Evaporative Condensing Unit Market by End-Use Industry (Commercial, Power, and Chemical), Application (Refrigeration, and Air Conditioning), and Region (North America, Europe, Asia-Pacific, Middle East & Africa, and South America) - Global Forecast to 2026

[147 Pages Report] The evaporative condensing unit market is projected to reach USD 1.61 Billion by 2026, at a CAGR of 7.2% between 2016 and 2026. The years considered for the study are:

- Base Year 2015

- Estimated Year 2016

- Projected Year 2026

- Forecast Period 2016 to 2021 (mid-term) and 2016 to 2026 (long term)

For the companies profiled in the report, 2015 has been considered as the base year. In certain cases wherein information is unavailable for the base year, the years prior to it have been considered.

The objectives of this study are:

- To define, describe, and forecast the evaporative condensing unit market based on end-use industry, application, and region

- To analyze and forecast the volume (units) and value (USD million) of the evaporative condensing unit market

- To provide detailed information regarding key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions made to the overall market

- To analyze opportunities in the market for stakeholders and draw a competitive landscape of the market

- To forecast the market size in terms of value with respect to five main regions (along with countries), namely, Asia-Pacific, North America, Europe, Middle East & Africa, and South America.

- To strategically profile key players and comprehensively analyze their core competencies

- To analyze competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and research & development activities (R&D) in the evaporative condensing unit market

Research Methodology:

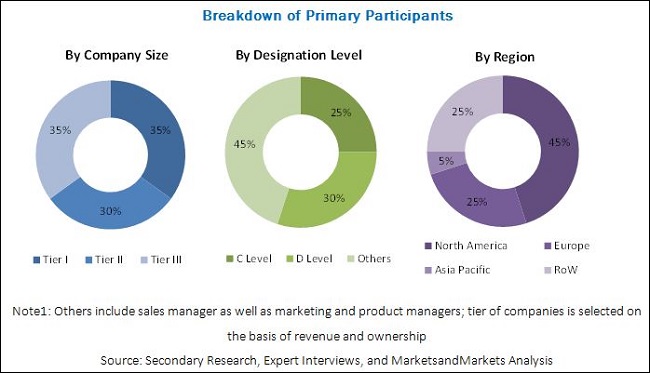

The research methodology used to estimate and forecast the evaporative condensing unit market begins with obtaining data on key vendor revenues through annual reports, company websites, and secondary research that includes Shecco Publications and articles from the U.S. Department of Energy. Vendor offerings are also taken into consideration to determine market segmentation. After arriving at the overall market size, the total market was split into several segments and subsegments, which were later verified through primary research by conducting extensive interviews with key personnel, such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The breakdown of profiles of primaries is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The evaporative condensing unit market has a diversified ecosystem of key players, including component suppliers, along with stakeholders, vendors, end users, and government organizations. Companies operating in the evaporative condensing unit market include Baltimore Aircoil Company, Inc., Evapco Inc., Johnson Controls Inc., SPX Corporation, and Mammoth Inc., among others.

The report provides detailed qualitative and quantitative analysis of the evaporative condensing unit market, along with market drivers, restraints, and opportunities. Top players of this market are profiled in detail, along with recent developments and other strategic industry-related activities.

Target Audience

- Evaporative Condensing Unit Manufacturers

- Evaporative Condensing Unit Traders, Suppliers, and Distributors

- Government and Research Organizations

- Association and Industrial Bodies

- Raw Material Suppliers and Distributors

- Shipping Companies

- Industry Associations

This study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.

Scope of the Report: This research report categorizes the evaporative condensing unit market on the basis of end-use industry, application, and region, forecasting revenues as well as analyzing trends in each of the submarkets.

