In-Wheel Motor Market by Propulsion (BEV, HEV, PHEV & FCEV), Vehicle Type (PC & CV), Motor (Axial & Radial), Cooling (Air & Liquid), Power Output (Up to 60 kW, 60-90 kW & Above 90 kW), Vehicle Class, Motor Weight, and Region - Global Forecast to 2026

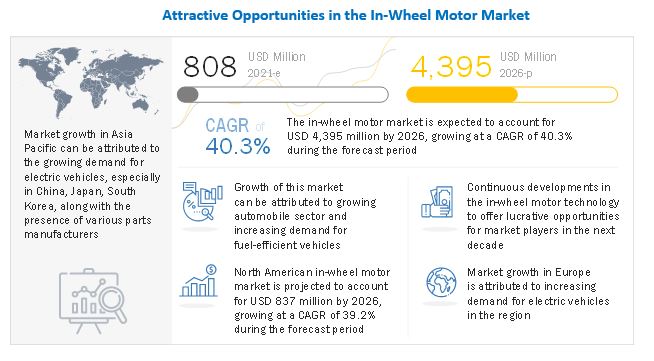

The global in-wheel motor market in terms of revenue was estimated to be worth $808 million in 2021 and is poised to reach $4,395 million by 2026, growing at a CAGR of 40.3% from 2021 to 2026. The global In-Market is driven by increased performance, driving range, reliability, and provision for improved electric vehicle performance similar to Internal Combustion Engine (ICE) vehicles Additionally, it helps to reduce vehicle part count, complexity, and cost by integrating power electronics into the system. The system can also be combined with regenerative braking to enhance performance and increase distance coverage per charge.

To know about the assumptions considered for the study, Request for Free Sample Report

In-wheel motor is an electric motor that is mounted on the wheel to power the wheels directly. It is used in an electric vehicle drivetrain system. It helps improve the driving experience and generates more power. As power goes straight from the motor to the wheel, the in-wheel motor reduces the distance the power travels, which in turn increases the efficiency of the motor.

The growth of the in-wheel motor market is driven by increased driving range, reliability, and improved vehicle performance. Additionally, it helps to reduce vehicle part count, complexity, and cost by integrating power electronics into the system. The system can also be combined with regenerative braking to enhance performance and increase distance coverage per charge. However, factors such as high price and increase in unsprang weight in the wheel can restrain the growth of this market.

The growth of the in-wheel motor market is directly proportional to the growth of electric vehicle sales. Electric vehicle sales have increased significantly, especially in countries such as Japan, China, Germany, France, Netherlands, Norway, the UK, and the US. These countries, with favourable government policies, incentives, and infrastructure investment, account for more than 90% of the world’s EV sales.

The increase in R&D expenses can provide lucrative opportunities for in-wheel motor manufacturers to develop technologies to increase the efficiency of a vehicle. Various component manufacturers are focusing on developing an efficient system for future transport. The growing interest in self-driving cars is expected to boost the development of advanced technologies such as in-wheel motor to provide the best-in-class driving experience.

Market Dynamics:

Driver: Increasing penetration of electric vehicles globally.

The market for electric vehicles is growing at a fast pace. The global EV sales surged by 38% in 2020 vis-à-vis 2019 despite the conventional vehicle industry mired with the COVID-19 pandemic that resulted in negative growth. Factors such as the growing demand for low emission and government regulations supporting long-range, zero-emission vehicles through subsidies & tax rebates have compelled manufacturers to provide electric vehicles around the world. With increased sales of electric vehicles, the demand for electric vehicle parts and components is also rising rapidly.

Restraint: Increase in unsprung weight in wheel.

Automakers prefer to keep the unsprung mass in the vehicle to a minimum to improve the ride quality. The incorporation of in-wheel motor technology in a vehicle increases unsprung weight, which can deteriorate ride comfort. The unsprung weight or mass includes the weight of the suspension, brakes, bearings, wheels or tracks, and a few other components directly connected to the wheel. The unsprung weight also includes the weight of components such as wheel axles, wheel bearings, wheel hubs, tires, and a portion of the weight of driveshafts, springs, shock absorbers, and suspension links. If the vehicle's brakes are mounted on the wheel, which is directly subjected to unsprung weight, it will increase the stress of the wheel. Thus, the increase in unsprung weight can restrain the incorporation of in-wheel motor technology in vehicles.

Opportunity: Change in the regulatory environment globally.

Over the last decade, there has been enormous support on the policy front in order to promote electric vehicles (EVs). According to a report published by the International Energy Agency, 10 million cars were on the world’s roads in 2020, and sales of electric cars were 4.6% of the total car sales around the world. These developments are a testament to the increase in proclivity towards electric vehicles due to the policy support and increase in awareness about climate change due to the burning of fossil fuels.

Challenge: Rise in incidents of failure.

One of the major challenges that can hinder the growth of in-wheel motors is rising incidents of failure. Hyundai Motor experienced motor failures in their electric buses, which compelled them to discontinue the use of in-wheel motors. Hyundai’s in-wheel motor has experienced wear of rotors and dissimilarity phenomenon on various occasions. As per the company, the gear of the moderator in the in-wheel motor was defunct, resulting in metal powder caused by wear or dissimilarity. In some cases, it was repeatedly observed in the vehicles causing the vehicles to stop while driving. Subsequently, Hyundai Motor recalled its 253 electric buses “Elec-city” produced and sold between November 2018 and February 2020. The company has taken a major step to stop the use of in-wheel motors and convert the power system of electric buses from an in-wheel motor to a regular electric motor from March 2021.

Axial flux motor segment is estimated to account for the larger market share during the forecast period.

