In Vivo Toxicology Market Size, Share & Trends by Product (Animal Models, Reagents & Kits), Test Type (Chronic, Sub-acute), Toxicity Endpoints (Systemic, Immunotoxicity), Testing Facility (Outsourced, In-house), End User (Academic & Research Institute, CROs) & Region - Forecast to 2025

In Vivo Toxicology Market Size, Share & Trends

The global in vivo toxicology market in terms of revenue was estimated to be worth $5.0 billion in 2020 and is poised to reach $6.6 billion by 2025, growing at a CAGR of 11.5% from 2020 to 2025. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Key attributing factors contributing to the growth of global market include development of innovative animal models and expanding competition in the in vivo toxicology testing market space. However, stringent laws and regulations pertaining to use of animal models in research is expected to emerge as a key challenge to this market.

In Vivo Toxicology Market Trends

To know about the assumptions considered for the study, download the pdf brochure

In Vivo Toxicology Market Dynamics

Driver: Exclusive in vivo toxicology tests

With the introduction of alternative methods such as in vitro and in silico toxicology testing, several toxicology tests are conducted through laboratory methods. However, certain tests are exclusive to in vivo toxicology testing, such as tests for carcinogenicity, developmental (including teratogenicity in offspring) & reproductive toxicity, mutagenicity, and neurotoxicity.

The growing focus on carcinogenic toxicity tests for drugs is likely to propel the use of animal models for in vivo toxicology testing. According to the Cancer Research Institute, the number of active drugs in development grew by more than 90%, to 3,876 in 2019. Long-term rodent carcinogenicity studies for assessing the carcinogenic potential of drugs in humans are currently being examined.

Similarly, in vivo developmental and reproductive toxicology tests are also mandatory for drugs to pass through regulatory channels. Zebrafish models have been extensively used for developmental toxicology studies due to the ease of identifying toxic effects in the developing embryo of zebrafish models. These exclusive tests for in vivo studies support market growth.

Restraint: Alternatives to animal testing

Development of improved non-animal In vitro models is expected to restrain the growth of in vivo toxicology market. Such models have gained immense traction in toxicology testing across human stem cells, drugs. cell culture models, and high-throughput testing. Additionally, the increasing adoption of alternative toxicology testing solutions expected to limit the demand for animal models.

Challenge: Regulations and laws for the ethical use of animals in research

Implementing laws and regulations for animal protection and welfare has resulted in restrictive practices and bans on animals for different purposes. In the last five years, many countries have banned the use of animals in the cosmetic industry.

Moreover, institutes funded by the National Institutes of Health (NIH) are required to adhere to Public Health Service (PHS) policy and follow the Guide for the Care and Use of Laboratory Animals developed by the Institute for Laboratory Animal Research (ILAR). To increase the chances of funding, research institutes seek accreditation from the Association for the Assessment and Accreditation of Laboratory Animal Care International (AAALAC), a privately funded membership-based organization.

Opportunity: Rising demand for humanized animal models

Humanized animal models are important tools for conducting preclinical research to gain insights into human biology. These models are developed through the engraftment of human cells or tissues, leading to the expression of human proteins in animals.

Humanized mice are increasingly being used as models for biomedical research applications, such as cancer, infectious diseases, HIV/AIDS, regenerative medicine, and hepatitis. In March 2019, the National Institute of Allergy and Infectious Diseases (NIAID), an agency of the US Department of Health and Human Services, announced funding for projects to conduct detailed characterization, direct comparisons, and further development of humanized immune system (HIS) mouse models. The need to identify the actual effects of drugs on humans, as well as the growing focus on studying human-specific infections, therapies, and immune responses, is promoting the development and use of humanized animal models

By Product, the consumables accounted for the largest share of the in vivo toxicology market

Based on the product, the market is categorized into consumables and instruments Reagents & kits accounted for the largest share of the consumables segment. Wide use of immunoassays for antibody analysis in biological samples is the key attributive factor to the segment growth. Rapid immunoassay (RIA) is an emerging technique that quantifies antigen concentration. Advantages associated with this technique such as, easy automation, high senstitvity, and enhanced signal detection is expected to fuel its adoption in the future.

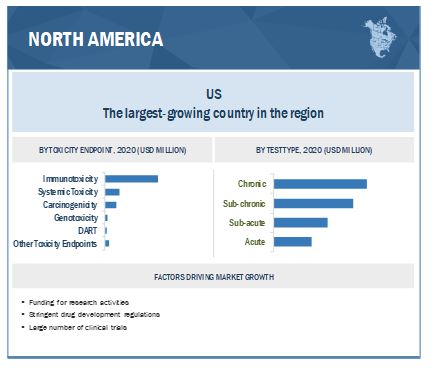

By toxicity endpoint, the immunotoxicity segment accounted for the largest share of the in vivo toxicology market

Based on toxicity endpoint, the global market is segmented into systemic toxicity, immunotoxicity, genotoxicity, carcinogenicity, developmental & reproductive toxicity (DART), and other toxicity endpoints. Immunotoxicity a result of the adverse effects arising from the immune system functions caused due to excessive drug exposure, biologics, or exposure to chemical compunds. Exposure to benzene, asbestos, and halogenated aromatic hydrocarbons may lead to immunosuppression in humans.

By test type, chronic toxicity testing segment accounted for the largest share of the in vivo toxicology market

Based on test type, the global market is segmented into chronic, sub-chronic, acute, and sub-acute test type. Chronic toxicity tests are carried out with a minimum of one rodent and one non-rodent species. The test compound is administered over more than 90 days, and the animals are observed periodically. A chronic toxicology study provides inferences about the long-term effect of a test substance in animals, and it may be extrapolated to the human safety of the test substance. Hence, drugs used for longer-duration therapy such as chemotherapeutic agents, anti-cancer, anti-convulsive, anti-hypertensives and anti-arthritis require chronic toxicity testing further driving the segment growth.

