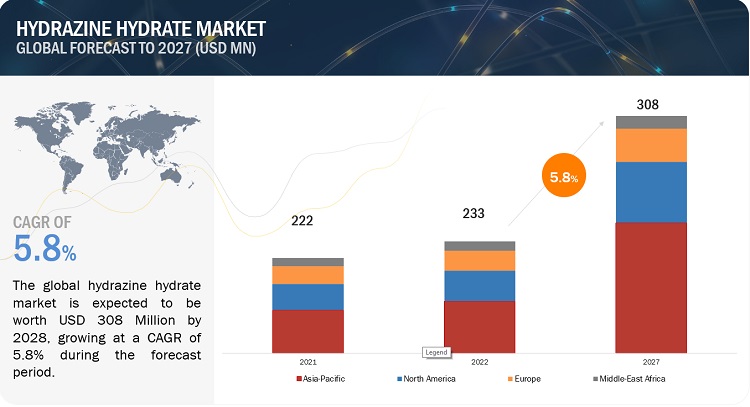

Hydrazine Hydrate Market by Concentration Level (24%-35%, 40%-55%, 60%-85% & 100%), Application (Polymerization & Blowing Agents, Pharmaceuticals, Agrochemicals, Water Treatment), and Region (Asia Pacific, North America, Europe) - Global Forecast to 2027

Updated on : July 28, 2025

Hydrazine Hydrate Market

The global hydrazine hydrate market was valued at USD 233 million in 2022 and is projected to reach USD 308 million by 2027, growing at 5.8% cagr from 2022 to 2027. One of the main reasons making an positive outlook for the market is the mounting demand for polymer foams, growing pharmaceutical industry and rising demand from agrochemicals industry. Also, the chances for use of hydrazine hydrate in fuel cells is pushing the market. Due to these incentives, the demand for hydrazine hydrate in pharmaceutical industry, agrochemical indsutry ad polymer industry is increased.

Hydrazine Hydrate Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Hydrazine Hydrate Market Dynamics

Driver: Mounting demand for polymer foams

Due to increasing use of hydrazine hydrate and its derivatives as foaming agents in the plastic industry, the manufacturers of hydrazine hydrate are expanding their production capacities to manufacture azodicarbonamide, which is used in the polymer industry. Also, the growth of several end-use industries for instanc: packaging, automotive, furniture & bedding and building & construction industries, which would push the market for polymer foams in the coming years. This will increase the requirement for hydrazine hydrate in the polymer industry.

Restraints: Harmful properties of hydrazine hydrate affecting the demand in several applications

Hydrazine hydrate is a strong reducing agent, highly reactive and unstable inorganic chemical compound, which is extremely explosive when kept in an unstable state. Furthermore, the inhalation of hydrazine hydrate can create a harmful effects on the lungs, liver, spleen, and thyroid and have been reported in animals chronically (long-term). Also, it has toxic nature and carcinogenic properties which will cause a serious risk to the growth of hydrazine hydrate market.

Opportunities: Mounting use of hydrazine hydrate in fuel cells

Owing to the mounting need to curtail carbon emissions into the atmosphere, there has been an enhanced necessity for hydrazine hydrate-based fuel cells. Also, there has been a rising trend of using hydrazine hydrate-based fuel cells. This is directing to a substantial growth in requirement for hydrazine hydrate and, accordingly, opening giant market opportunities for the market players. Furthermore, the potential application of hydrazine hydrate in fuel cells as an helpful substitute for hydrogen and oxygen is projected to present gainful openings to hydrazine hydrate market players

Challenges: Ecological challenges

Hydrazine hydrate is mainly released in water with smaller proportions, into the air and soil. Because of its carciogenic properties, it is extremely hazardous for aquatic organisms and plant life. Also, the degradation of hydrazine in water may be slow, depending on the surrounding conditions. Conversely, the contamination of soil, water, and the atmosphere can be escaped by proper methods of transport, storage, and waste disposal of hydrazine hydrate. Only few manufacturers take notice of these factors while manufacturing and using hydrazine hydrate.

