Image Recognition in Retail Market by Technology (Code Recognition, Digital Image Processing) Component (Software and Services), Application (Visual Product Search, Security Surveillance), Deployment Type, and Region - Global Forecast to 2025

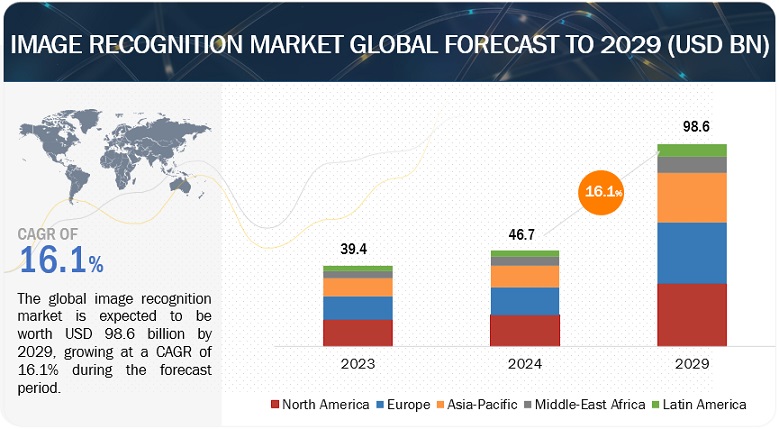

The global Image Recognition in Retail Market size was valued at $1.4 billion in 2020 and it is projected to reach $3.7 billion by the end of 2025 at a CAGR of 22.0% during the forecast period. Need to increase on-shelf availability, enhance customer experience, and maximize RoI is one of the major factors expected to drive the growth of this market.

COVID-19 Impact on the Global Image Recognition in Retail Market

The COVID-19 pandemic is expected to impact the global retail industry. The major impact of COVID-19 observed on the market is reduction in in-store shoppers, which in turn, there is reduction in retail sales. Image recognition in retail includes technologies to enhance the in-store experiences of customers. Since the disease is spreading enormously, shoppers are avoiding crowded places and are not gathering at public places such as malls and stores. This has adversely affected the sales rate of the retail sector due to the shutting down of stores and malls in the pandemic period resulting in hefty losses to owners.

Image Recognition in Retail Market Dynamics

Driver: Need to increase on-shelf availability, enhance customer experience, and maximize RoI

Retailers have started to leverage the capabilities of image recognition applications to make enhanced decisions in the most minimum possible time. Image recognition technologies reduce manual errors in audits and finding out-of-stock products. Thus, it helps retailers increase the on-shelf availability of products before they are out-of-stock. Therefore, image recognition software can help retail businesses manage the entire workload, including the audit, ensure planogram compliance, SKU positions, and monitor shelves efficiently. The aforementioned benefits of image recognition help retailers to emphasize more on generating revenue and increasing their sales. Moreover, image recognition helps retailers eliminates labor costs and enables employees to focus on core functionalities. Image recognition is further expected to transform the retail business by helping enterprises identify and answer complex problems while empowering people and businesses to make smarter decisions, thereby improving productivity. Image recognition further offers a huge market potential for businesses to grow and add more value to their offerings.

Restraint: High risk related to customer data thefts

The image recognition technology processes image data and provide the user with desired outputs. It also requires related technologies to enhance its functionalities, such as Machine Learning (ML), deep learning, Natural Language Processing (NLP), and facial recognition to processes on the stored data and provides actionable results. These technologies churn useful information from enormous volumes of data and help businesses in making critical decisions. Presently, data theft is one of the global risks faced by several shoppers. For shopping, customers require to feed details such as profile image, location, and bank accounts to mobile apps of a particular store. Furthermore, in the case of outsourcing data analysis to a third-party Business Intelligence (BI) vendor, organizations have to ensure that the BI vendor secures the customer’s data appropriately.

Opportunity: Growing adoption of cloud-based image recognition solutions

The exponential growth in cloud services offers a huge space for image recognition vendors to grow and expand to different locations. Cloud computing is proving to be beneficial for retailers. Most solution provider companies are deploying the solution on demand for their customers, and this is shifting the trend toward a cloud-based IT framework. The implementation cost and hardware cost for image recognition technologies are expensive, and every retailer does not have dedicated IT resources and robust infrastructure to support it. The implementation cost is one of the major factors for businesses to adopt image recognition solutions through cloud-based deployments. The cloud computing pay-per-use module and security features are cost-efficient for businesses. Cloud-based image recognition solutions reduce the upfront costs and eliminate concerns with regards to the maintenance of servers. Thus, cloud-based image recognition solutions are useful, as they improve the scalability of images capture and are cost-effective for retailers that find on-premises solutions expensive. The increasing adoption of cloud-based technology is a great opportunity for the growth of image recognition solution providers in retail, which would eliminate concerns related to expenditure and installation process

