Emergency Spill Response Market by Type (Product (Booms, Skimmers, Transfer Products, Sorbents), Services (Product Rental, Waste Management, Manpower Training), Spill Material (Oil, Chemical & Hazardous), Vertical - Global Forecast to 2022

The emergency spill response market is estimated to be worth USD 33.68 Billion by 2022, at a CAGR of 7.0% during the forecast period. For the purpose of this study, the base year considered is 2015 and the market forecast is provided for the period between 2016 and 2022. This report aims to estimate the market size and future growth potential of the market on the basis of different segments such as type, spill material, spill environment, vertical, and region. It also analyzes subsegments with respect to individual growth trends, future prospects, and contribution to the emergency spill response market.

The emergency spill response market is expected to be worth USD 33.68 Billion by 2022, at a CAGR of 7.0% between 2016 and 2022. The market is expected to witness significant growth in the coming years owing to stringent environmental regulations across world to reduce the environmental pollution from spills. The government agencies across the world are focused to reduce environmental pollution from the spills, thereby driving the emergency spill response market.

This report focuses on detailed segmentations of the emergency spill response market, combined with the qualitative and quantitative analysis of each and every aspect of the classification based on type, spill material, spill environment, vertical, and geography. Based on type, the market has been classified into products and services. The products include booms, skimmers, dispersants and dispersant products, in-situ burning products, sorbents, transfer products, radio communication products, and vacuum products. The services segment has been classified into product rental services, waste management services, manpower training services, transportation and disposal services, spill response drill and exercise services, tracking and surveillance services, risk assessments and analysis services, and other services.

Based on products, skimmers would hold the largest emergency spill response market size due to the high demand for mechanical recovery methods for spill recovery. The products using mechanical recovery method are in high demand as they remove the spilled content from the spill environment, thus reducing the impact of spills on the environment.

The product rental services segment is expected to hold the largest between 2016 and 2022.Companies depend on the response agencies for the Tier 2 and Tier 3 level response for product rental services, which are economical. The increasing dependence on the response organizations is expected to further strengthen this market.

The government vertical is expected to hold the largest market share between 2016 and 2022. This is primarily because government agencies globally are focused on reducing the environmental pollution from spills. Thus, organizations such as coast guards and environmental protection agencies are a major source of revenue for the emergency spill response market.

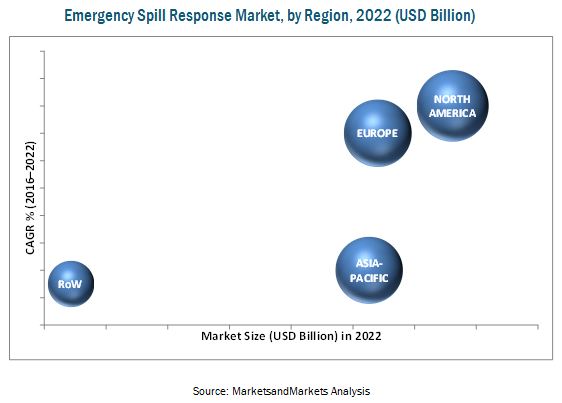

North America accounted for the largest share of 30.4% of the market in 2015. This large share can be attributed to the presence of a large number of oil rigs and subsea oil operations as well as the government focus on reducing the environmental impact of spills.

Factors such as declining large spills across the world may hamper the growth of the market. However, Polyeco Group (Greece) is expected to benefit from its complementary product and service portfolio as its offering includes waste management services. Oil Spill Response Ltd (U.K.) is expected to have competitive advantage through its stock pile of products strategically located to cater to spills across the world.

