Industrial Absorbents Market by Material type (cellulose, corncob, clay, PP), Product (pads, booms & socks, rolls, pillows, sheets & mats, granules), Type (universal, oil-only, HAZMAT), End-use industry, and Region - Global forecast to 2028

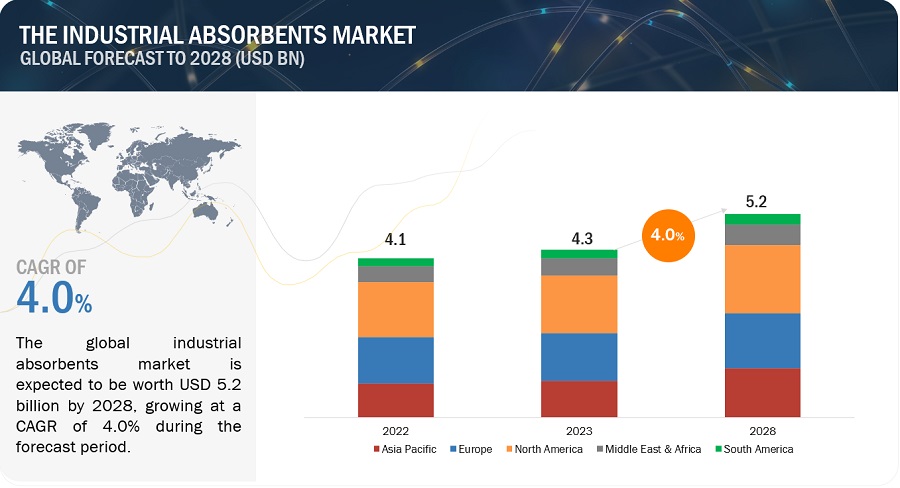

The industrial absorbents market is projected to grow from USD 4.3 billion in 2023 to USD 5.2 billion by 2028, at a CAGR of 4.0% from 2023 to 2028. The industrial absorbents market has observed stable growth throughout the study period and is expected to continue with the same trend during the forecast period. The key factors driving the growth of this market are growing environmental concerns and regulations with respect to the spillage of oil and chemicals.

Attractive Opportunities in the Industrial Absorbents Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Growing environmental concerns and regulations regarding oil and chemical spills on the environment

Oil and chemical spills hold the potential to impact entire ecosystems, posing risks not just to the environment but also to human life. These spills, whether on land or water, have far-reaching repercussions, especially devastating marine environments rich in corals, seabirds, fishes, and marshlands. Leaks from production processes or pipeline ruptures can further contaminate underground water reserves. The aftermath of spills also incurs significant economic burdens on governments or companies, necessitating spending on healthcare for affected individuals and extensive cleanup measures. A poignant example is BP Plc's expenditure of USD 65.77 billion for response, cleanup, and compensation following the Gulf of Mexico oil spill in 2010. Consequently, governments worldwide are taking proactive steps, implementing environmental protection policies and legislation to safeguard against pollution's adverse effects.

Environmental regulatory bodies closely monitor companies to prevent and manage oil or chemical spills. Governments globally develop contingency plans and maintain reserves of spill control resources as a precautionary measure. Media and NGOs play a pivotal role in raising awareness, compelling responsible agencies and organizations to take action that mitigates the environmental impact of spills. As concerns over spill consequences intensify and environmental regulations tighten, the industrial absorbents market is poised to witness significant growth.

Restraint: Saturation and buoyancy of industrial absorbent products

Spill control products based on industrial absorbents possess specific absorption capacities determined by their size and intended use. These products, including pads, rolls, pillows, and booms & socks, reach saturation when exposed to fluids during usage. Additionally, spill control products with oleophilic or hydrophobic properties lose their floating ability after constant contact with oil, chemicals, or water, impacting their efficacy in absorbing and recovering fluid substances.

This inefficiency leads to challenges in assessing the saturation level of these spill control products. Among various industrial absorbent materials, natural organic absorbents are flammable and lose their effectiveness with petroleum fluids, restricting their utility in key industries like oil & gas and chemicals, which are primary consumers of industrial absorbents. Consequently, the saturation and loss of floating capacity in spill control products emerge as pivotal limitations restraining the growth of the industrial absorbents market.

Opportunity: Growth opportunity for reusable industrial absorbent products

Reusable industrial absorbents share similar properties with non-reusable counterparts. They can be utilized multiple times until reaching saturation and losing their water-repelling capabilities. Only a few major market players offer these reusable industrial absorbent products within the industrial absorbents market. These reusable variants find extensive applications, particularly in oil & gas and food processing industries, specifically in the universal and oil-only segments. Additionally, workplace safety regulations advocating for worker safety will propel the growth of reusable absorbents. They play a crucial role in soaking up floor fluids, preventing slips and falls.

Furthermore, through substantial research and development efforts, it's possible to create high-quality and cost-efficient reusable absorbent products, paving the way for their enhanced adoption in various industries.

