Industrial Adhesives Market by Type (Water-based Adhesives, Solvent-based Adhesives, Hot-Melt Adhesives, Pressure Sensitive Adhesives), Material Base (Synthetic, Natural), Composition, End-Use Industry, and Region - Global Forecast to 2021

The industrial adhesives market is projected to grow from USD 41.47 Billion in 2016 to USD 53.37 Billion by 2021, at a CAGR of 5.2% between 2016 and 2021. Factors such as increasing applicability of industrial adhesives across varied end-use industries and technological advancements are driving the growth of the market.

The industrial adhesives market has been segmented on the basis of type, material base, composition, end-use industry, and region. The years considered for the study are:

Base Year 2015

Estimated Year 2016

Projected Year 2021

Forecast Period 2016 to 2021

For company profiles in the report, 2015 has been considered as the base year. Wherever the information was unavailable for the base year, the years prior to it have been considered.

Objectives of the study:

- To define and segment the industrial adhesives market on the basis of type, composition, end-use industry, material base, and region

- To identify market dynamics currently impacting the growth of the market, such as drivers, restraints, opportunities, and challenges

- To analyze and forecast the demand for industrial adhesives, in terms of value and volume

- To estimate, analyze, and forecast the market with respect to key countries

- To analyze and forecast the demand for industrial adhesives in varied end-use industries, such as pressure sensitive products, packaging, construction & woodworking, and transportation, among others

- To analyze recent developments such as facility & capacity expansions, partnerships & collaborations, and new product developments in the market

- To strategically identify and profile key players in the industrial adhesives market

Research Methodology

This research study involves the extensive usage of secondary sources, such as directories and databases (such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for the technical, market-oriented, and commercial study of the market. The research methodology used for the report can be explained as follows:

- Analysis of the country-wise industrial adhesives market

- Analysis of different types of industrial adhesives used by various end-use industries and the benefits offered by them for product formulations

- Analysis of the industrial adhesives peer markets

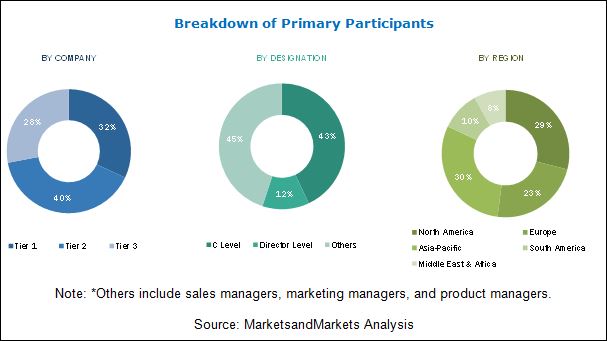

The figure below showcases the breakdown of primaries on the basis of company, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The industrial adhesives value chain includes key suppliers as well as manufacturers of adhesives and sealants such as H.B. Fuller (Minnesota, U.S.), Henkel AG & Co. KGaA (Germany), The Dow Chemical Company (U.S.), and Sika AG (Switzerland), among others. Growth in the industrial adhesives market is primarily attributed to the increasing demand for industrial adhesives from the construction & woodworking, packaging, pressure sensitive products, and transportation, among other end-use industries.

Target Audience:

- Manufacturers of Industrial Adhesives

- Suppliers, Distributors, and Traders of Industrial Adhesives

- Government and Research Organizations

- Associations and Industrial Bodies

- Trade Experts

- Investors

- Entrepreneurs

- Policy Professionals

- Consulting Companies/Consultants in Chemical and Material Sectors

- Technology Startups and Venture Capital Funds

Scope of the Report:

Industrial Adhesives Market, By Material Base:

- Synthetic

- Natural

Industrial Adhesives Market, By Composition:

- Acrylic

- Starch and Dextrin

- Vinyl

- Epoxy Resins

- Rubber

- Polyolefin Polymers

- Amine-based resins

- Others

Industrial Adhesives Market, By Type:

- Water-based Adhesives

- Solvent-based Adhesives

- Hot-Melt Adhesives

- Pressure Sensitive Adhesives

- Others

Industrial Adhesives Market, By End Use Industry:

- Pressure Sensitive Products

- Packaging Industry

- Construction & Woodworking Industry

- Transportation Industry

- Others

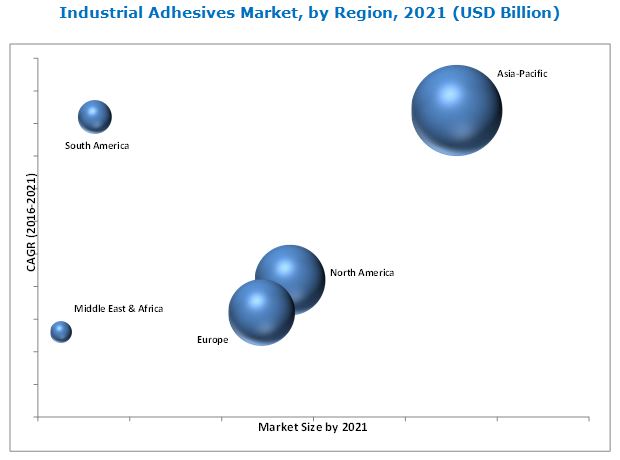

Industrial Adhesives Market, By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations as per specific needs of clients. The following customization options are available for the report:

- Product Analysis

- Low Cost Sourcing Locations

- Industrial Adhesives Safety Standards

- Trade Analysis

The global industrial adhesives market is projected to grow from USD 41.47 Billion in 2016 to USD 53.37 Billion by 2021, at a CAGR of 5.2% from 2016 to 2021. Growth in the packaging, construction & woodworking, and transportation end-use industries and technological advancements are factors driving the demand for industrial adhesives.

The acrylic composition segment of the market accounted for the largest share in 2015, and is expected to continue its dominance during the forecast period. This growth is mainly attributed to the rise in demand for acrylic from the packaging industry. Moreover, its physical attributes such as high cohesion, adhesion, viscosity, resistance to sunlight and water/moisture, and the ability to withstand temperature fluctuations contribute towards the growth of the acrylic segment of the industrial adhesives market.

The water-based segment accounted for the largest share of the market in 2015. The development of water-based adhesives provides better performance, promotes green economy, and offers a good combination of strength, cost effectiveness, and weight reduction for automobile components.

The packaging end-use industry segment registered the largest consumption of industrial adhesives in 2015. Industrial adhesives are mainly used for the packaging of various products, such as fruits, vegetables, poultry, seafood, meat, cosmetics, and furniture, among others.

The Asia-Pacific region led the global industrial adhesives market in 2015. Rapid industrialization and infrastructural developments offer lucrative growth opportunities in the market in this region. High economic growth rate, growth in the manufacturing sector, cheap labor, and global shift of consumption and production capacities from developed markets to emerging markets are additional factors propelling the growth of the Asia-Pacific industrial adhesives market.

Factors such as volatile price of raw materials and various safety and technological constraints are expected to restrict the growth of the industrial adhesives market.

There are various companies operating in the market. Henkel AG & Co. KGaA (Dusseldorf, Germany) is one of the key players in the market. The company has adopted multiple strategies such as expansions, new product launches, joint ventures, and mergers & acquisitions to enhance its position in the market. H.B. Fuller (U.S.), another key player in the market, has expanded its production facilities, launched new products, and acquired various ancillary companies in order to cater to the increasing demand for industrial adhesives from several end-use industries. Sika AG (Switzerland) has launched various new products and merged with leading players of the industrial adhesives market to strengthen its market position. In addition, Huntsman Corporation (Texas, U.S.), The Dow Chemical Company (Michigan, U.S.), and BASF SE (Germany) have witnessed various developmental activities over the last five years.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Industrial Adhesives Market

4.2 Industrial Adhesives Market: Key Regions

4.3 Emerging Economies Expected to Witness High Growth in Asia-Pacific Industrial Adhesives Market

4.4 Market Regional Snapshot

4.5 Market: Emerging & Developed Nations

4.6 Market, By Composition

4.7 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.1.1 Major Advantages of Adhesives

5.1.2 Disadvantages of Adhesives

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Augmented Growth in the Packaging, Construction, and Woodworking & Transportation Market

