Individual Quick Freezing (IQF) Market by Equipment Type (Spiral and Tunnel), Processing Stages (Pre-processing, Freezing, and Packaging), Technology (Mechanical and Cryogenic), Product (Fruits & Vegetables and Seafood), and Region - Forecast to 2022

[137 Pages Report] The global individual quick freezing (IQF) market was valued at USD 14.77 Billion in 2016, and is projected to grow at a CAGR of 5.9% to reach USD 20.82 Billion by 2022. The objectives of the report are to define, segment, and estimate the size of the global market, in both quantitative and qualitative terms; furthermore, the market has been segmented on the basis of equipment type, processing stages, technology, product, and region. The report also aims to provide detailed information about the crucial factors influencing the growth of the market, strategical analysis of micromarkets, opportunities for stakeholders, details of the competitive landscape, and profiles of the key players, with respect to their market share and competencies.

The years considered for the study are as follows:

|

Report Metrics |

Details |

|

Base year |

2016 |

|

Beginning of projection period |

2017 |

|

End of projection period |

2022 |

Research Methodology:

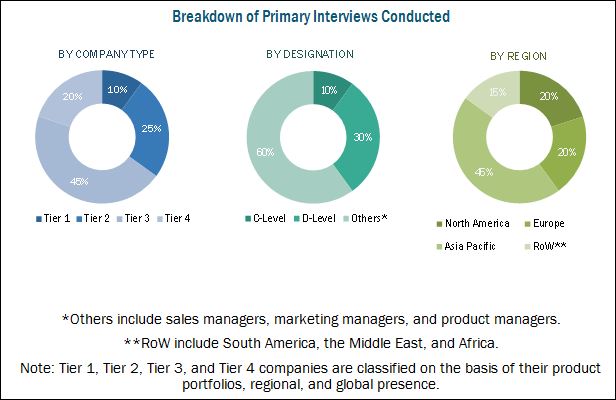

This research study involved the extensive use of secondary sources (which included directories and databases) such as Hoovers, Forbes, Bloomberg Businessweek, and Factiva to identify & collect information useful for this technical, market-oriented, and commercial study of the individual quick freezing market. The primary sources that have been involved include industry experts from core & related industries and preferred suppliers, dealers, manufacturers, alliances, standards & certification organizations from companies, and organizations related to all segments of this industrys value chain. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative & quantitative information as well as to assess future prospects. The following figure depicts the market research methodology applied in drafting this report on the individual quick freezing market.

To know about the assumptions considered for the study, download the pdf brochure

The key manufacturers in the individual quick freezing market include MAREL (Iceland), JBT (US), GEA (Germany), The Linde Group (Germany), Air Products and Chemicals (US), Air Liquide (France), and Messer Group (Germany). These companies have diversified product portfolios and advance freezing technologies at major strategic locations. The other companies which are profiled include PATKOL (Thailand), OctoFrost Group (Sweden), Cryogenic Systems Equipment (US), Starfrost (UK), and Scanico (Denmark).

The stakeholders for individual quick freezing market are mentioned below:

- Food & beverage manufacturers, suppliers, and processors

- Traders and retailers

- Distributors, importers, and exporters

- Intermediary suppliers

- IQF governing associations and regulatory authorities of several countries

- Research organizations and associations such as the Food and Agriculture Organization (FAO), Food and Drug Administration (FDA), Indian Ministry of Food Processing Industries (MoFPI), Canadian Food Inspection Agency, China Food and Drug Administration(CFDA), New Zealand Food Safety Authority (NZFSA), and European Food Safety Authority (EFSA)

Scope of the Individual Quick Freezing (IQF) Market Report:

This research report categorizes the individual quick freezing market based on equipment type, processing stages, technology, product, and region.

