Industrial Salt Market by Source (Rock Salt, Natural Brine), Manufacturing Process (Conventional Mining, Vacuum Evaporation, Solar Evaporation), Application (Chemical Processing, De-Icing, Water Treatment, Oil & Gas), and Region - Global Forecast to 2022

The global industrial salts market is expected to grow from USD 12.70 billion in 2017 to USD 14.93 billion by 2022, at a cagr 2.8% from 2017 to 2022. Industrial salts are manufactured by the use of natural resources such as rock salt deposits or natural brine such as sea water and salty lakes. These are produced by conventional mining, vacuum evaporation or solar evaporation processes. Industrial salts are used in the chemical processing, de-icing, water treatment, oil & gas, agriculture among others owing to their availability in large quantities and cost-effectiveness. The base year considered for the study is 2016, and the forecast has been provided for the period between 2017 and 2022.

Market Dynamics

Drivers

- The growth of application areas of industrial salts

- Economic and large availability of salt reserves

Restraints

- Environmental & Health concerns over the usage of salts in certain applications

Opportunities

- Lack of cost-effective substitutes

Challenges

- Cost-intensive logistical operations and leasing of salt mines or salt pans affecting continuous supply

The growth of application areas of industrial salts

The demand for industrial salts is driven by the growth of its application areas. Chemical processing is the major application of industrial salts. Industrial salts are particularly used as raw material in the manufacturing of caustic soda, chlorine, and soda ash. The increasing demand for these chemicals is expected to drive the consumption of industrial salts. High demand for these chemicals is expected in emerging economies such as China and India. Asia-Pacific is projected to be the fastest-growing market for chlor-alkali industry.

The market for industrial salts in Europe is expected to grow slowly as the European chlor-alkali industry is undergoing a transition with the ban on mercury-based technology for caustic soda manufacturing. Several manufacturing facilities are being converted or shut down owing to the transition. However, the market is expected to pick up once the transition is complete. New manufacturing facilities in countries such as Egypt and India would increase the global production capacity of caustic soda, which would boost the market for industrial salts. Similarly, a growing number of water treatment projects are expected to increase the usage of industrial salts.

Several water treatment projects are taken up which would enhance the demand for industrial salts. For instance, in India, as much as 27 water treatment projects are either under construction or in the pre-construction stage. These project would use industrial salts for the purpose of water softening and purification process. Use of industrial salts in de-icing is highly dependent on the geography and regional climatic patterns. Countries with high snowfall expectancy store industrial salts for clearing roadways. Instances of a shortage of salt supply for road de-icing have occurred in the past. Hence, countries have started accumulating more inventories for de-icing applications.

The following are the major objectives of the study.

- To define, describe, and forecast the global industrial salts market in terms of volume and value

- To provide insights regarding significant factors influencing the growth of the industrial salts market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the global industrial salts market on the basis of source, manufacturing process, application, and region

- To analyze the market segmentation and estimated the market size for North America (U.S., Canada, Mexico), Europe (Germany, France, Italy, U.K. and Poland) Asia-Pacific (China, India, Japan, South Korea, and Indonesia), South America (Brazil and Argentina), and the Middle East & Africa (Saudi Arabia, UAE, and South Africa)

- To analyze the opportunities in the industrials salts market for stakeholders and details of the competitive landscape for the market leaders

- To strategically profile critical players in the industrial salts market

- To analyze competitive developments such as new product launches, capacity expansions, and mergers & acquisitions in the industrial salts market

