Immuno Oncology Assays Market Size, Share & Trends by Product & Service (Consumables, Instruments, Software), Technology (PCR, NGS, Immunoassay), Cancer Indications (Lung, Breast, Colorectal, Bladder, Melanoma), Application (Research, Diagnostics) - Global Forecast to 2026

Immuno Oncology Assays Market Size, Share & Trends

The size of global immuno oncology assays market in terms of revenue was estimated to be worth $4.4 billion in 2021 and is poised to reach $7.9 billion by 2026, growing at a CAGR of 12.5% from 2021 to 2026. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Market growth is driven by the increased demand for personalized medicine, rising incidence of cancer and the growing adoption of targeted therapy, and the growing significance of companion diagnostics in drug development.

To know about the assumptions considered for the study, Request for Free Sample Report

Immuno Oncology Assays Market Dynamics

Driver: Rising incidence of cancer and growing adoption of targeted therapies

Cancer is a complex disease that develops through the multi-stage carcinogenesis process involving multiple molecular pathway events. Thus, various hurdles are associated with cancer diagnosis, prognosis, and therapy. In this regard, due to the complex nature of cancer, a single marker is not helpful. Moreover, in terms of its molecular profile, each cancer is different from other cancer types. Hence, the use of immuno-oncology assays has been particularly significant in understanding cancer signatures and developing customized therapies.

Globally, the prevalence of cancer has increased significantly over the last few years. Cancer, which has become the leading cause of death globally, accounted for 9.6 million deaths in 2018. According to GLOBOCAN, the number of cancer cases will rise to approximately 30 million by 2040 from 18 million in 2018. More than 60% of new cancer cases occur in Africa, Asia, and Central and South America; 70% of global cancer deaths also occur in these regions. Thus, the growth in the incidence and prevalence of cancer has resulted in a need to conduct extensive research for diagnosis and treatment; immuno-oncology assays form an important part of this research.

Opportunity: Emerging markets offer lucrative opportunities

Emerging economies such as China, India, South Korea, Brazil, and Mexico offer significant growth opportunities to major market players. This can be attributed to their low regulatory barriers, improvements in healthcare infrastructure, growing patient population, and rising healthcare expenditure. The regulatory policies in the Asia Pacific are more adaptive and business-friendly than those in developed countries. This, along with the increasing competition in mature markets, has drawn key players in the immuno-oncology assays market to focus on emerging countries.

Restraint: Requirement of high capital investments and low cost-benefit ratio

Significant capital investments are required for the discovery, development, and validation of biomarkers. Additionally, due to the high drug attrition in clinical trials (with almost 30% of drugs failing in Phase III), diagnostic manufacturers are exposed to significant financial challenges. To gain approval for in vitro diagnostics (IVD) from regulators, manufacturers need successful Phase III clinical trials, which depend on well-validated biomarker tests. Huge investments are required to run clinical trials and address stringent regulatory requirements, which not only affect the ability of small companies to develop biomarkers but also severely affect innovation. Hence, along with the high amount of capital investments, the low cost-benefit ratio is hindering the growth of the immuno-oncology assays market for biomarker detection.

In 2020, consumables segment accounted for the largest share of the immuno oncology assays market, by product & service

Based on product & service, the immuno-oncology assays market is segmented into consumables, instruments, and software & services. The consumables segment accounted for the largest share of the immuno-oncology assays market in 2020. The requirement of consumables in large numbers as compared to instruments is the main factor driving the growth of this segment.

In 2020, PCR segment accounted for the largest share in the immuno oncology assays market, by technology

The immuno-oncology assays market is segmented into PCR, immunoassay, NGS, flow cytometry, and ISH based on technology. In 2020, the PCR segment accounted for the largest share. The growing use of PCR in immuno-oncology biomarker identification and discovery research is driving the growth of this segment.

