Hydroponics Market by Type (Aggregate systems and Liquid systems), Equipment, Input (Nutrients and Grow media), Crop Type (Vegetables, Fruits, Flowers), Farming Method (Indoor and Outdoor), Crop Area, and Region - Global Forecast to 2027

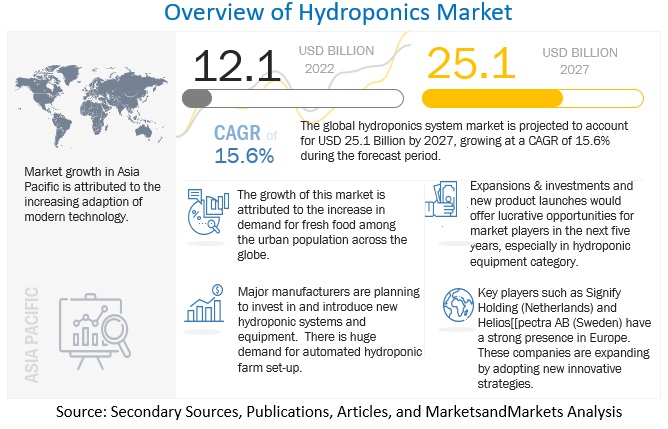

The global hydroponics system market in terms of revenue was estimated to be worth $12.1 billion in 2022 and is poised to reach $25.1 billion by 2027, growing at a CAGR of 15.6% from 2022 to 2027. The global hydroponics crop market is estimated to be valued at USD 37.7 billion in 2022 and is projected to reach USD 53.4 billion by 2027, recording a CAGR of 7.2%.

- 2022 Market Size: USD $12.1 Billion

- 2027 Projected Market Size: USD $25.1 Billion

- CAGR (2022-2027): 15.6%

- Europe: Largest market

Hydroponic systems or soil-less agriculture reduce the farmer’s consumption of resources, enabling this farming technique to be adopted by many stakeholders, ranging from home gardeners to professional growers and supermarkets to restaurants. According to the UN reports on the global population, in 2018, plants grown in hydroponic systems achieved a 20–25% higher yield than the traditional agriculture system, with its productivity being 2–5 times higher. Also, owing to their controlled environmental conditions, the effect of climatic changes can be balanced with the help of these systems, thereby not affecting the annual crop production.

To know about the assumptions considered for the study, Request for Free Sample Report

Hydroponics Market Growth Dynamics

Drivers: Hydroponic systems help conserve natural resources

A key advantage of hydroponic farming is the lack of soil and land required to grow plants. By stacking plants vertically, the requirement of vast parcels of land for farming is dismissed as more crops can be grown in a fraction of the area. Commercial hydroponic growers can cultivate hydroponic produce in only one-fifth of the land needed against those farmed conventionally. It helps farmers save significantly on land costs while also being able to cultivate the produce in higher volumes with lower space and energy requirements. Growing vertically and stacking plants closer together helps grow multiple crop types with minimal complexities as those faced in conventional farming.

Restraints: High capital investment for large-scale farms

The initial investment required to set up a hydroponic farm is high; the equipment needed for a hydroponic farm is extensive and often expensive to buy and maintain. Different types of equipment, including HVAC systems, fans, ventilation, irrigation systems, control systems, rails, and lights, are the key cost factors in a hydroponic farm. On average, a 500-sq. ft. hydroponic farm can cost up to USD 110,000 for a base-level system that is not fully automated. Larger and more automated farms can cost USD 500,000- 800,000 per 1,000 sq. ft., depending on the level of autonomous function. The costs in this instance are considering only the setup costs of the farm; however, when upgrades are factored in, it can result in a recurring cost for the farm as the equipment will need to be upgraded every 3–4 years to improve the yield and productivity of the farm.

Opportunities: Growth in popularity of hydroponics to provide high profit margins

More than 700 companies are operating in the hydroponics space globally. While around 300 startups farms are currently involved in the market, some of the notable startup companies are Easy Urban Garden (Industrial Hydroponics), WallFarm (Automated Hydroponics), Oasis Biotech (Indoor Hydroponics), HydroGreen Global Technologies (Livestock Feed), and Ponix Systems (Consumer Hydroponics). Due to the increased popularity and adoption of hydroponics, many new players are entering the market. Larry Ellison, founder, chairman, and CTO of Oracle launched a hydroponic farming startup named Sensei in Los Angeles. The company plans to build ten greenhouses covering 200,000 square feet on the Hawaiian island of Lanai, and instead of measuring output by volume, Sensei will measure nutrition per acre.

Challenges: Debate on certifying hydroponic produce as organic

There has been a debate on the certification of hydroponically grown crops as organic. In Europe, crops grown hydroponically cannot be labeled as “organic,” while in the US, crops grown hydroponically can be labeled as organic as long as they meet other criteria for USDA certification. In 2018, members of the European Parliament voted to approve new regulations for the certification and labeling of organic food. According to this new regulation, by the beginning of 2021, the European Union will no longer accept produce labeled “organic” that has been produced hydroponically, including “container production.” European hydroponic producers who use approved organic inputs will still be able to export their produce to the US.

By type, the liquid systems segment is projected to grow at a higher CAGR in the hydroponics market during the forecast period

Deep water culture (DWC) is the easiest type of hydroponic system that one can build and maintain at home even. In this system, the plants grow with their roots submerged directly in nutrient-rich water. For home growers, this can be achieved by growing in large opaque storage containers or buckets. Commercial growers use rafts that float on a large waterbed; these work like a conveyor belt with young plants added on one side, moving along until ready for harvest on the other side. The platform that holds the plants is usually made of Styrofoam and floats directly on the nutrient solution.

By equipment, the LED grow light segment is anticipated to grow at the highest CAGR in the hydroponics market during the study period

Growers have the ability to experiment with light recipes to change the flavour, size, and potency of their produce when using spectrum changeable LED grow lights. The spectrum, intensity, and number of hours of exposure to light give tremendous control to growers. These aspects are all simple to regulate and modify when using spectrum changeable LED lighting. With LED lights, growers may control all these aspects, whether customers want a sweeter or milder flavour, a greater aroma, or a change in colour.

By input, the nutrient segment dominated the hydroponics market in terms of market share during the review period

Nitrogen, phosphorus, and potassium are the major nutrients required for the growth of plants. The deficiency of these macronutrients results in discoloration, stunted growth, and scattered spots in the plants. During the vegetative stage, plants need higher amounts of nitrogen for foliage production. Nitrogen is the primary reason behind the deep green color of the plant leaves when they’re healthy. Higher the level of nitrogen, the higher the speed of growth rate among the plants.

By crop type, the fruits segment is anticipated to grow at the highest CAGR in the hydroponics market during the forecast period

Different types of berries can be grown using hydroponics; strawberries are among the most common berries grown using hydroponic methods. Berries fundamentally require three primary nutrients—nitrogen, potassium, and phosphorus. Apart from that, the presence of calcium, magnesium, and sulfur in the water is also required to supplement the growth of berries in hydroponic conditions. The weight of the berries is not a deterrent and can be grown in a common rail system using the nutrient film technique or the ebb & flow system. The different types of berries that can be grown hydroponically include strawberries, blueberries, cranberries, and raspberries.