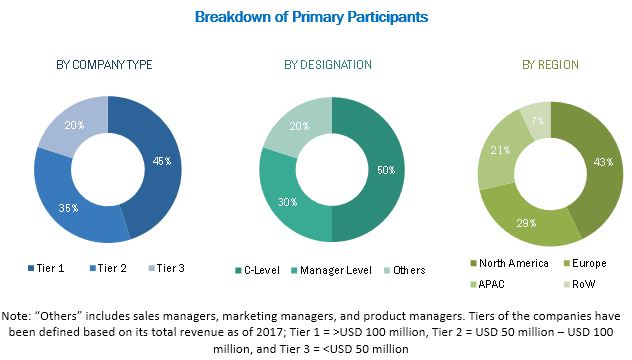

During this research study, major players operating in the industrial salts market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The industrial salts market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the industrial salts market are K+S AG (Germany), Cargill, Inc. (U.S.), Compass Minerals America Inc. (U.S.), China National salt Industry Co. (China), Tata Chemicals Ltd. (India), Mitsui & Co. Ltd. (Japan), Rio Tinto Group (U.K.), COMPAGNIE DU SALINS DU MIDI AND SALINES DE L'EST (France), Dominion Salt Ltd. (New Zealand) and Exportadora de Sal de C.V. (Mexico).

Target Audience

- Suppliers of Raw Materials

- Manufacturers of Industrial salts

- Traders, Distributors, and Suppliers of Industrial salts

- Government & Regional Agencies, Research Organizations, and Investment Research Firms of Composites

Report Scope

By Source Type:

- Rock Salt

- Natural brine

By Manufacturing Process Type

- Conventional Mining

- Solar Evaporation

- Vacuum Pan Evaporation

By Application:

- Chemical Processing

- De-icing

- Water Treatment

- Oil & Gas

- Agriculture

- Others

By Geography

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa

- South America

Critical questions which the report answers

- How is the market scenario for the industrial salts market in the next five years?

- Which are the key players in the market and how intense is the competition?

- What are the strategies adopted by the key players to enhance/maintain their market share?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market in APAC based on application

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The Industrial salts market was valued at USD 12.70 billion in 2016 and is projected to reach USD 14.93 billion by 2022, at a CAGR of 2.8% from 2017 to 2022 Growth of chlor-alkali industry is driving the growth of the Industrial salts market in the chemical processing application. The growing use of Industrial salts for de-icing and water treatment applications are also fueling the growth of the Industrial salts market across the globe. Agriculture and oil & gas among others are the application areas of industrial salts.

Industrial salts are defined as sodium chloride manufactured industrially through extraction from rock salt or sea water. These salts are then further purified and blended with additives according to the requirement of the specific application. Industrial salts find usage in applications such as chemical processing, water treatment, de-icing, agriculture, and oil & gas, among others.

The industrial salts market has been segmented, on the basis of source type, into natural brine and rock salt. The demand for rock salt is expected to grow at the highest CAGR between 2017 and 2022. The growth of this segment of the Industrial salts market can be attributed to the large availability reserves of salt in salt mines. Rock salt is also commonly referred to as mineral "halite." Rock salt generally comprises Sodium chloride with impurities such as gypsum (CaSO4) and sylvite (KCl). Rock salt deposits are found buried underground in arid regions such as dry lake beds, inland marginal seas, enclosed bays, and estuaries. These rock salts are mined either by conventional mining, continuous mining equipment or by solution mining

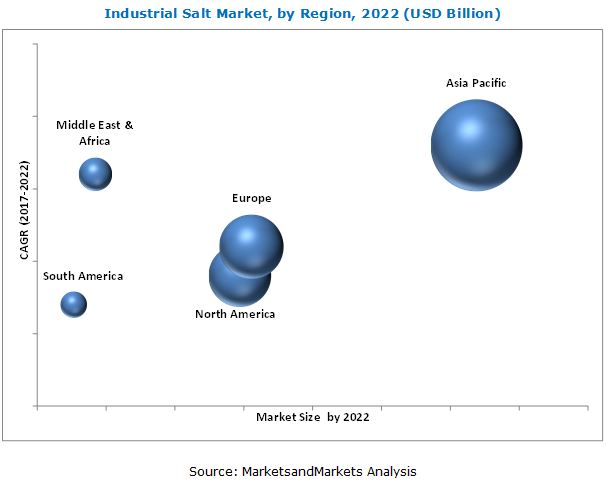

The Asia-Pacific region accounted for the largest share of the industrial salts market in 2016. It was followed by the European region. Increased demand for Industrial salts from the Asia Pacific region can be attributed to the growth in the chemical processing and water treatment sector. Expansions of the chlor-alkali industry, as well as an increasing number of water treatment plants, are expected to drive the growth of the Asia Pacific Industrial salts market during the forecast period.