In 2020, research applications segment accounted for the largest share in the immuno oncology assays market, by application

The immuno-oncology assays market is segmented into research applications and clinical diagnostics based on application. In 2020, the research applications segment accounted for the largest share of the immuno-oncology assays market. The rising prominence of biomarker-based drug development is driving the growth of this segment.

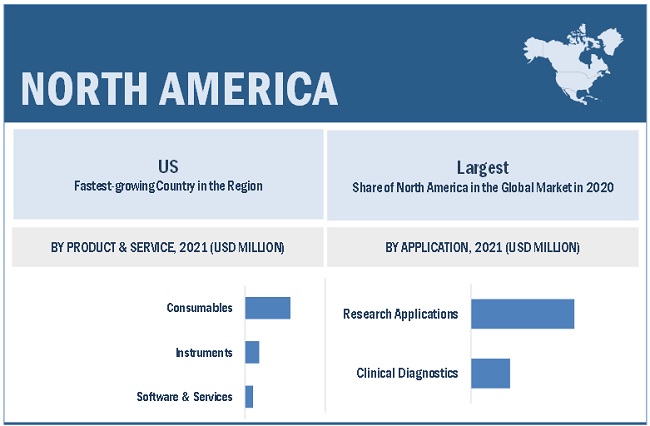

North America is the largest regional market for immuno oncology assays market

The global immuno-oncology assays market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2020, North America accounted for the largest share of the global immuno-oncology assays market. The North American immuno-oncology assays market's growth can be attributed to the increasing demand for personalized medicine, rising adoption of advanced omics technologies for biomarker discovery, and growing government support for the discovery and development of biomarkers.

To know about the assumptions considered for the study, download the pdf brochure

The key players of the global immuno oncology assays market are:

- Thermo Fisher Scientific, Inc. (US)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Agilent Technologies, Inc. (US)

- Illumina, Inc. (US)

- Merck Millipore (US)

Scope of the Immuno Oncology Assays Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$4.4 billion |

|

Projected Revenue Size by 2027 |

$7.9 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 12.5% |

|

Market Driver |

Rising incidence of cancer and growing adoption of targeted therapies |

|

Market Opportunity |

Emerging markets offer lucrative opportunities |

This report categorizes the immuno oncology assays market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Consumables

- Instruments

- Software & Services

By Technology

- PCR

- Immunoassay

- NGS

- ISH

- Flow Cytometry

By Indication

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Bladder Cancer

- Melanoma

- Other Cancers

By Application

- Research Applications

- Clinical Diagnostics

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- Italy

- France

- UK

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In July 2020, HTG Molecular Diagnostics, Inc. (US) launched its HTG EdgeSeq Pan B-Cell Lymphoma Panel.

- In August 2019, Agilent Technologies, Inc. (US), along with The National University of Singapore (NUS) and the National University Hospital (NUH), established Singapore's first integrated translational R&D hub that leverages biochemical innovation and research data analytics to develop new methods of translating clinical research into clinical diagnostics.

- In May 2018, Invivoscribe, Inc. (US) partnered with the American University of Beirut Medical Center (Lebanon) to establish a new center of excellence facility in the Middle East. This facility provides testing for all hematologic diseases, including leukemia and lymphoma.

Frequently Asked Questions (FAQs):

What is the size of Immuno Oncology Assays Market?

The global immuno oncology assays Market size is projected to reach USD 7.9 billion by 2026, growing at a CAGR of 12.5%.

What are the major growth factors of Immuno Oncology Assays Market?

Market growth is driven by the increased demand for personalized medicine, rising incidence of cancer and the growing adoption of targeted therapy, and the growing significance of companion diagnostics in drug development.

Who all are the prominent players of Immuno Oncology Assays Market?