To know about the assumptions considered for the study, download the pdf brochure

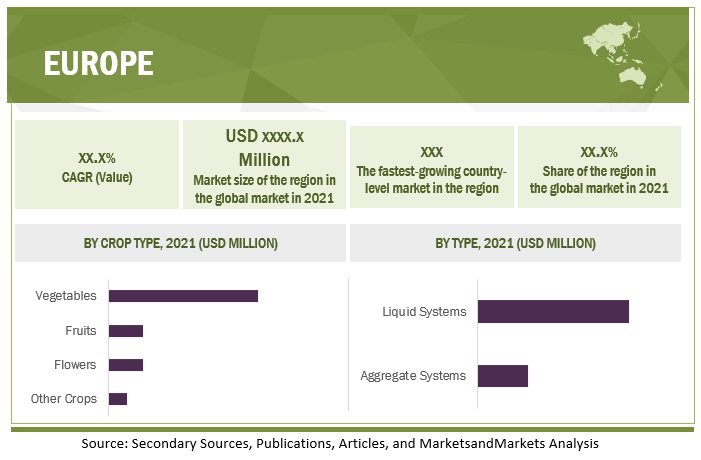

According to the FAO 2017, greenhouse crop production experienced growth throughout the world, with around 405,000 ha of greenhouses spread throughout Europe. In Europe, the Netherlands contributes highest market share in the global hydroponics market. The country was ranked first in the world in terms of the area of greenhouse farms. The Westland region in the Netherlands has a high concentration of greenhouse farms. The greenhouses in the Netherlands produce all kinds of vegetables, including cucumbers, tomatoes, carrots, and paprika. Netherlands is followed by Spain. It produces tons of greenhouse vegetables and fruits such as tomatoes, peppers, zucchinis and cucumbers. The land area used for greenhouse cultivation in the country has grown at a rapid rate in recent years.

Signify Holding (Netherlands) signed a partnership agreement with Artechno (Netherlands), a scalable, automated vertical farm system provider, to make it easier for growers and entrepreneurs to start a vertical farm using Philips GreenPower LED lighting.

Key Market Players:

Key players in this market include ScottsMiracle-Gro (US), Triton Foodworks Pvt. Ltd. (India), Green Sense Farms (US), Emirates Hydroponic Farm (UAE), Gotham Greens (US), Hydrodynamics International (US), American Hydroponics (US), Advanced Nutrients (US), Emerald Harvest (US), VitaLink (UK), Freight Farms (US), AeroFarms (US), Nature’s Miracle (India), Bright Farms (US), InFarm (Germany), Badia Farms (UAE), Argus Control Systems (Canada), Logiqs B.V. (Netherlands), LumiGrow, Inc. (US), Hydroponic Systems International (Spain), Signify Holding (Netherlands), and Heliospectra AB (Sweden).

Scope of the Report

|

Report Metric |

Details |

|

Market Revenue in 2022 |

USD 12.1 billion |

|

Estimated value by 2027 |

USD 25.1 billion |

|

Growth Rate |

Growing at a CAGR of 15.6% |

|

Growth Opportunities |

Growth in popularity of hydroponics to provide high profit margins |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD) |

|

Market Report Segmentation |

Type, Equipment, Input, Crop Type, Farming Method, Crop Area, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and Rest of the world |

|

Key Players in NA Region |

|

Target Audience:

- Processed food & beverage manufacturers

- Government and research organizations

- Hydroponics system distributors

- Crop growers

- Marketing directors

- Key executives from various key companies and organizations in the hydroponics market

Report Scope:

This research report categorizes the hydroponics market based on Type, equipment, input, crop type, farming method, crop area, and region

By Type

- Aggregate systems

- Ebb & flow systems

- Drip systems

- Wick systems

- Liquid systems

- Deep water culture

- Nutrient film technique (NFT)

- Aeroponics

By Equipment

- HVAC

- LED grow lights

- Control systems

- Irrigation systems

- Material handling equipment

- Other equipment

By Input

- Nutrients

- NPK

- Trace minerals

- Other nutrients

- Grow media

- Rockwool

- Perlite & vermiculite

- Coco fiber

- Other grow media

By Crop type

- Vegetables

- Tomatoes

- Leafy greens

- Cucumbers

- Peppers

- Other vegetables

- Fruits

- Flowers

- Other crop types

By Farming method

- Indoor

- Outdoor

By Crop area

- Upto 1000 square feet

- 1000-10000 square feet

- 10000-50000 square feet

- Above 50000 square feet

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Key Questions Addressed by the Report

What is the hydroponics market?

The hydroponics market refers to the industry focused on soilless farming techniques where crops are grown using nutrient-rich water solutions, often in controlled environments like greenhouses or vertical farms.

What is driving the growth of the hydroponics market?

Key drivers include urbanization, increasing demand for pesticide-free and fresh produce, water scarcity, limited arable land, and advancements in controlled environment agriculture (CEA) technologies.

How large is the global hydroponics market?

As of 2022, the global hydroponics market is valued between USD 12.1 billion and USD 15.1 billion, with forecasts of reaching over USD 15.6 billion by 2027.

What are the main types of hydroponic systems?

Major types include Nutrient Film Technique (NFT), Deep Water Culture (DWC), Ebb & Flow (Flood and Drain), Wick Systems, Drip Systems, and Aeroponics.

How does hydroponics compare to traditional soil farming?

Hydroponics allows faster crop growth, higher yields, and year-round cultivation using less water and land compared to traditional farming. However, it requires higher upfront investment and technical expertise.

What are the challenges in the hydroponics market?

Challenges include high initial setup costs, energy consumption for lighting and climate control, technical know-how requirements, and limited awareness among small-scale farmers.

Which regions are leading in hydroponics adoption?

Europe and North America are major adopters due to advanced infrastructure and consumer demand for organic produce. The Asia-Pacific region is rapidly growing, led by China, Japan, and India, driven by urban farming initiatives.

What role does hydroponics play in sustainability?

Hydroponics supports sustainability by reducing water usage by up to 90%, minimizing pesticide reliance, enabling local food production, and reducing transportation-related carbon emissions.

Who are the key players in the hydroponics market?

Leading companies include AeroFarms (US), BrightFarms (US), Freight Farms (US), HydroFarm Holdings (US), Scotts Miracle-Gro (US), and European firms such as Signify (Netherlands) and Priva (Netherlands).

What is the future outlook for the hydroponics market?

The market is expected to grow significantly due to rising food demand, increasing urban vertical farming projects, government support for sustainable agriculture, and technological innovations like automation, AI, and IoT integration.