Industrial salts applications in chemical processing, de-icing, water treatment, oil & gas, and agriculture drive the growth of industrial salts market

Chemical Processing

Industrial salts are used as raw material for the production of different chemicals. Industrial salts in the chemical industry are largely used for the manufacturing of caustic soda, chlorine, and soda ash. The chlor-alkali industry manufactures caustic soda and chlorine by the electrolysis of industrial grade salt.

De-icing

Industrial salts are widely employed as an economical option for the de-icing of roads, platform, and walkways. Industrial salts have the ability to lower the freezing point, thereby, melting the ice. De-icing accounts for the second-largest share of the overall industrial salts market. Industrial salts used for de-icing is of the lowest grade with higher levels of impurities compared to grades used for other applications. Though industrial salts are inexpensive and are non-toxic, Concerns over environment and health in certain application have resulted in a slight decline in their usage. Usage of sodium chloride has resulted in changing the electrolytic balance in plants and trees. The salt is also corrosive in nature, resulting in damage to automotive parts. However, alternatives such as calcium chloride and potassium chloride are expensive and come with their own disadvantages. Innovations such as the use of magnesium chloride liquid along with sodium chloride for improved properties are expected to drive the market for industrial salts in de-icing applications.

Water Treatment

Industrial salts used for water treatment are typically employed in water softening systems. Water softening systems involve a process that effectively removes calcium and magnesium salts from water by ion exchange process using resins. Industrial salts are used for the resin regeneration, which would improve the performance of the resin as well as the system. Salts of different geometries such as coarse, granulated, or salt pellets are used for these purposes. Industrial salts are also used in the treatment of drinking water or swimming pools as a source of chlorine, which serves as disinfectants. Increasing demand for clean water is expected to drive the market for industrial salts in the water treatment application segment.

Oil & Gas

Industrial salts are used as an additive in mud used as drilling fluids. This mud lubricates and also acts as a coolant for the drilling head. Industrial salt obtained from solar evaporation, vacuum pan evaporation, or conventional mining processes are used for this application. The performance of the drilling fluids varies largely on the concentration of salt in the mud. Salt in drilling muds also serves as flocculants, thinners/dispersants, diverting agents, acidizing specialty additives, and stabilizers. With newer oil & gas drilling wells projected to start, the demand for industrial salts is expected to increase.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the global trends in the industrial salts market?

Industrial salts are used in a wide range of applications. However, the use of the same has raised environmental and health concerns. These applications include food processing and de-icing. Industrial salts have been used traditionally in the food processing industry for food preservation and flavoring. However, the use of salts in food processing causes health issues such as increased blood pressure and cardiovascular disease due to the sodium content. Similarly, industrial salts are hygroscopic in nature, and as a result, they absorb moisture which leads to corrosion. This affects the use of industrial salts for de-icing applications as they tend to make roads slippery and causes corrosion of metallic structures and automotive parts

Key players in the market include K+S AG (Germany), Cargill, Inc. (U.S.), Compass Minerals America Inc. (U.S.), China National salt Industry Co. (China), Tata Chemicals Ltd. (India), Mitsui & Co. Ltd. (Japan), Rio Tinto Group (U.K.), COMPAGNIE DU SALINS DU MIDI AND SALINES DE L'EST (France), Dominion Salt Ltd. (New Zealand) and Exportadora de Sal de C.V. (Mexico). These players are increasingly undertaking mergers and acquisitions, and product launches to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Global Industrial Salt Market, By Region and Key Countries

1.4 Years Considered for the Study

1.5 Currency and Pricing

1.6 Units Considered

1.7 Limitations

1.8 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in Industrial Salt Market

4.2 Industrial Salt Market in Asia-Pacific, By Country and Application, 2016

4.3 Industrial Salt Market, By Application

4.4 Industrial Salt Market, By Source

5 Market Overview (Page No. - 39)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Growth of Application Areas of Industrial Salt