Challenge: Reducing large oil spills

During vessel operations such as loading/discharging and bunkering, significant spills can occur due to various reasons like collision, groundings, hull or equipment failures, fires, explosions, adverse weather, or human errors. According to the International Tanker Owners Pollution Federation Limited, the frequency of major spills has notably decreased over the past 46 years. The average number of spills per year dropped from 24.5 tons in 1970-1979 to 1.8 tons in 2010-2017. This decline is attributed to lessons learned from past incidents.

The reduced occurrence of major oil spills has led to a decreased demand for spill response or control products, impacting the sales of industrial absorbents. Given that oil & gas remain a key consumer of these absorbents and their products, the decline in major oil spills may consequently affect the spill response and control the product market.

Industrial Absorbent Market: Ecosystem

The synthetic segment is projected to be the largest segment during the forecast period.

The synthetic material type segment is expected to dominate the industrial absorbents market in the forecast period due to several factors. Technological advancements have led to the development of synthetic materials with superior absorption capacities and versatile applications across various industries. These synthetic absorbents, derived from materials like polypropylene, polyurethane, polyester, and polyethylene, offer high absorbency rates, non-flammability, and excellent water repellency. Their efficiency in absorbing a wide range of fluids, especially in oil & gas, chemical, food processing, and healthcare industries, positions synthetic absorbents as the preferred choice. Additionally, the rising focus on sustainability and stringent spill control regulations further drive the demand for synthetic absorbents, anticipating their dominance in the market.

Pads are expected to be the largest segment of the industrial absorbents market by product during the forecast period.

By product, the pads segment accounted for the largest share of the industrial absorbents market in 2022 due to its versatility and widespread usage across industries. These spill response products, available in various sizes, are extensively used for cleaning up diverse spills, including oil, water-based liquids, and mild chemicals. Their adaptability to different spill scenarios, along with their efficiency in various applications across industries such as oil & gas, chemical, and healthcare, positions pads as the primary choice for spill control. Moreover, their role in addressing workplace safety concerns and the ease of deployment further contribute to their anticipated dominance in the industrial absorbents market.

By type, the oil-only segment is estimated to account for the largest share of the industrial absorbents market during the forecast period.

Oil-only types of absorbents are uniquely designed to selectively absorb petroleum hydrocarbons and oil-based liquids while repelling water-based fluids. Their crucial role in managing oil spills, their extensive use in the oil & gas industry, and their effectiveness in various applications across spill scenarios position the oil-only segment as the primary choice for spill control. Moreover, the emphasis on environmental protection and stringent regulations regarding oil spill response further drives the demand for oil-only absorbents, contributing to their anticipated dominance in the industrial absorbents market.

The oil & gas segment is estimated to account for the largest share of the industrial absorbents market during the forecast period.

The oil & gas segment is poised to secure the largest share in the industrial absorbents market during the forecast period due to its extensive use and high demand for spill control products. The industry's operations across downstream, midstream, and upstream activities involve inherent spill risks, necessitating effective spill response measures. Given the potential environmental and economic repercussions of oil and chemical spills, the oil & gas sector heavily relies on industrial absorbents for spill containment and recovery. This sector's significant consumption of these absorbents across various applications, coupled with stringent regulations and heightened awareness regarding environmental protection, reinforces its position as the primary consumer, driving its dominance in the industrial absorbents market.

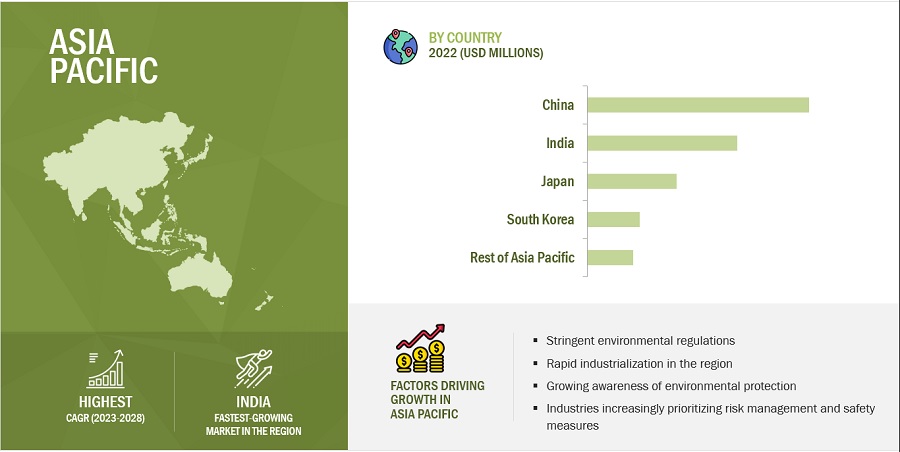

Asia Pacific is projected to grow at the highest CAGR during the forecast period.

