Indoor Farming Technology Market by Growing System (Hydroponics, Aeroponics, Aquaponics, Soil-based, Hybrid), Facility Type, Component, Crop Type (Fruits & Vegetables, Herbs & Microgreens, Flowers & Ornamentals) and Region - Global Forecast to 2028

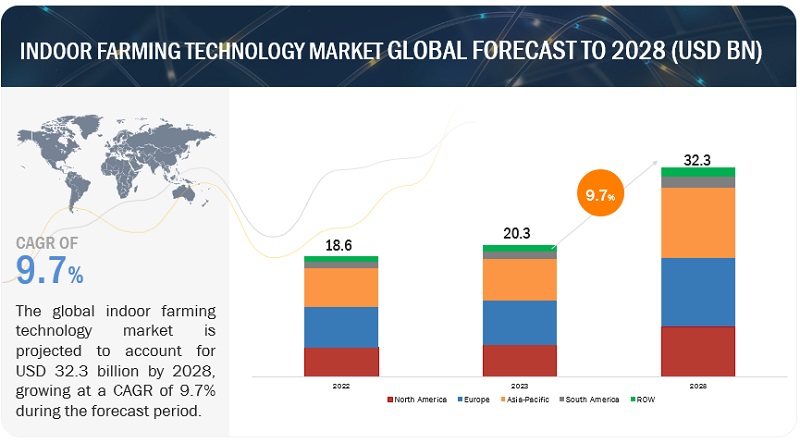

The global indoor farming technology market size was valued at US$ 18.6 billion in 2022 and is poised to grow from US$ 20.3 billion in 2023 to US$ 32.3 billion by 2028, growing at a CAGR of 9.7% in the forecast period (2023-2028). Owing to the increase in demand for fresh foods with high nutritive value, the need for higher yields using limited space and water, and the lesser impact of external weather conditions drive the indoor farming technology market. Indoor farming technology involves the use of controlled environment agriculture methods to cultivate crops in an enclosed space, typically indoors. This approach allows for precise control over environmental factors such as temperature, humidity, light, and nutrient levels. Indoor farming technologies aim to optimize growing conditions, increase crop yields, and address challenges associated with traditional outdoor farming.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Rising demand for fresh foods with higher nutritive value

Indoor farming refers to the cultivation of crops or plants of both large and small sizes. Indoor farming is used on a wide scale to supplement local food sources and give consumers nutritious, fresh products. Because this farming method manages plant-fertilizing nutrients, the food generated using this technology is extremely nutritious. Indoor farming allows for the cultivation of a wide range of crops, including leafy vegetables, herbs, vegetables, fruits, micro greens, and flowers. Indoor vertical farming methods produce organic food that is free of agrochemical contamination. As a result, the increasing consumer demand for pesticide and herbicide-free food, as well as the growing need to reduce the carbon footprint of traditional agricultural practices, are driving forces for indoor vertical farming. For example, in 2016, Fujitsu Limited (Japan) established a vertical farming initiative in which lettuce with a low potassium level was cultivated, resulting in exceptionally nutritious lettuce with no unpleasant taste for people with kidney disease.

Restraint: There are restrictions on the types of crops that can be planted.

Indoor farming is not an appealing alternative for some farmers because it can only cultivate a restricted number of crops. Furthermore, controlled-environment farming can only generate a limited number of fruit and vegetable kinds. There are also restrictions on the plant species that can be grown indoors. Some fruits and plants, for example, have numerous edible components such as leaves, stems, and roots. These plant species would waste vertical farming space and resources. Before beginning the plantation, numerous aspects such as temperature adjustment, adequate water supply management, identification and provision of nutrients to the plants, the growth mechanism to be used, and individual harvest time of plants must be considered. As a result, growing various varieties of plants in indoor farms may be problematic. Fruits and vegetables are the best plants for vertical farming since they grow quickly. Water and sunlight are scarce and crops such as sugarcane, rice, and wheat require a lot of water and take a long time to harvest, making them challenging to cultivate utilizing indoor farming.

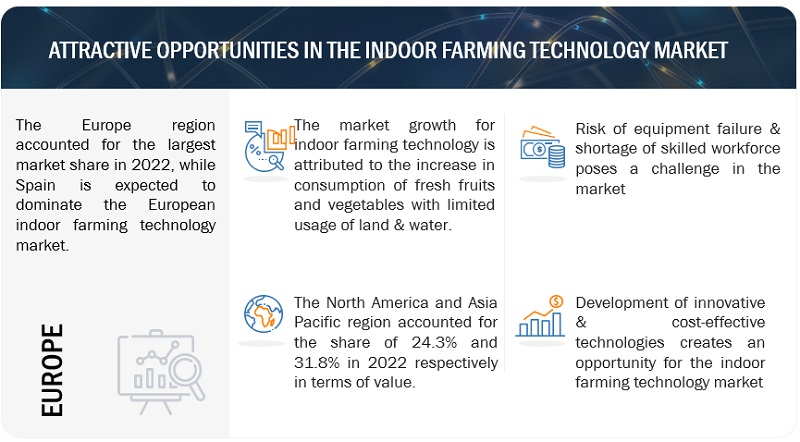

Opportunity: Development of innovative and cost-effective technologies

Many indoor farming methods lack a long commercial track record, and studies are still being undertaken to determine the impact of these technologies on plant shelf life. The impact of LED illumination on plants was evaluated in a study conducted at the Illumination Research Centre (New York), and the results were favorable. However, the technology is still in its early stages and requires further development before it can be considered ideally helpful and financially viable. To reduce the carbon footprint of indoor farming, new technologies must be created. Growers are more interested in investing in technologies that will reduce their labor expenses, as labor is necessary on large-scale farms for monitoring, maintenance, fertilizer supply, and harvesting. As a result, there is a potential opportunity to create completely automated urban farms based on vertical farming and controlled environment agriculture.

Challenge: Insufficient funding

Finding an investor is difficult in many agriculture-related firms, which may function as a barrier, leading to fewer growers investing in indoor farming. Furthermore, restricted funding hinders the speed of research and development for indoor farming in public institutions and colleges, limiting the availability of data and knowledge that would otherwise entice cultivators to invest. However, in the current context, some sources of high finance are available for players in the indoor farming technology market arena. For example, one of the indoor farming players, Aerofarms (US), obtained USD 50 million from Goldman Sachs Group (US) and Prudential Financial, Inc. (US).