The key players in the emergency spill response market are competing with each other with the help of new product launches, partnerships, agreements, and acquisitions. Major players operating in the market include Veolia Environnement S.A. (France), Polyeco Group (Greece), Elastec, Inc. (U.S.), Markleen A/S (Norway), Clean Harbors, Inc. (U.S.). US Ecology, Inc. (U.S.), Oil Spill Response Ltd (U.K.), Marine Well Containment Company (U.S.), Vikoma International Ltd (U.K.), DESMI A/S (Denmark), and Adler and Allan Limited (U.K.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Value Chain Analysis – Emergency Spill Response

2.2.1 Secondary and Primary Research

2.2.1.1 Key Industry Insights

2.2.2 Secondary Data

2.2.2.1 Key Data From Secondary Sources

2.2.3 Primary Data

2.2.3.1 Breakdown of Primaries

2.2.3.2 Key Data From Primary Sources

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.1.1 Approach for Capturing the Market Share Using Bottom-Up Analysis (Demand Side)

2.3.2 Top-Down Approach

2.3.2.1 Approach for Capturing the Market Share Using Top-Down Analysis (Supply Side)

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Global Emergency Spill Response Market

4.2 Market, By Vertical

4.3 Market, By Type

4.4 Market, By Spill Material

4.5 Market, By Spill Environment

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Vertical

5.2.3 By Spill Material

5.2.4 By Spill Environment

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Awareness Regarding the Effects of Spill on the Environment

5.3.1.2 Increased International Trade and Transportation

5.3.2 Restraints

5.3.2.1 Reduced Incidents of Large Spills on Sea

5.3.3 Opportunities

5.3.3.1 Government Initiatives to Strengthen Response to Oil Spills on Sea

5.3.4 Challenges

5.3.4.1 Environmental Challenges for Spill Response in the Arctic Region

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Market, By Type (Page No. - 54)