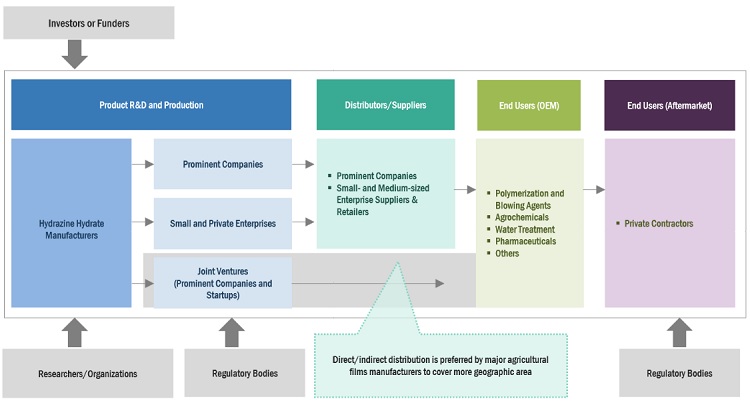

Hydrazine Hydrate Market Ecosystem

Prominent companies in this Hydrazine Hydrate Industry include well-established, financially stable hydrazine hydrate manufacturers. These businesses have been in business for a while and have a extensive range of products, pioneering technologies, and strong international sales and marketing networks. Top companies in this market include Arkema S.A. (France), LANXESS AG (Germany), Lonza Group AG (Switzerland), LGC Science Group Holdings Limited (UK), and Nippon Carbide Industries Co., Inc. (Japan).

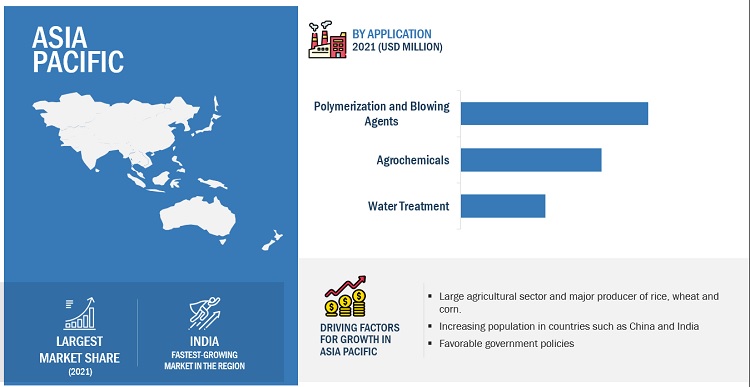

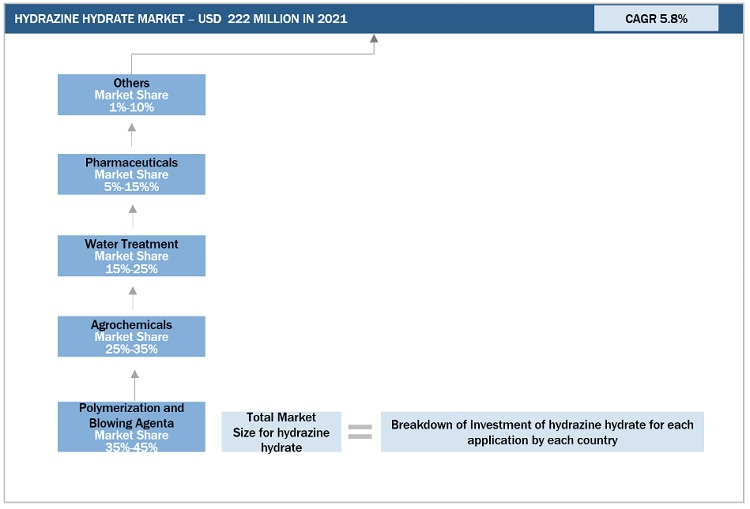

Based on application, polymerization & blowing agents is projected to be the largest market for hydrazine hydrate, in terms of value, during the forecast period.

Polymerization & blowing agents is the largest application for hydrazine hydrate due to polymer industries often use hydrazine hydrate as foaming agent in manufacturing. Likewise, the derivatives of hydrazine hydrates are used as low temperature blowing agents and polymerization initiators such as azodicarbonamide and azobis isobutyronitrile,.

Based on concentration level, 60%-85% was the largest segment for hydrazine hydrate market, in terms of value, in 2021.