Indoor Farming Technology Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of indoor farming technology. These companies have been operating in the market for several years and possess state-of-the-art technologies, a diversified product portfolio, and strong global sales and marketing networks. Prominent companies in this market include Scotts Company LLC (US), Signify Holding (Netherlands), EVERLIGHT ELECTRONICS CO., LTD (Taiwan), NETAFIM (Israel), Heliospectra AB (Sweden), Argus Control Systems Limited (Canada), Lumigrow, Inc (Canada), weisstechnik (US), Priva (Netherlands), LOGIQS.B.V. (Netherlands).

Lesser impact of external weather conditions

Indoor farming frequently uses growing technologies such as hydroponics and artificial lighting to deliver nutrients to plants. Furthermore, it protects crops from adverse weather conditions and maintains optimal levels in the enclosed facility. Most places experience occasional rainfall shortages as a result of the steady shift in global climate conditions. Changes in rainfall and temperature may reduce agricultural productivity in countries such as India, the United States, Australia, and the Philippines. With global weather patterns becoming more unpredictable and global warming becoming a growing problem, indoor farming is a viable solution. Because the same water is used in irrigation systems, indoor farming conserves drinking water, which is becoming a limited resource. Indoor farming is a viable solution for many drought-stricken countries. Crop production in indoor farming takes place in a controlled atmosphere, and productivity is largely independent of outside weather conditions. Because the vertical growing platforms are set at ambient temperatures, fewer crops are lost due to hurricanes, hail, drought, and snap freezes. Indoor farm, also known as vertical farm or controlled environment agriculture, involves cultivating crops in indoor environments where environmental factors like light, temperature, humidity, and nutrients can be precisely controlled.

Higher crop yields with minimal room and water

Indoor farming has a better yield than traditional agricultural methods, which is one of its key advantages. Indoor farming facilities produce optimal growing conditions for farmers, allowing them to develop a crop from seed to harvesting stages in less time and with higher yields in each cycle while having a limited land area. According to USDA data, the average output of greenhouse hydroponic tomatoes in 2016 was 10.59 pounds per square foot, while traditionally grown tomatoes yielded 185 pounds per square foot. As a result, by stacking additional layers and expanding the growing area, indoor farms can boost overall crop yield. According to the Food and Agriculture Organization of the United Nations, food output must increase by 70% before 2050 to meet global food demands. This expansion is required because urbanization is consuming arable land while lowering the total agricultural land area. As a result, indoor farming is a feasible option for helping to satisfy the food needs of the world's growing population. Indoor farming tackles the issue of restricted space by allowing certain plants to be cultivated in smaller spaces. For example, in vertical farming, each facility constructed reduces the demand for land use by a hundredfold. When compared to conventional farming, there is less water waste. Because indoor farms recirculate and reuse water, they require 95% less water to grow the same crops as outdoor farms. When plants or crops are produced in vertical greenhouses, the transpiration process occurs, allowing farmers to reuse the water for irrigation. Because the odds of water waste are reduced, this strategy aids in resource conservation. In 2014, agricultural irrigation had the biggest proportion of worldwide water reuse, followed by landscape irrigation. Agricultural and landscape irrigation accounted for 52.0% of the overall share. This demonstrates that the amount of water reuse in agriculture is greater.

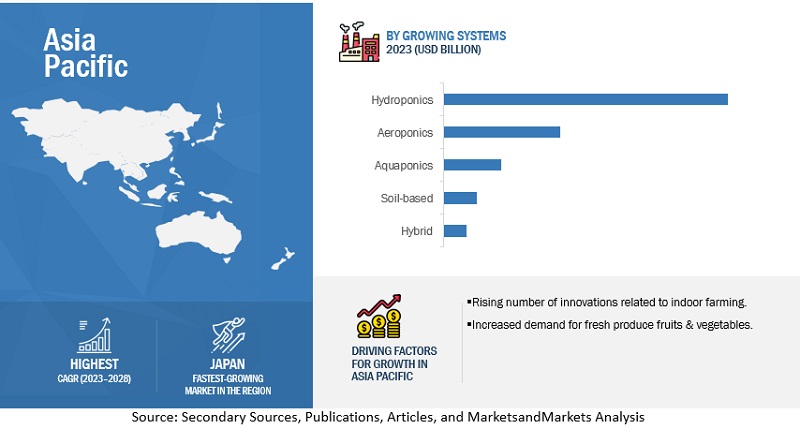

Asia Pacific to boost market growth during the forecast period.

The Asia Pacific region is expected to grow at the fastest rate, as demand for indoor farming technology has increased due to increased investment by overseas business lines in agricultural operations to exclusively meet crop growers' demands for export-quality crops. Furthermore, the farming business in the Asia Pacific region has been changing away from traditional agricultural practices and towards technology and innovative ways. These adjustments result in the upgrading of crop management techniques to increase crop premium value. In 2020, the Asia Pacific region's indoor farming technology market accounted for approximately 30.7% of the global market in terms of value.

The key players in this market are Scotts Company LLC (US), Signify Holding (Netherlands), EVERLIGHT ELECTRONICS CO., LTD (Taiwan), NETAFIM (Israel), Heliospectra AB (Sweden), Argus Control Systems Limited (Canada), Lumigrow, Inc (Canada), weisstechnik (US), Priva (Netherlands), LOGIQS.B.V. (Netherlands), Certhon (Netherlands), Bluelab (New Zealand), Barton Breeze (India), Green Sense Farms Holdings, Inc. (US), Greener Crop Inc. (Dubai), Sensaphone (US), Freight Farms, Inc (US), Climate Control Systems Inc (US), Sky Greens (Singapore), SANANBIO (China). The study includes an in-depth competitive analysis of these key players in the indoor farming technology market with their company profiles, recent developments, and key market strategies.