7.1 Introduction

7.2 Products

7.2.1 Booms

7.2.1.1 Oil Booms

7.2.1.1.1 Offshore Protection Booms

7.2.1.1.1.1 Internal Foam Floatation Booms

7.2.1.1.1.2 Self-Inflating Booms

7.2.1.1.1.3 Pressure Inflatable Booms

7.2.1.1.1.4 Fence Booms

7.2.1.1.2 Shore Protection Booms

7.2.1.1.2.1 Exclusion Booms

7.2.1.1.2.2 Diversion Booms

7.2.1.1.2.3 River Booms

7.2.1.1.2.4 Shore Sealing Booms

7.2.1.1.2.5 Beach Berms

7.2.1.2 Chemical Booms

7.2.1.3 Universal Booms

7.2.2 Skimmers

7.2.3 Dispersants & Dispersant Products

7.2.4 In-Situ Burning Products

7.2.4.1 Fire Resistant Booms

7.2.4.2 Igniters

7.2.4.3 Chemical Herders

7.2.5 Sorbents

7.2.6 Transfer Products

7.2.6.1 Pumps

7.2.7 Radio Communication Products

7.2.7.1 Remote Sensing Products

7.2.7.1.1 Radars

7.2.7.1.2 Satellite Remote Sensing

7.2.7.1.3 Laser Flouro Sensors

7.2.7.1.4 Ultraviolet Sensors

7.2.7.1.5 Infrared Sensors

7.3 Services

7.3.1 Product Rental Services

7.3.2 Waste Management Services

7.3.3 Manpower Training Services

7.3.4 Transportation and Disposal Services

7.3.5 Spill Response Drill & Exercise Services

7.3.6 Tracking & Surveillance Services

7.3.7 Risk Assessments & Analysis

7.3.8 Other Services

8 Market, By Spill Material (Page No. - 70)

8.1 Introduction

8.2 Oil Spills

8.3 Chemical & Hazardous Material Spills

9 Market, By Spill Environment (Page No. - 76)

9.1 Introduction

9.2 Spills on Land

9.3 Spills on Sea

10 Market, By Vertical (Page No. - 93)

10.1 Introduction

10.2 Transportation

10.3 Chemical

10.4 Oil & Gas

10.5 Ports & Harbors

10.6 Government

10.7 Industrial Facilities

11 Regional Analysis (Page No. - 101)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 U.K.

11.3.2 Norway

11.3.3 Germany

11.3.4 France

11.3.5 Ireland

11.4 APAC

11.4.1 India

11.4.2 China

11.4.3 Malaysia

11.4.4 Indonesia

11.4.5 Australia

11.5 Rest of the World (RoW)

11.5.1 Middle East & Africa

11.5.2 South America

12 Competitive Landscape (Page No. - 122)

12.1 Overview

12.2 Market Ranking Analysis, 2015

12.3 Competitive Situation and Trends

12.3.1 Mergers & Acquisitions

12.3.2 New Product Launches

12.3.3 Partnerships, Joint Ventures, and Collaborations

13 Company Profiles (Page No. - 127)

13.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

13.2 Oil Spill Response Limited

13.3 Marine Well Containment Company

13.4 Polyeco Group

13.5 Vikoma International Ltd

13.6 Desmi A/S

13.7 Veolia Environnement S.A.

13.8 Clean Harbors, Inc.

13.9 US Ecology, Inc.

13.10 Adler and Allan Limited

13.11 Markleen A/S.

13.12 Elastec Inc.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 152)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (75 Tables)

Table 1 List of Major Secondary Sources

Table 2 Intensity of Competitive Rivalry and Bargaining Power of Buyers Had A High Impact on the Market

Table 3 Emergency Spill Response Market, By Type, 2014-2022 (USD Billion)

Table 4 Market, By Product Type, 2014-2022 (USD Million)

Table 5 Booms Segment, By Type, 2014-2022 (USD Million)

Table 6 Oil Booms Subsegment, By Type, 2014-2022 (USD Million)

Table 7 Offshore Protection Oil Booms Subsegment, By Type, 2014-2022 (USD Million)

Table 8 Shore Protection Oil Booms Subsegment, By Type, 2014-2022 (USD Million)

Table 9 Skimmers Segment, By Type, 2014-2022 (USD Million)

Table 10 Dispersants& Dispersant Products Segment, By Type, 2014-2022 (USD Million)

Table 11 In-Situ Burning Products Segment, By Type, 2014-2022 (USD Million)

Table 12 Transfer Products Segment, By Type, 2014-2022 (USD Million)

Table 13 Pumps Sub Segment, By Type, 2014-2022 (USD Million)

Table 14 Remote Sensing Products Subsegment, By Type, 2014-2022 (USD Million)

Table 15 Market, By Service Type, 2014-2022 (USD Million)

Table 16 Market, By Spill Material, 2014-2022 (USD Billion)

Table 17 Market for Oil Spills, By Type, 2014-2022 (USD Billion)

Table 18 Market for Oil Spills, By Product Type, 2014-2022 (USD Million)

Table 19 Market for Oil Spills, By Service Type, 2014-2022 (USD Million)

Table 20 Market for Chemical & Hazardous Materials, By Type, 2014-2022 (USD Billion)

Table 21 Market for Chemical & Hazardous Materials, By Product Type, 2014-2022 (USD Million)

Table 22 Market for Chemical & Hazardous Materials, By Service Type, 2014-2022 (USD Million)

Table 23 Market, By Spill Environment, 2014-2022 (USD Billion)

Table 24 Market for Spills on Land, By Type, 2014-2022 (USD Billion)

Table 25 Market for Spills on Land, By Product Type, 2014-2022 (USD Million)

Table 26 Market for Spills on Land, By Service Type, 2014-2022 (USD Million)

Table 27 North America Emergency Spill Response Product Market for Spills on Land, By Product Type, 2014-2022 (USD Million)

Table 28 North America Market for Spills on Land, By Service Type, 2014-2022 (USD Million)

Table 29 Europe Market for Spills on Land, By Product Type, 2014-2022 (USD Million)

Table 30 Europe Market for Spills on Land, By Service Type, 2014-2022 (USD Million)

Table 31 Asia-Pacific Market for Spills on Land, By Product Type, 2014-2022 (USD Million)

Table 32 Asia-Pacific Market for Spills on Land, By Service Type, 2014-2022 (USD Million)

Table 33 RoW Market for Spills on Land, By Product Type, 2014-2022 (USD Million)

Table 34 RoW Market for Spills on Land, By Service Type, 2014-2022 (USD Million)

Table 35 Market for Spills on Sea, By Type, 2014-2022 (USD Billion)

Table 36 Market for Spills on Sea, By Product Type, 2014-2022 (USD Million)

Table 37 Market for Spills on Sea, By Service Type, 2014-2022 (USD Million)

Table 38 North America Emergency Spill Response Product Market for Spills on Sea, By Product Type, 2014-2022 (USD Million)

