Hydrogen Aircraft Market by Power Source (Hydrogen Combustion, Hydrogen Fuel Cell), Platform (Unmanned Aerial Vehicles, Air Taxis, and Business Jets), Range, Passenger Capacity, Technology, and Region (2020-2030)

Update: 11/22/2024

Hydrogen Aircraft Market Summary

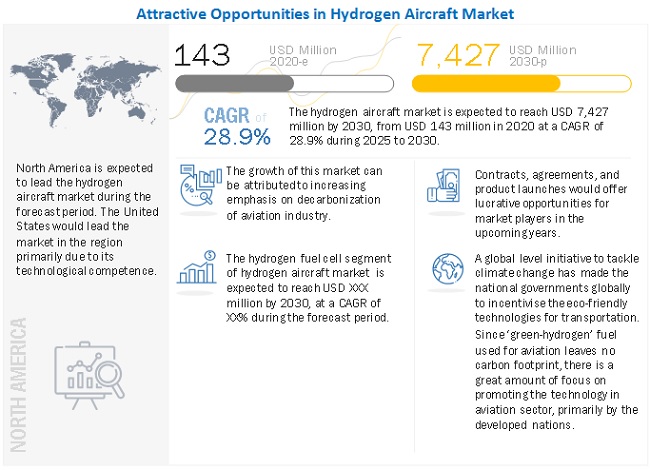

The Global Hydrogen Aircraft Market Size is predicted to increase from USD 143 million in 2020 to approximately USD 7,427 million by 2030, expanding at a CAGR of 28.9% from 2022 to 2027.

Hydrogen Aircraft Market Key Takeaways

-

By targeting aviation decarbonization, the hydrogen aircraft market is set to grow from USD 143 million in 2020 to USD 7,427 million by 2030, at a CAGR of 28.9%, driven by regulatory pressures and environmental goals.

-

By advancing hydrogen fuel cell technologies, both public and private sectors led by players like Airbus and Event 38 are accelerating the development of zero emission aircraft solutions.

-

By supporting clean aviation through national policies, Europe is emerging as a key region, with initiatives like the UK’s H2GEAR program actively promoting hydrogen powered commercial aircraft.

-

By strong market presence and innovation, North America held the largest market share (36.6%) in 2020, fueled by major players like ZeroAvia and growing investment in advanced air mobility.

-

By growing focus on smaller aircraft formats, the up to 4 passengers segment is expected to register the highest CAGR, supported by prototype development and urban air mobility use cases.

-

By shorter operational range demands, the up to 20 km segment is projected to account for the largest market share, driven by early stage hydrogen aircraft deployments with limited payload and endurance.

-

By increasing adoption of fuel cell propulsion, the hydrogen fuel cell segment is expected to grow at the highest CAGR, offering longer endurance and reduced emissions compared to combustion based systems.

-

By facing significant challenges in hydrogen storage including cost, volume, durability, and refueling time the market’s long term growth will rely on overcoming these technical and regulatory hurdles.

Hydrogen Aircraft Market Size & Forecast Report

-

2020 Market Size: USD 143 million

-

2030 Projected Market Size: USD 7,427 million

-

CAGR (2020-2030): 28.9%

-

North America: Largest Market Share

Some of the major factors driving the Hydrogen Aircraft Industry include the increasing focus of the aviation industry on decarbonization, increasing air passenger traffic across the globe, and advantages of hydrogen aircraft over conventional aircraft.

To know about the assumptions considered for the study, Request for Free Sample Report

Hydrogen Aircraft MarketDynamics:

Driver: Focus of the aviation industry on decarbonization

The largest advantage that hydrogen aircraft offer is the lack of harmful emissions, as the only by-product of hydrogen combustion or fuel cells is H20 (water). According to Air Transport Action Group (ATAG), global emissions due to aviation were approximately 915 million tons CO2, which accounted for 2% global human-induced emissions and 12% due to all forms of transportation. Various countries, particularly those in the European Union (EU) such as Germany, UK, France, etc. are undertaking efforts to curb emissions and are indirectly promoting the use of hydrogen aircraft for aviation. This is evident from examples such as the grants given to the H2GEAR programme by the UK government. The H2GEAR programme aims to manufacture small hydrogen run aircraft for commercial purposes with major companies such as GKN Aerospace leading the program.

Opportunity:Development of fuel cell technologies in the aviation industry

- Development and research in hydrogen fuel cells is expected to enable feasibility in the adoption of hydrogen fuel cells for the aviation sector. There is an increasing focus on the development of fuel cells by both, the public and private sectors.

- For example, in June 2022, Event 38, a US-based maker of mapping drones, announced the successful test flight of one of its E400 UAVs modified to run on a hydrogen cell. This is the first step toward deploying the cleaner and more effective technology compared to batteries or gas power.There has been increasing attention on the development of hydrogen fuel cells. For instance, Airbus, a major aviation company that plans to introduce its commercial hydrogen aircraft by 2035, recently partnered with ElringKlinger, a company with over 20 years of experience as both, a fuel cell system and component supplier. The purpose of the partnership is to focus on the developments in hydrogen fuel cells.

Challenge:Storage of hydrogen fuel in aircraft

Storage of hydrogen in aircraft, as well as automobiles, is a major challenge. The major challenges faced in the storage of hydrogen are:

- Weight and Volume: The weight and volume of hydrogen storage systems are presently too high, leading to a lower vehicle range. Materials and components are needed that allow compact, lightweight, hydrogen storage systems to enable longer range conventional aircraft.