Asia Pacific is anticipated to experience the highest CAGR in the industrial absorbents market during the forecast period due to several factors. The Asia Pacific region has been experiencing rapid industrialization, leading to increased manufacturing activities across various sectors. This expansion heightens the risk of spills and accidents, thus increasing the need for industrial absorbents to mitigate environmental damage. Moreover, stringent environmental regulations imposed by governments in countries like China, India, Japan, and South Korea drive the demand for industrial absorbents. Compliance with these regulations necessitates the use of absorbents to manage and contain spills and pollutants effectively.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The 3M Company (US), Brady Corporation (US), Decorus Europe Ltd. (UK), Johnson Matthey Plc (UK), Ansell Ltd. (Australia), Meltblown Technologies Inc. (US), Monarch Green, Inc. (US), New Pig Corporation (US), and Oil-Dri Corporation of America (US) are some of the major players in the global industrial absorbents market.

These players have been focusing on expansion, acquisition, and agreement strategies that help them expand their businesses in untapped and potential markets. They have adopted various organic and inorganic growth strategies to enhance their position in the industrial absorbents market.

Read More: Industrial Absorbents Companies

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for Years |

2018 to 2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Material type, Product, Type, End-use industry, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies Covered |

3M Company (US), Brady Corporation (US), Decorus Europe Ltd. (UK), Johnson Matthey Plc (UK), Kimberly-Clark Professional (US), Meltblown Technologies Inc. (US), Monarch Green, Inc. (US), New Pig Corporation (US), and Oil-Dri Corporation of America (US), and others. |

This research report categorizes the industrial absorbents market based on material type, product, type, end-use industry, and region.

Based on the material type, the industrial absorbents market has been segmented as follows:

-

Natural Organic

- Cellulose

- Corncob

-

Natural Inorganic

- Clay

-

Synthetic

- Polypropylene

- Polyester

Based on the product, the industrial absorbents market has been segmented as follows:

- Pads

- Rolls

- Pillows

- Granules

- Booms & Socks

- Sheets & Mats

- Others

Based on the type, the industrial absorbents market has been segmented as follows:

- Universal

- Oil-Only

- HAZMAT/Chemical

Based on the end-use industry, the industrial absorbents market has been segmented as follows:

-

Oil & Gas

- Upstream

- Midstream

- Downstream

- Chemical

- Food Processing

- Healthcare

- Others

Based on the region, the industrial absorbents market has been segmented as follows:

-

North America

- US

- Canada

- Mexico

-

Europe

- GERMANY

- FRANCE

- SPAIN

- UK

- ITALY

- REST OF EUROPE

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Specific

-

South America

- Brazil

- Argentina

- Rest of South America

-

Middle East & Africa

-

GCC Countries

- UAE

- Saudi Arabia

- Rest of GCC

- Iran

- South Africa

- Rest of Middle East & Africa

-

GCC Countries

Recent Developments

- In August 2023, New Pig Corporation, leading players in industrial absorbents products, acquired the former US Foods 165,000 square foot warehouse facility in Altoona. This additional warehouse space is to accommodate growth and product development of industrial absorbents.

- In May 2023, Denios expanded its production with a new 4,200 square meter assembly and storage hall. The hall expansion caters to mold making, final assembly, and sensor-equipped room systems, producing around 2,000 systems annually and offering comprehensive customer support. With global production sites, including France, the Czech Republic, Italy, China, and the US, this expansion at the Bad Oeynhausen headquarters strengthens Denios's international presence and allows for further growth.

- In May 2023, 3M invested USD 146 million to expand its biotech manufacturing support, aiming to enhance filtration technology for bioprocessing and pharmaceutical manufacturing. In relation to the industrial absorbent market, advancements in filtration technology and purification methods, such as those developed by 3M, can significantly impact the production of absorbent materials used in various industrial applications. These advancements contribute to improved filtration efficiency and purity, potentially enhancing the quality and effectiveness of industrial absorbents in managing spills, controlling pollution, and maintaining environmental safety standards.

Frequently Asked Questions (FAQ):

What is the key driver and opportunity for the industrial absorbents market?

Growing environmental concerns and regulations regarding oil and chemical spills on the environment as well as growth opportunities for reusable industrial absorbent products are the primary drivers and opportunities, respectively.

Which region is expected to hold the highest market share in the industrial absorbents market?

The industrial absorbents market in North America is expected to dominate the market share in 2028 due to rapid development and investment in oil & gas infrastructure.

What material type of industrial absorbents account for a significant share?

Synthetic material type material accounts for a significant share of the industrial absorbents market.

Who are the major service providers of industrial absorbents?

The key manufacturers operating in the market are 3M Company (US), Brady Corporation (US), Decorus Europe Ltd. (UK), Johnson Matthey Plc (UK), Kimberly-Clark Professional (US), Meltblown Technologies Inc. (US), Monarch Green, Inc. (US), New Pig Corporation (US), and Oil-Dri Corporation of America (US).

What total CAGR is expected for the industrial absorbents from 2023 to 2028?