Based on motor type, the in-wheel motor market is segmented into axial flux motor and radial flux motor. The axial flux motor has high power density and efficiency than the radial flux motor. It is compact and can be placed in or close to each wheel of the vehicle. It is mainly used in high-torque and low-speed applications. Axial flux motors are compact, lightweight, and highly efficient. They are used to increase the output torque and efficiency and can be used as direct drives in electric vehicles. The manufacturing and assembling processes are simple as compared to a radial flux motor. Thus, the segment would continue to lead the market over the forecast period.

Passenger Car segment is estimated to account for the larger market share during the forecast period.

The growth of in-wheel motors in passenger cars can be attributed to factors such as improved efficiency, high torque, increased power, and better vehicle handling for new and existing vehicles. Most EV makers are focusing on improving the overall driving range, lower weight, and optimizing the vehicles' design. EV makers can ensure optimum space utilization as well as improved power efficiency by using in-wheel motors. Apart from the EV makers, Tier 1 companies are keen on improving the performance of electric cars in terms of weight, driving range, space, and overall handling. Thus, the passenger cars segment would remain dominant over the forecast period. The commercial vehicles segment has a relatively higher penetration of in-wheel motors due to the higher requirement of power. Thus, the segment is expected to register a faster growth rate during the forecast period.

Asia Pacific is expected to remain the dominant region during the forecast period.

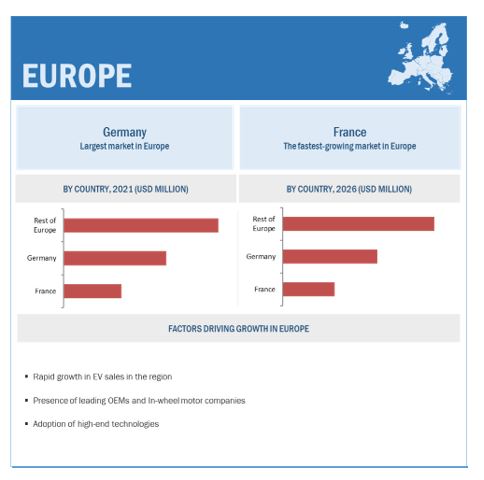

Asia Pacific is expected to be the largest and the fastest-growing market for in-wheel motors due to rapid growth in EV sales across countries such as Japan and China. Major players such as Protean Electric and Elaphe are already making efforts to strengthen their presence in China due to the large EV market in the country. Europe is expected to show rapid growth due to strong EV sales in recent years, thereby emerging as the second-largest market for in-wheel motors. The market is primarily governed by countries such as Germany, the UK, and other Nordic countries. Europe is also home to major in-wheel motor manufacturers, thereby supporting the market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

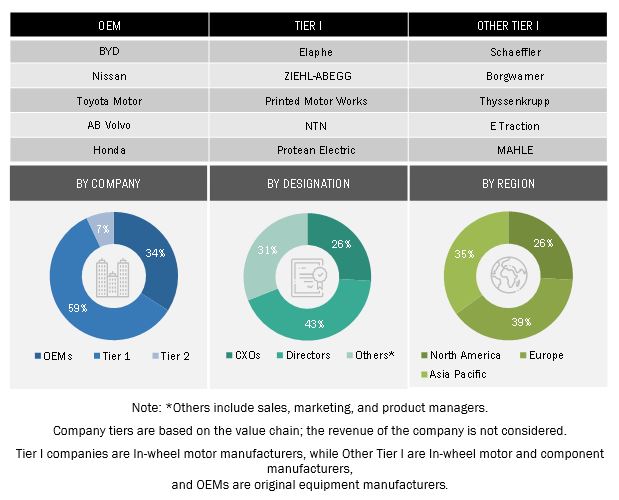

The in-wheel motor market ecosystem consists of in-wheel motor manufacturers such as Protean Electric (US), Elaphe (Slovenia), ZIEHL-ABEGG (Germany), Printed Motor Works (UK), and NTN (Japan). The ecosystem also covers various OEMs such as Tesla (US), Nissan Motor Corporation (Japan), BYD (China), BMW (Germany), and Volkswagen (Germany).

Scope of the report

|

Report Attributes |

Details |

|

Market size value in 2021: |

USD 808 million |

|

Projected to reach by 2026: |

USD 4,395 million |

|

CAGR: |

40.3% |

|

Base Year Considered: |

2020 |

|

Forecast Period: |

2021-2026 |

|

Largest Market: |

Asia Pacific |

|

Region Covered: |

North America, Asia Pacific, and Europe |

|

Segments Covered: |

Vehicle Type, Motor Type, Cooling Type, Propulsion Type, Power Output, Vehicle Class, Motor Weight, and Component and Region |

|

Companies Covered: |

Protean Electric (UK), Elaphe Ltd. (Slovenia), Printed Motor Works (UK), ZIEHL-ABEGG (Germany), NTN Corporation (Japan), and Schaeffler (Germany). A total of 25 major company profiles covered and provided. |

This research report categorizes the in-wheel motor market based on Vehicle Type, Motor Type, Cooling Type, Propulsion Type, Power Output, Vehicle Class, Motor Weight, Component, and Region.

By Propulsion

- BEV

- FCEV

- HEV

- PHEV

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Motor Type

- Axial Flux Motor

- Radial Flux Motor

By Cooling Type

- Air-cooled

- Liquid-cooled

By Power Output Type

- Up to 60 KW

- 60–90 KW

- Above 90 KW

By Vehicle Class

- Mid-priced

- Luxury

By Motor Weight

- Less than 20 Kg

- 20-30 Kg

- Above 30 Kg

By Region

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

-

Europe

- France

- Germany

- Spain

- UK

- Sweden

- The Netherlands

- Norway

Recent Developments

- In June 2021, Local Motors and Protean Electric extended their long-standing partnership, inking a further three-year deal valued at USD 7.3 million. Under the extended partnership, Protean Electric will deliver its ProteanDrive in-wheel motors for Olli 2.0, the electric autonomous shuttles by Local Motors.