- Efficiency: Energy efficiency is a challenge for all hydrogen storage approaches. Life cycle energy efficiency is a challenge for chemical hydride storage in which the byproduct is regenerated offboard. In addition, the energy required for compression and liquefaction needs to be considered for the compressed and liquid hydrogen technologies.

- Durability: The durability of hydrogen storage systems is inadequate. Materials and components are needed that enable hydrogen storage systems with a lifetime of 1,500 cycles.

- Refueling Time: The refueling time required is too long. There is a need to develop hydrogen storage systems with refueling times of less than three minutes over the lifetime of the system.

- Cost: The cost of onboard hydrogen storage systems is too high, particularly in comparison with conventional storage systems for petroleum fuels. Low-cost materials and components for hydrogen storage systems are needed, as well as low-cost, high-volume manufacturing methods.

- Codes and Standards: Applicable codes and standards for hydrogen storage systems and interface technologies that are expected to facilitate implementation/commercialization and ensure safety and public acceptance have not been even established in countries such as the US.

During the forecast period, the hydrogen fuel cellis projected to grow at the highest CAGR

The hydrogen aircraft market is divided into two categories based on power source:hydrogen combustion and hydrogen fuel cell. The growth of the hydrogen fuel cell market is increasing due to the rising demand for fuel cell electric vehicles such as advanced air mobility.

During the forecast period, the up to 4 passengers isestimated to grow at the highest CAGR

The hydrogen aircraft market is divided into three categories based on passenger capacity: up to 4 passengers, 5 to 10 passengers, and more than 10 passengers. Owing to the development of the various hydrogen powered aircraft prototype the up to 4 passengers is expected to grow at a higher CAGR.

During the forecast period, the upto 20 km segment is expected to account for the largest market size

The hydrogen aircraft market is divided into three segments based on range: up to 20 km, 20 km to 100 km, and more than 100 km. In 2020, it is expected that the upto 20 km segment would be the largest. The aircraft's range is influenced by a number of parameters, including its aircraft type, payload capacity fuel capacity, and others.

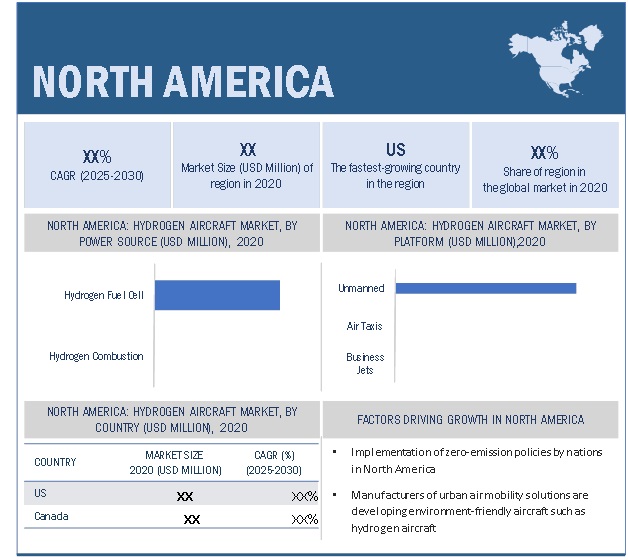

North America: “North American region is expected to have the largest share in 2020

North America has a share of 36.6% of the hydrogen powered aircraft market in 2020. This region accounts to have the largest share of the global market in 2020. The countries studied under this region is US and Canada. The growth in this region is due to the entry of major players in the hydrogen aircraft market. Major initiatives for green energy in advanced air mobility is also driving the market in this region.

Hydrogen Aircraft Market Ecosystem

Key Market Players

The Hydrogen Aircraft Companies are dominated by a few globally established players such as Airbus SE (Netherlands), Urban Aeronautics Ltd (Israel), GKN Aerospace (UK), ZeroAvia Inc (US) and HES Energy Systems (Singapore). These players areindustry majors and have largely benefitted from their well-recognized brands, a wide range of products, and strong distribution capabilities in the hydrogen aircraft market. These companies have well-equipped strong distribution networks across the North American, European and Asia Pacific.

Hydrogen Aircraft Market Size and Scope

|

Report Metric |

Details |

|

Market size available for years |

2020–2030 |

|

Forecast Period |

2021–2030 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

By Range, Platform, Power Source, Technology, and Passenger Capacity |

|

Base Year considered |

2020 |

This study categorizes the Hydrogen Aircraft Market based on the following segments and subsegments:

Hydrogen Aircraft Market, By Range

- Up to 20 km

- 20 km to 100 km

- More than 100 km

Hydrogen Aircraft Market, By Platform

- Unmanned Aerial Vehicles

- Air Taxis

- Business Jets

Hydrogen Aircraft Market, By Power Source

- Hydrogen Combustion

- Hydrogen Fuel Cell

Hydrogen Aircraft Market, By Technology

- Fully Hydrogen-Powered Aircraft

- Hybrid Electric Aircraft

Hydrogen Aircraft Market, By Passenger Capacity

- Up to 4 Passengers

- 5 to 10 Passengers

- More than 10 Passengers

Hydrogen Aircraft Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent developments

- In May 2022, In Filton UK, Airbus has decided to establish a facility to create hydrogen fuel systems for use in aircraft. The ZEDC (Zero Emission Development Centre) will concentrate on creating a cryogenic fuel system that can be cost effective and be used in Airbus' ZEROe passenger aircraft, which is anticipated to enter service in 2035.

- In March 2022, In a joint venture with Gloyer-Taylor Laboratories (GTL), HyPoint has announced that it will receive carbon composite liquid hydrogen fuel tanks from GTL which will be integrated with its own hydrogen fuel cell technology.