The market is expected to record a CAGR of 4.0% from 2023-2028. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing environmental concerns and regulations regarding oil and chemical spills- Innovation in industrial absorbent product developmentRESTRAINTS- Saturation and buoyancy of industrial absorbent products- Limited disposal options for used absorbents- Availability of cost-effective substitutesOPPORTUNITIES- Growth opportunity for reusable industrial absorbent productsCHALLENGES- Reducing large oil spills- Fluctuating raw material prices

-

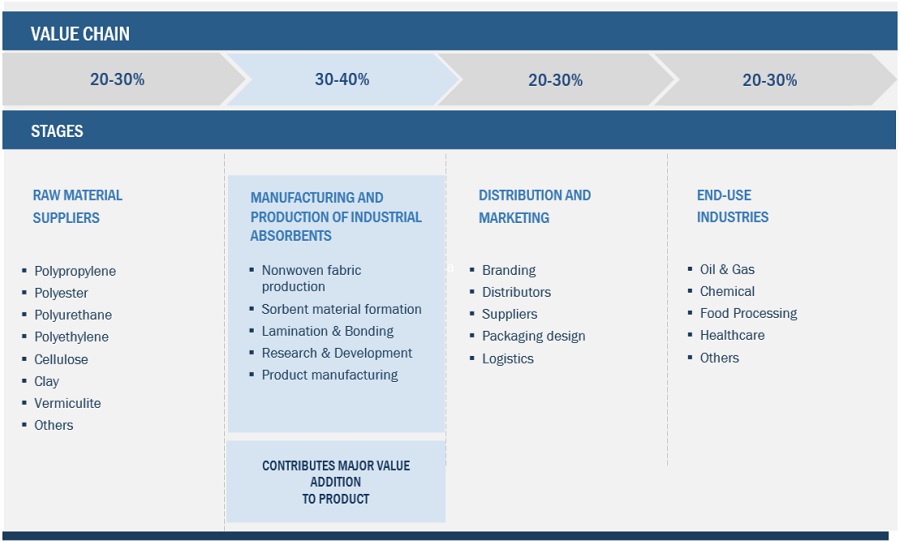

5.3 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURING AND PRODUCTION OF INDUSTRIAL ABSORBENTSDISTRIBUTION & MARKETINGEND-USE INDUSTRIES

-

5.4 ECOSYSTEM

-

5.5 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.6 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7 KEY CONFERENCES AND EVENTS (2023–2024)

-

5.8 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.9 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

-

5.10 PATENT ANALYSISMETHODOLOGYMAJOR PATENTS

- 5.11 TECHNOLOGY ANALYSIS

-

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS FOR INDUSTRIAL ABSORBENT MANUFACTURERS/SUPPLIERS

-

5.13 PRICING ANALYSISAVERAGE SELLING PRICE OF INDUSTRIAL ABSORBENTS, BY REGIONAVERAGE SELLING PRICE OF INDUSTRIAL ABSORBENTS, BY MARKET PLAYER

-

5.14 CASE STUDYPROBLEM STATEMENT: USAGE OF SINGLE-USE INDUSTRIAL ABSORBENT PRODUCTS LEADING TO WASTE GENERATION AND INCREASE IN OVERALL OPERATIONAL COST

- 6.1 INTRODUCTION

-

6.2 UNIVERSALHIGH ABSORBENT CAPACITY AND VERSATILE NATURE TO DRIVE MARKET

-

6.3 OIL-ONLYHIGH AFFINITY FOR HYDROPHOBIC LIQUIDS TO DRIVE MARKET

-

6.4 HAZMAT/CHEMICALREQUIREMENT FOR HIGH-QUALITY SPILL CONTROL PRODUCTS TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 PADSWIDE USAGE FOR CLEAN-UP TO DRIVE MARKET

-

7.3 ROLLSAVAILABILITY IN DIFFERENT SIZES AND SHAPES TO DRIVE MARKET

-

7.4 PILLOWSLARGE SURFACE AREA, HIGH CAPACITY, AND FAST-WICKING FILLERS TO DRIVE MARKET

-

7.5 GRANULESCOST-EFFECTIVENESS TO DRIVE MARKET

-

7.6 BOOMS & SACKSWATER REPELLING NATURE AND ABSORPTION OF ONLY OIL-BASED LIQUIDS TO DRIVE MARKET

-

7.7 SHEETS & MATSINCREASED USAGE IN FLOOR APPLICATIONS TO DRIVE MARKET

- 7.8 OTHER PRODUCTS

- 8.1 INTRODUCTION

-

8.2 NATURAL ORGANICNON-TOXIC, BIODEGRADABLE, AND DISPOSABLE NATURE TO DRIVE MARKETCELLULOSECORNCOB

-

8.3 NATURAL INORGANICAVAILABILITY IN LARGE QUANTITIES TO DRIVE MARKETCLAY

-

8.4 SYNTHETICHIGHER ABSORPTION CAPACITY TO DRIVE MARKETPOLYPROPYLENEPOLYESTER

- 9.1 INTRODUCTION

-

9.2 OIL & GASINCREASING DEMAND FOR OIL & GAS FROM EMERGING COUNTRIES TO DRIVE MARKETUPSTREAMMIDSTREAMDOWNSTREAM

-

9.3 CHEMICALQUICK RESPONSE AND MINIMIZED SPILLAGE IMPACT ON ENVIRONMENT TO DRIVE MARKET

-

9.4 FOOD PROCESSINGMAINTENANCE OF HIGH ENVIRONMENTAL STANDARDS DURING FOOD PROCESSING TO DRIVE MARKET

-

9.5 HEALTHCARENECESSITY TO UPHOLD AND PRESERVE HYGIENIC ENVIRONMENT IN HEALTHCARE INDUSTRY TO DRIVE MARKET

- 9.6 OTHER END-USE INDUSTRIES

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICRECESSION IMPACTCHINA- China to lead Asia Pacific industrial absorbents marketJAPAN- Stringent environmental laws, promotion of circular economy, and technological advancements to drive marketINDIA- Rapid industrialization and increase in environmental consciousness to drive marketSOUTH KOREA- Industrial developments and technological innovations to fuel growthREST OF ASIA PACIFIC