By testing facility, outsourced testing facilities segment accounted for the largest share of the in vivo toxicology market

Based on the testing facility, the global market is segmented into outsourced testing facilities and in-house testing facilities. The outsourced testing facilities segment accounted for the largest market share in 2020 and is expected to maintain its dominance throughout the forecast period. High focus on cost curtailment and increasing need to access skilled labor boost the segment growth.

By end user, academic and research institutes segment accounted for the largest share of the in vivo toxicology market

Based on the end user, the global market has been broadly segmented into pharmaceutical & biotechnology companies, academic & research institutes, contract research organizations, and other end users. As per an article published in 2019, the number of partnerships amongst academic and corporate institutions has increased significantly from 2016-2019 and this trend is set to continue in the near future. More than 90% of the research papers published by key entities were in collaboration with academic/research institutes and or government labs.

North America accounted for the largest share of the in vivo toxicology market in 2020

North America, includes the US and Canada, accounted for the highest market share in the in vivo toxicology market. High demand for personalized medicines is the key driving factor of the North America market. Additioally, the expansion of the stem cell research sector in Canada, which is primarily driven by large-scale investments due to the implementation of the Canadian Stem Cell Strategy and Action Plan is another contributing factor to the North America market. In 2020, a grant of USD 675,000 to the Stem Cell Network for developinga potential cell therapy against SARS-CoV-2 infection.

Key Market Players

The major players operating in this market are by Charles River Laboratories (US), The Jackson Laboratory (US), Envigo (US), Taconic Biosciences, Inc. (US), and JANVIER LABS (France), Thermo Fisher Scientific (US), Danaher Corporation (US), Waters Corporation (US), Agilent Technologies (US), Shimadzu Corporation (Japan), Bruker Corporation (US), PerkinElmer (US). Other prominent players include Merck KGaA (Germany), GE Healthcare (US), and Bio-Rad Laboratories (US), genOway (France), Cyagen Biosciences (US), GVK BIO (India), PolyGene (Switzerland), Crown Biosciences (US), TransCure bioServices (France), Ozgene Pty Ltd. (Australia), Harbour BioMed (US) among others.

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

Product, Test Type,Toxicity End Point,Testing Facility, End User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Latin America and Middle East & Africa |

|

Companies Covered |

Charles River Laboratories (US), The Jackson Laboratory (US), Envigo (US), Taconic Biosciences, Inc. (US), and JANVIER LABS (France), Thermo Fisher Scientific (US), Danaher Corporation (US), Waters Corporation (US), Agilent Technologies (US), Shimadzu Corporation (Japan), Bruker Corporation (US), PerkinElmer (US). Other prominent players include Merck KGaA (Germany), GE Healthcare (US), and Bio-Rad Laboratories (US), genOway (France), Cyagen Biosciences (US), GVK BIO (India), PolyGene (Switzerland), Crown Biosciences (US), TransCure bioServices (France), Ozgene Pty Ltd. (Australia), Harbour BioMed (US) (Total 23 companies) |

The study categorizes the in vivo toxicology market into the following segments and subsegments:

-

By Product

- Instruments

-

Consumables

- Reagents & Kits

-

Animal Models

- Mice Models

- Rat Models

- Other Animal Models (Guinea Pigs, Hamsters, Rabbits, and Human Primates)

-

By Test Type

- Acute

- Sub-acute

- Sub-chronic

- Chronic test type

-

By Testing facility

- outsourced testing facility

- In-house testing facility

-

By Toxicity End Point

- Immunotoxicity

- Systemic toxicity

- Carcinogenicity

- Genotoxicity

- Developmental & reproductive toxicity (DART)

- Other toxicity endpoints

-

By End User

- Academic and Research Institutes

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Other End Users

-

Company Type

- Tier 1 Pharmaceutical Companies

- Tier 2 Pharmaceutical Companies

- Tier 3 Pharmaceutical Companies

-

By Region

- North America

-

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- The Middle East and Africa

Recent Developments

- In 2020, GenOway acquired exclusive worldwide rights from Merck for its foundational CRISPR/Cas9 portfolio in the rodent field.

- In 2020, Taconic entered into an agreement with the University of Texas Medical Branch to distribute humanized ACE2 mice for COVID-19 research.

- In 2020, The Jackson Laboratory started the production of ACE2 mice to support the research on COVID-19.

- In 2020, Danaher Corporation acquired GE Healthcare’s Life Sciences business.

- In 2020, Thermo Fisher launched Orbitrap Exploris 240 and Orbitrap Exploris 120 mass spectrometers.

- In 2020, Waters Corporation announced the establishment of Immerse Cambridge, a research laboratory in the heart of Cambridge’s Kendall Square. Immerse Cambridge will serve as a strategic, collaborative space in the community, where Waters can partner with academia and research to accelerate the next generation of scientific advancements.

Frequently Asked Questions (FAQ):

What are the growth opportunities in the in vivo toxicology market across major regions in the future?

Increasing demand for personalized medicines and ongoing innovations in animal models provides growth opportunities to in vivo toxicology market

Emerging countries have immense opportunities for the growth and adoption of the in vivo toxicology market. Will this scenario continue during the next five years?

Emerging markets also provide room for innovation. India, in particular, has a large infrastructure, with substantial government and private funding in the country’s pharmaceutical and biotechnology industry. This has resulted in many large pharmaceutical and biotechnology companies establishing state-of-the-art research facilities in China to drive the next breakthrough drug discoveries in conjunction with other Asian countries such as India

Which testing facility holds the largest market share in the in vivo toxicology market?