- In February 2022, Airbus and CFM International announced that they will work together on testing a hydrogen-fueled engine on A380 aircraft. The companies will work together with the goal of conducting the first tests in the middle of 2022. This demonstration might pave the way for an aircraft thatwill transport people while emitting no carbon dioxide which is expected to enter the market by 2035.

- In March 2022, Airbus and Delta Air Lines have signed a Memorandum of Understanding (MoU) to work together on hydrogen-powered aircraft development. The company will collaborate with Airbus on the development of hydrogen aircraft, making it the first US-based airline to do so.By 2035, Airbus plans to introduce a hydrogen-powered aircraft into service.

Frequently Asked Questions (FAQs):

What is the current size of the hydrogen aircraft market?

The hydrogen aircraft market is estimated to be USD 143 million in 2020 and is projected to reach USD 7,427 million by 2030, at a CAGR of 28.9% from 2020 to 2030.

Who are the winners in the hydrogen aircraftmarket?

GKN Aerospace (UK), Airbus SE (Netherlands), Urban Aeronautics Ltd (Israel), ZeroAvia Inc (US) and HES Energy Systems (Singapore)are some of the winners in the market.

What are some of the technological advancements in the market?

Some of the technological advancements in the hydrogen aircraft market are the development ofhydrogen fuel cell and hydrogen combustion The increased advancemets in hydrogen fuel cells technology offerspotential benefits such as significant energy efficiency and decarbonization to a wide range of industries including automotive and heavy transport.

What are the factors driving the growth of the market?

The fators driving the growth of this market are aviation industry’s focus on decarbonization, Increasing air passenger traffic across the globe, need for alternative and sustainable fuel energy, advantages of hydrogen powered aircraft over conventional aircraft and also due to the increasing price of fuel.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKETS COVERED

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

2.1.1 RESEARCH FLOW

FIGURE 2 RESEARCH DESIGN

2.2 RESEARCH DATA

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

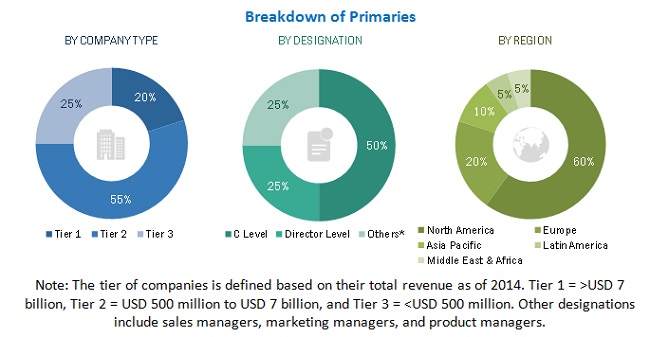

2.2.2.2 Breakdown of primaries

2.3 FACTOR ANALYSIS

2.3.1 INTRODUCTION

2.3.2 DEMAND-SIDE ANALYSIS

2.3.2.1 Focus of the aviation industry on decarbonization

2.3.3 SUPPLY-SIDE ANALYSIS

2.3.3.1 Advantages of hydrogen aircraft over conventional aircraft

2.4 MARKET DEFINITION AND SCOPE

2.5 SEGMENTS AND SUBSEGMENTS

2.6 MARKET-SIZE ESTIMATION

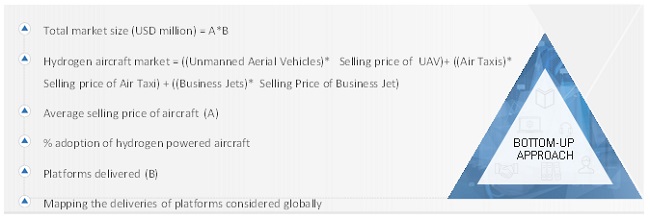

2.6.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

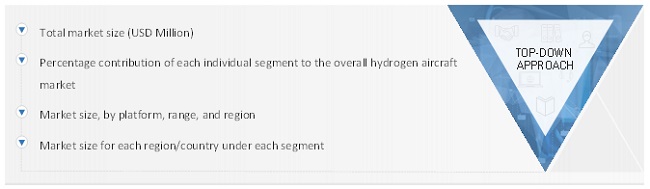

2.6.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.7 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.8 GROWTH RATE ASSUMPTIONS

2.9 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.9.1 ASSUMPTIONS

2.9.2 RISKS IMPACT ANALYSIS

2.9.3 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 6 HYDROGEN FUEL CELL SEGMENT PROJECTED TO LEAD HYDROGEN AIRCRAFT MARKET BY POWER SOURCE

FIGURE 7 MORE THAN 10 PASSENGERS SEGMENT PROJECTED TO ACCOUNT FOR LARGEST SHARE OF HYDROGEN AIRCRAFT MARKET BY PASSENGER CAPACITY IN 2030

FIGURE 8 UP TO 20 KM SEGMENT PROJECTED TO LEAD THE HYDROGEN AIRCRAFT MARKET BY RANGE DURING THE FORECAST PERIOD

FIGURE 9 UNMANNED AERIAL VEHICLES SEGMENT PROJECTED TO LEAD HYDROGEN AIRCRAFT BY PLATFORM MARKET DURING THE FORECAST PERIOD

FIGURE 10 HYBRID ELECTRIC AIRCRAFT SEGMENT PROJECTED TO LEAD HYDROGEN AIRCRAFT MARKET BY TECHNOLOGY DURING THE FORECAST PERIOD