Key Market Players

The key players in this include Scotts Company LLC (US), Signify Holding (Netherlands), EVERLIGHT ELECTRONICS CO., LTD (Taiwan), NETAFIM (Israel), Heliospectra AB (Sweden), Argus Control Systems Limited (Canada), Lumigrow, Inc (Canada), weisstechnik (US), Priva (Netherlands), LOGIQS.B.V. (Netherlands). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the Indoor Farming Technology Market Report

| Report Metric | Details |

|---|---|

| Base Year: | 2022 |

| Indoor Farming Technology Market Size in 2023: | USD 20.3 billion |

| Forecast Period: | 2023 to 2028 |

| Forecast Period 2023 to 2028 CAGR: | 9.7% |

| 2028 Value Projection: | USD 32.3 billion |

| No. of Pages: | 269 |

| Tables, & Figures: | 215 Tables, 57 Figures |

| Segments covered: | Growing System, Facility Type, Component, Crop Type, and Region |

| Growth Drivers: |

|

Report Scope:

Indoor Farming Technology Market:

By Growing System

- Hydroponics

- Aeroponics

- Aquaponics

- Soil-based

- Hybrid

By Facility type

- Glass or poly greenhouses

- Indoor vertical farms

- Container farms

- Indoor DWC systems

By Component

-

Hardware

- Climate Control Systems

- Lighting Systems

- Communication Systems

- Sensors

- System Controls

- Irrigation Systems

- Other hardware

- Software & Services

By crop type

-

Fruits & vegetables

-

Leafy greens

- Lettuce

- Kale

- Spinach

- Other leafy greens

- Tomatoes

- Strawberries

- Eggplants

- Other fruits & vegetables

-

Leafy greens

-

Herbs & microgreens

- Basil

- Herbs

- Tarragon

- Wheatgrass

-

Flowers & ornamentals

- Perennials

- Annuals

- Ornamentals

- Other crop types

By Region

- North America

- Europe

- Asia Pacific

- South America

- RoW

Recent Developments

- In May 2022, Signify Holding acquired the fluence for offering indoor farming lighting solutions that help Signify's position in the attractive North American horticulture lighting market and they also acquired Pierlite that strengthens Signity's position in the Australian and New Zealand lighting markets.

- In January 2023, Priva partnered with Aranet to serve the growing demand for more, and new greenhouse sensors to generate data are the main driver of the collaboration between Aranet and Priva. This partnership will bridge the gap between wireless sensor platforms and other data sources in greenhouses.

- In December 2021, Hawthorne acquired RIV Capital Inc (Canada) as the company is specialized in cannabis with a portfolio of 13 companies across various segments of the cannabis value chain. This gives an advantage to Hawthorne.

Frequently Asked Questions (FAQ):

How big is the indoor farming technology market?

With a compound annual growth rate (CAGR) of 9.7%, the indoor farming technology market is expected to grow from USD 20.3 billion by 2023 to USD 32.3 billion by 2028.

Which players are involved in the manufacturing of the Indoor farming technology market?

Scotts Company LLC (US), Signify Holding (Netherlands), EVERLIGHT ELECTRONICS CO., LTD (Taiwan), NETAFIM (Israel), Heliospectra AB (Sweden), Argus Control Systems Limited (Canada), Lumigrow, Inc (Canada), weisstechnik (US), Priva (Netherlands), LOGIQS.B.V. (Netherlands).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for Indoor farming technology market?

On request, We will provide market size, key players, growth rate of this industry in the Oceania region.

What is the future growth potential of Indoor farming technology market?

The future growth potential of the Indoor farming technology market looks promising, propelled by several key factors. With the global population on the rise and urbanization expanding, indoor farming emerges as a practical solution to meet the demand for food in densely populated urban areas. These technologies, including vertical farming and hydroponics, are designed for efficient resource utilization, making them particularly appealing in regions facing constraints on water and land availability. Ongoing technological advancements in automation, artificial intelligence, and data analytics further enhance the efficiency and productivity of indoor farming, attracting investments and fostering market growth.

What are the key challenges faced in the indoor farming technology market?

Lack of adequate funding and shortage in the availability of skilled workforce are the major key challenges for the indoor farming technology market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSRISE IN GLOBAL POPULATION AND FOOD REQUIREMENTSDECLINE IN PER CAPITA ARABLE LAND

-

5.3 MARKET DYNAMICSDRIVERS- Rising demand for fresh foods with higher nutritive value- Need for higher yields using limited space and water- Lesser impact of external weather conditionsRESTRAINTS- High initial investments- Limitations on types of crops grown- Lack of government incentives and high prices of hydroponically grown produce dissuading market adoptionOPPORTUNITIES- Development of innovative and cost-effective technologies- Production of biopharmaceutical productsCHALLENGES- Lack of adequate funding- Shortage in availability of skilled workforce- Risk of equipment failure and delay in learning curve among growers

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLYSYSTEM PROVIDERSTECHNOLOGY PROVIDERSCONSULTING AND MANAGEMENT SERVICE PROVIDERSEND USERS

- 6.3 SUPPLY CHAIN ANALYSIS

-

6.4 TECHNOLOGY ANALYSISTECHNOLOGICAL ADVANCEMENTS- Mobile applications and data tracking for assessment of real-time information

- 6.5 PRICING ANALYSIS

-

6.6 MARKET ECOSYSTEMDEMAND SIDESUPPLY SIDE

-

6.7 TRENDS/DISRUPTIONS IMPACTING BUYERS IN INDOOR FARMING TECHNOLOGY MARKET

-

6.8 PATENT ANALYSISLIST OF MAJOR PATENTS

-

6.9 TRADE ANALYSIS OF INDOOR FARMING SYSTEMSTRADING PRICES FOR INDOOR FARMING SYSTEMS

- 6.10 KEY CONFERENCES AND EVENTS

-

6.11 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.12 PORTER’S FIVE FORCES ANALYSISINDOOR FARMING TECHNOLOGY MARKET: PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSDEGREE OF COMPETITION

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.14 CASE STUDY ANALYSISLUMIGROW’S CUSTOMERS USE GROW LIGHT SENSORS TO MANAGE LIGHTSIGNIFY’S LED LIGHTING SOLUTION FOR GOODLEAF TO INCREASE PERENNIAL FOOD PRODUCTION

