Hydrogen Peroxide Market

Hydrogen Peroxide Market by Product Function (Chemical Synthesis, Bleaching, Disinfectant, Cleaning & Etching, Others), Grade (90% Hydrogen Peroxide, 35% Hydrogen Peroxide, 6 to 10% Hydrogen Peroxide, 3% Hydrogen Peroxide), End-use Industry (Pulp & Paper, Food and Beverages, Water Treatment, Textiles & Laundry, Oil and Gas, Healthcare, Electronics, Others), & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The hydrogen peroxide market is anticipated to expand from USD 3,659.8 million in 2025 to USD 4,702.6 million in 2030 with a compound annual growth rate (CAGR) of 5.1%. The global hydrogen peroxide market is experiencing steady growth due to its versatility across various industries, including pulp and paper, textiles, chemicals, healthcare, food processing, and water treatment. Its popularity stems from its properties as a strong oxidizer that decomposes into water and oxygen, making it an environmentally friendly option. As a result, hydrogen peroxide is commonly used for disinfecting, bleaching, and oxidation. In the pulp and paper industry, hydrogen peroxide plays a crucial role in the bleaching process. Its use in healthcare is also increasing, particularly for sterilizing and cleaning surfaces, especially in the wake of the pandemic. Additionally, growing environmental concerns and stricter regulations regarding industrial waste have led to an increased adoption of hydrogen peroxide for water treatment and wastewater management.

KEY TAKEAWAYS

-

BY PRODUCT FUNCTIONThe market is segmented by product function into chemical synthesis, bleaching, disinfectant, cleaning & etching, and other product functions. The is poised for growth driven by increasing demand for sustainable and effective bleaching, disinfecting, and cleaning solutions amid tightening environmental regulations and rising hygiene awareness. Advances in production technology and expanding applications in emerging sectors, such as semiconductor cleaning and advanced oxidation processes, further fuel this trend. Its versatility and eco-friendly profile position it as a key chemical in the evolving global market.

-

BY GRADEThe hydrogen peroxide market is segmented by concentration grades, each serving specific applications and industries. Grades of 90% or higher are mainly used in highly specialized industrial and aerospace sectors, such as rocket propellants, advanced electronics manufacturing, and strong oxidizing agents in chemical synthesis and mining. These high concentrations are valued for their powerful reactivity but require stringent safety controls due to their hazardous nature. The 35% grade, often referred to as food grade or industrial grade, is the most dominant in terms of market share, driven by its extensive use in the pulp and paper industry for bleaching, as well as in textile, water treatment, and chemical manufacturing. Lower grades, specifically the 6-10% and 3% concentrations, are primarily used in healthcare, household, and consumer products. The 6-10% grade is common in pharmaceutical and cleaning applications, including wound care, oral hygiene, and hair bleaching, offering a balance between efficacy and safety. The 3% grade is the standard for over-the-counter antiseptics, household disinfectants, and oral care products, recognized as safe for topical use and surface cleaning but not for ingestion.

-

BY END-USE INDUSTRYThe market is segmented by end-use industry into pulp & paper, food & beverages, water treatment, textile & laundry, oil & gas, healthcare, electronics, and other end-use industries. Hydrogen peroxide consumption driven by its strong oxidizing, bleaching, and disinfecting properties. Its unique ability to break down into environmentally benign byproducts—water and oxygen—makes it an increasingly preferred choice in sectors aiming to reduce their environmental footprint while maintaining high performance. From pulp & paper bleaching to food safety, water treatment, and textile processing, hydrogen peroxide plays a critical role in enhancing product quality, ensuring safety, and meeting stringent regulatory standards. The growing demand for sustainable and efficient industrial processes is propelling the adoption of hydrogen peroxide in diverse fields such as oil & gas, healthcare, electronics, and agriculture. In oil & gas, it supports enhanced oil recovery and formation maintenance; in healthcare, it acts as a potent antimicrobial and wound care agent; in electronics, it is essential for precision cleaning and manufacturing; and in agriculture and mining, it aids in pathogen control and metal extraction. This broad applicability, combined with its eco-friendly profile, positions hydrogen peroxide as a key chemical for future industrial growth and innovation.

