Image Recognition in CPG Market by Component (Hardware, Solutions & Services), Application (Inventory Analysis, Product and Shelf Monitoring Analysis & Gauging Emotions), Deployment Mode, End User (Online & Offline), and Region - Global Forecast to 2025

Image Recognition in CPG Market Size, Trends & Forecast

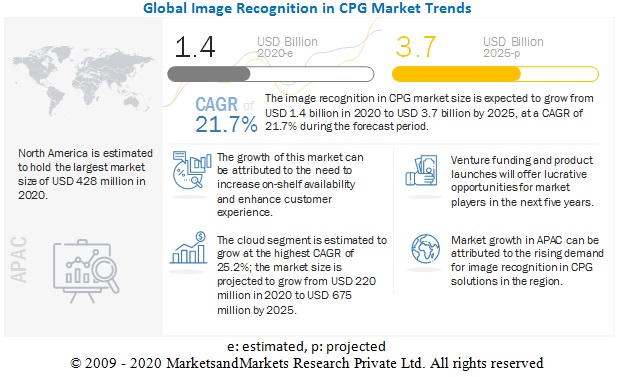

[329 Pages Report] The global Image Recognition in CPG Market size was exceeded $1.4 billion in 2020 and is anticipated to hit a revenue around $3.7 billion by the cease of 2025 at an increasing CAGR of 21.7% for the forecast period between 2020 to 2025. The base year for estimation is 2019 and the market size available for the years 20120 to 2025. Image recognition in CPG involved increased in the need for efficient and profitable retail execution processes with adherence to compliance standards is one of the major factors expected to drive the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Latest Trends

The COVID-19 pandemic has resulted in an increased demand for CPG products. In the US, there was an upsurge in online and offline sales in March once lockdown was announced by the governors of respective states. This decision led to a sudden spike in average sales of both online and offline products by 15x for 2 weeks. According to Adobe Digital Economy Index July 2020, the pandemic resulted in USD 93.9 billion extra spent online since March. US online grocery stores saw a 3% increase in average daily sales in July.

Image Recognition in CPG Market Growth Dynamics

Driving Factors

Image recognition solutions are revolutionizing the way CPG companies manage customer interactions, market products online and offline, and manage store inventory. Image recognition technology is increasingly being used to search for products online for purchase. For example, Snapchat’s parent company, Snap, is currently working on developing a visual product feature in Snapchat that will leverage image recognition technology and help users to take pictures of products in the real world; and identify, browse, and purchase items on Amazon. With the boom in the e-commerce industry, even more so during the COVID-19 pandemic, entrepreneurs and retailers have realized that conventional strategies of sales promotions, marketing, and visual merchandising will not be sustainable in the CPG industry in the long term. Hence, retailers are quickly adapting to the new era of AI and image recognition to deliver next level customer experience. The use of image recognition for shelf recognition, product placement, and maintaining compliance with merchandising standards is quickly gaining momentum. Image recognition technology is assisting manufacturers, retailers, and marketers to understand their market and react dynamically.

Restraining Factors

The high cost involved in making image recognition systems could be a hindrance to the growth of the market. Most of the enabling technologies, such as face recognition, deep learning, computer vision, AI, ML, and gesture recognition, have huge development costs. Thus, companies that lack financial resources do not opt for image recognition offerings even if they are interested in such solutions to increase productivity. Well-known vendor solutions in the market such as Microsoft Computer Vision API, Microsoft Emotion API, Amazon Rekognition, Google Cloud Vision API, and IBM Watson Visual Recognition are highly priced, making it difficult for small CPG companies to deploy them. The huge cost of implementing image recognition solutions and training AI enablers to execute a specific task will act as a deterrent for small retail and e-commerce businesses; this could prove to be a restraint for image recognition solution vendors during the forecast period.