On the basis of End-Use Industry:

- Commercial

- Power

- Chemical

On the basis of Application:

- Refrigeration

- Air Conditioning

On the basis of Region:

- Asia-Pacific

- Europe

- North America

- Middle East & Africa

- South America

The following customization options are available for the report:

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe evaporative condensing unit market

Company Information

- Detailed analysis and profiling of additional market players (up to 3 companies)

The evaporative condensing unit market is projected to reach USD 1.61 Billion by 2026, at a CAGR of 7.2% between 2016 and 2026. This growth can be attributed to the increasing demand for evaporative condensing units from end-use industries due to its energy efficient features. Technologically advanced evaporative condensing units are being preferred by consumers due to their extended durability and shelf life, and improved performance of refrigeration and air-conditioning systems. The growing demand for advanced refrigeration systems is expected to fuel the growth of the evaporative condensing unit market.

The refrigeration application segment is expected to lead the evaporative condensing unit market. The demand for evaporative condensing units is growing, owing to advancement in refrigeration technologies. The growing food processing & storage facility industry in emerging nations is expected to drive the demand for evaporative condensing unit market in refrigeration.

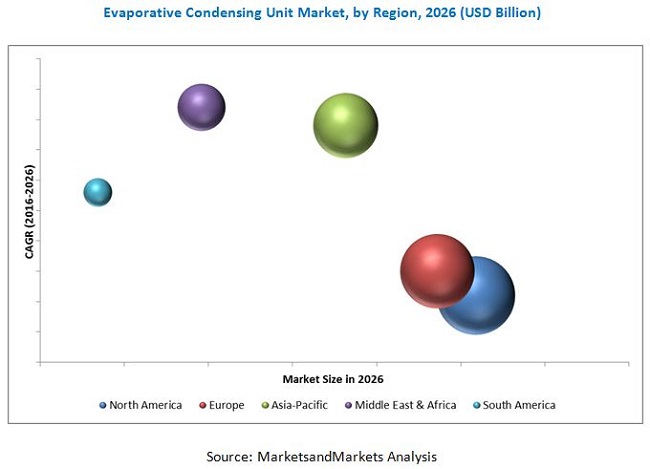

The Middle East & Africa is expected to lead the evaporative condensing unit market between 2016 and 2026. Saudi Arabia is expected to lead the evaporative condensing unit market in the Middle East & Africa. High economic growth of Saudi Arabia is significantly contributing to the growth of the evaporative condensing unit market in the region.

Growing industrialization is steadily increasing the demand for multipurpose high-performance evaporative condensing units. The Middle East & Africa evaporative condensing unit market is projected to grow at the second- highest CAGR during the forecast period, owing to the dominance of the chemical industry, which contributes to the increasing demand for evaporative condensing units in the region.

Increasing concerns about high global warming potential (GWP) of common chlorofluorocarbon (CFC) refrigerants have adversely affected the growth of the evaporative condensing unit market in Europe and North America. In Europe, standards, such as EN 378 and ISO 5149 have to be met in context of non-toxic, non-flammable refrigerants. In the U.S., obtaining the EPA SNAP approval is mandatory before using ammonia in refrigerants. The European Environment Agency monitors ammonia emissions from industries, institutions and households, commercial, and agriculture sectors, and has imposed strict restrictions on the use of ammonia.

Major players, such as Baltimore Aircoil Company Inc. and Evapco Inc. dominate the evaporative condensing unit market. Most of the developments in the market are new product launches, which clearly indicate the need for constant product development in order to maintain or increase market share. Suppliers depend heavily on their brand equity and have to promote consistently through advertising. Manufacturers constantly look to develop customer loyalty by providing after sales services in this market. Key market players operating in the condensing unit market, such as Baltimore Aircoil Company, Inc., Evapco Inc., Johnson Controls Inc., SPX Corporation, Mammoth Inc., among others, have adopted various strategies to increase their market shares. Agreements and new product launches were some of the key strategies adopted by the market players to grow in the evaporative condensing unit market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Market Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Significant Opportunities for the Evaporative Condensing Unit Market (2016-2021)

4.2 Evaporative Condensing Unit Market, By Region (2016-2021)

4.3 North America Evaporative Condensing Unit Market Share (2015)

4.4 Evaporative Condensing Unit Market Attractiveness

4.5 Evaporative Condensing Unit Market, By End-Use Industry, 2015

4.6 Evaporative Condensing Unit Market Size: Developed vs Emerging Nations

4.7 Life Cycle Analysis, By Region

4.8 Life Cycle Analysis, By End-Use Industry

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By End-Use Industry

5.2.2 By Application

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth of End-Use Industries in Emerging Countries