5.1.1.2 Cost-Effective and Abundant Availability of Salt Reserves

5.1.2 Restraints

5.1.2.1 Environmental and Health Concerns Over the Usage of Salt in Certain Applications

5.1.3 Opportunities

5.1.3.1 Lack of Cost Effective Substitutes

5.1.4 Challenges

5.1.4.1 High Cost Logistical Operations and Leasing of Salt Mines Or Salt Pans

5.2 Porter’s Five Forces Analysis

5.2.1 Threat of New Entrants

5.2.2 Threat of Substitutes

5.2.3 Bargaining Power of Suppliers

5.2.4 Bargaining Power of Buyers

5.2.5 Intensity of Competitive Rivalry

6 Industrial Salt Market, By Source (Page No. - 48)

6.1 Introduction

6.2 Natural Brine

6.3 Rock Salt

7 Industrial Salt Market, By Manufacturing Process (Page No. - 53)

7.1 Introduction

7.2 Conventional Mining

7.3 Solar Evaporation

7.4 Vacuum Pan Evaporation

8 Industrial Salt Market, By Application (Page No. - 60)

8.1 Introduction

8.2 Chemical Processing

8.2.1 Caustic Soda Manufacturing

8.2.2 Soda Ash Manufacturing

8.3 De-Icing

8.4 Water Treatment

8.5 Oil & Gas

8.6 Agriculture

8.7 Others

9 Industrial Salt Market, By Region (Page No. - 71)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 U.K.

9.3.3 France

9.3.4 Poland

9.3.5 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 South Korea

9.4.5 Indonesia

9.4.6 Rest of Asia-Pacific

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

9.5.4 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

9.7 Introduction

9.8 Competitive Leadership Mapping, Industrial Salt Market

9.8.1 Visionary Leaders

9.8.2 Innovators

9.8.3 Dynamic Differentiators

9.8.4 Emerging Companies

9.9 Overview

9.10 Competitive Benchmarking

9.10.1 Strength of Product Portfolio(25 Players)

9.10.2 Business Strategy Excellence(25 Players)

9.11 Top 4 Industry Players in Industrial Salt Market

9.11.1 K+S AG (Germany)

9.11.2 Cargill, Inc. (The U.S.)

9.11.3 Compass Minerals International Inc. (The U.S.)

9.11.4 China National Salt Industry Corporation (China)

10 Company Profiles (Page No. - 136)

10.1 Cargill, Inc.

10.1.1 Business Overview

10.1.2 Products Offered

10.1.3 Strength of Product Portfolio

10.1.4 Business Strategy Excellence

10.1.5 Recent Developments

10.2 China National Salt Industry Corporation (CNSIC)

10.2.1 Business Overview

10.2.2 Products Offered

10.2.3 Strength of Product Portfolio

10.2.4 Business Strategy Excellence

10.3 Tata Chemicals Ltd.

10.3.1 Business Overview

10.3.2 Products Offered

10.3.3 Strength of Product Portfolio

10.3.4 Business Strategy Excellence

10.3.5 Recent Developments

10.4 Mitsui & Co. Ltd.

10.4.1 Business Overview

10.4.2 Products Offered

10.4.3 Strength of Product Portfolio

10.4.4 Business Strategy Excellence

10.5 Rio Tinto PLC.

10.5.1 Business Overview

10.5.2 Products Offered

10.5.3 Strength of Product Portfolio

10.5.4 Business Strategy Excellence

10.6 Compass Minerals International Inc.

10.6.1 Business Overview

10.6.2 Products Offered

10.6.3 Strength of Product Portfolio

10.6.4 Business Strategy Excellence

10.6.5 Recent Developments

10.7 K+S AG

10.7.1 Business Overview

10.7.2 Products Offered

10.7.3 Strength of Product Portfolio

10.7.4 Business Strategy Excellence

10.7.5 Recent Developments

10.8 Exportadora De Sal De C.V.

10.8.1 Business Overview

10.8.2 Products Offered

10.8.3 Strength of Product Portfolio

10.8.4 Business Strategy Excellence

10.9 Ineos Group Holdings S.A.

10.9.1 Business Overview

10.9.2 Products Offered

10.9.3 Strength of Product Portfolio

10.9.4 Business Strategy Excellence

10.10 CK Life Sciences International Holdings Inc.

10.10.1 Business Overview

10.10.2 Product Offerings

10.10.3 Strength of Product Portfolio

10.10.4 Business Strategy Excellence

