Food Waste Management Market by Waste Type (Cereals, Dairy Products), Application (Animal Feed, Fertilizers), End user (Primary Food Producers, Food Manufacturers), Process (Aerobic Digestion, Anaerobic Digestion), and Region - Global Forecast to 2022

[154 Pages Report] The global food waste management market size was valued at USD 30.00 billion in 2016, and is projected to grow at a CAGR of 5.97% to reach USD 42.37 billion by 2022.

The objectives of the report

- To define, segment and forecast the size of the market by application, process, waste type, end user, and region.

- To focus on services offered across the food value chain to manage, recycle, or reduce waste food

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape of the market leaders

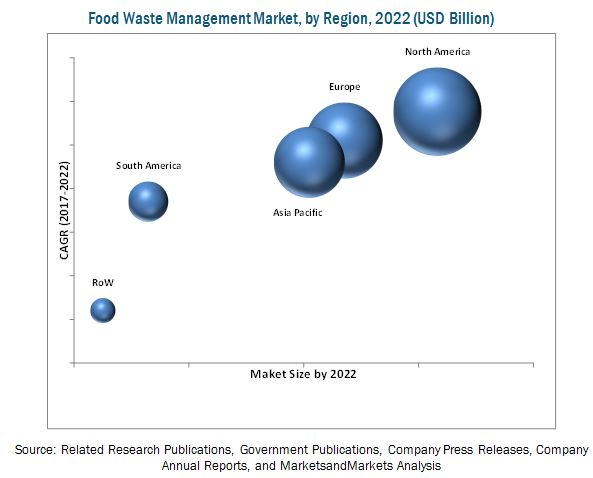

- To project the size of the market and its submarkets, in terms of value, with respect to five regions (along with their key countries): North America, South America, Europe, Asia-Pacific, and Rest of the World (RoW)

-

To analyze the competitive developments such as:

- mergers & acquisitions

- expansions & investments

- agreements, partnerships, and joint ventures

- To strategically profile the key players and comprehensively analyze their product & service portfolios and core competencies

The years considered for the study are as follows:

|

Report Metric |

Details |

|

Base year |

2016 |

|

Estimated year |

2017 |

|

Projected year |

2022 |

|

Forecast period |

2017-2022 |

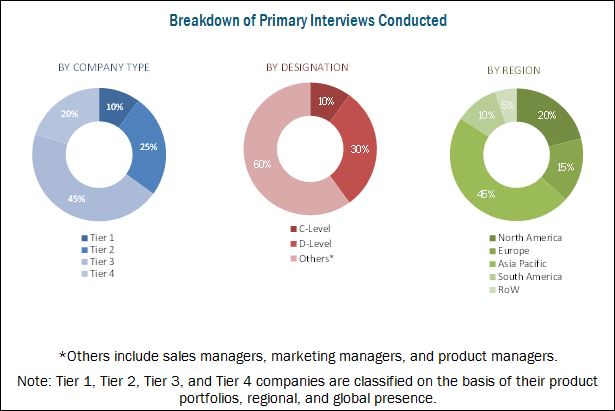

This research study involves the extensive use of secondary sources (which included directories and databases)—such as Hoovers, Forbes, Bloomberg Businessweek, and Factiva—to identify & collect information useful for technical, market-oriented, and commercial study of the global market. The primary sources that have been involved include industry experts from core & related industries and preferred suppliers, dealers, manufacturers, alliances, standards & certification organizations from companies, and organizations related to all segments of this industry’s value chain. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative & quantitative information as well as to assess future prospects. The following figure depicts the market research methodology applied in drafting this report on the food waste management market.

To know about the assumptions considered for the study, download the PDF brochure

Market Ecosystem

The various contributors involved in the value chain of market include manufacturers, suppliers, distributors, importers, and exporters. The key manufacturers who comprise the food waste management market include Veolia Environnement (France), SUEZ (France), Waste Management, Inc. (U.S.), FCC Environment (U.K.) Ltd. (U.K.), Remondis SE & Co. KG (Germany), Stericycle, Inc. (U.S.), and Clean Harbors, Inc. (US). These companies have diversified service portfolios and advance waste disposal technologies at major strategic locations. The other companies which are profiled include Covanta Holding Corporation (US), Advanced Disposal Services, Inc. (U.S.), Waste Connections, Inc. (Canada), and Republic Services, Inc. (U.S.).