Thermo Fisher Scientific, Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Agilent Technologies, Inc. (US), Illumina, Inc. (US), NanoString Technologies, Inc. (US), Sartorius AG (Germany), HTG Molecular Diagnostics, Inc. (US), QIAGEN N.V. (Netherlands), Merck Millipore (US), PerkinElmer, Inc. (US), Abbott Laboratories, Inc. (US), Guardant Health, Inc. (US), bioMérieux SA (France), Myriad Genetics, Inc. (US), MESO SCALE DIAGNOSTICS, LLC. (US), Seegene Inc. (South Korea), Bio-Rad Laboratories, Inc. (US), Charles River Laboratories, Inc. (US), Olink (Sweden), ASURAGEN, INC. (US), Invivoscribe, Inc. (US), Creative Biolabs (US), ReachBio LLC (US), and NMI Technologietransfer GmbH (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 IMMUNO-ONCOLOGY ASSAYS MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

FIGURE 2 IMMUNO-ONCOLOGY ASSAYS MARKET: RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Key industry insights

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 IMMUNO-ONCOLOGY ASSAYS MARKET: BOTTOM-UP APPROACH

FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3.2 TOP-DOWN APPROACH

FIGURE 6 IMMUNO-ONCOLOGY ASSAYS MARKET: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19 HEALTH ASSESSMENT

2.7 COVID-19 ECONOMIC ASSESSMENT

2.8 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 8 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 9 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

2.9 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE IMMUNO-ONCOLOGY ASSAYS MARKET

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 10 IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2021 VS. 2026 (USD MILLION)

FIGURE 11 IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2021 VS. 2026 (USD MILLION)

FIGURE 12 IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 13 IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 14 IMMUNO-ONCOLOGY ASSAYS MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 IMMUNO-ONCOLOGY ASSAYS MARKET OVERVIEW

FIGURE 15 RISING PREVALENCE OF CANCER TO DRIVE MARKET GROWTH

4.2 IMMUNO-ONCOLOGY ASSAYS MARKET SHARE, BY PRODUCT & SERVICE, 2021 VS. 2026

FIGURE 16 CONSUMABLES SEGMENT WILL CONTINUE TO DOMINATE THE MARKET IN 2026

4.3 IMMUNO-ONCOLOGY ASSAYS MARKET SHARE, BY TECHNOLOGY, 2021 VS. 2026

FIGURE 17 NGS SEGMENT TO GAIN MARKET SHARE BETWEEN 2021 AND 2026

4.4 IMMUNO-ONCOLOGY ASSAYS MARKET SHARE, BY INDICATION, 2021 VS. 2026

FIGURE 18 LUNG CANCER SEGMENT TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4.5 IMMUNO-ONCOLOGY ASSAYS MARKET SHARE, BY APPLICATION, 2021 VS. 2026

FIGURE 19 RESEARCH APPLICATIONS SEGMENT WILL CONTINUE TO DOMINATE THE MARKET IN 2026

4.6 IMMUNO-ONCOLOGY ASSAYS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 20 ASIA PACIFIC TO REGISTER THE HIGHEST GROWTH RATE IN THE IMMUNO-ONCOLOGY ASSAYS MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 IMMUNO-ONCOLOGY ASSAYS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising incidence of cancer and growing adoption of targeted therapies

TABLE 1 GLOBAL CANCER INCIDENCE, BY COUNTRY, 2018 VS. 2025

TABLE 2 PROJECTED INCREASE IN THE GLOBAL NUMBER OF CANCER PATIENTS, 2015 VS. 2018 VS. 2035

TABLE 3 RESEARCH FUNDING FOR NATIONAL CANCER INSTITUTE, 2016 VS. 2017 VS. 2018 (USD MILLION)

5.2.1.2 Increased demand for personalized medicine

TABLE 4 GROWTH IN FDA PERSONALIZED MEDICINE APPROVAL RATE, 2005–2018

5.2.2 RESTRAINTS

5.2.2.1 Requirement of high capital investments and low cost-benefit ratio

5.2.2.2 Unfavorable regulatory and reimbursement scenario

5.2.2.3 High cost of immunotherapy

TABLE 5 COST OF KEYTRUDA, BY COUNTRY (2018)

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets offer lucrative opportunities