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 HYDROPONICS MARKET SEGMENTATION

1.3.1 GEOGRAPHIC SCOPE

1.3.2 PERIOD CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED FOR THE STUDY, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 2 HYDROPONICS MARKET: RESEARCH DESIGN CHART

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 3 EXPERT INSIGHTS

2.1.2.2 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS, BY VALUE CHAIN, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 HYDROPONICS MARKET SIZE ESTIMATION, BY CROP TYPE

2.2.2 HYDROPONICS MARKET SIZE ESTIMATION, BY TYPE

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

TABLE 2 HYDROPONICS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 6 HYDROPONICS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 7 HYDROPONICS MARKET, BY INPUT, 2022 VS. 2027 (USD MILLION)

FIGURE 8 HYDROPONICS MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 9 HYDROPONICS MARKET, BY EQUIPMENT, 2022 VS. 2027 (USD MILLION)

FIGURE 10 HYDROPONICS MARKET, BY FARMING METHOD, 2022 VS. 2027 (USD MILLION)

FIGURE 11 HYDROPONICS MARKET, BY CROP AREA, 2022 VS. 2027 (USD MILLION)

FIGURE 12 HYDROPONICS MARKET (VALUE), BY REGION

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 13 RISE IN DEMAND FOR FRESH FOOD IN URBAN AREAS ACROSS GLOBE TO DRIVE MARKET FOR HYDROPONICS

4.2 EUROPE: HYDROPONICS MARKET, BY CROP TYPE & COUNTRY

FIGURE 14 VEGETABLES SEGMENT AND NETHERLANDS TO ACCOUNT FOR LARGEST RESPECTIVE SHARES IN EUROPEAN MARKET IN 2022

4.3 BY MARKET, BY TYPE

FIGURE 15 LIQUID SYSTEMS TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 HYDROPONICS MARKET, BY KEY CROP TYPE & REGION

FIGURE 16 VEGETABLES AND EUROPE TO DOMINATE RESPECTIVE SEGMENTS DURING FORECAST PERIOD

4.5 BY MARKET, BY CROP TYPE

FIGURE 17 VEGETABLE CULTIVATION TO BE LARGEST MARKET DURING FORECAST PERIOD

4.6 HYDROPONICS MARKET, BY INPUT

FIGURE 18 NUTRIENT INPUT TO DOMINATE MARKET DURING FORECAST PERIOD

4.7 BY MARKET, BY EQUIPMENT

FIGURE 19 LED GROW LIGHTS TO LEAD MARKET DURING FORECAST PERIOD

4.8 BY MARKET, BY FARMING METHOD

FIGURE 20 INDOOR FARMING TO DOMINATE MARKET DURING FORECAST PERIOD

4.9 BY MARKET, BY CROP AREA

FIGURE 21 CROP AREAS OF ABOVE 50,000 TO BE LARGEST MARKET DURING FORECAST PERIOD

5 HYDROPONICS MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 RISE IN RATE OF URBANIZATION AND DECLINE IN ARABLE LAND

FIGURE 22 PERCENTAGE OF LAND USED FOR AGRICULTURE, 1990–2018

FIGURE 23 MOST URBANIZED REGIONS, 2018

5.3 HYDROPONICS MARKET DYNAMICS

FIGURE 24 HYDROPONICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS

5.3.1.1 Higher yield compared with conventional agricultural practices

TABLE 3 PER-ACRE YIELD OF CROPS: SOIL CULTIVATION VS. HYDROPONICS

5.3.1.2 Controlled environment farming eliminates external factors on crop growth

FIGURE 25 HARVESTED AREA OF GREENHOUSE VEGETABLES, 2012–2016 (HA)

5.3.1.3 Conservation of natural resources

5.3.1.3.1 Improved yield and higher productivity with limited land resources

5.3.1.3.2 Lower water utilization compared with conventional farming methods

5.3.1.4 Increase in demand for cannabis using hydroponics

5.3.2 RESTRAINTS

5.3.2.1 High capital investment for large-scale farms

5.3.2.2 Lack of government incentives and high prices of hydroponically grown produce dissuading market adoption

5.3.3 OPPORTUNITIES

5.3.3.1 Growth in popularity of hydroponics to provide high profit margins

5.3.3.2 Increase in application of hydroponic systems in restaurants and grocery stores

5.3.4 CHALLENGES

5.3.4.1 Debate on certifying hydroponic produce as organic

FIGURE 26 COUNTRIES WITH HIGHEST CONSUMPTION OF ORGANIC FOOD PER CAPITA, 2020 (EUR)

5.3.4.2 Spread of waterborne diseases and algae in closed systems

5.3.4.3 Risk of equipment failure and delay in learning curve among growers

6 INDUSTRY TRENDS (Page No. - 65)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 27 HYDROPONICS MARKET: VALUE CHAIN ANALYSIS

6.2.1 RAW MATERIALS

6.2.2 HYDROPONIC SYSTEM PROVIDERS

6.2.3 HYDROPONIC TECHNOLOGY PROVIDERS

6.2.4 CONSULTING & MANAGEMENT SERVICES

6.2.5 GROWERS & END USERS

6.3 TECHNOLOGY ANALYSIS

6.4 PRICING ANALYSIS

FIGURE 28 MARKET FOR HYDROPONICS PRICING ANALYSIS AMONG KEY PLAYERS, BY MAJOR EQUIPMENT, 2021 (USD/UNIT)

FIGURE 29 HYDROPONICS AVERAGE PRICING ANALYSIS, BY REGION, 2017–2021 (USD/SQUARE FOOT)

FIGURE 30 HYDROPONICS AVERAGE PRICING ANALYSIS, BY MAJOR EQUIPMENT, 2017–2021 (USD/UNIT)

6.5 PATENT ANALYSIS

FIGURE 31 PATENTS GRANTED FOR THE MARKET, 2011–2021

FIGURE 32 REGIONAL ANALYSIS OF PATENTS GRANTED FOR THE MARKET, 2011–2021

TABLE 4 KEY PATENTS PERTAINING TO THE MARKET, 2020

6.6 MARKET MAP

FIGURE 33 HYDROPONICS MARKET MAP

TABLE 5 MARKET FOR HYDROPONICS: ECOSYSTEM

6.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 MARKET FOR HYDROPONICS: PORTER’S FIVE FORCES ANALYSIS

6.7.1 THREAT FROM NEW ENTRANTS

6.7.2 THREAT FROM SUBSTITUTES

6.7.3 BARGAINING POWER OF SUPPLIERS

6.7.4 BARGAINING POWER OF BUYERS

6.7.5 DEGREE OF COMPETITION

6.8 TRADE ANALYSIS

TABLE 7 TOP TEN IMPORTERS AND EXPORTERS OF POLYCARBONATES, 2021 (KT AND USD ‘000)

TABLE 8 TOP TEN IMPORTERS AND EXPORTERS OF POLYETHYLENE, 2021

TABLE 9 TOP TEN IMPORTERS AND EXPORTERS OF POLYMETHYL-METHACRYLATE, 2021 (KT AND ‘000)

TABLE 10 TOP TEN IMPORTERS AND EXPORTERS OF POLYVINYL CHLORIDE, 2021 (KT AND USD ‘000)

6.9 KEY CONFERENCES & EVENTS

TABLE 11 HYDROPONICS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

6.10 TARIFF AND REGULATORY LANDSCAPE

6.10.1 KEY REGULATIONS FOR HYDROPONICS

6.10.1.1 North America

6.10.1.1.1 US

6.10.1.1.2 Canada

6.10.1.2 Europe

6.10.1.3 Asia Pacific

6.10.1.3.1 India

6.10.1.3.2 China

6.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.10.3 TRENDS/DISRUPTIONS IMPACTING BUYERS IN THE MARKET

FIGURE 34 TRENDS/DISRUPTIONS IMPACTING BUYERS IN THE MARKET

6.11 CASE STUDY ANALYSIS

6.11.1 FREIGHT FARMS’ GREENERY S HELPED NEW GROWERS START BUSINESSES

6.11.2 SIGNIFY’S LED LIGHTING SOLUTION FOR GOODLEAF TO INCREASE PERENNIAL FOOD PRODUCTION

6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 35 INFLUENCE OF STAKEHOLDERS IN BUYING HYDROPONIC SYSTEMS, BY TYPE