- In June 2019, NEVS acquired UK-based automotive technology firm Protean Electric for developing next-generation electric and autonomous vehicles. Protean Electric will continue to act as an independent entity post the acquisition.

- In January 2019, Hanseatische Fahrzeug Manufaktur (HFM) partnered with Elaphe to use in-wheel motors developed by Elaphe for its autonomous electric vehicle platform, “Motionboard”.

- In November 2018, Schaeffler acquired Elmotec Statomat GmbH, one of the world’s leading manufacturers of production machinery for the high-volume construction of electric motors with expertise in the field of winding technology. This acquisition helped Schaeffler expand its expertise in electric motors construction besides driving forward the implementation of its electric mobility strategy.

Frequently Asked Questions (FAQ):

What is the current size of the global in-wheel motor market?

The global in-wheel motor market is estimated to be USD 808 million in 2021 and projected to reach USD 4,395 million by 2026, at a CAGR of 40.3%

Who are the winners in the global in-wheel motor market?

The in-wheel motor market is dominated by companies such as Protean Electric (US), Elaphe (Slovenia), ZIEHL-ABEGG (Germany), Printed Motor Works (UK), and NTN (Japan). These companies are focused on improving the in-wheel motor, in terms of size, design, weight and power output. These companies also adopt expansion strategies, and undertake collaborations, partnerships, and mergers & acquisitions with other participants of EV ecosystem to support the penetration of in-wheel motor and gain prominence in the market.

What are the new market trends impacting the growth of the in-wheel motor market?

Lightweight in-wheel motor, transmission-equipped in-wheel motor, and wireless charging for in-wheel motor some of the major trends affecting this market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 IN-WHEEL MOTOR MARKET SEGMENTATION

1.3.2 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 PACKAGE SIZE

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 2 IN-WHEEL MOTOR MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.1 List of primary participants

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR THE MARKET: BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY FOR THE MARKET: TOP-DOWN APPROACH

FIGURE 9 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF NTN CORPORATION’S IN-WHEEL MOTOR REVENUE ESTIMATION

FIGURE 10 MARKET: RESEARCH DESIGN & METHODOLOGY

FIGURE 11 CAGR PROJECTIONS: FACTOR ANALYSIS

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 12 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.5.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY-SIDE

2.6 ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 13 IN-WHEEL MOTOR: MARKET OVERVIEW

FIGURE 14 IN-WHEEL MOTOR MARKET, BY REGION, 2021–2026 (UNITS)

FIGURE 15 MARKET, BY REGION, 2021–2026

FIGURE 16 MARKET, BY MOTOR TYPE, 2021 VS. 2026 (UNITS)

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE GLOBAL OPPORTUNITIES IN THE IN-WHEEL MOTOR MARKET

FIGURE 17 GROWING EFFORTS TOWARD IMPROVING PERFORMANCE OF ELECTRIC VEHICLES TO DRIVE THE MARKET

4.2 GLOBAL MARKET, BY POWER OUTPUT

FIGURE 18 UP TO 60 KW SEGMENT EXPECTED TO LEAD THE MARKET

4.3 GLOBAL MARKET, BY MOTOR TYPE

FIGURE 19 RADIAL FLUX MOTOR EXPECTED TO HOLD LARGER MARKET SHARE

4.4 GLOBAL MARKET, BY PROPULSION TYPE

FIGURE 20 BEV EXPECTED TO DOMINATE THE MARKET DURING FORECAST PERIOD

4.5 GLOBAL MARKET, BY VEHICLE TYPE

FIGURE 21 PASSENGER CARS EXPECTED TO LEAD MARKET

4.6 GLOBAL MARKET, BY REGION

FIGURE 22 ASIA PACIFIC ESTIMATED TO HOLD LARGEST SHARE OF MARKET IN 2021 (UNITS)

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 IN-WHEEL MOTOR MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Improved dynamics, increased simplicity, and efficiency of vehicles

5.2.1.2 Reduced weight and provides more space

5.2.1.3 Increase in investments & rise in mergers & acquisitions

5.2.1.4 Increasing penetration of electric vehicles globally

FIGURE 24 GLOBAL EV AND BEV PASSENGER CAR SALES

5.2.2 RESTRAINTS

5.2.2.1 Increase in unsprung weight in wheels

5.2.2.2 Inability to mount on conventional vehicles

5.2.3 OPPORTUNITIES

5.2.3.1 Change in the regulatory environment globally

TABLE 2 CHANGE IN REGULATORY ENVIRONMENT GLOBALLY

5.2.3.2 Rising opportunities for commercial and off-highway electric vehicles

5.2.3.3 Rising trend of autonomous technology in vehicles

TABLE 3 AUTONOMOUS VEHICLE DEVELOPMENTS

5.2.4 CHALLENGES

5.2.4.1 High costs

5.2.4.2 Complexity in controlling individual wheel speed

5.2.4.3 Rise in incidents of failure

TABLE 4 IMPACT OF MARKET DYNAMICS ON IN-WHEEL MOTOR MARKET

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS: CONSISTENT EFFORTS FOR PRODUCT IMPROVEMENT INCREASES THE DEGREE OF COMPETITION

TABLE 5 MARKET: IMPACT OF PORTERS FIVE FORCES

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 RIVALRY AMONG EXISTING COMPETITORS

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 26 MARKET: SUPPLY CHAIN ANALYSIS

