India HCM Market In SMB Sector, by Vertical (IT & ITES, Manufacturing, Professional Services, Retail & Wholesale, Automobile, Healthcare, Textile, Hospitality), & City (Bengaluru, Mumbai, NCR, Hyderabad, Chennai, Pune, Rest of India) - Forecast to 2022

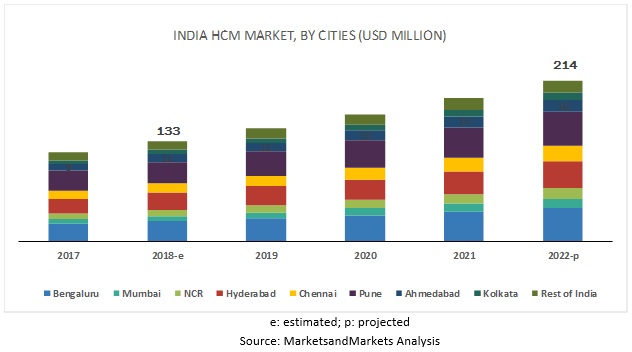

[81 Pages Report] MarketsandMarkets expects the India HCM Market in SMB to grow from USD 133 million in 2018 to USD 214 million by 2022, at a Compound Annual Growth Rate (CAGR) of 12.5% during forecast period. Central government initiatives, such as Make in India, Startup India, and Skill India are expected to drive the India HCM market.

In the India HCM market by city, Ahmedabad and Pune to grow at the highest CAGRs during the forecast period

Economic and political support from governments and the increasing number of startups are fueling the growth of the market in both the cities. Moreover, the emerging advancements in digitization have led to automation of business processes across cities.

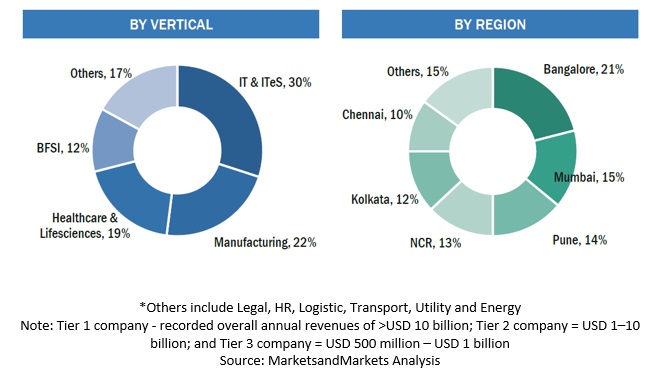

In the India HCM market by vertical, IT and ITES vertical to hold the largest market size during the forecast period

The IT and ITES vertical is very active in terms of adopting HCM software. The software helps streamline business processes across locations to a centralized process. Moreover, the adopting companies makes sure that their employees undergo training to understand the current technical environment. Therefore, advanced technologies and various software and solutions are helping this vertical prioritize its actions and manage its workforce smoothly.

Bengaluru to hold the largest market size during the forecast period

Bengaluru emerged as the biggest city in terms of adopting HCM software, especially among the Small and Medium-sized Businesses (SMBs). The SMBs are growing their business around technology companies. Moreover, Bengaluru being one of the hi-tech cities in India with the highest number of startups, is expected to drive this market.

The major vendors of the market include Keka (Hyderabad), Darwinbox (Hyderabad), greytHR (Bengaluru), ZingHR (Mumbai), People Works (Bengaluru), and Zoho People (US). These companies have adopted various organic and inorganic growth strategies to further expand their presence in India.

MnM View of Keka

Keka concentrates on direct selling and leverages its unique selling proposition (USP) on special features and customer support, such as a customer winning user interface, and consistent and free support services to enter new markets or acquire new customers. Unique features such as Performance Manager and Geofencing are utilized to cross-sell and upsell its product. Strong emphasis on retaining the existing customers by fulfilling their special requirements, such as new feature integration or third-party Application Program Interface (API), has helped the company stay ahead of the competition. Keka’s primary source of marketing is through word-of-mouth, as its user experience and automated support services provide it a significant edge over its key competitors, such as greytHR.

MnM view of greytHR

greytHR’s focus is mainly on customer satisfaction. It offers 30-day free trial to clients with access to full features and generates a bill after the trial period based on the plan chosen. The company is a renowned brand for HCM in the SMBs sector. Its strong partner ecosystem is helping it gain customers, claiming to add about 20–25 new customers/city in a month, and targets to cater to 10,000 clients over the next 3 years. Positioned itself in the market as a low-cost software (mainly due to lack of strategic modules), the company targets SMBs in various locations. Clients can disconnect anytime with no lock-in period or no upfront cost. This ‘pay-after-use model’ is helping the company gain traction in the market.

MnM view of ZingHR

ZingHR has 2 types of partners: Resellers, and support and implementation partners. Resellers only provide leads to ZingHR and help in selling the company’s products. They do not provide any support or implementation assistance. ZingHR takes care of them by itself. The support and implementation partners are system integrators who resell and integrate ZingHR software with their own software/services. If a customer purchases ZingHR software through the support and implementation partners, then all the installation and technical support will be provided by the partners themselves. ZingHR will only provide online support to these customers.