-

6.15 REGULATORY FRAMEWORKINTRODUCTIONREGULATIONS, BY REGION- North America- Europe- Asia PacificCOMMON STANDARDS AND CERTIFICATIONS

-

7.1 INTRODUCTIONRECESSION IMPACT ON COMPONENT SEGMENT

-

7.2 HARDWAREUSED TO CARRY OUT ENTIRE FUNCTIONING IN INDOOR FARMINGCLIMATE CONTROL SYSTEMSLIGHTING SYSTEMSCOMMUNICATION SYSTEMSSENSORSSYSTEM CONTROLSIRRIGATION SYSTEMSOTHERS

-

8.1 INTRODUCTIONRECESSION IMPACT ON CROP TYPE SEGMENT

-

8.2 FRUITS & VEGETABLESACCEPTANCE OF INDOOR FARMING TO GROW FRUITS & VEGETABLES ACROSS REGIONSLEAFY GREENS- Lettuce- Kale- Spinach- OthersTOMATOESSTRAWBERRIESEGGPLANTSOTHER FRUITS & VEGETABLES

-

8.3 HERBS & MICROGREENSYEAR-LONG HARVEST BENEFITS BOOST GROWTH OF INDOOR FARM-PRODUCED HERBS AND MICROGREENSBASILHERBSTARRAGONWHEATGRASS

-

8.4 FLOWERS & ORNAMENTALSINDOOR FARMING ADOPTION FOR FLOWERS AND ORNAMENTALS WITNESSES GRADUAL GROWTHPERENNIALSANNUALSORNAMENTALS

-

8.5 OTHER CROP TYPESGROWING AWARENESS AND APPLICATIONS ACROSS CROP TYPES TO PROPEL DEMAND IN COMING YEARS

-

9.1 INTRODUCTIONRECESSION IMPACT ON FACILITY TYPE SEGMENT

-

9.2 GLASS OR POLY GREENHOUSESWIDESPREAD AVAILABILITY AND ACCEPTANCE OF GLASS OR POLY GREENHOUSES

-

9.3 INDOOR VERTICAL FARMSDEPLETING ARABLE AND AGRICULTURAL LAND FOR PRODUCTION OF FRUITS & VEGETABLES TO BOOST DEMAND FOR INDOOR VERTICAL FARMS

-

9.4 CONTAINER FARMSNEWER WAYS OF CULTIVATING CROPS GAINING IMMENSE TRACTION

-

9.5 INDOOR DEEP-WATER CULTURE SYSTEMSDEMAND FOR HEALTHIER AND NUTRIENT-RICH LEAFY VEGETABLES TO DRIVE DEMAND FOR INDOOR DEEP-WATER CULTURE SYSTEMS

-

10.1 INTRODUCTIONRECESSION IMPACT ON GROWING SYSTEMS SEGMENT

-

10.2 AEROPONICSAEROPONICS ENABLE HIGHER PRODUCTION OR YIELD TO FACILITATE FASTER GROWTH OF PLANTS

-

10.3 HYDROPONICSUSED FOR GROWING CROPS IN SOIL-LESS MEDIUM

-

10.4 AQUAPONICSGROWING AWARENESS AND INNOVATION REGARDING NEWER INDOOR FARMING TECHNIQUES TO BOOST DEMAND FOR AQUAPONICS

-

10.5 SOIL-BASEDGROWING PREVALENCE OF LACK OF FOOD SECURITY TO BOOST DEMAND FOR SOIL-BASED FARMING

-

10.6 HYBRIDDEVELOPMENTS ACROSS ARRAY OF TECHNIQUES IN INDOOR FARMING MARKET TO HELP GAIN DEMAND FOR HYBRID FARMING

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Introduction of newer farming kits and techniques by system providersCANADA- High awareness about modern farming techniquesMEXICO- Larger greenhouse area used for cultivation

-

11.3 EUROPERECESSION IMPACT ANALYSISSPAIN- Increase in investments in sustainable farming practices and advanced setups to achieve higher volumes of produceNETHERLANDS- Increasing inclination toward efficient farmingUK- Increase in awareness and steady adoption among local growers and cultivators to exhibit positive outlookSWEDEN- Gradual adoption of modern farming techniquesITALY- Growth in organic croplands and rise in demand and supply of organic products to bolster demand for hydroponics indoor farming techniquesREST OF EUROPE- Demand for controlled environment agriculture to create growth opportunities

-

11.4 ASIA PACIFICRECESSION IMPACT ANALYSISCHINA- Increase in population and government intervention to drive initiatives for indoor farming techniquesJAPAN- Growing initiatives from government and institutions to promote indoor farmingSINGAPORE- Farmers shifting toward such cultivation techniquesTAIWAN- Small agriculture field size led to increased adoption of indoor farmingREST OF ASIA PACIFIC- Demand for minimum wastage of food to boost indoor farming techniques

-

11.5 SOUTH AMERICARECESSION IMPACT ANALYSISBRAZIL- High adoption rate of indoor farming to increase demandARGENTINA- Increased adoption among growers to drive demand for indoor farmingREST OF SOUTH AMERICA

-

11.6 REST OF THE WORLDRECESSION IMPACT ANALYSISMIDDLE EAST- Lack of food security and increasing imports to drive demand for indoor farming in Middle EastAFRICA- Increased government initiatives to drive demand for indoor farming

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS - 2022

- 12.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.4 COMPANY REVENUE ANALYSIS OF KEY PLAYERS, 2019–2022

- 12.5 KEY PLAYERS’ ANNUAL REVENUE VS. GROWTH

- 12.6 KEY PLAYERS’ EBIDTA

- 12.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

12.8 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSPRODUCT FOOTPRINT

-

12.9 INDOOR FARMING TECHNOLOGY MARKET: STARTUP/SME EVALUATION QUADRANT, 2021PROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESCOMPETITIVE BENCHMARKING OF OTHER PLAYERS