Application Insights

Major cloud companies such as AWS, Microsoft, and Google are heavily investing in enhancing their image recognition in the CPG market offerings to optimize in-store and online retail execution. The demand for cloud-based services has soared even more due to the outbreak of COVID-19. Intelligence Retail, a computer vision and AI provider for merchandising solutions, leverages the IBM cloud and analytics solution featuring cutting-edge Graphic Processing Units (GPUs) to help retailers and CPG companies drive sales, decrease audit costs, boost performance, and drive customer loyalty. Microsoft is leveraging its Microsoft Azure stack to rapidly process huge data volumes for store shelf management and to empower CPG representatives to gain real-time visibility into the retail execution process. In early 2019, Trax partnered with Google Cloud to leverage Google’s cloud and edge computing technology combined with Trax’s image recognition and ML capabilities to effectively manage in-store inventory and every SKU present on the shelf with actionable real-time insights. In 2019, Salesforce, an American cloud-based CRM company, launched Consumer Goods Cloud to elevate the in-store experience using AI. The Consumer Goods Cloud enables field representatives from the CPG companies to ensure optimum shelf stock levels and ensure an image recognition and object detection solution for easy inventory management, and planogram compliance checks. Such organic and inorganic strategies supported by underlying cloud infrastructure would promote the future growth of the image recognition market in the CPG industry

Solution Insights

Installation and set-up of image recognition software and hardware can be overwhelming for newcomers. Some image recognition solutions also require some amount of coding to function. For example, Microsoft Computer Vision API for image processing requires knowledge of programming to set up, making it a tedious job for firsthand operators. CPG manufacturers are accustomed to traditional ways of operating their retail store outlets. Hence, it becomes extremely cumbersome for retailers to decipher various functions, ever evolving Application Programming Interfaces (APIs), and complex ML and AI algorithms. Image recognition embedded with AI-based features will take some time to become mainstream due to the complexities involved in its implementation. Consequently, CPG manufacturers tend to rely on traditional methods of auditing and operating using visual merchandising, discounts, cross-selling, and up-selling which are not profitable in the long run. Image recognition providers must focus on launching user friendly solutions to help retailers and manufacturers understand their market in real-time while adhering to retail compliance norms.

The online end user segment to grow at the highest CAGR during the forecast period

The online segment is estimated to grow from USD 517 million in 2020 to USD 1,455 million by 2025, at the highest CAGR of 22.8% during the forecast period. With the advent of e-commerce, the customer shopping experience has been transformed. Unlike in brick-and-mortar stores, customers no longer have to stand in long queues to buy their preferred goods. Image recognition solutions apply different techniques and technology, such as AI and deep learning techniques in the field of computer vision. Tech giants such as Microsoft and Google are investing millions of dollars in new AI projects to support the image recognition in CPG market. E-commerce image recognition solutions help to understand objects in an image and find similar products.

The Cloud segment to grow at the highest CAGR during the forecast period

The cloud segment is estimated to grow at the highest CAGR of 25.2%; the market size is projected to grow from USD 220 million in 2020 to USD 675 million by 2025. Increasing internet usage is driving the growth of cloud- based image recognition technologies. Many offline stores have adopted cloud image recognition solutions to avoid additional costs. Cloud-based services reduce licensing costs, cut down on unnecessary IT staff, focus on maintenance, and offer greater flexibility to expand their business. Companies such as Google provide solutions such as Vision API which helps to extract texts from images. The engine behind the API classifies images, detects objects and people’s faces, and recognizes printed words within images. Another cloud recognition company, Vuforia, offers cloud recognition services that enable developers to host and manage image targets online. The solution helps CPG companies and stores in product visualization, instore traffic generation and product recognition.