Target Audience

- Food waste management service providers

- Food waste management consultants and organizations

- Retail chains, food service providers, restaurants, and waste producers & collectors

- Food associations and regulatory authorities of several countries

- Research organizations and associations such as the Food and Agriculture Organization (FAO), the Food Waste Reduction Alliance (FWRA), the European Federation of Food Banks (EFFB), the Food Marketing Institute (FMI), the European Food Safety Authority (EFSA), and the US Department of Agriculture (USDA)

Scope of the Report

This research report categorizes the food waste management market based on waste type, process, application, end user, and region.

On the basis of waste type, the food waste management market has been segmented into the following:

- Cereals

- Dairy products

- Fruit & vegetable

- Meat

- Fish & seafood

- Oilseeds & pulses

- Processed food

- Coffee grounds & tea

On the basis of Process, the food waste management market has been segmented into the following:

- Aerobic digestion (composting)

- Anaerobic digestion

- Incineration/ combustion

- Others (redistribution, minimization, and disposal)

On the basis of application, the food waste management market has been segmented into the following:

- Feed

- Fertilizers

- Biofuel

- Power generation

On the basis of the end user, the food waste management market has been segmented into the following:

- Primary food producers

- Food manufacturers

- Food distributors & suppliers

- Food service providers

- Municipalities & households

On the basis of region, the food waste management market has been segmented into the following:

- North America

- Europe

- Asia-Pacific

- South America

- Rest of the World (Africa and the Middle East)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Service Analysis

- Service matrix, which gives a detailed comparison of the service portfolios of each company

Application Analysis.

- Further breakdown of food waste management into feed, fertilizers, biofuel, and power generation

Regional Analysis

- Further breakdown of the Rest of Europe food waste management market into Russia, Spain, and Poland

- Further breakdown of the Rest of Asia-Pacific food waste management market into Indonesia, Singapore, and Thailand

- Further breakdown of the RoW food waste management market into the Middle East and Africa

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The growth of the market is attributed to increasing use of organic waste for the production of feed & fertilizers, rise in global food waste, and need for reducing greenhouse gas emission. The fruits & vegetables segment is projected to dominate the global market through the forecast period, as a large quantity of waste is generated from fruits & vegetables along with roots and tubers. These wastes/scraps are easily available raw materials for compost and as feed for anaerobic/aerobic digestions.

The major restraining factor for the market has been the landfill and incineration techniques causing adverse effects on the environment.

On the basis of end users, the municipalities & households segment is estimated to dominate the global food waste management market, followed by the food service providers segment in 2017. The waste generated from the day-to-day use items, such as product packaging, clothing, food scraps, newspapers, paints, batteries, is known as municipality & household waste. Communities in the US offer a variety of options for conveniently and safely managing household waste. Waste management companies focus on recycling a large amount of waste generated from the residential sector. New technologies are used to reduce and recycle the waste.

The global market based on the anaerobic digestion segment is projected to grow at the highest CAGR between 2017 and 2022. This segment is estimated to account for the largest market share in 2017. The energy produced through anaerobic digestion is neither dependent on weather nor subject to price fluctuations. Thus, it is considered a lucrative source of energy and an effective alternative to fossil fuel.

The food waste management market, by application, has been segmented as feed, fertilizers, biofuel, and power generation. The feed segment is estimated to account for the largest market share in 2017. Food waste mainly consists of organic waste that can be completely decontaminated by techniques such as thermal treatment and sterilization and can safely be used as feed. There are various methods for yielding feed from waste; for instance, processing of organic waste from larvae to yield feed.

The North American region is projected to hold the largest market share, followed by the European region, in 2022. North America is estimated to be the fastest-growing food waste management market in the forecast period. This is mainly due to the Solid Waste Association of North America (SWANA), which supports and offers different types of services and practices, such as storage and recycling of residential waste, integrated solid waste management, institutional, commercial, and industrial solid waste in order to reduce waste in the region.

Landfill and incineration techniques causing adverse effects on the environment is one of the major restraining factors for the market. Landfilling and incineration processes have been traditionally used for waste disposal. Incinerators are prioritized over landfilling as they are more convenient, requires a small area, and eliminate the problem of methane gas release from the landfill. The calorific value of waste, which is the amount of heat released from waste combustion, is directly related to the moisture content of waste and is considered a key performance indicator of the incineration process. Landfills and incineration both contribute to the emission of GHG, which is one of the main causes of global warming. Overflown landfills may also spread epidemic diseases in their surrounding areas.