Challenge: Low resolution image size and storage issues

When a staff member clicks images of a large number of shelf images from various stores, there are high chances of capturing blurry images. A large number of images are rejected due to the lack of sophisticated technology to detect poor quality images in real time. Collecting such a huge amount of image data is very expensive for product recognition. Thus, there is a need for high-resolution images to be captured. When an image recognition technology detects a face, figure, or a product in an image or a still photo from video capture, the relative size of that face as compared to the enrolled image size affects how well the face will be recognized. A High Definition (HD) video has a low resolution compared to images captured via digital cameras, and thus occupies a significant amount of disk space. Heavy data transfer requires more computers over a network, which further limits the processing speed. Therefore, low resolution images and the lack of storage data could pose major challenges for image recognition solution providers

Digital Processing Image segment to grow at the highest CAGR during the forecast period

The adoption of digital image processing is rising significantly due to the growing use of digital images in almost every field. It uses computer algorithms to perform image processing on digital images. The technique further helps in the processing of videos and removing blur images, apart from providing easy compression and transmission of images. It further enables a wider range of algorithms to be applied to the input data and avoid problems, such as noise build-up and signal distortion during the processing of data. The technology further allows images to be defined over two dimensions or more, which categorizes digital image processing as multidimensional systems.

Vision Analytics segment to grow at the highest CAGR during the forecast period

The first and foremost area where image recognition has created value is vision analytics, which is crucial in understanding trend-based on historical data. Retailers have the constant need to anticipate future trend in order to stay ahead in the market and generate maximum revenue. The vision analytics application provides relevant insights by accurately recognizing objects in images. The application’s insights are not limited to purchasing behavior, and its capability extends to assess almost every possible aspect related to retail, including pricing, on-shelf product availability, sales, and many more. It also helps retailers to understand the geographical trend. Thus, vision analytics helps retailers to make informed decisions for future growth.

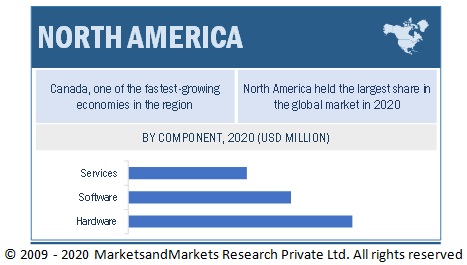

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global image recognition in retail market, while Asia Pacific (APAC) is likely to grow at the highest CAGR during the forecast period. North America is expected to be the leading region in terms of adopting image recognition in retail solutions and services. The US and Canada are expected to be the major contributors to the North American market. Enterprises in the region are the most progressive in terms of the adoption of Artificial Intelligence (AI), Machine Learning (ML), and cloud adoption, thereby boosting the growth of the image recognition in retail market. Moreover, the presence of major image recognition in retail vendors in the region to drive market growth.

The image recognition in retail market is dominated by a few globally established players such as, IBM (US), AWS (US), Trax (Singapore), Microsoft (US), and Google (US).

Scope of Report

|

Report Metrics |

Details |

|

Market size available for years |

2014–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast unit |

Value (USD Billion) |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Segments covered |

Technology, Component, Application, Deployment Type, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

The major market players include IBM (US), AWS (US), Google (US), Microsoft (US), and Trax (Singapore) (Total 26 companies) |

This research report categorizes the image recognition in retail market to forecast revenues and analyze trends in each of the following submarkets:

By Technology:

- Code Recognition

- Digital Image Processing

- Facial Recognition

- Object Recognition

- Others

By Component:

- Software

-

Services

- Professional Services

- Managed Services

By Application:

- Visual Product Search

- Security and Surveillance

- Vision Analytics

- Marketing and Advertising

- Others

By Deployment Type:

- On-Premises

- Cloud

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- Rest of Europe

-

APAC

- China

- India

- Rest of APAC

-

MEA

- United Arab Emirates (UAE)

- Saudi Arabia

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In April 2020, Microsoft partnered with Coca-Cola. The partnership aims to regulate its business operations on Microsoft Azure cloud and offer rich new digital experiences that will provide innovative solutions. These solutions will aid the Coca-Cola Company achieve new insights from data across the enterprise, enabling a 360-degree view of the business, and increases customer and employee experiences.

- In March 2020, Trax acquired Survey.com to combine both companies’ technologies, cater to needs of emerging CPG market and grocery retailers, and strengthen its position in image recognition in retail market.

- In August 2019, AWS enhanced Amazon Rekognition. The enhanced solution provides high accuracy of gender identification and emotion detection; and improved functionality to its face analysis features.

Frequently Asked Questions (FAQ):

What is the current size of global image recognition in retail market?

The global image recognition in retail market is estimated to be USD 1.4 billion in 2020 and projected to reach USD 3.7 billion by 2025, at a CAGR of 22.0%.

What is image recognition in retail?

Image recognition is a technology that assists users in identifying objects, logos, people, and places through digital images. The use of image recognition software and services in the retail market offer several benefits, such as accurate identification of out-of-stock products on shelves, ensure planogram compliance, product recommendations, increased visibility of products, analysis of future requirements, and understanding region-wise product sales, and customer experience recognition.

Who are the key market players in the image recognition in retail market?

