Industrial Cooling System Market by End User (Power Generation, Industrial Manufacturing, Petrochemical Processing, Food Processing & Storage, Petroleum & Natural Gas Refining, Pharmaceutical, Data Center), Type & by Region - Global Forecasts to 2021

The industrial cooling system market is projected to reach USD 17.24 Billion by 2021, at a CAGR of 5.0%.

The Objectives of Industrial Cooling System Market Study are:

- To define, describe, and forecast the market based on type, end user, and region

- To analyze and forecast the value (USD million) of the global market

- To provide detailed information regarding key factors influencing the growth of the market, such as drivers, restraints, opportunities, and industry-specific challenges

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contribution made to the overall market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape of the market

- To forecast the market size with respect to five main regions (along with countries), namely, Asia-Pacific, Europe, North America, Middle East & Africa, and Latin America

- To strategically profile key players and comprehensively analyze their core competencies

- To analyze competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and research & development activities (R&D) in the global industrial cooling system market

The years considered for the study are:

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2021

- Forecast Period – 2016 to 2021

- For company profiles in the report, 2015 has been considered as the base year. In certain cases, wherein information is unavailable for the base year, the years prior to it have been considered.

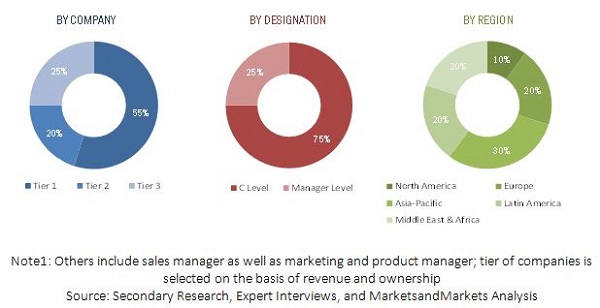

Industrial Cooling System Market Research Methodology

The research methodology used to estimate and forecast the global industrial cooling systems market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. After arriving at the overall market size, the total market was split into several segments and subsegments, which were later verified through primary research by conducting extensive interviews with key personnel, such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The breakdown of profiles of primaries is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

Key Players in Industrial Cooling System Market

The industrial cooling system value chain includes raw material manufacturers, product manufacturers, and end-use industries. The global industrial cooling system manufacturers also produce and supply cooling system components. For example, Brentwood Industries, Inc. (U.S.), SPX Corporation (U.S.), and Star Cooling Towers Pvt. Ltd (India) manufacture cooling system components as well as industrial cooling systems. Key manufactures for industrial cooling systems are Baltimore Aircoil Company (U.S.), Evapco, Inc. (U.S.), Paharpur Cooling Towers (India), Hamon & Cie International SA (Belgium), and Spig SPA (Italy), among others.

Target Audience in Industrial Cooling System Market

- Industrial Cooling System Producers

- Industrial Cooling System Traders, Suppliers, and Distributors

- Government and Research Organizations

- Association and Industrial Bodies

- Raw Material Suppliers and Distributors

- Shipping Companies

- Industry Associations

- “This study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments”.

Industrial Cooling System Market Report Scope

This research report categorizes the global industrial cooling system market on the basis of type, end user, and region, forecasting revenues as well as analyzing trends in each of the submarkets.

On the basis of Type:

- Evaporative Cooling System

- Air Cooling System

- Hybrid Cooling System

- Water Cooling System

On the basis of End User:

- Power Generation

- Industrial Manufacturing

- Petrochemical Processing

- Food Processing & Storage

- Petroleum & Natural Gas Refining

- Pharmaceuticals

- Data Center

On the basis of Region:

- Asia-Pacific

- Europe

- North America

- Middle East & Africa

- Latin America

The following customization options are available for the report:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Industrial Cooling System Market Product Analysis

- Product Matrix, which gives a detailed comparison of product portfolio of each company

Industrial Cooling System Market Geographic Analysis

- Further breakdown of Rest of APAC and Rest of Europe industrial cooling systems market

Industrial Cooling System Market Company Information

- Detailed analysis and profiling of additional market players (up to five companies)

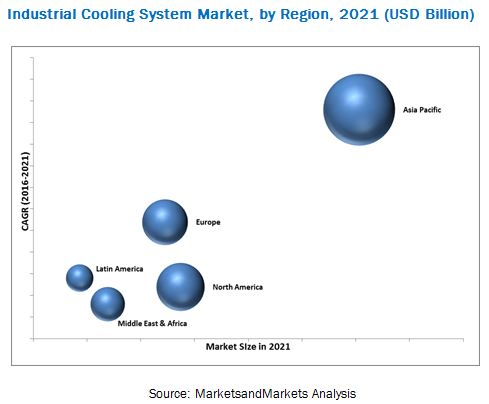

The global industrial cooling system market is projected to reach USD 17.24 Billion by 2021, at a CAGR of 5.0% between 2016 and 2021. This growth is mainly attributed to impressive development of power generation manufacturing industry in Asia-Pacific, increasing nuclear power generation capacities, and rising demand of cooling systems in thermal power generation industry.