-

12.10 COMPETITIVE SCENARIODEALSOTHERS

-

13.1 MAJOR PLAYERSSIGNIFY HOLDING- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewEVERLIGHT ELECTRONICS CO., LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSCOTTS COMPANY LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNETAFIM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHELIOSPECTRA AB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARGUS CONTROL SYSTEMS LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLUMIGROW- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWEISSTECHNIK- Business overview- Products/Solutions/Services offered- MnM viewPRIVA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLOGIQS B.V.- Business overview- Products/Solutions/Services offered- MnM viewILLUMITEX- Business overview- Products/Solutions/Services offered- MnM viewAMHYDRO- Business overview- Products/Solutions/Services offered- MnM viewRICHEL GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVERTICAL FARM SYSTEMS- Business overview- Products/Solutions/Services offered- MnM viewHYDROPONIC SYSTEM INTERNATIONAL- Business overview- Products/Solutions/Services offered- MnM viewCERTHON- Business overview- Products/Solutions/Services offered- MnM viewBLUELAB- Business overview- Products/Solutions/Services offered- MnM viewBARTON BREEZE- Business overview- Products/Solutions/Services offered- MnM viewGREEN SENSE FARMS HOLDINGS, INC- Business overview- Products/Solutions/Services offered- MnM viewGREENER CROPS- Business overview- Products/Solutions/Services offered- MnM view

-

13.2 OTHER PLAYERS/STARTUPSSENSAPHONEFREIGHT FARMSCLIMATE CONTROL SYSTEMSSKY GREENSSANANBIO

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 COMMERCIAL GREENHOUSE MARKETMARKET DEFINITIONMARKET OVERVIEWCOMMERCIAL GREENHOUSE MARKET, BY TYPE

-

14.4 HYDROPONICS MARKETMARKET DEFINITIONMARKET OVERVIEWHYDROPONICS MARKET, BY TYPE

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 INDOOR FARMING TECHNOLOGY MARKET SNAPSHOT, 2023 VS. 2028 (VALUE)

- TABLE 3 INDOOR FARMING TECHNOLOGY MARKET ECOSYSTEM

- TABLE 4 TOP TEN IMPORTERS AND EXPORTERS OF POLYCARBONATES, 2022 (KT AND USD ‘000)

- TABLE 5 TOP TEN IMPORTERS AND EXPORTERS OF POLYETHYLENE, 2022

- TABLE 6 TOP TEN IMPORTERS AND EXPORTERS OF POLYMETHYL-METHACRYLATE, 2022 (KT AND ‘000)

- TABLE 7 TOP TEN IMPORTERS AND EXPORTERS OF POLYVINYL CHLORIDE, 2022 (KT AND USD ‘000)

- TABLE 8 INDOOR FARMING TECHNOLOGY MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2022–2023

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR COMPONENT TYPES

- TABLE 15 KEY BUYING CRITERIA FOR COMPONENT TYPES

- TABLE 16 INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 17 INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 18 HARDWARE MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 19 HARDWARE MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 20 HARDWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 HARDWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 23 INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 24 INDOOR FARMING TECHNOLOGY MARKET IN FRUIT & VEGETABLE CULTIVATION, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 25 INDOOR FARMING TECHNOLOGY MARKET IN FRUIT & VEGETABLE CULTIVATION, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 26 INDOOR FARMING TECHNOLOGY MARKET IN FRUIT & VEGETABLE CULTIVATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 INDOOR FARMING TECHNOLOGY MARKET IN FRUIT & VEGETABLE CULTIVATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 INDOOR FARMING TECHNOLOGY MARKET IN LEAFY GREENS CULTIVATION, BY CROP, 2018–2022 (USD MILLION)

- TABLE 29 INDOOR FARMING TECHNOLOGY MARKET IN LEAFY GREENS CULTIVATION, BY CROP, 2023–2028 (USD MILLION)

- TABLE 30 INDOOR FARMING TECHNOLOGY MARKET IN HERBS & MICROGREENS CULTIVATION, BY CROP, 2018–2022 (USD MILLION)

- TABLE 31 INDOOR FARMING TECHNOLOGY MARKET IN HERBS & MICROGREENS CULTIVATION, BY CROP, 2023–2028 (USD MILLION)

- TABLE 32 INDOOR FARMING TECHNOLOGY MARKET IN HERBS & MICROGREENS CULTIVATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 INDOOR FARMING TECHNOLOGY MARKET IN HERBS & MICROGREENS CULTIVATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 INDOOR FARMING TECHNOLOGY MARKET IN FLOWER & ORNAMENTAL CROP CULTIVATION, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 35 INDOOR FARMING TECHNOLOGY MARKET IN FLOWER & ORNAMENTAL CROP CULTIVATION, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 36 INDOOR FARMING TECHNOLOGY MARKET IN FLOWER & ORNAMENTAL CROP CULTIVATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 INDOOR FARMING TECHNOLOGY MARKET IN FLOWER & ORNAMENTAL CROP CULTIVATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 INDOOR FARMING TECHNOLOGY MARKET IN OTHER CROP CULTIVATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 INDOOR FARMING TECHNOLOGY MARKET IN OTHER CROP CULTIVATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2018–2022 (USD MILLION)

- TABLE 41 INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 42 GLASS OR POLY GREENHOUSES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 GLASS OR POLY GREENHOUSES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 INDOOR VERTICAL FARMS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 INDOOR VERTICAL FARMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 CONTAINER FARMS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 CONTAINER FARMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 INDOOR DWC SYSTEMS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 INDOOR DWC SYSTEMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 51 INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 52 AEROPONICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 AEROPONICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 HYDROPONICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 HYDROPONICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 AQUAPONICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 AQUAPONICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 SOIL-BASED INDOOR FARMING TECHNOLOGY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 SOIL-BASED INDOOR FARMING TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 HYBRID INDOOR FARMING TECHNOLOGY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 HYBRID INDOOR FARMING TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 INDOOR FARMING TECHNOLOGY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 INDOOR FARMING TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2018–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 74 US: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 75 US: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 76 CANADA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 77 CANADA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 78 MEXICO: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 79 MEXICO: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: INDOOR FARMING TECHNOLOGY MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 81 EUROPE: INDOOR FARMING TECHNOLOGY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 83 EUROPE: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2018–2022 (USD MILLION)

