Impact Modifiers Market by Type (ABS, AIM, ASA, MBS, EPDM, CPE), By Application (PVC, Polyamide, Polyesters, Engineering Plastics), End-Use Industry (Packaging, Construction, Consumer Goods, Automotive), Region - Global Forecast to 2025

Updated on : May 19, 2023

Impact Modifiers Market

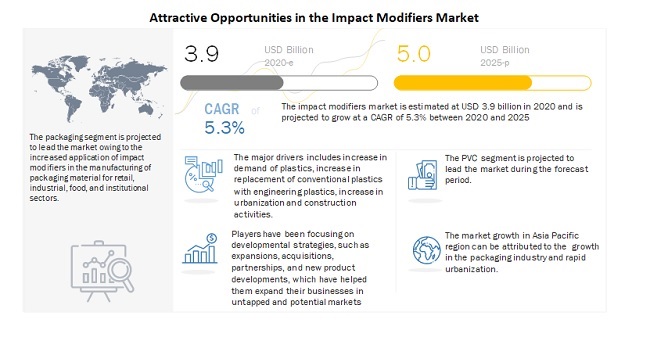

The impact modifiers market was valued at USD 3.9 billion in 2020 and is projected to reach USD 5.0 billion by 2025, growing at a cagr 5.3% from 2020 to 2025. The major drivers for the market include an increase in demand for plastics, replacement of conventional plastics with engineering plastics, and urbanization & construction activities. However, the prohibition of PVC products across various end-use industries restrains the market growth. Moreover, the demand for plastics in packaging applications and the development of impact modifiers for bio-based polymers are expected to propel the market for impact modifiers.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid-19 Impact On The Global Impact Modifiers Market

The outbreak of COVID-19 has now spread across major APAC, European, and North American countries, affecting the market for impact modifiers since most global companies have headquarters in these regions. COVID-19 had disrupted the supply chain, which had slowed down market growth due to a lack of raw materials and unavailability of manpower. The lockdown in major countries due to this pandemic has also led to shutting down of the production facilities of plastic products.

- The COVID-19 pandemic has had a detrimental impact on the global construction business and affected the supply and cost of material & labor, which are the key cost components of construction projects. Moreover, disruption in the transportation industry has also affected the value chain of the construction industry, affecting the impact modifiers market.

- The spread of the pandemic to European and North American countries has led to a decrease in the demand for automobiles, and thus, their production. Europe and North America are the hubs for automotive manufacturers, and lockdowns imposed by governments have led to significant losses to manufacturers in these regions. This decrease in the production of vehicles has led to a reduction in the consumption of plastics for manufacturing automotive parts, affecting the market growth.

- The demand for packaging has increased during the pandemic; however, there has been a slight disruption. The major hindrance for this industry was the lockdown, as the employees were asked to stay at home during the pandemic. Due to this, many of the packaging units were closed, or the production of packaging products had declined.

Impact Modifiers Market Dynamics

Driver: Increase in demand for plastics

Plastics have many applications in several industries, such as packaging, construction, automotive, consumer goods, textile, agriculture, and medical, among others. Plastics, especially engineering plastics, possess superior mechanical and electrical properties, excellent abrasion resistance, superior chemical resistance, and other properties in comparison to those of conventional materials such as metals, glass, paper, and ceramics. Continuous innovation and the need for lighter material in several applications are encouraging the replacement of conventional materials with plastic. The increase in consumption of polymers has also increased the usage of impact modifiers in the manufacturing of products for various applications, which improve the mechanical and impact properties of the final product and reduce its cycle time.

Restraints: Prohibition of PVC products across various end-use industries

The increasing environmental concerns have encouraged construction builders to shift their focus to sustainable or green building designs from conventional ones to create energy-efficient commercial buildings. There are regulations formulated by the US Green Building Council that prohibits the use of PVC in green buildings. In the packaging industry, PVC has been banned or restricted in many countries, such as Canada, Spain, South Korea, and the Czech Republic. According to the Center for Health, Environment & Justice, PVC was prohibited in food packaging or utensils.

Opportunities: Development of impact modifiers for bio-based plastics

The rising concern for the environment is driving the market for bio-plastic materials. Bio-plastics are made up of biodegradable material and cellulose. These plastics are derived from renewable biomass sources or bio-degradable sources such as PLA. The leading players in the impact modifiers market are focusing on carrying out R&D activities to develop impact modifiers that can be used in different industries for different applications. With the increased demand for bio-based polymers, there is a requirement for developing new and improved impact modifiers. This, in turn, is expected to lead to advancements in the field of impact modifiers.