-

10.3 EUROPERECESSION IMPACTGERMANY- Commitment to sustainability and effective spill response to fuel demandFRANCE- Regulatory imperatives and heightened environmental consciousness to drive marketUK- Government regulations and increase in demand for environmentally friendlier products to drive marketSPAIN- Rise in industrial activities and investments and integration of absorbents in various industry verticals to drive marketITALY- Growing industrial sectors and tightening environmental regulations to fuel growthREST OF EUROPE

-

10.4 NORTH AMERICARECESSION IMPACTUS- Strategic spill response solutions in evolving oil & gas sector to drive marketCANADA- Thriving resource extraction industries to drive growthMEXICO- Stringent environmental regulations and growing chemical & petrochemical industries to drive growth

-

10.5 MIDDLE EAST & AFRICARECESSION IMPACTGCC COUNTRIES- Saudi Arabia- UAE- Rest of GCC CountriesSOUTH AFRICA- Government initiatives to drive industrial absorbents marketREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Rapid growth in oil & gas processing to drive industrial absorbents marketARGENTINA- Increasing demand for spill control products to drive marketREST OF SOUTH AMERICA

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE ANALYSIS

-

11.4 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS- 3M- Johnson Matthey Plc- Ansell ltd.- Brady Corporation- Oil-Dri Corporation of America

-

11.5 COMPANY EVALUATION MATRIX (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINTPROGRESSIVE COMPANIESCOMPETITIVE BENCHMARKING

- 11.6 COMPETITIVE SCENARIO

-

12.1 KEY PLAYERSNEW PIG CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsDECORUS EUROPE- Business overview- Products/Solutions/Services offeredMELTBLOWN TECHNOLOGIES INC.- Business overview- Products/Solutions/Services offeredDENIOS- Business overview- Products/Solutions/Services offered- Recent developments3M- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJOHNSON MATTHEY- Business overview- Products/Solutions/Services offered- MnM viewOIL-DRI CORPORATION OF AMERICA- Business overview- Products/Solutions/Services offered- MnM viewBRADY CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewANSELL LTD.- Business overview- Products/Solutions/Services offered- MnM viewGOLTENS- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSASA ENVIRONMENTAL PRODUCTS- Products/Solutions/Services offeredCHEMTEX INDUSTRIES- Products/Solutions/Services offeredDRIZIT ENVIRONMENTAL- Products/Solutions/Services offeredENRETECH- Products/Solutions/Services offeredEP MINERALS- Products/Solutions/Services offeredFENTEX- Products/Solutions/Services offeredGEI WORKS- Products/Solutions/Services offeredKIMBERLY-CLARK PROFESSIONAL- Products/Solutions/Services offeredSHARE CORPORATION- Products/Solutions/Services offeredSYSBEL- Products/Solutions/Services offeredTOLSA- Products/Solutions/Services offered

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 INDUSTRIAL ABSORBENTS INTERCONNECTED MARKETSSUPER ABSORBENT POLYMERS (SAP) MARKET- Market definition- Market overview

-

13.4 SODIUM POLYACRYLATEHIGH WATER ABSORBING ABILITY OF SODIUM POLYACRYLATE TO DRIVE DEMAND

-

13.5 POLYACRYLATE/POLYACRYLAMIDE COPOLYMERINCREASE IN USE OF POLYACRYLAMIDE COPOLYMER IN VARIOUS APPLICATIONS TO FUEL MARKET

- 13.6 OTHERS

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 INDUSTRIAL ABSORBENTS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 INDUSTRIAL ABSORBENTS MARKET SNAPSHOT

- TABLE 3 ANNUAL QUANTITY OF OIL SPILL (2010–2022)

- TABLE 4 INDUSTRIAL ABSORBENTS MARKET: ROLE IN ECOSYSTEM

- TABLE 5 IMPACT OF PORTER’S FIVE FORCES ON INDUSTRIAL ABSORBENTS MARKET

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 INDUSTRIAL ABSORBENTS MARKET: KEY CONFERENCES AND EVENTS (2023–2024)

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 12 EXPORT DATA ON HS CODE 392690: ARTICLES OF PLASTICS AND ARTICLES OF OTHER MATERIALS OF HEADING (USD MILLION)

- TABLE 13 IMPORT DATA ON HS CODE 392690: ARTICLES OF PLASTICS AND ARTICLES OF OTHER MATERIALS OF HEADING (USD MILLION)