FIGURE 11 NORTH AMERICA ACCOUNTED FOR THE LARGEST SHARE OF THE HYDROGEN AIRCRAFT MARKET BY REGION FOR 2020

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE OPPORTUNITIES IN THE HYDROGEN AIRCRAFT MARKET

FIGURE 12 RISING FOCUS OF AVIATION INDUSTRY ON DECARBONIZATION IS EXPECTED TO DRIVE THE HYDROGEN AIRCRAFT MARKET

4.2 HYDROGEN AIRCRAFT MARKET, BY PLATFORM

FIGURE 13 UNMANNED AERIAL VEHICLES SEGMENT PROJECTED TO DOMINATE HYDROGEN AIRCRAFT MARKET DURING THE FORECAST PERIOD

4.3 HYDROGEN AIRCRAFT MARKET, BY POWER SOURCE

FIGURE 14 HYDROGEN FUEL CELL SEGMENT PROJECTED TO LEAD THE HYDROGEN AIRCRAFT MARKET DURING THE FORECAST PERIOD

4.4 HYDROGEN AIRCRAFT MARKET, BY COUNTRY

FIGURE 15 HYDROGEN AIRCRAFT MARKET IN THE UK IS PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 HYDROGEN AIRCRAFT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Focus of the aviation industry on decarbonization

5.2.1.2 Increasing air passenger traffic across the globe

5.2.1.3 Advantages of hydrogen aircraft over conventional aircraft

5.2.1.4 Hydrogen offers alternative air transportation solutions

5.2.2 RESTRAINTS

5.2.2.1 High costs associated with the production of hydrogen

FIGURE 17 HYDROGEN AIRCRAFT MARKET: HYDROGEN GENERATION COSTS BY METHODS OF GENERATION

5.2.3 OPPORTUNITIES

5.2.3.1 Development of fuel cell technologies in the aviation industry

5.2.3.2 Focus of governments on the development of hydrogen aircraft

5.2.4 CHALLENGES

5.2.4.1 Retrofitting existing aircraft into hydrogen aircraft

5.2.4.2 Storage of hydrogen fuel in aircraft

5.2.4.3 Sustainable hydrogen production for aircraft

5.3 RANGE/SCENARIOS

FIGURE 18 IMPACT OF COVID-19 ON THE HYDROGEN AIRCRAFT MARKET: GLOBAL SCENARIO

5.4 IMPACT OF COVID-19 ON HYDROGEN AIRCRAFT MARKET

5.5 TRENDS/DISRUPTION IMPACTING CUSTOMERS’ BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR HYDROGEN AIRCRAFT MARKET

5.6 SELLING PRICE ANALYSIS

TABLE 2 AVERAGE SELLING PRICE OF HYDROGEN POWERED PLATFORM 2025, USD THOUSAND

5.7 HYDROGEN AIRCRAFT MARKET ECOSYSTEM

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 END USERS

TABLE 3 HYDROGEN AIRCRAFT MARKET: MARKET ECOSYSTEM

5.8 VALUE CHAIN ANALYSIS

5.9 USE CASES

5.9.1 HYDROGEN: A FUTURE FUEL FOR AVIATION

5.9.2 SCIENTISTS LEADING THE WAY IN NEW-GENERATION CLEANER AIR TRAVEL

5.9.3 FRANCE’S COMMITMENT FOR HYDROGEN DEPLOYMENT ACCORDING TO ITS NATIONAL ENERGY AND CLIMATE PLAN (NECP)

5.9.4 FUEL CELLS FOR NON-PROPULSION APPLICATIONS

5.10 TARIFF REGULATORY LANDSCAPE FOR HYDROGEN PRODUCTION

5.10.1 SINGAPORE:

5.10.2 UAE

5.10.3 UK:

5.10.4 FRANCE:

5.10.5 US:

5.10.6 CALIFORNIA

5.11 TECHNOLOGY ANALYSIS

5.11.1 FUEL CELL TECHNOLOGY

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 INTENSITY OF COMPETITIVE RIVALRY IS LOW IN THE HYDROGEN AIRCRAFT MARKET

6 INDUSTRY TRENDS (Page No. - 62)

6.1 INTRODUCTION

6.2 EXPECTED TECHNOLOGY ROADMAP OF THE AVIATION INDUSTRY FOR THE FUTURE

FIGURE 20 TECHNOLOGY ROADMAP OF THE AVIATION INDUSTRY

6.3 DEVELOPMENTS IN HYDROGEN AIRCRAFT

6.4 TECHNOLOGICAL ADVANCEMENTS IN THE AVIATION INDUSTRY

6.4.1 ARTIFICIAL INTELLIGENCE

6.4.2 BIG DATA ANALYTICS

6.4.3 INTERNET OF THINGS (IOT)

6.5 TECHNOLOGY TRENDS IN THE HYDROGEN AIRCRAFT MARKET

6.5.1 HYDROGEN COMBUSTION

6.5.2 HYDROGEN FUEL CELL

6.6 IMPACT OF MEGATRENDS

6.7 INNOVATIONS AND PATENT REGISTRATIONS, 2004 - 2016

TABLE 5 INNOVATIONS AND PATENT REGISTRATIONS

7 HYDROGEN AIRCRAFT MARKET, BY POWER SOURCE (Page No. - 67)

7.1 INTRODUCTION

FIGURE 21 BY POWER SOURCE, 2020–2030 (USD MILLION) *

TABLE 6 BY POWER SOURCE, 2020–2024 (USD MILLION)

TABLE 7 BY POWER SOURCE, 2025–2030 (USD MILLION)

TABLE 8 FOR POWER SOURCE, BY REGION, 2020–2024 (USD MILLION)