To know about the assumptions considered for the study, download the pdf brochure

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global image recognition in CPG market, while Asia Pacific (APAC) is likely to grow at the highest CAGR during the forecast period. North America is a major IT hub in terms of technology adoption and IT infrastructure. In terms of market size, North America is a significant contributor to the global image recognition in CPG market. The US and Canada are the major contributors to the North American market. Canada and the US are increasingly witnessing the merging of artificial intelligence with image recognition and augmented reality; this is expected to drive market growth in the region. The United States is home to major AI-based image recognition companies, leading to increasing adoption of the technology across the region. As a result, many companies are making their move towards the US market, intending to develop an assemblage of AI capabilities. There has been a growing demand for image recognition in the CPG sector in Canada to improve product placements and assist in object identification. Enterprises in the region are most progressive in the adoption of AI, computer vision, deep learning, and the cloud, thereby boosting the growth of the market. This, coupled with the region’s strong financial position, enables significant investments in leading tools and technologies for effective business operations

Top Companies in Image Recognition in CPG Market

The image recognition in CPG market is dominated by a few globally established players such as, IBM (US), AWS (US), Trax (Singapore), Microsoft (US), and Google (US).

Image Recognition in CPG Market Report Scope

|

Report Metrics |

Details |

|

Market size available for years |

2014–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast unit |

Value (USD Million) |

|

Segments covered |

By Component, Application, Deployment Type, End user type and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM (US), Google (US), Qualcomm (US), Microsoft (US), AWS (US), Trax (Singapore), Catchoom (Spain), Slyce (US), LTU Tech (France), Imagga (Bulgaria), Vispera(Turkey), Blippar(UK), Ricoh innovations (US), Clarifai(US), Deepomatic (France), Wikitude (Austria), Huawei (China), Honeywell (US), Toshiba (Japan), Oracle (US) |

This research report categorizes the image recognition in CPG market to forecast revenues and analyze trends in each of the following submarkets:

By Component:

- Hardware

- Solution

- Services

By Application:

- Inventory analysis

- Product and Shelf Monitoring Analysis

- Auditing Product Placement

- Product Placement Trend Analysis

- Assessing Compliance and Competition

- Category Analysis

- Gauging emotions

By Deployment Type:

- cloud

- On-Premises

By End user type:

- Online

- Offline

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- Rest of Europe

-

APAC

- China

- Japan

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia

- United Arab Emirates (UAE)

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In April 2020, Microsoft partnered with Coca-Cola. The partnership aims to regulate its business operations on Microsoft Azure cloud and offer rich new digital experiences that will provide innovative solutions. These solutions will aid the Coca-Cola Company achieve new insights from data across the enterprise, enabling a 360-degree view of the business, and increases customer and employee experiences.

- In March 2020, Trax acquired Survey.com to combine both companies’ technologies, cater to needs of emerging CPG market and grocery retailers, and strengthen its position in image recognition in retail market.

- In August 2019, AWS enhanced Amazon Rekognition. The enhanced solution provides high accuracy of gender identification and emotion detection; and improved functionality to its face analysis features.

Frequently Asked Questions (FAQ):

What is the current size of global image recognition in CPG market?

What is image recognition in CPG?

Who are the key companies in the image recognition in CPG market?

What are the top trends in the in the image recognition in CPG market?

Following are the current market trends impacting the image recognition in CPG market:

Driving factors for the image recognition in CPGmarket:

- Need for efficient and profitable retail execution processes with adherence to compliance standards

- Technological advancements to boost demand for image recognition among CPG companies

Opportunities for the image recognition in CPGmarket:

- Integration of AI with image recognition solutions in the CPG industry to improve store performance

Accelerating demand for cloud-powered image recognition solutions to aid CPG representatives in smooth retail execution

What is the COVID-19 impact on image recognition in CPG market?