5.3.1.2 Improved Efficiency Over Air-Cooled Condensing Units

5.3.1.3 Improved Durability and Shelf Life

5.3.2 Restraints

5.3.2.1 Stringent Environmental Regulations Imposed on Refrigerants/Gases Used in Evaporative Condensing Units

5.3.3 Opportunities

5.3.3.1 Technological Advancements in the Field of Evaporative Condensing Units

5.3.4 Challenges

5.3.4.1 Unviable for Small Application Systems

5.4 Revenue Pocket Matrix

5.4.1 Revenue Pocket Matrix for End-Use Industries

5.4.2 Revenue Pocket Matrix for Applications

5.5 Evaporative Condensing Unit Cost Structure

6 Industry Trends (Page No. - 43)

6.1 Value Chain Analysis

6.1.1 Screw Compressor-Based Condensing Unit

6.1.2 Scroll Compressor-Based Condensing Unit

6.1.3 Centrifugal Compressor-Based Condensing Unit

6.2 Economic Indicators

6.2.1 Industry Outlook

6.2.1.1 Cold Storage

6.2.1.2 Construction

6.2.1.3 Manufacturing

7 Evaporative Condensing Unit Market, By Design (Page No. - 47)

7.1 Introduction

7.2 Combined Flow

7.3 Counter Flow

7.4 Induced Draft

7.5 Forced Draft

8 Evaporative Condensing Unit Market, By End-Use Industry (Page No. - 48)

8.1 Introduction

8.2 Commercial

8.3 Power

8.4 Chemical

9 Evaporative Condensing Unit Market, By Application (Page No. - 53)

9.1 Introduction

9.2 Refrigeration

9.3 Air Conditioning

10 Evaporative Condensing Unit Market, By Region (Page No. - 59)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia and New Zealand

10.3 North America

10.3.1 U.S.

10.3.2 Canada

10.3.3 Mexico

10.4 Europe

10.4.1 Germany

10.4.2 France

10.4.3 U.K.

10.4.4 Italy

10.4.5 Spain

10.4.6 Rest of Europe

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 Turkey

10.5.3 Egypt

10.5.4 Rest of Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Chile

10.6.4 Rest of South America

11 Competitive Landscape (Page No. - 108)

11.1 Overview

11.2 New Product Launches: the Most Popular Growth Strategy

11.3 Competitive Situation and Trends

11.3.1 New Product Launches

11.3.2 Agreements

11.3.3 Expansions

11.3.4 Mergers & Acquisitions

11.3.5 Joint Ventures

12 Company Profiles (Page No. - 114)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

12.2 Aaon, Inc.

12.3 Baltimore Aircoil Company, Inc.

12.4 Daikin Industries, Ltd.

12.5 Decsa S.R.L.

12.6 Evapco Inc.

12.7 Johnson Controls Inc.

12.8 Mammoth Inc. (Nortek Air Solutions, LLC)

12.9 SPX Corporation

12.10 Tιcnicas Evaporativas, S.L.

12.11 Temp Tech Co., Ltd.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 137)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (116 Tables)

Table 1 Evaporative Condensing Unit Cost Structure

Table 2 Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 3 Evaporative Condensing Unit Market for Commercial End-Use Industry, By Region, 20142026 (Units)

Table 4 Evaporative Condensing Unit Market for Power End-Use Industry, By Region, 20142026 (Units)

Table 5 Evaporative Condensing Unit Market for Chemical End-Use Industry, By Region, 20142026 (Units)

Table 6 Evaporative Condensing Unit Market, By Application

Table 7 Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 8 Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 9 Evaporative Condensing Unit Market in Refrigeration Application, By Region, 20142026 (USD Million)

Table 10 Evaporative Condensing Unit Market in Refrigeration Application, By Region, 20142026 (Units)

Table 11 Evaporative Condensing Unit Market in Air Conditioning Application, By Region, 20142026 (USD Million)

Table 12 Evaporative Condensing Unit Market in Air Conditioning Application, By Region, 20142026 (Units)