Challenges: Fluctuations in the prices of raw materials

Fluctuation in raw material prices of polymers and monomers used for producing polymers is a major restraint to the growth of the impact modifiers market. Polymers are manufactured using monomers, which are crude oil-based products and, thus, fluctuations in pricing and availability of crude oil is a major consideration in their production and use. The availability of crude oil-based products, such as polymers and elastomers, depends on imports and production across countries. The prices of raw materials depend mostly on logistics, labor cost, trading cost, and tariffs. All these factors affect the growth of the market for polymers, which affects the development of the impact modifiers market.

Based on type, the acrylic impact modifiers segment is projected to lead the market during the forecast period

Based on type, the acrylic impact modifiers segment is estimated to account for the largest share of the impact modifiers market in 2019. AIM improves impact resistance performance, increases the surface gloss as well as weatherability of the product. It is suitable for outdoor products and is used widely in PVC profiles, pipe fittings, sheets, boards, and pipes, among others. AIM has excellent low-temperature impact resistance, a wide processing range for high-speed extrusion, and improves the impact strength and rigidity of the product. Acrylic-based impact modifiers are free-flowing powders that are cost-effective and are designed for better performance of products.

Based on application, the PVC segment is expected to be the largest segment in the market

PVC is the largest application segment of the impact modifiers market and is expected to account for the highest market share of the global impact modifiers market by the application during the forecast period. This growth is attributed mainly to its easy availability and low cost and the increasing applicability of PVC among varied end-use industries, such as packaging, construction, automotive, and consumer goods. PVC is used mainly in pipes, windows, flooring, roofing, inflatable structures, and lighter structures. It contributes to the quality, cost-effectiveness, and safety of construction material.

Based on the end-use industry, the packaging segment is projected to grow at the highest CAGR in the impact modifiers market during 2020-2025

The packaging segment is estimated to account for the largest share of the global impact modifiers market in 2019. Increasing demand for impact modifiers from the pharmaceutical and food packaging sectors is driving the growth of the impact modifiers market in the packaging application. Further, the changing lifestyles of consumers with rising disposable income has increased the importance of plastics as packaging products. The usage of plastics for airtight packaging helps in preserving and protecting goods, as well as ensuring that products are not damaged during transportation.

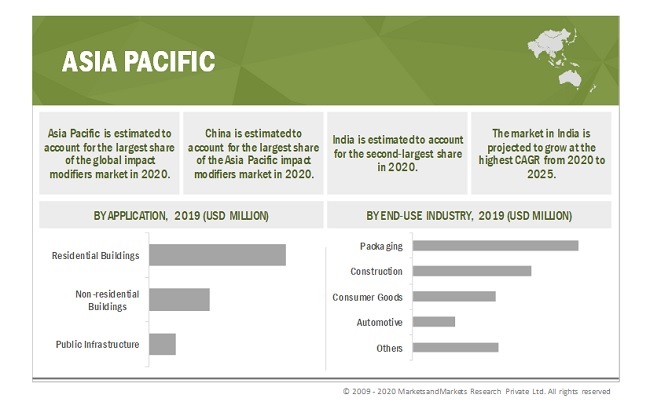

Asia Pacific is expected to witness the highest growth in the impact modifiers market during the forecast period

Asia Pacific is the fastest-growing market for impact modifiers globally. China, being one of the largest manufacturers and consumers of plastics, is expected to dominate the market in the region owing to increasing demand from end-use applications such as packaging, automotive, construction, and consumer goods. Further, improved economic conditions in emerging countries have also led to the growth of the market in the region. India is expected to grow at the highest rate owing to rapid urbanization & industrialization, growing disposable income, and availability of cheap labor. APAC is anticipated to be highly affected by the spread of COVID-19, mainly China, Japan, and India.

To know about the assumptions considered for the study, download the pdf brochure

Impact Modifiers Market Players

Major companies such as Dow Inc. (US), Lanxess A.G. (Germany), Kaneka Corporation (Japan), Arkema S.A. (France), Mitsubishi Chemical Corporation (Japan), LG Chem Ltd. (South Korea), Shandong Ruifeng Chemical Co., Ltd. (China), Mitsui Chemicals, Inc. (Japan), Wacker Chemie AG (Germany), Formosa Plastics Corp. (Taiwan), Sundow Polymers Co., Ltd. (China), SI Group, Inc. (US), Akdeniz Kimya San. ve Tic. Inc. (Turkey), En-Door (China), Novista Group (China), and Indofil Industries Limited (India), among others, are key players in the impact modifiers market. These players have been focusing on developmental strategies, such as expansions, acquisitions, partnerships, and new product developments, which have helped them expand their businesses in untapped and potential markets.