-

BY REGIONThe global hydrogen peroxide market is experiencing robust growth, driven by increasing demand across diverse industries amid rising environmental awareness and stringent regulations. Key sectors such as pulp & paper, healthcare, electronics, and agriculture are boosting demand, particularly with the shift toward sustainable and eco-friendly solutions. Innovations in production technology, coupled with the compound's versatility in high-purity applications like semiconductor cleaning, are further propelling market expansion, positioning hydrogen peroxide as a critical component in the global push for industrial efficiency and environmental compliance.

-

COMPETITIVE LANDSCAPEMajor market players in the vapor recovery units market are adopting both organic and inorganic growth strategies, including product launches and geographic expansions. Companies such as Solvay (Belgium), OCI Limited (South Korea), and Nouryon (Netherlands) are focusing on product lanuches and expansions to strengthen market reach and enhance consumer accessibility. These strategic initiatives are helping companies address diverse needs across regions while maintaining competitive differentiation.

The hydrogen peroxide market is witnessing a steady growth, this surge is primarily driven by surging demand in the pulp and paper industry for chlorine-free bleaching processes, alongside increasing applications in wastewater treatment, electronics for semiconductor wafer cleaning, and healthcare as a disinfectant, particularly in the post-pandemic era. Asia-Pacific has a dominating position in the market, fueled by rapid industrialization in China and India, while recent innovations like Solvay's expansion to 48 kilotons of photovoltaic-grade production and Nouryon's low-carbon Eka HP Puroxide underscore the shift toward sustainable, eco-friendly formulations amid stringent regulations from bodies like the EPA and FDA.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The hydrogen peroxide market is undergoing a fundamental transformation that mirrors the broader industrial shift toward sustainability and technological advancement. The shift is driven by three key forces: technological innovation, environmental imperatives, and high-value specialty applications. Advanced oxidation processes (AOPs) are replacing chlorine-based systems in water treatment, while the semiconductor industry's demand for ultra-high-purity grades (with impurities below 0.01 ppb) is creating premium market segments. On-site electrochemical generation technology is disrupting the traditional centralized production model, enabling decentralized manufacturing that reduces transportation costs and safety risks while utilizing renewable energy sources. This transformation is accelerated by regulatory pressures favoring eco-friendly alternatives and the industry's evolution from a volume-based commodity business to a technology-driven specialty chemicals market. Companies are investing heavily in R&D for green chemistry initiatives, photocatalytic production methods, and advanced purification technologies to serve emerging applications in aerospace propulsion, semiconductor fabrication, and next-generation environmental remediation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for surface disinfectants

-

Growing demand for hydrogen peroxide as oxidizing agent

Level

-

Operational hazards and specialized handling requirements

-

Regulatory pressure on effluent discharge

Level

-

Demand for high-purity chemical grades from semiconductor and electronics industries

-

Integration into textile processing for sustainable finishing

Level

-

Limited shelf stability and disruption constraints in hot climates

-

Water and energy-intensive manufacturing process

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for surface disinfectants

Hydrogen peroxide is a powerful disinfectant that destroys essential components of microbial cells, effectively neutralizing a wide range of harmful microorganisms, including bacteria, viruses, fungi, and spores. The global demand for surface disinfectants has surged due to increased awareness surrounding health, hygiene, and infection prevention. This demand is especially prominent in healthcare environments, where the risk of disease transmission is significantly high. According to the Centers for Disease Control and Prevention (CDC), hospital-acquired infections (HAIs) are responsible for an estimated 1.7 million infections and 99,000 related deaths annually in the US, including infections such as pneumonia, urinary tract infections, and surgical-site infections. These figures reflect the critical importance of rigorous and consistent disinfection protocols in medical facilities to reduce infection rates and protect patients.

Restraint: Operational hazards and specialized handling requirements

Hydrogen peroxide's physical and chemical properties make it an effective oxidizing agent, but it also presents significant operational hazards, particularly at industrial concentrations above 30%. It is thermodynamically unstable and decomposes exothermically into oxygen and water, which can result in rapid gas release, temperature surges, and pressure build-up if containment measures fail. These risks are amplified in the presence of catalytic contaminants such as transition metals, trace organics, or UV exposure, necessitating stringent purity control and handling protocols. To mitigate these risks, hydrogen peroxide storage and processing systems must comply with international safety standards such as NFPA 432 (formerly NFPA 43B) (US) and ISO 22088. These standards mandate the use of corrosion-resistant materials like passivated stainless steel and high-grade aluminum, along with automated venting, double containment, and active cooling systems. Facilities must also implement segregated storage areas, vapor suppression systems, and personnel protective equipment (PPE) protocols to prevent incidents.

