India Connected Car Market by Service/Application (Telematics, Ride Sharing, OTA Updates), Form Factor (Embedded, Tethered, and Integrated), Platform (Android Auto, CarPlay, MirrorLink), Connectivity (Cellular and DSRC), and Hardware - Forecast to 2025

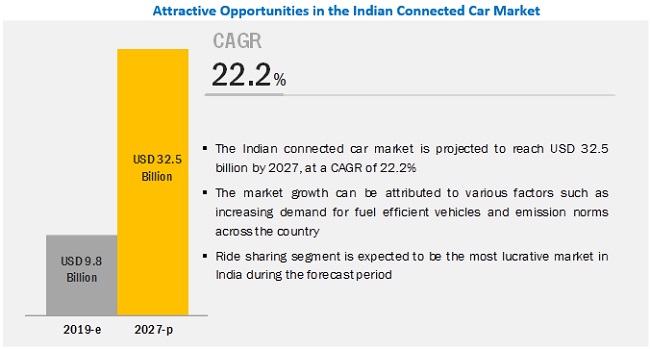

[114 Pages Report] The India connected car market is projected to grow at a CAGR of 22.2% during the forecast period, to reach USD 32.5 billion by 2025 from an estimated USD 9.8 billion in 2019. Some of the major growth drivers are increase in connected features offered by automobile manufacturers in economy models and government mandates regarding connected technology in passenger cars.

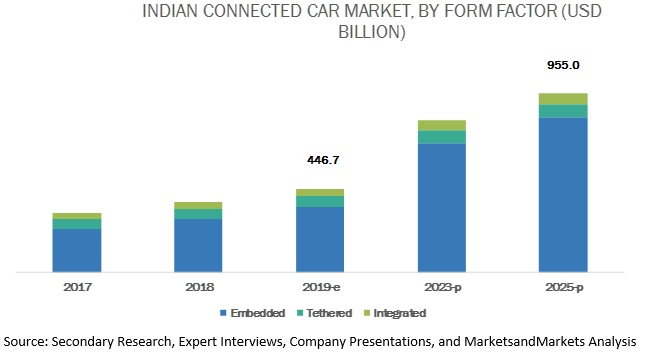

By Form Factor: Embedded segment is expected to be the largest as well as the fastest segment in the India connected car market

The embedded form is expected to be the largest and fastest growing form factor for connected cars in India during the forecast period. One of the key drivers for the embedded form segment is the increase in demand for infotainment and navigation services in India. The government has also started implementing mandates for connected services. For instance, the India government has mandated connected features for public transport vehicles under AIS-140. The mandate was regulated and enforced from April 2018 and is expected to be a crucial factor for the integration of connected technologies in passenger cars in the coming years. This has been done for the development of an intelligent transportation system (ITS), which is a key feature for a smart city. Hence, the embedded form segment would be driven by government initiatives and regulations.

By Connectivity Technology: Cellular segment is expected to dominate the India connected car market

Owing to the increase in connected features offered by automobile manufacturers in economy models and government mandates regarding connected technology in passenger cars, the cellular segment is likely to witness exponential growth in the near future. Also, gradual growth in such features in buses, trucks, and LCVs has further inflated the growth of this segment during the forecast period.

By Hardware: Sensor is estimated to be the fastest market during the forecast period

The sensor segment is expected to dominate the India connected car market during the forecast period. With increasing initiatives by several governments to implement an intelligent transport system, OEMs and Tier I suppliers are manufacturing smart antennas to meet the requirement of connected car services. Sensors act as eyes of the vehicle and help monitor the distance from ahead, behind, or the sides of the vehicle and provide vital data for control console.

The embedded connected car solution is estimated to hold a major share of the India connected car market. Currently, however, the embedded form is facing many challenges. The majority of customers are reluctant to pay extra for embedded connected car solutions. These customers prefer using a smartphone to fulfill the need for in-car connectivity. These challenges would continue to exist in the short term. The growth of embedded form of connected car solutions in the long term can be attributed to various disruptive factors such as government mandates, changes in pricing model, and increase in cloud-based services. The India government has mandated connected services for public transport which came into effect from April 2018. The government is likely to mandate these services for cars and other vehicles in the near future. Mandates such as GPS tracking and SOS services will, in turn, drive the growth of embedded form of connected car solutions. The changes in pricing models of solutions such as shared data plans, split billing, and reprogrammable SIMs by telecom companies are expected to reduce the overall cost of data plans for end-users.