Intelligence Retail (US), Imagga (Bulgaria), Vispera (Turkey), Snap2Insight (US), ParallelDots (US), Clarifai (US), NEC Corporation (Japan), Qualcomm (US), Slyce (US), Catchoom (Spain), Deepomatic (France), Blippar (UK), Ricoh Innovations (US), LTU (France), ShelfWise (Poland), Trigo (Israel), Wikitude (Austria), Standard Cognition (US), Huawei (China), Honeywell (US), and Zippin (US).

What are the top trends in the in the image recognition in retail market?

Following are the current market trends impacting the image recognition in retail market:

Driving factors for the image recognition in retail market:

- Increasing technological developments to boost the adoption of image recognition solutions among retailers

- Need to increase on-shelf availability, enhance customer experience, and maximize RoI

Opportunities for the image recognition in retail market:

- Increasing need to make informed decisions among retailers

- Growing adoption of cloud-based image recognition solutions

- Rising demand for brand recognition among end users

What is the COVID-19 impact on image recognition in retail market?

The outbreak of the COVID-19 has led to a growth in the demand for the vision analytics application for understanding the customer’s buying behavior of essential and non-essential items. It can also help analyze the trend of the region-wise product sale as well as the in-store availability across traditional and small retail shops. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

FIGURE 6 IMAGE RECOGNITION IN RETAIL MARKET: MARKET SEGMENTATION

FIGURE 7 MARKET: REGIONS COVERED

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2014–2019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 8 IMAGE RECOGNITION IN RETAIL MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 10 MARKET: RESEARCH METHODOLOGY

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP (SUPPLY SIDE): ILLUSTRATIVE EXAMPLE OF AMAZON WEB SERVICES

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 55)

TABLE 3 GLOBAL IMAGE RECOGNITION IN RETAIL MARKET SIZE, 2014–2019 (USD MILLION)

TABLE 4 POST- COVID-19: GLOBAL MARKET SIZE, 2019–2025 (USD MILLION)

FIGURE 12 GLOBAL MARKET TO WITNESS STEADY GROWTH DURING THE FORECAST PERIOD

FIGURE 13 SEGMENTS WITH HIGH MARKET SHARES IN THE MARKET IN 2020

FIGURE 14 NORTH AMERICA TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 ATTRACTIVE OPPORTUNITIES IN THE IMAGE RECOGNITION IN RETAIL MARKET

FIGURE 15 INCREASING TECHNOLOGICAL DEVELOPMENTS TO BOOST THE ADOPTION OF IMAGE RECOGNITION SOLUTIONS AMONG RETAILERS

4.2 NORTH AMERICA: MARKET, BY COMPONENT AND COUNTRY, 2020

FIGURE 16 SOFTWARE SEGMENT AND UNITED STATES TO ACCOUNT FOR HIGHER MARKET SHARES IN 2020

4.3 MARKET, BY DEPLOYMENT TYPE, 2020–2025

FIGURE 17 CLOUD DEPLOYMENT TYPE TO GROW AT A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

4.4 MARKET, BY COMPONENT, 2020–2025

FIGURE 18 SERVICES SEGMENT TO GROW AT A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 IMAGE RECOGNITION IN RETAIL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing technological developments to boost the adoption of image recognition solutions among retailers

5.2.1.2 Need to increase on-shelf availability, enhance customer experience, and maximize RoI due to COVID-19

5.2.2 RESTRAINTS

5.2.2.1 High risk related to customer data thefts

5.2.2.2 High cost of image recognition services

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing need to make informed decisions among retailers

5.2.3.2 Growing adoption of cloud-based image recognition solutions

5.2.3.3 Rising demand for brand recognition among end users

5.2.4 CHALLENGES

5.2.4.1 Low resolution image size and storage issues

5.2.4.2 Growing instances of shoplifting

5.3 COVID-19-DRIVEN MARKET DYNAMICS

5.3.1 IMAGE RECOGNITION IN RETAIL MARKET: DRIVERS AND THEIR IMPACT

5.3.2 MARKET: RESTRAINTS AND THEIR IMPACT

5.3.3 MARKET: OPPORTUNITIES AND THEIR IMPACT

5.3.4 MARKET: CHALLENGES AND THEIR IMPACT

5.3.5 CUMULATIVE GROWTH ANALYSIS

5.4 ADJACENT MARKETS

TABLE 5 ADJACENT MARKETS TO MARKET

5.5 USE CASES

5.5.1 USE CASE 1: PARALLELDOTS

5.5.2 USE CASE 2: TRAX

5.5.3 USE CASE 3: VISPERA

6 IMAGE RECOGNITION IN RETAIL MARKET, BY TECHNOLOGY (Page No. - 68)

6.1 INTRODUCTION

6.1.1 TECHNOLOGY: COVID-19 IMPACT

FIGURE 20 MARKET TO DECLINE CONSIDERABLY DURING 2019-2020 OWING TO THE COVID-19 PANDEMIC

FIGURE 21 DIGITAL IMAGE PROCESSING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

6.1.2 MARKET ESTIMATES AND FORECASTS, BY TECHNOLOGY, 2014–2025

TABLE 6 MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 7 MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