Veolia Environnement (France) is likely to emerge as a leading market player in the food waste management market in the coming years, owing to its line of various waste management services, which are highly useful in the food industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Market Overview (Page No. - 27)

3.1 Introduction

3.2 Market Insights

3.3 Market Dynamics

3.3.1 Drivers

3.3.1.1 Rise in Global Food Waste

3.3.1.2 Increase in Usage of Organic Waste for the Production of Animal Feed and Fertilizers

3.3.1.3 Need for Reducing Greenhouse Gas Emissions

3.3.2 Restraints

3.3.2.1 Landfill and Incineration Techniques Causing Adverse Effects on the Environment

3.3.3 Opportunities

3.3.3.1 Lack of Integrated Waste Management in the Private Sector in Asia

3.3.3.2 Need for Generating an Alternate Source of Energy

3.3.3.3 Emergence of Technologies for Waste Disposal

3.3.3.4 Focus on Rural Areas

3.3.4 Challenges

3.3.4.1 Segregation & Collection of Waste

3.4 Supply Chain

4 Regulations (Page No. - 35)

4.1 Overview

4.2 North America

4.2.1 Us

4.2.2 Canada

4.3 European Union (EU)

4.4 Asia-Pacific

4.4.1 China

4.4.2 India

4.4.3 Australia

5 Executive Summary (Page No. - 38)

6 Premium Insights (Page No. - 42)

6.1 Market Opportunities for Food Waste Management Service Providers

6.2 Market, By Region

6.3 North America: Market, By Country & End User

6.4 Market, By Process

6.5 Market: Country Level Overview

7 Food Waste Management Market, By Process (Page No. - 47)

7.1 Introduction

7.2 Aerobic Digestion

7.3 Anaerobic Digestion

7.4 Incineration/Combustion

7.5 Other Processes

8 Food Waste Management Market, By End User (Page No. - 53)

8.1 Introduction

8.2 Primary Food Producers

8.3 Food Manufacturers

8.4 Food Distributors & Suppliers

8.5 Food Service Providers

8.6 Municipalities & Households

9 Food Waste Management Market, By Application (Page No. - 60)

9.1 Introduction

9.2 Animal Feed

9.3 Fertilizers

9.4 Biofuel

9.5 Power Generation

10 Food Waste Management Market, By Waste Type (Page No. - 65)

10.1 Introduction

10.2 Cereals

10.3 Dairy Products

10.4 Fruits & Vegetables

10.5 Meat

10.6 Fish and Sea Food

10.7 Oilseeds & Pulses

10.8 Processed Food

10.9 Coffee Grounds & Tea

11 Food Waste Management Market, By Method (Page No. - 73)

11.1 Introduction

11.2 Prevention

11.3 Recovery

11.4 Recycling

11.5 Others (Redistribution, Minimisation & Disposal)

12 Food Waste Management Market, By Region (Page No. - 75)

12.1 Introduction

12.2 North America

12.2.1 Us

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Germany

12.3.2 France

12.3.3 Italy

12.3.4 Uk

12.3.5 Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.2 Japan

12.4.3 India

12.4.4 Australia & New Zealand

12.4.5 Rest of Asia Pacific

12.5 South America

12.5.1 Brazil

12.5.2 Argentina

12.5.3 Chile

12.5.4 Rest of South America

12.6 Rest of the World (RoW)

12.6.1 Middle East

12.6.2 Africa

13 Competitive Landscape (Page No. - 104)

13.1 Introduction

13.2 Competitive Leadership Mapping

13.2.1 Visionary Leaders

13.2.2 Innovators

13.2.3 Dynamic Differentiators

13.2.4 Emerging Companies

13.3 Competitive Benchmarking

13.3.1 Strength of Service Portfolio (For 25 Companies)

13.3.2 Business Strategy Excellence (For 25 Companies)

*Top 25 Companies Analyzed for This Study are – Veolia Environnement (France), Suez (France), Waste Management, Inc. (US), Republic Services, Inc. (US), Remondis SE & Co. Kg (Germany), Andritz AG (Austria), Stericycle, Inc. (US), Waste Connections, Inc. (Canada), Clean Harbors, Inc. (US), Covanta Holding Corporation (US), Biffa Group Limited (UK), Rumpke Consolidated Companies, Inc. (US), Advanced Disposal Services, Inc. (US), Cleanaway Waste Management Limited (Australia), Fcc Environment (UK) Limited (UK), Smith Recycling (Milton Keynes) Limited (UK), Biancamano S.P.A (Italy), Quest Resource Management Group, LLC. (US), Refood GmbH & Co. Kg (Germany), Ecofast Italia (Italy), Masias Recycling (Spain), Eco Food Recycling (UK), E.O.M.S. Recycling, Inc. (US), Missouri Organic Recycling. (US), Organix Recycling, LLC (US)