- TABLE 14 OVERVIEW OF PATENTS

- TABLE 15 INDUSTRIAL ABSORBENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 16 INDUSTRIAL ABSORBENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 17 INDUSTRIAL ABSORBENTS MARKET, BY PRODUCT, 2019–2022 (USD MILLION)

- TABLE 18 INDUSTRIAL ABSORBENTS MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 19 INDUSTRIAL ABSORBENTS MARKET, BY MATERIAL TYPE, 2019–2022 (USD MILLION)

- TABLE 20 INDUSTRIAL ABSORBENTS MARKET, BY MATERIAL TYPE, 2023–2028 (USD MILLION)

- TABLE 21 INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 22 INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 23 OIL & GAS: INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 OIL & GAS: INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 CHEMICAL: INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 CHEMICAL: INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 FOOD PROCESSING: INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 FOOD PROCESSING: INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 HEALTHCARE: INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 HEALTHCARE: INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 OTHERS: INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 OTHERS: INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 36 INDUSTRIAL ABSORBENTS MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 37 ASIA PACIFIC: INDUSTRIAL ABSORBENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 38 ASIA PACIFIC: INDUSTRIAL ABSORBENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 40 ASIA PACIFIC: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 41 CHINA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 42 CHINA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 43 JAPAN: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 44 JAPAN: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 45 INDIA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 46 INDIA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 47 SOUTH KOREA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 48 SOUTH KOREA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 49 REST OF ASIA PACIFIC: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 50 REST OF ASIA PACIFIC: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 51 EUROPE: INDUSTRIAL ABSORBENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 52 EUROPE: INDUSTRIAL ABSORBENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 53 EUROPE: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 54 EUROPE: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 55 GERMANY: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 56 GERMANY: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 57 FRANCE: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 58 FRANCE: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 59 UK: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 60 UK: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 61 SPAIN: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 62 SPAIN: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 63 ITALY: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 64 ITALY: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 65 REST OF EUROPE: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 66 REST OF EUROPE: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: INDUSTRIAL ABSORBENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: INDUSTRIAL ABSORBENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 71 US: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 72 US: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 73 CANADA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 74 CANADA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 75 MEXICO: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 76 MEXICO: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 77 MIDDLE EAST & AFRICA: INDUSTRIAL ABSORBENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 78 MIDDLE EAST & AFRICA: INDUSTRIAL ABSORBENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 79 MIDDLE EAST & AFRICA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 80 MIDDLE EAST & AFRICA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 81 SAUDI ARABIA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 82 SAUDI ARABIA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 83 UAE: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 84 UAE: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 85 SOUTH AFRICA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 86 SOUTH AFRICA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 87 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 88 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 89 SOUTH AMERICA: INDUSTRIAL ABSORBENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 90 SOUTH AMERICA: INDUSTRIAL ABSORBENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 91 SOUTH AMERICA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 92 SOUTH AMERICA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 93 BRAZIL: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 94 BRAZIL: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 95 ARGENTINA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 96 ARGENTINA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 97 REST OF SOUTH AMERICA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 98 REST OF SOUTH AMERICA: INDUSTRIAL ABSORBENTS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 99 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- TABLE 100 INDUSTRIAL ABSORBENTS MARKET: DEGREE OF COMPETITION

- TABLE 101 INDUSTRIAL ABSORBENTS MARKET: END USE FOOTPRINT

- TABLE 102 INDUSTRIAL ABSORBENTS MARKET: MATERIAL FOOTPRINT

- TABLE 103 INDUSTRIAL ABSORBENTS MARKET: COMPANY REGION FOOTPRINT

- TABLE 104 INDUSTRIAL ABSORBENTS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 105 INDUSTRIAL ABSORBENTS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 106 INDUSTRIAL ABSORBENTS MARKET: OTHERS, 2021–2023

- TABLE 107 NEW PIG CORPORATION: COMPANY OVERVIEW

- TABLE 108 NEW PIG CORPORATION: PRODUCTS OFFERED

- TABLE 109 NEW PIG CORPORATION: DEALS

- TABLE 110 DECORUS EUROPE: COMPANY OVERVIEW

- TABLE 111 DECORUS EUROPE: PRODUCTS OFFERED

- TABLE 112 MELTBLOWN TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 113 MELTBLOWN TECHNOLOGIES INC.: PRODUCTS OFFERED