What are image recognition in CPG market Services?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 6 IMAGE RECOGNITION IN CPG MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM THE SOLUTIONS/SERVICES OF VENDORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM HARDWARE, SOLUTIONS, AND SERVICES

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, TOP DOWN (DEMAND SIDE): SHARE OF IMAGE RECOGNITION IN CPG IN THE OVERALL IT MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

FIGURE 10 COMPETITIVE LEADERSHIP MAPPING MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

FIGURE 11 STARTUP/SME COMPETITIVE LEADERSHIP MAPPING: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 12 GLOBAL IMAGE RECOGNITION IN CPG MARKET TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

FIGURE 13 LEADING SEGMENTS IN MARKET IN 2020

FIGURE 14 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN IMAGE RECOGNITION IN CPG MARKET

FIGURE 15 INCREASING TECHNOLOGICAL DEVELOPMENTS TO BOOST ADOPTION OF IMAGE RECOGNITION SOLUTIONS AMONG RETAILERS

4.2 MARKET BY END USER AND DEPLOYMENT MODE

FIGURE 16 OFFLINE SEGMENT AND ON-PREMISE SEGMENT TO HOLD HIGH MARKET SHARES IN 2020

4.3 MARKET BY REGION

FIGURE 17 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET INVESTMENT SCENARIO

FIGURE 18 EUROPE AND ASIA PACIFIC TO EMERGE AS BEST MARKETS FOR INVESTMENTS OVER THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IMAGE RECOGNITION IN THE CPG MARKET

5.2.1 DRIVERS

5.2.1.1 Need for efficient and profitable retail execution processes with adherence to compliance standards

5.2.1.2 Technological advancements to boost demand for image recognition among CPG companies

5.2.2 RESTRAINTS

5.2.2.1 High installation cost of image recognition services

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of AI with image recognition solutions in the CPG industry to improve store performance

5.2.3.2 Accelerating demand for cloud-powered image recognition solutions to aid CPG representatives in smooth retail execution

5.2.4 CHALLENGES

5.2.4.1 CPG manufacturers and retailers dependency on traditional auditing methods

5.3 COVID-19 DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

TABLE 3 COVID-19 IMPACT: IMAGE RECOGNITION IN CPG MARKET

5.4 VALUE CHAIN

FIGURE 20 VALUE CHAIN OF MARKET

5.5 ECOSYSTEM: IMAGE RECOGNITION IN CPG

5.6 AVERAGE SELLING PRICE/PRICING MODEL OF IMAGE RECOGNITION IN CPG PLAYERS

5.7 TECHNOLOGY ANALYSIS

5.7.1 CODE RECOGNITION

5.7.2 DIGITAL IMAGE PROCESSING

5.7.3 OBJECT RECOGNITION

5.8 USE CASES

5.8.1 USE CASE: PLANORAMA

5.8.2 USE CASE: SNAP2INSIGHT

5.8.3 USE CASE: INFRRD

5.8.4 USE CASE: VISPERA

5.8.5 USE CASE: TRAX

6 COVID-19 IMPACT ON IMAGE RECOGNITION IN CPG MARKET (Page No. - 58)

7 IMAGE RECOGNITION IN CPG MARKET, BY COMPONENT (Page No. - 59)

7.1 INTRODUCTION

7.1.1 COMPONENT: MARKET DRIVERS

7.1.2 COMPONENT: IMAGE RECOGNITION IN CPG VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 21 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 4 MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 5 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

7.2 HARDWARE

TABLE 6 HARDWARE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 7 HARDWARE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3 SOLUTIONS

TABLE 8 SOLUTIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 9 SOLUTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.4 SERVICES

TABLE 10 SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 11 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 IMAGE RECOGNITION IN CPG MARKET, BY APPLICATION (Page No. - 65)

8.1 INTRODUCTION

FIGURE 22 GAUGING EMOTIONS SEGMENT WILL REGISTER HIGHEST GROWTH IN FORECAST PERIOD

8.1.1 APPLICATION: MARKET DRIVERS

8.1.2 APPLICATION: IMAGE RECOGNITION IN CPG VENDOR INITIATIVES AND DEVELOPMENTS

TABLE 12 MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 13 MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

8.2 INVENTORY ANALYSIS

TABLE 14 INVENTORY ANALYSIS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 15 INVENTORY ANALYSIS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 PRODUCT AND SHELF MONITORING ANALYSIS