On the basis of Equipment Type, the market has been segmented into the following:

- Spiral freezer

- Tunnel freezer

- Box freezer

- Others (blast and plate freezers)

On the basis of Processing Stages, the market has been segmented into the following:

- Pre-processing

- Freezing

- Packaging

On the basis of Technology, the market has been segmented into the following:

- Mechanical IQF

- Cryogenic IQF

On the basis of Product, the market has been segmented into the following:

- Fruits & vegetables

- Seafood

- Meat & poultry

- Dairy products

- Convenience food

On the basis of Region, the market has been segmented into the following:

- North America

- Europe

- Asia Pacific

- Rest of the World (South America, the Middle East, and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Equipment Analysis

- Further breakdown of individual quick freezing into spiral freezer, tunnel freezer, box freezer, and others (blast and plate freezers)

Regional Analysis

- Further breakdown of the Rest of Europe individual quick freezing market into Denmark, Finland, Iceland, Norway, and Sweden

- Further breakdown of the Rest of Asia Pacific individual quick freezing market into Thailand, Vietnam, Indonesia, Malaysia, Singapore, and Pakistan

- Further breakdown of the RoW individual quick freezing market into South America, the Middle East, and Africa

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The primary factors that drive the individual quick freezing (IQF) market are development and expansion of food retail chains by multinationals, consumer demand for perishable foods, growth in demand for availability of non-seasonal food products, and increase in demand for convenience food products.

The increase in the number of consumers for frozen food products across the globe has led to an increased interest among the manufacturers to provide frozen food items due to extended shelf-life and quality. The consumption of individual quick freezing products in the food & beverage industry has led to more streamlined processing stages pre-processing, freezing, and packaging of frozen food products. The major restraining factor for the market has environmental concerns regarding greenhouse gas emissions.

The global market is segmented on the basis of equipment type, processing stages, technology, product, and region. On the basis of equipment type, the spiral freezer segment dominated the global market, followed by tunnel freezer segment, in 2016. The temperature range and mechanical loads involved in the freezing operation are high; hence, the components of this system are required to be highly durable. Spiral freezers are used to rapidly cool and freeze products; these freezers assure product freezing quality with minimum product shrinkage.

Among the processing stages, the freezing segment accounted for the largest market share in 2016. Freezing helps in the retention of food quality and extends the storage life of foods whose water content is high. The freezing process taps the beneficial effects of low temperatures at which microorganisms cannot grow, reduces chemical reactions, and delays cellular metabolic reactions. Frozen food ensure non-seasonal year-round availability, minimize wastage, is less likely to deteriorate in transit or storage, is less perishable than fresh or chilled food, and is easier to use.

The global market, by technology, is segmented as mechanical IQF and cryogenic IQF. The mechanical IQF segment accounted for the larger market share in 2016. Mechanical IQF is most frequently used by food manufacturers for chilling, frosting, and freezing food products. Mechanical IQF involves a standard mechanical refrigeration cycle, which uses commonly used refrigerating agents such as carbon dioxide or ammonia. Mechanical IQF is now loaded with the latest design and intelligent system control to provide the best food safety, low maintenance, and energy efficiency.

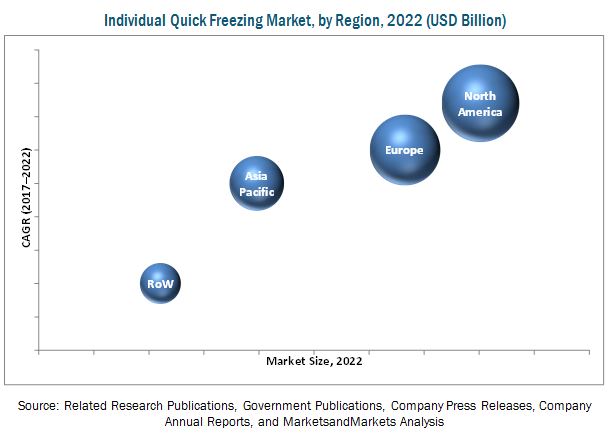

The North American region is projected to hold the largest market share, followed by the European region, in 2022. The North American region is projected to be the fastest-growing individual quick freezing market in the forecast period. This is mainly due to the presence of a large number of manufacturers of IQF equipment in the region and increase in the consumption of frozen food products among the consumers.

Environmental concerns regarding greenhouse gas emissions is one of the major restraining factors for the market. The food supply chains have an unmeasured impact on the environment. This impact is observed up and downstream of the food supply chain. The refrigeration and freezing equipment play a key role in the food supply chain for long shelf-life, storage, and transport of the food products from farm to table. The typical emissions from food processing and distribution are from releases of greenhouse gases from refrigerant leakage, heat transfer processes, emissions from diesel engines, emissions from transportation vehicles, and air conditioning at retail & convenience shops. The use of these gases lead to environmental concerns such as ozone depletion and global warming.