Some of the major restraints identified in the India connected car market are lack of supporting infrastructure in and unavailability of standard platforms. Since 2017, there has been a significant increase in cybersecurity threats and data breaches. This factor may pose a challenge for the growth of the market to a certain extent.

Key Market Players

Some of the major players in the India connected car market are Bosch (Germany), Harman (US), Denso (Japan), NXP (Netherlands), Garmin (US), UNO Minda (India), and Delphi (UK). The last chapter of this report covers a comprehensive study of the key vendors operating in the market. The evaluation of market players is done by taking various factors into account, such as new product development, R&D expenditure, business strategies, product revenue, and organic and inorganic growth.

Additionally, the emergence of startups in different parts of the country has been identified. These startups provide advanced engineering and innovative solutions that can change the current situation of the automobile industry. Also, these startups can prove to be a game changer by providing connected car services at optimized cost. Several OEMs have collaborated with India startups to offer connected car technologies in the India market. For instance, Tata Motors has partnered with various startups such as TruckEasy for making connected cars a reality on India roads with advanced technological and engineering features.

Scope of the Report

by Platform

- Android Auto

- CarPlay

- MirrorLink

- Others

by Connectivity Form Factor

- Embedded

- Tethered

- Integrated

by Service/Application

- Telematics

- Navigation

- Infotainment

- Ride Sharing/Hailing

- Others (OTA updates, safety & security, autonomous driving)

by Hardware

- Smart antenna

- Display

- Electronic Control Unit (ECU)

- Sensors

by Connectivity Technology

- Cellular

- Dedicated Short Range Communication (DSRC)

Critical Questions:

- How will the trend of connected cars in India shape the automotive software market in the long term?

- How will the implementation of emission norms and increasing adoption of EVs impact the market?

- What changes can be expected in the connected car technology owing to increase in cybersecurity threats?

- How can automotive software developers cater to the demand for advance technologies to integrate ADAS features in the vehicles?

- What are the key strategies adopted by the leading players in this market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered in the Report

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Demand-Side Analysis

2.4.1.1 Creating Value From Data Driven Services

2.4.1.2 Growing Demand for Smart Mobility in India

2.4.2 Supply Side Analysis

2.4.2.1 Growing Market of Automotive Electronics in India

2.4.2.2 the Emerging Bubble of Startups in India

2.5 Market Size Estimation

2.5.1 Bottom-Up Approach

2.5.2 Top-Down Approach

2.6 Market Breakdown and Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 India Connected Car Market, 2019 vs. 2025

4.2 Market, By Hardware

4.3 Market, By Service/Application

4.4 Market, By Connectivity Form Factor

4.5 Market, By Connectivity Technology

4.6 Market, By Platform

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Trends

5.2.1 Telematics is the Key for Connected Car in India

5.2.2 Automobile Manufacturers Have Begun to Provide Standard Connected Services

5.2.3 Customized Connected Solutions By Emerging Players

5.3 Customer Preferences

5.3.1 New Technology Explorers

5.3.2 Safety Seekers

5.3.3 New Technology Adopters

5.3.4 Convenience Seekers

5.4 Government Initiatives & Regulations

5.4.1 Government Initiatives

5.4.2 Government Regulations

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Economy Car Manufacturers Attempting to Provide Luxury Features