10.11 Other Key Players in the Market

10.11.1 Akzonobel N.V.

10.11.2 State Enterprise Arytomsol

10.11.3 Wilson Salt Company

10.11.4 Infosa

10.11.5 Amra Salt Co.

10.11.6 Donald Brown Group

10.11.7 Italkali Societa Italiana Sali Alcalini S.P.A

10.11.8 Wacker Chemie AG

10.11.9 Swiss Saltworks AG

10.11.10 Irish Salt Mining & Exploration Co. Ltd. (I.S.M.E. Co. Ltd.)

10.11.11 Atisale S.P.A.

10.11.12 Dev Salt Pvt. Ltd.

10.11.13 Salins Group

10.11.14 Dominion Salt Ltd

10.11.15 Naikai Salt Industries Co. Ltd.

11 Appendix (Page No. - 163)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Introducing RT: Real Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

List of Tables (158 Tables)

Table 1 Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 2 Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 3 Natural Salt Brine Market Size, By Region, 2015–2022 (USD Million)

Table 4 Natural Salt Brine Market Size, By Region, 2015–2022 (Million Tons)

Table 5 Rock Salt Market Size, By Region, 2015–2022 (USD Million)

Table 6 Rock Salt Market Size, By Region, 2015–2022 (Million Tons)

Table 7 Industrial Salt Market Size, By Manufacturing Process, 2015–2022 (USD Million)

Table 8 Industrial Salt Market Size, By Manufacturing Process, 2015–2022 (Million Tons)

Table 9 Industrial Salt Market Size for Conventional Mining Process, By Region 2015–2022 (USD Million)

Table 10 Industrial Salt Market Size for Conventional Mining Process, By Region 2015–2022 (Million Tons)

Table 11 Industrial Salt Market Size for Solar Evaporation Process, By Region 2015–2022 (USD Million)

Table 12 Industrial Salt Market Size for Solar Evaporation Process, By Region 2015–2022 (Million Tons)

Table 13 Industrial Salt Market Size for Vacuum Pan Evaporation Process, By Region 2015–2022 (USD Million)

Table 14 Industrial Salt Market Size for Vacuum Pan Evaporation Process, By Region 2015–2022 (Million Tons)

Table 15 Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 16 Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 17 Industrial Salt Market Size in Chemical Processing, By Region 2015–2022 (USD Million)

Table 18 Industrial Salt Market Size in Chemical Processing, By Region 2015–2022 (Million Tons)

Table 19 Industrial Salt Market Size in De-Icing, By Region 2015–2022 (USD Million)

Table 20 Industrial Salt Market Size in De-Icing, By Region 2015–2022 (Million Tons)

Table 21 Industrial Salt Market Size in Water Treatment, By Region 2015–2022 (USD Million)

Table 22 Industrial Salt Market Size in Water Treatment, By Region 2015–2022 (Million Tons)

Table 23 Industrial Salt Market Size in Oil & Gas, By Region 2015–2022 (USD Million)

Table 24 Industrial Salt Market Size in Oil & Gas, By Region 2015–2022 (Million Tons)

Table 25 Industrial Salt Market Size in Agriculture, By Region 2015–2022 (USD Million)

Table 26 Industrial Salt Market Size in Agriculture, By Region 2015–2022 (Million Tons)

Table 27 Industrial Salt Market Size in Other Applications, By Region 2015–2022 (USD Million)

Table 28 Industrial Salt Market Size in Other Applications, By Region 2015–2022 (Million Tons)

Table 29 Industrial Salt Market Size, By Region, 2015–2022 (USD Million)

Table 30 Industrial Salt Market Size, By Region, 2015–2022 (Million Tons)

Table 31 North America: Industrial Salt Market Size, By Country, 2015–2022 (USD Million)

Table 32 North America: Industrial Salt Market Size, By Country, 2015–2022 (Million Tons)

Table 33 North America: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 34 North America: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 35 North America: Industrial Salt Market Size, By Manufacturing Process, 2015–2022 (USD Million)