By testing facility, the outsourced testing facility segment is expected to dominate the market,over the forecast period. The large share of this segment is attributed to the increasing R&D investments and cost-saving strategies of pharmaceutical, biopharmaceutical, and medical devices companies, resulting in increased outsourcing of services to CROs .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 IN VIVO TOXICOLOGY MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 2 BREAKDOWN OF PRIMARIES: IN VIVO TOXICOLOGY MARKET

2.1.3 MARKET DATA ESTIMATION & TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 4 MARKET SIZE ESTIMATION (COMPANY REVENUE ANALYSIS-BASED ESTIMATION)

FIGURE 5 GLOBAL MARKET SIZE (USD MILLION)

FIGURE 6 GLOBAL MARKET: GROWTH RATE OF TOP COMPANIES (2017−2019)

FIGURE 7 GLOBAL MARKET: FINAL CAGR PROJECTIONS (2020−2025)

FIGURE 8 GLOBAL MARKET: CAGR PROJECTIONS FROM THE ANALYSIS OF DEMAND-SIDE DRIVERS AND OPPORTUNITIES

2.3 INDUSTRY INSIGHTS

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 9 IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 10 GLOBAL MARKET, BY TEST TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 11 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 IN VIVO TOXICOLOGY MARKET OVERVIEW

FIGURE 12 INCREASING PHARMACEUTICAL R&D ACTIVITIES TO DRIVE MARKET GROWTH

4.2 GLOBAL MARKET SHARE, BY TOXICITY ENDPOINT, 2020 VS. 2025

FIGURE 13 IMMUNOTOXICITY SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2025

4.3 GLOBAL MARKET, BY TESTING FACILITY, 2020 VS. 2025 (USD MILLION)

FIGURE 14 OUTSOURCED TESTING FACILITIES SEGMENT TO REGISTER THE HIGHEST GROWTH IN THE FORECAST PERIOD

4.4 GLOBAL MARKET SHARE, BY END USER, 2020 VS. 2025

FIGURE 15 ACADEMIC & RESEARCH INSTITUTES ARE THE LARGEST END USERS OF IN VIVO TOXICOLOGY PRODUCTS

5 MARKET OVERVIEW (Page No. - 54)

5.1 MARKET DYNAMICS

FIGURE 16 IN VIVO TOXICOLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Increasing pharmaceutical R&D activities

TABLE 1 R&D INVESTMENTS OF NOTE

5.1.1.2 Innovations in animal models

TABLE 2 INNOVATIVE ANIMAL MODELS DEVELOPED AND LAUNCHED BY PLAYERS

5.1.1.3 Exclusive in vivo toxicology tests

5.1.1.4 Increasing demand for personalized medicine

5.1.2 RESTRAINTS

5.1.2.1 Alternatives to animal testing

5.1.3 OPPORTUNITIES

5.1.3.1 Rising demand for humanized animal models

5.1.4 CHALLENGES

5.1.4.1 Regulations and laws for the ethical use of animals in research

5.2 IMPACT OF COVID-19 ON THE VIVO TOXICOLOGY MARKET

5.3 REGULATORY ASSESSMENT

5.3.1 INTRODUCTION

5.3.2 NORTH AMERICA

5.3.3 EUROPE

5.3.4 CHINA

5.3.5 JAPAN

5.3.6 INDIA

5.3.7 AUSTRALIA

5.3.8 BRAZIL

5.4 PATENT ANALYSIS

5.4.1 TOP EIGHT INSTITUTES WITH THE HIGHEST NO. OF PATENT FILINGS FOR ANIMAL MODELS IN THE LAST 10 YEARS

5.4.2 TOP 20 ACTIVE COUNTRIES IN PATENT FILING (ANIMAL MODELS) IN THE LAST 10 YEARS

5.4.3 FIELD OF STUDY IN PATENT FILING (ANIMAL MODELS) IN THE LAST 10 YEARS

5.5 TRADE ANALYSIS

5.5.1 TRADE ANALYSIS FOR CHROMATOGRAPHY AND ELECTROPHORESIS INSTRUMENTS

TABLE 3 IMPORT DATA FOR ELECTROPHORESIS AND CHROMATOGRAPHY INSTRUMENTS, BY COUNTRY, 2016–2020 (USD THOUSAND)

5.5.2 TRADE ANALYSIS FOR DIAGNOSTIC AND LABORATORY REAGENTS

TABLE 4 IMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2016-2020 (USD THOUSAND)

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 17 DIRECT DISTRIBUTION STRATEGY PREFERRED BY PROMINENT COMPANIES

5.7.1 KEY INFLUENCERS

5.8 VALUE CHAIN ANALYSIS

FIGURE 18 MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASES

5.9 ECOSYSTEM ANALYSIS OF THE IN VIVO TOXICOLOGY MARKET

FIGURE 19 ECOSYSTEM ANALYSIS

6 IN VIVO TOXICOLOGY MARKET, BY PRODUCT (Page No. - 73)

6.1 INTRODUCTION

TABLE 6 GLOBAL MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

6.2 CONSUMABLES

TABLE 7 GLOBAL MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 8 GLOBAL MARKET FOR CONSUMABLES, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 NORTH AMERICA: MARKET FOR CONSUMABLES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 10 EUROPE: MARKET FOR CONSUMABLES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 11 ASIA PACIFIC: MARKET FOR CONSUMABLES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 12 LATIN AMERICA: MARKET FOR CONSUMABLES,BY COUNTRY, 2018–2025 (USD MILLION)