Power generation segment dominated the global market in 2015, followed by industrial manufacturing segment. The industrial manufacturing segment is expected to grow at the highest CAGR from 2016 to 2021. The industrial manufacturing process has cooling requirements for heat rejection at different stages, which encourages the installation of cooling systems. Rapidly growing manufacturing base in Asia-Pacific offering cheap labor and operational cost is driving the demand of industrial cooling systems from end-user industries.

Asia-Pacific is the fastest-growing market, as it is a major consumer of industrial cooling systems. There is an increasing demand for industrial cooling systems from both developed and developing countries of this region, such as Japan, China, India, Australia, and others. Top manufacturers from the U.S. and Western Europe are now focusing on Asia-Pacific to meet the region’s growing demand.

Increasing population, urbanization, and the growing manufacturing industry are increasing the demand of industrial cooling systems from end-user industries, thus driving the growth of the market in Asia-Pacific. The rising food & beverages and nuclear power industry, coupled with low-cost manufacturing (especially in China and India), is expected to further boost the industrial cooling system market in this region.

On the bases of type, evaporative cooling system dominate the industrial cooling market due to their high energy efficiency, vast applications in power industries, and high performance over any other cooling system.

One of the major factors inhibiting the growth of the market is the sluggish growth of industrial cooling system market in Europe and North America as these markets are matured markets having limited demand for cooling systems. However, replacement demand for cooling systems in North America and Europe is expected to provide good opportunities to product innovators in the cooling systems industry.

Key Industrial Cooling System Market Industry Players

Key players operating in the global market, such as Baltimore Aircoil Company (U.S.), Bell Cooling Tower (India), Brentwood Industries Inc. (U.S.), Hamon Group (Belgium), Johnson Controls Inc. (U.S.), Paharpur Cooling Towers (India), SPIG S.p.A. (Italy), SPX Corporation (U.S.), among others, have adopted various strategies to increase their market shares. Agreements/contracts/partnerships, new product/technology launches, expansions, acquisitions, and research & development are some of the key strategies adopted by market players to achieve growth in the global industrial cooling systems market.

Frequently Asked Questions (FAQ):

Which are the Key players operating in the global Industrial Cooling System Market ?

Key players include Baltimore Aircoil Company (U.S.), Bell Cooling Tower (India), Brentwood Industries Inc. (U.S.), Hamon Group (Belgium) and more.

What factors are driving the growth of Industrial Cooling System Market ?

Increasing population, urbanization, and the growing manufacturing industry are increasing the demand of industrial cooling systems from end-user industries, thus driving the growth of the market in Asia-Pacific.

Which is the fastest growing region in Industrial Cooling System Market ?

Asia-Pacific is the fastest-growing market, as it is a major consumer of industrial cooling systems.

Can you provide market share analysis of key players in Industrial Cooling System Market?

Yes, we can provide company ranking/market size analysis of key players. Is there any specific companies that you like to focus on?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Regional Scope

1.3.2 Markets Covered

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.3.1 Key Industry Insights

2.3.2 Assumptions

2.3.3 Limitations

3 Executive Summary (Page No. - 27)

3.1 Introduction

3.2 Historical Backdrop

3.3 Current Scenario

3.4 Future Trend

3.5 Conclusion

4 Premium Insights (Page No. - 31)

4.1 Significant Opportunities for Global Industrial Cooling System Market (2016 & 2021)

4.2 Market Growth, By Region (2016-2021)

4.3 Global Market Attractiveness

4.4 Global Market, Major Types

4.5 Global Market, Major End-Use Industries

4.6 Global Market: Developed Markets and Developing Markets

4.7 Life Cycle Analysis, By Type

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Global Market, By Type

5.2.2 Global Market, By End User

5.2.3 Global Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Stringent Environmental Regulations are Driving the Demand for Cooling System