5.4.1 IN-WHEEL MOTOR MANUFACTURERS

5.4.2 COMPONENT MANUFACTURERS

5.4.3 OEMS

5.5 ECOSYSTEM

FIGURE 27 MARKET: ECOSYSTEM

TABLE 6 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.6 TECHNOLOGY ANALYSIS

5.6.1 INTRODUCTION

5.6.2 IN-WHEEL MOTOR WITH 360 DEGREE STEERING

FIGURE 28 360-DEGREE CORNER MODULE

5.6.3 IN-WHEEL MODULAR PLATFORM WITH SOFTWARE INTEGRATION

5.6.4 INDEPENDENT WHEEL TORQUE CONTROL

5.7 PRICING ANALYSIS

FIGURE 29 MARKET: APPROXIMATE PRICE OF MOTORS BY YEAR

FIGURE 30 EV POWERTRAIN COST BREAKDOWN IN 2025 (ESTIMATE)

5.8 PATENT ANALYSIS

5.9 CASE STUDIES

5.9.1 ELECTRIC PICK-UP TRUCKS EQUIPPED WITH IN-WHEEL MOTORS BY LORDSTOWN MOTORS

5.9.2 ELAPHE’S L1500 IN-WHEEL MOTORS

5.9.3 LEXUS LF-30 CONCEPT CAR WITH IN-WHEEL MOTOR

5.9.4 NISSAN BLADEGLIDER EQUIPPED WITH TWO IN-WHEEL MOTORS

5.10 COVID-19 HEALTH ASSESSMENT

FIGURE 31 COVID-19: GLOBAL PROPAGATION

FIGURE 32 COVID-19 PROPAGATION: SELECT COUNTRIES

5.11 COVID-19 ECONOMIC ASSESSMENT

FIGURE 33 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.11.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 34 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 35 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

5.12 MARKET: COVID-19 IMPACT

5.12.1 IMPACT ON RAW MATERIAL SUPPLY

5.12.2 IMPACT ON EV DEMAND

5.12.3 OEM ANNOUNCEMENTS

TABLE 7 OEM ANNOUNCEMENTS

5.13 MARKET SCENARIO ANALYSIS

FIGURE 36 IMPACT OF COVID-19 ON MARKET

5.13.1 MARKET - MOST LIKELY SCENARIO

TABLE 8 MARKET (MOST LIKELY SCENARIO), BY REGION, 2021–2026 (UNITS)

5.13.2 MARKET - OPTIMISTIC SCENARIO

TABLE 9 MARKET (OPTIMISTIC), BY REGION, 2021–2026 (UNITS)

5.13.3 MARKET – PESSIMISTIC SCENARIO

TABLE 10 MARKET (PESSIMISTIC), BY REGION, 2021–2026 (UNITS)

5.14 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 37 KEY FUTURE TRENDS/DISRUPTIONS EXPECTED TO IMPACT THE MARKET

6 IN-WHEEL MOTOR MARKET, BY COMPONENT (Page No. - 78)

6.1 INTRODUCTION

6.2 SUSPENSION

6.3 ROTOR AND STATOR

6.4 WHEEL BEARINGS

6.5 REGENERATIVE BRAKING SYSTEM

7 IN-WHEEL MOTOR MARKET, BY MOTOR WEIGHT (Page No. - 79)

7.1 INTRODUCTION

7.2 OPERATIONAL DATA

7.3 LESS THAN 20 KG

7.4 20-30 KG

7.5 ABOVE 30 KG

8 IN-WHEEL MOTOR MARKET, BY COOLING TYPE (Page No. - 81)

8.1 INTRODUCTION

TABLE 11 GLOBAL MARKET, BY COOLING TYPE, 2018–2020 (UNITS)

TABLE 12 GLOBAL MARKET, BY COOLING TYPE, 2021–2026 (UNITS)

FIGURE 38 LIQUID-COOLED IN-WHEEL MOTOR SEGMENT IS EXPECTED TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

8.2 OPERATIONAL DATA

TABLE 13 IN-WHEEL MOTOR OFFERING, BY COOLING TYPE

8.3 ASSUMPTIONS

TABLE 14 ASSUMPTIONS: BY COOLING TYPE

8.4 RESEARCH METHODOLOGY

8.5 AIR-COOLED IN-WHEEL MOTOR

8.5.1 ANTICIPATED GROWTH IN LOW POWERED COMPACT EVS TO DRIVE THE AIR-COOLED IN-WHEEL MOTOR SEGMENT

TABLE 15 AIR-COOLED: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 16 AIR-COOLED: MARKET, BY REGION, 2021–2026 (UNITS)

8.6 LIQUID-COOLED IN-WHEEL MOTOR

8.6.1 CONSISTENT IMPROVEMENT IN EV POWER EXPECTED TO BOOST THE GROWTH OF LIQUID-COOLED IN-WHEEL MOTORS

TABLE 17 LIQUID-COOLED: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 18 LIQUID-COOLED: MARKET, BY REGION, 2021–2026 (UNITS)

8.7 KEY PRIMARY INSIGHTS

9 IN-WHEEL MOTOR MARKET, BY MOTOR TYPE (Page No. - 88)

9.1 INTRODUCTION

TABLE 19 GLOBAL MARKET, BY MOTOR TYPE, 2018–2020 (UNITS)