6.2.1 REAGENTS & KITS

6.2.1.1 Reagents & kits hold the largest share of the consumables market

TABLE 13 GLOBAL MARKET FOR REAGENTS & KITS, BY REGION, 2018–2025 (USD MILLION)

TABLE 14 NORTH AMERICA: MARKET FOR REAGENTS & KITS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 15 EUROPE: MARKET FOR REAGENTS & KITS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 16 ASIA PACIFIC: MARKET FOR REAGENTS & KITS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 17 LATIN AMERICA: MARKET FOR REAGENTS & KITS, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.2 ANIMAL MODELS

TABLE 18 IN VIVO TOXICOLOGY MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 19 GLOBAL MARKET FOR ANIMAL MODELS, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 NORTH AMERICA: MARKET FOR ANIMAL MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 21 EUROPE: MARKET FOR ANIMAL MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 22 ASIA PACIFIC: MARKET FOR ANIMAL MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 23 LATIN AMERICA: MARKET FOR ANIMAL MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.2.1 Mice models

6.2.2.1.1 Mice models are widely used in in vivo toxicity testing

TABLE 24 PROMINENT MICE MODELS AVAILABLE IN THE MARKET

TABLE 25 GLOBAL MARKET FOR MICE MODELS, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 NORTH AMERICA: MARKET FOR MICE MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 27 EUROPE: MARKET FOR MICE MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 28 ASIA PACIFIC: MARKET FOR MICE MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 29 LATIN AMERICA: MARKET FOR MICE MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.2.2 Rat models

6.2.2.2.1 Ease of performing surgery on rat models and development of genetically modified rat models drive the market

TABLE 30 IN VIVO TOXICOLOGY MARKET FOR RAT MODELS, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET FOR RAT MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 32 EUROPE: MARKET FOR RAT MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 33 ASIA PACIFIC: MARKET FOR RAT MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 34 LATIN AMERICA: MARKET FOR RAT MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.2.3 Other animal models

TABLE 35 GUINEA PIG AND HAMSTER MODELS: ADVANTAGES AND USAGE

TABLE 36 NON-RODENT ANIMAL MODELS: ADVANTAGES AND USAGE

TABLE 37 GLOBAL MARKET FOR OTHER ANIMAL MODELS, BY REGION, 2018–2025 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET FOR OTHER ANIMAL MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 39 EUROPE: MARKET FOR OTHER ANIMAL MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 40 ASIA PACIFIC: MARKET FOR OTHER ANIMAL MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 41 LATIN AMERICA: MARKET FOR OTHER ANIMAL MODELS, BY COUNTRY, 2018–2025 (USD MILLION)

6.3 INSTRUMENTS

6.3.1 GROWING RESEARCH AND INTRODUCTION OF COMBINATION INSTRUMENTS ARE KEY GROWTH FACTORS

TABLE 42 IN VIVO TOXICOLOGY MARKET FOR INSTRUMENTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET FOR INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 44 EUROPE: MARKET FOR INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 45 ASIA PACIFIC: MARKET FOR INSTRUMENTS,BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 46 LATIN AMERICA: MARKET FOR INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

7 IN VIVO TOXICOLOGY MARKET, BY TEST TYPE (Page No. - 92)

7.1 INTRODUCTION

TABLE 47 GLOBAL MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

7.2 CHRONIC TOXICITY TESTING

7.2.1 CHRONIC TOXICITY TESTING IS ESSENTIAL FOR NEW DRUG ENTITY APPROVALS

TABLE 48 CHRONIC TOXICITY TESTING MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 49 NORTH AMERICA: CHRONIC TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 50 EUROPE: CHRONIC TOXICITY TESTING MARKET, BY COUNTRY,2018–2025 (USD MILLION)

TABLE 51 ASIA PACIFIC: CHRONIC TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 52 LATIN AMERICA: CHRONIC TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.3 SUB-CHRONIC TOXICITY TESTING

7.3.1 SUB-CHRONIC TOXICITY TESTS PROVIDE DATA ON MANY PARAMETERS OF CHRONIC TOXICITY

TABLE 53 SUB-CHRONIC TOXICITY TESTING MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 54 NORTH AMERICA: SUB-CHRONIC TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 EUROPE: SUB-CHRONIC TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 56 ASIA PACIFIC: SUB-CHRONIC TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 57 LATIN AMERICA: SUB-CHRONIC TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.4 SUB-ACUTE TOXICITY TESTING

7.4.1 LONG OBSERVATION REQUIREMENTS AND HIGH ANIMAL SAMPLE SIZES ARE CHALLENGES ASSOCIATED WITH SUB-ACUTE TESTING

TABLE 58 SUB-ACUTE TOXICITY TESTING MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 59 NORTH AMERICA: SUB-ACUTE TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 60 EUROPE: SUB-ACUTE TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 61 ASIA PACIFIC: SUB-ACUTE TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 62 LATIN AMERICA: SUB-ACUTE TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5 ACUTE TOXICITY TESTING

7.5.1 DISADVANTAGES OF ACUTE TOXICITY TESTING HAVE DRIVEN USE OF ALTERNATIVES

TABLE 63 ALTERNATIVE METHODS TO DETERMINE LD50 IN ACUTE TOXICITY TESTING

TABLE 64 ACUTE TOXICITY TESTING MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 65 NORTH AMERICA: ACUTE TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 66 EUROPE: ACUTE TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 67 ASIA PACIFIC: ACUTE TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 68 LATIN AMERICA: ACUTE TOXICITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