Opportunity: Demand for high-purity chemical grades from semiconductor and electronics industries

The semiconductor industry requires ultra-high-purity (UHP) chemicals for wafer cleaning, surface preparation, and microfabrication. Hydrogen peroxide, particularly in concentrations above 30% with extremely low metal content, is a key component in RCA cleaning and SC1 and SC2 processes. It plays a critical role in removing organic contaminants, particles, and trace metals from silicon wafers without introducing defects or ionic residues. This demand is rising alongside the rapid expansion of global semiconductor manufacturing. According to the Semiconductor Industry Association (SIA), global semiconductor sales reached USD 627.6 billion in 2024, marking an increase of 19.1% compared to the 2023 total of USD 526.8 billion. This growth reflects the surge in demand for logic, memory, and advanced packaging technologies, all of which require extensive use of wet process chemicals, including high-purity hydrogen peroxide.

Challenge: Limited shelf stability and disruption constraints in hot climates

Hydrogen peroxide, especially in concentrations above 30% used for industrial applications, is chemically unstable and decomposes more rapidly when exposed to elevated temperatures or ultraviolet light. In regions with consistently high ambient temperatures, such as Southeast Asia, Sub-Saharan Africa, and the Middle East, this instability presents a major challenge for safe storage and distribution. Without adequate cooling systems or UV-protected storage infrastructure, hydrogen peroxide breaks down into water and oxygen, releasing gas and increasing pressure in sealed containers. This decomposition not only reduces its shelf life and performance but also increases the risk of leakage or container rupture. In many rural or remote agricultural economies, such as in Nigeria or the Philippines, cold chain logistics are either absent or limited to perishable food and pharmaceuticals, making it difficult to maintain the chemical integrity of hydrogen peroxide during transport and storage.

hydrogen-peroxide-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

To enhance operational efficiency and reduce logistical costs by producing hydrogen peroxide directly at Suzano's pulp mill in Imperatriz, Maranhão, Brazil. | Solvay implemented its myH2O2 technology to establish a dedicated hydrogen peroxide production unit on-site. This facility utilizes Suzano's hydrogen feedstock, utilities, and site services, supplying all of the site's hydrogen peroxide needs for pulp bleaching. The unit is remotely controlled from Solvay's peroxides plant in Curitiba, approximately 2,700 km away. This integration minimizes transportation costs and ensures a reliable supply tailored to Suzano's requirements. |

|

To develop a more sustainable and cost-effective method for producing propylene glycol by directly converting hydrogen peroxide and propylene, eliminating intermediate steps. | Dow and Evonik collaborated to start up a pioneering HPPG pilot plant at Evonik's site in Hanau, Germany. Utilizing the HYPROSYN process, the plant enables direct synthesis of propylene glycol from hydrogen peroxide and propylene, bypassing the traditional production of propylene oxide. This innovation reduces water consumption by over 95% compared to conventional methods and allows existing propylene glycol plants to be retrofitted with this technology, promoting sustainability and cost savings. |

|

To meet the growing demand for specialty hydrogen peroxide applications in China, particularly in sectors like solar energy, cosmetics, and food packaging. | Evonik and Fuhua formed a joint venture to produce and market specialty-grade hydrogen peroxide. Fuhua is constructing a 200-kiloton industrial-grade hydrogen peroxide plant using Evonik's licensed technology. The joint venture will further purify this product into specialty grades suitable for various applications. This collaboration combines Evonik's expertise in hydrogen peroxide production with Fuhua's local market knowledge and resources, aiming to supply high-quality hydrogen peroxide for future-facing industries. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis section outlines the network of companies active in the hydrogen peroxide market. Key stakeholders within this ecosystem include manufacturers, distributors, and end-users . Each participant in the ecosystem is interconnected and influenced by value chain efficiency, regulatory standards, technological advancements, and market demand. The diagram below illustrates the major stakeholders in the hydrogen peroxide market and their respective roles within the ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Hydrogen Peroxdie Market, By Type

The bleaching segment is expected to experience high growth due to its essential applications in industries such as pulp and paper, textiles, and cosmetics. Companies in this sector have the opportunity to expand their bleaching operations to meet the increasing demand from the global market, particularly in the Asia Pacific region, where textile production and e-commerce packaging are on the rise. To align with stringent environmental regulations and consumer demands for sustainability, developing low-residue, eco-friendly bleaching formulations is crucial. This includes creating chlorine-free bleaching chemicals for the pulp and paper industry.

