Industrial Fire Brigade Training Program and Services Market by Training Mode, training Topic, Training Type, Training Level, Industry Vertical, Fire Protection System (Products, Vertical) - Global Forecast to 2022

[161 Pages Report] The industrial fire brigade training program and services market is expected to be worth USD 95.1 Million by 2022, at a CAGR of 8.54% between 2016 and 2022. In this research report, the market is segmented on the basis of region and industry vertical. The North American Market has been segmented on the basis of training mode, training topic, training type, and training level. Furthermore, the industrial fire protection systems market has been segmented on the basis of products and verticals. The growing awareness of the industrial fire brigade to prevent damages caused by fire and the continuous modification of industrial codes are the major factors driving this market. However, the high dependence of the market on the oil and gas industry is a restraint for this market.

Years Considered for this Report:

2015: Base Year

2016: Estimated Year

2022: Forecast Year

2016–2022: Forecast Period

The industrial fire brigade training program and services market is expected to be worth USD 95.1 Million by 2022, at a CAGR of 8.54% between 2016 and 2022. Some key factors driving this market are continuous modification of industrial codes, regulations, and safety standards for industrial fire brigades and growing awareness of the industrial fire brigade to prevent damages caused by fire. The key opportunity for this market is the rising demand for industrial fire brigade training programs from chemical, electrical, manufacturing, and other industries.

The oil and gas and manufacturing vertical is expected to the largest share of the industrial fire brigade training program and services market during the forecast period. The oil and gas industry experiences a large number of fatalities and financial losses due to fires every year. The industry gives special attention to facilitating training to reduce the losses caused by fire. The oil and gas and mining companies often provide suggestions regarding their training requirements to the institutes.

Among all the major products of the industrial fire protection systems market, the fire management market is expected to hold the largest share of this market during the forecast period. The fire analysis market is expected to grow at the highest CAGR in the forecast period owing to the increasing need for sophisticated fire analysis, which helps in proper decision making and fire prevention. The use of fire analysis software and tools helps firefighters and other disaster management companies to take their decisions quickly and more accurately so that the damages from fire can be minimized.

The market for in-house training using in-house instructors in the industrial fire brigade training program and services market is expected to hold the highest share in the forecast period. The reason for this is the advantages offered such as cost saving in terms of training and traveling as well as specific, convenient, and customized training, among others. The market for combination training is expected to grow at the highest rate because combination training enables firefighters to have access to firefighting equipment as well as classrooms for in-class refreshers. They may get to experience both incipient and advanced level firefighting using dry chemicals, water, fog, and foam as extinguishing agents.

The market for exterior firefighting training level in the industrial fire brigade training program and services market is expected to hold the largest share during the forecast period because this course is extensively taken by firefighters where there is a high degree of exterior fire hazards in industry verticals such as oil and gas, mining, electrical utility, and offshore installations. The fees for this course are also higher compared to other training level courses. The market for incipient stage firefighting is expected to grow at the highest rate because incipient firefighting is a prerequisite for entry into the advanced exterior, interior structural, and brigade leader courses.

In terms of geographic regions, North America is expected to hold the largest market share in 2016. The market for industrial fire brigade training program and services is expected to grow exponentially in North America. The industrial fire brigade training programs in this region are mostly governed by the National Fire Protection Association (NFPA) and Occupational Safety and Health Administration (OSHA) standards. Based on the finding of the report published by the NFPA in April 2016, the U.S. administration has mandated the fire protection and safety regulations due to large number of fires at industrial or manufacturing properties each year, leading to loss of human lives and property damage worth millions. The APAC market is expected to grow at the highest rate between 2016 and 2022.

The recent low prices of oil and fossil fuels have placed additional pressure on industry participants to focus on production efficiency, cost reductions, and shortening the shutdown time or turnarounds. Thus, the decrease in the budget allocated for training may affect the industrial fire brigade training programs being conducted in the oil and gas industries to some extent.