8 IN VIVO TOXICOLOGY MARKET, BY TESTING FACILITY (Page No. - 102)

8.1 INTRODUCTION

TABLE 69 GLOBAL MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

8.2 OUTSOURCED TESTING FACILITIES

8.2.1 FOCUS ON COST CURTAILMENT AND NEED TO ACCESS SKILLED LABOR & EXPERTISE HAS BOOSTED OUTSOURCING

TABLE 70 GLOBAL MARKET FOR OUTSOURCED TESTING FACILITIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET FOR OUTSOURCED TESTING FACILITIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 72 EUROPE: MARKET FOR OUTSOURCED TESTING FACILITIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET FOR OUTSOURCED TESTING FACILITIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 74 LATIN AMERICA: MARKET FOR OUTSOURCED TESTING FACILITIES, BY COUNTRY, 2018–2025 (USD MILLION)

8.3 IN-HOUSE TESTING FACILITIES

8.3.1 HIGH COSTS OF IN-HOUSE TESTING RESTRICT MARKET GROWTH

TABLE 75 IN VIVO TOXICOLOGY MARKET FOR IN-HOUSE TESTING FACILITIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET FOR IN-HOUSE TESTING FACILITIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 77 EUROPE: MARKET FOR IN-HOUSE TESTING FACILITIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET FOR IN-HOUSE TESTING FACILITIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 79 LATIN AMERICA: MARKET FOR IN-HOUSE TESTING FACILITIES, BY COUNTRY, 2018–2025 (USD MILLION)

9 IN VIVO TOXICOLOGY MARKET, BY TOXICITY ENDPOINT (Page No. - 109)

9.1 INTRODUCTION

TABLE 80 GLOBAL MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

9.2 IMMUNOTOXICITY

9.2.1 IMMUNOTOXICITY TESTING HOLDS THE LARGEST SHARE OF THE MARKET,BY ENDPOINT

TABLE 81 GLOBAL MARKET FOR IMMUNOTOXICITY, BY REGION, 2018–2025 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET FOR IMMUNOTOXICITY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 83 EUROPE: MARKET FOR IMMUNOTOXICITY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 84 ASIA PACIFIC: MARKET FOR IMMUNOTOXICITY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 85 LATIN AMERICA: MARKET FOR IMMUNOTOXICITY, BY COUNTRY, 2018–2025 (USD MILLION)

9.3 SYSTEMIC TOXICITY

9.3.1 SYSTEMIC TOXICITY HELPS IDENTIFY A RANGE OF PARAMETERS IN PHARMA/BIOLOGIC TESTING

TABLE 86 IN VIVO TOXICOLOGY MARKET FOR SYSTEMIC TOXICITY, BY REGION, 2018–2025 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET FOR SYSTEMIC TOXICITY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 88 EUROPE: MARKET FOR SYSTEMIC TOXICITY,BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET FOR SYSTEMIC TOXICITY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 90 LATIN AMERICA: MARKET FOR SYSTEMIC TOXICITY,BY COUNTRY, 2018–2025 (USD MILLION)

9.4 CARCINOGENICITY

9.4.1 RISING CANCER RESEARCH IS DRIVING THE MARKET FOR CARCINOGENICITY TESTING

TABLE 91 GLOBAL MARKET FOR CARCINOGENICITY, BY REGION, 2018–2025 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET FOR CARCINOGENICITY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 93 EUROPE: MARKET FOR CARCINOGENICITY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET FOR CARCINOGENICITY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 95 LATIN AMERICA: MARKET FOR CARCINOGENICITY, BY COUNTRY, 2018–2025 (USD MILLION)

9.5 GENOTOXICITY

9.5.1 GENOTOXICITY TESTING HELPS ISOLATE MUTATIVE SUBSTANCES

TABLE 96 TYPES OF GENOTOXICITY TESTS

TABLE 97 IN VIVO TOXICOLOGY MARKET FOR GENOTOXICITY, BY REGION, 2018–2025 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET FOR GENOTOXICITY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 99 EUROPE: MARKET FOR GENOTOXICITY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET FOR GENOTOXICITY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 101 LATIN AMERICA: MARKET FOR GENOTOXICITY, BY COUNTRY, 2018–2025 (USD MILLION)

9.6 DEVELOPMENTAL & REPRODUCTIVE TOXICITY

9.6.1 RISING PREVALENCE OF SEXUAL HEALTH & DEVELOPMENTAL ABNORMALITIES DRIVE MARKET GROWTH

TABLE 102 GLOBAL MARKET FOR DART, BY REGION, 2018–2025 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET FOR DART, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 104 EUROPE: MARKET FOR DART, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET FOR DART, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 106 LATIN AMERICA: MARKET FOR DART, BY COUNTRY, 2018–2025 (USD MILLION)

9.7 OTHER TOXICITY ENDPOINTS

TABLE 107 IN VIVO TOXICOLOGY MARKET FOR OTHER TOXICITY ENDPOINTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET FOR OTHER TOXICITY ENDPOINTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 109 EUROPE: MARKET FOR OTHER TOXICITY ENDPOINTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET FOR OTHER TOXICITY ENDPOINTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 111 LATIN AMERICA: MARKET FOR OTHER TOXICITY ENDPOINTS, BY COUNTRY, 2018–2025 (USD MILLION)

10 IN VIVO TOXICOLOGY MARKET, BY END USER (Page No. - 124)

10.1 INTRODUCTION

TABLE 112 IN VIVO TOXICOLOGY MARKET, BY END USER, 2018–2025 (USD MILLION)

10.2 ACADEMIC & RESEARCH INSTITUTES

10.2.1 GROWING PARTNERSHIPS AND HIGH USE OF INSTRUMENTS & CONSUMABLES DRIVE MARKET GROWTH

TABLE 113 GLOBAL MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2018–2025 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 115 EUROPE: MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 117 LATIN AMERICA: MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2018–2025 (USD MILLION)