5.3.1.2 Amended Preference for High Performance Adhesives

5.3.1.3 Technological Furtherance in End-User Industries

5.3.2 Restraints

5.3.2.1 Volatile Price of Raw Material

5.3.3 Opportunities

5.3.3.1 Propounded Environmental Regulations

5.3.3.2 Ascending Demand for Lightweight & Low Carbon Emitting Vehicles

5.3.4 Challenges

5.3.4.1 High Disbursement on R&D

6 Industry Trends (Page No. - 51)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Threat of New Entrants

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Rivalry

7 Industrial Adhesives Market, By Material Base (Page No. - 56)

7.1 Introduction

7.2 Synthetic

7.3 Natural

8 Industrial Adhesives Market, By Composition (Page No. - 63)

8.1 Introduction

8.2 Acrylic

8.3 Vinyl

8.4 Epoxy Resins

8.5 Polyolefin Polymers

8.6 Rubber

8.7 Amine-Based Resins

8.9 Others

9 Industrial Adhesives Market, By Type (Page No. - 82)

9.1 Introduction

9.1.1 Water-Based Adhesives

9.1.2 Solvent-Based Adhesives

9.1.3 Hot-Melt Adhesives

9.1.4 Pressure Sensitive Adhesives

9.1.5 Others

10 Industrial Adhesives Market, By End-Use Industry (Page No. - 93)

10.1 Introduction

10.1.1 Pressure Sensitive Products

10.1.2 Packaging Industry

10.1.3 Construction & Woodworking Industry

10.1.4 Transportation Industry

10.1.5 Others

11 Industrial Adhesives Market, By Region (Page No. - 100)

11.1 Introduction

11.2 Asia-Pacific

11.3 North America

11.4 Europe

11.5 South America

11.6 Middle East & Africa

12 Competitive Landscape (Page No. - 142)

12.1 Introduction

12.1.1 New Product Launches: the Most Popular Growth Strategy

12.2 Maximum Developments in 2015

12.3 Henkel AG & Company, KGaA (Dusseldorf, Germany): the Most Active Player

12.4 Competitive Situation & Trends

12.5 New Product Launches

12.6 Mergers & Acquisitions

12.7 Expansions

12.8 Partnerships, Agreements, & Collaborations

12.9 Joint Ventures

12.10 Divestitures

13 Company Profiles (Page No. - 153)

(Overview, Financial*, Products & Services, Strategy, and Developments)

13.1 H. B. Fuller

13.2 Pidilite Industries Limited

13.3 Huntsman Corporation

13.4 3M Company

13.5 Henkel AG & Company, KGaA

13.6 Sika AG

13.7 The DOW Chemical Company

13.8 BASF SE

13.9 Solvay Group

13.10 E. I. Du Pont De Nemours and Company

13.11 List of Additional Companies

13.11.1 Hitachi Chemical Company Ltd.

13.11.2 Mitsubishi Chemicals Corporation

13.11.3 Bayer Material Science (Covestro)

13.11.4 Avery Denison Group

13.11.5 Adhesive Films Inc.

13.11.6 Toyo Polymer Co. Ltd.

13.11.7 Bostik SA

13.11.8 Royal Adhesives & Sealants

13.11.9 Bemis

13.11.10 Master Bond Inc.

13.11.11 Ashland Inc.

*Details Might Not Be Captured in Case of Unlisted Companies

14 Appendix (Page No. - 194)

14.2 Introducing RT : Real-Time Market Intelligence

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Available Customizations

14.5 Related Reports

List of Tables (127 Tables)

Table 1 Industrial Adhesives Market, By Material Base

Table 2 Industrial Adhesives Market, By Composition

Table 3 Market, By Type

Table 4 Market, By End-User Industry

Table 5 Market, By Material Base, 20142021 (USD Billion)

Table 6 Market, By Material Base, 20142021 (Kilotons)

Table 7 Synthetic Industrial Adhesives Market, By Region, 20142021 (USD Billion)

Table 8 Synthetic Industrial Adhesives Market, By Region, 20142021 (Kilotons)

Table 9 Natural Market, By Region, 20142021 (USD Billion)

Table 10 Natural Market, By Region, 20142021 (Kilotons)

Table 11 Market, By Composition, 20142021 (USD Billion)

Table 12 Market, By Composition, 20142021 (Kilotons)

Table 13 Acrylic Industrial Adhesives Market, By Region, 20142021 (USD Billion)

Table 14 Acrylic Market, By Region, 20142021 (Kilotons)