- TABLE 85 EUROPE: INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 87 EUROPE: INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 89 EUROPE: INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 90 SPAIN: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 91 SPAIN: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 92 NETHERLANDS: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 93 NETHERLANDS: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 94 UK: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 95 UK: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 96 SWEDEN: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 97 SWEDEN: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 98 ITALY: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 99 ITALY: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 100 REST OF EUROPE: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 101 REST OF EUROPE: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: INDOOR FARMING TECHNOLOGY MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: INDOOR FARMING TECHNOLOGY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2018–2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 112 CHINA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 113 CHINA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 114 JAPAN: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 115 JAPAN: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 116 SINGAPORE: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 117 SINGAPORE: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 118 TAIWAN: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 119 TAIWAN: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 122 SOUTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 123 SOUTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 124 SOUTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 125 SOUTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 126 SOUTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2018–2022 (USD MILLION)

- TABLE 127 SOUTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 128 SOUTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 129 SOUTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 130 SOUTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 131 SOUTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 132 BRAZIL: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 133 BRAZIL: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 134 ARGENTINA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 135 ARGENTINA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 136 REST OF SOUTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 137 REST OF SOUTH AMERICA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 138 ROW: INDOOR FARMING TECHNOLOGY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 139 ROW: INDOOR FARMING TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 140 ROW: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 141 ROW: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 142 ROW: INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2018–2022 (USD MILLION)

- TABLE 143 ROW: INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 144 ROW: INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 145 ROW: INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 146 ROW: INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 147 ROW: INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 148 MIDDLE EAST: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 149 MIDDLE EAST: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 150 AFRICA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2018–2022 (USD MILLION)

- TABLE 151 AFRICA: INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 152 INDOOR FARMING TECHNOLOGY: DEGREE OF COMPETITION

- TABLE 153 INDOOR FARMING TECHNOLOGY: COMPONENT TYPE FOOTPRINT OF KEY PLAYERS

- TABLE 154 INDOOR FARMING TECHNOLOGY: COMPANY FACILITY FOOTPRINT OF KEY PLAYERS

- TABLE 155 INDOOR FARMING TECHNOLOGY: COMPANY REGION FOOTPRINT OF KEY PLAYERS

- TABLE 156 INDOOR FARMING TECHNOLOGY: OVERALL COMPANY FOOTPRINT OF KEY PLAYERS

- TABLE 157 DETAILED LIST OF OTHER PLAYERS

- TABLE 158 COMPETITIVE BENCHMARKING (OTHER PLAYERS), 2021

- TABLE 159 INDOOR FARMING TECHNOLOGY: DEALS, 2018–2023

- TABLE 160 OTHERS, 2018–2021

- TABLE 161 SIGNIFY HOLDING: BUSINESS OVERVIEW

- TABLE 162 SIGNIFY HOLDING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 SIGNIFY HOLDING: DEALS

- TABLE 165 EVERLIGHT ELECTRONICS CO., LTD: BUSINESS OVERVIEW

- TABLE 166 EVERLIGHT ELECTRONICS CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 EVERLIGHT ELECTRONICS CO., LTD: DEALS

- TABLE 168 SCOTTS COMPANY LLC: BUSINESS OVERVIEW

- TABLE 169 SCOTTS COMPANY LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 SCOTTS COMPANY LLC: DEALS

- TABLE 171 NETAFIM: BUSINESS OVERVIEW

- TABLE 172 NETAFIM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 NETAFIM: DEALS

- TABLE 174 HELIOSPECTRA AB: BUSINESS OVERVIEW

- TABLE 175 HELIOSPECTRA AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 HELIOSPECTRA AB: OTHERS

- TABLE 177 ARGUS CONTROL SYSTEMS LIMITED: BUSINESS OVERVIEW

- TABLE 178 ARGUS CONTROL SYSTEMS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 ARGUS CONTROL SYSTEMS LIMITED: DEALS

- TABLE 180 LUMIGROW: BUSINESS OVERVIEW

- TABLE 181 LUMIGROW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 LUMIGROW: DEALS

- TABLE 183 WEISS TECHNIK: BUSINESS OVERVIEW

- TABLE 184 WEISSTECHNIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 PRIVA: BUSINESS OVERVIEW

- TABLE 186 PRIVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 PRIVA: DEALS

- TABLE 188 LOGIQS B.V.: BUSINESS OVERVIEW

- TABLE 189 LOGIQS B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 ILLUMITEX: BUSINESS OVERVIEW

- TABLE 191 ILLUMITEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 AMHYDRO: BUSINESS OVERVIEW

- TABLE 193 AMHYDRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 RICHEL GROUP: BUSINESS OVERVIEW

- TABLE 195 RICHEL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 RICHEL GROUP: OTHERS

- TABLE 197 VERTICAL FARM SYSTEMS: BUSINESS OVERVIEW

- TABLE 198 VERTICAL FARM SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 HYDROPONIC SYSTEM INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 200 HYDROPONIC SYSTEM INTERNATIONAL: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 201 CERTHON: BUSINESS OVERVIEW

- TABLE 202 CERTHON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 BLUELAB: BUSINESS OVERVIEW

- TABLE 204 BLUE LAB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 BARTON BREEZE: BUSINESS OVERVIEW

- TABLE 206 BARTON BREEZE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 GREEN SENSE FARMS HOLDINGS, INC: BUSINESS OVERVIEW

- TABLE 208 GREEN SENSE FARMS HOLDINGS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 209 GREENER CROP: BUSINESS OVERVIEW

- TABLE 210 GREENER CROP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 ADJACENT MARKETS TO INDOOR FARMING TECHNOLOGY MARKET

- TABLE 212 COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 213 COMMERCIAL GREENHOUSE MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 214 HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 215 HYDROPONICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 INDOOR FARMING TECHNOLOGY MARKET: RESEARCH DESIGN

- FIGURE 3 INDOOR FARMING TECHNOLOGY MARKET SIZE ESTIMATION – DEMAND SIDE (TOP-DOWN APPROACH)

- FIGURE 4 INDOOR FARMING TECHNOLOGY MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 DATA TRIANGULATION METHODOLOGY