TABLE 16 PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 17 PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 18 PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 19 PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

8.3.1 AUDITING PRODUCT PLACEMENT

TABLE 20 AUDITING PRODUCT PLACEMENT: IMAGE RECOGNITION IN CPG MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 21 AUDITING PRODUCT PLACEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.2 PRODUCT PLACEMENT TREND ANALYSIS

TABLE 22 PRODUCT PLACEMENT TREND ANALYSIS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 23 PRODUCT PLACEMENT TREND ANALYSIS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.3 ASSESSING COMPLIANCE AND COMPETITION

TABLE 24 ASSESSING COMPLIANCE AND COMPETITION: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 25 ASSESSING COMPLIANCE AND COMPETITION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.4 CATEGORY ANALYSIS

TABLE 26 CATEGORY ANALYSIS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 27 CATEGORY ANALYSIS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.4 GAUGING EMOTIONS

TABLE 28 GAUGING EMOTIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 29 GAUGING EMOTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 IMAGE RECOGNITION IN CPG MARKET, BY DEPLOYMENT MODE (Page No. - 75)

9.1 INTRODUCTION

FIGURE 23 CLOUD SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

9.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

9.1.2 DEPLOYMENT TYPE: IMAGE RECOGNITION IN CPG VENDOR INITIATIVES AND DEVELOPMENTS

TABLE 30 MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 31 MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

9.2 CLOUD

TABLE 32 CLOUD: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 33 CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3 ON-PREMISE

TABLE 34 ON-PREMISE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 35 ON-PREMISE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10 IMAGE RECOGNITION IN CPG MARKET, BY END USER (Page No. - 80)

10.1 INTRODUCTION

10.1.1 END USER: MARKET DRIVERS

10.1.2 END USER: IMAGE RECOGNITION IN CPG VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 24 ONLINE SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 36 MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 37 MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

10.2 ONLINE

TABLE 38 ONLINE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 39 ONLINE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.3 OFFLINE

TABLE 40 OFFLINE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 41 OFFLINE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11 IMAGE RECOGNITION IN CPG MARKET, BY REGION (Page No. - 85)

11.1 INTRODUCTION

11.1.1 REGULATORY IMPLICATIONS

11.1.1.1 General Data Protection Regulation (GDPR)

11.1.1.2 Federal Information Security Management Act (FISMA)

11.1.1.3 National Commission on Informatics and Liberty (CNIL)

FIGURE 25 ASIA PACIFIC EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 42 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 43 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: COVID-19 IMPACT

11.2.2 NORTH AMERICA: MARKET DRIVERS

11.2.3 NORTH AMERICA: MARKET VENDOR INITIATIVES AND DEVELOPMENTS

FIGURE 26 NORTH AMERICA MARKET SNAPSHOT

TABLE 44 NORTH AMERICA: IMAGE RECOGNITION IN CPG MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 48 NORTH AMERICA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 49 NORTH AMERICA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.2.4 UNITED STATES

TABLE 56 UNITED STATES: IMAGE RECOGNITION IN CPG MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 57 UNITED STATES: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 58 UNITED STATES: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 59 UNITED STATES: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 60 UNITED STATES: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 61 UNITED STATES: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 62 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 63 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 64 UNITED STATES: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 65 UNITED STATES: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.2.5 CANADA

TABLE 66 CANADA: IMAGE RECOGNITION IN CPG MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 67 CANADA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 68 CANADA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 69 CANADA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 70 CANADA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 71 CANADA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 72 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 73 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 74 CANADA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 75 CANADA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: COVID-19 IMPACT

11.3.2 EUROPE: IMAGE RECOGNITION IN CPG MARKET DRIVERS

11.3.3 EUROPE: MARKET VENDOR INITIATIVES AND DEVELOPMENT

TABLE 76 EUROPE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 80 EUROPE: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 81 EUROPE: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.3.4 UNITED KINGDOM