- TABLE 114 DENIOS: COMPANY OVERVIEW

- TABLE 115 DENIOS: PRODUCTS OFFERED

- TABLE 116 DENIOS: DEALS

- TABLE 117 DENIOS: OTHERS

- TABLE 118 3M: COMPANY OVERVIEW

- TABLE 119 3M: PRODUCTS OFFERED

- TABLE 120 3M: DEALS

- TABLE 121 3M: OTHERS

- TABLE 122 JOHNSON MATTHEY: COMPANY OVERVIEW

- TABLE 123 JOHNSON MATTHEY: PRODUCTS OFFERED

- TABLE 124 OIL-DRI CORPORATION OF AMERICA: COMPANY OVERVIEW

- TABLE 125 OIL-DRI CORPORATION OF AMERICA: PRODUCTS OFFERED

- TABLE 126 BRADY CORPORATION: COMPANY OVERVIEW

- TABLE 127 BRADY CORPORATION: PRODUCTS OFFERED

- TABLE 128 ANSELL LTD.: COMPANY OVERVIEW

- TABLE 129 ANSELL LTD.: PRODUCTS OFFERED

- TABLE 130 GOLTENS: COMPANY OVERVIEW

- TABLE 131 GOLTENS: PRODUCTS OFFERED

- TABLE 132 ASA ENVIRONMENTAL PRODUCTS: COMPANY OVERVIEW

- TABLE 133 ASA ENVIRONMENTAL PRODUCTS: PRODUCTS OFFERED

- TABLE 134 CHEMTEX INDUSTRIES: COMPANY OVERVIEW

- TABLE 135 CHEMTEX INDUSTRIES: PRODUCTS OFFERED

- TABLE 136 DRIZIT ENVIRONMENTAL: COMPANY OVERVIEW

- TABLE 137 DRIZIT ENVIRONMENTAL: PRODUCTS OFFERED

- TABLE 138 ENRETECH: COMPANY OVERVIEW

- TABLE 139 ENRETECH: PRODUCTS OFFERED

- TABLE 140 EP MINERALS: COMPANY OVERVIEW

- TABLE 141 EP MINERALS: PRODUCTS OFFERED

- TABLE 142 FENTEX: COMPANY OVERVIEW

- TABLE 143 FENTEX: PRODUCTS OFFERED

- TABLE 144 GEI WORKS: COMPANY OVERVIEW

- TABLE 145 GEI WORKS: PRODUCTS OFFERED

- TABLE 146 KIMBERLY-CLARK PROFESSIONAL: COMPANY OVERVIEW

- TABLE 147 KIMBERLY-CLARK PROFESSIONAL: PRODUCTS OFFERED

- TABLE 148 SHARE CORPORATION: COMPANY OVERVIEW

- TABLE 149 SHARE CORPORATION: PRODUCTS OFFERED

- TABLE 150 SYSBEL: COMPANY OVERVIEW

- TABLE 151 SYSBEL: PRODUCTS OFFERED

- TABLE 152 TOLSA: COMPANY OVERVIEW

- TABLE 153 TOLSA: PRODUCTS OFFERED

- TABLE 154 SUPER ABSORBENT POLYMERS MARKET, BY TYPE, 2017–2020 (KILOTON)

- TABLE 155 SUPER ABSORBENT POLYMERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

- TABLE 156 SUPER ABSORBENT POLYMERS MARKET, BY TYPE, 2021–2026 (KILOTON)

- TABLE 157 SUPER ABSORBENT POLYMERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

- FIGURE 1 INDUSTRIAL ABSORBENTS MARKET SEGMENTATION

- FIGURE 2 INDUSTRIAL ABSORBENTS MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED FOR ASSESSING DEMAND FOR INDUSTRIAL ABSORBENTS

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 INDUSTRIAL ABSORBENTS MARKET: DATA TRIANGULATION

- FIGURE 7 SYNTHETIC MATERIAL TYPE TO LEAD INDUSTRIAL ABSORBENTS MARKET DURING FORECAST PERIOD

- FIGURE 8 PADS SEGMENT TO LEAD INDUSTRIAL ABSORBENTS MARKET DURING FORECAST PERIOD

- FIGURE 9 OIL-ONLY SEGMENT TO LEAD INDUSTRIAL ABSORBENTS MARKET DURING FORECAST PERIOD

- FIGURE 10 OIL & GAS INDUSTRY TO LEAD INDUSTRIAL ABSORBENTS MARKET DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF INDUSTRIAL ABSORBENTS MARKET IN 2022

- FIGURE 12 INCREASING DEMAND FOR INDUSTRIAL ABSORBENTS FROM OIL & GAS INDUSTRY TO DRIVE MARKET

- FIGURE 13 ASIA PACIFIC TO WITNESS HIGHEST GROWTH BETWEEN 2023 TO 2028

- FIGURE 14 PADS PRODUCT SEGMENT ACCOUNTED FOR LARGEST SHARE OF INDUSTRIAL ABSORBENTS MARKET IN 2022

- FIGURE 15 SYNTHETIC SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 OIL-ONLY SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 17 INDUSTRIAL ABSORBENTS MARKET IN INDIA AND CHINA TO REGISTER HIGH GROWTH DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN INDUSTRIAL ABSORBENTS MARKET

- FIGURE 19 HIGHEST VALUE ADDITION DURING MANUFACTURING PHASE

- FIGURE 20 INDUSTRIAL ABSORBENTS MARKET: ECOSYSTEM

- FIGURE 21 INDUSTRIAL ABSORBENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 24 LIST OF MAJOR PATENTS FOR INDUSTRIAL ABSORBENTS