Impact Modifiers Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 3.9 billion |

|

Revenue Forecast in 2025 |

USD 5.0 billion |

|

CAGR |

5.3% |

|

Market size available for years |

2018 - 2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020 - 2025 |

|

Forecast units |

Value (USD Million) and Volume (Kiloton) |

|

Segments covered |

Type, Application, End-Use Industry and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

Dow Inc. (US), Lanxess A.G. (Germany), Kaneka Corporation (Japan), Arkema S.A. (France), Mitsubishi Chemical Corporation (Japan), LG Chem Ltd. (South Korea), Shandong Ruifeng Chemical Co., Ltd. (China), Mitsui Chemicals, Inc. (Japan), Wacker Chemie AG (Germany), Formosa Plastics Corp. (Taiwan), Sundow Polymers Co., Ltd. (China), SI Group, Inc. (US), Akdeniz Kimya San. ve Tic. Inc. (Turkey), ), En-Door (China), Novista Group (China), and Indofil Industries Limited (India) and among others |

On the basis of type:

- ABS

- ASA

- AIM

- MBS

- EPDM

- CPE

- Others (Glass Fiber, Epoxy Resin, and Polyolefin)

On the basis of application:

- PVC

- Polyamide

- Polyesters

- Engineering Plastics

- Others (Non-Reactive Modified Polyolefin and Cross-Linked Polyacrylate)

On the basis of end-use industry:

- Packaging

- Construction

- Consumer Goods

- Automotive

- Others (Agriculture, Pharmaceutical, Furniture, and Sports)

On the basis of Region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

Recent Developments

- In June 2020, Mitsui Chemicals and Prime Polymer, in which Mitsui Chemicals has a 65% stake, jointly established a company to build a new polypropylene plant in the Netherlands. The plant has a capacity of 30,000 mt/year, and operations had begun in June 2020. This expansion was done with a view of increasing demand for PP to meet light-weighting needs in bumpers, instrument panels, and more.

- In September 2019, Arkema completed acquired its partner’s stake in Taixing Sunke Chemicals, its joint venture manufacturing acrylic monomers in China. With the acquisition, Arkema has become the sole shareholder of the company. With this transaction, the company would be able to support the growth of its customers in Asia and benefit from greater flexibility to run this business in a region which accounts for more than 50% of the global acrylic acid demand. This would also help in the uninterrupted supply for acrylic monomer for manufacturing acrylic base impact modifiers.

- In August 2018, Mitsui Chemicals, Inc. announced that Mitsui Elastomers Singapore Pte Ltd, a wholly-owned subsidiary based in Singapore, has raised its production capacity for TAFMER high-performance elastomers. This is expected to boost the market size for impact modifiers.

Frequently Asked Questions (FAQ):

What are impact modifiers?

Impact modifiers enable plastic products to absorb shocks and protect the products from cracking or breaking. The use of impact modifiers improves properties of polymers, such as impact strength, toughness, and hardness. Impact modifiers are either compounded with the polymer melt or during the production of plastic products. The elastomeric or rubbery nature of impact modifiers helps the plastic products to absorb or dissipate the energy of an impact to stop craze or crack propagation. The impact modifiers market is segmented into types, applications, and end-use industries. Impact modifiers are used in packaging, construction, automotive, consumer goods, and other end-use industries.

What is the major application of impact modifiers?

Based on application, the impact modifiers market is segmented into PVC, nylon, PBT, engineering plastics, and others. Out of these categories, PVC is the most widely used application in impact modifiers, followed by nylon, which is used in many end-use industries

What are the major driving factors for impact modifiers?

The major drivers for the market include an increase in demand for plastics, replacement of conventional plastics with engineering plastics, and urbanization and construction activities.

What is a major industry that uses impact modifiers?

Based on end-use industry, the impact modifiers market is segmented into packaging, construction, automotive, and consumer goods, among others. The packaging industry contributed the largest share in the impact modifiers market. The use of plastics for airtight packaging helps in preserving and protecting goods, as well as ensuring that the products are not damaged during transportation.

Who are the leading impact modifiers provider in the world?

Dow Inc. (US), Lanxess A.G. (Germany), Kaneka Corporation (Japan), Arkema S.A. (France), Mitsubishi Chemical Corporation (Japan), LG Chem Ltd. (South Korea), Shandong Ruifeng Chemical Co., Ltd. (China), Mitsui Chemicals, Inc. (Japan), Wacker Chemie AG (Germany), Formosa Plastics Corp. (Taiwan), Sundow Polymers Co., Ltd. (China), SI Group, Inc. (US), Akdeniz Kimya San. ve Tic. Inc. (Turkey), ), En-Door (China), Novista Group (China), and Indofil Industries Limited (India), among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 IMPACT MODIFIERS MARKET: INCLUSIONS AND EXCLUSIONS

FIGURE 2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES MADE IN THE REVAMPED VERSION