TABLE 88 UNITED KINGDOM: IMAGE RECOGNITION IN CPG MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 89 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 90 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 91 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 92 UNITED KINGDOM: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 93 UNITED KINGDOM: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 94 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 95 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 96 UNITED KINGDOM: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 97 UNITED KINGDOM: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.3.5 GERMANY

TABLE 98 GERMANY: IMAGE RECOGNITION IN CPG MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 99 GERMANY: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 100 GERMANY: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 101 GERMANY: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 102 GERMANY: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 103 GERMANY: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 104 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 105 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 106 GERMANY: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 107 GERMANY: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 108 REST OF EUROPE: IMAGE RECOGNITION IN CPG MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 109 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 110 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 111 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 112 REST OF EUROPE: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 113 REST OF EUROPE: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 114 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 115 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 116 REST OF EUROPE: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 117 REST OF EUROPE: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: COVID-19 IMPACT

11.4.2 ASIA PACIFIC: IMAGE RECOGNITION IN CPG MARKET DRIVERS

11.4.3 ASIA PACIFIC: MARKET VENDOR INITIATIVES AND DEVELOPMENT

FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 118 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 122 ASIA PACIFIC: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 123 ASIA PACIFIC: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.4.4 CHINA

TABLE 130 CHINA: IMAGE RECOGNITION IN CPG MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 131 CHINA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 132 CHINA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 133 CHINA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 134 CHINA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 135 CHINA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 136 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 137 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 138 CHINA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 139 CHINA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.4.5 JAPAN

TABLE 140 JAPAN: IMAGE RECOGNITION IN CPG MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 141 JAPAN: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 142 JAPAN: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 143 JAPAN: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 144 JAPAN: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 145 JAPAN: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 146 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 147 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 148 JAPAN: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 149 JAPAN: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 150 REST OF ASIA PACIFIC: IMAGE RECOGNITION IN CPG MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 151 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 152 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 153 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 154 REST OF ASIA PACIFIC: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 155 REST OF ASIA PACIFIC: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 156 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 157 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 158 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 159 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.2 MIDDLE EAST AND AFRICA: IMAGE RECOGNITION IN CPG MARKET DRIVERS

11.5.3 MIDDLE EAST AND AFRICA: MARKET VENDOR INITIATIVES AND DEVELOPMENT

TABLE 160 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.5.4 KINGDOM OF SAUDI ARABIA

TABLE 172 KINGDOM OF SAUDI ARABIA: IMAGE RECOGNITION IN CPG MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 173 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 174 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 175 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 176 KINGDOM OF SAUDI ARABIA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 177 KINGDOM OF SAUDI ARABIA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 178 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 179 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 180 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 181 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.5.5 UNITED ARAB EMIRATES

TABLE 182 UNITED ARAB EMIRATES: IMAGE RECOGNITION IN CPG MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 183 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 184 UNITED ARAB EMIRATES: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 185 UNITED ARAB EMIRATES: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 186 UNITED ARAB EMIRATES: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 187 UNITED ARAB EMIRATES: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 188 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 189 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 190 UNITED ARAB EMIRATES: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 191 UNITED ARAB EMIRATES: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.5.6 REST OF MIDDLE EAST AND AFRICA

TABLE 192 REST OF MIDDLE EAST AND AFRICA: IMAGE RECOGNITION IN CPG MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 193 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 194 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 195 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 196 REST OF MIDDLE EAST AND AFRICA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 197 REST OF MIDDLE EAST AND AFRICA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 198 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 199 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 200 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 201 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: COVID-19 IMPACT

11.6.2 LATIN AMERICA: IMAGE RECOGNITION IN CPG MARKET DRIVERS

TABLE 202 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 206 LATIN AMERICA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 207 LATIN AMERICA: PRODUCT AND SHELF MONITORING ANALYSIS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.6.3 BRAZIL

11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 147)