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

- FIGURE 26 AVERAGE SELLING PRICE OF INDUSTRIAL ABSORBENTS, BY REGION

- FIGURE 27 AVERAGE SELLING PRICE OF INDUSTRIAL ABSORBENTS OF MARKET PLAYER, BY PRODUCT

- FIGURE 28 OIL-ONLY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 PADS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 SYNTHETIC SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 CHEMICAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN INDUSTRIAL ABSORBENTS MARKET DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC: INDUSTRIAL ABSORBENTS MARKET SNAPSHOT

- FIGURE 34 EUROPE: INDUSTRIAL ABSORBENTS MARKET SNAPSHOT

- FIGURE 35 NORTH AMERICA: INDUSTRIAL ABSORBENTS MARKET SNAPSHOT

- FIGURE 36 REVENUE ANALYSIS OF KEY COMPANIES (2018–2022)

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN INDUSTRIAL ABSORBENTS MARKET, 2022

- FIGURE 38 INDUSTRIAL ABSORBENTS MARKET SHARE ANALYSIS

- FIGURE 39 COMPANY EVALUATION MATRIX: INDUSTRIAL ABSORBENTS MARKET (TIER 1 COMPANIES)

- FIGURE 40 INDUSTRIAL ABSORBENTS MARKET: COMPANY FOOTPRINT

- FIGURE 41 START-UPS/SMES EVALUATION MATRIX: INDUSTRIAL ABSORBENTS MARKET

- FIGURE 42 3M: COMPANY SNAPSHOT

- FIGURE 43 JOHNSON MATTHEY: COMPANY SNAPSHOT

- FIGURE 44 OIL-DRI CORPORATION OF AMERICA: COMPANY SNAPSHOT

- FIGURE 45 BRADY CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 ANSELL LTD.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current industrial absorbents market size—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and measures with industry experts across the value chain of industrial absorbents through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, notifications by regulatory bodies, trade directories, and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

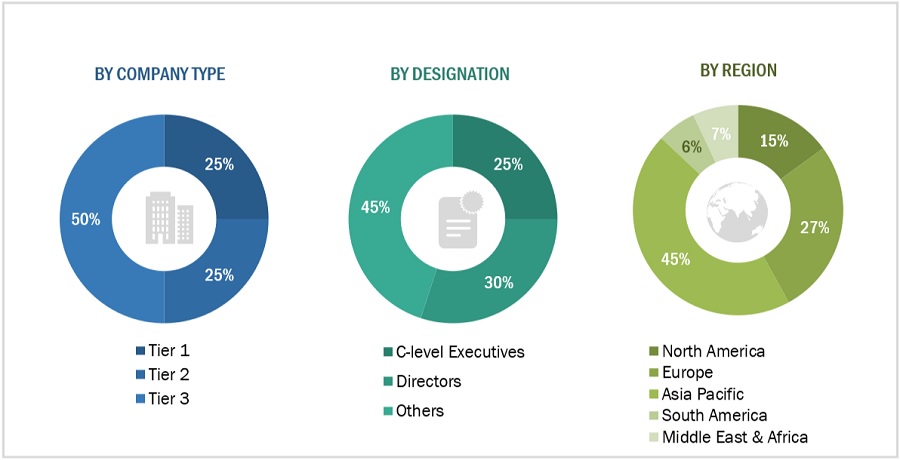

The industrial absorbents market comprises several stakeholders in the supply chain, such as manufacturers, equipment manufacturers, traders, associations, and regulatory organizations. The development of various end-use industries characterizes the demand side of this market. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the industrial absorbents market. These methods were also used extensively to determine the market size of various segments. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the industrial absorbents market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Industrial Absorbents Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Industrial Absorbents Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine each market segment’s and subsegment’s exact statistics. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Industrial absorbents are porous materials designed to soak up liquids or gases from spills on land or water, serve to avert wastage, damage, or hazards resulting from leaks, drips, sprays, or spills of substances like oil, water, or chemicals during industrial activities. Comprised chiefly of materials such as polypropylene, polyester, polyurethane, cellulose, and clay, these absorbents exhibit oleophilic, hydrophilic, or hydrophobic properties.

The study of the industrial absorbents market encompasses both naturally occurring and synthetic absorbents utilized across various industrial settings for spill control, containment, and remediation purposes. The analysis includes an array of major industrial absorbent products like pads, rolls, pillows, granules, booms & socks, as well as sheets & mats.

Key Stakeholder

- Raw Material Manufacturers

- Industrial Absorbent Manufacturers

- Spill Control Product Manufacturers and Suppliers

- Manufacturers and Suppliers from End-Use Industries

- Environmental Protection Agencies

- Spill Tracking & Surveillance Companies

- Environment Regulatory Bodies and Agencies

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- Investment Banks and Private Equity Firms

Report Objectives:

- To define, describe, and forecast the size of the global industrial absorbents market in terms of value and volume

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the industrial absorbents market

- To analyze and forecast the size of various segments (type & nature) of the industrial absorbents market based on five major regions—North America, Europe, Asia Pacific, South America, Middle East & Africa—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as expansions, new product developments, partnerships, and acquisitions, product launches to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the industrial absorbents market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Industrial Absorbents Market