5.3.1.2 Technological Advancements in Industrial Cooling Systems Market

5.3.1.3 Rising Demand From the Developing Markets of Asia-Pacific

5.3.2 Restraints

5.3.2.1 Sluggish Growth of Industrial Cooling System Market in Europe and North America

5.3.3 Opportunities

5.3.3.1 Growing Demand From Nuclear Power Generation

5.3.4 Challenges

5.3.4.1 Requirement of Large Amounts of Water

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.1.1 Value Chain Analysis

6.1.1.1 Raw Materials

6.1.1.2 Component Manufacturers

6.1.1.3 Industrial Cooling System Manufacturers

6.1.1.4 End-Use Industries

6.2 Porter’s Five Forces Analysis

6.2.1 Threat of New Entrants

6.2.2 Threat of Substitutes

6.2.3 Bargaining Power of Suppliers

6.2.4 Bargaining Power of Buyers

6.2.5 Intensity of Competitive Rivalry

6.3 Economic Indicators

6.3.1 Industry Outlook

6.3.1.1 Automotive

6.3.1.2 Electronics

6.3.1.3 Healthcare & Pharmaceutical

6.3.1.4 Manufacturing

6.3.1.5 Oil & Gas Industry

6.3.1.6 Power Generation

6.3.2 Country Outlook

6.3.2.1 Australia

6.3.2.2 Brazil

6.3.2.3 Canada

6.3.2.4 China

6.3.2.5 Chile

6.3.2.6 France

6.3.2.7 Germany

6.3.2.8 India

6.3.2.9 Italy

6.3.2.10 Japan

6.3.2.11 Mexico

6.3.2.12 New Zealand

6.3.2.13 Saudi Arabia

6.3.2.14 South Korea

6.3.2.15 Thailand

6.3.2.16 U.K.

6.3.2.17 U.S.

7 Industrial Cooling System Market, By Type (Page No. - 62)

7.1 Introduction

7.2 Evaporative Cooling Systems

7.3 Air Cooling Systems

7.4 Hybrid Cooling Systems

7.5 Water Cooling Systems

8 Industrial Cooling Systems Market, By End User (Page No. - 68)

8.1 Introduction

8.2 By End User

8.2.1 Power Generation

8.2.2 Industrial Manufacturing

8.2.3 Petrochemical Processing

8.2.4 Food Processing & Storage

8.2.5 Petroleum & Natural Gas Refining

8.2.6 Pharmaceuticals

8.2.7 Data Center

9 Industrial Cooling System Market, By Region (Page No. - 77)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 Japan

9.2.3 India

9.2.4 South Korea

9.2.5 Australia

9.2.6 New Zealand

9.2.7 Thailand

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 France

9.4.3 Italy

9.4.4 U.K.

9.4.5 Sweden

9.5 Latin America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Chile

9.6 Middle East & Africa

9.6.1 UAE

9.6.2 Saudi Arabia

9.6.3 Qatar

9.6.4 Kuwait

9.6.5 Oman

10 Competitive Landscape (Page No. - 114)

10.1 Overview

10.2 Future Trends

10.3 Maximum Developments in 2014 & 2015

10.4 New Product/Technology Launches

10.5 Agreements/Contracts/Partnerships

10.6 Expansions

10.7 Mergers & Acquisitions/Joint Venture/Alliance

11 Company Profiles (Page No. - 122)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Introduction

11.2 SPX Corporation

11.3 Hamon Group

11.4 Johnson Controls Inc.

11.5 Airedale International Air Conditioning Ltd.

11.6 American Power Conversion Corporation (APC)

11.7 Black Box Corporation

11.8 Emerson Electric Co.

11.9 Rittal GmbH & Co. KG

11.10 SPIG S.P.A.

11.11 Paharpur Cooling Towers Limited

11.12 Baltimore Aircoil Company Inc.

11.13 EVAPCO Inc.

11.14 Brentwood Industries, Inc.

11.15 Star Cooling Towers Pvt. Ltd.

11.16 ENEXIO

11.17 Bell Cooling Towers

11.18 Mesan Group

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 162)

12.1 Discussion Guide

12.2 Introducing RT: Real Time Market Intelligence

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

List of Tables (85 Tables)

Table 1 Global Industrial Cooling System Market Snapshot

Table 2 International Car Sales Outlook

Table 3 Australia: Economic Outlook

Table 4 Brazil: Economic Outlook

Table 5 Canada: Economic Outlook

Table 6 China: Economic Outlook

Table 7 Chile: Economic Outlook

Table 8 France: Economic Outlook

Table 9 Germany: Economic Outlook

Table 10 India: Economic Outlook

Table 11 Italy: Economic Outlook

Table 12 Japan: Economic Outlook

Table 13 Mexico: Economic Outlook

Table 14 New Zealand: Economic Outlook

Table 15 Saudi Arabia: Economic Outlook

Table 16 South Korea: Economic Outlook

Table 17 Thailand: Economic Outlook

Table 18 U.K.: Economic Outlook

Table 19 U.S.: Economic Outlook

Table 20 Industrial Cooling System Market, By Type, 2014–2021 (USD Million)