Table 39 North America Market for Spills on Sea, By Service Type, 2014-2022 (USD Million)

Table 40 Europe Market for Spills on Sea, By Product Type, 2014-2022 (USD Million)

Table 41 Europe Market for Spills on Sea, By Service Type, 2014-2022 (USD Million)

Table 42 Asia-Pacific Market for Spills on Sea, By Product Type, 2014-2022 (USD Million)

Table 43 Asia-Pacific Market for Spills on Sea, By Service Type, 2014-2022 (USD Million)

Table 44 RoW Market for Spills on Sea, By Product Type, 2014-2022 (USD Million)

Table 45 RoW Market for Spills on Sea, By Service Type, 2014-2022 (USD Million)

Table 46 Market, By Vertical, 2014-2022 (USD Million)

Table 47 Market for Transportation Vertical, By Region, 2014-2022 (USD Million)

Table 48 Market for Chemical Vertical, By Region, 2014-2022 (USD Million)

Table 49 Market for Oil & Gas Vertical, By Region, 2014-2022 (USD Million)

Table 50 Market for Ports & Harbors Vertical, By Region, 2014-2022 (USD Million)

Table 51 Market for Government Vertical, By Region, 2014-2022 (USD Million)

Table 52 Market for Industrial Facilities Vertical, By Region, 2014-2022 (USD Million)

Table 53 Market, By Region, 2014–2022 (USD Billion)

Table 54 North America Market, By Country, 2014–2022 (USD Million)

Table 55 Market in North America, 2014–2022 (USD Million)

Table 56 North America Market, By Product Type, 2014–2022 (USD Million)

Table 57 North America Market, By Service Type, 2014–2022 (USD Million)

Table 58 Europe Market, By Country, 2014–2022 (USD Million)

Table 59 Europe Market, 2014–2022 (USD Million)

Table 60 Europe Market, By Product Type, 2014–2022 (USD Million)

Table 61 Europe Market, By Service Type, 2014–2022 (USD Million)

Table 62 APAC Market, By Country, 2014–2022 (USD Million)

Table 63 APAC Market, 2014–2022 (USD Million)

Table 64 APAC Market, By Product Type, 2014–2022 (USD Million)

Table 65 APAC Market, By Service Type, 2014–2022 (USD Million)

Table 66 RoW Market, By Region, 2014–2022 (USD Million)

Table 67 RoW Market, 2014–2022 (USD Million)

Table 68 RoW Market, By Product Type, 2014–2022 (USD Million)

Table 69 RoW Market, By Service Type, 2014–2022 (USD Million)

Table 70 Market: Company Ranking, 2015

Table 71 Emergency Spill Response Products Market: Company Ranking, 2015

Table 72 Emergency Spill Response Services Market: Company Ranking, 2015

Table 73 Most Significant Mergers & Acquisitions in Market

Table 74 Most Significant New Product Launches in the Market

Table 75 Recent Partnerships, Joint Ventures and Collaborations in the Market

List of Figures (65 Figures)

Figure 1 Market Segmentation

Figure 2 Emergency Spill Response Market: Research Design

Figure 3 Value Chain – Emergency Spill Response

Figure 4 Bottom-Up Approach to Arrive at the Market Size

Figure 5 Top-Down Approach to Arrive at the Market Size

Figure 6 Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Market, By Vertical (2016)

Figure 9 Skimmers Expected to Be the Largest Product Type Segment During the Forecast Period

Figure 10 North America Held the Largest Share of the Market in 2015

Figure 11 Increasing Focus of Government Agencies on Protecting the Environment From Spills is Expected to Fuel Growth of the Market During the Forecast Period

Figure 12 Government Segment Expected to Hold the Largest Market Size During the Forecast Period

Figure 13 Government Vertical and North America Region Held the Leading Segments of Market

Figure 14 Manpower Training Services Segment Expected to Grow at the Highest Rate During the Forecast Period

Figure 15 Oil Spills Estimated to Be the Largest Spill Material Segment During the Forecast Period

Figure 16 Spills on Sea Expected to Be the Largest Spill Environment Segment of the Market During the Forecast Period.

