Impact Investing Market by Illustrative Sector (Education, HealthCare, Housing, Agriculture, Environment, Clean Energy Access, Climate Change, Financial Inclusion, Rural Development, Sanitation & Waste Management), and Country - Global Forecast to 2020

Impact Investment refers to investment that aims to generate measurable, social or environmental impact along with a financial gain. The global impact investing market is estimated to be valued at USD 135 Billion in 2015 and is expected to grow at a CAGR of 17.86 % during the forecast period to reach to USD 307 Billion by 2020.

The key factors driving the growth of this market include the initiatives taken by Governments in relation to impact investment, increasing interest from traditional not-for-profit fund managers, supportive government policies by offering tax breaks and reliefs and initiation of social impact bonds and impact investing platform in various countries.

Objectives of the Study

- To present an outline of the global eco-system of impact investing market with a sector and country level estimate of market sizes and growth forecasts

- To assess and estimate the current market sizes across sectors on selected markets

- To forecast growth of impact investing markets at global and country level

Research Methodology

Top-down approaches were used to validate the size of the global impact investing market and estimate the size of the countries. Various secondary sources such as associations such as Global Impact Investing Network(GIIN), Impact investors Council (IIC), government data sources, industry journals, databases, and annual reports of the organizations have been used to identify and collect information useful for the study of this market. Primary sources such as investors, intermediaries, and advisors, were interviewed to obtain and validate information as well as to fathom dynamics of this market.

Some of the key asset owners in impact investing market are Triodos N.V. (Netherlands), Sarona (Canada) and Omidyar (U.S.), while key asset managers are RISE (Canada), Leapfrog (U.K.), responsAbility (Switzerland) and Acumen (U.S.). Revolution Foods (U.S.), Vestergaard Frendsen (Denmark), Vasham(Indonesia) and Waterhealth International (U.S.) are some of the impact enterprises and key enablers in this market are Intellecap(India), Unitus(U.S.), LAVCA(U.S.) and GIIRS(U.S.).

Target Audience:

- Impact Asset Owners - Institutional Investors, Development Banks, Foundations, Family Offices, High-Networth Individuals

- Impact Asset Managers - Private Equities, Venture Capitalists, Wealth Managers, Funds, Advisors and Intermediaries

- Impact Enterprises - Profit with Purpose companies or Social Enterprises

- Impact Enablers - Research and Consulting Firms, Professional Services, Networks and Associations, Incubators and Accelerators

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report:

The research report categorizes the impact investing market into the following segments and geographies:

Impact Investment Market, by Illustative Sector

- Education

- HealthCare

- Housing

- Agriculture

- Environment

- Clean Energy Access

- Climate Change

- Financial Inclusion

- Rural Development

- Sanitation & Waste Management

- Skills Development

- Water

- Others

Impact Investing Market, by Countries

- Argentina

- Australia

- Brazil

- Canada

- Finland

- France

- Germany

- India

- Israel

- Italy

- Japan

- Mexico

- Portugal

- UK

- USA

The impact investing market is expected to grow from an estimated value of USD 135 Billion in 2015 to USD 307 Billion by 2020, at a CAGR of 17.86% from 2015 to 2020. The global market is set to witness a significant growth, due to increase in demand for impact capital, growing ecosystem support and impact readiness. Principal capital providers include development banks and investment funds. Lately, other institutional investors, such as pension funds and insurance companies, have grown their stake significantly. However, the marginal presence of retail investors indicates that the market is yet to see financial broadening and deepening.

In impact investment, the main asset classes are private debt and private equity constituting about 75% of the overall asset pie. Asset classes are getting diversified with the introduction and launch of innovative financial instruments such as social impact bonds; development impact bonds; green bonds; and other quasi-equity, quasi-debt hybrid products. Most impact investment companies are privately held, without any offload to public or retail investors.

There is growing convergence within impact investing spectrum - with Global Impact Investing Networks (GIIN) definition gaining larger acceptance - enabling the social and environmental impact to co-exists with financial returns. Rather, in many developing countries, social impact businesses have scaled to reach market-based returns.