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 BASE NUMBER CALCULATION

FIGURE 3 BASE NUMBER CALCULATION - APPROACH 1

FIGURE 4 BASE NUMBER CALCULATION - APPROACH 2

FIGURE 5 BASE NUMBER CALCULATION - APPROACH 3

2.2 FORECAST NUMBER CALCULATION

2.3 MARKET ENGINEERING PROCESS

2.3.1 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 RESEARCH DATA

2.6.1 SECONDARY DATA

2.6.1.1 Key data from secondary sources

2.6.2 PRIMARY DATA

2.6.2.1 Key data from primary sources

2.6.2.2 Breakdown of primary interviews

2.6.2.3 Key industry insights

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 8 PRE- & POST-COVID-19 MARKET SIZE OF IMPACT MODIFIERS

FIGURE 9 APAC TO DOMINATE THE IMPACT MODIFIERS MARKET

FIGURE 10 PACKAGING TO LEAD THE IMPACT MODIFIERS MARKET

FIGURE 11 PVC SEGMENT TO LEAD THE IMPACT MODIFIERS MARKET

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN THE IMPACT MODIFIERS MARKET

FIGURE 12 INCREASING DEMAND FROM PVC SEGMENT OFFERS LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 IMPACT MODIFIERS MARKET, BY APPLICATION

FIGURE 13 PVC TO BE THE LARGEST SEGMENT

4.3 IMPACT MODIFIERS MARKET, BY END-USE INDUSTRY

FIGURE 14 PACKAGING TO BE THE FASTEST-GROWING SEGMENT

4.4 IMPACT MODIFIERS MARKET, BY END-USE INDUSTRY AND REGION

FIGURE 15 APAC TO ACCOUNT FOR THE LARGEST MARKET SHARE

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE IMPACT MODIFIERS MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in demand for plastics

TABLE 1 PLASTIC CONSUMPTION, BY COUNTRY, 2014-2018, (KILOTON)

5.2.1.2 Conventional materials being replaced by engineering plastics in end-use applications

5.2.1.3 Increase in urbanization and construction activities

TABLE 2 URBAN POPULATION, BY COUNTRY, 2014-2018

5.2.1.4 No close substitute

5.2.2 RESTRAINTS

5.2.2.1 Prohibition of PVC products across various end-use industries

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for polymers in packaging applications

5.2.3.2 Development of impact modifiers for bio-based plastics

5.2.4 CHALLENGES

5.2.4.1 Fluctuations in the prices of raw materials

FIGURE 17 CRUDE OIL PRICES, (2010-2019)

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 18 IMPACT MODIFIERS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

5.5 INDUSTRY TRENDS

5.5.1 PLASTICS INDUSTRY

TABLE 3 GLOBAL PLASTICS PRODUCTION, BY REGION

5.5.2 AUTOMOTIVE INDUSTRY

FIGURE 19 SALES OF VEHICLES, BY REGION

5.5.3 CONSTRUCTION INDUSTRY

5.6 IMPACT OF COVID-19

TABLE 4 INTERIM ECONOMIC OUTLOOK FORECAST, 2019-2021 (PERCENTAGE)

5.6.1 CONSTRUCTION INDUSTRY

5.6.2 AUTOMOTIVE INDUSTRY

5.6.3 PACKAGING INDUSTRY

6 IMPACT MODIFIERS MARKET, BY TYPE (Page No. - 61)

6.1 INTRODUCTION

FIGURE 20 IMPACT MODIFIERS MARKET, BY TYPE, 2020 & 2025 (USD MILLION)

TABLE 5 IMPACT MODIFIERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 6 IMPACT MODIFIERS MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

6.2 TECHNOLOGY OVERVIEW

6.2.1 FUNCTIONALIZED POLYOLEFIN

6.2.2 CORE-SHELL

6.2.3 TPE

6.2.4 BULK ELASTOMERIC COMPOUND

6.3 ABS

6.3.1 INCREASING DEMAND FROM AUTOMOTIVE INDUSTRY TO DRIVE THE MARKET

TABLE 7 ABS IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 8 ABS IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

6.4 AIM

6.4.1 AIM IMPACT MODIFIERS TO LEAD THE MARKET

TABLE 9 AIM IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 10 AIM IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

6.5 ASA

6.5.1 WEATHER RESISTANCE AND PROCESSABILITY PROPERTIES TO PROPEL THE MARKET

TABLE 11 ASA IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 12 ASA IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

6.6 MBS

6.6.1 MBS IMPACT MODIFIERS TO GROW AT THE HIGHEST RATE

6.6.1.1 MBS IMPACT MODIFIERS FOR PC

6.6.1.2 MBS IMPACT MODIFIERS FOR PC/ABS, PC/PBT BLEND

6.6.1.3 MBS IMPACT MODIFIERS FOR POLYESTERS

TABLE 13 MBS IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 14 MBS IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

6.7 EPDM

6.7.1 HIGH RESISTANCE TO TEARING, SOLVENTS, ABRASION, AND HIGH TEMPERATURE TO DRIVE THE MARKET

TABLE 15 EPDM IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 16 EPDM IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