13.4 Food Waste Management Ranking Analysis

14 Company Profiles (Page No. - 110)

(Company Overview, Strength of Product Portfolio, Product Offerings, Business Strategy Excellence, Recent Developments)*

14.1 Veolia Environnement

14.2 Suez

14.3 Waste Management, Inc.

14.4 Republic Services, Inc.

14.5 Stericycle, Inc.

14.6 Covanta Holding Corporation

14.7 Remondis SE & Co. Kg

14.8 Waste Connections, Inc.

14.9 Clean Harbors, Inc.

14.10 Biffa Group Limited

14.11 Rumpke Consolidated Companies, Inc.

14.12 Advanced Disposable Services Inc.

*Details on Company Overview, Strength of Product Portfolio, Product Offerings, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 145)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (65 Tables)

Table 1 Market Size for Food Waste Management, By Process, 2015–2022 (USD Million)

Table 2 Food Waste Management By Aerobic Digestion Market Size, By Region, 2015–2022 (USD Million)

Table 3 Food Waste Management By Anaerobic Digestion Market Size, By Region, 2015–2022 (USD Million)

Table 4 Food Waste Management By Incineration/Combustion Market Size, By Region, 2015–2022 (USD Million)

Table 5 Food Waste Management By Other Processes Market Size, By Region, 2015–2022 (USD Million)

Table 6 food Waste Management Market Size for Food Waste Management, By End User, 2015–2022 (USD Million)

Table 7 Primary Food Producers: Market Size for Food Waste Management, By Region, 2015–2022 (USD Million)

Table 8 Food Manufacturers: Market Size, By Region, 2015–2022 (USD Million)

Table 9 Food Distributors & Suppliers: Market Size, By Region, 2015–2022 (USD Million)

Table 10 Food Service Providers: Market Size, By Region, 2015–2022 (USD Million)

Table 11 Municipalities & Households: Edible Waste Management Market Size, By Region, 2015–2022 (USD Million)

Table 12 Market Size, By Application, 2015-2022 (USD Million)

Table 13 Market Size for Animal Feed, By Region, 2015-2022 (USD Million)

Table 14 Market Size for Fertilizers, By Region, 2015-2022 (USD Million)

Table 15 Market Size for Biofuel, By Region, 2015-2022 (USD Million)

Table 16 Food Waste Management Market Size for Power Generation, By Region, 2015-2022 (USD Million)

Table 17 Market Size, By Type, 2015–2022 (USD Million)

Table 18 Cereal Waste Management Market Size, By Region, 2015–2022 (USD Million)

Table 19 Dairy Products Waste Management Market Size, By Region, 2015–2022 (USD Million)

Table 20 Fruits & Vegetables Waste Management Market Size, By Region, 2015–2022 (USD Million)

Table 21 Meat Waste Management Market Size, By Region, 2015–2022 (USD Million)

Table 22 Fish & Seafood Waste Management Market Size, By Region, 2015–2022 (USD Million)

Table 23 Oilseeds & Pulses Waste Management Market Size, By Region, 2015–2022 (USD Million)

Table 24 Processed Food Waste Management Market Size, By Region, 2015–2022 (USD Million)

Table 25 Coffee Ground Waste Management Market Size, By Region, 2015–2022 (USD Million)

Table 26 Market Size, By Region, 2015–2022 (USD Million)

Table 27 North America: Edible Waste Management Market Size, By Country, 2015–2022 (USD Million)

Table 28 North America: Market Size, By Waste Type, 2015–2022 (USD Million)

Table 29 North America: Market Size, By Process, 2015–2022 (USD Million)

Table 30 North America: Market Size, By End User, 2015–2022 (USD Million)

Table 31 US: Edible Waste Management Market Size, By End User, 2015–2022 (USD Million)

Table 32 Canada: Market Size, By End User, 2015–2022 (USD Million)

Table 33 Mexico: Market Size, By End User, 2015–2022 (USD Million)

Table 34 Europe: Edible Waste Management Market Size, By Country, 2015–2022 (USD Million)

Table 35 Europe: Market Size, By Waste Type, 2015–2022 (USD Million)

Table 36 Europe: Market Size, By Process, 2015–2022 (USD Million)

Table 37 Europe: Market Size, By End User, 2015–2022 (USD Million)

Table 38 Germany: Market Size, By End User, 2015–2022 (USD Million)

Table 39 France: Market Size, By End User, 2015–2022 (USD Million)

Table 40 Italy: Edible Waste Management Market Size, By End User, 2015–2022 (USD Million)

Table 41 U.K.: Market Size, By End User, 2015–2022 (USD Million)

Table 42 Rest of Europe: Edible Waste Management Market Size, By End User, 2015–2022 (USD Million)