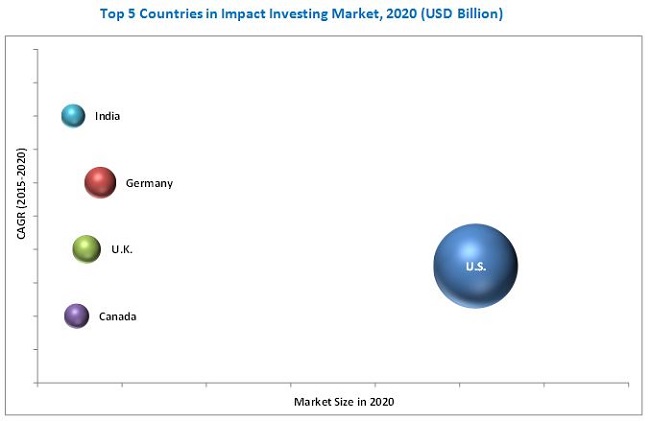

The U.S. is the largest impact investing market in the world. Institutional investors and fund managers particularly private equity lead the impact investing space in the U.S. Activities such as First B Corp Legislation, the Affordable Care Act and Jobs Act in 2010, and beginning of the First Pay for Success project in New York City are shaping the impact investing space in the U.S. Growing interest by foundations in mission investing supplementing their grant-making by using a portion of their endowment for loans and investments to support their impact missions is driving the market.

Some of the key asset owners in impact investing market are Triodos N.V. (Netherlands), Sarona (Canada) and Omidyar (U.S.), while key asset managers are RISE (Canada), Leapfrog (U.K.), responsAbility (Switzerland) and Acumen (U.S.). Revolution Foods (U.S.), Vestergaard Frendsen (Denmark), Vasham(Indonesia) and Waterhealth International (U.S.) are some of the impact enterprises and key enablers in this market are Intellecap(India), Unitus(U.S.), LAVCA(U.S.) and GIIRS(U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 5)