6.8 CPE

6.8.1 INCREASING DEMAND FOR RIGID AND SOFT PVC TO FUEL THE DEMAND

TABLE 17 CPE IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 18 CPE IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

6.9 OTHERS

TABLE 19 OTHERS IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 20 OTHERS IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

7 IMPACT MODIFIERS MARKET, BY APPLICATION (Page No. - 72)

7.1 INTRODUCTION

FIGURE 21 IMPACT MODIFIERS MARKET, BY APPLICATION, 2020 & 2025 (USD MILLION)

TABLE 21 IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 22 IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

7.2 PVC

7.2.1 INCREASE IN THE DEMAND FOR PVC IN CONSTRUCTION ACTIVITIES TO DRIVE THE MARKET

TABLE 23 IMPACT MODIFIERS MARKET SIZE IN PVC, BY REGION, 2018-2025 (USD MILLION)

TABLE 24 IMPACT MODIFIERS MARKET SIZE IN PVC, BY REGION, 2018-2025 (KILOTON)

7.3 POLYAMIDE

7.3.1 INCREASING USAGE IN VARIOUS INDUSTRIES TO DRIVE THE MARKET

TABLE 25 POLYAMIDE: IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 26 POLYAMIDE: IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

7.4 POLYESTERS

7.4.1 INCREASING DEMAND FROM AUTOMOTIVE AND PACKAGING INDUSTRIES TO FUEL THE MARKET FOR POLYESTERS

TABLE 27 IMPACT MODIFIERS MARKET SIZE IN POLYESTERS, BY REGION, 2018-2025 (USD MILLION)

TABLE 28 IMPACT MODIFIERS MARKET SIZE IN POLYESTERS, BY REGION, 2018-2025 (KILOTON)

7.5 ENGINEERING PLASTICS

7.5.1 INCREASING APPLICATION OF ENGINEERING PLASTICS TO DRIVE THE MARKET

TABLE 29 IMPACT MODIFIERS MARKET SIZE IN ENGINEERING PLASTICS, BY REGION, 2018-2025 (USD MILLION)

TABLE 30 IMPACT MODIFIERS MARKET SIZE IN ENGINEERING PLASTICS, BY REGION, 2018-2025 (KILOTON)

7.6 OTHERS

TABLE 31 IMPACT MODIFIERS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

TABLE 32 IMPACT MODIFIERS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018-2025 (KILOTON)

8 IMPACT MODIFIERS MARKET, BY END-USE INDUSTRY (Page No. - 80)

8.1 INTRODUCTION

FIGURE 22 IMPACT MODIFIERS MARKET, BY END-USE INDUSTRY, 2020 & 2025 (USD MILLION)

TABLE 33 IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 34 IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

8.2 PACKAGING

8.2.1 INCREASE IN DEMAND FOR PLASTIC IN THE PACKAGING APPLICATION TO DRIVE THE MARKET

TABLE 35 IMPACT MODIFIERS MARKET SIZE IN PACKAGING INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

TABLE 36 IMPACT MODIFIERS MARKET SIZE IN PACKAGING INDUSTRY, BY REGION, 2018-2025 (KILOTON)

8.3 CONSTRUCTION

8.3.1 INCREASING CONSTRUCTION ACTIVITIES ARE PROJECTED TO FUEL THE MARKET

TABLE 37 IMPACT MODIFIERS MARKET SIZE IN CONSTRUCTION INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

TABLE 38 IMPACT MODIFIERS MARKET SIZE IN CONSTRUCTION INDUSTRY, BY REGION, 2018-2025 (KILOTON)

8.4 CONSUMER GOODS

8.4.1 INCREASING DEMAND FOR PLASTICS IN CONSUMER GOODS TO FUEL THE MARKET

TABLE 39 IMPACT MODIFIERS MARKET SIZE IN CONSUMER GOODS INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

TABLE 40 IMPACT MODIFIERS MARKET SIZE IN CONSUMER GOODS INDUSTRY, BY REGION, 2018-2025 (KILOTON)

8.5 AUTOMOTIVE

8.5.1 INCREASING ADOPTION OF ELECTRIC VEHICLES AND AUTONOMOUS CARS IN DEVELOPED ECONOMIES TO TRIGGER THE MARKET

TABLE 41 IMPACT MODIFIERS MARKET SIZE IN AUTOMOTIVE INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

TABLE 42 IMPACT MODIFIERS MARKET SIZE IN IN AUTOMOTIVE INDUSTRY, BY REGION, 2018-2025 (KILOTON)

8.6 OTHERS

TABLE 43 IMPACT MODIFIERS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2018-2025 (USD MILLION)

TABLE 44 IMPACT MODIFIERS MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2018-2025 (KILOTON)