Table 43 Asia Pacific: Edible Waste Management Market Size, By Country, 2015–2022 (USD Million)

Table 44 Asia Pacific: Food Waste Management Market Size, By Waste Type, 2015–2022 (USD Million)

Table 45 Asia Pacific: Market Size, By Process, 2015–2022 (USD Million)

Table 46 Asia Pacific: Market Size, By End User, 2015–2022 (USD Million)

Table 47 China: Edible Waste Management Market Size, By End User, 2015–2022 (USD Million)

Table 48 Japan: Market Size, By End User, 2015–2022 (USD Million)

Table 49 India: Market Size, By End User, 2015–2022 (USD Million)

Table 50 Australia & New Zealand: Market Size, By End User, 2015–2022 (USD Million)

Table 51 Rest of Asia Pacific: Market Size, By End User, 2015–2022 (USD Million)

Table 52 South America: Edible Waste Management Market Size, By Country, 2015–2022 (USD Million)

Table 53 South America: Market Size, By Waste Type, 2015–2022 (USD Million)

Table 54 South America: Market Size, By Process, 2015–2022 (USD Million)

Table 55 South America: Market Size, By End User, 2015–2022 (USD Million)

Table 56 Brazil: Edible Waste Management Market Size, By End User, 2015–2022 (USD Million)

Table 57 Argentina: Market Size, By End User, 2015–2022 (USD Million)

Table 58 Chile: Edible Waste Management Market Size, By End User, 2015–2022 (USD Million)

Table 59 Rest of South America: Edible Waste Management Market Size, By End User, 2015–2022 (USD Million)

Table 60 RoW: Market Size, By Region, 2015–2022 (USD Million)

Table 61 RoW: Market Size, By Waste Type, 2015–2022 (USD Million)

Table 62 RoW: Market Size, By Process, 2015–2022 (USD Million)

Table 63 RoW: Market Size, By End User, 2015–2022 (USD Million)

Table 64 Middle East: Market Size for Food Waste Management, By End User, 2015–2022 (USD Million)

Table 65 Africa: Market Size, By End User, 2015–2022 (USD Million)

List of Figures (33 Figures)

Figure 1 Market Segmentation

Figure 2 Market Segmentation, By Region

Figure 3 Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation & Methodology

Figure 7 Food Waste Management Market: Drivers, Restraints, Opportunities, and Challenges

Figure 8 Per Capita Food Losses and Waste, at Consumption and Pre-Consumptions Stages, By Region (2009–2010)

Figure 9 Cumulative Greenhouse Gas Emission, 1990–2011 (Global %)

Figure 10 Food Waste Disposed of and Recycled in Singapore

Figure 11 Food Service Providers Segment, By End User, Projected to Be the Fastest-Growing Segment During the Forecast Period

Figure 12 Market for Food Waste Management, By Waste Type (2017 vs 2022): Fruits & Vegetables Segment Projected to Be the Largest

Figure 13 Market, By Process (2017 vs 2022): Anaerobic Digestion Segment Projected to Be the Largest

Figure 14 North America Dominated the Edible Waste Management Market in 2016

Figure 15 Attractive Growth Opportunities in the Edible Waste Management Market for Service Providers Between 2017 & 2022

Figure 16 North America to Grow at the Highest Rate From 2017 to 2022

Figure 17 US is Estimated to Account for the Largest Share of the Edible Waste Management Market in 2017

Figure 18 Anaerobic Digestion Dominated the Edible Waste Management Market as A Major Waste Management Process Across All Regions in 2016

Figure 19 UK Market to Grow at the Highest CAGR Among Key Markets of Each Region

Figure 20 Composting Process Flow

Figure 21 Market Size for Food Waste Management, By Region, 2015-2022 (USD Million)

Figure 22 North America: Market Snapshot

Figure 23 Global Food Waste Management: Competitive Leadership Mapping, 2017

Figure 24 Veolia Environnement: Company Snapshot

Figure 25 Suez : Company Snapshot

Figure 26 Waste Management Inc.: Company Snapshot

Figure 27 Republic Services Inc.: Company Snapshot

Figure 28 Stericycle, Inc.: Company Snapshot

Figure 29 Covanta Holding Corporation: Company Snapshot

Figure 30 Waste Connections, Inc.: Company Snapshot

Figure 31 Clean Harbors, Inc.: Company Snapshot

Figure 32 Biffa Group Limited : Company Snapshot

Figure 33 Advanced Disposable Services Inc.: Company Snapshot

Growth opportunities and latent adjacency in Food Waste Management Market