6.2 CODE RECOGNITION

6.2.1 CODE RECOGNITION: MARKET DRIVERS

6.2.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 8 CODE RECOGNITION: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 9 CODE RECOGNITION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 10 NORTH AMERICA: CODE RECOGNITION MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 11 NORTH AMERICA: CODE RECOGNITION MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.2.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY,2014–2025

TABLE 12 EUROPE: CODE RECOGNITION MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 13 EUROPE: CODE RECOGNITION MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.3 DIGITAL IMAGE PROCESSING

6.3.1 DIGITAL IMAGE PROCESSING: MARKET DRIVERS

6.3.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 14 DIGITAL IMAGE PROCESSING: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 15 DIGITAL IMAGE PROCESSING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 16 NORTH AMERICA: DIGITAL IMAGE PROCESSING MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 17 NORTH AMERICA: DIGITAL IMAGE PROCESSING MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.3.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 18 EUROPE: DIGITAL IMAGE PROCESSING MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 19 EUROPE: DIGITAL IMAGE PROCESSING MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.4 FACIAL RECOGNITION

6.4.1 FACIAL RECOGNITION: MARKET DRIVERS

6.4.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 20 FACIAL RECOGNITION: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 21 FACIAL RECOGNITION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.4.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 22 NORTH AMERICA: FACIAL RECOGNITION MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 23 NORTH AMERICA: FACIAL RECOGNITION MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.4.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY 2014–2025

TABLE 24 EUROPE: FACIAL RECOGNITION MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 25 EUROPE: FACIAL RECOGNITION MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.5 OBJECT RECOGNITION

6.5.1 OBJECT RECOGNITION: MARKET DRIVERS

6.5.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 26 OBJECT RECOGNITION: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 27 OBJECT RECOGNITION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.5.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY 2014–2025

TABLE 28 NORTH AMERICA: OBJECT RECOGNITION MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 29 NORTH AMERICA: OBJECT RECOGNITION MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.5.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 30 EUROPE: OBJECT RECOGNITION MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 31 EUROPE: OBJECT RECOGNITION MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.6 OTHER TECHNOLOGIES

6.6.1 OTHER TECHNOLOGIES: MARKET DRIVERS

6.6.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 32 OTHER TECHNOLOGIES: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 33 OTHER TECHNOLOGIES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.6.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 34 NORTH AMERICA: OTHER TECHNOLOGIES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 35 NORTH AMERICA: OTHER TECHNOLOGIES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.6.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 36 EUROPE: OTHER TECHNOLOGIES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 37 EUROPE: OTHER TECHNOLOGIES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7 IMAGE RECOGNITION IN RETAIL MARKET, BY COMPONENT (Page No. - 86)

7.1 INTRODUCTION

7.1.1 COMPONENT: COVID-19 IMPACT

FIGURE 22 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

7.1.2 MARKET ESTIMATES AND FORECASTS, BY COMPONENT, 2014–2025

TABLE 38 MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 39 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

7.2 SOFTWARE

7.2.1 SOFTWARE: MARKET DRIVERS

7.2.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 40 SOFTWARE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 41 SOFTWARE: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 42 NORTH AMERICA: SOFTWARE MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 43 NORTH AMERICA: SOFTWARE MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.2.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 44 EUROPE: SOFTWARE MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 45 EUROPE: SOFTWARE MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.3 SERVICES

7.3.1 SERVICES: MARKET DRIVERS

7.3.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 46 SERVICES: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 47 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 48 NORTH AMERICA: SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 49 NORTH AMERICA: SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.3.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 50 EUROPE: SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 51 EUROPE: SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

FIGURE 23 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

7.3.5 MARKET ESTIMATES AND FORECASTS, BY TYPE, 2014–2025

TABLE 52 SERVICES: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 53 SERVICES: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

7.3.6 PROFESSIONAL SERVICES

7.3.6.1 Professional services: Market drivers

7.3.6.2 Market estimates and forecasts, by region, 2014-2025

TABLE 54 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 55 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.6.3 Market estimates and forecasts, by north American country, 2014–2025

TABLE 56 NORTH AMERICA: PROFESSIONAL SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 57 NORTH AMERICA: PROFESSIONAL SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.3.6.4 Market estimates and forecasts, by European country, 2014–2025

TABLE 58 EUROPE: PROFESSIONAL SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 59 EUROPE: PROFESSIONAL SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.3.7 MANAGED SERVICES

7.3.7.1 Managed services: Market drivers

7.3.7.2 Market estimates and forecasts, by region, 2014-2025

TABLE 60 MANAGED SERVICES: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 61 MANAGED SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.7.3 Market estimates and forecasts, by north American country, 2014–2025

TABLE 62 NORTH AMERICA: MANAGED SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 63 NORTH AMERICA: MANAGED SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.3.7.4 Market estimates and forecasts, by European country, 2014–2025

TABLE 64 EUROPE: MANAGED SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 65 EUROPE: MANAGED SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8 IMAGE RECOGNITION IN RETAIL MARKET, BY APPLICATION (Page No. - 101)