- FIGURE 6 INDICATORS OF RECESSION

- FIGURE 7 WORLD INFLATION RATE: 2011–2021

- FIGURE 8 GLOBAL GDP: 2011–2021 (USD TRILLION)

- FIGURE 9 RECESSION INDICATORS AND IMPACT ON INDOOR FARMING TECHNOLOGY MARKET

- FIGURE 10 GLOBAL INDOOR FARMING TECHNOLOGY MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 11 INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 INDOOR FARMING TECHNOLOGY MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 INDOOR FARMING TECHNOLOGY MARKET, BY REGION

- FIGURE 16 GROWTH IN TREND OF YEAR-ROUND CROP PRODUCTION TO DRIVE MARKET

- FIGURE 17 FRUITS & VEGETABLES SEGMENT DOMINATED EUROPEAN MARKET IN 2022

- FIGURE 18 HYDROPONICS SEGMENT DOMINATED MARKET ACROSS ALL REGIONS BETWEEN 2023 AND 2028

- FIGURE 19 CHINA TO BE MOST LUCRATIVE MARKET FOR INDOOR FARMING TECHNOLOGY

- FIGURE 20 GLOBAL POPULATION GROWTH TREND, 2011–2021 (BILLION)

- FIGURE 21 TOTAL AVAILABLE ARABLE LAND, 1950–2020 (HECTARES/PERSON)

- FIGURE 22 INDOOR FARMING TECHNOLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 INDOOR FARMING TECHNOLOGY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 INDOOR FARMING TECHNOLOGY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 INDOOR FARMING TECHNOLOGY MARKET PRICING ANALYSIS AMONG KEY PLAYERS, BY MAJOR HARDWARE COMPONENT, 2022 (USD/UNIT)

- FIGURE 26 HYDROPONICS AVERAGE PRICING ANALYSIS, BY REGION, 2017–2021 (USD/SQUARE FOOT)

- FIGURE 27 ECOSYSTEM MAP

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING BUYERS IN INDOOR FARMING TECHNOLOGY MARKET

- FIGURE 29 LIST OF TOP PATENTS IN MARKET FOR LAST TEN YEARS

- FIGURE 30 JURISDICTIONS WITH MOST PATENT APPROVALS FOR INDOOR FARMING TECHNOLOGY, 2012–2022

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR COMPONENT TYPES

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR INDOOR FARMING TECHNOLOGY

- FIGURE 33 INDOOR FARMING TECHNOLOGY MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 34 HARDWARE MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 35 FRUITS & VEGETABLES SEGMENT TO DOMINATE MARKET FROM 2023 TO 2028

- FIGURE 36 INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 37 INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2023 VS. 2028 (USD MILLION)

- FIGURE 38 ASIA PACIFIC COUNTRIES TO WITNESS SIGNIFICANT GROWTH IN INDOOR FARMING TECHNOLOGY MARKET (2023–2028)

- FIGURE 39 INFLATION: COUNTRY-LEVEL DATA (2018–2021)

- FIGURE 40 NORTH AMERICA INDOOR FARMING TECHNOLOGY MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 41 EUROPE: INDOOR FARMING TECHNOLOGY MARKET SNAPSHOT

- FIGURE 42 EUROPE INDOOR FARMING TECHNOLOGY MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 43 ASIA PACIFIC: INDOOR FARMING TECHNOLOGY MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC INDOOR FARMING TECHNOLOGY MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 45 SOUTH AMERICA INDOOR FARMING TECHNOLOGY MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 46 REST OF THE WORLD INDOOR FARMING TECHNOLOGY MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 47 COMPANY REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2019–2022 (USD BILLION)

- FIGURE 48 ANNUAL REVENUE, 2021 (USD MILLION) VS. REVENUE GROWTH, 2019–2021 (%)

- FIGURE 49 EBITDA, 2021 (USD BILLION)

- FIGURE 50 INDOOR FARMING TECHNOLOGY MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 51 INDOOR FARMING TECHNOLOGY MARKET: COMPANY EVALUATION QUADRANT, 2022 (OVERALL MARKET)

- FIGURE 52 INDOOR FARMING TECHNOLOGY MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