12.1 INTRODUCTION

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 28 MARKET EVALUATION FRAMEWORK, IMAGE RECOGNITION IN CPG FRAMEWORK

12.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 29 IMAGE RECOGNITION IN CPG, REVENUE ANALYSIS

12.4 HISTORICAL REVENUE ANALYSIS

FIGURE 30 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

12.5 RANKING OF KEY PLAYERS IN THE IMAGE RECOGNITION IN CPG MARKET, 2020

13 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 151)

13.1 COMPANY EVALUATION MATRIX

13.1.1 COMPETITIVE EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

TABLE 214 EVALUATION CRITERIA

13.1.2 STAR

13.1.3 PERVASIVE

13.1.4 EMERGING LEADERS

13.1.5 PARTICIPANT

FIGURE 31 IMAGE RECOGNITION IN CPG MARKET (GLOBAL), COMPETITIVE EVALUATION MATRIX, 2020

13.2 COMPANY PROFILES

(Business overview, Solutions and hardware offered, Recent developments, SWOT analysis, COVID-19 related strategies & MnM View)*

13.2.1 IBM

FIGURE 32 IBM: COMPANY SNAPSHOT

FIGURE 33 IBM: SWOT ANALYSIS

13.2.2 GOOGLE

FIGURE 34 GOOGLE: COMPANY SNAPSHOT

FIGURE 35 GOOGLE: SWOT ANALYSIS

13.2.3 QUALCOMM

FIGURE 36 QUALCOMM: COMPANY SNAPSHOT

FIGURE 37 QUALCOMM: SWOT ANALYSIS

13.2.4 MICROSOFT

FIGURE 38 MICROSOFT: COMPANY SNAPSHOT

FIGURE 39 MICROSOFT: SWOT ANALYSIS

13.2.5 AWS

FIGURE 40 AWS: COMPANY SNAPSHOT

FIGURE 41 AWS: SWOT ANALYSIS

13.2.6 TRAX

13.2.7 CATCHOOM

13.2.8 SLYCE

13.2.9 LTU TECH

13.2.10 IMAGGA

13.2.11 VISPERA

13.2.12 BLIPPAR

13.2.13 RICOH INNOVATIONS

13.2.14 CLARIFAI

13.2.15 DEEPOMATIC

13.2.16 WIKITUDE

13.2.17 HUAWEI

13.2.18 HONEYWELL

13.2.19 TOSHIBA

13.2.20 ORACLE

*Details on Business overview, Solutions and hardware offered, Recent developments, SWOT analysis, COVID-19 related strategies & MnM View might not be captured in case of unlisted companies.

13.3 RIGHT TO WIN

13.4 STARTUP/SME EVALUATION MATRIX, 2020

13.4.1 PROGRESSIVE

13.4.2 RESPONSIVE

13.4.3 DYNAMIC

13.4.4 STARTING BLOCKS

FIGURE 42 IMAGE RECOGNITION IN CPG MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING, 2020

13.5 STARTUP/SME PROFILES

13.5.1 INTELLIGENCE RETAIL

13.5.2 SNAP2INSIGHT

13.5.3 PARALLELDOTS

13.5.4 SHELFWISE

13.5.5 TRIGO

13.5.6 STANDARD COGNITION

13.5.7 INFFRD

13.5.8 UNISPECTRAL LTD.

13.5.9 AIRY3D

14 ADJACENT/RELATED MARKETS (Page No. - 195)

14.1 INTRODUCTION

14.2 IMAGE RECOGNITION IN RETAIL MARKET

14.2.1 MARKET DEFINITION

TABLE 215 IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 216 VISUAL PRODUCT SEARCH: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 217 SECURITY AND SURVEILLANCE: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 218 VISION ANALYTICS: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 219 MARKETING AND ADVERTISING: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 220 OTHER APPLICATIONS: IMAGE RECOGNITION IN RETAIL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