The key players in the industrial fire brigade training program market and services include Texas A&M Engineering Extension Service (U.S.), Lakeland College (Canada), Falck (Denmark), Lambton College (Canada), and Oklahoma state University (U.S.), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

6 Industry Trends

7 North America Industrial Fire Brigade Training Program and Services Market

7.1 Market, By Training Type

7.2 Market, By Training Mode

7.3 Market, By Training Level

7.4 Market, By Training Topic

7.5 Market, By Industry Vertical

8 European Market

9 Asia-Pacific Market

10 RoW Market

11 Industrial Fire Protection Systems Overview

12 Competitive Landscape

13 Company Profiles

13.1 Texas A&M Engineering Extension Service

13.2 Lakeland College

13.3 Falck

13.4 Lambton College

13.5 Oklahoma State University

13.6 Fire Service College

13.7 Parkland College

13.8 International Fire Training Center

13.9 Delaware State Fire School

13.10 Sakra Emergency Response Brigade

13.11 Norquest College

13.12 South Carolina Fire Academy

13.13 Louisiana State University

13.14 Petrosafe Technologies

13.15 Nova Scotia Firefighters School

13.16 Cerm

14 Appendix

List of Tables (44 Tables)

3.1 Market, By Region, 2014–2022 (USD Million)

5.1 Drivers

5.2 Restraints

5.3 Opportunities

5.4 Challenges

7.1 Segmentation: By Training Type

7.2 North American Market, By Training Type, 2014–2022 (USD Million)

7.3 Segmentation: By Training Mode

7.4 North American Market, By Training Mode, 2014–2022 (USD Million)

7.5 Segmentation: By Training Level

7.6 North American Market, By Training Level, 2014–2022 (USD Million)

7.7 Segmentation: By Training Topic

7.8 North American Market, By Training Topic, 2014–2022 (USD Million)

7.9 Segmentation: By Industry Vertical

7.1 North American Market, By Industry Vertical, 2014–2022 (USD Million)

8.1 European Market, By Industry Vertical, 2014–2022 (USD Million)

9.1 Asia-Pacific Market, By Industry Vertical, 2014–2022 (USD Million)

10.1 RoW Market, By Industry Vertical, 2014–2022 (USD Million)

11.1 Industrial Fire Protection Systems Market Size, 2014-2022 (USD Million)

11.2 Fire Protection Systems By Product

11.3 Industrial Fire Protection Systems Market Size, By Product, 2014-2022 (USD Million)

11.4 Fire Protection Systems By Vertical

11.5 Industrial Fire Protection Systems Market Size, By Vertical, 2014-2022 (USD Million)

11.6 Industrial Fire Protection Systems in Energy & Power Vertical, By Geography, 2014-2022 (USD Million)

11.7 Industrial Fire Protection Systems in Energy & Power Vertical, By North America, 2014-2022 (USD Million)

11.8 Industrial Fire Protection Systems in Energy & Power Vertical, By Europe, 2014-2022 (USD Million)

11.9 Industrial Fire Protection Systems in Energy & Power Vertical, By APAC, 2014-2022 (USD Million)

11.10 Industrial Fire Protection Systems in Energy & Power Vertical, By RoW, 2014-2022 (USD Million)

11.11 Industrial Fire Protection Systems in Manufacturing Vertical, By Geography, 2014-2022 (USD Million)

11.12 Industrial Fire Protection Systems in Manufacturing Vertical, By North America, 2014-2022 (USD Million)

11.13 Industrial Fire Protection Systems in Manufacturing Vertical, By Europe, 2014-2022 (USD Million)

11.14 Industrial Fire Protection Systems in Manufacturing Vertical, By APAC, 2014-2022 (USD Million)

11.15 Industrial Fire Protection Systems in Manufacturing Vertical, By RoW, 2014-2022 (USD Million)

11.16 Industrial Fire Protection Systems in Oil, Gas & Mining Vertical, By Geography, 2014-2022 (USD Million)

11.17 Industrial Fire Protection Systems in Oil, Gas & Mining Vertical, By North America, 2014-2022 (USD Million)

11.18 Industrial Fire Protection Systems in Oil, Gas & Mining Vertical, By Europe, 2014-2022 (USD Million)

11.19 Industrial Fire Protection Systems in Oil, Gas & Mining Vertical, By APAC, 2014-2022 (USD Million)

11.20 Industrial Fire Protection Systems in Oil, Gas & Mining Vertical, By RoW, 2014-2022 (USD Million)