- FIGURE 53 SIGNIFY HOLDING: COMPANY SNAPSHOT

- FIGURE 54 EVERLIGHT ELECTRONICS CO., LTD: COMPANY SNAPSHOT

- FIGURE 55 SCOTTS COMPANY LLC: COMPANY SNAPSHOT

- FIGURE 56 NETAFIM: COMPANY SNAPSHOT

- FIGURE 57 HELIOSPECTRA AB: COMPANY SNAPSHOT

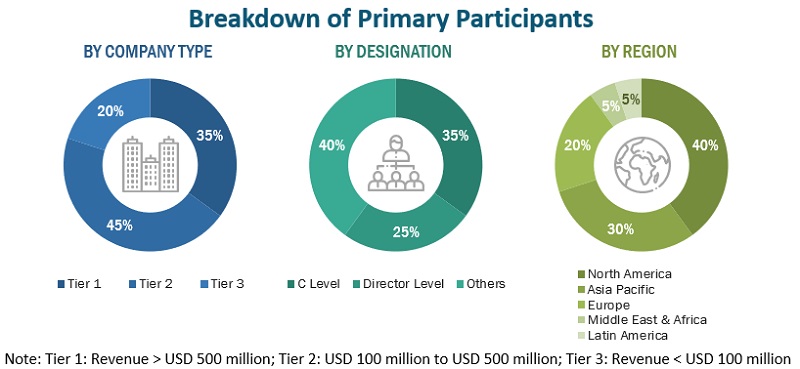

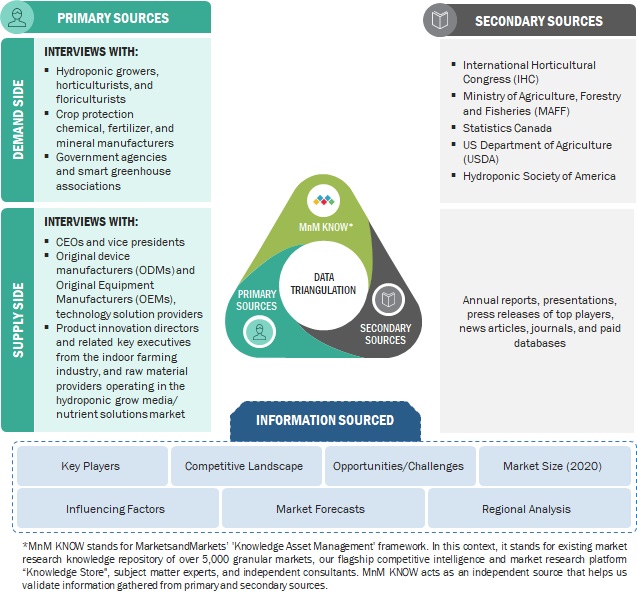

This research study involved the extensive use of secondary sources—directories and databases, such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the indoor farming technology market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), and C-level executives of key market players and industry consultants—to obtain and verify critical qualitative and quantitative information, as well as to assess growth prospects. The following figure depicts the research design applied in drafting this report on the indoor farming technology market.

Secondary Research

In the secondary research process, various secondary sources were referred to, to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, which include hydroponic system manufacturers, grow media and nutrient formulators, suppliers, and hydroponic crop growers in the supply chain. Various primary sources from both the supply and demand sides of the indoor farming technology market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include research institutions, hydroponic growers, government agencies, horticulturists, floriculturists, and hydroponic and indoor farming associations. The primary sources from the supply side include hydroponic system manufacturers, grow media and nutrient manufacturers, raw material suppliers, and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

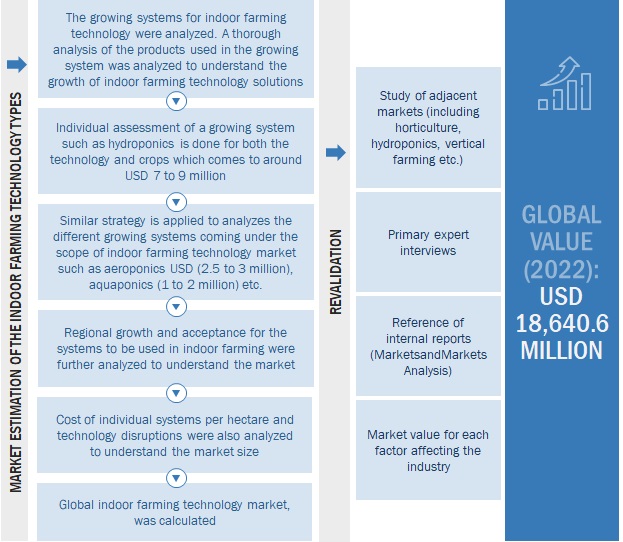

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the indoor farming technology market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The adjacent market—the hydroponics market and commercial greenhouse market—was considered to validate further the market details of indoor farming technology.

Bottom-up approach:

-

- The market size was analyzed based on the share of each type of indoor farming technology and its penetration within the growing systems at regional and country levels. Thus, the global market was estimated with a bottom-up approach to the growing systems at the country level.

- Other factors include demand within the supply chain including the indoor farming industry; function trends; pricing trends; adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the indoor farming technology market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Market Size Estimation: Bottom-up Approach

In the bottom-up approach, each country's market size for indoor farming technology and the growing systems, including hydroponics, aeroponics, aquaponics, soil based, and hybrid was arrived at through secondary sources, such as annual reports, investor presentations, journals, and government publications. The bottom-up procedure was also implemented on the data extracted from secondary research to validate the market segment sizes obtained.

The penetration rate of each solution of indoor farming technology as a percentage of the application sector in each country was calculated from secondary sources. Country-level data for indoor farming technology were estimated based on the adoption rate of each solution of indoor farming technology within the growing systems. The growing system of each component type was tracked via product mapping and studied for its penetration level to estimate the market size at the regional level. Each product type was studied for its commercially available growing system and component type. The market size arrived at was further validated by primary respondents.

Market Size Estimation Methodology: Top-down Approach

For the calculation of each type of specific market segment, the most appropriate, immediate parent and peer market sizes were used for implementing the top-down procedure.

Further, appropriate weightage was assigned to the data derived from each parameter to arrive at the final shares for each region. The regional demand-supply trends, presence of manufacturing units, and regulatory scenario were also analyzed to further validate the shares arrived at. These shares were then confirmed with primary respondents from across regions.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall indoor farming technology market and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Indoor farming is a method of growing crops or plants, usually on a large scale, entirely indoors. This method of farming often implements methods of cultivation such as hydroponics, aquaponics, and aeroponics and utilizes artificial lights and other systems to provide plants with the optimal conditions required for their growth. The technology used to consistently provide an indoor environment suitable for plants, coupled with equipment used for indoor cultivation, is known as indoor farming technology. The application of technology in indoor farming to increase yield has emerged as a major technological innovation. Some indoor farms are created in an area as small as a basement and used by a single gardener to provide fresh produce for their homes.

Key Stakeholders

- Hydroponic hardware manufacturers, suppliers

- Research & development institutions

- Traders & retailers

- Distributors, importers, and exporters

-

Regulatory bodies

- Food and Drug Administration (FDA)

- United States Department of Agriculture (USDA)

- European Food Safety Agency (EFSA)

- EUROPA

- Food Safety Australia and New Zealand (FSANZ)

- Government agencies

- Intermediary suppliers

- Universities and industry bodies

- Manufacturers of commercial greenhouse and indoor farming equipment

- Original design manufacturing (ODM) and original equipment manufacturing (OEM) technology solution providers

- Sensor providers

- Software solution providers

- Individual and large growers

- Horticulturists and floriculturists

- Research institutes and organizations

Report Objectives

Market Intelligence

- Determining and projecting the size of the indoor farming technology market based on growing systems, facility type, component, crop type, and region over five years ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

-

Analyzing the demand-side factors based on the following:

- Impact of macro- and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the indoor farming technology market

Competitive Intelligence

- Identifying and profiling the key market players in the indoor farming technology market

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations and technology in the indoor farming technology market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe’s indoor farming technology market, by key country

- Further breakdown of the Rest of South America’s indoor farming technology market, by key country.

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Indoor Farming Technology Market