10.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

10.3.1 GROWING IMPORTANCE OF PRECLINICAL TOXICOLOGY EVALUATION HAS INCREASED DEMAND FOR TESTING, ESPECIALLY IN PHARMA COMPANIES

TABLE 118 IN VIVO TOXICOLOGY MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 120 EUROPE: MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 122 LATIN AMERICA: MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

10.4 CONTRACT RESEARCH ORGANIZATIONS

10.4.1 CONTRACT SERVICES HAVE REGISTERED RISING DEMAND DUE TO INCREASING COSTS OF RESEARCH

TABLE 123 IN VIVO TOXICOLOGY MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 124 NORTH AMERICA: MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 125 EUROPE: MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 127 LATIN AMERICA: MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

10.5 OTHER END USERS

TABLE 128 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET FOR OTHER END USERS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 130 EUROPE: MARKET FOR OTHER END USERS,BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET FOR OTHER END USERS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 132 LATIN AMERICA: MARKET FOR OTHER END USERS,BY COUNTRY, 2018–2025 (USD MILLION)

11 IN VIVO TOXICOLOGY MARKET, BY REGION (Page No. - 135)

11.1 INTRODUCTION

FIGURE 20 IN VIVO TOXICOLOGY MARKET SNAPSHOT

TABLE 133 GLOBAL MARKET, BY REGION, 2018–2025 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 21 NORTH AMERICA: IN VIVO TOXICOLOGY MARKET SNAPSHOT

TABLE 134 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 135 NORTH AMERICA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 136 NORTH AMERICA: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 137 NORTH AMERICA: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 138 NORTH AMERICA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 139 NORTH AMERICA: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 140 NORTH AMERICA: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 141 NORTH AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.1 US

11.2.1.1 Government funding for life sciences research drives the market growth in the US

TABLE 142 US: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 143 US: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 144 US: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 145 US: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 146 US: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 147 US: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 148 US: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Growth in stem cell research activities expected to lead to market expansion

TABLE 149 CANADA: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 150 CANADA: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 151 CANADA: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 152 CANADA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 153 CANADA: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 154 CANADA: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 155 CANADA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3 EUROPE

TABLE 156 EUROPE: IN VIVO TOXICOLOGY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 157 EUROPE: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 158 EUROPE: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 159 EUROPE: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 160 EUROPE: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 161 EUROPE: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 162 EUROPE: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 163 EUROPE: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.1 UK

11.3.1.1 Increasing focus on cancer research in the UK is a key market growth driver

TABLE 164 UK: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 165 UK: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 166 UK: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 167 UK: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 168 UK: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 169 UK: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 170 UK: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.2 GERMANY

11.3.2.1 Germany accounted for the second-largest share of the European market

TABLE 171 GERMANY: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 172 GERMANY: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 173 GERMANY: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 174 GERMANY: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 175 GERMANY: MARKET, BY TOXICITY ENDPOINT,2018–2025 (USD MILLION)

TABLE 176 GERMANY: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 177 GERMANY: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Increased investments in proteomics and genomics to fuel growth of mice models

TABLE 178 FRANCE: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 179 FRANCE: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 180 FRANCE: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 181 FRANCE: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 182 FRANCE: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 183 FRANCE: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 184 FRANCE: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Growth in the biotechnology and pharmaceutical industries to drive market growth

TABLE 185 ITALY: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 186 ITALY: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 187 ITALY: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 188 ITALY: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 189 ITALY: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 190 ITALY: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 191 ITALY: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Short study start-up times and rising R&D expenditure to boost the growth of the Spanish market

TABLE 192 SPAIN: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 193 SPAIN: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 194 SPAIN: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 195 SPAIN: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 196 SPAIN: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 197 SPAIN: MARKET, BY TESTING FACILITY,2018–2025 (USD MILLION)

TABLE 198 SPAIN: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 199 ROE: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 200 ROE: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 201 ROE: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 202 ROE: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 203 ROE: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 204 ROE: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 205 ROE: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 22 ASIA PACIFIC: IN VIVO TOXICOLOGY MARKET SNAPSHOT

TABLE 206 ASIA PACIFIC: MARKET, BY COUNTRY,2018–2025 (USD MILLION)

TABLE 207 ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 208 ASIA PACIFIC: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 209 ASIA PACIFIC: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 210 ASIA PACIFIC: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 211 ASIA PACIFIC: MARKET, BY TOXICITY ENDPOINT,2018–2025 (USD MILLION)

TABLE 212 ASIA PACIFIC: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 213 ASIA PACIFIC: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.1 CHINA

11.4.1.1 International alliances for R&D are driving the market

TABLE 214 CHINA: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 215 CHINA: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 216 CHINA: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 217 CHINA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 218 CHINA: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 219 CHINA: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 220 CHINA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Increasing focus on personalized diagnostics products to support market growth

TABLE 221 JAPAN: IN VIVO TOXICOLOGY MARKET, BY PRODUCT,2018–2025 (USD MILLION)

TABLE 222 JAPAN: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 223 JAPAN: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 224 JAPAN: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 225 JAPAN: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 226 JAPAN: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 227 JAPAN: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Robust growth in the biotech industry in India to boost the market growth

TABLE 228 INDIA: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 229 INDIA: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 230 INDIA: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 231 INDIA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 232 INDIA: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 233 INDIA: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 234 INDIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.4 REST OF ASIA PACIFIC

TABLE 235 ROAPAC: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 236 ROAPAC: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 237 ROAPAC: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 238 ROAPAC: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 239 ROAPAC: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 240 ROAPAC: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 241 ROAPAC: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.5 LATIN AMERICA