14.3 IOT IN RETAIL MARKET

14.3.1 MARKET DEFINITION

TABLE 221 IOT IN RETAIL MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 222 OPERATIONS MANAGEMENT: IOT IN RETAIL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 223 ASSET MANAGEMENT: IOT IN RETAIL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 224 CUSTOMER EXPERIENCE MANAGEMENT: IOT IN RETAIL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 225 ADVERTISING AND MARKETING: IOT IN RETAIL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

14.4 AI IN RETAIL MARKET

14.4.1 MARKET DEFINITION

TABLE 226 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 227 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY TECHNOLOGY, 2015–2022 (USD MILLION)

TABLE 228 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY SOLUTION, 2015–2022 (USD MILLION)

TABLE 229 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 230 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 231 ARTIFICIAL INTELLIGENCE IN RETAIL MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

15 APPENDIX (Page No. - 203)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved major activities in estimating the current market size for the image recognition in CPG market. An exhaustive secondary research was done to collect information on the image recognition in CPG industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like Top-down and competitive leadership methodology were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the image recognition in CPG market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications such as Retail Dive, IEEE, and Magzter; and articles from recognized authors, directories, and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives; all of which were further validated by the primary sources

Primary Research

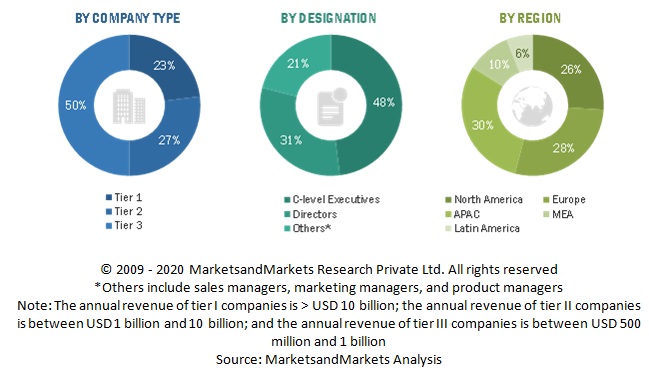

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, related key executives from image recognition in CPG vendors, image recognition in CPG solution and hardware providers, industry associations, independent image recognition in CPG consultants, and key opinion leaders.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this market estimation approach, we identified 20 image recognitions in CPG players, including IIBM, Google, AWS, Qualcomm, Microsoft, Trax, LTU, and Slyce. These companies account for 60% of the global image recognition in CPG market. After confirming these companies with industry experts through primary interviews, we estimated their total revenue through annual reports, SEC filings, and paid databases. Company revenues pertaining to the Business Units (BUs) that offer image recognition in CPG solutions were identified through similar sources. We then collected the data of revenue generated through specific image recognition in CPG solutions from primaries. The consolidated revenue of image recognition in CPG offerings comprised 30%–35% of the market, which was again confirmed through primary interviews with industry experts. With the assumption that the rest of the market is held by smaller players (part of the unorganized market), the collective market size of organized players (55%–60%) and unorganized players (40%–45%) was assumed to be the market size of the global image recognition in CPG market for FY 2020.

Top-down approach and competitive leadership methodology were used to estimate and validate the total size of the image recognition in CPG market. These methods were also used extensively to determine the size of various sub segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The aggregate of all companies’ revenues were extrapolated to estimate the overall market size.

- All percentage shares and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the image recognition in CPG market by component, deployment, application, end user type, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the image recognition in CPG market

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the image recognition in CPG market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players of the image recognition in CPG market and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments, such as new product launches and enhancements; acquisitions; and partnerships and collaborations, in the image recognition in CPG market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic analysis

- Further breakup of the North America image recognition in CPG market into countries

- Further breakup of the Europe market into countries

- Further breakup of the APAC market into countries

- Further breakup of the MEA market into countries

- Further breakup of the Latin America market into countries

Company information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Image Recognition in CPG Market

Kindly provide market dynamics of Image Recognition in CPG Market