TABLE 9 FOR POWER SOURCE, BY REGION, 2025–2030 (USD MILLION)

7.2 HYDROGEN COMBUSTION

7.3 HYDROGEN FUEL CELL

8 HYDROGEN AIRCRAFT MARKET, BY PASSENGER CAPACITY (Page No. - 71)

8.1 INTRODUCTION

FIGURE 22 UP TO 4 PASSENGERS SEGMENT OF HYDROGEN AIRCRAFT MARKET TO GROW AT HIGHEST CAGR, 2020-2030

TABLE 10 MARKET SIZE, BY PASSENGER CAPACITY, 2020-2024 (USD MILLION)

TABLE 11 MARKET SIZE, BY PASSENGER CAPACITY, 2025-2030 (USD MILLION)

TABLE 12 MARKET FOR PASSENGER CAPACITY, BY REGION, 2020–2024 (USD MILLION)

TABLE 13 MARKET FOR PASSENGER CAPACITY, BY REGION, 2025–2030 (USD MILLION)

8.2 UP TO 4 PASSENGERS

8.3 5 TO 10 PASSENGERS

8.4 MORE THAN 10 PASSENGERS

9 HYDROGEN AIRCRAFT MARKET, BY RANGE (Page No. - 75)

9.1 INTRODUCTION

FIGURE 23 MARKET, BY RANGE, 2020–2030 (USD MILLION)

TABLE 14 MARKET, BY RANGE, 2020–2024 (USD MILLION)

TABLE 15 MARKET, BY RANGE, 2025–2030 (USD MILLION)

TABLE 16 MARKET FOR RANGE, BY REGION, 2020–2024 (USD MILLION)

TABLE 17 MARKET FOR RANGE CAPACITY, BY REGION, 2025–2030 (USD MILLION)

9.2 UP TO 20 KM

9.3 20 KM TO 100 KM

9.4 MORE THAN 100 KM

10 HYDROGEN AIRCRAFT MARKET, BY PLATFORM (Page No. - 79)

10.1 INTRODUCTION

FIGURE 24 AIR TAXIS SEGMENT TO GROW AT THE HIGHEST CAGR, 2025-2030

TABLE 18 MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 19 MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 20 MARKET FOR PLATFORM, BY REGION, 2020–2024 (USD MILLION)

TABLE 21 MARKET FOR PLATFORM, BY REGION, 2025–2030 (USD MILLION)

10.2 UNMANNED AERIAL VEHICLES

10.3 AIR TAXIS

10.4 BUSINESS JETS

11 HYDROGEN AIRCRAFT MARKET, BY TECHNOLOGY (Page No. - 83)

11.1 INTRODUCTION

FIGURE 25 HYBRID ELECTRIC AIRCRAFT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGER SHARE OF THE HYDROGEN AIRCRAFT MARKET IN 2030

TABLE 22 MARKET SIZE, BY TECHNOLOGY, 2020-2024 (USD MILLION)

TABLE 23 MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

11.2 FULLY HYDROGEN POWERED AIRCRAFT

11.2.1 LIQUID HYDROGEN AIRCRAFT

11.2.2 HYDROGEN FUEL CELL AIRCRAFT

11.3 HYBRID ELECTRIC AIRCRAFT

12 HYDROGEN AIRCRAFT MARKET, BY REGION (Page No. - 86)

12.1 INTRODUCTION

FIGURE 26 NORTH AMERICA ACCOUNTED FOR THE LARGEST SHARE OF THE HYDROGEN AIRCRAFT MARKET IN 2020

TABLE 24 MARKET SIZE, BY REGION, 2020-2024 (USD MILLION)

TABLE 25 MARKET SIZE, BY REGION, 2025-2030 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 27 NORTH AMERICA MARKET SNAPSHOT

TABLE 26 NORTH AMERICA: MARKET SIZE, BY POWER SOURCE, 2020-2024 (USD MILLION)

TABLE 27 NORTH AMERICA: MARKET SIZE, BY POWER SOURCE, 2025-2030 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY PASSENGER CAPACITY, 2020-2024 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY PASSENGER CAPACITY, 2025-2030 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020-2024 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

12.2.2 US

12.2.2.1 Entry of major US companies in the hydrogen aircraft or related markets

TABLE 36 US: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 37 US: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 38 US: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 39 US: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Launch of major initiatives in advanced air mobility

TABLE 40 CANADA: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 41 CANADA: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 42 CANADA: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 43 CANADA: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

12.3 EUROPE

12.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 28 EUROPE MARKET SNAPSHOT

TABLE 44 EUROPE: MARKET SIZE, BY POWER SOURCE, 2020-2024 (USD MILLION)

TABLE 45 EUROPE: MARKET SIZE, BY POWER SOURCE, 2025-2030 (USD MILLION)

TABLE 46 EUROPE: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 47 EUROPE: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

TABLE 48 EUROPE: MARKET SIZE, BY PASSENGER CAPACITY, 2020-2024 (USD MILLION)

TABLE 49 EUROPE: MARKET SIZE, BY PASSENGER CAPACITY, 2025-2030 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 51 EUROPE: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY COUNTRY, 2020-2024 (USD MILLION)

TABLE 53 EUROPE: MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

12.3.2 UK

12.3.2.1 Aircraft development funding by government

TABLE 54 UK: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 55 UK: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 56 UK: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 57 UK: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

12.3.3 GERMANY

12.3.3.1 Government strategy to source hydrogen sustainably

TABLE 58 GERMANY: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 59 GERMANY: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 60 GERMANY: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 61 GERMANY: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 Government initiatives to boost hydrogen production