2 Impact Investing Market (Page No. - 7)

2.1 an Understanding

2.2 Key Stats Few Glimpses

2.3 Ecosystem Overview

3 Research Methodology of Impact Investing Market (Page No. - 17)

4 Estimate and Forecast of Impact Investing Market (Page No. - 18)

4.1 Based on Giin Study

4.2 Based on Bop Estimates

4.3 Based on Private Capital Adoption

5 Executive Summary of Impact Investing Market (Page No. - 22)

5.1 Market Share of Regions

5.2 Top Growing Countries

6 Global Impact Investing Market History: Pre - 2007 and Post 2007 (Page No. - 28)

7 Impact Investing Market Trends Driving It to Inflection (Page No. - 31)

8 Impact Investing Market Challenges (Page No. - 36)

9 Global Impact Investing Growth (Page No. - 39)

10 Global Impact Investing Market- By Country (Page No. - 41)

11 Global Impact Investing Market - By Sectors (Page No. - 44)

12 Impact Investing Market Insights (Page No. - 46)

13 Global Impact Asset Owners Illustrative Players (Page No. - 50)

14 Global Impact Asset Managers Illustrative Players (Page No. - 52)

15 Global Impact Enterprises Illustrative Players (Page No. - 54)

16 Global Impact Enablers Illustrative Players (Page No. - 56)

17 Impact Investing Market Country Overview (Page No. - 58)

17.1 Argentina

17.1.1 Overview

17.1.2 Market Size and Forecast

17.2 Australia

17.2.1 Overview

17.2.2 Market Size and Forecast

17.2.3 Market Size By Sector

17.2.4 Key Constituents Illustrative Players

17.3 Brazil

17.3.1 Overview

17.3.2 Market Size and Forecast

17.3.3 Market Size By Sector

17.3.4 Key Constituents Illustrative Players

17.4 Canada

17.4.1 Overview

17.4.2 Market Size and Forecast

17.4.3 Market Size By Sector

17.4.4 Key Constituents Illustrative Players

17.5 Finland

17.5.1 Overview

17.5.2 Market Size and Forecast

17.6 France

17.6.1 Overview

17.6.2 Market Size and Forecast

17.6.3 Market Size By Sector

17.6.4 Key Constituents Illustrative Players

17.7 Germany

17.7.1 Overview

17.7.2 Market Size and Forecast

17.7.3 Market Size By Sector

17.7.4 Key Constituents Illustrative Players

17.8 India

17.8.1 Overview

17.8.2 Market Size and Forecast

17.8.3 Market Size By Sector

17.8.4 Key Constituents Illustrative Players

17.9 Israel

17.9.1 Overview

17.10 Italy

17.10.1 Overview

17.10.2 Market Size and Forecast

17.10.3 Market Size By Sector

17.11 Japan

17.11.1 Overview

17.11.2 Market Size and Forecast

17.11.3 Market Size By Sector

17.11.4 Key Constituents Illustrative Players

17.12 Mexico

17.12.1 Overview

17.12.2 Market Size and Forecast

17.12.3 Market Size By Sector

17.12.4 Key Constituents Illustrative Players

17.13 Portugal

17.13.1 Overview

17.14 The United Kingdom

17.14.1 Overview

17.14.2 Market Size and Forecast

17.14.3 Market Size By Sector

17.14.4 Key Constituents Illustrative Players

17.15 The United States of America

17.15.1 Overview

17.15.2 Market Size and Forecast

17.15.3 Market Size By Sector

17.15.4 Key Constituents Illustrative Players

17.16 Additional Countries Under Study

17.17 References Indicative List Only

17.18 Disclaimer

List of Tables (14 Tables)

Table 1 Investments By Country in USD Billions

Table 2 Impact Investment in Argentina (USD Million)

Table 3 Impact Investment in Australia (USD Million)

Table 4 Impact Investment in Brazil (USD Million)

Table 5 Impact Investment in Canada (USD Million)

Table 6 Impact Investment in Finland (USD Million)

Table 7 Impact Investment in France (USD Million)

Table 8 Impact Investment in Germany (USD Million)

Table 9 Impact Investment in India (USD Million)

Table 10 Impact Investment in Italy (USD Million)

Table 11 Impact Investment in Japan (USD Million)

Table 12 Impact Investment in Mexico (USD Million)

Table 13 Impact Investment in UK (USD Million)

Table 14 Impact Investment in US (USD Million)

List of Figures (29 Figures)

Figure 1 Global Impact Investment Trend (USD Billion)

Figure 2 Global Impact Investment (2015) By Country (USD Billion)

Figure 3 Global Impact Investment (2020) By Country (USD Billion)

Figure 4 Global Impact Investment (2015) By Focus Area (USD Billion)

Figure 5 Global Impact Investment (2020) By Focus Area (USD Billion)

Figure 6 Impact Investment in Argentina (USD Million)

Figure 7 Impact Investment in Australia (USD Million)

Figure 8 Impact Investment (2015) in Australia By Sector (%)

Figure 9 Impact Investment in Brazil (USD Million)

Figure 10 Impact Investment (2015) in Brazil By Sector (%)

Figure 11 Impact Investment in Canada (USD Million)

Figure 12 Impact Investment (2015) in Canada By Sector (%)

Figure 13 Impact Investment in Finland (USD Million)

Figure 14 Impact Investment in France (USD Million)

Figure 15 Impact Investment (2015) in France By Sector (%)

Figure 16 Impact Investment in Germany (USD Million)

Figure 17 Impact Investment (2015) in Germany By Sector (%)

Figure 18 Impact Investment in India (USD Million)

Figure 19 Impact Investment (2015) in India By Sector (%)

Figure 20 Impact Investment in Italy (USD Million)

Figure 21 Impact Investment (2015) in Italy By Sector (%)

Figure 22 Impact Investment in Japan (USD Million)

Figure 23 Impact Investment (2015) in Japan By Sector (%)

Figure 24 Impact Investment in Mexico (USD Million)

Figure 25 Impact Investment (2015) in Mexico By Sector (%)

Figure 26 Impact Investment in UK (USD Million)

Figure 27 Impact Investment (2015) in UK By Sector (%)

Figure 28 Impact Investment in US (USD Million)

Figure 29 Impact Investment (2015) in US By Sector (%)

List of Exhibits (15 Exhibits)

Exhibit 1 Key Socio Economic Stats Argentina

Exhibit 2 Key Socio Economic Stats Australia

Exhibit 3 Key Socio Economic Stats Brazil

Exhibit 4 Key Socio Economic Stats Canada

Exhibit 5 Key Socio Economic Stats Finland

Exhibit 6 Key Socio Economic Stats France

Exhibit 7 Key Socio Economic Stats Germany

Exhibit 8 Key Socio Economic Stats India

Exhibit 9 Key Socio Economic Stats Israel

Exhibit 10 Key Socio Economic Stats Italy

Exhibit 11 Key Socio Economic Stats Japan

Exhibit 12 Key Socio Economic Stats Mexico

Exhibit 13 Key Socio Economic Stats Portugal

Exhibit 14 Key Socio Economic Stats UK

Exhibit 15 Key Socio Economic Stats USA

Growth opportunities and latent adjacency in Impact Investing Market