5.2.3.2 Growing significance of companion diagnostics

5.2.4 CHALLENGES

5.2.4.1 Low awareness of cancer immunotherapy

5.3 IMPACT OF COVID-19 ON THE IMMUNO-ONCOLOGY ASSAYS MARKET

5.4 PRICING ANALYSIS

TABLE 6 PRICE OF IMMUNO-ONCOLOGY ASSAYS (2021)

5.5 PATENT ANALYSIS

5.6 TRADE ANALYSIS

5.6.1 TRADE ANALYSIS FOR DIAGNOSTIC AND LABORATORY REAGENTS

TABLE 7 IMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 8 IMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2016–2020 (TONS)

5.7 VALUE CHAIN ANALYSIS

FIGURE 22 MAJOR VALUE IS ADDED DURING THE MANUFACTURING & ASSEMBLY PHASE

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 23 DISTRIBUTION—A STRATEGY PREFERRED BY PROMINENT COMPANIES

5.9 ECOSYSTEM ANALYSIS OF THE IMMUNO-ONCOLOGY ASSAYS MARKET

FIGURE 24 IMMUNO-ONCOLOGY ASSAYS MARKET: ECOSYSTEM ANALYSIS

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 IMMUNO-ONCOLOGY ASSAYS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF BUYERS

5.10.4 BARGAINING POWER OF SUPPLIERS

5.10.5 DEGREE OF COMPETITION

5.11 PESTLE ANALYSIS

5.12 REGULATORY LANDSCAPE

5.12.1 NORTH AMERICA

5.12.1.1 US

5.12.1.2 CANADA

5.12.2 EUROPE

5.12.3 ASIA PACIFIC

5.12.3.1 JAPAN

5.12.3.2 INDIA

5.12.4 LATIN AMERICA

5.12.4.1 BRAZIL

5.12.4.2 MEXICO

5.12.5 MIDDLE EAST

5.12.6 AFRICA

5.13 TECHNOLOGY ANALYSIS

5.14 YC-YCC SHIFT

5.14.1 YC-YCC SHIFT FOR THE IMMUNO-ONCOLOGY ASSAYS MARKET

6 IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE (Page No. - 71)

6.1 INTRODUCTION

TABLE 10 IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

6.2 CONSUMABLES

6.2.1 RECURRENT PURCHASE OF KITS IS A MAJOR FACTOR DRIVING MARKET GROWTH

TABLE 11 KEY PRODUCTS IN THE CONSUMABLES MARKET

TABLE 12 IMMUNO-ONCOLOGY ASSAYS MARKET FOR CONSUMABLES, BY REGION, 2019–2026 (USD MILLION)

6.3 INSTRUMENTS

6.3.1 LAUNCH OF TECHNOLOGICALLY ADVANCED PRODUCTS TO SUPPORT MARKET GROWTH

TABLE 13 KEY PRODUCTS IN THE INSTRUMENTS MARKET

TABLE 14 IMMUNO-ONCOLOGY ASSAYS MARKET FOR INSTRUMENTS, BY REGION, 2019–2026 (USD MILLION)

6.4 SOFTWARE & SERVICES

6.4.1 INCREASING NEED TO DELIVER ACCURATE AND TIMELY ANALYSIS OF DIAGNOSTIC TESTS TO SUPPORT MARKET GROWTH

TABLE 15 IMMUNO-ONCOLOGY ASSAYS MARKET FOR SOFTWARE & SERVICES, BY REGION, 2019–2026 (USD MILLION)

7 IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY (Page No. - 77)

7.1 INTRODUCTION

TABLE 16 IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

7.2 POLYMERASE CHAIN REACTION

7.2.1 EMERGENCE OF ADVANCED PCR TECHNOLOGIES TO SUPPORT MARKET GROWTH

TABLE 17 IMMUNO-ONCOLOGY ASSAYS MARKET FOR POLYMERASE CHAIN REACTION, BY REGION, 2019–2026 (USD MILLION)