60%-85% concentration level is mostly used in manufacturing of veterinary drugs, chemical synthesis, polymerization processes as initiator or blowing agent, and as a propellant in emergency power units (EPU) in the single-engine aircrafts and F16 fighter aircrafts. The 60%-85% concentration level of hydrazine hydrate accounted for the largest market share.

“Asia Pacific accounted for the largest market share for hydrazine hydrate market, in terms of value, in 2021”

In terms of value, Asia Pacific is the largest market for hydrazine hydrate, followed by Europe. This is due to the increasing demand in the rapidly growing agrochemical and polymer sectors especially in China and India. Also the favorable government policies in Asia Pacific region gives boost to hydrazine hydrate market.

To know about the assumptions considered for the study, download the pdf brochure

Hydrazine Hydrate Market Players

The key players profiled in the report include Arkema S.A. (France), LANXESS AG (Germany), Lonza Group AG (Switzerland), LGC Science Group Holdings Limited (UK), and Nippon Carbide Industries Co., Inc. (Japan) and among others, are the key manufacturers that holds major market share in the last few years. Major focus was given to the collaborations, partnerships and new product development due to the changing requirements of users across the world.

Hydrazine Hydrate Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 233 million |

|

Revenue Forecast in 2027 |

USD 308 million |

|

CAGR |

5.8% |

|

Years considered for the study |

2017–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (Ton) and Value (USD Thousand) |

|

Segments covered |

Concentration Level, Application, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

Arkema S.A. (France), LANXESS AG (Germany), Lonza Group AG (Switzerland), LGC Science Group Holdings Limited (UK), and Nippon Carbide Industries Co., Inc. (Japan) |

This report categorizes the global hydrazine hydrate market based on concentration level, application, and region.

On the basis of concentration level, the hydrazine hydrate market has been segmented as follows:

- 100%

- 60%-85%

- 40%-55%

- 24%-35%

On the basis of application, the hydrazine hydrate market has been segmented as follows:

- Agrochemicals

- Water treatment

- Polymerization & Blowing Agents

- Pharmaceuticals

- Others

On the basis of region, the hydrazine hydrate market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In May 2022, Lanxess AG has made a partnership with Provivi Inc. to scale up the production of pheromone products, through its Saltigo business unit. Also, In 2021, the French Agency of Food, Environmental and Occupational Health & Safety (ANSES) granted regulatory approval for Provivi's insect pheromone product.

- In May 2022, Lonza Group AG made a collaboration with ALSA Ventures to provide development and production services for biotech firms.

- In January 2020, LGC Science Group Holdings Limited acquired C/D/N Isotopes company, which is a prominent manufacturer and supplier of deuterium-labeled compounds.

Frequently Asked Questions (FAQ):

What are the major developments impacting the market?

The chances for use hydrazine hydrate in fuel cell is expected to shift market trends.

Who are major players in hydrazine hydrate market?

The key players profiled in the report include Arkema S.A. (France), LANXESS AG (Germany), Lonza Group AG (Switzerland), LGC Science Group Holdings Limited (UK), and Nippon Carbide Industries Co., Inc. (Japan).

What is the emerging application of hydrazine hydrate?

Polymerization & blowing agents, and pharmaceuticals is the emerging application for hydrazine hydrate market during the forecast period.

What are the major factors restraining market growth during the forecast period?

Harmful properties of hydrazine hydrate affecting the demand in several applications is thse major restraint for hydrate market market growth.

What are the various strategies key players are focusing within hydrate market market?