9 IMPACT MODIFIERS MARKET, BY REGION (Page No. - 88)

9.1 INTRODUCTION

FIGURE 23 IMPACT MODIFIERS MARKET SIZE, BY REGION, 2020-2025

TABLE 45 IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 46 IMPACT MODIFIERS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

9.2 APAC

FIGURE 24 SNAPSHOT: APAC IMPACT MODIFIERS MARKET

TABLE 47 APAC: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 48 APAC: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 49 APAC: IMPACT MODIFIERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 50 APAC: IMPACT MODIFIERS MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 51 APAC: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 52 APAC: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 53 APAC: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 54 APAC: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.2.1 CHINA

9.2.1.1 China to lead the impact modifiers market in APAC

TABLE 55 CHINA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 56 CHINA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 57 CHINA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 58 CHINA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.2.2 JAPAN

9.2.2.1 Increasing demand in the automotive and packaging industries to drive the market

TABLE 59 JAPAN: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 60 JAPAN: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 61 JAPAN: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 62 JAPAN: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.2.3 INDIA

9.2.3.1 Availability of cheap labor and rise in the flow of FDI in the manufacturing sector to drive the market

TABLE 63 INDIA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 64 INDIA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 65 INDIA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 66 INDIA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.2.4 SOUTH KOREA

9.2.4.1 High demand from the packaging industry to drive the market

TABLE 67 SOUTH KOREA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 68 SOUTH KOREA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 69 SOUTH KOREA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 70 SOUTH KOREA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.2.5 REST OF APAC

TABLE 71 REST OF APAC: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 72 REST OF APAC: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 73 REST OF APAC: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 74 REST OF APAC: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3 EUROPE

FIGURE 25 EUROPE: IMPACT MODIFIERS MARKET SNAPSHOT

TABLE 75 EUROPE: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 76 EUROPE: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 77 EUROPE: IMPACT MODIFIERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 78 EUROPE: IMPACT MODIFIERS MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 79 EUROPE: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 80 EUROPE: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 81 EUROPE: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 82 EUROPE: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3.1 GERMANY

9.3.1.1 Germany to lead the market in Europe

TABLE 83 GERMANY: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 84 GERMANY: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 85 GERMANY: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 86 GERMANY: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3.2 FRANCE

9.3.2.1 Increase in new construction projects to drive the market

TABLE 87 FRANCE: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 88 FRANCE: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 89 FRANCE: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 90 FRANCE: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3.3 UK

9.3.3.1 Increased investments by the government in construction and other industries to drive the market

TABLE 91 UK: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 92 UK: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 93 UK: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 94 UK: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3.4 ITALY

9.3.4.1 Increasing application in packaging and automotive industries to drive the market

TABLE 95 ITALY: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 96 ITALY: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 97 ITALY: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 98 ITALY: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3.5 SPAIN

9.3.5.1 Increasing demand from packaging and construction industries is driving the market

TABLE 99 SPAIN: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 100 SPAIN: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 101 SPAIN: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 102 SPAIN: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.3.6 REST OF EUROPE

TABLE 103 REST OF EUROPE: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 104 REST OF EUROPE: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 105 REST OF EUROPE: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 106 REST OF EUROPE: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.4 NORTH AMERICA

FIGURE 26 NORTH AMERICA: IMPACT MODIFIERS MARKET SNAPSHOT

TABLE 107 NORTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 108 NORTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 109 NORTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 110 NORTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 111 NORTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 112 NORTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 113 NORTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 114 NORTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.4.1 US

9.4.1.1 The US is projected to lead the impact modifiers market in North America

TABLE 115 US: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 116 US: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 117 US: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 118 US: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.4.2 CANADA

9.4.2.1 Increasing construction activities to drive the market in Canada

TABLE 119 CANADA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 120 CANADA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 121 CANADA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 122 CANADA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.4.3 MEXICO

9.4.3.1 Increasing plastics production to drive the growth of the market

TABLE 123 MEXICO: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 124 MEXICO: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 125 MEXICO: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 126 MEXICO: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.5 MIDDLE EAST & AFRICA

FIGURE 27 MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SNAPSHOT

TABLE 127 MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 129 MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 130 MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 131 MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 133 MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 134 MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.5.1 SAUDI ARABIA

9.5.1.1 Increasing opportunities in end-use industries to fuel the market

TABLE 135 SAUDI ARABIA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 136 SAUDI ARABIA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 137 SAUDI ARABIA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 138 SAUDI ARABIA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.5.2 SOUTH AFRICA

9.5.2.1 Increase in the consumption of plastics to fuel the market

TABLE 139 SOUTH AFRICA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 140 SOUTH AFRICA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 141 SOUTH AFRICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 142 SOUTH AFRICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.5.3 TURKEY