7.3 IMMUNOASSAY

7.3.1 IMMUNOASSAYS HAVE THE POTENTIAL TO REDUCE CANCER MORTALITY RATE BY FACILITATING THE DIAGNOSIS OF CANCER AT AN EARLY STAGE

TABLE 18 IMMUNO-ONCOLOGY ASSAYS MARKET FOR IMMUNOASSAY, BY REGION, 2019–2026 (USD MILLION)

7.4 NEXT-GENERATION SEQUENCING

7.4.1 NGS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 19 IMMUNO-ONCOLOGY ASSAYS MARKET FOR NEXT-GENERATION SEQUENCING, BY REGION, 2019–2026 (USD MILLION)

7.5 IN SITU HYBRIDIZATION

7.5.1 HIGH DEMAND FOR IN SITU HYBRIDIZATION IN THE DIAGNOSIS OF SMALL TUMORS TO DRIVE MARKET GROWTH

TABLE 20 IMMUNO-ONCOLOGY ASSAYS MARKET FOR IN SITU HYBRIDIZATION, BY REGION, 2019–2026 (USD MILLION)

7.6 FLOW CYTOMETRY

7.6.1 GROWING INCIDENCE & PREVALENCE OF CANCER TO SUPPORT MARKET GROWTH

TABLE 21 IMMUNO-ONCOLOGY ASSAYS MARKET FOR FLOW CYTOMETRY, BY REGION, 2019–2026 (USD MILLION)

8 IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION (Page No. - 85)

8.1 INTRODUCTION

TABLE 22 IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

8.2 LUNG CANCER

8.2.1 INCREASING RESEARCH ON LUNG CANCER BIOMARKERS TO DRIVE MARKET GROWTH

TABLE 23 LUNG CANCER INCIDENCE, BY REGION, 2018 VS. 2025

TABLE 24 IMMUNO-ONCOLOGY ASSAYS MARKET FOR LUNG CANCER, BY REGION, 2019–2026 (USD MILLION)

8.3 BREAST CANCER

8.3.1 INCREASING GOVERNMENT FUNDING FOR BREAST CANCER RESEARCH TO DRIVE MARKET GROWTH

TABLE 25 BREAST CANCER INCIDENCE, BY REGION, 2018 VS. 2025

TABLE 26 IMMUNO-ONCOLOGY ASSAYS MARKET FOR BREAST CANCER, BY REGION, 2019–2026 (USD MILLION)

8.4 COLORECTAL CANCER

8.4.1 INCREASING PREVALENCE OF COLORECTAL CANCER TO PROPEL MARKET GROWTH

FIGURE 25 COLORECTAL CANCER INCIDENCE RATE IN KEY COUNTRIES (2018)

TABLE 27 IMMUNO-ONCOLOGY ASSAYS MARKET FOR COLORECTAL CANCER, BY REGION, 2019–2026 (USD MILLION)

8.5 BLADDER CANCER

8.5.1 BLADDER CANCER SEGMENT TO WITNESS SLOWER GROWTH OWING TO THE LIMITED ADOPTION OF IMMUNO-ONCOLOGY ASSAYS

TABLE 28 IMMUNO-ONCOLOGY ASSAYS MARKET FOR BLADDER CANCER, BY REGION, 2019–2026 (USD MILLION)

8.6 MELANOMA

8.6.1 GROWING INCIDENCE OF MELANOMA TO DRIVE THE DEMAND FOR IMMUNO-ONCOLOGY ASSAYS

TABLE 29 IMMUNO-ONCOLOGY ASSAYS MARKET FOR MELANOMA, BY REGION, 2019–2026 (USD MILLION)

8.7 OTHER CANCERS

TABLE 30 GLOBAL CANCER INCIDENCE, 2020

TABLE 31 IMMUNO-ONCOLOGY ASSAYS MARKET FOR OTHER CANCERS, BY REGION, 2019–2026 (USD MILLION)