Table 36 North America: Industrial Salt Market Size, By Manufacturing Process, 2015–2022 (Million Tons)

Table 37 North America: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 38 North America: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 39 U.S.: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 40 U.S.: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 41 U.S.: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 42 U.S.: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 43 Canada: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 44 Canada: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 45 Canada: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 46 Canada : Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 47 Mexico: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 48 Mexico: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 49 Mexico: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 50 Mexico: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 51 Europe: Industrial Salt Market Size, By Country, 2015–2022 (USD Million)

Table 52 Europe: Industrial Salt Market Size, By Country, 2015–2022 (Million Tons)

Table 53 Europe: Industrial Salt Market Size, By Manufacturing Process, 2015–2022 (USD Million)

Table 54 Europe: Industrial Salt Market Size, By Manufacturing Process, 2015–2022 (Million Tons)

Table 55 Europe: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 56 Europe: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 57 Europe: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 58 Europe: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 59 Germany: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 60 Germany: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 61 Germany: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 62 Germany: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 63 U.K.: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 64 U.K.: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 65 U.K.: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 66 U.K.: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 67 France: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 68 France: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 69 France: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 70 France: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 71 Italy: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 72 Italy: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 73 Italy: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 74 Italy: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 75 Poland: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 76 Poland: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons )

Table 77 Poland: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 78 Poland: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons )

Table 79 Rest of Europe: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 80 Rest of Europe: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 81 Rest of Europe: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 82 Rest of Europe: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 83 Asia-Pacific: Industrial Salt Market Size, By Country, 2015–2022 (USD Million)

Table 84 Asia-Pacific: Industrial Salt Market Size, By Country, 2015–2022 (Million Tons)

Table 85 Asia-Pacific: Industrial Salt Market Size, By Manufacturing Process, 2015–2022 (USD Million)

Table 86 Asia-Pacific: Industrial Salt Market Size, By Manufacturing Process, 2015–2022 (Million Tons)

Table 87 Asia-Pacific: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 88 Asia-Pacific: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 89 Asia-Pacific: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 90 Asia-Pacific: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 91 China: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 92 China: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 93 China: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 94 China : Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 95 India: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 96 India: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 97 India: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 98 India: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 99 Japan: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 100 Japan: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 101 Japan: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 102 Japan: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 103 South Korea: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 104 South Korea: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 105 South Korea: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 106 South Korea : Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 107 Indonesia: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 108 Indonesia: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 109 Indonesia: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 110 Indonesia: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 111 Rest of Asia-Pacific: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 112 Rest of Asia-Pacific: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 113 Rest of Asia-Pacific: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 114 Rest of Asia-Pacific: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 115 Middle East & Africa: Industrial Salt Market Size, By Country, 2015–2022 (USD Million)

Table 116 Middle East & Africa: Industrial Salt Market Size, By Country, 2015–2022 (Million Tons)

Table 117 Middle East & Africa: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 118 Middle East & Africa: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 119 Middle East & Africa: Industrial Salt Market Size, By Manufacturing Process, 2015–2022 (USD Million)

Table 120 Middle East & Africa: Industrial Salt Market Size, By Manufacturing Process, 2015–2022 (Million Tons)

Table 121 Middle East & Africa: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 122 Middle East & Africa : Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 123 Saudi Arabia: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 124 Saudi Arabia: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 125 Saudi Arabia: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 126 Saudi Arabia : Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 127 UAE: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 128 UAE: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 129 UAE: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 130 UAE: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 131 South Africa: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 132 South Africa: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 133 South Africa: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 134 South Africa: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 135 Rest of Middle East & Africa: Industrial Salt Market Size, By Source, 2015–2022 (USD Million)

Table 136 Rest of Middle East & Africa: Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Table 137 Rest of Middle East & Africa: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 138 Rest of Middle East & Africa: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 139 South America: Industrial Salt Market Size, By Country, 2015–2022 (USD Million)

Table 140 South America: Industrial Salt Market Size, By Country, 2015–2022 (Million Tons)

Table 141 South America: Industrial Salt Market Size, By Source Type, 2015–2022 (USD Million)

Table 142 South America: Industrial Salt Market Size, By Type, 2015–2022 (Million Tons)