Key players are majorly focused on new product launch and partnering with local or regional players within the market, in order to attract larger market share globally. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for polymer foams- Growing demand in agrochemical industry- Expanding pharmaceuticals sectorRESTRAINTS- Toxic and carcinogenic properties affecting demand in various applications- Availability of substitutes in water treatment applicationOPPORTUNITIES- Opportunities for use of hydrazine hydrate in fuel cellsCHALLENGES- Environmental challenges- Hazards associated with use of hydrazine

-

5.3 PORTER'S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITION RIVALRY

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIABUYING CRITERIA

-

5.5 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIAL SUPPLIERMANUFACTURERDISTRIBUTION TO END USERS

-

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSESREVENUE SHIFT & REVENUE POCKETS FOR HYDRAZINE HYDRATES

-

6.3 CONNECTED MARKETS: ECOSYSTEM

-

6.4 TECHNOLOGY ANALYSISALTERNATIVE TO UREA-BASED TECHNOLOGY USING ENVIRONMENTALLY FRIENDLY AMMONIA AND HYDROGEN PEROXIDE

-

6.5 CASE STUDIESFILTRATION OF HYDRAZINE HYDRATE WASTE SALT USING WATER WASHING-BASED INTEGRATED TECHNIQUE FOR PRODUCING SODIUM HYDRATE VIA ION-EXCHANGE MEMBRANE ELECTROLYSIS

-

6.6 TRADE DATAIMPORT SCENARIO OF HYDRAZINE HYDRATEEXPORT SCENARIO OF HYDRAZINE HYDRATE

-

6.7 PRICING ANALYSISAVERAGE SELLING PRICES OF KEY PLAYERS, BY APPLICATIONAVERAGE SELLING PRICE TRENDS

-

6.8 REGULATORY FRAMEWORKS AND THEIR IMPACT ON HYDRAZINE HYDRATE MARKETREGULATORY BODIES IN HYDRAZINE HYDRATEREGULATIONS RELATED TO HYDRAZINE HYDRATE

- 6.9 KEY CONFERENCES & EVENTS IN 2023

-

6.10 PATENT ANALYSISAPPROACHDOCUMENT TYPEJURISDICTION ANALYSISTOP APPLICANTS

- 7.1 INTRODUCTION

-

7.2 24%–35%RISING DEMAND FROM WATER TREATMENT PLANTS TO INFLUENCE MARKET GROWTH SIGNIFICANTLY

-

7.3 40%–55%GROWING DEMAND FOR HYDRAZINE HYDRATE FROM AGROCHEMICAL AND POLYMER APPLICATIONS TO DRIVE MARKET

-

7.4 60%–85%HYDRAZINE HYDRATE AND ITS DERIVATIVES INCREASINGLY USED IN PHARMACEUTICALS

-

7.5 100%DEVELOPING CHEMICAL AND POLYMER INDUSTRIES IN ASIA PACIFIC TO BOOST GROWTH OF 100% CONCENTRATED HYDRAZINE HYDRATE MARKET

- 8.1 INTRODUCTION

-

8.2 POLYMERIZATION & BLOWING AGENTSRISING DEMAND FROM ASIA PACIFIC TO INFLUENCE MARKET

-

8.3 PHARMACEUTICALSGROWING DEMAND FROM HEALTHCARE SECTOR TO IMPACT MARKET

-

8.4 AGROCHEMICALSINCREASING DEMAND FOR CROP PROTECTION TO INFLUENCE MARKET

-

8.5 WATER TREATMENTRISING URBANIZATION IN DEVELOPING COUNTRIES TO DRIVE MARKET

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICASIA PACIFIC HYDRAZINE HYDRATE MARKET, BY CONCENTRATION LEVELASIA PACIFIC HYDRAZINE HYDRATE MARKET, BY APPLICATIONASIA PACIFIC HYDRAZINE HYDRATE MARKET, BY COUNTRY- China- Japan- India- South Korea- Taiwan- Indonesia- Malaysia

-

9.3 EUROPEEUROPE HYDRAZINE HYDRATE MARKET, BY CONCENTRATION LEVELEUROPE HYDRAZINE HYDRATE MARKET, BY APPLICATIONEUROPE HYDRAZINE HYDRATE MARKET, BY COUNTRY- Germany- France- UK- Russia- Italy

-

9.4 NORTH AMERICANORTH AMERICA HYDRAZINE HYDRATE MARKET, BY CONCENTRATION LEVELNORTH AMERICA HYDRAZINE HYDRATE MARKET, BY APPLICATIONNORTH AMERICA HYDRAZINE HYDRATE MARKET, BY COUNTRY- US- Canada- Mexico