9 IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION (Page No. - 94)

9.1 INTRODUCTION

TABLE 32 IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

9.2 RESEARCH APPLICATIONS

9.2.1 RISING PROMINENCE OF BIOMARKER-BASED DRUG DEVELOPMENT TO DRIVE THE RESEARCH APPLICATIONS MARKET

TABLE 33 IMMUNO-ONCOLOGY ASSAYS MARKET FOR RESEARCH APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

9.3 CLINICAL DIAGNOSTICS

9.3.1 BENEFITS OF IMMUNO-ONCOLOGY ASSAYS ARE DRIVING THEIR ADOPTION IN CLINICAL DIAGNOSTICS

TABLE 34 IMMUNO-ONCOLOGY ASSAYS MARKET FOR CLINICAL DIAGNOSTICS, BY REGION, 2019–2026 (USD MILLION)

10 IMMUNO-ONCOLOGY ASSAYS MARKET, BY REGION (Page No. - 98)

10.1 INTRODUCTION

TABLE 35 IMMUNO-ONCOLOGY ASSAYS MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 26 NORTH AMERICA: CANCER INCIDENCE & MORTALITY, 2012–2035

FIGURE 27 NORTH AMERICA: IMMUNO-ONCOLOGY ASSAYS MARKET SNAPSHOT

TABLE 36 NORTH AMERICA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 The US dominates the North American immuno-oncology assays market

TABLE 41 US: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 42 US: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 43 US: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 44 US: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 45 US: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increasing government initiatives focused on promoting research to support market growth

TABLE 46 CANADA: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 47 CANADA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 48 CANADA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 49 CANADA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 50 CANADA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.3 EUROPE

FIGURE 28 EUROPE: CANCER INCIDENCE & MORTALITY, 2012–2035

TABLE 51 EUROPE: IMMUNO-ONCOLOGY ASSAYS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 52 EUROPE: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 53 EUROPE: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 54 EUROPE: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 55 EUROPE: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany to dominate the European immuno-oncology assays market during the forecast period

TABLE 56 GERMANY: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 57 GERMANY: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 58 GERMANY: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 59 GERMANY: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 60 GERMANY: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.2 ITALY

10.3.2.1 Increasing life science R&D in Italy to drive market growth

TABLE 61 ITALY: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 62 ITALY: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 63 ITALY: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 64 ITALY: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 65 ITALY: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Increasing government funding for research to support market growth in France

TABLE 66 FRANCE: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 67 FRANCE: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 68 FRANCE: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 69 FRANCE: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 70 FRANCE: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.4 UK

10.3.4.1 Growth in the country’s life science industry and increasing focus on research to propel market growth

TABLE 71 UK: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 72 UK: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 73 UK: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 74 UK: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Increasing focus on the advancement of personalized medicine in Spain to drive market growth

TABLE 75 SPAIN: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 76 SPAIN: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 77 SPAIN: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 78 SPAIN: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 79 ROE: CANCER INCIDENCE, BY COUNTRY, 2020 VS. 2040

TABLE 80 ROE: LUNG CANCER INCIDENCE, BY COUNTRY, 2020 VS. 2040

TABLE 81 ROE: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 82 ROE: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 83 ROE: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 84 ROE: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: CANCER INCIDENCE & MORTALITY, 2012–2035

FIGURE 30 ASIA PACIFIC: IMMUNO-ONCOLOGY ASSAYS MARKET SNAPSHOT

TABLE 85 APAC: IMMUNO-ONCOLOGY ASSAYS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 86 APAC: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 87 APAC: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 88 APAC: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 89 APAC: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China accounts for the largest share of the APAC market

TABLE 90 CHINA: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 91 CHINA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 92 CHINA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 93 CHINA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 94 CHINA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Research initiatives toward the development of precision medicine are supporting market growth in Japan