Table 13 Evaporative Condensing Unit Market, By Region, 20142026 (USD Million)

Table 14 Evaporative Condensing Unit Market, By Region, 20142026 (Units)

Table 15 Asia-Pacific: Evaporative Condensing Unit Market, By Country, 20142026 (USD Million)

Table 16 Asia-Pacific: Evaporative Condensing Unit Market, By Country, 20142026 (Units)

Table 17 Asia-Pacific: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 18 Asia-Pacific: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 19 Asia-Pacific: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 20 China: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 21 China: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 22 China: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 23 India: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 24 India: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 25 India: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 26 Japan: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 27 Japan: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 28 Japan: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 29 South Korea: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 30 South Korea: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 31 South Korea: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 32 Indonesia: Evaporative Condensing Unit Market, By End-Use Industry, 20142021 (Units)

Table 33 Indonesia: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 34 Indonesia: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 35 Malaysia: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 36 Malaysia: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 37 Malaysia: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 38 Australia and New Zealand: Evaporative Condensing Unit Market, By End-Use Industry, 20142021 (Units)

Table 39 Australia and New Zealand: Evaporative Condensing Unit Market, By Application, 20142021 (USD Million)

Table 40 Australia and New Zealand: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 41 North America: Evaporative Condensing Unit Market, By Country, 20142026 (USD Million)

Table 42 North America: Evaporative Condensing Unit Market, By Country, 20142026 (Units)

Table 43 North America: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 44 North America: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 45 North America: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 46 U.S.: Evaporative Condensing Unit Market, By End-Use Industry, 20142021 (Units)

Table 47 U.S.: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 48 U.S.: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 49 Canada: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 50 Canada: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 51 Canada: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 52 Mexico: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 53 Mexico: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 54 Mexico: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 55 Europe: Evaporative Condensing Unit Market, By Country, 20142026 (USD Million)

Table 56 Europe: Evaporative Condensing Unit Market, By Country, 20142026 (Units)

Table 57 Europe: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 58 Europe: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 59 Europe: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 60 Germany: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 61 Germany: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 62 Germany: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 63 France: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 64 France: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 65 France: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 66 U.K.: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 67 U.K.: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 68 U.K.: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 69 Italy: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 70 Italy: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 71 Italy: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 72 Spain: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 73 Spain: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 74 Spain: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 75 Rest of Europe: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 76 Rest of Europe: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 77 Rest of Europe: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 78 Middle East & Africa: Evaporative Condensing Unit Market, By Country, 20142026 (USD Million)

Table 79 Middle East & Africa: Evaporative Condensing Unit Market, By Country, 20142026 (Units)

Table 80 Middle East & Africa: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units )

Table 81 Middle East & Africa: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 82 Middle East & Africa: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 83 Saudi Arabia: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 84 Saudi Arabia: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 85 Saudi Arabia: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 86 Turkey: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 87 Turkey: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 88 Turkey: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 89 Egypt: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 90 Egypt: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 91 Egypt: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 92 Rest of Middle East & Africa: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 93 Rest of Middle East & Africa: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 94 Rest of Middle East & Africa: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 95 South America: Evaporative Condensing Unit Market, By Country, 20142026 (USD Million)

Table 96 South America: Evaporative Condensing Unit Market, By Country, 20142026 (Units)

Table 97 South America: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 98 South America: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 99 South America: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 100 Brazil: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 101 Brazil: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 102 Brazil: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 103 Argentina: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 104 Argentina: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 105 Argentina: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 106 Chile: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 107 Chile: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 108 Chile: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 109 Rest of South America: Evaporative Condensing Unit Market, By End-Use Industry, 20142026 (Units)

Table 110 Rest of South America: Evaporative Condensing Unit Market, By Application, 20142026 (USD Million)

Table 111 Rest of South America: Evaporative Condensing Unit Market, By Application, 20142026 (Units)

Table 112 New Product Launches, 20112016

Table 113 Agreements, 20112016

Table 114 Expansions, 20112016

Table 115 Mergers & Acquisitions, 20112016

Table 116 Joint Ventures, 20112016

List of Figures (53 Figures)