Table 21 Evaporative Cooling System Market, By Region, 2014–2021 (USD Million)

Table 22 Air Cooling System Market, By Region, 2014–2021 (USD Million)

Table 23 Hybrid Cooling System Market, By Region, 2014–2021 (USD Million)

Table 24 Water Cooling System Market, By Region, 2014–2021 (USD Million)

Table 25 Industrial Cooling Systems Market, By End User,2014–2021 (USD Million)

Table 26 Industrial Cooling System Market for Power Generation, By Region, 2014–2021 (USD Million)

Table 27 Market for Industrial Manufacturing, By Region, 2014–2021 (USD Million)

Table 28 Market for Petrochemical Processing, By Region, 2014–2021 (USD Million)

Table 29 Market for Food Processing & Storage, By Region, 2014–2021 (USD Million)

Table 30 Market for Petroleum & Natural Gas Refining, By Region, 2014–2021 (USD Million)

Table 31 Market for Pharmaceuticals, By Region, 2014–2021 (USD Million)

Table 32 Market for Data Center, By Region, 2014–2021 (USD Million)

Table 33 Market, By Region, 2014–2021 (USD Million)

Table 34 Asia-Pacific Industrial Cooling System Market, By Type, 2014–2021 (USD Million)

Table 35 Asia-Pacific Market, By Country, 2014–2021 (USD Million)

Table 36 Asia-Pacific Market, By End User, 2014–2021 (USD Million)

Table 37 Asia-Pacific Power Generation End-User Market, By Country, 2014–2021 (USD Million)

Table 38 Asia-Pacific Industrial Manufacturing End-User Segment Market, By Country, 2014–2021 (USD Million)

Table 39 China Market, By Type,2014–2021 (USD Million)

Table 40 Japan Market, By Type,2014–2021 (USD Million)

Table 41 India Market, By Type,2014–2021 (USD Million)

Table 42 South Korea Market, By Type, 2014–2021 (USD Million)

Table 43 Australia Market, By Type, 2014–2021 (USD Million)

Table 44 New Zealand Market, By Type, 2014–2021 (USD Million)

Table 45 Thailand Market, By Type,2014–2021 (USD Million)

Table 46 North America Industrial Cooling System Market, By Type, 2014–2021 (USD Million)

Table 47 North America Market, By Country, 2014–2021 (USD Million)

Table 48 North America Market, By End-User, 2014–2021 (USD Million)

Table 49 North America Power Generation End-User Segment Market, By Country, 2014–2021 (USD Million)

Table 50 North America Industrial Manufacturing End-User Segment Market, By Country, 2014–2021 (USD Million)

Table 51 U.S. Market, By Type, 2014–2021 (USD Million)

Table 52 Canada Market, By Type, 2014–2021 (USD Million)

Table 53 Mexico Market, By Type, 2014–2021 (USD Million)

Table 54 Europe Industrial Cooling System Market, By Type, 2014–2021 (USD Million)

Table 55 Europe Market, By Country, 2014–2021 (USD Million)

Table 56 Europe Market, By End-User, 2014–2021 (USD Million)

Table 57 Europe Power Generation End-User Segment Market, By Country, 2014–2021 (USD Million)

Table 58 Europe Industrial Manufacturing End-User Segment Market, By Country, 2014–2021 (USD Million)

Table 59 Germany Market, By Type, 2014–2021 (USD Million)

Table 60 France Market, By Type, 2014–2021 (USD Million)

Table 61 Italy Market, By Type,2014–2021 (USD Million)

Table 62 U.K. Market, By Type,2014–2021 (USD Million)

Table 63 Sweden Industrial Cooling System Market, By Type, 2014–2021 (USD Million)

Table 64 Latin America Industrial Cooling System Market, By Type, 2014–2021 (USD Million)

Table 65 Latin America Market, By Country, 2014–2021 (USD Million)

Table 66 Latin America Market, By End User, 2014–2021 (USD Million)

Table 67 Latin America Power Generation End-User Segment Market, By Country, 2014–2021 (USD Million)

Table 68 Latin America Industrial Manufacturing End-User Segment Market, By Country, 2014–2021 (USD Million)

Table 69 Brazil Market, By Type,2014–2021 (USD Million)

Table 70 Argentina Market, By Type, 2014–2021 (USD Million)

Table 71 Chile Market, By Type,2014–2021 (USD Million)

Table 72 Middle East & Africa Industrial Cooling System Market, By Type, 2014–2021 (USD Million)