TABLE 62 FRANCE: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 63 FRANCE: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 64 FRANCE: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 65 FRANCE: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

12.3.5 RUSSIA

12.3.5.1 Russia aiming to lead export of hydrogen

TABLE 66 RUSSIA: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 67 RUSSIA: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 68 RUSSIA: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 69 RUSSIA: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

12.3.6 NETHERLANDS

12.3.6.1 Hydrogen aircraft development initiatives at grassroot levels

TABLE 70 NETHERLANDS: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 71 NETHERLANDS: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 72 NETHERLANDS: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 73 NETHERLANDS: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 29 ASIA PACIFIC MARKET SNAPSHOT

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY POWER SOURCE, 2020-2024 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET SIZE, BY POWER SOURCE, 2025-2030 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 77 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET SIZE, BY PASSENGER CAPACITY, 2020-2024 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY PASSENGER CAPACITY, 2025-2030 (USD MILLION)

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020-2024 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Increased collaborative activities by companies

TABLE 84 CHINA: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 85 CHINA: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 86 CHINA: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 87 CHINA: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

12.4.3 JAPAN

12.4.3.1 Anticipated government funding to reduce greenhouse gas emissions

TABLE 88 JAPAN: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 89 JAPAN: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 90 JAPAN: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 91 JAPAN: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

12.4.4 INDIA

12.4.4.1 Government sponsored research & development in the hydrogen technology

TABLE 92 INDIA: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 93 INDIA: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 94 INDIA: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 95 INDIA: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

12.4.5 SOUTH KOREA

12.4.5.1 Entry of major players in the hydrogen market and government development programs

TABLE 96 SOUTH KOREA: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 97 SOUTH KOREA: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 98 SOUTH KOREA: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 99 SOUTH KOREA: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

12.4.6 SINGAPORE

12.4.6.1 Major alliance undertaken to consolidate the hydrogen value chain

TABLE 100 SINGAPORE: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 101 SINGAPORE: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 102 SINGAPORE: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 103 SINGAPORE: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

12.5 REST OF THE WORLD

12.5.1 PESTLE ANALYSIS: REST OF THE WORLD

FIGURE 30 REST OF THE WORLD MARKET SNAPSHOT

TABLE 104 REST OF THE WORLD: MARKET SIZE, BY POWER SOURCE, 2020-2024 (USD MILLION)

TABLE 105 REST OF THE WORLD: MARKET SIZE, BY POWER SOURCE, 2025-2030 (USD MILLION)

TABLE 106 REST OF THE WORLD: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 107 REST OF THE WORLD: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 108 REST OF THE WORLD: MARKET SIZE, BY PASSENGER CAPACITY, 2020-2024 (USD MILLION)

TABLE 109 REST OF THE WORLD: MARKET SIZE, BY PASSENGER CAPACITY, 2025-2030 (USD MILLION)

TABLE 110 REST OF THE WORLD: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 111 REST OF THE WORLD: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

TABLE 112 REST OF THE WORLD: MARKET SIZE, BY REGION, 2020-2024 (USD MILLION)

TABLE 113 REST OF THE WORLD: MARKET SIZE, BY REGION, 2025-2030 (USD MILLION)

12.5.2 MIDDLE EAST & AFRICA

12.5.2.1 New startups in the region

TABLE 114 MIDDLE EAST & AFRICA: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 115 MIDDLE EAST & AFRICA: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 116 MIDDLE EAST & AFRICA: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 117 MIDDLE EAST & AFRICA: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

12.5.3 LATIN AMERICA

TABLE 118 LATIN AMERICA: MARKET SIZE, BY PLATFORM, 2020-2024 (USD MILLION)

TABLE 119 LATIN AMERICA: MARKET SIZE, BY PLATFORM, 2025-2030 (USD MILLION)

TABLE 120 LATIN AMERICA: MARKET SIZE, BY RANGE, 2020-2024 (USD MILLION)

TABLE 121 LATIN AMERICA: MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 126)

13.1 INTRODUCTION

13.2 RANKING OF LEADING PLAYERS, 2020

FIGURE 31 MARKET RANKING OF LEADING PLAYERS IN THE HYDROGEN AIRCRAFT MARKET, 2020

13.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2020

13.4 COMPETITIVE OVERVIEW

TABLE 122 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE HYDROGEN AIRCRAFT MARKET BETWEEN 2017 AND 2020

13.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 123 COMPANY PRODUCT FOOTPRINT

TABLE 124 COMPANY APPLICATION FOOTPRINT

TABLE 125 COMPANY INDUSTRY FOOTPRINT

TABLE 126 COMPANY REGION FOOTPRINT

13.6 COMPANY EVALUATION QUADRANT

13.6.1 STAR

13.6.2 EMERGING LEADER

13.6.3 PERVASIVE

13.6.4 PARTICIPANT

FIGURE 32 HYDROGEN AIRCRAFT MARKET COMPETITIVE LEADERSHIP MAPPING, 2020

13.7 HYDROGEN AIRCRAFT MARKET COMPETITIVE LEADERSHIP MAPPING (STARTUPS)

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 DYNAMIC COMPANIES

13.7.4 STARTING BLOCKS

FIGURE 33 HYDROGEN AIRCRAFT MARKET (STARTUPS) COMPETITIVE LEADERSHIP MAPPING, 2020

13.8 COMPETITIVE SCENARIO

13.8.1 MERGERS & ACQUISITIONS

TABLE 127 MERGERS & ACQUISITIONS, 2019-2020

13.8.2 NEW PRODUCT LAUNCHES

TABLE 128 NEW PRODUCT LAUNCHES, 2018-2021

13.8.3 CONTRACTS, PARTNERSHIPS & AGREEMENTS

TABLE 129 CONTRACTS, PARTNERSHIPS & AGREEMENTS, 2019-2021

13.8.4 COLLABORATIONS & EXPANSIONS

TABLE 130 COLLABORATIONS & EXPANSIONS, 2019-2021

14 COMPANY PROFILES (Page No. - 139)

14.1 KEY PLAYERS

(Business Overview, Products & Solutions, Key Insights, Recent Developments, MnM View)*