TABLE 16 INFLUENCE OF STAKEHOLDERS IN BUYING TOP TWO TYPES

6.12.2 BUYING CRITERIA

FIGURE 36 KEY BUYING CRITERIA FOR HYDROPONIC FARMING METHODS

TABLE 17 KEY BUYING CRITERIA FOR HYDROPONICS FARMING METHOD TYPES

7 HYDROPONICS MARKET, BY TYPE (Page No. - 87)

7.1 INTRODUCTION

FIGURE 37 HYDROPONICS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 18 MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 19 MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

7.2 AGGREGATE SYSTEMS

7.2.1 PREFERABLE USAGE FOR HEAVIER CROPS TO DRIVE GROWTH OF AGGREGATE SYSTEMS

TABLE 20 AGGREGATE HYDROPONIC SYSTEMS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 21 AGGREGATE HYDROPONIC SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 22 AGGREGATE HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 23 AGGREGATE HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

7.2.2 EBB & FLOW SYSTEMS

TABLE 24 EBB & FLOW HYDROPONIC SYSTEMS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 25 EBB & FLOW HYDROPONIC SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.3 DRIP SYSTEMS

TABLE 26 DRIP HYDROPONIC SYSTEMS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 27 DRIP HYDROPONIC SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.4 WICK SYSTEMS

TABLE 28 WICK HYDROPONIC SYSTEMS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 29 WICK HYDROPONIC SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 LIQUID SYSTEMS

7.3.1 HIGH PREFERENCE FOR VEGETABLE CULTIVATION AND HYBRID FARMING TO PROPEL GROWTH OPPORTUNITIES

TABLE 30 LIQUID HYDROPONIC SYSTEMS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 31 LIQUID HYDROPONIC SYSTEMS MARK, BY REGION, 2022–2027 (USD MILLION)

TABLE 32 LIQUID HYDROPONIC SYSTEMS MARK, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 33 LIQUID HYDROPONIC SYSTEMS MARK, BY SUBTYPE, 2022–2027 (USD MILLION)

7.3.2 DEEP WATER CULTURE

TABLE 34 DEEP WATER CULTURE HYDROPONIC SYSTEMS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 35 DEEP WATER CULTURE HYDROPONIC SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3.3 NUTRIENT FILM TECHNIQUE (NFT)

TABLE 36 NFT HYDROPONICS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 37 NFT MARKET FOR HYDROPONICS, BY REGION, 2022–2027 (USD MILLION)

7.3.4 AEROPONICS

TABLE 38 AEROPONICS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 39 AEROPONICS MARKET, BY REGION, 2022–2027 (USD MILLION)

8 HYDROPONICS MARKET, BY EQUIPMENT (Page No. - 101)

8.1 INTRODUCTION

FIGURE 38 MARKET FOR HYDROPONICS, BY EQUIPMENT, 2022 VS. 2027 (USD MILLION)

TABLE 40 MARKET FOR HYDROPONICS, BY EQUIPMENT, 2019–2021 (USD MILLION)

TABLE 41 MARKET FOR HYDROPONICS, BY EQUIPMENT, 2022–2027 (USD MILLION)

8.2 HVAC

8.2.1 UNCERTAINTIES IN REGIONAL CLIMATE AND RISE OF MODERN FARMING TECHNIQUES AND EQUIPMENT TO DRIVE DEMAND

8.3 LED GROW LIGHTS

8.3.1 LED GROW LIGHTS: HIGH-COST EQUIPMENT IN HYDROPONIC SYSTEMS

8.4 CONTROL SYSTEMS

8.4.1 INCREASE IN SCOPE FOR AUTOMATION AND SMART FARMING TO CREATE GROWTH OPPORTUNITIES FOR CONTROL SYSTEMS

8.5 IRRIGATION SYSTEMS

8.5.1 RISE IN DEMAND FOR WATER-USE-EFFICIENT AND SMART IRRIGATION SYSTEMS—FACTORS FOR MARKET GROWTH

8.6 MATERIAL HANDLING EQUIPMENT

8.6.1 FOCUS ON SHORTENING SUPPLY CHAIN THROUGH FARM-TO-FORK CONCEPT TO DRIVE DEMAND FOR MATERIAL HANDLING EQUIPMENT

8.7 OTHER EQUIPMENT

9 HYDROPONICS MARKET, BY INPUT (Page No. - 107)

9.1 INTRODUCTION

FIGURE 39 HYDROPONICS MARKET, BY INPUT, 2022 VS. 2027 (USD MILLION)

TABLE 42 HYDROPONICS MARKET, BY INPUT, 2019–2021 (USD MILLION)

TABLE 43 HYDROPONICS MARKET, BY INPUT, 2022–2027 (USD MILLION)

9.2 NUTRIENTS

9.2.1 NUTRIENTS ESSENTIAL IN HYDROPONIC SYSTEMS FOR ALL CROPS GROWN

TABLE 44 HYDROPONIC NUTRIENT INPUT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 45 HYDROPONIC NUTRIENT INPUT MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 46 HYDROPONIC NUTRIENT INPUT MARKET, BY NUTRIENT TYPE, 2019–2021 (USD MILLION)

TABLE 47 HYDROPONIC NUTRIENT INPUT MARKET, BY NUTRIENT TYPE, 2022–2027 (USD MILLION)

9.2.2 NPK

9.2.3 TRACE MINERALS

9.2.4 OTHER NUTRIENTS

9.3 GROW MEDIA

9.3.1 SUPPORT FOR PLANT GROWTH IN HYDROPONIC SYSTEMS OWING TO LOW COSTS TO DRIVE MARKET IN DEVELOPING COUNTRIES

TABLE 48 HYDROPONIC GROW MEDIA INPUT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 49 HYDROPONIC GROW MEDIA INPUT MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 HYDROPONIC GROW MEDIA INPUT MARKET, BY GROW MEDIA TYPE, 2019–2021 (USD MILLION)

TABLE 51 HYDROPONIC GROW MEDIA INPUT MARKET, BY GROW MEDIA TYPE, 2022–2027 (USD MILLION)

9.3.2 ROCKWOOL

9.3.3 PERLITE & VERMICULITE

9.3.4 COCO FIBER

9.3.5 OTHER GROW MEDIA

10 HYDROPONICS MARKET, BY CROP TYPE (Page No. - 115)

10.1 INTRODUCTION

FIGURE 40 HYDROPONICS MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 52 MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 53 MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

10.2 VEGETABLES

10.2.1 WIDER ACCEPTANCE OF HYDROPONICS FOR GROWING VEGETABLES ACROSS MULTIPLE REGIONS TO FUEL DEMAND

TABLE 54 MARKET FOR HYDROPONICS IN VEGETABLE CULTIVATION, BY REGION, 2019–2021 (USD MILLION)