8.1 INTRODUCTION

8.1.1 APPLICATION: COVID-19 IMPACT

FIGURE 24 VISION ANALYTICS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

8.1.2 MARKET ESTIMATES AND FORECASTS, BY APPLICATION, 2014–2025

TABLE 66 MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 67 MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

8.2 VISUAL PRODUCT SEARCH

8.2.1 VISUAL PRODUCT SEARCH: MARKET DRIVERS

8.2.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 68 VISUAL PRODUCT SEARCH: AIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 69 VISUAL PRODUCT SEARCH: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.2.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 70 NORTH AMERICA: VISUAL PRODUCT SEARCH MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 71 NORTH AMERICA: VISUAL PRODUCT SEARCH MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.2.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 72 EUROPE: VISUAL PRODUCT SEARCH MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 73 EUROPE: VISUAL PRODUCT SEARCH MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.3 SECURITY AND SURVEILLANCE

8.3.1 SECURITY AND SURVEILLANCE: MARKET DRIVERS

8.3.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 74 SECURITY AND SURVEILLANCE: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 75 SECURITY AND SURVEILLANCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 76 NORTH AMERICA: SECURITY SURVEILLANCE MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 77 NORTH AMERICA: SECURITY SURVEILLANCE MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.3.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 78 EUROPE: SECURITY SURVEILLANCE MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 79 EUROPE: SECURITY SURVEILLANCE MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.4 VISION ANALYTICS

8.4.1 VISION ANALYTICS: MARKET DRIVERS

8.4.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 80 VISION ANALYTICS: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 81 VISION ANALYTICS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.4.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY,2014–2025

TABLE 82 NORTH AMERICA: VISION ANALYTICS MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 83 NORTH AMERICA: VISION ANALYTICS MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.4.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 84 EUROPE: VISION ANALYTICS MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 85 EUROPE: VISION ANALYTICS MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.5 MARKETING AND ADVERTISING

8.5.1 MARKETING AND ADVERTISING: MARKET DRIVERS

8.5.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 86 MARKETING AND ADVERTISING: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 87 MARKETING AND ADVERTISING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.5.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY,2014–2025

TABLE 88 NORTH AMERICA: MARKETING AND ADVERTISING MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKETING AND ADVERTISING MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.5.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 90 EUROPE: MARKETING AND ADVERTISING MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 91 EUROPE: MARKETING AND ADVERTISING MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.6 OTHER APPLICATIONS

8.6.1 OTHER APPLICATIONS: MARKET DRIVERS

8.6.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 92 OTHER APPLICATIONS: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 93 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.6.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY,2014–2025

TABLE 94 NORTH AMERICA: OTHER APPLICATIONS MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 95 NORTH AMERICA: OTHER APPLICATIONS MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.6.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 96 EUROPE: OTHER APPLICATIONS MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 97 EUROPE: OTHER APPLICATIONS MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9 IMAGE RECOGNITION IN RETAIL MARKET, BY DEPLOYMENT TYPE (Page No. - 119)

9.1 INTRODUCTION

9.1.1 DEPLOYMENT TYPE: COVID-19 IMPACT

FIGURE 25 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

9.1.2 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE, 2014–2025

TABLE 98 MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2019 (USD MILLION)

TABLE 99 MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.2 ON-PREMISES

9.2.1 ON-PREMISES: MARKET DRIVERS

9.2.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 100 ON-PREMISES: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 101 ON-PREMISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.2.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 102 NORTH AMERICA: ON-PREMISES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 103 NORTH AMERICA: ON-PREMISES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.2.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 104 EUROPE: ON-PREMISES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 105 EUROPE: ON-PREMISES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.3 CLOUD

9.3.1 CLOUD: MARKET DRIVERS

9.3.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 106 CLOUD: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 107 CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 108 NORTH AMERICA: CLOUD MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 109 NORTH AMERICA: CLOUD MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.3.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 110 EUROPE: CLOUD MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 111 EUROPE: CLOUD MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10 IMAGE RECOGNITION IN RETAIL MARKET, BY REGION (Page No. - 128)

10.1 INTRODUCTION

FIGURE 26 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

10.1.1 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 112 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 113 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: COVID-19 IMPACT

10.2.2 NORTH AMERICA: MARKET DRIVERS

FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

10.2.3 MARKET ESTIMATES AND FORECASTS, BY TECHNOLOGY, 2014–2025

TABLE 114 NORTH AMERICA: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

10.2.4 MARKET ESTIMATES AND FORECASTS, BY COMPONENT, 2014–2025

TABLE 116 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.2.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE, 2014–2025

TABLE 118 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.2.6 MARKET ESTIMATES AND FORECASTS, BY APPLICATION, 2014–2025

TABLE 120 NORTH AMERICA: AIL MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

10.2.7 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE, 2014–2025

TABLE 122 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2019 (USD MILLION)

TABLE 123 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

10.2.8 MARKET ESTIMATES AND FORECASTS, BY COUNTRY, 2014–2025

TABLE 124 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.2.9 UNITED STATES