Hydrogen Peroxide Market, By Grade

The 35% hydrogen peroxide segment is experiencing the most rapid growth. This is largely due to its ideal combination of concentration, versatility, safety, and affordability, making it suitable for a wide range of industrial and institutional applications. Lower concentrations, such as 3% or 6–10%, are primarily used for domestic or pharmaceutical-grade purposes, while the high concentration (90%) is reserved for specialized niches like aerospace and specialty chemicals. In contrast, the industrial strength of 35% hydrogen peroxide makes it particularly well-suited for bulk applications in various industries, including pulp and paper, textiles, food processing, electronics, wastewater treatment, and healthcare sterilization.

Hydrogen Peroxide Market, By End-use Industry

Pulp and paper is the fastest-growing segment in the hydrogen peroxide industry. This growth is primarily driven by the increasing demand for environmentally friendly and sustainable bleaching agents. Hydrogen peroxide is widely used in the bleaching of pulp because it is a clean oxidizer that decomposes into oxygen and water, making it safer and more environmentally friendly than traditional chlorine-based reagents. Additionally, the rising demand for paper, especially for packaging purposes due to the growth of e-commerce and the global shift away from plastic, is further stimulating the use of hydrogen peroxide.

REGION

Asia Pacific to be the fastest-growing region in the global hydrogen peroxide market during the forecast period

Asia Pacific is expected to record the highest market growth for hydrogen peroxide during the forecast period, owing to the rapidly developing industrial base and economic growth in the region. India, China, and Southeast Asian nations are among the largest users of hydrogen peroxide, particularly in the pulp and paper, textiles, and chemical sectors. Increasing demand for environmentally friendly and sustainable products in these sectors is driving the application of hydrogen peroxide, particularly in wastewater treatment and chlorine-free bleaching. The robust economic growth in the region, as well as increased investments in industry and infrastructure capacities, is stimulating the demand for hydrogen peroxide in various industries like food processing, electronics, and semiconductors. In addition, the growth in regulatory schemes encouraging green chemicals and environmentally friendly processes is driving the use of hydrogen peroxide, as it is broken down into water and oxygen and, therefore, serves as an eco-friendly alternative to other chemicals.

hydrogen-peroxide-market: COMPANY EVALUATION MATRIX

In the hydrogen peroxide market matrix, Arkema (Star) leads with a strong market share and broad product footprint, supported by its advanced production technologies, robust customer base, and established presence across end-use industries. The company’s continued focus on system efficiency, emission reduction, and compliance solutions reinforces its leadership position. Gujarat Alkalies and Chemicals Ltd. (Emerging Leaders) are rapidly strengthening their presence through technological innovation, system customization, and strategic partnerships in key chemical markets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3,485.1 MN |

| Market Forecast in 2030 (Value) | USD 4,702.6 MN |

| Growth Rate | 5.10% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN) and Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: hydrogen-peroxide-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| A multinational chemical company planning to enter the hydrogen peroxide market sought an assessment of global supply chain vulnerabilities and competitive positioning, particularly in the Asia-Pacific region, amid rising raw material costs and regulatory shifts toward sustainable production. | We conducted a tailored research study involving primary and secondary analysis of trade data from 2020–2025. This included a proprietary H2O2 pricing model adjusted for regional feedstock fluctuations and a SWOT analysis customized to their planned 100,000-ton annual capacity facility. | Delivered a 5-year demand forecast enabling the client to prioritize low-risk entry points and secure cost savings on initial investments. Included a sustainability compliance toolkit aligned with EU REACH and upcoming U.S. EPA guidelines, reducing regulatory risk exposure |

RECENT DEVELOPMENTS

- February 2025 : Zeeco Inc. opened the Advanced Research Complex in the US, fueling innovation through cutting-edge infrastructure, knowledge, and real-world testing facilities.