TABLE 55 MARKET FOR HYDROPONICS IN VEGETABLE CULTIVATION, BY REGION, 2022–2027 (USD MILLION)

TABLE 56 MARKET FOR HYDROPONICS IN VEGETABLE CULTIVATION, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 57 MARKET FOR HYDROPONICS IN VEGETABLE CULTIVATION, BY CROP TYPE, 2022–2027 (USD MILLION)

10.2.2 TOMATOES

10.2.3 LEAFY GREENS

10.2.4 CUCUMBERS

10.2.5 PEPPERS

10.2.6 OTHER VEGETABLES

10.3 FRUITS

10.3.1 RISE IN DEMAND AND YEAR-LONG HARVEST BENEFITS TO SUPPLEMENT HYDROPONIC FRUIT GROWTH

TABLE 58 MARKET FOR HYDROPONICS IN FRUIT CULTIVATION, BY REGION, 2019–2021 (USD MILLION)

TABLE 59 MARKET FOR HYDROPONICS IN FRUIT CULTIVATION, BY REGION, 2022–2027 (USD MILLION)

10.4 FLOWERS

10.4.1 HYDROPONIC ADOPTION FOR FLOWERS HIGHEST IN NETHERLANDS

TABLE 60 MARKET FOR HYDROPONICS IN FLOWER CULTIVATION, BY REGION, 2019–2021 (USD MILLION)

TABLE 61 MARKET FOR HYDROPONICS IN FLOWER CULTIVATION, BY REGION, 2022–2027 (USD MILLION)

10.5 OTHER CROP TYPES

TABLE 62 MARKET FOR HYDROPONICS IN OTHER CROP CULTIVATION, BY REGION, 2019–2021 (USD MILLION)

TABLE 63 HYDROPONICS MARKET IN OTHER CROP CULTIVATION, BY REGION, 2022–2027 (USD MILLION)

11 HYDROPONICS MARKET, BY FARMING METHOD (Page No. - 124)

11.1 INTRODUCTION

FIGURE 41 HYDROPONICS MARKET, BY FARMING METHOD, 2022 VS. 2027 (USD MILLION)

TABLE 64 MARKET FOR HYDROPONICS, BY FARMING METHOD, 2019–2021 (USD MILLION)

TABLE 65 MARKET FOR HYDROPONICS, BY FARMING METHOD, 2022–2027 (USD MILLION)

11.2 OUTDOOR FARMING

11.2.1 LESS REQUIREMENT OF ENERGY RESOURCES TO ALLOW COST SAVING IN OUTDOOR FARMING

11.3 INDOOR FARMING

11.3.1 BETTER CONTROL OVER GROWING ENVIRONMENT TO INCREASE YIELD

11.3.1.1 LED light-based

11.3.1.2 Natural light-based

12 HYDROPONICS MARKET, BY CROP AREA (Page No. - 128)

12.1 INTRODUCTION

FIGURE 42 HYDROPONICS MARKET, BY CROP AREA, 2022 VS. 2027 (USD MILLION)

TABLE 66 HYDROPONICS MARKET, BY CROP AREA, 2019–2021 (USD MILLION)

TABLE 67 HYDROPONICS MARKET, BY CROP AREA, 2022–2027 (USD MILLION)

12.2 UP TO 1,000 SQUARE FEET

12.2.1 LOW MAINTENANCE COSTS IN INDOOR SPACES TO DRIVE GROWTH

12.3 1,000–5,000 SQUARE FEET

12.3.1 OUTDOOR FARMS WITH VARIED PURPOSES TO DRIVE MARKET

12.4 5,001–10,000 SQUARE FEET

12.4.1 LARGE FARMS FOR DESIRED CROPS TO GAIN POPULARITY

12.5 10,001–50,000 SQUARE FEET

12.5.1 LARGE SPACES OFFER FLEXIBILITY IN SYSTEM TYPE

12.6 ABOVE 50,000 SQUARE FEET

12.6.1 COMMERCIAL FARMS USE ADVANCED EQUIPMENT FOR BETTER PRODUCTIVITY

13 HYDROPONICS MARKET, BY REGION (Page No. - 132)

13.1 INTRODUCTION

FIGURE 43 GEOGRAPHIC SNAPSHOT (2022–2027): RAPIDLY GROWING MARKETS EMERGE AS NEW HOT SPOTS

TABLE 68 HYDROPONIC TYPES MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 69 HYDROPONIC TYPES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 70 HYDROPONIC INPUTS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 71 HYDROPONIC INPUTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 72 HYDROPONIC CROP MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 73 HYDROPONIC CROP MARKET, BY REGION, 2022–2027 (USD MILLION)

13.2 NORTH AMERICA

TABLE 74 NORTH AMERICA: HYDROPONIC TYPES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 75 NORTH AMERICA: HYDROPONIC TYPES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: HYDROPONIC CROP TYPES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: HYDROPONIC CROP TYPES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: AGGREGATE HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 81 NORTH AMERICA: AGGREGATE HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: LIQUID HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 83 NORTH AMERICA: LIQUID HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET FOR HYDROPONICS IN VEGETABLE CULTIVATION, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET FOR HYDROPONICS IN VEGETABLE CULTIVATION, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET FOR HYDROPONICS, BY INPUT, 2019–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET FOR HYDROPONICS, BY INPUT, 2022–2027 (USD MILLION)

13.2.1 US

13.2.1.1 Favorable government schemes and newer farming kits and techniques by hydroponic system providers to propel market

TABLE 90 US: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 91 US: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 92 US: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 93 US: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

13.2.2 CANADA

13.2.2.1 High awareness about modern farming techniques to fuel growth prospects

TABLE 94 CANADA: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 95 CANADA: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 96 CANADA: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 97 CANADA: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

13.2.3 MEXICO

13.2.3.1 Larger greenhouse area used for cultivation to be major factor

TABLE 98 MEXICO: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 99 MEXICO: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 100 MEXICO: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 101 MEXICO: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

13.3 EUROPE

FIGURE 44 EUROPE: HYDROPONICS MARKET SNAPSHOT

TABLE 102 EUROPE: HYDROPONIC TYPES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 103 EUROPE: HYDROPONIC TYPES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 104 EUROPE: HYDROPONIC CROP TYPES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 105 EUROPE: HYDROPONIC CROP TYPES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 107 EUROPE: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 108 EUROPE: AGGREGATE HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 109 EUROPE: AGGREGATE HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 110 EUROPE: LIQUID HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 111 EUROPE: LIQUID HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 112 EUROPE: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 113 EUROPE: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: MARKET FOR HYDROPONICS IN VEGETABLE CULTIVATION, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 115 EUROPE: MARKET FOR HYDROPONICS IN VEGETABLE CULTIVATION, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 116 EUROPE: MARKET FOR HYDROPONICS, BY INPUT, 2019–2021 (USD MILLION)

TABLE 117 EUROPE: HYDROPONICS MARKET, BY INPUT, 2022–2027 (USD MILLION)

13.3.1 NETHERLANDS

13.3.1.1 Greater inclination toward efficient farming to drive growth

TABLE 118 NETHERLANDS: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 119 NETHERLANDS: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 120 NETHERLANDS: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 121 NETHERLANDS: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