Table 15 Vinyl Industrial Adhesives Market, By Region, 20142021 (USD Billion)

Table 16 Vinyl Market, By Region, 20142021 (Kilotons)

Table 17 Epoxy Resins Industrial Adhesives Market, By Region, 20142021 (USD Billion)

Table 18 Epoxy Resins Market, By Region, 20142021 (Kilotons)

Table 19 Polyolefin Polymers Industrial Adhesives Market, By Region, 20142021 (USD Billion)

Table 20 Polyolefin Polymers Market, By Region, 20142021 (Kilotons)

Table 21 Rubber Industrial Adhesives Market, By Region, 20142021 (USD Billion)

Table 22 Rubber Market, By Region, 20142021 (Kilotons)

Table 23 Amine-Based Resins Industrial Adhesives Market, By Region, 20142021 (Kilotons)

Table 24 Starch and Dextrin Market, By Region, 20142021 (USD Billion)

Table 25 Starch and Dextrin Industrial Adhesives Market, By Region, 20142021 (Kilotons)

Table 26 Other Industrial Adhesives Market, By Region, 20142021 (USD Billion)

Table 27 Other Market, By Region, 20142021 (Kilotons)

Table 28 Industrial Adhesives Market, By Type, 2014-2021 (USD Billion)

Table 29 Market, By Type, 2014-2021 (Kilo Tons)

Table 30 Water-Based Industrial Adhesives Market, By Region, 2014-2021 (USD Billion)

Table 31 Water-Based Market, By Region, 2014-2021 (Kilo Tons)

Table 32 Solvent-Based Adhesives Market, By Region, 2014-2021 (USD Billion)

Table 33 Solvent-Based Adhesives Market, By Region, 2014-2021 (Kilo Tons)

Table 34 Hot-Melt Adhesives Market, By Region, 2014-2021 (USD Billion)

Table 35 Hot-Melt Adhesives Market, By Region, 2014-2021 (Kilo Tons)

Table 36 Pressure Sensitive Industrial Adhesives Market, By Region, 2014-2021 (USD Billion)

Table 37 Pressure Sensitive Adhesives Market, By Region, 2014-2021 (Kilo Tons)

Table 38 Other Industrial Adhesives Market, By Region, 20142021 (USD Billion)

Table 39 Other Adhesives Market, By Region, 2014-2021 (Kilo Tons)

Table 40 Market, By End-Use Industry, 2014-2021 (USD Billion)

Table 41 Market, By End-Use Industry, 2014-2021 (Kilotons)

Table 42 Market for Pressure Sensitive Products, By Region, 2014-2021 (Kilotons)

Table 43 Industrial Adhesives Market for Packaging Industry, By Region, 2014-2021 (Kilotons)

Table 44 Market for Construction & Woodworking Industry, By Region, 2014-2021 (Kilotons)

Table 45 Market for Transportation Industry, By Region, 2014-2021 (Kilotons)

Table 46 Market for Other End-Use Industries , By Region, 2014-2021 (Kilotons)

Table 47 Market, By Region, 20142021 (USD Billion)

Table 48 Market, By Region, 20142021 (Kilo Tons)

Table 49 Asia-Pacific Industrial Adhesives Market, By Country, 20142021 (USD Billion)

Table 50 Asia-Pacific Market, By Country, 20142021 (Kilo Tons)

Table 51 Asia-Pacific Market, By Material Base, 20142021 (USD Billion)

Table 52 Asia-Pacific Market, By Material Base, 20142021 (Kilo Tons)

Table 53 Asia-Pacific Market, By Type, 20142021 (USD Billion)

Table 54 Asia-Pacific Market, By Type, 20142021 (Kilo Tons)

Table 55 Asia-Pacific Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 56 Asia-Pacific Market, By Composition, 20142021 (USD Billion)

Table 57 Asia-Pacific Market, By Composition, 20142021 (Kilo Tons)

Table 58 China Industrial Adhesives Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 59 India Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 60 Japan Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 61 Australia Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 62 New Zealand Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 63 Malaysia Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 64 Hong Kong Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 65 Rest of Asia-Pacific Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 66 North America Industrial Adhesives Market, By Country, 20142021 (USD Billion)

Table 67 North America Market, By Country, 20142021 (Kilo Tons)