TABLE 242 LATIN AMERICA: IN VIVO TOXICOLOGY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 243 LATIN AMERICA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 244 LATIN AMERICA: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 245 LATIN AMERICA: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 246 LATIN AMERICA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 247 LATIN AMERICA: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 248 LATIN AMERICA: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 249 LATIN AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Growing biologics sector in the country to drive the market

TABLE 250 BRAZIL: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 251 BRAZIL: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 252 BRAZIL: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 253 BRAZIL: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 254 BRAZIL: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 255 BRAZIL: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 256 BRAZIL: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.5.2 MEXICO

11.5.2.1 Favorable business environment for market players to support market growth

TABLE 257 MEXICO: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 258 MEXICO: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 259 MEXICO: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 260 MEXICO: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 261 MEXICO: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 262 MEXICO: MARKET, BY TESTING FACILITY,2018–2025 (USD MILLION)

TABLE 263 MEXICO: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.5.3 REST OF LATIN AMERICA

TABLE 264 ROLATAM: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 265 ROLATAM: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 266 ROLATAM: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 267 ROLATAM: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 268 ROLATAM: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 269 ROLATAM: MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 270 ROLATAM: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

11.6.1 INFRASTRUCTURAL DEVELOPMENT TO CONTRIBUTE TO MARKET GROWTH IN THE MEA

TABLE 271 MIDDLE EAST & AFRICA: IN VIVO TOXICOLOGY MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 272 MIDDLE EAST & AFRICA: MARKET FOR CONSUMABLES, BY TYPE, 2018–2025 (USD MILLION)

TABLE 273 MIDDLE EAST & AFRICA: MARKET FOR ANIMAL MODELS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 274 MIDDLE EAST & AFRICA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 275 MIDDLE EAST & AFRICA: MARKET, BY TOXICITY ENDPOINT, 2018–2025 (USD MILLION)

TABLE 276 MIDDLE EAST & AFRICA: IN VIVO TOXICOLOGY MARKET, BY TESTING FACILITY, 2018–2025 (USD MILLION)

TABLE 277 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 194)

12.1 INTRODUCTION

12.2 MARKET SHARE ANALYSIS (2019)

FIGURE 23 IN VIVO TOXICOLOGY MARKET FOR ANIMAL MODELS, BY KEY PLAYER, 2019

12.2.1 ENVIGO (US)

12.3 MARKET RANKING ANALYSIS

FIGURE 24 COMPANY RANKING IN THE IN VIVO TOXICOLOGY INSTRUMENTS MARKET, 2019

12.4 MARKET EVALUATION FRAMEWORK (ANIMAL MODELS)

TABLE 278 MARKET EVALUATION FRAMEWORK: PRODUCT LAUNCHES WAS THE MAJOR STRATEGY ADOPTED BY PLAYERS

12.5 COMPETITIVE SCENARIO

12.5.1 KEY PRODUCT LAUNCHES

12.5.2 KEY ACQUISITIONS

12.5.3 KEY COLLABORATIONS

12.5.4 KEY EXPANSIONS

12.6 MARKET EVALUATION FRAMEWORK (INSTRUMENTS)

12.6.1 KEY MARKET DEVELOPMENTS

12.6.1.1 Product launches

12.6.1.2 Acquisitions

12.6.1.3 Partnerships, collaborations, and agreements

12.6.1.4 Expansions

12.7 COMPANY PRODUCT FOOTPRINT

TABLE 279 PRODUCT PORTFOLIO ANALYSIS: IN VIVO TOXICOLOGY MARKET (ANIMAL MODELS)

12.8 COMPANY GEOGRAPHIC FOOTPRINT

TABLE 280 GEOGRAPHIC REVENUE MIX: IN VIVO TOXICOLOGY MARKET (2019)

12.9 REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 25 REVENUE ANALYSIS: IN VIVO TOXICOLOGY MARKET (2019)

12.10 COMPETITIVE LEADERSHIP MAPPING: IN VIVO TOXICOLOGY MARKET FOR ANIMAL MODELS

12.10.1 STARS

12.10.2 EMERGING LEADERS

12.10.3 PERVASIVE PLAYERS

12.10.4 PARTICIPANTS

FIGURE 26 IN VIVO TOXICOLOGY MARKET FOR ANIMAL MODELS: COMPANY EVALUATION MATRIX, 2019

12.11 COMPETITIVE LEADERSHIP MAPPING: IN VIVO TOXICOLOGY MARKET FOR INSTRUMENTS

12.11.1 STARS

12.11.2 EMERGING LEADERS

12.11.3 PERVASIVE PLAYERS

12.11.4 PARTICIPANTS

FIGURE 27 IN VIVO TOXICOLOGY MARKET FOR INSTRUMENTS: COMPANY EVALUATION MATRIX, 2019

13 COMPANY PROFILES (Page No. - 208)

13.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, MnM View)*

13.1.1 CHARLES RIVER LABORATORIES

TABLE 281 CHARLES RIVER LABORATORIES: BUSINESS OVERVIEW

FIGURE 28 CHARLES RIVER LABORATORIES: COMPANY SNAPSHOT (2019)

13.1.2 THE JACKSON LABORATORY

TABLE 282 THE JACKSON LABORATORY: BUSINESS OVERVIEW

FIGURE 29 THE JACKSON LABORATORY: COMPANY SNAPSHOT (2019)

13.1.3 ENVIGO

TABLE 283 ENVIGO: BUSINESS OVERVIEW

13.1.4 TACONIC BIOSCIENCES

TABLE 284 TACONIC BIOSCIENCES, INC.: BUSINESS OVERVIEW

13.1.5 GENOWAY

TABLE 285 GENOWAY: BUSINESS OVERVIEW

FIGURE 30 GENOWAY: COMPANY SNAPSHOT (2019)