TABLE 20 GLOBAL MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

FIGURE 39 RADIAL FLUX MOTOR EXPECTED TO LEAD THE MARKET DURING THE FORECAST PERIOD

9.2 OPERATIONAL DATA

TABLE 21 IN-WHEEL MOTOR TYPES

9.3 ASSUMPTIONS

TABLE 22 ASSUMPTIONS: BY MOTOR TYPE

9.4 RESEARCH METHODOLOGY

9.5 AXIAL FLUX MOTOR

9.5.1 AXIAL FLUX MOTOR SEGMENT TO BE DRIVEN BY GROWING INCLINATION TOWARD COMPACT EVS

TABLE 23 AXIAL FLUX: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 24 AXIAL FLUX: MARKET, BY REGION, 2021–2026 (UNITS)

9.6 RADIAL FLUX MOTOR

9.6.1 RADIAL FLUX IN-WHEEL MOTORS TO REMAIN A LARGER SEGMENT DUE TO THEIR HIGHER EFFICIENCY

TABLE 25 RADIAL FLUX: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 26 RADIAL FLUX: MARKET, BY REGION, 2021–2026 (UNITS)

9.7 KEY PRIMARY INSIGHTS

10 IN-WHEEL MOTOR MARKET, BY POWER OUTPUT (Page No. - 94)

10.1 INTRODUCTION

TABLE 27 GLOBAL MARKET, BY POWER OUTPUT, 2018–2020 (UNITS)

TABLE 28 GLOBAL MARKET, BY POWER OUTPUT, 2021–2026 (UNITS)

FIGURE 40 IN-WHEEL MOTORS HAVING POWER OUTPUT UP TO 60 KW EXPECTED TO BE THE LARGEST SEGMENT FROM 2021–2026

10.2 OPERATIONAL DATA

10.3 ASSUMPTIONS

TABLE 29 ASSUMPTIONS: BY POWER OUTPUT

10.4 RESEARCH METHODOLOGY

10.5 UP TO 60 KW

10.5.1 AVAILABILITY OF A LARGE NUMBER OF VEHICLES WITH POWER OUTPUT UP TO 60 KW DRIVE THIS SEGMENT

TABLE 30 UP TO 60 KW: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 31 UP TO 60 KW: MARKET, BY REGION, 2021–2026 (UNITS)

10.6 60-90 KW

10.6.1 ELECTRIC BUSES AND PICK-UP TRUCKS TO EMERGE AS PROMISING APPLICATIONS OF 60-90 KW MOTORS

TABLE 32 60-90 KW: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 33 60-90 KW: MARKET, BY REGION, 2021–2026 (UNITS)

10.7 ABOVE 90 KW

10.7.1 INCREASING DEVELOPMENT OF HIGH-PERFORMANCE ELECTRIC VEHICLES WILL BOOST THE SEGMENT

TABLE 34 ABOVE 90 KW: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 35 ABOVE 90 KW: MARKET, BY REGION, 2021–2026 (UNITS)

10.8 KEY PRIMARY INSIGHTS

11 IN-WHEEL MOTOR MARKET, BY PROPULSION TYPE (Page No. - 101)

11.1 INTRODUCTION

TABLE 36 GLOBAL MARKET, BY PROPULSION TYPE, 2018–2020 (UNITS)

TABLE 37 GLOBAL MARKET, BY PROPULSION TYPE, 2021–2026 (UNITS)

FIGURE 41 BEV SEGMENT IS EXPECTED TO LEAD MARKET FROM 2021–2026

11.2 OPERATIONAL DATA

TABLE 38 POPULAR EVS ACROSS THE WORLD: UNIT SALES, 2020

11.3 ASSUMPTIONS

TABLE 39 ASSUMPTIONS: BY PROPULSION TYPE

11.4 RESEARCH METHODOLOGY

11.5 BATTERY ELECTRIC VEHICLE (BEV)

11.5.1 HIGH BEV SALES WORLDWIDE TO SUPPORT THE GROWTH OF THIS SEGMENT

TABLE 40 BEV: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 41 BEV: MARKET, BY REGION, 2021–2026 (UNITS)

11.6 FUEL CELL ELECTRIC VEHICLE (FCEV)

11.6.1 GROWING GOVERNMENT INITIATIVES TOWARD FUEL CELL DEVELOPMENT EXPECTED TO BOOST DEMAND

TABLE 42 FCEV: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 43 FCEV: MARKET, BY REGION, 2021–2026 (UNITS)

11.7 HYBRID ELECTRIC VEHICLE (HEV)

11.7.1 HIGHER EFFICIENCY & RELIABILITY OF HEVS DRIVE THEIR DEMAND

TABLE 44 HEV: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 45 HEV: MARKET, BY REGION, 2021–2026 (UNITS)

11.8 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

11.8.1 HIGH ELECTRIC RANGE OF PHEVS WILL DRIVE THE MARKET SIGNIFICANTLY

TABLE 46 PHEV: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 47 PHEV: MARKET, BY REGION, 2021–2026 (UNITS)

11.9 KEY PRIMARY INSIGHTS

12 IN-WHEEL MOTOR MARKET, BY VEHICLE TYPE (Page No. - 111)

12.1 INTRODUCTION

TABLE 48 GLOBAL MARKET, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 49 GLOBAL MARKET, BY VEHICLE TYPE, 2021–2026 (UNITS)

TABLE 50 GLOBAL MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 51 GLOBAL MARKET, BY VEHICLE TYPE, 2021–2026 (USD MILLION)

FIGURE 42 PASSENGER CARS SEGMENT EXPECTED TO LEAD THE MARKET FOR IN-WHEEL MOTORS DURING FORECAST PERIOD

12.2 OPERATIONAL DATA

TABLE 52 EUROPE: ELECTRIC VEHICLE SALES, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 53 ASIA PACIFIC: ELECTRIC VEHICLE SALES, BY VEHICLE TYPE, 2018–2020 (UNITS)