TABLE 95 JAPAN: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 96 JAPAN: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 97 JAPAN: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 98 JAPAN: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 99 JAPAN: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Increased demand for early cancer diagnosis to support market growth in India

TABLE 100 INDIA: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 101 INDIA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 102 INDIA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 103 INDIA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 104 INDIA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 105 ROAPAC: INCIDENCE OF CANCER, BY COUNTRY, 2020 VS. 2040

TABLE 106 ROAPAC: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 107 ROAPAC: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 108 ROAPAC: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 109 ROAPAC: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 GROWING CONTRACT RESEARCH AND MANUFACTURING ACTIVITIES IN THE REGION TO SUPPORT MARKET GROWTH

TABLE 110 LATIN AMERICA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 111 LATIN AMERICA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 112 LATIN AMERICA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 113 LATIN AMERICA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 INCREASING FOCUS ON PRECISION MEDICINE TO DRIVE THE MARKET GROWTH

TABLE 114 MIDDLE EAST & AFRICA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 115 MIDDLE EAST & AFRICA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 116 MIDDLE EAST & AFRICA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY INDICATION, 2019–2026 (USD MILLION)

TABLE 117 MIDDLE EAST & AFRICA: IMMUNO-ONCOLOGY ASSAYS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 142)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 31 REVENUE SHARE ANALYSIS OF THE TOP PLAYERS IN THE IMMUNO-ONCOLOGY ASSAYS MARKET

11.4 MARKET SHARE ANALYSIS

FIGURE 32 IMMUNO-ONCOLOGY ASSAYS MARKET SHARE, BY KEY PLAYER (2020)

11.5 COMPANY EVALUATION QUADRANT

11.5.1 LIST OF EVALUATED VENDORS

11.5.2 STARS

11.5.3 EMERGING LEADERS

11.5.4 PERVASIVE PLAYERS

11.5.5 PARTICIPANTS

FIGURE 33 IMMUNO-ONCOLOGY ASSAYS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

11.6 COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS/SMES (2020)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 34 IMMUNO-ONCOLOGY ASSAYS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS/SMES, 2020

11.7 PRODUCT AND GEOGRAPHICAL FOOTPRINT ANALYSIS OF TOP PLAYERS

FIGURE 35 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS OF TOP PLAYERS IN THE IMMUNO-ONCOLOGY ASSAYS MARKET

11.8 COMPETITIVE SCENARIO

11.8.1 MARKET EVALUATION FRAMEWORK, 2018–2020

11.8.2 PRODUCT LAUNCHES & REGULATORY APPROVALS

TABLE 118 KEY PRODUCT LAUNCHES & REGULATORY APPROVALS

11.8.3 DEALS

TABLE 119 KEY DEALS

11.8.4 OTHER DEVELOPMENTS

TABLE 120 OTHER KEY DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 151)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1.1 THERMO FISHER SCIENTIFIC, INC.

TABLE 121 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

FIGURE 36 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2020)

12.1.2 F. HOFFMANN-LA ROCHE LTD.

TABLE 122 F. HOFFMANN-LA ROCHE LTD: BUSINESS OVERVIEW

FIGURE 37 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2020)

12.1.3 ILLUMINA, INC.

TABLE 123 ILLUMINA, INC.: BUSINESS OVERVIEW

FIGURE 38 ILLUMINA, INC.: COMPANY SNAPSHOT (2020)

12.1.4 MERCK MILLIPORE

TABLE 124 MERCK MILLIPORE: BUSINESS OVERVIEW

FIGURE 39 MERCK MILLIPORE: COMPANY SNAPSHOT (2020)

12.1.5 AGILENT TECHNOLOGIES, INC.

TABLE 125 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 40 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2020)

12.1.6 ABBOTT LABORATORIES, INC.

TABLE 126 ABBOTT LABORATORIES, INC.: BUSINESS OVERVIEW

FIGURE 41 ABBOTT LABORATORIES, INC.: COMPANY SNAPSHOT (2020)