- July 2024 : Dover Corporation acquired Demaco Holland B.V. as part of OPW's Clean Energy Solutions segment.

- January 2024 : Cimarron Energy, Inc. teamed up with CleanConnect.ai to roll out a state-of-the-art emissions management and performance optimization platform.

- May 2023 : BORSIG GmbH completed a 1,400-square-meter office building in Gladbeck, Germany. This eco-friendly building marks the start of an ambitious expansion plan

- December 2022 : Dover Corporation took a big step by acquiring Witte Pumps & Technology GmbH, which is renowned for its precision gear pumps. This acquisition is not only to boost Dover's global presence but also to strengthen its capability to deliver innovative product solutions.

Table of Contents

Methodology

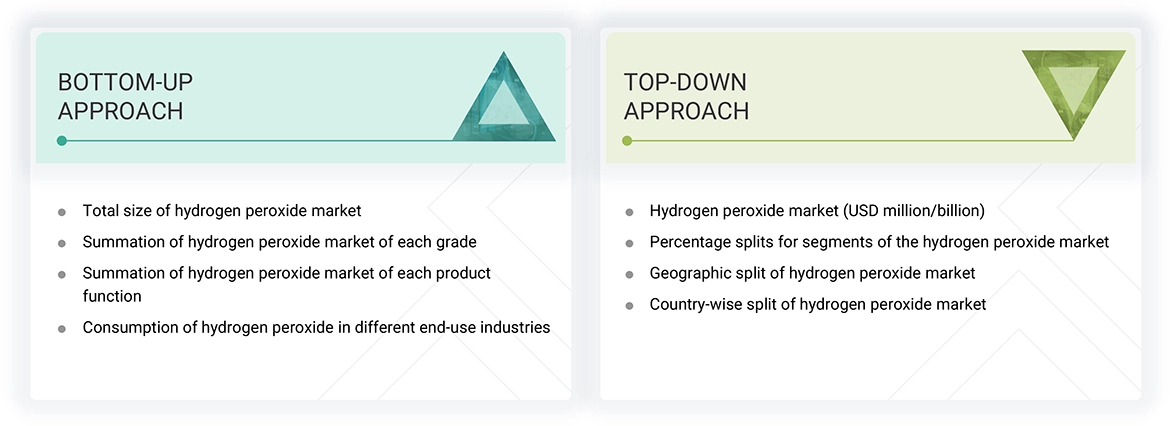

The study involved four major activities to estimate the current global size of the hydrogen peroxide market. Exhaustive secondary research was conducted to gather information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of hydrogen peroxide through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the hydrogen peroxide market. After that, the market breakdown and data triangulation procedures were used to determine the size of the different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Business Standard, Bloomberg, World Bank, and Factiva were referred to identify and collect information for this study on the hydrogen peroxide market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the hydrogen peroxide market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the hydrogen peroxide industry. The breakdown of the profiles of primary respondents is as follows:

Breakdown of Primary Interviews

Notes: Companies are classified based on their revenue – Tier 1 = > USD 7 billion, Tier 2 = USD 500 million to USD 7 billion, and Tier 3 = < USD 500 million.

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the hydrogen peroxide market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the hydrogen peroxide market. The data was triangulated by studying various factors and trends from both the demand and supply sides.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Market Definition

Hydrogen peroxide is a clear, colorless liquid compound widely used as a strong oxidizing and bleaching agent across various industries. It plays a critical role in pulp and paper bleaching, textile processing, wastewater treatment, electronics cleaning, and as a disinfectant in healthcare and food industries. Available in different concentrations, hydrogen peroxide is valued for its environmentally friendly decomposition into water and oxygen, making it a sustainable chemical solution.

Stakeholders

- Hydrogen Peroxide Manufacturers

- Hydrogen Peroxide Distributors

- Raw Material Suppliers

- Research & Development Entities

- Industry Associations and Regulatory Bodies

- End Users

Report Objectives

- To estimate and forecast the hydrogen peroxide market in terms of value and volume

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market size based on grade, product function, end-use industry, and region

- To forecast the market size, along with segments and submarkets, in key regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets for individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as mergers & acquisitions, expansions & investments, and agreements in the hydrogen peroxide market

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Hydrogen Peroxide Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Hydrogen Peroxide Market