TABLE 54 NORTH AMERICA: ELECTRIC VEHICLE SALES, BY VEHICLE TYPE, 2018–2020 (UNITS)

12.3 ASSUMPTIONS

TABLE 55 ASSUMPTIONS: VEHICLE TYPE

12.4 RESEARCH METHODOLOGY

12.5 PASSENGER CARS (PC)

12.5.1 HIGH PASSENGER CAR SALES WORLDWIDE TO ENSURE THE DOMINANCE OF THIS SEGMENT

TABLE 56 PASSENGER CARS: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 57 PASSENGER CARS: MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 58 PASSENGER CARS: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 59 PASSENGER CARS: MARKET, BY REGION, 2021–2026 (USD MILLION)

12.6 COMMERCIAL VEHICLES (CV)

12.6.1 HIGHER PENETRATION OF IN-WHEEL MOTORS IN COMMERCIAL VEHICLES TO DRIVE THE SEGMENT GROWTH

TABLE 60 COMMERCIAL VEHICLES: MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 61 COMMERCIAL VEHICLES: MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 62 COMMERCIAL VEHICLES: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 63 COMMERCIAL VEHICLES: MARKET, BY REGION, 2021–2026 (USD MILLION)

12.7 KEY PRIMARY INSIGHTS

13 IN-WHEEL MOTOR MARKET, BY VEHICLE CLASS (Page No. - 119)

13.1 INTRODUCTION

TABLE 64 GLOBAL MARKET, BY VEHICLE CLASS, 2018–2020 (UNITS)

TABLE 65 GLOBAL MARKET, BY VEHICLE CLASS, 2021–2026 (UNITS)

FIGURE 43 MID-PRICED SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

13.2 OPERATIONAL DATA

TABLE 66 POPULAR EVS ACROSS THE WORLD, BY VEHICLE CLASS

13.3 ASSUMPTIONS

TABLE 67 ASSUMPTIONS: BY VEHICLE CLASS

13.4 RESEARCH METHODOLOGY

13.5 MID-PRICED

13.6 LUXURY

13.7 KEY PRIMARY INSIGHTS

14 IN-WHEEL MOTOR MARKET, BY REGION (Page No. - 124)

14.1 INTRODUCTION

FIGURE 44 GLOBAL MARKET, BY REGION, 2021 VS. 2026

TABLE 68 GLOBAL MARKET, BY REGION, 2018–2020 (UNITS)

TABLE 69 GLOBAL MARKET, BY REGION, 2021–2026 (UNITS)

TABLE 70 GLOBAL MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 71 GLOBAL MARKET, BY REGION, 2021–2026 (USD MILLION)

14.2 ASIA PACIFIC

FIGURE 45 CHINA EXPECTED TO LEAD MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

TABLE 72 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 73 ASIA PACIFIC MARKET, BY COUNTRY, 2021–2026 (UNITS)

TABLE 74 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

14.2.1 CHINA

14.2.1.1 High adoption of EVs and focused electrification of public transport to boost the market growth in China

TABLE 76 CHINA: MARKET, BY MOTOR TYPE, 2018–2020 (UNITS)

TABLE 77 CHINA: MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

14.2.2 INDIA

14.2.2.1 Change in the regulatory environment and fall in EV costs to push the growth of this market in India

TABLE 78 INDIA: MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

14.2.3 JAPAN

14.2.3.1 Japan to experience growth of market with an increase in the sale of electric vehicles

TABLE 79 JAPAN: MARKET, BY MOTOR TYPE, 2018–2020 (UNITS)

TABLE 80 JAPAN: MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

14.2.4 SOUTH KOREA

14.2.4.1 South Korea to experience growth of market with rise in the sale of HEVs

TABLE 81 SOUTH KOREA: MARKET, BY MOTOR TYPE, 2018–2020 (UNITS)

TABLE 82 SOUTH KOREA: MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

14.3 EUROPE

FIGURE 46 GERMANY EXPECTED TO LEAD MARKET IN EUROPE DURING FORECAST PERIOD

TABLE 83 EUROPE: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 84 EUROPE: MARKET, BY COUNTRY, 2021–2026 (UNITS)

TABLE 85 EUROPE: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

14.3.1 FRANCE

14.3.1.1 Government offering purchase grants projected to boost market

TABLE 87 FRANCE: MARKET, BY MOTOR TYPE, 2018–2020 (UNITS)

TABLE 88 FRANCE: MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

14.3.2 GERMANY

14.3.2.1 Rising sales of hybrid vehicles by domestic players expected to drive the market

TABLE 89 GERMANY: MARKET, BY MOTOR TYPE, 2018–2020 (UNITS)

TABLE 90 GERMANY: MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

14.3.3 SPAIN

14.3.3.1 Improvement in the EV infrastructure to boost the market

TABLE 91 SPAIN: MARKET, BY MOTOR TYPE, 2018–2020 (UNITS)

TABLE 92 SPAIN: MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

14.3.4 THE NETHERLANDS

14.3.4.1 Government focus towards greener vehicles to drive the market

TABLE 93 NETHERLANDS: MARKET, BY MOTOR TYPE, 2018–2020 (UNITS)

TABLE 94 NETHERLANDS: MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

14.3.5 NORWAY

14.3.5.1 Emergence of e-mobility and high EV adoption rate to boost demand

TABLE 95 NORWAY: MARKET, BY MOTOR TYPE, 2018–2020 (UNITS)

TABLE 96 NORWAY: MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

14.3.6 SWEDEN

14.3.6.1 Government incentives and subsidies to drive the market

TABLE 97 SWEDEN: MARKET, BY MOTOR TYPE, 2018–2020 (UNITS)