5.5.1.2 Government Initiatives for Implementing the Connected Car Technology

5.5.2 Restraints

5.5.2.1 Lack of Supporting Infrastructure

5.5.2.2 Unavailability of Standard Platforms

5.5.3 Opportunities

5.5.3.1 Emerging Profit Pool for Automotive Industry

5.5.3.2 Evolution of the New Value Chain Ecosystem of the Automotive Industry

5.5.4 Challenges

5.5.4.1 Increase in the Threat of Data Breach and Cyber Security for Connected Vehicles

5.5.4.2 Increase in Price of the Vehicle With Connected Services

5.6 Macro Indicator Analysis

5.6.1 Introduction

6 By Platform (Page No. - 45)

6.1 Introduction

6.2 Android Auto

6.3 Carplay

6.4 Mirrorlink

6.5 Others

7 By Connectivity Form Factor (Page No. - 48)

7.1 Introduction

7.2 Embedded

7.3 Tethered

7.4 Integrated

8 By Service/Application (Page No. - 52)

8.1 Introduction

8.2 Telematics

8.3 Ride Sharing/Hailing

8.4 Others (Ota Updates, Safety & Security, Autonomous Driving)

9 By Hardware (Page No. - 56)

9.1 Introduction

9.2 Smart Antenna

9.3 Display

9.4 Electronic Control Unit (ECU)

9.5 Sensors

10 By Connectivity Technology (Page No. - 61)

10.1 Introduction

10.2 Cellular

10.3 Dedicated Short Range Communication (Dsrc)

11 Competitive Landscape (Page No. - 64)

11.1 Overview

11.2 Market Ranking Analysis

11.3 Competitive Scenario

11.3.1 Partnership

11.3.2 New Product Development

11.3.3 Collaboration

11.3.4 Expansion

12 Company Profiles (Page No. - 70)

(Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

12.1 Bosch

12.2 Denso

12.3 NXP

12.4 Garmin

12.5 Harman

12.6 Tomtom

12.7 Uno Minda

12.8 Sasken

12.9 Delphi

12.10 Stmicroelectronics

12.11 IBM

12.12 Nuance

*Details on Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 107)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.3.1 Additional Company Profiles

13.3.1.1 Business Overview

13.3.1.2 SWOT Analysis

13.3.1.3 Recent Developments

13.3.1.4 MnM View

13.3.2 Detailed Analysis of India Connected Car Market By Vehicle Class

13.3.3 Detailed Analysis of India Connected Car By Embedded Connectivity Form Factor

13.4 Related Reports

13.5 Author Details

List of Tables (25 Tables)

Table 1 Currency Exchange Rates (Per 1 USD)

Table 2 Usage of Data By Various Stakeholders of the Value Chain

Table 3 Emerging Startups of India

Table 4 Intelligent Transportation System Functions and Subfunctions

Table 5 India Connected Car Market, By Connectivity Form Factor, 2017–2025 (‘000 Units)

Table 6 Market, By Connectivity Form Factor, 2017–2025 (USD Million)

Table 7 Embedded: Market, 2017–2025

Table 8 Tethered: Market, 2017–2025

Table 9 Integrated: Market, 2017–2025

Table 10 Market, By Service, 2017–2025 (USD Million)

Table 11 Telematics: Market, 2017–2025 (USD Million)

Table 12 Ride Sharing/Hailing: Market, 2017–2025 (USD Million)

Table 13 Others: Market, 2017–2025 (USD Million)

Table 14 India Connected Car Market, By Hardware, 2017–2025 (USD Million)

Table 15 Smart Antenna: Market, 2017–2025 (USD Million)

Table 16 Display: Market, 2017–2025 (USD Million)

Table 17 Electronic Control Unit (ECU): Market, 2017–2025 (USD Million)

Table 18 Sensors: Market, 2017–2025 (USD Million)

Table 19 Market, By Connectivity Technology, 2017–2025 (‘000 Units)

Table 20 Market, By Connectivity Technology, 2017–2025 (USD Million)

Table 21 Cellular: India Connected Car Market, 2017–2025

Table 22 Recent Partnerships, 2014–2018

Table 23 Recent New Product Developments, 2014–2018

Table 24 Recent Collaborations, 2014–2018

Table 25 Recent Expansions, 2014–2018

List of Figures (44 Figures)

Figure 1 India Connected Car Market: Research Design

Figure 2 Research Design Model

Figure 3 Breakdown of Primary Interviews

Figure 4 Automotive Electronics in Connected Car Market

Figure 5 Market: Bottom-Up Approach

Figure 6 Market: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Embedded Systems to Be the Largest Segment During the Forecast Period, 2019 vs. 2025 (USD Million)

Figure 9 Ride Sharing/Hailing to Dominate the Market, 2019 vs. 2025 (By Value)

Figure 10 Attractive Opportunities in Market

Figure 11 ECU is Estimated to Dominate the Market, 2019 vs. 2025 (USD Million)

Figure 12 Ride Sharing/Hailing is Estimated to Lead the Market, 2019 vs. 2025 (USD Million)

Figure 13 Embedded Form is Estimated to Dominate the India Connected Car Market, 2019 vs. 2025 (USD Million)

Figure 14 Cellular is Estimated to Dominate the Market, 2019 vs. 2025 (USD Million)

Figure 15 Android Auto is Estimated to Lead the Market, 2018 (By Volume)

Figure 16 India Connected Car: Customer Preference

Figure 17 India Connected Car: Market Dynamics

Figure 18 Profit Pools for Automotive Industry (2017 vs 2035)