Table 73 Middle East & Africa Market, By Country, 2014–2021 (USD Million)

Table 74 Middle East & Africa Market, By End User, 2014–2021 (USD Million)

Table 75 Middle East & Africa Power Generation End-User Segment Market, By Country, 2014–2021 (USD Million)

Table 76 Middle East & Africa Industrial Manufacturing End-User Segment Market, By Country, 2014–2021 (USD Million)

Table 77 UAE Market, By Type, 2014–2021 (USD Million)

Table 78 Saudi Arabia Market, By Type, 2014–2021 (USD Million)

Table 79 Qatar Market, By Type,2014–2021 (USD Million)

Table 80 Kuwait Industrial Cooling System Market, By Type,2014–2021 (USD Million)

Table 81 Oman Industrial Cooling Systems Market, By Type,2014–2021 (USD Million)

Table 82 New Product/Technology Launches, 2012–2015

Table 83 Agreements/Contracts/Partnerships, 2012–2015

Table 84 Expansion, 2013–2015

Table 85 Mergers & Acquisitions, 2014–2015

List of Figures (51 Figures)

Figure 1 Industrial Cooling System: Market Segmentation

Figure 2 Industrial Cooling System Market, Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Global Industrial Cooling Systems Market: Data Triangulation

Figure 6 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 7 Market for Evaporative Cooling System to Register the Highest Growth Between 2016 and 2021

Figure 8 Market for Industrial Manufacturing to Register the Highest Growth Between 2016 and 2021

Figure 9 Asia-Pacific to Be the Dominating Market Between 2016 and 2021

Figure 10 Global Industrial Cooling System Market to Witness Moderate Growth Between 2016 and 2021

Figure 11 Asia-Pacific to Grow at the Highest Rate Between 2016 and 2021

Figure 12 Asia-Pacific to Be the Fastest-Growing Market for Industrial Cooling System Between 2016 and 2021

Figure 13 Evaporative Cooling System Segment to Register the Highest Growth Rate

Figure 14 Power Generation Segment to Account for the Largest Market Share in 2016

Figure 15 China to Emerge as A Lucrative Market

Figure 16 Industrial Cooling Systems Market: Life Cycle Analysis

Figure 17 Global Market, By Type

Figure 18 Global Market, By End User

Figure 19 Global Market, By Region

Figure 20 Drivers, Restraints, Opportunities, and Challenges in the Global Industrial Cooling System Market

Figure 21 Porter’s Five Forces Analysis

Figure 22 Manufacturing Industry Growth Rate, 2015

Figure 23 Oil Production, By Region, 2013-2014

Figure 24 World Installed Capacity, By Energy Sources, 2012-2040

Figure 25 The Evaporative Cooling System Segment is Projected to Lead the Industrial Cooling Systems Market During the Forecast Period

Figure 26 Power Generation Segment Leads the Industrial Cooling System Market, 2016 vs. 2021 (USD Million)

Figure 27 Asia-Pacific Expected to Be A Lucrative Region for the Market During the Forecast Period

Figure 28 Asia-Pacific Expected to Witness High Growth in the Industrial Cooling Systems Market

Figure 29 Asia-Pacific Market Snapshot

Figure 30 North America Market Snapshot

Figure 31 Europe Market Snapshot

Figure 32 Latin America Market Snapshot

Figure 33 Middle East & Africa Market Snapshot

Figure 34 Companies Adopted Organic as Well as Inorganic Growth Strategies Between 2012 and 2016

Figure 35 Battle for Market Share: New Product/Technology Launch Was the Key Strategy

Figure 36 Industrial Cooling System Market, Developmental Share, 2012–2015

Figure 37 Regional Revenue Mix of Prominent Market Players

Figure 38 SPX Corporation: Company Snapshot

Figure 39 SPX Corporation: SWOT Analysis

Figure 40 Hamon Group: Company Snapshot

Figure 41 Hamon & CIE International SA: SWOT Analysis

Figure 42 Johnson Controls Inc.: Company Snapshot

Figure 43 Johnson Controls Inc.: SWOT Analysis

Figure 44 Airedale International Air Conditioning Ltd.: SWOT Analysis

Figure 45 Schneider Electric Se: Company Snapshot

Figure 46 American Power Conversion Corporation (APC): SWOT Analysis

Figure 47 Black Box Corporation: Company Snapshot

Figure 48 Black Box Corporation: SWOT Analysis

Figure 49 Emerson Electric Co.: Company Snapshot

Figure 50 Emerson Electric Co.: SWOT Analysis

Figure 51 Rittal GmbH & Co. KG.: SWOT Analysis

Growth opportunities and latent adjacency in Industrial Cooling System Market