10.2.9.1 Market estimates and forecasts, by technology, 2014-2025

TABLE 126 UNITED STATES: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 127 UNITED STATES: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

10.2.9.2 Market estimates and forecasts, by component, 2014-2025

TABLE 128 UNITED STATES: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 129 UNITED STATES: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.2.9.3 Market estimates and forecasts, by service, 2014-2025

TABLE 130 UNITED STATES: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 131 UNITED STATES: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.2.9.4 Market estimates and forecasts, by application, 2014-2025

TABLE 132 UNITED STATES: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 133 UNITED STATES: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

10.2.9.5 Market estimates and forecasts, by deployment type, 2014-2025

TABLE 134 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2019 (USD MILLION)

TABLE 135 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

10.2.10 CANADA

10.2.10.1 Market estimates and forecasts, by technology, 2014-2025

TABLE 136 CANADA: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 137 CANADA: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

10.2.10.2 Market estimates and forecasts, by component, 2014-2025

TABLE 138 CANADA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 139 CANADA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.2.10.3 Market estimates and forecasts, by service, 2014-2025

TABLE 140 CANADA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 141 CANADA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.2.10.4 Market estimates and forecasts, by application, 2014-2025

TABLE 142 CANADA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 143 CANADA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

10.2.10.5 Market estimates and forecasts, by deployment type, 2014-2025

TABLE 144 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2019 (USD MILLION)

TABLE 145 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: COVID-19 IMPACT

10.3.2 EUROPE: MARKET DRIVERS

10.3.3 MARKET ESTIMATES AND FORECASTS, BY TECHNOLOGY, 2014–2025

TABLE 146 EUROPE: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 147 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

10.3.4 MARKET ESTIMATES AND FORECASTS, BY COMPONENT, 2014–2025

TABLE 148 EUROPE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 149 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.3.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE, 2014–2025

TABLE 150 EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 151 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.3.6 MARKET ESTIMATES AND FORECASTS, BY APPLICATION, 2014–2025

TABLE 152 EUROPE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 153 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

10.3.7 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE, 2014–2025

TABLE 154 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2019 (USD MILLION)

TABLE 155 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

10.3.8 MARKET ESTIMATES AND FORECASTS, BY COUNTRY, 2014–2025

TABLE 156 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 157 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.3.9 UNITED KINGDOM

10.3.9.1 Market estimates and forecasts, by technology, 2014-2025

TABLE 158 UNITED KINGDOM: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 159 UNITED KINGDOM: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

10.3.9.2 Market estimates and forecasts, by component, 2014-2025

TABLE 160 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 161 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.3.9.3 Market estimates and forecasts, by service, 2014-2025

TABLE 162 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 163 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.3.9.4 Market estimates and forecasts, by application, 2014-2025

TABLE 164 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 165 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

10.3.9.5 Market estimates and forecasts, by deployment type, 2014-2025

TABLE 166 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2019 (USD MILLION)

TABLE 167 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

10.3.10 GERMANY

10.3.10.1 Market estimates and forecasts, by technology, 2014-2025

TABLE 168 GERMANY: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 169 GERMANY: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

10.3.10.2 Market estimates and forecasts, by component, 2014-2025

TABLE 170 GERMANY: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 171 GERMANY: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.3.10.3 Market estimates and forecasts, by service, 2014-2025

TABLE 172 GERMANY: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 173 GERMANY: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.3.10.4 Market estimates and forecasts, by application, 2014-2025

TABLE 174 GERMANY: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 175 GERMANY: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

10.3.10.5 Market estimates and forecasts, by deployment type, 2014-2025

TABLE 176 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2019 (USD MILLION)

TABLE 177 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

10.3.11 REST OF EUROPE

10.3.11.1 Market estimates and forecasts, by technology, 2014-2025

TABLE 178 REST OF EUROPE: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 179 REST OF EUROPE: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

10.3.11.2 Market estimates and forecasts, by component, 2014-2025

TABLE 180 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 181 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.3.11.3 Market estimates and forecasts, by service, 2014-2025

TABLE 182 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 183 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.3.11.4 Market estimates and forecasts, by application, 2014-2025

TABLE 184 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 185 REST OF EUROPE: MARKET SIZE,BY APPLICATION, 2019–2025 (USD MILLION)

10.3.11.5 Market estimates and forecasts, by deployment type, 2014-2025

TABLE 186 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2019 (USD MILLION)

TABLE 187 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: COVID-19 IMPACT

10.4.2 ASIA PACIFIC: MARKET DRIVERS

FIGURE 28 ASIA PACIFIC: MARKET SNAPSHOT

10.4.3 MARKET ESTIMATES AND FORECASTS, BY TECHNOLOGY, 2014–2025

TABLE 188 ASIA PACIFIC: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 189 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

10.4.4 MARKET ESTIMATES AND FORECASTS, BY COMPONENT, 2014–2025

TABLE 190 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 191 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.4.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE, 2014–2025

TABLE 192 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 193 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.4.6 MARKET ESTIMATES AND FORECASTS, BY APPLICATION, 2014–2025