13.3.2 GERMANY

13.3.2.1 Establishment of hydroponic farms by recognized and regional players to fuel market

TABLE 122 GERMANY: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 123 GERMANY: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 124 GERMANY: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 125 GERMANY: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

13.3.3 UK

13.3.3.1 Government support to set up vertical farms to power market

TABLE 126 UK: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 127 UK: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 128 UK: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 129 UK: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.3.4 SPAIN

13.3.4.1 Increase in investments in sustainable farming practices and advanced set-ups to help achieve greater produce

TABLE 130 SPAIN: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 131 SPAIN: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 132 SPAIN: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 133 SPAIN: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

13.3.5 ITALY

13.3.5.1 Growth in organic croplands and rise in supply of organic products to bolster demand for hydroponics

TABLE 134 ITALY: MARKET FOR HYDROPONICST, BY TYPE, 2019–2021 (USD MILLION)

TABLE 135 ITALY: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 136 ITALY: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 137 ITALY: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

13.3.6 FRANCE

13.3.6.1 Gradual adoption of modern farming techniques to increase opportunities

TABLE 138 FRANCE: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 139 FRANCE: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 140 FRANCE: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 141 FRANCE: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.3.7 POLAND

13.3.7.1 Increase in awareness and steady adoption among local cultivators to exhibit a positive outlook

TABLE 142 POLAND: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 143 POLAND: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 144 POLAND: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 145 POLAND: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

13.3.8 TURKEY

13.3.8.1 Increase in protected cultivation to support growth of hydroponics

TABLE 146 TURKEY: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 147 TURKEY: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 148 TURKEY: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 149 TURKEY: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

13.3.9 REST OF EUROPE

TABLE 150 REST OF EUROPE: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 151 REST OF EUROPE: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 152 REST OF EUROPE: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 153 REST OF EUROPE: MARKET FOR HYDROPONICS BY CROP TYPE, 2022–2027 (USD MILLION)

13.4 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: MARKET FOR HYDROPONICS SNAPSHOT

TABLE 154 ASIA PACIFIC: HYDROPONIC TYPES MARKET, BY COUNTRY/REGION, 2019–2021 (USD MILLION)

TABLE 155 ASIA PACIFIC: HYDROPONIC TYPES MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 156 ASIA PACIFIC: HYDROPONIC CROP TYPES MARKET, BY COUNTRY/REGION, 2019–2021 (USD MILLION)

TABLE 157 ASIA PACIFIC: HYDROPONIC CROP TYPES MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 159 ASIA PACIFIC: HYDROPONICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 160 ASIA PACIFIC: AGGREGATE HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 161 ASIA PACIFIC: AGGREGATE HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 162 ASIA PACIFIC: LIQUID HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 163 ASIA PACIFIC: LIQUID HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET FOR HYDROPONICS IN VEGETABLE CULTIVATION, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 167 ASIA PACIFIC: MARKET FOR HYDROPONICS IN VEGETABLE CULTIVATION, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET FOR HYDROPONICS, BY INPUT, 2019–2021 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET FOR HYDROPONICS, BY INPUT, 2022–2027 (USD MILLION)

13.4.1 CHINA

13.4.1.1 Population growth and favorable regulatory environment to drive adoption of hydroponics

TABLE 170 CHINA: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 171 CHINA: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 172 CHINA: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 173 CHINA: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

13.4.2 INDIA

13.4.2.1 Shift toward in-house cultivation and investments by key players to propel market growth

TABLE 174 INDIA: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 175 INDIA: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 176 INDIA: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 177 INDIA: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.4.3 JAPAN

13.4.3.1 Government and related institutions’ initiatives to promote greenhouse farming to drive market

TABLE 178 JAPAN: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 179 JAPAN: HYDROPONICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 180 JAPAN: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 181 JAPAN: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

13.4.4 AUSTRALIA & NEW ZEALAND

13.4.4.1 Scarcity of fresh water and harsh climatic conditions to promote growth of hydroponics

TABLE 182 AUSTRALIA & NEW ZEALAND: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 183 AUSTRALIA & NEW ZEALAND: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 184 AUSTRALIA & NEW ZEALAND: HYDROPONICS MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 185 AUSTRALIA & NEW ZEALAND: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.4.5 SOUTH KOREA

13.4.5.1 Small agricultural field size led to increased adoption of hydroponics

TABLE 186 SOUTH KOREA: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 187 SOUTH KOREA: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 188 SOUTH KOREA: HYDROPONICS MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 189 SOUTH KOREA: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.4.6 SINGAPORE

13.4.6.1 Trend toward food security with minimum wastage to fuel growth

TABLE 190 SINGAPORE: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 191 SINGAPORE: HYDROPONICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 192 SINGAPORE: HYDROPONICS MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 193 SINGAPORE: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.4.7 VIETNAM

13.4.7.1 Greater need for fresh vegetables and fruits to boost demand for hydroponics

TABLE 194 VIETNAM: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 195 VIETNAM: HYDROPONICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 196 VIETNAM: HYDROPONICS MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 197 VIETNAM: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.4.8 MALAYSIA

13.4.8.1 Higher demand for urban farming to reduce wastage to impact hydroponics

TABLE 198 MALAYSIA: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 199 MALAYSIA: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 200 MALAYSIA: HYDROPONICS MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 201 MALAYSIA: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.4.9 THAILAND

13.4.9.1 Increase in awareness and shift in consumer preference toward new technology to impact market

TABLE 202 THAILAND: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 203 THAILAND: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 204 THAILAND: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 205 THAILAND: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

13.4.10 INDONESIA

13.4.10.1 Adoption of newer technology for in-house crop cultivation to boost market

TABLE 206 INDONESIA: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 207 INDONESIA: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 208 INDONESIA: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 209 INDONESIA: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.4.11 REST OF ASIA PACIFIC

TABLE 210 REST OF ASIA PACIFIC: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 211 REST OF ASIA PACIFIC: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 212 REST OF ASIA PACIFIC: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 213 REST OF ASIA PACIFIC: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.5 SOUTH AMERICA

TABLE 214 SOUTH AMERICA: HYDROPONIC TYPES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 215 SOUTH AMERICA: HYDROPONIC TYPES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 216 SOUTH AMERICA: HYDROPONIC CROP TYPES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 217 SOUTH AMERICA: HYDROPONIC CROP TYPES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 218 SOUTH AMERICA: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 219 SOUTH AMERICA: HYDROPONICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 220 SOUTH AMERICA: AGGREGATE HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 221 SOUTH AMERICA: AGGREGATE HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 222 SOUTH AMERICA: LIQUID HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 223 SOUTH AMERICA: LIQUID HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 224 SOUTH AMERICA: HYDROPONICS MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 225 SOUTH AMERICA: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 226 SOUTH AMERICA: MARKET FOR HYDROPONICS IN VEGETABLE CULTIVATION, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 227 SOUTH AMERICA: HYDROPONICS MARKET IN VEGETABLE CULTIVATION, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 228 SOUTH AMERICA: HYDROPONICS MARKET, BY INPUT, 2019–2021 (USD MILLION)

TABLE 229 SOUTH AMERICA: HYDROPONICS MARKET, BY INPUT, 2022–2027 (USD MILLION)