Figure 17 North America Accounted for the Largest Share of the Market

Figure 18 Market Segmentation

Figure 19 Market Segmentation: By Type

Figure 20 Market Segmentation: By Vertical

Figure 21 Market Segmentation: By Spill Material

Figure 22 Market Segmentation: By Environment

Figure 23 Market Segmentation, By Region

Figure 24 Drivers, Restraints, Opportunities, and Challenges in the Market

Figure 25 Increasing Global Sea Trade Between 1970 and 2015 (Million of Tons)

Figure 26 The Number of Spills on Sea Between 1970 and 2015 (Thousand Units)

Figure 27 Value Chain Analysis of the Market

Figure 28 Porter’s Five Forces Analysis of the Market

Figure 29 Porter’s Five Forces Analysis: Market, 2015

Figure 30 Market: Threat of New Entrants

Figure 31 Market: Threat of Substitutes

Figure 32 Market: Bargaining Power of Suppliers

Figure 33 Market: Bargaining Power of Buyers

Figure 34 Market: Intensity of Competitive Rivalry

Figure 35 Market, By Type

Figure 36 Market, By Booms

Figure 37 Oil Booms Expected to Have the Largest Market Size ,By Type, in the Forecast Period

Figure 38 Skimmers Expected to Be the Largest Segment of the Market During the Forecast Period

Figure 39 Market, By Spill Material

Figure 40 Skimmers Segment Projected to Lead the Market for Oil Spills From 2016 to 2022

Figure 41 Market, By Spill Environment

Figure 42 The Skimmers Segment is Anticipated to Lead the Market for Spills on LAN, 2016 vs 2022

Figure 43 The Skimmers Segment is Projected to Lead the Market for Spills on Sea, 2016 vs 2022

Figure 44 Market, By Vertical

Figure 45 The Government Vertical Segment is Projected to Lead the Market During the Forecast Period

Figure 46 The North America Market for Government Vertical is Expected to Account for the Largest Market Share in 2016 and 2022

Figure 47 Norway Expected to Grow at the Highest CAGR During the Forecast Period

Figure 48 North America is Projected to Be the Largest Market for By 2022

Figure 49 North America Market Snapshot

Figure 50 Mexico Was the Largest Market for Market During the Forecast Period

Figure 51 Europe Market Snapshot

Figure 52 Norway Expected Tobe the Largest Market By 2022

Figure 53 APAC Market Snapshot

Figure 54 India is Projected to Be the Largest Market for By 2022

Figure 55 Companies Adopted Mergers & Acquisitions as Key Growth Strategies From 2014 to 2016