Figure 1 Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Evaporative Condensing Unit Market in Asia-Pacific Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 6 Commercial End-Use Industry Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 7 Refrigeration Application Segment to Register High CAGR Between 2016 and 2021

Figure 8 Asia-Pacific to Witness the Highest Growth in the Evaporative Condensing Unit Market

Figure 9 Evaporative Condensing Unit Market to Witness Moderate Growth Between 2016 and 2021

Figure 10 Asia-Pacific to Grow at the Highest CAGR Between 2016 and 2021

Figure 11 U.S. Accounted for the Largest Share in the North America Evaporative Condensing Unit Market

Figure 12 Asia-Pacific to Be the Fastest-Growing Market for Evaporative Condensing Unit Between 2016 and 2021

Figure 13 Commercial End-Use Industry Segment in Europe Accounted for the Largest Market Share in 2015

Figure 14 India to Emerge as A Lucrative Market Between 2016 and 2021

Figure 15 Asia-Pacific Evaporative Condensing Unit Market Projected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Commercial End-Use Industry Segment Projected to Register Highest Growth During the Forecast Period

Figure 17 Evaporative Condensing Unit Market, By Region

Figure 18 Overview of the Forces Governing the Evaporative Condensing Unit Market

Figure 19 Cold Storage Construction Market, 2016 & 2021 (Million Cubic Meters)

Figure 20 Revenue Pocket Matrix: End-Use Industry

Figure 21 Revenue Pocket Matrix: Application

Figure 22 Components Account for Major Value Addition

Figure 23 Cold Storage Construction Market, 2016 & 2021

Figure 24 Construction Industry Growth Rate, 2014

Figure 25 Manufacturing Industry Growth Rate, 2014

Figure 26 Commercial Segment Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 Europe Estimated to Lead the Evaporative Condensing Unit Market for Commercial End-Use Industry in 2016

Figure 28 North America to Lead the Evaporative Condensing Unit Market for Power End-Use Industry From 2016-2021

Figure 29 North America to Lead the Evaporative Condensing Unit Market for Chemical End-Use Industry From 2016-2021

Figure 30 Refrigeration Application Segment to Grow at the Highest CAGR During the Forecast Period

Figure 31 North America to Lead the Evaporative Condensing Unit Market in Refrigeration Application From 2016-2021

Figure 32 North America to Lead the Evaporative Condensing Unit Market in Air Conditioning Application in 2016

Figure 33 Regional Snapshot (20162021): Chile, India, and Egypt are Emerging as Lucrative Markets for Evaporative Condensing Units

Figure 34 Asia-Pacific Evaporative Condensing Unit Market Snapshot

Figure 35 North America Evaporative Condensing Unit Market Snapshot

Figure 36 Europe Evaporative Condensing Unit Market Snapshot

Figure 37 Middle East & Africa Evaporative Condensing Unit Market Snapshot

Figure 38 South America Evaporative Condensing Unit Market Snapshot

Figure 39 Companies Adopted New Product Launches as the Key Growth Strategy Between 2011 and 2016

Figure 40 New Product Launches Was the Most Popular Strategy Adopted By the Market Players Between 2011 and 2016

Figure 41 Bailtimore Aircoil Company Inc. Held the Largest Market Share for Evaporative Condensing Unit Market in 2015

Figure 42 Regional Revenue Mix of the Key Market Players

Figure 43 Aaon, Inc.: Company Snapshot

Figure 44 Aaon, Inc.: SWOT Analysis

Figure 45 Baltimore Aircoil Company, Inc.: SWOT Analysis

Figure 46 Daikin Industries, Ltd.: Company Snapshot

Figure 47 Daikin Industries, Ltd.: SWOT Analysis

Figure 48 Decsa S.R.L.: SWOT Analysis

Figure 49 Evapco Inc.: SWOT Analysis

Figure 50 Johnson Controls Inc.: Company Snapshot

Figure 51 Johnson Controls Inc.: SWOT Analysis

Figure 52 SPX Corporation: Company Snapshot

Figure 53 SPX Corporation: SWOT Analysis

Growth opportunities and latent adjacency in Evaporative Condensing Unit Market