14.1.1 AIRBUS SE

FIGURE 34 AIRBUS SE: COMPANY SNAPSHOT

TABLE 131 AIRBUS SE: BUSINESS OVERVIEW

14.1.2 AEROVIRONMENT INC.

FIGURE 35 AEROVIRONMENT INC.: COMPANY SNAPSHOT

TABLE 132 AEROVIRONMENT INC.: BUSINESS OVERVIEW

14.1.3 AERODELFT

TABLE 133 AERODELFT: BUSINESS OVERVIEW

14.1.4 SKAI (UNDER ALAKA’I TECHNOLOGIES)

TABLE 134 SKAI: BUSINESS OVERVIEW

14.1.5 HES ENERGY SYSTEMS

TABLE 135 HES ENERGY SYSTEMS: BUSINESS OVERVIEW

14.1.6 PIPISTREL D.O.O

TABLE 136 PIPISTREL D.O.O: BUSINESS OVERVIEW

14.1.7 URBAN AERONAUTICS LTD.

TABLE 137 URBAN AERONAUTICS LTD.: BUSINESS OVERVIEW

14.1.8 ZEROAVIA INC.

TABLE 138 ZEROAVIA INC.: BUSINESS OVERVIEW

14.1.9 GKN AEROSPACE (UNDER MELROSE INDUSTRIES PLC.)

FIGURE 36 GKN AEROSPACE: COMPANY SNAPSHOT

TABLE 139 GKN AEROSPACE: BUSINESS OVERVIEW

14.1.10 FLYKA

TABLE 140 FLYKA: BUSINESS OVERVIEW

14.1.11 APUS GROUP

TABLE 141 APUS GROUP: BUSINESS OVERVIEW

14.2 OTHER PLAYERS

14.2.1 HYPOINT INC.

TABLE 142 HYPOINT INC.: BUSINESS OVERVIEW

14.2.2 HONEYWELL INTERNATIONAL INC.

FIGURE 37 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 143 HONEYWELL INTERNATIONAL INC: BUSINESS OVERVIEW

14.2.3 INTELLIGENT ENERGY HOLDINGS

TABLE 144 INTELLIGENT ENERGY HOLDINGS: BUSINESS OVERVIEW

14.2.4 PLUG POWER INC.

FIGURE 38 PLUG POWER INC.: COMPANY SNAPSHOT

TABLE 145 PLUG POWER INC.: BUSINESS OVERVIEW

14.2.5 DOOSAN MOBILITY INNOVATION

TABLE 146 DOOSAN MOBILITY INNOVATION: BUSINESS OVERVIEW

14.2.6 SHANGHAI PEARL HYDROGEN ENERGY TECHNOLOGY CO. LTD.

TABLE 147 SHANGHAI PEARL HYDROGEN ENERGY TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

*Details on Business Overview, Products & Solutions, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

15 HYDROGEN AIRCRAFT ADJACENT MARKETS (Page No. - 169)

15.1 AUTONOMOUS AIRCRAFT

15.1.1 MARKET DEFINITION

15.1.2 AUTONOMOUS AIRCRAFT MARKET, BY END USE

FIGURE 39 AUTONOMOUS AIRCRAFT MARKET, BY END USE, 2018 & 2030 (USD MILLION)

TABLE 148 AUTONOMOUS AIRCRAFT MARKET SIZE, BY END USE, 2018–2030 (USD MILLION)

15.1.2.1 Commercial aircraft

15.1.2.1.1 Increasingly autonomous capability

TABLE 149 AUTONOMOUS AIRCRAFT MARKET FOR COMMERCIAL AIRCRAFT, BY REGION, 2016–2030 (USD MILLION)

15.1.2.2 Cargo & delivery aircraft

15.1.2.2.1 Package pickup and delivery, cargo transport

TABLE 150 AUTONOMOUS AIRCRAFT MARKET FOR CARGO & DELIVERY AIRCRAFT, BY REGION, 2016–2030 (USD MILLION)

15.1.2.3 Air medical services

15.1.2.3.1 Emergency medical services in remote, non-accessible, or heavy traffic areas

TABLE 151 AUTONOMOUS AIRCRAFT MARKET FOR AIR MEDICAL SERVICES, BY REGION, 2016–2030 (USD MILLION)

15.1.2.4 Passenger air vehicle

15.1.2.4.1 Urban air mobility – passenger travel, air taxi

TABLE 152 AUTONOMOUS AIRCRAFT MARKET FOR AIR TAXI, BY REGION, 2016–2030 (USD MILLION)

15.1.2.5 Personal air vehicle

15.1.2.5.1 One and two seater aircraft for intracity travel

TABLE 153 AUTONOMOUS AIRCRAFT MARKET FOR PERSONAL AIR VEHICLES, BY REGION, 2016–2030 (USD MILLION)