13.1.6 HARBOUR BIOMED

TABLE 286 HARBOUR BIOMED: BUSINESS OVERVIEW

13.1.7 CROWN BIOSCIENCE

TABLE 287 CROWN BIOSCIENCE, INC.: BUSINESS OVERVIEW

13.1.8 TRANSCURE BIOSERVICES

TABLE 288 TRANSCURE BIOSERVICES: BUSINESS OVERVIEW

13.1.9 OZGENE PTY LTD.

TABLE 289 OZGENE PTY LTD.: BUSINESS OVERVIEW

13.1.10 THERMO FISHER SCIENTIFIC

TABLE 290 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

FIGURE 31 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2019)

13.1.11 DANAHER CORPORATION

TABLE 291 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 32 DANAHER CORPORATION: COMPANY SNAPSHOT (2019)

13.1.12 AGILENT TECHNOLOGIES

TABLE 292 AGILENT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 33 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2019)

13.1.13 WATERS CORPORATION

TABLE 293 WATERS CORPORATION: BUSINESS OVERVIEW

FIGURE 34 WATERS CORPORATION: COMPANY SNAPSHOT (2019)

13.1.14 SHIMADZU CORPORATION

TABLE 294 SHIMADZU CORPORATION: BUSINESS OVERVIEW

FIGURE 35 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2019)

13.1.15 BIO-RAD LABORATORIES

TABLE 295 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

FIGURE 36 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2019)

13.1.16 BRUKER CORPORATION

TABLE 296 BRUKER CORPORATION: BUSINESS OVERVIEW

FIGURE 37 BRUKER CORPORATION: COMPANY SNAPSHOT (2019)

13.1.17 PERKINELMER

TABLE 297 PERKINELMER, INC.: BUSINESS OVERVIEW

FIGURE 38 PERKINELMER, INC.: COMPANY SNAPSHOT (2019)

13.2 OTHER PLAYERS

13.2.1 MERCK KGAA

TABLE 298 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 39 MERCK KGAA: COMPANY SNAPSHOT (2019)

13.2.2 GE HEALTHCARE

TABLE 299 GE HEALTHCARE: BUSINESS OVERVIEW

FIGURE 40 GE HEALTHCARE: COMPANY SNAPSHOT (2019)

13.2.3 JANVIER LABS

TABLE 300 JANVIER LABS: BUSINESS OVERVIEW

13.2.4 INGENIOUS TARGETING LABORATORY

TABLE 301 INGENIOUS TARGETING LABORATORY: BUSINESS OVERVIEW

13.2.5 POLYGENE

TABLE 302 POLYGENE: BUSINESS OVERVIEW

13.2.6 GVK BIO

TABLE 303 GVK BIO: BUSINESS OVERVIEW

13.2.7 CYAGEN BIOSCIENCES

TABLE 304 CYAGEN BIOSCIENCES: BUSINESS OVERVIEW

13.2.8 DATA SCIENCES INTERNATIONAL

TABLE 305 DATA SCIENCE INTERNATIONAL: BUSINESS OVERVIEW

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 269)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 RELATED REPORTS

14.4 AUTHOR DETAILS

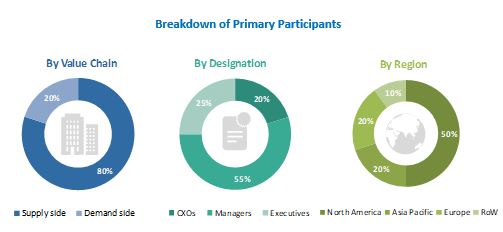

This market research study involved extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the global in vivo toxicology market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the in vivo toxicology market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from the National Institutes of Health (NIH), Centers for Disease Control and Prevention (CDC), US Food and Drug Administration (FDA), World Bank, World Health Organization (WHO), United States Environmental Protection Agency (USEPA), National Institute of Environmental Health Sciences (NIEHS), Association of Assessment and Accreditation of Laboratory Animal Care (AAALAC), Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), Federation of European Toxicologists and European Societies of Toxicology (EUROTOX), Institute of Laboratory Animal Sciences (ILAS), National Council for the Control of Animal Experimentation (CONCEA), Organisation for Economic Co-operation and Development (OECD), and the World Bank. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global in vivo toxicology market, which was validated through primary research

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global in vivo toxicology market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as personnel from pharmaceutical and biopharmaceutical industries) and the supply side (such as C-level and D-level executives, business heads, marketing and sales managers of key manufacturers, and distributors) across five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Approximately 80% and 20% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by product, test type, testing facility, toxicity endpoint, end user,company type, and region).

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Report Objectives

- To define, describe, and measure the global in vivo toxicology market based on product, test type, testing facility, toxicity endpoint, end user, and region

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the global in vivo toxicology market

- To analyze the opportunities in the global in vivo toxicology market for key stakeholders and provide details of the competitive landscape for major market leaders

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America and Middle East & Africa

- To profile the key players and comprehensively analyze their core competencies2 in terms of key developments, product portfolios, and financials

- To track and analyze competitive developments such as partnerships, agreements, alliances, joint ventures, collaborations, product launches, expansions, acquisitions, grants/funds, and licensing agreements, among others, in the in vivo toxicology market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in In Vivo Toxicology Market

Urgently require study on In Vivo Toxicology Market Size, Share, Trends, Opportunities and Forecast to 2021 - 2030

Which of the end user segment is expected to dominate the Global In Vivo Toxicology Market?

What is the global geographical growth scenario of the In Vivo Toxicology Market?