-

9.5 SOUTH AMERICASOUTH AMERICA HYDRAZINE HYDRATE MARKET, BY CONCENTRATION LEVELSOUTH AMERICA HYDRAZINE HYDRATE MARKET, BY APPLICATIONSOUTH AMERICA HYDRAZINE HYDRATE MARKET, BY COUNTRY- Brazil- Argentina

-

9.6 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA HYDRAZINE HYDRATE MARKET, BY CONCENTRATION LEVELMIDDLE EAST & AFRICA HYDRAZINE HYDRATE MARKET, BY APPLICATIONMIDDLE EAST & AFRICA HYDRAZINE HYDRATE MARKET, BY COUNTRY- Saudi Arabia- UAE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

10.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2021MARKET SHARE OF KEY PLAYERS- Arkema S.A.- LANXESS AG- Lonza Group AG- LGC Science Group Holdings Limited- Nippon Carbide Industries Co., Inc.

- 10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

10.5 COMPANY EVALUATION QUADRANT (TIER 1)STARSEMERGING LEADERSPARTICIPANTS

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 START-UPS/SMES EVALUATION QUADRANTRESPONSIVE COMPANIESSTARTING BLOCKS

- 10.8 COMPETITIVE SCENARIOS AND TRENDS

-

11.1 MAJOR PLAYERSLANXESS AG- Business overview- Products/Solutions/Services offered- LANXESS AG: Recent developments- MnM viewARKEMA S.A.- Business overview- Products/Solutions/Services offered- MnM viewLONZA GROUP AG- Business overview- Products/Solutions/Services offered- Lonza Group AG: Recent developments- MnM viewHPL ADDITIVES LIMITED- Business overview- Products/Solutions/Services offered- MnM viewWEIFANG YAXING CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewOTSUKA-MGC CHEMICAL COMPANY, INC.- Business overview- Products/Solutions/Services offered- MnM viewYIBIN TIANYUAN GROUP CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewLGC SCIENCE GROUP HOLDINGS LIMITED- Business overview- Products/Solutions/Services offered- LGC Science Group Holdings Limited: Recent developments- MnM viewHUNAN ZHUZHOU CHEMICAL INDUSTRY GROUP CO., LTD.- Business overview- Products/Solutions/Services offeredNIPPON CARBIDE INDUSTRIES CO., INC.- Business overview- Products/Solutions/Services offered- MnM view

-

11.2 OTHER KEY PLAYERSDAYANG CHEM (HANGZHOU) CO., LTD.JAPAN FINECHEM COMPANY, INC.TANGSHAN CHENHONG INDUSTRIAL CO., LTD.JINAN FOREVER CHEMICAL CO., LTD.CAPOT CHEMICAL CO., LTD.CHONGQING CHEMICAL MEDICINE HOLDINGS (GROUP) CO., LTD.HUMMEL CROTON INC.UNIVERSAL OIL FIELD CHEMICALS PVT. LTD.NANJING BENZHI CHEMICAL CO., LTD.DUBI CHEM MARINE INTERNATIONAL ESTAVANSCHEMTRIANGULUM CHEMICALS PRIVATE LIMITEDOQEMA LTD.ARIHANT CHEMICALCHEMTEX SPECIALITY LIMITED

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 HYDRAZINE HYDRATE MARKETMARKET DEFINITIONMARKET OVERVIEWBLOWING AGENT MARKET, BY REGION- Asia Pacific- North America- Europe

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 HYDRAZINE HYDRATE MARKET: RISK ASSESSMENT

- TABLE 2 HYDRAZINE HYDRATE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 4 GDP TRENDS AND FORECASTS, BY MAJOR ECONOMIES, 2020–2027 (USD BILLION)

- TABLE 5 HYDRAZINE HYDRATES MARKET: ROLE IN ECOSYSTEM

- TABLE 6 IMPORTS OF HYDRAZINE HYDRATE, BY REGION, 2013–2021 (USD THOUSAND)

- TABLE 7 EXPORTS OF HYDRAZINE HYDRATE, BY REGION, 2013–2021 (USD THOUSAND)

- TABLE 8 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/KG)

- TABLE 9 AVERAGE SELLING PRICE OF HYDRAZINE HYDRATE, BY REGION, 2020–2027 (USD/KG)

- TABLE 10 HYDRAZINE HYDRATE MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 11 PATENT APPLICATIONS ACCOUNT FOR 60% OF ALL PATENTS

- TABLE 12 LIST OF PATENTS BY YIBIN TIANYUAN GROUP

- TABLE 13 LIST OF PATENTS BY NANJING BENZHI CHEMICAL CO., LTD.