11.21 Industrial Fire Protection Systems in Other Verticals Vertical, By Geography, 2014-2022 (USD Million)

11.22 Industrial Fire Protection Systems in Other Verticals Vertical, By North America, 2014-2022 (USD Million)

11.23 Industrial Fire Protection Systems in Other Verticals Vertical, By Europe, 2014-2022 (USD Million)

11.24 Industrial Fire Protection Systems in Other Verticals Vertical, By APAC, 2014-2022 (USD Million)

11.25 Industrial Fire Protection Systems in Other Verticals Vertical, By RoW, 2014-2022 (USD Million)

12.1 Market Share Analysis

List of Figures (24 Figures)

3.1 Oil, Gas and Mining to Be the Dominant Vertical in the Industrial Fire Protection System Market

3.2 Fire Management Market to Hold the Largest Share of the Global Industrial Fire Protection Systems Market for the Forecast Period

3.3 Incipient Stage Firefighting Training Level to Grow at the Highest Rate in the Forecast Period

3.4 Classroom and On-Site Training Mode to Hold the Largest Share of the North American Market During the Forecast Period

4.1 North American Market to Witness Prominent Growth Between 2016 and 2022

4.2 Management and Specialist Training to Hold the Major Share of the Training Topic Market in 2016

4.3 Electrical Utitlity Vertical to Grow at the Fastest CAGR During the Forecast Period

4.4 Products to Continue Domiating the Industrial Fire Protection System Market in the Forecast Period

4.5 In-House Training Using In-House Instructors and Combination Training Programs to Dominate the Market During the Forecast Period

5.1 Market Dynamics of Global Market

5.2 Global Market Drivers Impact Analysis

5.3 Global Market Restraints Impact Analysis

5.4 Global Market Opportunities Impact Analysis

5.5 Global Market Challenges Impact Analysis

6.1 Global Market Value Chain Analysis

6.2 Bargaining Power of Buyer

6.3 Bargaining Power of Supplier

6.4 Threat of New Entrant

6.5 Threat of Substitutes

6.6 Intensity of Competitive Rivalry

6.7 Impact Analysis of Porters Analysis

14.1 Marketsandmarkets Knowledge Store Snapshot

14.2 Marketsandmarkets Knowledge Store: Electronics & Semiconductor Industry Snapshot

14.3 Introducing RT: Real Time Market Intelligence

The objective of the report is to define, describe, and forecast the industrial fire brigade training program and services market on the basis of basis of industry vertical as well as North American market on the basis of training mode, training topic, training type, and training level; to forecast the market size in terms of value for various segments with regard to four main regions, namely, North America, Europe, Asia-Pacific, and RoW; to provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges); to study the value chain and analyze the impact of Porter’s five forces on the market; and to analyze the micromarkets with respect to the individual growth trends, future prospects, and contribution to the total market.

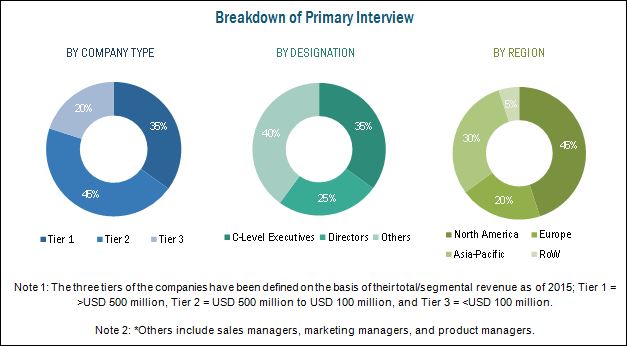

The research methodology used to estimate and forecast this market begins with capturing data on key vendor revenue through secondary sources such as National Fire Protection Association (U.S.) and Fire Protection Association (U.K.), among others. The vendor offerings are also taken into consideration to determine the market segmentation. A combination of top-down and bottom-up procedures has been employed to arrive at the overall size of the industrial fire brigade training program and services market from the revenues of key players in the market. After arriving at the overall market size, the total market has been split into several segments and sub segments which have been verified through the primary research by conducting extensive interviews of people holding key positions such as CEOs, VPs, directors, and executives. Market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub segments. The breakdown of profiles of primaries is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