TABLE 98 SWEDEN: MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

14.3.7 UK

14.3.7.1 Investments in ultra-low emission vehicles will boost the demand for in-wheel motors

TABLE 99 UK: MARKET, BY MOTOR TYPE, 2018–2020 (UNITS)

TABLE 100 UK: MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

14.4 NORTH AMERICA

TABLE 101 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (UNITS)

TABLE 102 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (UNITS)

TABLE 103 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

14.4.1 CANADA

14.4.1.1 Increasing development in electric vehicle infrastructure is expected to boost the market

TABLE 105 CANADA: MARKET, BY MOTOR TYPE, 2018–2020 (UNITS)

TABLE 106 CANADA: MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

14.4.2 US

14.4.2.1 Robust growth of the EV market will fuel the demand for in-wheel motors

TABLE 107 US: MARKET, BY MOTOR TYPE, 2018–2020 (UNITS)

TABLE 108 US: MARKET, BY MOTOR TYPE, 2021–2026 (UNITS)

15 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 145)

15.1 ASIA PACIFIC IS THE KEY MARKET FOR IN-WHEEL MOTORS

15.2 UP TO 60 KW TO REMAIN THE MOST LUCRATIVE SEGMENT FOR IN-WHEEL MOTORS

15.3 CONCLUSION

16 COMPETITIVE LANDSCAPE (Page No. - 146)

16.1 OVERVIEW

FIGURE 47 KEY DEVELOPMENTS BY LEADING PLAYERS IN IN-WHEEL MOTOR MARKET FROM 2018–2021

16.2 MARKET RANKING ANALYSIS

FIGURE 48 IN-WHEEL MOTOR: MARKET RANKING ANALYSIS

16.3 COMPETITIVE SCENARIO

16.3.1 NEW PRODUCT LAUNCHES

TABLE 109 NEW PRODUCT LAUNCHES, 2018–2021

16.3.2 DEALS

TABLE 110 DEALS, 2018–2021

16.3.3 OTHERS

TABLE 111 OTHERS, 2018–2021

16.4 COMPANY EVALUATION QUADRANT

16.4.1 STARS

16.4.2 EMERGING LEADERS

16.4.3 PERVASIVE

16.4.4 PARTICIPANTS

FIGURE 49 IN-WHEEL MOTOR MARKET: COMPANY EVALUATION QUADRANT, 2020

TABLE 112 IN-WHEEL MOTOR MARKET: COMPANY FOOTPRINT, 2020

TABLE 113 IN-WHEEL MOTOR MARKET: REGION FOOTPRINT, 2020

TABLE 114 COMPANY VEHICLE TYPE FOOTPRINT (7 COMPANIES)

16.5 WINNERS VS. TAIL-ENDERS

TABLE 115 WINNERS VS. TAIL-ENDERS

17 COMPANY PROFILES (Page No. - 155)

(Overview, Product offerings, Recent developments & MnM View)*

17.1 KEY COMPANIES

17.1.1 NEVS (PROTEAN ELECTRIC)

TABLE 116 NEVS: BUSINESS OVERVIEW

TABLE 117 NEVS: PRODUCTS OFFERED

TABLE 118 NEVS: DEALS

TABLE 119 NEVS: OTHERS

17.1.2 PRINTED MOTOR WORKS

TABLE 120 PRINTED MOTOR WORKS: BUSINESS OVERVIEW

TABLE 121 PRINTED MOTOR WORKS: PRODUCTS OFFERED

TABLE 122 PRINTED MOTOR WORKS: NEW PRODUCT DEVELOPMENTS

17.1.3 ZIEHL-ABEGG

TABLE 123 ZIEHL-ABEGG: BUSINESS OVERVIEW

TABLE 124 ZIEHL-ABEGG: PRODUCTS OFFERED

TABLE 125 ZIEHL- ABEGG: OTHERS

17.1.4 ELAPHE

TABLE 126 ELAPHE: BUSINESS OVERVIEW

TABLE 127 ELAPHE: PRODUCTS OFFERED

TABLE 128 ELAPHE: PRODUCT LAUNCHES

TABLE 129 ELAPHE: DEALS

17.1.5 SCHAEFFLER

TABLE 130 SCHAEFFLER: BUSINESS OVERVIEW

FIGURE 50 SCHAEFFLER: COMPANY SNAPSHOT

TABLE 131 SCHAEFFLER: PRODUCTS OFFERED

TABLE 132 SCHAEFFLER: DEALS

17.1.6 NSK LTD.

TABLE 133 NSK LTD: BUSINESS OVERVIEW

FIGURE 51 NSK LTD.: COMPANY SNAPSHOT

TABLE 134 NSK: PRODUCTS OFFERED

TABLE 135 NSK: PRODUCT LAUNCHES

17.1.7 ECOMOVE

TABLE 136 ECOMOVE: BUSINESS OVERVIEW

TABLE 137 ECOMOVE: PRODUCTS OFFERED

17.1.8 TAJIMA EV

TABLE 138 TAJIMA EV: BUSINESS OVERVIEW

17.1.9 YASA

TABLE 139 YASA: BUSINESS OVERVIEW

TABLE 140 YASA: PRODUCTS OFFERED

17.1.10 NTN

TABLE 141 NTN: BUSINESS OVERVIEW

FIGURE 52 NTN: COMPANY SNAPSHOT

TABLE 142 NTN: PRODUCTS OFFERED

TABLE 143 NTN: PRODUCT LAUNCHES

TABLE 144 NTN: DEALS

17.1.11 E-TRACTION

TABLE 145 E-TRACTION: BUSINESS OVERVIEW

TABLE 146 E-TRACTION: PRODUCTS OFFERED

17.1.12 TM4

TABLE 147 TM4: BUSINESS OVERVIEW

TABLE 148 TM4: PRODUCTS OFFERED

17.1.13 GEMMOTORS

TABLE 149 GEMMOTORS: BUSINESS OVERVIEW

TABLE 150 GEMMOTORS: PRODUCTS OFFERED

*Details on Overview, Product offerings, Recent developments & MnM View might not be captured in case of unlisted companies.