- TABLE 14 TOP 10 PATENT OWNERS IN US, 2011-2021

- TABLE 15 HYDRAZINE HYDRATE MARKET SIZE, BY CONCENTRATION LEVEL, 2017–2020 (USD THOUSAND)

- TABLE 16 HYDRAZINE HYDRATE MARKET SIZE, BY CONCENTRATION LEVEL, 2021–2027 (USD THOUSAND)

- TABLE 17 HYDRAZINE HYDRATE MARKET SIZE, BY CONCENTRATION LEVEL, 2017–2020 (TON)

- TABLE 18 HYDRAZINE HYDRATE MARKET SIZE, BY CONCENTRATION LEVEL, 2021–2027 (TON)

- TABLE 19 24%–35% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

- TABLE 20 24%–35% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

- TABLE 21 24%–35% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 22 24%–35% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 23 40%–55% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

- TABLE 24 40%–55% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

- TABLE 25 40%–55% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 26 40%–55% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 27 60%–85% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

- TABLE 28 60%–85% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

- TABLE 29 60%–85% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 30 60%–85% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 31 100% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

- TABLE 32 100% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

- TABLE 33 100% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 34 100% CONCENTRATED HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 35 HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 36 HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION 2021–2027 (USD THOUSAND)

- TABLE 37 HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 38 HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 39 POLYMERIZATION & BLOWING AGENTS: HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

- TABLE 40 POLYMERIZATION & BLOWING AGENTS: MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

- TABLE 41 POLYMERIZATION & BLOWING AGENTS: MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 42 POLYMERIZATION & BLOWING AGENTS: MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 43 PHARMACEUTICALS: HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

- TABLE 44 PHARMACEUTICALS: MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

- TABLE 45 PHARMACEUTICALS: MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 46 PHARMACEUTICALS: MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 47 AGROCHEMICALS: HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

- TABLE 48 AGROCHEMICALS: MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

- TABLE 49 AGROCHEMICALS: MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 50 AGROCHEMICALS: MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 51 WATER TREATMENT: HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

- TABLE 52 WATER TREATMENT: MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

- TABLE 53 WATER TREATMENT: MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 54 WATER TREATMENT: MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 55 OTHER APPLICATIONS: HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

- TABLE 56 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

- TABLE 57 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 58 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 59 HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

- TABLE 60 HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2021–2027 (USD THOUSAND)

- TABLE 61 HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2017–2020 (TON)

- TABLE 62 HYDRAZINE HYDRATE MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 63 ASIA PACIFIC: HYDRAZINE HYDRATE MARKET SIZE, BY CONCENTRATION LEVEL, 2017–2020 (USD THOUSAND)

- TABLE 64 ASIA PACIFIC: MARKET SIZE, BY CONCENTRATION LEVEL, 2021–2027 (USD THOUSAND)

- TABLE 65 ASIA PACIFIC: MARKET SIZE, BY CONCENTRATION LEVEL, 2017–2020 (TON)

- TABLE 66 ASIA PACIFIC: MARKET SIZE, BY CONCENTRATION LEVEL, 2021–2027 (TON)

- TABLE 67 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 68 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 69 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 70 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 71 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

- TABLE 72 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (USD THOUSAND)

- TABLE 73 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

- TABLE 74 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 75 CHINA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 76 CHINA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 77 CHINA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 78 CHINA: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 79 JAPAN: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 80 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 81 JAPAN: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 82 JAPAN: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 83 INDIA: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 84 INDIA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 85 INDIA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 86 INDIA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 87 SOUTH KOREA: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 88 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 89 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 90 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 91 TAIWAN: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 92 TAIWAN: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 93 TAIWAN: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 94 TAIWAN: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 95 INDONESIA: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 96 INDONESIA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 97 INDONESIA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 98 INDONESIA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 99 MALAYSIA: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 100 MALAYSIA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 101 MALAYSIA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 102 MALAYSIA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 103 EUROPE: HYDRAZINE HYDRATE MARKET SIZE, BY CONCENTRATION LEVEL, 2017–2020 (USD THOUSAND)