This report provides valuable insights regarding the ecosystem of this market such as fire safety equipment suppliers and manufacturers, industrial fire brigade training program providers and end consumers, among others. The ecosystem of the market consists of the fire safety equipment manufacturers and suppliers such as Honeywell International Inc. (U.S.), Siemens AG (Germany), Tyco International PLC (Ireland), among others who supply fire protection equipment and fire response systems. Some of the industrial fire brigade training program providers include Texas A&M Engineering Extension Service (U.S.), Lakeland College (U.S.), South Carolina Fire Academy (U.S.), and Petrosafe Technologies (U.S.), among others. The end users include U.S. Strategic Petroleum Reserve, Duke Energy (U.S.), National Grid (London), China National Petroleum Corporation (China), Kuwait Petroleum Corporation (Kuwait), British Petroleum (U.K.), and Lyondell/Equistar Chemicals (U.S.), among others.

Key Target Audience:

- Raw material and manufacturing equipment suppliers

- Electronic design automation (EDA) and design tool vendors

- Integrated device manufacturers (IDMs)

- Fire protection systems foundry members

- Fire brigade systems intellectual property players

- Fire protection systems technology platform developers

- Fire protection systems semiconductor device manufacturers

- Fire protection systems component manufacturers

- Fire protection systems product manufacturers (ODMs)

- Fire protection systems original equipment manufacturers (OEMs)

- Fire brigade training service providers

- ODM and OEM technology solution providers

- Assembly, testing, and packaging vendors

- Distributors and traders

- Research organizations

- Fire protection organizations, forums, alliances, and associations

The study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years (depends on the range of forecast period) for prioritizing the efforts and investments.

Report Scope:

In this report, the industrial fire brigade training program and services market has been segmented as follows:

-

Market, by Region:

- North America

- Europe

- Asia-Pacific

- RoW

-

Market, by Industry Vertical :

- Electric utility

- Oil, gas, and mining

- Chemical processing facilities

- Manufacturing

- Others (pipeline companies, construction, transportation and logistics, entertainment industry, local, state, and federal government)

North American industrial fire brigade training program and services market has been segmented on the basis of the following:

-

Market, by Training Mode:

- Certifications

- Classroom

- Conferences

- Hands on

- Online

- On-site

- State-approved continuing education

- Webinars

-

Market, by Training Topic:

- System installation

- Alarms and Codes

- Safety Standards

- Inspection, Testing and maintenance

- Management and Specialist

-

Market, by Training Type:

- In-house training using in-house instructors

- In-house training using contract instructors

- Off-site using in-house instructors

- Off-site using contract instructors

- Combination

-

Market, by Training Level:

- Incipient stage firefighting

- Interior firefighting

- Exterior firefighting

- Specialty courses

Industrial fire protection system market has been segmented on the basis of the following:

-

Market, by Product:

- Fire detection

- Fire management

- Fire analysis

- Fire response

- Others (rescue equipment and torches)

-

Market, by Industry Vertical :

- Energy & power

- Manufacturing

- Oil, gas, & mining

- Other verticals (telecom & it, public utilities, and media sectors)

Competitive Landscape

Company Profiles: Detailed analysis of the major companies/institutes present in the industrial fire brigade training program and services market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Industrial Fire Brigade Training Program and Services Market

I would like to understand the market scope and scenario for the training types and training modes.

I would like to understand the market sizing and forecasts for Fire Protection systems, Fire Systems Commissioning, Industrial Fire Brigages, and Fire Protection/Prevention Programs. Does the scope of the report cover this?