Scope of the report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2022 |

|

Base year considered |

2017 |

|

Forecast period |

2017–2022 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Verticals, and Cities |

|

Geographies covered |

India |

|

Companies covered |

Keka (Hyderabad), Darwinbox (Hyderabad), greytHR (Bengaluru), ZingHR (Mumbai), People Works (Bengaluru), and Zoho (Chennai) |

This research report categorizes the India HCM market based on vertical and cities

Based on verticals the India HCM market in SMB has been segmented as follows:

- IT and ITES

- Manufacturing

- Professional Services

- Retail and Wholesale

- Automobile

- Healthcare and Life Sciences

- Chemicals

- Textiles

- Hospitality

- Others (Legal, HR, Logistic, Transport, Utility and Energy)

Based on cities, the India HCM market has been segmented as follows:

- Bengaluru

- Mumbai

- NCR

- Hyderabad

- Chennai

- Pune

- Ahmedabad

- Kolkata

- Rest of India

Recent Developments

- In January 2019, greytHR finalized its funding, which would be utilized to strengthen operational its HR modules only. The funding will not be used for strategic HR modules, as the company does not have plans to target large enterprises.

Critical Questions the Report Answers

- What are the current trends in the India HCM market that are driving the demand for technological advancements?

- Where will all these developments take the industry in the mid- to long-term?

- Who are the vendors in the market and what is their competitive analysis?

- What are the drivers and challenges of the market?

- Which products have been analysed in the market?

Frequently Asked Questions (FAQ):

What is Human Capital Management (HCM)?

What are the top companies in India HCM market?

What are the major factors driving the India HCM market?

What is the impact of HCM in IT and ITeS industry vertical across India?

Which cities have the high growth rate in the India HCM market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 9)

1.1 Objectives of the Study

1.2 Market Scope

1.3 Market Definition

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Research Data

2.1.1 Key Data From Secondary Data

2.1.2 Key Data From Primary Data

2.2 Market Estimation and Forecast Methodology

2.3 Vendor Analysis Matrix Methodology

2.3.1 Vendor Inclusion Criteria

2.4 Research Assumptions

3 Premium Insights (Page No. - 19)

3.1 Premium Insights

4 Market Overview (Page No. - 22)

4.1 Market Drivers

4.2 Market Restraints

4.3 Market Opportunity

4.4 Market Challenges

5 India HCM Market in SMB Opportunity (Page No. - 27)

5.1 India HCM Market Opportunity in SMB, By Verticals

5.2 Market Opportunity in SMB, By Cities

6 Competitive Landscape (Page No. - 31)

6.1 Vendor Offerings: Market Snapshot

6.1.1 Vendor Offerings Comparision – (Keka, Darwinbox, Greythr)

6.1.2 Vendor Offerings Comparision – (Zinghr, Peopleworks, Zoho People)

7 Company Profile (Page No. - 35)

7.1 Keka

7.2 Darwinbox

7.3 Greythr

7.4 Zinghr

7.5 Peopleworks

7.6 Zoho People

8 Appendix (Page No. - 76)

8.1 Marketsandmarkets Knowledge Store: Snapshot

8.2 Our Custom Research and Consulting

8.3 Related Reports

8.4 Disclaimer

List of Tables (12 Tables)

Table 1 Key Data From Secondary Sources

Table 2 Key Data From Primary Sources

Table 3 Research Assumptions

Table 4 India HCM Market Size in SMB Sector, 2017–2022 (USD Million)

Table 5 Market Drivers

Table 6 Market Restraints

Table 7 Market Opportunities

Table 8 Market Challenges

Table 9 India HCM Market Size in SMB, By Vertical, 2017–2022 (USD Million)

Table 10 India HCM Market Size in SMB, By City, 2017–2022 (USD Million)

Table 11 HCM Vendor Comaprison (Keka, Darwinbox, Greythr)

Table 12 HCM Vendor Comaprison (Zinghr, Peopleworks, Zoho People)

List of Figures (8 Figures)

Figure 1 Markets Covered

Figure 2 Years Considered in the Report

Figure 3 India SMB Human Capital Management Market: Research Design

Figure 4 Market Estimation and Forecast Methodology

Figure 5 Vendor Analysis: Criteria Weightage

Figure 6 India HCM in Market SMB: Drivers, Restraints, Opportunities, and Challenges

Figure 7 India HCM Market in SMB, 2017–2022 (USD Million)

Figure 8 Ecosystem Vendor Classification

The study consists of 4 major activities to estimate the current market size of the India Human Capital Management (HCM) market in SMB (Small and Medium-Sized Business) sector. An exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the India HCM market.

Secondary research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications, and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; and databases.

Primary research

Various primary sources from both supply and demand sides of the India HCM market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors who provide the solutions and associated service providers and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of the primary respondents’ profiles:

To know about the assumptions considered for the study, download the pdf brochure

India HCM Market size estimation

For making market estimates and forecasting the India HCM market and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the India HCM market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report objectives

- To provide detailed information regarding the major factors influencing the growth of the Human Capital Management (HCM) software market in Small and Medium-sized Businesses (SMBs) sector (drivers, restraints, opportunities, and industry specific challenges)

- To forecast the revenues of the India SMBs’ HCM market and its various segments with respect to major cities, namely, Bengaluru, Mumbai, NCR, Hyderabad, Chennai, Pune, Ahmadabad, Kolkata and Rest of India

- To analyze market opportunities for stakeholders by identifying high-growth segments, potential regional markets, industry trends, and future growth prospects of the India SMB HCM market

- To analyze the submarkets with respect to individual growth trends, future prospects and contribution to the HCM market

- To strategically profile the key players of the India HCM market ecosystem and comprehensively analyze their products and core competencies in each segment

- To analyze competitive developments, such as special features, future plans, implementation, and support methods and delivery model

Growth opportunities and latent adjacency in India HCM Market