15.1.2.6 Combat and ISR

15.1.2.6.1 Military operations with autonomous capabilities

TABLE 154 AUTONOMOUS AIRCRAFT MARKET FOR COMBAT AND ISR, BY REGION, 2016–2030 (USD MILLION)

15.1.2.7 Others

15.1.2.7.1 Agriculture, science and research, survey, mapping and photography

TABLE 155 AUTONOMOUS AIRCRAFT MARKET OTHERS, BY REGION, 2016–2030 (USD MILLION)

15.2 URBAN AIR MOBILITY

15.2.1 MARKET DEFINITION

15.2.2 URBAN AIR MOBILITY MARKET, BY RANGE

FIGURE 40 INTRACITY SEGMENT PROJECTED TO LEAD URBAN AIR MOBILITY MARKET FROM 2020 TO 2030

TABLE 156 URBAN AIR MOBILITY MARKET SIZE, BY RANGE, 2017-2019 (USD MILLION)

TABLE 157 URBAN AIR MOBILITY MARKET SIZE, BY RANGE, 2020-2030 (USD MILLION)

15.2.3 INTERCITY (100 KILOMETERS TO 400 KILOMETERS)

15.2.4 INTRACITY (20 KILOMETERS TO 100 KILOMETERS)

16 APPENDIX (Page No. - 176)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATION

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

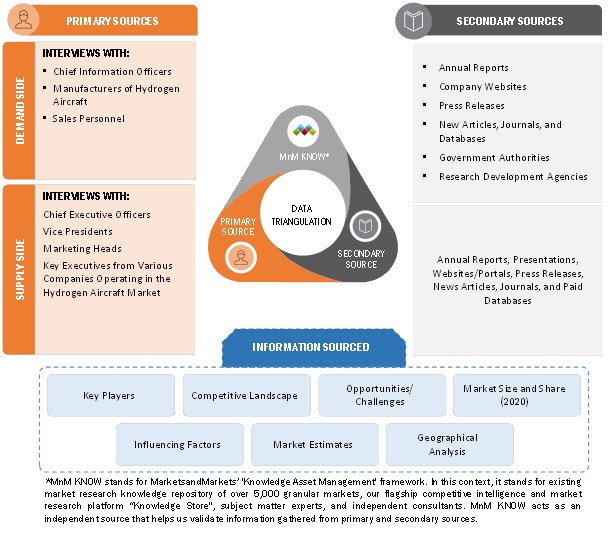

This research study involved the use of extensive secondary sources, including directories; databases; and information portals such as D&B Hoovers, Bloomberg, BusinessWeek, Factiva, and white papers, to identify and collect relevant information about the hydrogen aircraft market. Primary sources included industry experts, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to the industry’s value chain. All primary sources from different categories were interviewed to obtain and verify critical qualitative and quantitative information, as well as assess prospects of the market.

Secondary Research

The market size for hydrogen aircraft was derived from secondary data available through paid and unpaid sources. Secondary sources referred for this research study included corporate filings such as annual reports, investor presentations, and financial statements, and trade, business, and professional associations. In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and companies' investor presentations; white papers and certified publications; articles from recognized authors; manufacturing associations; directories; and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, the market’s monetary chain, the total pool of key players, market classification, segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both, the market and technology oriented perspectives.

Primary Research

In the primary research process, various sources from both, the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Extensive primary research was conducted to obtain qualitative and quantitative information such as market statistics, average selling prices, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to range, platform, technology, passenger capacity, power source, and region. Extensive primary research was conducted after obtaining information regarding the hydrogen aircraft market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across four regions, namely, North America, Europe, Asia Pacific, and Rest of the World. This primary data was obtained through questionnaires, mails, and telephonic interviews. The impact of the COVID-19 pandemic on hydrogen aircraft industry was also discussed with industry experts.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the size of the Hydrogen Aircraft market. Figures depicted in the bottom-up approach and top-down approach below offer a representation of the market size estimation process employed for this study on the Hydrogen Aircraft market.

The research methodology used to estimate the market size also included the following details:

- Key players in the market were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, project managers, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, and analyzed by MarketsandMarkets and presented in this report.

Market size estimation methodology: Top- down approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market size estimation methodology: Bottom-up approach

Data triangulation

After arriving at the market size, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process. The data was triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size was validated using both, top-down and bottom-up approaches.

In the top-down approach, the market size of Hydrogen Aircraft market was arrived at by calculating the country-level data. Moreover, in the bottom-up approach, the market size was derived by estimating the revenues of key companies operating in the market and validating the data acquired from primary research.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used to develop this report.

Report objectives

- To define, describe, segment, and forecast the size of the Hydrogen Aircraft market based on range, platform, power source, technology, passenger capacity, and region

- To analyze the degree of competition in the market by identifying various parameters, including key market players

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the Hydrogen Aircraft market

- To forecast the market size of segments, with respect to various regions, including North America, Europe, Asia Pacific, and the rest of the world, along with the major countries/sub-regions in each region

- To strategically profile key market players and comprehensively analyze their market rankings and core competencies1

- To track and analyze competitive developments, such as new product launches, merger & acquisitions, contract, agreement, partnership, collaborations, and expansions & developments of key players in the Hydrogen Aircraft market

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the Hydrogen Aircraft market

- To identify industry trends, market trends, and technology trends currently prevailing in the Hydrogen Aircraft market

-

To strategically analyze micromarkets2 with respect to individual technological trends and prospects of the Hydrogen Aircraft market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of market players (Up to 5)

Country-level Analysis

- Cross Segmentation, subject to data availability

- Market analysis of a few countries in the Middle East and Latin American regions, subject to data availability

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hydrogen Aircraft Market