9.5.3.1 Increasing demand for impact modifiers from the construction sector to drive the market

TABLE 143 TURKEY: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 144 TURKEY: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 145 TURKEY: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 146 TURKEY: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 147 REST OF MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 148 REST OF MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 149 REST OF MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 150 REST OF MIDDLE EAST & AFRICA: IMPACT MODIFIERS MARKET SIZE,BY END-USE INDUSTRY, 2018-2025 (KILOTON)S

9.6 SOUTH AMERICA

FIGURE 28 SOUTH AMERICA: IMPACT MODIFIERS MARKET SNAPSHOT

TABLE 151 SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 152 SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 153 SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 154 SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 155 SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 156 SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 157 SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 158 SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.6.1 BRAZIL

9.6.1.1 Rising demand for residential construction is fueling the market

TABLE 159 BRAZIL: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 160 BRAZIL: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 161 BRAZIL: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 162 BRAZIL: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.6.2 ARGENTINA

9.6.2.1 Growing construction activities are fueling the impact modifiers market in Argentina

TABLE 163 ARGENTINA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 164 ARGENTINA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 165 ARGENTINA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 166 ARGENTINA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

9.6.3 REST OF SOUTH AMERICA

TABLE 167 REST OF SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 168 REST OF SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 169 REST OF SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 170 REST OF SOUTH AMERICA: IMPACT MODIFIERS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 145)

10.1 INTRODUCTION

10.2 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

10.2.1 MARKET SHARE ANALYSIS

FIGURE 29 MARKET SHARE ANALYSIS OF TOP PLAYERS IN THE IMPACT MODIFIERS MARKET

10.2.2 PRODUCT FOOTPRINT

FIGURE 30 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE IMPACT MODIFIERS MARKET

10.3 COMPANY EVALUATION MATRIX

10.3.1 STAR

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE

FIGURE 31 IMPACT MODIFIERS MARKET: COMPANY EVALUATION MATRIX, 2019

10.4 SME EVALUATION MATRIX, 2019

FIGURE 32 IMPACT MODIFIERS MARKET: SME COMPANY EVALUATION MATRIX, 2019

11 COMPANY PROFILES (Page No. - 150)

(Business overview, Products offered, Recent Developments, Winning imperatives, Threat from competition, SWOT Analysis, Right to Win)*