TABLE 194 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 195 ASIA PACIFIC: MARKET SIZE,BY APPLICATION, 2019–2025 (USD MILLION)

10.4.7 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE, 2014–2025

TABLE 196 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2019 (USD MILLION)

TABLE 197 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

10.4.8 MARKET ESTIMATES AND FORECASTS, BY COUNTRY, 2014–2025

TABLE 198 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 199 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.4.9 CHINA

10.4.10 INDIA

10.4.11 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.2 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.3 MARKET ESTIMATES AND FORECASTS, BY TECHNOLOGY, 2014–2025

TABLE 200 MIDDLE EAST AND AFRICA: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 201 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

10.5.4 MARKET ESTIMATES AND FORECASTS, BY COMPONENT, 2014–2025

TABLE 202 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 203 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.5.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE, 2014–2025

TABLE 204 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 205 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.5.6 MARKET ESTIMATES AND FORECASTS, BY APPLICATION, 2014–2025

TABLE 206 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 207 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

10.5.7 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE, 2014–2025

TABLE 208 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2019 (USD MILLION)

TABLE 209 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

10.5.8 MARKET ESTIMATES AND FORECASTS, BY COUNTRY, 2014–2025

TABLE 210 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 211 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.5.9 UNITED ARAB EMIRATES

10.5.10 SAUDI ARABIA

10.5.11 REST OF MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: COVID-19 IMPACT

10.6.2 LATIN AMERICA: MARKET DRIVERS

10.6.3 MARKET ESTIMATES AND FORECASTS, BY TECHNOLOGY, 2014–2025

TABLE 212 LATIN AMERICA: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

10.6.4 MARKET ESTIMATES AND FORECASTS, BY COMPONENT, 2014–2025

TABLE 214 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 215 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.6.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE, 2014–2025

TABLE 216 MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.6.6 MARKET ESTIMATES AND FORECASTS, BY APPLICATION, 2014–2025

TABLE 218 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 219 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

10.6.7 MARKET ESTIMATES AND FORECASTS, BY DEPLOYMENT TYPE, 2014–2025

TABLE 220 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2019 (USD MILLION)

TABLE 221 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

10.6.8 MARKET ESTIMATES AND FORECASTS, BY COUNTRY, 2014–2025

TABLE 222 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 223 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.6.9 BRAZIL

10.6.10 MEXICO

10.6.11 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 184)

11.1 INTRODUCTION

FIGURE 29 KEY DEVELOPMENTS IN THE IMAGE RECOGNITION IN RETAIL MARKET DURING 2017–2020

11.1.1 NEW SOLUTION LAUNCHES/SOLUTION ENHANCEMENTS

TABLE 224 NEW SOLUTION LAUNCHES/ SOLUTION ENHANCEMENTS, 2017–2019

11.1.2 PARTNERSHIPS AND COLLABORATIONS

TABLE 225 PARTNERSHIPS AND COLLABORATIONS, 2017–2019

11.1.3 MERGERS AND ACQUISITIONS

TABLE 226 MERGERS AND ACQUISITIONS, 2017–2020

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 VISIONARY LEADERS

11.2.2 INNOVATORS

11.2.3 DYNAMIC DIFFERENTIATORS

11.2.4 EMERGING COMPANIES

FIGURE 30 IMAGE RECOGNITION IN RETAIL (GLOBAL), COMPETITIVE LEADERSHIP MAPPING, 2020

11.3 MARKET SHARE, 2020

FIGURE 31 MARKET SHARE OF KEY PLAYERS IN THE IMAGE RECOGNITION IN RETAIL MARKET, 2020

12 COMPANY PROFILES (Page No. - 190)

12.1 INTRODUCTION

FIGURE 32 GEOGRAPHIC REVENUE MIX OF THE MARKET PLAYERS

(Business Overview, Solutions Offered, Recent Developments, and SWOT Analysis)*

12.2 AWS

FIGURE 33 AWS: COMPANY SNAPSHOT

FIGURE 34 AWS: SWOT ANALYSIS

12.3 IBM

FIGURE 35 IBM: COMPANY SNAPSHOT

FIGURE 36 IBM: SWOT ANALYSIS

12.4 GOOGLE

FIGURE 37 GOOGLE: COMPANY SNAPSHOT

FIGURE 38 GOOGLE: SWOT ANALYSIS

12.5 MICROSOFT

FIGURE 39 MICROSOFT: COMPANY SNAPSHOT

FIGURE 40 MICROSOFT: SWOT ANALYSIS

12.6 TRAX

FIGURE 41 TRAX: SWOT ANALYSIS

12.7 NEC CORPORATION

FIGURE 42 NEC CORPORATION: COMPANY SNAPSHOT

12.8 QUALCOMM

FIGURE 43 QUALCOMM: COMPANY SNAPSHOT

12.9 CATCHOOM

12.10 SLYCE

12.11 LTU

12.12 INTELLIGENCE RETAIL

12.13 SNAP2INSIGHT

12.14 IMAGGA

12.15 PARALLELDOTS

12.16 VISPERA

12.17 BLIPPAR

12.18 RICOH INNOVATIONS

12.19 CLARIFAI

12.20 DEEPOMATIC

12.21 SHELFWISE

12.22 TRIGO

12.23 WIKITUDE

12.24 HUAWEI

12.25 HONEYWELL

12.26 STANDARD COGNITION

12.27 ZIPPIN

*Details on Business Overview, Solutions Offered, Recent Developments, and SWOT Analysis might not be captured in case of unlisted companies.