Table 68 North America Market, By Material Base, 20142021 (USD Billion)

Table 69 North America Market, By Material Base, 20142021 (Kilo Tons)

Table 70 North America Market, By Type, 20142021 (USD Billion)

Table 71 North America Market, By Type, 20142021 (Kilo Tons)

Table 72 North America Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 73 North America Market, By Composition, 20142021 (USD Billion)

Table 74 North America Market, By Composition, 20142021 (Kilo Tons)

Table 75 U.S. Market , By End-Use Industry, 20142021 (Kilo Tons)

Table 76 Canada Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 77 Mexico Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 78 Europe Industrial Adhesives Market, By Country, 20142021 (USD Billion)

Table 79 Europe Market, By Country, 20142021 (Kilo Tons)

Table 80 Europe Market, By Material Base, 20142021 (USD Billion)

Table 81 Europe Market, By Material Base, 20142021 (Kilo Tons)

Table 82 Europe Market, By Type, 20142021 (USD Billion)

Table 83 Europe Market, By Type, 20142021 (Kilo Tons)

Table 84 Europe Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 85 Europe Market, By Composition, 20142021 (USD Billion)

Table 86 Europe Market, By Composition, 20142021 (Kilo Tons)

Table 87 Germany Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 88 France Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 89 U.K. Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 90 Italy Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 91 Russia Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 92 Belgium Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 93 Spain Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 94 Rest of Europe Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 95 South America Industrial Adhesives Market, By Country, 20142021 (USD Billion)

Table 96 South America Market, By Country, 20142021 (Kilo Tons)

Table 97 South America Market, By Material Base, 20142021 (USD Billion)

Table 98 South America Market, By Material Base, 20142021 (Kilo Tons)

Table 99 South America Market, By Type, 20142021 (USD Billion)

Table 100 South America Market, By Type, 20142021 (Kilo Tons)

Table 101 South America Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 102 South America Market, By Composition, 20142021 (USD Billion)

Table 103 South America Market, By Country, 20142021 (Kilo Tons)

Table 104 Brazil Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 105 Argentina Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 106 Colombia Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 107 Peru Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 108 Rest of South America Industrial Adhesives Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 109 Middle East & Africa Industrial Adhesives Market, By Country, 20142021 (USD Billion)

Table 110 Middle East & Africa Market, By Country, 20142021 (Kilo Tons)

Table 111 Middle East & Africa Market, By Material Base, 20142021 (USD Billion)

Table 112 Middle East & Africa Market, By Material Base, 20142021 (Kilo Tons)

Table 113 Middle East & Africa Market, By Type, 20142021 (USD Billion)

Table 114 Middle East & Africa Market, By Type, 20142021 (Kilo Tons)

Table 115 Middle East & Africa Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 116 Middle East & Africa Market, By Composition, 20142021 (USD Billion)

Table 117 Middle East & Africa Market, By Country, 20142021 (Kilo Tons)

Table 118 South Africa Market , By End-Use Industry, 20142021 (Kilo Tons)

Table 119 Saudi Arabia Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 120 UAE Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 121 Iran Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 122 Rest of the Middle East & Africa Industrial Adhesives Market, By End-Use Industry, 20142021 (Kilo Tons)

Table 123 New Product Launches, 2011-2016

Table 124 Mergers & Acquisitions, 2011-2016

Table 125 Expansions, 2010-2016

Table 126 Partnerships, Agreements, & Collaborations, 2011-2016

Table 127 Joint Ventures, 2011-2016

List of Figures (62 Figures)

Figure 1 Industrial Adhesives: Market Segmentation

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews, By Company Type, Designation, & Region

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Industrial Adhesives Market: Data Triangulation

Figure 7 Construction & Woodworking Segment Expected to Dominate Industrial Adhesives Market During the Forecast Period

Figure 8 Asia-Pacific Expected to Be the Fastest-Growing Market for Industrial Adhesives During the Forecast Period

Figure 9 Industrial Adhesives Market, By Country, 2015 (USD Billion)

Figure 10 Packaging Industry and Construction & Woodworking Segments Anticipated to Drive the Demand for Industrial Adhesives

Figure 11 Asia-Pacific Expected to Be the Key Market for Industrial Adhesives

Figure 12 China is Estimated to Account for the Largest Share of the Asia-Pacific Industrial Adhesives Market