17.2 OTHER KEY PLAYERS

17.2.1 GENERAL MOTORS

TABLE 151 GENERAL MOTORS: BUSINESS OVERVIEW

17.2.2 TESLA

TABLE 152 TESLA: BUSINESS OVERVIEW

17.2.3 FORD MOTOR COMPANY

TABLE 153 FORD MOTOR COMPANY: BUSINESS OVERVIEW

17.2.4 VOLKSWAGEN

TABLE 154 VOLKSWAGEN: BUSINESS OVERVIEW

17.2.5 BMW

TABLE 155 BMW: BUSINESS OVERVIEW

17.2.6 DAIMLER

TABLE 156 DAIMLER AG: BUSINESS OVERVIEW

17.2.7 VOLVO

TABLE 157 VOLVO: BUSINESS OVERVIEW

17.2.8 MITSUBISHI MOTORS

TABLE 158 MITSUBISHI MOTORS: BUSINESS OVERVIEW

17.2.9 TOYOTA

TABLE 159 TOYOTA: BUSINESS OVERVIEW

17.2.10 HONDA

TABLE 160 HONDA: BUSINESS OVERVIEW

17.2.11 HYUNDAI

TABLE 161 HYUNDAI: BUSINESS OVERVIEW

17.2.12 NISSAN

TABLE 162 NISSAN: BUSINESS OVERVIEW

18 APPENDIX (Page No. - 184)

18.1 KEY INSIGHTS OF INDUSTRY EXPERTS

18.2 DISCUSSION GUIDE

18.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.4 AVAILABLE CUSTOMIZATIONS

18.5 RELATED REPORTS

18.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the in-wheel motor market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications. Some of the secondary sources referred include the European Alternative Fuel Observatory (EAFO), MarkLines, the Alternative Fuels Data Center (AFDC), corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and automotive associations. Secondary data was collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the In-wheel motor market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand-side [vehicle manufacturers (in terms of component supply), country-level government associations, and trade associations] and supply-side (OEMs and component manufacturers) players across three major regions, namely, North America, Europe, and Asia Pacific. 28% and 72% of primary interviews were conducted from the demand and supply side, respectively. Primary data was collected through questionnaires, e-mails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach including bottom-up and top-down approach was followed to estimate and validate the value of the global in-wheel motor market and other dependent submarkets, as mentioned below:

- Key players in the global market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players as well as interviews with industry experts for detailed market insights.

- All major penetration rates, percentage shares, splits, and breakdowns for the global market were determined by using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the global in-wheel motor market size, in terms of volume (units) and value (USD million)

- To define, describe, and forecast the global market based on motor type, propulsion type, vehicle type, power output, cooling type, component, motor weight, vehicle class, and region

- To segment and forecast the global market size by motor type (Radial Flux Motor and Axial Flux Motor)

- To segment and forecast the global market size by propulsion type (Hybrid Electric Vehicle (HEV), Plug-in Hybrid Electric Vehicle (PHEV), Fuel Cell Electric Vehicle (FCEV), and Battery Electric Vehicle (BEV))

- To segment and forecast the global market size by vehicle type (Passenger Cars and Commercial Vehicles)

- To segment and forecast the market size by power output type (Up to 60 kW, 60–90 kW, and Above 90 kW)

- To segment and forecast the global market size by cooling type (Air-cooled In-wheel Motor and Liquid-cooled In-wheel Motor)

- To segment and forecast the global market size by vehicle class (Mid-priced and Luxury)

- To define and describe the market by motor weight (Less than 20 kg, 20–30 kg, and Above 30 kg)

- To define and describe the global market by component (Suspension, Stator & Rotor, Wheel Bearings, and Regenerative Braking System)

- To forecast the global market size with respect to key regions, namely, North America, Europe, and Asia Pacific

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze recent developments partnerships, product innovations, and mergers & acquisitions in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in line with company-specific needs.

- In-wheel motor market, by vehicle type, at the country-level (For countries covered in the report)

- market, by motor weight, at the region-level (For regions covered in the report)

- market, by vehicle class, at the region-level (For regions covered in the report)

Company information

- Profiles of additional market players (Up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in In-Wheel Motor Market

In wheel motor market report was published in Oct 2021 and it covers the market estimation for In-Wheel Motor by Propulsion / Vehicle Type / Motor / Cooling / Power Output/ Vehicle Class/ Motor Weight for the period 2018-2026 in terms Volume along with detailed competitive landscape with key players Market Share Analysis, Developments of Key Market Players Like There Contracts & Agreements, Investments & Expansions, Joint Venture, Partnerships, And Collaborations and their Business Overview, Products/solutions/services Offered, Recent Developments, SWOT Analysis. It also covered the Market estimations of In-Wheel Motor Market in terms of Volume by different Equipment types at regional and country level for the period 2018-2026. Report also includes 1) Market Estimates, CAGRs and Forecasts. 2) Rising demand in the Emerging Markets. 3) Opportunity analysis in market for key stakeholders by identification of high growth segments. 4) Trend analysis and study of drivers and restraints that will affect the global landscape. 5) Key playing fields and burning issues in sector. 6) Market share, contracts & developments, strategies, product innovations of key companies/players. 6) Competition mapping

Who are the top vendors in the In-Wheel Motor Market? What is the competitive scenario among them?