MAREL (Iceland) is likely to emerge as a leading market player in the individual quick freezing market in the coming years, owing to its line of various individual quick freezing equipments, which is highly useful in the food industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Research Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in this Market

4.2 Individual Quick Freezing (IQF) Market, By Region (2016-2022)

4.3 North America: Individual Quick Freezing (IQF) Market, By Country & By Product

4.4 Market, By Processing Stages

4.5 Market, By Country

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in Consumer Demand for Perishable Foods

5.2.1.2 Increase in Demand for Convenience Food Products

5.2.1.3 Growth in Availability of Non-Seasonal Food Products

5.2.1.4 Development and Expansion of Food Retail Chains By Multinationals

5.2.2 Restraints

5.2.2.1 Environmental Concerns Regarding Greenhouse Gas Emissions

5.2.3 Opportunities

5.2.3.1 Demand for Premium Products on the Rise

5.2.3.2 Government Initiatives to Reduce Post-Harvest & Processed Food Wastage

5.2.3.3 Emerging Markets: New Growth Frontiers

5.2.4 Challenges

5.2.4.1 Strict Compliance With Food Safety Regulations

5.2.4.2 High Investment & Infrastructure Costs

6 Market For Individual Quick Freezing (IQF) , By Eqipment Type (Page No. - 38)

6.1 Introduction

6.2 Spiral Freezer

6.3 Tunnel Freezer

6.4 Box Freezer

6.5 Others

7 Market For Individual Quick Freezing (IQF), By Processing Stages (Page No. - 44)

7.1 Introduction

7.2 Pre-Processing

7.3 Freezing

7.4 Packaging

8 Market For Individual Quick Freezing (IQF), By Technology (Page No. - 49)

8.1 Introduction

8.2 Mechanical IQF

8.3 Cryogenic IQF

9 Market For Individual Quick Freezing (IQF), By Product (Page No. - 53)

9.1 Introduction

9.2 Fruits & Vegetables

9.2.1 Peas & Beans

9.2.2 Berries

9.2.3 Others

9.3 Seafood

9.3.1 Shrimp

9.3.2 Fish Fillets

9.3.3 Others

9.4 Meat & Poultry

9.4.1 Chicken & Chicken Products

9.4.2 Diced Meats

9.4.3 Others

9.5 Dairy Products

9.5.1 Milk-Based Products

9.5.2 Cheese

9.6 Convenience Food

10 Market For Individual Quick Freezing (IQF), By Region (Page No. - 68)

10.1 Introduction

10.2 North America

10.2.1 Us

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Italy

10.3.4 Uk

10.3.5 Spain

10.3.6 Russia

10.3.7 Poland

10.3.8 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 Australia & New Zealand

10.4.4 India

10.4.5 Rest of Asia Pacific

10.5 Rest of the World (RoW)

10.5.1 South America

10.5.2 Middle East

10.5.3 Africa

11 Competitive Landscape (Page No. - 96)

11.1 Individual Quick Freezing Market Ranking, Key Company, 2016

12 Company Profiles (Page No. - 97)

(Business Overview, Products Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments.)*

12.1 Marel

12.2 JBT

12.3 GEA

12.4 The Linde Group

12.5 Air Products and Chemicals

12.6 Air Liquide

12.7 Messer Group

12.8 Patkol

12.9 Octofrost Group

12.10 Cryogenic Systems Equipment

12.11 Starfrost

12.12 Scanico

*Details on Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, Key Relationships Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 130)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (71 Tables)

Table 1 Organizations Working Around the World to Improve the Food System

Table 2 Individual Quick Freezing (IQF) Market Size, By Eqipment Type, 20152022 (USD Million)

Table 3 Market Size for Spiral Freezer, By Region, 20152022 (USD Million)

Table 4 Market Size for Tunnel Freezer, By Region, 20152022 (USD Million)

Table 5 Market Size for Box Freezer, By Region, 20152022 (USD Million)

Table 6 Market Size for Other Equipment Type, By Region, 20152022 (USD Million)

Table 7 Market Size, By Processing Stages, 20152022 (USD Million)