Figure 13 Asia-Pacific and Middle East & Africa Expected to Witness Significant Growth During the Forecast Period

Figure 14 China and South Africa to Emerge as Lucrative Markets for Industrial Adhesives During the Forecast Period

Figure 15 Acrylic Expected to Be the Leading Segment Across All Regions

Figure 16 Asia-Pacific is Expected to Witness High Growth During the Forecast Period

Figure 17 Industrial Adhesives Market, By Region

Figure 18 Overview of Factors Influencing the Industrial Adhesives Market

Figure 19 Global Packaging Market, 2016-2021

Figure 20 Global Construction Market Growth Rate, By Region, 2013-2020

Figure 21 Crude Oil Prices, 2011-2016

Figure 22 Value Chain Analysis

Figure 23 Porters Five Forces Analysis

Figure 24 The Natural Segment of the Industrial Adhesives Market is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 25 The Asia-Pacific Region is Anticipated to Lead the Synthetic Segment of the Industrial Adhesives Market in 2016

Figure 26 The Starch and Dextrin Segment of the Industrial Adhesives Market is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 27 The Asia-Pacific Region Expected to Lead the Acrylic Segment of the Industrial Adhesives Market in 2016

Figure 28 The Asia-Pacific Region to Lead the Vinyl Segment of the Market in 2016

Figure 29 The Asia-Pacific Epoxy Resins Market to Grow at the Highest CAGR During the Forecast Period

Figure 30 The Asia-Pacific Region to Account for the Largest Share in the Polyolefin Polymers Segment of the Market in 2016

Figure 31 The Asia-Pacific Rubber Industrial Adhesives Market Projected to Grow at the Highest CAGR During the Forecast Period

Figure 32 The Asia-Pacific Region to Lead the Amine-Based Resins Segment of the Market in 2016

Figure 33 The Asia-Pacific Region to Lead the Starch and Dextrin Segment of the Market in 2016

Figure 34 The Asia-Pacific Region to Lead the Other Industrial Adhesives Market in 2016

Figure 35 The Water-Based Segment is Estimated to Lead the Market in 2016

Figure 36 Water-Based Segment of the Asia- Pacific Market is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 37 The North American Region is Estimated to Lead the Solvent-Based Segment of the Industrial Adhesives Market in 2016

Figure 38 The Hot-Melt Adhesives Segment is Expected to Lead the Asia-Pacific Industrial Adhesives Market

Figure 39 The Construction & Woodworking Industry Segment Estimated to Lead the Industrial Adhesives Market in 2016

Figure 40 Regional Snapshot (2016-2021): India, China, & South Africa are Emerging as New Strategic Locations

Figure 41 Market Snapshot: Asia-Pacific Industrial Adhesives India and China to Be the Fastest-Growing Countries

Figure 42 Market Snapshot: North America Industrial Adhesives Mexico to Be the Fastest-Growing Country

Figure 43 Market Snapshot: Europe Industrial Adhesives - Spain to Be the Fastest-Growing Country

Figure 44 New Product Launce: the Most Preferred Strategy Over the Last Five Years

Figure 45 New Product Launches Was the Key Strategy Between 2011 and 2016

Figure 46 Industrial Adhesives Market, Developmental Shares, 20122016

Figure 47 Industrial Adhesives Market: Growth Strategies, By Company, 20112016

Figure 48 H. B. Fuller: Company Snapshot

Figure 49 H. B. Fuller: SWOT Analysis

Figure 50 Pidilite Industries Limited: Company Snapshot

Figure 51 Pidilite Industries Limited: SWOT Analysis

Figure 52 Huntsman Corporation: Company Snapshot

Figure 53 Huntsman Corporation: SWOT Analysis

Figure 54 3M: Company Snapshot

Figure 55 3M Company: SWOT Analysis

Figure 56 Henkel AG & Company, KGaA: Company Snapshot

Figure 57 Henkel AG & Company, KGaA: SWOT Analysis

Figure 58 Sika AG: Company Snapshot

Figure 59 DOW Chemical Company: Company Snapshot

Figure 60 BASF SE: Company Snapshot

Figure 61 Solvay Group: Company Snapshot

Figure 62 E.I. Du Pont Nemours and Company: Company Snapshot

Growth opportunities and latent adjacency in Industrial Adhesives Market