- TABLE 104 EUROPE: MARKET SIZE, BY CONCENTRATION LEVEL, 2021–2027 (USD THOUSAND)

- TABLE 105 EUROPE: MARKET SIZE, BY CONCENTRATION LEVEL, 2017–2020 (TON)

- TABLE 106 EUROPE: MARKET SIZE, BY CONCENTRATION LEVEL, 2021–2027 (TON)

- TABLE 107 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 108 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 109 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 110 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 111 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

- TABLE 112 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (USD THOUSAND)

- TABLE 113 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

- TABLE 114 EUROPE: HYDRAZINE HYDRATE MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 115 GERMANY: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 116 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 117 GERMANY: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 118 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 119 FRANCE: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 120 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 121 FRANCE: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 122 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 123 UK: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 124 UK: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 125 UK: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 126 UK: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 127 RUSSIA: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 128 RUSSIA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 129 RUSSIA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 130 RUSSIA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 131 ITALY: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 132 ITALY: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 133 ITALY: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 134 ITALY: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 135 NORTH AMERICA: HYDRAZINE HYDRATE MARKET SIZE, BY CONCENTRATION LEVEL, 2017–2020 (USD THOUSAND)

- TABLE 136 NORTH AMERICA: MARKET SIZE, BY CONCENTRATION LEVEL, 2021–2027 (USD THOUSAND)

- TABLE 137 NORTH AMERICA: MARKET SIZE, BY CONCENTRATION LEVEL, 2017–2020 (TON)

- TABLE 138 NORTH AMERICA: MARKET SIZE, BY CONCENTRATION LEVEL, 2021–2027 (TON)

- TABLE 139 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 140 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 141 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 142 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 143 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

- TABLE 144 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD THOUSAND)

- TABLE 145 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

- TABLE 146 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 147 US: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 148 US: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 149 US: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 150 US: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 151 CANADA: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 152 CANADA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 153 CANADA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 154 CANADA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 155 MEXICO: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 156 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 157 MEXICO: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 158 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 159 SOUTH AMERICA: HYDRAZINE HYDRATE MARKET SIZE, BY CONCENTRATION LEVEL, 2017–2020 (USD THOUSAND)

- TABLE 160 SOUTH AMERICA: MARKET SIZE, BY CONCENTRATION LEVEL, 2021–2027 (USD THOUSAND)

- TABLE 161 SOUTH AMERICA: MARKET SIZE, BY CONCENTRATION LEVEL, 2017–2020 (TON)

- TABLE 162 SOUTH AMERICA: MARKET SIZE, BY CONCENTRATION LEVEL, 2021–2027 (TON)

- TABLE 163 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 164 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 165 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 166 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 167 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

- TABLE 168 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD THOUSAND)

- TABLE 169 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

- TABLE 170 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 171 BRAZIL: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 172 BRAZIL: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 173 BRAZIL: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 174 BRAZIL: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 175 ARGENTINA: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 176 ARGENTINA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 177 ARGENTINA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 178 ARGENTINA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 179 MIDDLE EAST & AFRICA: HYDRAZINE HYDRATE MARKET SIZE, BY CONCENTRATION LEVEL, 2017–2020 (USD THOUSAND)

- TABLE 180 MIDDLE EAST & AFRICA: MARKET SIZE, BY CONCENTRATION LEVEL, 2021–2027 (USD THOUSAND)

- TABLE 181 MIDDLE EAST & AFRICA: MARKET SIZE, BY CONCENTRATION LEVEL, 2017–2020 (TON)

- TABLE 182 MIDDLE EAST & AFRICA: MARKET SIZE, BY CONCENTRATION LEVEL, 2021–2027 (TON)

- TABLE 183 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 184 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 185 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 186 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 187 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

- TABLE 188 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD THOUSAND)

- TABLE 189 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (TON)