11.1 DOW INC.

FIGURE 33 DOW INC.: COMPANY SNAPSHOT

TABLE 171 DOW INC.: PRODUCTS OFFERED

FIGURE 34 DOW INC.: SWOT ANALYSIS

11.2 LANXESS AG

FIGURE 35 LANXESS AG: COMPANY SNAPSHOT

TABLE 172 LANXESS AG: PRODUCTS OFFERED

FIGURE 36 LANXESS AG.: SWOT ANALYSIS

11.3 KANEKA CORPORATION

FIGURE 37 KANEKA CORPORATION: COMPANY SNAPSHOT

TABLE 173 KANEKA CORPORATION: PRODUCTS OFFERED

FIGURE 38 KANEKA CORPORATION: SWOT ANALYSIS

11.4 ARKEMA S.A.

FIGURE 39 ARKEMA: COMPANY SNAPSHOT

TABLE 174 ARKEMA: PRODUCTS OFFERED

TABLE 175 ARKEMA S.A.: RECENT DEVELOPMENTS

FIGURE 40 ARKEMA S.A.: SWOT ANALYSIS

11.5 LG CHEM LTD.

FIGURE 41 LG CHEM LTD.: COMPANY SNAPSHOT

TABLE 176 LG CHEM LTD.: PRODUCTS OFFERED

TABLE 177 LG CHEM LTD.: RECENT DEVELOPMENTS

FIGURE 42 LG CHEM LTD.: SWOT ANALYSIS

11.6 FORMOSA PLASTICS CORP.

FIGURE 43 FORMOSA PLASTICS CORP.: COMPANY SNAPSHOT

TABLE 178 FORMOSA PLASTICS CORP.: PRODUCTS OFFERED

FIGURE 44 FORMOSA PLASTICS CORP.: SWOT ANALYSIS

11.7 SHANDONG RUIFENG CHEMICAL CO. LTD.

FIGURE 45 SHANDONG RUIFENG CHEMICAL CO., LTD.: COMPANY SNAPSHOT

TABLE 179 SHANDONG RUIFENG CHEMICAL CO., LTD.: PRODUCTS OFFERED

FIGURE 46 SHANDONG RUIFENG CHEMICAL CO., LTD.: SWOT ANALYSIS

11.8 MITSUI CHEMICALS, INC.

FIGURE 47 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT

TABLE 180 MITSUI CHEMICALS, INC.: PRODUCTS OFFERED

TABLE 181 MITSUI CHEMICALS, INC.: RECENT DEVELOPMENTS

FIGURE 48 MITSUI CHEMICALS, INC.: SWOT ANALYSIS

11.9 MITSUBISHI CHEMICAL CORPORATION

FIGURE 49 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

TABLE 182 MITSUBISHI CHEMICAL CORPORATION: PRODUCTS OFFERED

FIGURE 50 MITSUBISHI CHEMICAL CORPORATION: SWOT ANALYSIS

11.1 WACKER CHEMIE AG

FIGURE 51 WACKER CHEMIE AG: COMPANY SNAPSHOT

TABLE 183 WACKER CHEMIE AG: PRODUCTS OFFERED

FIGURE 52 WACKER CHEMIE AG: SWOT ANALYSIS

11.11 SUNDOW POLYMERS CO., LTD.

TABLE 184 SUNDOW POLYMERS CO., LTD.: PRODUCTS OFFERED

FIGURE 53 SUNDOW POLYMERS CO., LTD.: SWOT ANALYSIS

11.12 SI GROUP, INC.

TABLE 185 SI GROUP, INC.: PRODUCTS OFFERED

11.13 AKDENIZ KIMYA SAN. VE TIC. INC.

TABLE 186 AKDENIZ KIMYA SAN. VE TIC. INC.: PRODUCTS OFFERED

11.14 EN-DOOR

TABLE 187 EN-DOOR: PRODUCTS OFFERED

11.15 NOVISTA GROUP

TABLE 188 NOVISTA GROUP: PRODUCTS OFFERED

11.16 INDOFIL INDUSTRIES LIMITED

TABLE 189 INDOFIL INDUSTRIES LIMITED: PRODUCTS OFFERED

11.17 OTHER KEY PLAYERS

11.17.1 HANGZHOU KELI CHEMICAL CO., LTD.

11.17.2 SHANDONG XIANGSHENG PLASTIC INDUSTRY CO., LTD.

11.17.3 WEIFANG DAQIAN CHEMICALS CO., LTD.

11.17.4 ZIBO HAIHUA CHEMICAL CO., LTD.

11.17.5 AKD POLYMERS PVT. LTD.

11.17.6 SHANDONG REPOLYFINE ADDITIVES CO., LTD.

11.17.7 ELIX POLYMERS SL

11.17.8 SHANDONG DONGLIN NEW MATERIALS CO., LTD

11.17.9 SHANDONG RIKE CHEMICAL CO. LTD.

*Details on Business overview, Products offered, Recent Developments, Winning imperatives, Threat from competition, SWOT Analysis, Right to Win might not be captured in case of unlisted companies.

?

12 APPENDIX (Page No. - 197)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current impact of modifiers market size. Exhaustive secondary research was carried out to collect information on the market, peer markets, and the parent market. The next step was to validate the findings obtained from secondary sources, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary data includes company information acquired from annual reports, press releases, investor presentations; white papers; and articles from recognized authors. In the market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), both top-down and bottom-up approaches were extensively used, along with several data triangulation methods to obtain, verify, and validate the market revenues arrived at. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

Primary Research

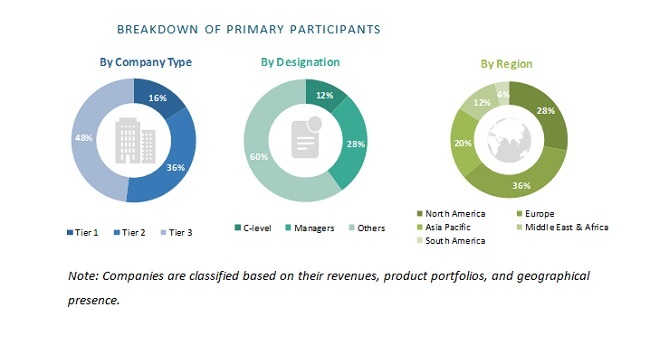

The impact modifiers market comprises stakeholders such as producers, suppliers, and distributors, and regulatory organizations in the supply chain. The demand side of this market is characterized by developments in end-use industries such as packaging, construction, consumer goods, automotive, and others. The supply side is characterized by market consolidation activities undertaken by impact modifiers manufacturers. Several primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

Breakdown of Primary Participants

To know about the assumptions considered for the study, download the pdf brochure

Note: Companies are classified based on their revenues, product portfolios, and geographical presence.

Market Size Estimation:

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the impact modifiers market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the market size for impact modifiers, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the market

- To estimate and forecast the impact modifiers market size based on type, application, and end-use industry

-

To analyze and forecast the impact modifiers market based on five key

regions – Asia Pacific (APAC), North America, Europe, the Middle East & Africa, and South America - To analyze the opportunities in the market for stakeholders and present a competitive landscape for market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

AVAILABLE CUSTOMIZATIONS

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Type Analysis

- A further breakdown of the type segment of the impact modifiers market with respect to a particular application

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Impact Modifiers Market