13.5.1 BRAZIL

13.5.1.1 High adoption rate of indoor farming to increase demand for hydroponics

TABLE 230 BRAZIL: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 231 BRAZIL: HYDROPONICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 232 BRAZIL: HYDROPONICS MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 233 BRAZIL: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.5.2 ARGENTINA

13.5.2.1 Greater adoption among growers to drive demand for hydroponics

TABLE 234 ARGENTINA: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 235 ARGENTINA: HYDROPONICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 236 ARGENTINA: HYDROPONICS MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 237 ARGENTINA: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.5.3 REST OF SOUTH AMERICA

TABLE 238 REST OF SOUTH AMERICA: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 239 REST OF SOUTH AMERICA: HYDROPONICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 240 REST OF SOUTH AMERICA: HYDROPONICS MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 241 REST OF SOUTH AMERICA: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.6 REST OF THE WORLD (ROW)

TABLE 242 ROW: HYDROPONIC TYPES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 243 ROW: HYDROPONIC TYPES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 244 ROW: HYDROPONIC CROP TYPES MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 245 ROW: HYDROPONIC CROP TYPES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 246 ROW: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 247 ROW: HYDROPONICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 248 ROW: AGGREGATE HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 249 ROW: AGGREGATE HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 250 ROW: LIQUID HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 251 ROW: LIQUID HYDROPONIC SYSTEMS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 252 ROW: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 253 ROW: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 254 ROW: HYDROPONICS MARKET IN VEGETABLE CULTIVATION, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 255 ROW: HYDROPONICS MARKET IN VEGETABLE CULTIVATION, BY SUBTYPE, 2022–2027 (USD MILLION)

TABLE 256 ROW: HYDROPONICS MARKET, BY INPUT, 2019–2021 (USD MILLION)

TABLE 257 ROW: HYDROPONICS MARKET, BY INPUT, 2022–2027 (USD MILLION)

13.6.1 SOUTH AFRICA

13.6.1.1 High production potential and availability of resources to boost market

TABLE 258 SOUTH AFRICA: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 259 SOUTH AFRICA: HYDROPONICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 260 SOUTH AFRICA: HYDROPONICS MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 261 SOUTH AFRICA: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.6.2 ISRAEL

13.6.2.1 Innovations in hydroponic technologies to drive adoption

TABLE 262 ISRAEL: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 263 ISRAEL: HYDROPONICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 264 ISRAEL: HYDROPONICS MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 265 ISRAEL: HYDROPONICS MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

13.6.3 UAE

13.6.3.1 Lack of food security and increasing imports to drive demand for hydroponics

TABLE 266 UAE: HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 267 UAE: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 268 UAE: HYDROPONICS MARKET, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 269 UAE: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

13.6.4 OTHERS IN ROW

TABLE 270 OTHERS IN ROW: MARKET FOR HYDROPONICS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 271 OTHERS IN ROW: MARKET FOR HYDROPONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 272 OTHERS IN ROW: MARKET FOR HYDROPONICS, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 273 OTHERS IN ROW: MARKET FOR HYDROPONICS, BY CROP TYPE, 2022–2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 210)

14.1 OVERVIEW

14.2 HYDROPONICS MARKET SHARE ANALYSIS

TABLE 274 MARKET FOR HYDROPONICS: DEGREE OF COMPETITION, 2021

14.3 KEY PLAYER STRATEGIES: SYSTEM INPUT COMPANIES

14.4 REVENUE SHARE ANALYSIS OF KEY PLAYERS

FIGURE 46 REVENUE ANALYSIS OF KEY PLAYERS IN HYDROPONICS MARKET, 2019–2021 (USD BILLION)

14.5 COMPANY EVALUATION QUADRANT (SYSTEM INPUT COMPANIES)

14.5.1 STARS

14.5.2 EMERGING LEADERS

14.5.3 PERVASIVE PLAYERS

14.5.4 PARTICIPANTS

FIGURE 47 HYDROPONICS MARKET: COMPANY EVALUATION QUADRANT, 2021 (SYSTEM INPUT COMPANIES)

14.6 PRODUCT FOOTPRINT (SYSTEM INPUT COMPANIES)

TABLE 275 COMPANY PRODUCT FOOTPRINT, BY TYPE

TABLE 276 COMPANY PRODUCT FOOTPRINT, BY EQUIPMENT

TABLE 277 COMPANY PRODUCT FOOTPRINT, BY INPUT

TABLE 278 COMPANY PRODUCT FOOTPRINT, BY REGIONAL FOOTPRINT (SYSTEM INPUT COMPANIES)

TABLE 279 COMPANY PRODUCT FOOTPRINT: OVERALL FOOTPRINT (SYSTEM INPUT COMPANIES)

TABLE 280 HYDROPONICS: COMPETITIVE BENCHMARKING OF SYSTEM INPUT COMPANIES

14.7 HYDROPONICS MARKET: COMPANY EVALUATION QUADRANT, 2021 (CROP GROWER COMPANIES)

14.7.1 STARS

14.7.2 EMERGING LEADERS

14.7.3 PERVASIVE PLAYERS

14.7.4 PARTICIPANTS

FIGURE 48 MARKET FOR HYDROPONICS: COMPANY EVALUATION QUADRANT, 2021 (CROP GROWER COMPANIES)

14.8 PRODUCT FOOTPRINT (CROP GROWER COMPANIES)

TABLE 281 COMPANY PRODUCT FOOTPRINT, BY CROP TYPE

TABLE 282 COMPANY PRODUCT FOOTPRINT, BY REGIONAL FOOTPRINT (CROP GROWER COMPANIES)

TABLE 283 COMPANY PRODUCT FOOTPRINT: OVERALL FOOTPRINT (CROP GROWER COMPANIES)