12.1.7 SARTORIUS AG

TABLE 127 SARTORIUS AG: BUSINESS OVERVIEW

FIGURE 42 SARTORIUS AG: COMPANY SNAPSHOT (2020)

12.1.8 NANOSTRING TECHNOLOGIES, INC.

TABLE 128 NANOSTRING TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 43 NANOSTRING TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2020)

12.1.9 HTG MOLECULAR DIAGNOSTICS, INC.

TABLE 129 HTG MOLECULAR DIAGNOSTICS, INC.: BUSINESS OVERVIEW

FIGURE 44 HTG MOLECULAR DIAGNOSTICS, INC.: COMPANY SNAPSHOT (2019)

12.1.10 PERKINELMER, INC.

TABLE 130 PERKINELMER, INC.: BUSINESS OVERVIEW

FIGURE 45 PERKINELMER, INC.: COMPANY SNAPSHOT (2020)

12.1.11 QIAGEN N.V.

TABLE 131 QIAGEN N.V.: BUSINESS OVERVIEW

FIGURE 46 QIAGEN N.V.: COMPANY SNAPSHOT (2019)

12.2 OTHER PLAYERS

12.2.1 BIOMÉRIEUX SA

TABLE 132 BIOMÉRIEUX SA: BUSINESS OVERVIEW

FIGURE 47 BIOMÉRIEUX SA: COMPANY SNAPSHOT (2020)

12.2.2 MYRIAD GENETICS, INC.

TABLE 133 MYRIAD GENETICS, INC.: BUSINESS OVERVIEW

FIGURE 48 MYRIAD GENETICS, INC.: COMPANY SNAPSHOT (2019)

12.2.3 GUARDANT HEALTH, INC.

TABLE 134 GUARDANT HEALTH, INC.: BUSINESS OVERVIEW

FIGURE 49 GUARDANT HEALTH, INC.: COMPANY SNAPSHOT (2019)

12.2.4 BIO-RAD LABORATORIES, INC.

12.2.5 CHARLES RIVER LABORATORIES, INC.

12.2.6 SEEGENE INC.

TABLE 135 SEEGENE INC.: BUSINESS OVERVIEW

12.2.7 MESO SCALE DIAGNOSTICS, LLC.

TABLE 136 MESO SCALE DIAGNOSTICS, LLC.: BUSINESS OVERVIEW

12.2.8 OLINK

12.2.9 ASURAGEN, INC.

12.2.10 INVIVOSCRIBE, INC.

12.2.11 CREATIVE BIOLABS

12.2.12 REACHBIO LLC

12.2.13 NMI TECHNOLOGIETRANSFER GMBH

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies

13 APPENDIX (Page No. - 208)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the immuno-oncology assays market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

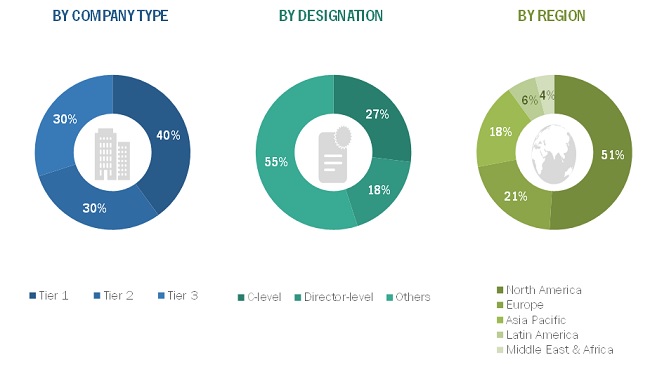

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the immuno-oncology assays market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the immuno-oncology assays market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global immuno-oncology assays market by product & service, technology, indication, application, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

- To track and analyze company developments such as product launches, partnerships, expansions, and acquisitions in the immuno-oncology assays market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Immuno-oncology assays market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa

Company profiles

- Additional five company profiles of players operating in the immuno-oncology assays market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Immuno Oncology Assays Market