Figure 19 Evolving Value Chain From Rigid to Dynamic Ecosystem

Figure 20 Cyber Attack Surfaces in Automotive

Figure 21 India: Increasing Gni Per Capita is Expected to Drive Connected Car Market

Figure 22 India Connected Car Market, By Platform, 2018 (By Volume)

Figure 23 Market, By Connectivity Form Factor, 2019 vs. 2025 (By Value)

Figure 24 Market, By Service/Application, 2019 vs. 2025 (By Value)

Figure 25 Market, By Hardware, 2019 vs. 2025 (By Value)

Figure 26 Key Developments By Leading Players in the Connected Car Market, 2014–2018

Figure 27 Connected Car Market Ranking: 2014–2018

Figure 28 Bosch: Company Snapshot

Figure 29 Bosch: SWOT Analysis

Figure 30 Denso: Company Snapshot

Figure 31 Denso: SWOT Analysis

Figure 32 NXP: Company Snapshot

Figure 33 Denso: SWOT Analysis

Figure 34 Garmin: Company Snapshot

Figure 35 Garmin: SWOT Analysis

Figure 36 Harman: Company Snapshot

Figure 37 Harman: SWOT Analysis

Figure 38 Tomtom: Company Snapshot

Figure 39 Uno Minda: Company Snapshot

Figure 40 Sasken: Company Snapshot

Figure 41 Delphi: Company Snapshot

Figure 42 Stmicroelectronics: Company Snapshot

Figure 43 IBM: Company Snapshot

Figure 44 Nuance: Company Snapshot

The India connected car market is valued at USD 7.5 billion in 2018 and is projected to reach USD 32.5 billion by 2025, at a compound annual growth rate (CAGR) of 22.2% during the forecast period. In this study, 2018 has been considered as the base year, and 2019–2025 the forecast period, for estimating the size of the market.

The report analyzes and forecasts the market size, by value (USD million), of the India connected car market. The report segments the connected car market in India and forecasts its size by service/application, connectivity form factor, connectivity technology, hardware, and platform. The report also provides a detailed analysis of various forces acting on the market, including drivers, restraints, opportunities, and challenges. It strategically profiles key players and comprehensively analyzes their market shares and core competencies. It also tracks and analyzes the competitive developments, such as joint ventures, mergers and acquisitions, new product launches, expansions, and other activities carried out by key industry participants.

The research methodology used in the report involves various secondary sources, such as Automotive Component Manufacturers Association (ACMA), GENIVI Alliance, Automotive Electronics Council (AEC), Automotive Research Association of India (ARAI), Driver and Vehicle Standards Agency (DVSA), and Ministry of Road Transport and Highways (MORTH). Experts from related industries and connected car devices vendors and service providers have been interviewed to understand the future trends of the India connected car market. The market size of the individual segments was determined through various secondary sources: industry associations; white papers; and journals. The vendor offerings were also taken into consideration to determine the market segmentation. The top-down and bottom-up approaches have been used to estimate and validate the size of the market. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments.

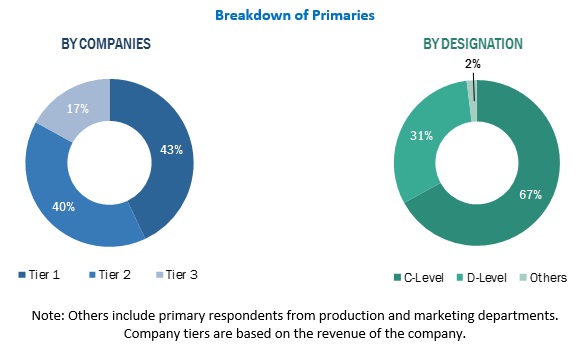

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the India connected car market consists of manufacturers, such as Bosch (Germany), Denso (Japan), NXP (Netherlands), Garmin (US), and Harman (US), and research institutes such as ACMA, AEC, ARAI, and MORTH.

Target Audience

- Automobile manufacturers

- Automobile organizations/associations

- Cloud service providers

- Compliance regulatory authorities

- Connected car hardware manufacturers

- Government agencies

- Information Technology (IT) companies and system integrators

- Investors and Venture Capitalists (VCs)

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis of India connected car market by vehicle class

- Detailed analysis of India connected car by embedded connectivity form factor

Growth opportunities and latent adjacency in India Connected Car Market