 Middle East Market Size, By Type, 2015-2022 (USD Million)

Table 85 Middle East Market Size, By End User, 2015-2022 (USD Million)

Table 86 Middle East Market Size, By Fit, 2015-2022 (USD Million)

Table 87 Middle East Market Size, By Component, 2015-2022 (USD Million)

Table 88 Others Market Size, By Type, 2015-2022 (USD Million)

Table 89 Others Market Size, By End User, 2015-2022 (USD Million)

Table 90 Others Market Size, By Fit, 2015-2022 (USD Million)

Table 91 Others Market Size, By Component, 2015-2022 (USD Million)

List of Figures (45 Figures)

Figure 1 Research Process Flow

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, & Region

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation

Figure 7 The Industrial IGGS Type Segment is Expected to Lead the IGGS Market During the Forecast Period

Figure 8 The Industrial End User Segment is Expected to Lead the IGGS Market During the Forecast Period

Figure 9 The OEM Fit Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 10 The Industrial IGGS Component Segment is Expected to Lead the IGGS Market During the Forecast Period

Figure 11 Asia Pacific is Estimated to Account for the Largest Share of the IGGS Market in 2017

Figure 12 Increased Demand for In-House IGGS is Expected to Drive the IGGS Market During the Forecast Period

Figure 13 The Marine IGGS Type Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 14 The Industrial IGGS Component Segment is Expected to Lead the IGGS Market in 2022

Figure 15 Metallurgical Industry Subsegment is Projected to Lead the Industrial IGGS End User Segment in 2022

Figure 16 The OEM Fit Segment is Projected to Lead the IGGS Market in 2022

Figure 17 India is Projected to Be the Fastest-Growing Market for IGGS During the Forecast Period

Figure 18 Inert Gas Generator Systems Market Dynamics

Figure 19 The Marine IGGS Type Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 20 The Inert Gas Deck House Module Subsegment of the Marine IGGS Type Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 21 The Marine IGGS Component Segment of the IGGS Market is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 22 The ASM Subsegment of the Industrial IGGS Component Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 23 The ASM Subsegment of the Aviation IGGS Component Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 24 The Filter (Demister) Subsegment of the Marine IGGS Component Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 25 The OEM Fit Segment is Projected to Grow at A Higher CAGR During the Forecast Period

Figure 26 The Marine OEM Fit Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 27 The Marine Retrofit Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 28 The Marine End User Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Industrial Segment, By Industry Type, 2017-2022 (USD Million)

Figure 30 Aviation Segment, By Aircraft Type, 2017-2022 (USD Million)

Figure 31 The Narrow Body Aircraft Subtype is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 The Rotary Wing Subtype is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 33 The LNG Tankers Subsegment of the Marine Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 34 Asia Pacific is Estimated to Account for the Largest Share of the IGGS Market in 2017

Figure 35 North America IGGS Market Snapshot

Figure 36 Europe IGGS Market Snapshot

Figure 37 Asia Pacific IGGS Market Snapshot

Figure 38 Revenue and Product-Based Rank Analysis of Top Players in the IGGS Market

Figure 39 Honeywell International .: Company Snapshot

Figure 40 Cobham: Company Snapshot

Figure 41 Eaton: Company Snapshot

Figure 42 Parker Hannifin: Company Snapshot

Figure 43 Air Liquide: Company Snapshot

Figure 44 Wartsila : Company Snapshot

Figure 45 Alfa Laval: Company Snapshot

Growth opportunities and latent adjacency in Inert Gas Generator System (IGGS) Market