Table 8 Market Size for Pre-Processing, By Region, 20152022 (USD Million)

Table 9 Market Size for Freezing, By Region, 20152022 (USD Million)

Table 10 Market Size for Packaging, By Region, 20152022 (USD Million)

Table 11 Market Size, By Technology, 20152022 (USD Million)

Table 12 Mechanical IQF Market Size, By Region, 20152022 (USD Million)

Table 13 Cryogenic IQF Market Size, By Region, 20152022 (USD Million)

Table 14 Market Size, By Product, 20152022 (USD Million)

Table 15 Market Size for Fruits & Vegetables, By Region, 20152022 (USD Million)

Table 16 Market Size for Peas & Beans, By Region, 20152022 (USD Million)

Table 17 Individual Quick Freezing (IQF) Market Size for Berries, By Region, 20152022 (USD Million)

Table 18 Market Size for Others, By Region, 20152022 (USD Million)

Table 19 Market Size for Seafood, By Region, 20152022 (USD Million)

Table 20 Market Size for Shrimps, By Region, 20152022 (USD Million)

Table 21 Market Size for Fish Fillets, By Region, 20152022 (USD Million)

Table 22 Market Size for Other Seafood, By Region, 20152022 (USD Million)

Table 23 Market Size for Meat & Poultry, By Region, 20152022 (USD Million)

Table 24 Market Size for Chicken & Chicken Products, By Region, 20152022 (USD Million)

Table 25 Market Size for Diced Meats, By Region, 20152022 (USD Million)

Table 26 Individual Quick Freezing (IQF) Market Size for Other Meat & Poultry Products, By Region, 20152022 (USD Million)

Table 27 Individual Quick Freezing (IQF) Market Size for Dairy Products, By Region, 20152022 (USD Million)

Table 28 Market Size for Milk-Based Products, By Region, 20152022 (USD Million)

Table 29 Market Size for Cheese, By Region, 20152022 (USD Million)

Table 30 Market Size for Convenience Food, By Region, 20152022 (USD Million)

Table 31 Market Size, By Region, 20152022 (USD Million)

Table 32 North America: Individual Quick Freezing (IQF) Market Size, By Country, 20152022 (USD Million)

Table 33 North America: Market Size, By Equipment Type, 20152022 (USD Million)

Table 34 North America: Market Size, By Processing Stages, 20152022 (USD Million)

Table 35 North America: Market Size, By Technology, 20152022 (USD Million)

Table 36 North America: Market Size, By Product, 20152022 (USD Million)

Table 37 US: Individual Quick Freezing (IQF) Market Size, By Equipment Type, 20152022 (USD Million)

Table 38 Canada: Individual Quick Freezing (IQF) Market Size, By Equipment Type, 20152022 (USD Million)

Table 39 Mexico: Individual Quick Freezing (IQF) Market Size, By Equipment Type, 20152022 (USD Million)

Table 40 Europe: Individual Quick Freezing (IQF) Market Size, By Country, 20152022 (USD Million)

Table 41 Europe: Market Size, By Equipment Type, 20152022 (USD Million)

Table 42 Europe: Market Size, By Processing Stages, 20152022 (USD Million)

Table 43 Europe: Market Size, By Technology, 20152022 (USD Million)

Table 44 Europe: Market Size, By Product, 20152022 (USD Million)

Table 45 Germany: By Market Size, By Equipment Type, 20152022 (USD Million)

Table 46 France: Individual Quick Freezing (IQF) Market Size, By Equipment Type, 20152022 (USD Million)

Table 47 Italy: By Market Size, By Equipment Type, 20152022 (USD Million)

Table 48 UK: Individual Quick Freezing (IQF) Market Size, By Equipment Type, 20152022 (USD Million)

Table 49 Spain: By Market Size, By Equipment Type, 20152022 (USD Million)

Table 50 Russia: By Market Size, By Equipment Type, 20152022 (USD Million)

Table 51 Poland: By Market Size, By Equipment Type, 20152022 (USD Million)

Table 52 Rest of Europe: By Market Size, By Equipment Type, 20152022 (USD Million)

Table 53 Asia Pacific: By Market Size, By Equipment Type, 20152022 (USD Million)

Table 54 Asia Pacific: Market Size, By Processing Stages, 20152022 (USD Million)