TABLE 284 HYDROPONICS: COMPETITIVE BENCHMARKING OF CROP GROWER COMPANIES

14.9 COMPETITIVE SCENARIO

14.9.1 NEW PRODUCT LAUNCHES

TABLE 285 MARKET FOR HYDROPONICS: NEW PRODUCT LAUNCHES, 2018–2022

14.9.2 DEALS

TABLE 286 MARKET FOR HYDROPONICS: DEALS, 2018–2022

14.9.3 OTHERS

TABLE 287 HYDROPONICS MARKET: OTHERS, 2018–2022

15 COMPANY PROFILES (Page No. - 231)

(Business overview, Products offered, Recent developments & MnM View)*

15.1 SYSTEM INPUT COMPANIES

15.1.1 SIGNIFY HOLDING

TABLE 288 SIGNIFY HOLDING: BUSINESS OVERVIEW

FIGURE 49 SIGNIFY HOLDING: COMPANY SNAPSHOT

TABLE 289 SIGNIFY HOLDING: NEW PRODUCT LAUNCHES

TABLE 290 SIGNIFY HOLDING: DEALS

TABLE 291 SIGNIFY HOLDING: OTHERS

15.1.2 HELIOSPECTRA AB

TABLE 292 HELIOSPECTRA AB: BUSINESS OVERVIEW

FIGURE 50 HELIOSPECTRA AB: COMPANY SNAPSHOT

TABLE 293 HELIOSPECTRA AB: NEW PRODUCT LAUNCHES

TABLE 294 HELIOSPECTRA AB: DEALS

TABLE 295 HELIOSPECTRA AB: OTHERS

15.1.3 SCOTTSMIRACLE-GRO

TABLE 296 SCOTTSMIRACLE-GRO: BUSINESS OVERVIEW

FIGURE 51 SCOTTSMIRACLE-GRO: COMPANY SNAPSHOT

TABLE 297 SCOTTSMIRACLE-GRO: DEALS

TABLE 298 SCOTTSMIRACLE-GRO: OTHERS

15.1.4 ARGUS CONTROL SYSTEMS

TABLE 299 ARGUS CONTROL SYSTEMS: BUSINESS OVERVIEW

TABLE 300 ARGUS CONTROL SYSTEMS: NEW PRODUCT LAUNCHES

TABLE 301 ARGUS CONTROL SYSTEMS: DEALS

15.1.5 LOGIQS B.V.

TABLE 302 LOGIQS B.V.: BUSINESS OVERVIEW

TABLE 303 LOGIQS B.V.: DEALS

15.1.6 LUMIGROW, INC.

TABLE 304 LUMIGROW, INC.: BUSINESS OVERVIEW

TABLE 305 LUMIGROW, INC.: NEW PRODUCT LAUNCHES

TABLE 306 LUMIGROW, INC.: DEALS

15.1.7 HYDROPONIC SYSTEMS INTERNATIONAL

TABLE 307 HYDROPONIC SYSTEMS INTERNATIONAL: BUSINESS OVERVIEW

TABLE 308 HYDROPONIC SYSTEMS INTERNATIONAL: NEW PRODUCT LAUNCHES

15.1.8 HYDRODYNAMICS INTERNATIONAL

TABLE 309 HYDRODYNAMICS INTERNATIONAL: BUSINESS OVERVIEW

15.1.9 AMERICAN HYDROPONICS

TABLE 310 AMERICAN HYDROPONICS: BUSINESS OVERVIEW

15.1.10 ADVANCED NUTRIENTS

TABLE 311 ADVANCED NUTRIENTS: BUSINESS OVERVIEW

TABLE 312 ADVANCED NUTRIENTS: NEW PRODUCT LAUNCHES

15.1.11 EMERALD HARVEST

TABLE 313 EMERALD HARVEST: BUSINESS OVERVIEW

15.1.12 VITALINK

TABLE 314 VITALINK: BUSINESS OVERVIEW

15.1.13 FREIGHT FARMS

TABLE 315 FREIGHT FARMS: BUSINESS OVERVIEW

TABLE 316 FREIGHT FARMS: NEW PRODUCT LAUNCHES

TABLE 317 FREIGHT FARMS: DEALS

15.2 HYDROPONIC CROP PRODUCERS

15.2.1 AEROFARMS

TABLE 318 AEROFARMS: BUSINESS OVERVIEW

TABLE 319 AEROFARMS: DEALS

TABLE 320 AEROFARMS: OTHERS

15.2.2 TRITON FOODWORKS PVT. LTD.

TABLE 321 TRITON FOODWORKS PVT. LTD.: BUSINESS OVERVIEW

15.2.3 GREEN SENSE FARMS

TABLE 322 GREEN SENSE FARMS: BUSINESS OVERVIEW

15.2.4 EMIRATES HYDROPONIC FARM

TABLE 323 EMIRATES HYDROPONIC FARM: BUSINESS OVERVIEW

15.2.5 GOTHAM GREENS

TABLE 324 GOTHAM GREENS: BUSINESS OVERVIEW

TABLE 325 GOTHAM GREENS: OTHERS

15.2.6 NATURE’S MIRACLE

TABLE 326 NATURE’S MIRACLE: BUSINESS OVERVIEW

TABLE 327 NATURE’S MIRACLE: NEW PRODUCT LAUNCHES

15.2.7 BRIGHT FARMS

TABLE 328 BRIGHT FARMS: BUSINESS OVERVIEW

TABLE 329 BRIGHT FARMS: NEW PRODUCT LAUNCHES

TABLE 330 BRIGHT FARMS: OTHERS

15.2.8 INFARM

TABLE 331 INFARM: BUSINESS OVERVIEW

TABLE 332 INFARM: DEALS

TABLE 333 INFARM: OTHERS

15.2.9 BADIA FARMS

TABLE 334 BADIA FARMS: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

16 ADJACENT AND RELATED MARKETS (Page No. - 279)

16.1 INTRODUCTION

TABLE 335 ADJACENT MARKETS TO THE HYDROPONICS MARKET

16.2 LIMITATIONS

16.3 VERTICAL FARMING MARKET

16.3.1 MARKET DEFINITION

16.3.2 MARKET OVERVIEW

TABLE 336 VERTICAL FARMING MARKET, BY GROWTH MECHANISM, 2018–2026 (USD MILLION)

16.4 SMART GREENHOUSE MARKET

16.4.1 MARKET DEFINITION

16.4.2 MARKET OVERVIEW

TABLE 337 SMART GREENHOUSE MARKET, BY COVERING MATERIAL TYPE, 2019–2025 (USD MILLION)

16.5 INDOOR FARMING MARKET

16.5.1 MARKET DEFINITION

16.5.2 MARKET OVERVIEW

TABLE 338 INDOOR FARMING TECHNOLOGY MARKET, BY FACILITY TYPE, 2019–2026 (USD MILLION)

17 APPENDIX (Page No. - 283)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 CUSTOMIZATION OPTIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

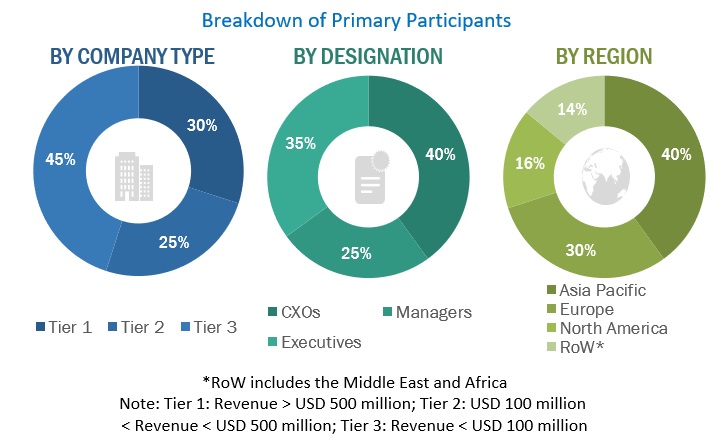

The study involved four major activities in estimating hydroponics market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders in the supply chain, including food & beverage manufacturers, growers and suppliers, importers and exporters, and intermediary suppliers such as traders and distributors of hydroponics products. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include hydroponics system manufacturers, crop growers, exporters, and importers. The primary sources from the demand side include retailers, wholesalers, and other distribution partners.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Hydroponics Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the hydroponics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the hydroponics market, in terms of value, were determined through primary and secondary research.

- All percentage shares split and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points, match the data assumed to be correct.

Report Objectives

- To describe and forecast the hydroponics market in terms of type, equipment, input, crop type, farming method, crop area, and region

- To describe and forecast the hydroponics market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the hydroponics market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the hydroponics market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in the hydroponics market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the Asia Pacific hydroponics market by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hydroponics Market