12.28 RIGHT TO WIN

13 ADJACENT MARKETS (Page No. - 227)

13.1 INTRODUCTION

TABLE 227 ADJACENT MARKETS AND FORECASTS

13.2 LIMITATIONS

13.3 IMAGE RECOGNITION IN RETAIL ECOSYSTEM AND ADJACENT MARKETS

13.4 IMAGE RECOGNITION IN RETAIL ADJACENT MARKET – AI IN RETAIL MARKET

TABLE 228 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 229 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY TECHNOLOGY, 2015–2022 (USD MILLION)

TABLE 230 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 231 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 232 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 233 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

13.5 IMAGE RECOGNITION IN RETAIL ADJACENT MARKET – IOT IN RETAIL MARKET

TABLE 234 IOT IN RETAIL MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 235 IOT IN RETAIL MARKET SIZE, BY PLATFORM, 2019–2025 (USD MILLION)

TABLE 236 IOT IN RETAIL MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 237 IOT IN RETAIL MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 238 IOT IN RETAIL MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 239 IOT IN RETAIL MARKET SIZE, BY OPERATIONS MANAGEMENT, 2019–2025 (USD MILLION)

TABLE 240 IOT IN RETAIL MARKET SIZE, BY ASSET MANAGEMENT, 2019–2025 (USD MILLION)

TABLE 241 IOT IN RETAIL MARKET SIZE, BY CUSTOMER EXPERIENCE MANAGEMENT, 2019–2025 (USD MILLION)

TABLE 242 IOT IN RETAIL MARKET SIZE, BY ADVERTISING AND MARKETING, 2019–2025 (USD MILLION)

TABLE 243 IOT IN RETAIL MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.6 IMAGE RECOGNITION IN RETAIL ADJACENT MARKET – FACIAL RECOGNITION

TABLE 244 FACIAL RECOGNITION MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 245 FACIAL RECOGNITION MARKET SIZE, BY SOFTWARE TOOLS, 2017–2024 (USD MILLION)

TABLE 246 FACIAL RECOGNITION MARKET SIZE, BY SERVICE, 2017–2024 (USD MILLION)

TABLE 247 FACIAL RECOGNITION MARKET SIZE, BY APPLICATION AREA, 2017–2024 (USD MILLION)

TABLE 248 FACIAL RECOGNITION MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 249 FACIAL RECOGNITION MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14 APPENDIX (Page No. - 238)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for the image recognition in retail market. An exhaustive secondary research was done to collect information on the image recognition in retail industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the image recognition in retail market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, and databases.

Primary Research

In the primary research process, various sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for making this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the image recognition in retail market.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), an extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types; the competitive landscape of image recognition in retail solution and service providers; and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key players’ strategies.

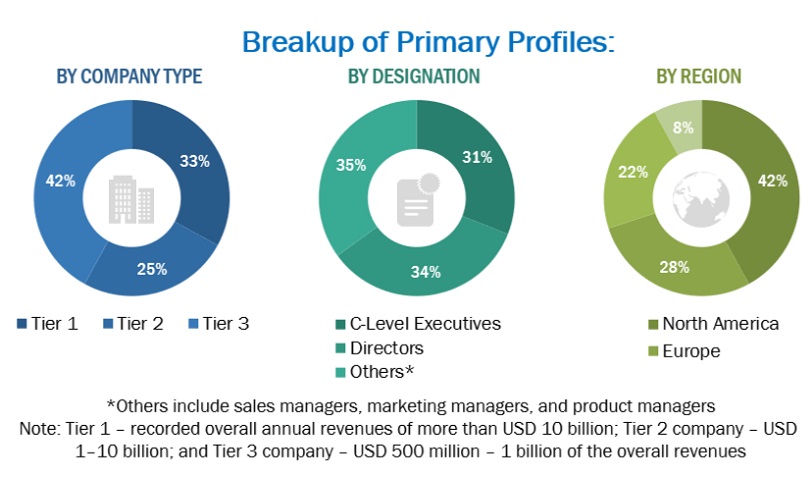

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the image recognition in retail market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry and markets were identified through extensive secondary research.

- The aggregate of all companies’ revenues were extrapolated to estimate the overall market size.

- All percentage shares and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the image recognition in retail market by technology, component, application, deployment type, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players of the image recognition in retail market and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments, such as new product launches and enhancements; acquisitions; and partnerships and collaborations, in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic analysis

- Further breakup of the APAC image recognition in retail market into countries

- Further breakup of the MEA market into countries

- Further breakup of the Latin American market into countries

Company information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Image Recognition in Retail Market