Table 143 South America: Industrial Salt Market Size, By Manufacturing Process, 2015–2022 (USD Million)

Table 144 South America: Industrial Salt Market Size, By Manufacturing Process, 2015–2022 (Million Tons)

Table 145 South America: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 146 South America: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 147 Brazil: Industrial Salt Market Size, By Source Type, 2015–2022 (USD Million)

Table 148 Brazil: Industrial Salt Market Size, By Type, 2015–2022 (Million Tons)

Table 149 Brazil: Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Table 150 Brazil: Industrial Salt Market Size, By Application, 2015–2022 (Million Tons)

Table 151 Argentina: Industrial Salt Market Size, By Source Type, 2015–2022 (USD Million)

Table 152 Argentina: Market Size, By Source, 2015–2022 (Million Tons)

Table 153 Argentina: Market Size, By Application, 2015–2022 (USD Million)

Table 154 Argentina: Market Size, By Application, 2015–2022 (Million Tons)

Table 155 Rest of South America: Industrial Salt Market Size, By Source Type, 2015–2022 (USD Million)

Table 156 Rest of South America: Market Size, By Type, 2015–2022 (Million Tons)

Table 157 Rest of South America: Market Size, By Application, 2015–2022 (USD Million)

Table 158 Rest of South America: Market Size, By Application, 2015–2022 (Million Tons)

List of Figures (37 Figures)

Figure 1 Industrial Salt: Market Segmentation

Figure 2 Industrial Salt Market: Research Design

Figure 3 Breakdown of Primary Interviews

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Data Triangulation: Industrial Salt Market

Figure 7 Rock Salt Dominates Overall Industrial Salt Market During the Forecast Period

Figure 8 Vacuum Pan Evaporation Process to Dominate Industrial Salt Market Between 2017 and 2022

Figure 9 Asia-Pacific Dominates Industrial Salt Market and Also Projected to Be the Fastest Growing Market During the Forecast Period

Figure 10 Increasing Demand From Chemical Processing Application to Drive Industrial Salt Market

Figure 11 China Was the Largest Industrial Salt Market in Asia-Pacific, 2016

Figure 12 Chemical Processing to Account for Largest Share of Overall Industrial Salt Market Between 2017 and 2022 (By Volume)

Figure 13 Rock Salt Accounted for Largest Market Share in 2016 (Million Tons)

Figure 14 Asia-Pacific Led Industrial Salt Market in 2016

Figure 15 Factors Governing Industrial Salt Market

Figure 16 Porter’s Five Forces: Industrial Salt Market

Figure 17 Industrial Salt Market Size, By Source, 2015–2022 (Million Tons)

Figure 18 Industrial Salt Market Size, By Manufacturing Process, 2015–2022 (USD Million)

Figure 19 Conventional Mining Process

Figure 20 Solar Evaporation Process

Figure 21 Vacuum Pan Evaporation Process

Figure 22 Industrial Salt Market Size, By Application, 2015–2022 (USD Million)

Figure 23 India and China are Fastest-Growing Industrial Salt Markets

Figure 24 U.S. Dominates North American Industrial Salt Market

Figure 25 Asia-Pacific Market Snapshot: China Dominates Industrial Salt Market in Asia-Pacific

Figure 26 Global Industrial Salt Market- Competitive Leadership Mapping, (2016)

Figure 27 Top Players in Industrial Salt Market, 2016

Figure 28 Cargill Inc.: Company Snapshot

Figure 29 China National Salt Industry Corporation (CNSIC): Company Snapshot

Figure 30 Tata Chemicals Ltd.: Company Snapshot

Figure 31 Mitsui & Co. Ltd.: Company Snapshot

Figure 32 Rio Tinto PLC.: Company Snapshot

Figure 33 Compass Minerals International Inc.: Company Snapshot

Figure 34 K+S AG: Company Snapshot

Figure 35 Exportadora De Sal De C.V.: Company Snapshot

Figure 36 Ineos Group Holding S.A.: Company Snapshot

Figure 37 CK Life Sciences International Holdings Inc.: Company Snapshot

Growth opportunities and latent adjacency in Industrial Salt Market