Table 55 Asia Pacific: Market Size, By Technology, 20152022 (USD Million)

Table 56 Asia Pacific: Market Size, By Product, 20152022 (USD Million)

Table 57 Asia Pacific: Market Size, By Country, 20152022 (USD Million)

Table 58 China: Individual Quick Freezing (IQF) Market Size, By Equipment Type, 20152022 (USD Million)

Table 59 Japan: By Market Size, By Equipment Type, 20152022 (USD Million)

Table 60 Australia & New Zealand: Individual Quick Freezing (IQF) Market Size, By Equipment Type, 20152022 (USD Million)

Table 61 India: By Market Size, By Equipment Type, 20152022 (USD Million)

Table 62 Rest of Asia Pacific: Individual Quick Freezing (IQF) Market Size, By Equipment Type, 20152022 (USD Million)

Table 63 RoW: Individual Quick Freezing (IQF) Market Size, By Region, 20152022 (USD Million)

Table 64 RoW: Market Size, By Equipment Type, 20152022 (USD Million)

Table 65 RoW: Market Size, By Processing Stages, 20152022 (USD Million)

Table 66 RoW: Market Size, By Technology, 20152022 (USD Million)

Table 67 RoW: Market Size, By Product, 20152022 (USD Million)

Table 68 South America: Individual Quick Freezing (IQF) Market Size, By Equipment Type, 20152022 (USD Million)

Table 69 Middle East: Individual Quick Freezing (IQF) Market Size, By Equipment Type, 20152022 (USD Million)

Table 70 Africa: Individual Quick Freezing (IQF) Market Size, By Equipment Type, 20152022 (USD Million)

Table 71 Top Five Companies in the Individual Quick Freezing Market, 2016

List of Figures (30 Figures)

Figure 1 Market Segmentation

Figure 2 Individual Quick Freezing (IQF) Market Segmentation, By Region

Figure 3 Individual Quick Freezing Market (IQF): Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, By Designation and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation & Methodology

Figure 8 By Market, By Processing Stages, (2017 vs 2022)

Figure 9 Market, By Product (2017 vs 2022)

Figure 10 Individual Quick Freezing (IQF) Market, By Equipment Type (2017 vs 2022)

Figure 11 By Market, By Region,2016

Figure 12 Attractive Growth Opportunities in the global Market Between 2017 & 2022

Figure 13 North America to Remain Dominant During the Forecast Period

Figure 14 The US is Estimated to Account for the Largest Share of this Market in 2017

Figure 15 Spiral Freezer Dominated the Individual Quick Freezing (IQF) Market as Preferred Freezer Used Across All Regions in 2016

Figure 16 Individual Quick Freezing Market of Germany to Grow at the Highest CAGR Among Key Countries

Figure 17 Market Dynamics: Global Individual Quick Freezing Market

Figure 18 By Market Size, By Equipment Type, 2017 vs 2022 (USD Million)

Figure 19 Market Size, By Processing Stages, 2017 vs 2022 (USD Million)

Figure 20 Market Size, By Product, 2017 vs 2022 (USD Million)

Figure 21 Market Size, By Region, 2017 vs 2022 (USD Million)

Figure 22 North America: Market Snapshot

Figure 23 Marel: Company Snapshot

Figure 24 JBT : Company Snapshot

Figure 25 GEA: Company Snapshot

Figure 26 The Linde Group: Company Snapshot

Figure 27 Air Products and Chemicals: Company Snapshot

Figure 28 Air Liquide: Company Snapshot

Figure 29 Messer Group: Company Snapshot

Figure 30 Patkol: Company Snapshot

Growth opportunities and latent adjacency in Individual Quick Freezing (IQF) Market

Hi, I am looking for a market orientation that will pinpoint the Individual Quick Freezing (IQF) Market market for machines that treat Blanch, Chill, and Freeze of vegetables, shrimps, and meat. Would it be possible to have a look at the sample report?

Hi, I am looking for a market orientation that will pinpoint the Individual Quick Freezing (IQF) Market for machines that treat Blanch, Chill, and Freeze of vegetables, shrimps, and meat. Would it be possible to have a look at the sample report?

I need the report catalog and price indication of the Malaysian Individual Quick Freezing Market.