Figure 56 Market Evaluation Framework

Figure 57 Battle for Market Share: Mergers & Acquisitions is the Key Strategy

Figure 58 Oil Spill Response Ltd.: SWOT Analysis

Figure 59 Marine Well Containment Company: SWOT Analysis

Figure 60 Polyeco Group: SWOT Analysis

Figure 61 Vikoma International Ltd.: SWOT Analysis

Figure 62 Desmi A/S.: SWOT Analysis

Figure 63 Veolia Environnement S.A.: Company Snapshot

Figure 64 Clean Harbors, Inc.: Company Snapshot

Figure 65 US Ecology, Inc.: Company Snapshot

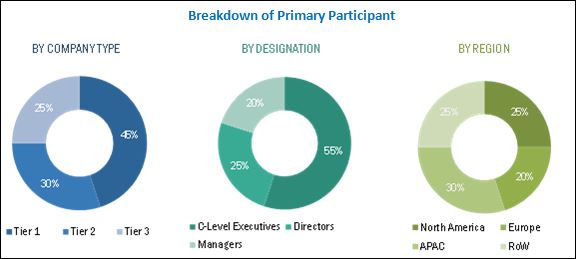

The research methodology used to estimate and forecast the emergency spill response market begins with capturing data on key vendor revenues through secondary research. The secondary sources considered for the research include major players’ annual reports, presentations, press releases, news articles, journals, publications from associations such as U.S. Environmental Protection Agency (EPA), International Tanker Owners Pollution Federation Limited (ITOPF), National Oceanic and Atmospheric Administration (NOAA), Spill Control Association of America (SCAA), International Marine Contractors Association (IMCA), and databases such as Factiva and Hoovers. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall market size of the global market from the revenue of the key players in the market. After arriving at the overall emergency spill response market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the emergency spill response market includes Murrenhil Corporation (Canada), Crucial, Inc.(U.S.), FOILEX Engineering AB (Sweden), Miko Marine AS (Norway), Vikoma International Ltd (U.K.), Fast Engineering Limited (Ireland), Markleen AS (Norway), Universal Remediation, Inc. (U.S.), and Kepner Plastics Fabricators, Inc.(U.S.). The companies involved in providing spill response solutions include Crucial, Inc. (U.S.), DESMI A/S (Denmark), Parker Systems, Inc.(U.S.), AllMaritim AS (Norway), Clean Harbors, Inc. (U.S.), Veolia Environnement S.A. (France), and Polyeco Group (UAE). The companies involved in providing spill response services include Briggs Marine & Environmental Services (U.K.), Fender & Spill Response Services LLC (UAE), QualiTech, Inc. (U.S.), SL Ross Environmental Research Ltd (Canada), Oil Spill Response Limited (U.K.), Gallagher Marine Systems, Inc. (U.S.), Marine Well Containment Company (U.S.), and OSRA International Limited (U.K.).

“This study answers several questions for the stakeholders, primarily which market segments to focus on in the next five years for prioritizing efforts and investments.”

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2015 |

|

Forecast period |

2016–2022 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Veolia Environnement S.A. (France), Polyeco Group (Greece), Elastec, Inc. (U.S.), Markleen A/S (Norway), Clean Harbors, Inc. (U.S.). US Ecology, Inc. (U.S.), Oil Spill Response Ltd (U.K.), Marine Well Containment Company (U.S.), Vikoma International Ltd (U.K.), DESMI A/S (Denmark), and Adler and Allan Limited (U.K.) |

Target Audience:

- Environmental Protection Agencies

- Emergency Spill Response Containment Manufacturers

- Oil Producing Companies

- Chemical & Hazardous Material Manufacturers

- Logistics and Transportation Companies

- Emergency Spill Response Service Providers

- Product Distributors and Vendors

- Spill Tracking & Surveillance Companies

- Environment Management Organizations

- Environment Regulatory Bodies and Agencies

Scope of the Report:

The emergency spill response market covered in this report has been segmented as follows:

Emergency Spill Response Market, by Type:

-

Products

- Booms

- Skimmers

- Dispersants & Dispersant Products

- In-Situ Burning Products

- Sorbents

- Transfer Products

- Radio Communication Products

- Vacuum Products

-

Services

- Product Rental Services

- Waste Management Services

- Manpower Training Services

- Transportation and Disposal Services

- Spill Response Drill & Exercise Services

- Tracking & Surveillance Services

- Risk Assessments & Analysis

- Other Services (Oiled Wildlife Services; Contingency Plan Development & Implementation Services; and Soil, Water, and Site Remediation Services)

Market, by Spill Material:

- Oil

- Chemical and Hazardous Materials

Market, by Spill Environment:

- Spills on Land

- Spills on Sea

Market, by Vertical:

- Transportation

- Chemical

- Oil & Gas

- Ports & Harbors

- Government

- Industrial Facilities

Market, by Region:

-

North America

- U.S.

- Canada

- Mexico

-

Europe

- Germany

- France

- U.K.

- Norway

- Ireland

-

APAC

- India

- China

- Malaysia

- Indonesia

- Australia

-

Rest of the World

- The Middle East & Africa

- South America

Available Customizations:

- Product matrix which gives a detailed comparison of product portfolio of each company

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Emergency Spill Response Market

We are interested in understanding the various services offered in the emergency spill response market. What % does the rental services contribute? Are there any smart products associated with these?

How do you look towards the oil & gas vertical of this market? What are the major impacting factors for this market?

We are looking at global market and specified geographical market for chemical and hazardous material spill cleanup kit market. How is it in the African and the Asia region?

Which materials and environments have you considered in the scope of the report? Has the regional analysis specific to the Middle East provided in the report?