- TABLE 190 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 191 SAUDI ARABIA: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 192 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 193 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 194 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 195 UAE: HYDRAZINE HYDRATE MARKET SIZE, BY APPLICATION, 2017–2020 (USD THOUSAND)

- TABLE 196 UAE: MARKET SIZE, BY APPLICATION, 2021–2027 (USD THOUSAND)

- TABLE 197 UAE: MARKET SIZE, BY APPLICATION, 2017–2020 (TON)

- TABLE 198 UAE: MARKET SIZE, BY APPLICATION, 2021–2027 (TON)

- TABLE 199 OVERVIEW OF STRATEGIES ADOPTED BY KEY HYDRAZINE HYDRATE MANUFACTURERS

- TABLE 200 HYDRAZINE HYDRATE MARKET: DEGREE OF COMPETITION, 2021

- TABLE 201 HYDRAZINE MARKET: PRODUCT TYPE FOOTPRINT (BY CONCENTRATION LEVEL)

- TABLE 202 HYDRAZINE HYDRATE MARKET: OVERALL APPLICATION FOOTPRINT

- TABLE 203 HYDRAZINE HYDRATE MARKET: COMPANY REGION FOOTPRINT

- TABLE 204 HYDRAZINE HYDRATE MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 205 HYDRAZINE HYDRATE MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 206 HYDRAZINE HYDRATE MARKET: DEALS (2019–2022)

- TABLE 207 LANXESS AG: COMPANY OVERVIEW

- TABLE 208 LANXESS AG: DEALS

- TABLE 209 ARKEMA S.A.: COMPANY OVERVIEW

- TABLE 210 LONZA GROUP AG: COMPANY OVERVIEW

- TABLE 211 LONZA GROUP AG: DEALS

- TABLE 212 HPL ADDITIVES LIMITED: COMPANY OVERVIEW

- TABLE 213 WEIFANG YAXING CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 214 OTSUKA-MGC CHEMICAL COMPANY, INC.: COMPANY OVERVIEW

- TABLE 215 YIBIN TIANYUAN GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 216 LGC SCIENCE GROUP HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 217 LGC SCIENCE GROUP HOLDINGS LIMITED.: DEALS

- TABLE 218 HUNAN ZHUZHOU CHEMICAL INDUSTRY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 219 NIPPON CARBIDE INDUSTRIES CO., INC.: COMPANY OVERVIEW

- TABLE 220 DAYANG CHEM (HANGZHOU) CO., LTD.: COMPANY OVERVIEW

- TABLE 221 JAPAN FINECHEM COMPANY, INC.: COMPANY OVERVIEW

- TABLE 222 TANGSHAN CHENHONG INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 223 JINAN FOREVER CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 224 CAPOT CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 225 CHONGQING CHEMICAL MEDICINE HOLDINGS (GROUP) CO., LTD.: COMPANY OVERVIEW

- TABLE 226 HUMMEL CROTON INC.: COMPANY OVERVIEW

- TABLE 227 UNIVERSAL OIL FIELD CHEMICALS PVT. LTD.: COMPANY OVERVIEW

- TABLE 228 NANJING BENZHI CHEMICAL CO., LTD: COMPANY OVERVIEW

- TABLE 229 DUBI CHEM MARINE INTERNATIONAL EST: COMPANY OVERVIEW

- TABLE 230 AVANSCHEM: COMPANY OVERVIEW

- TABLE 231 TRIANGULUM CHEMICALS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 232 OQEMA LTD.: COMPANY OVERVIEW

- TABLE 233 ARIHANT CHEMICAL: COMPANY OVERVIEW

- TABLE 234 CHEMTEX SPECIALTY LIMITED: COMPANY OVERVIEW

- TABLE 235 ASIA PACIFIC: BLOWING AGENT MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 236 ASIA PACIFIC: BLOWING AGENT MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

- TABLE 237 ASIA PACIFIC: BLOWING AGENT MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 238 ASIA PACIFIC: BLOWING AGENT MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

- TABLE 239 NORTH AMERICA: BLOWING AGENT MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 240 NORTH AMERICA: BLOWING AGENT MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

- TABLE 241 NORTH AMERICA: BLOWING AGENT MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 242 NORTH AMERICA: BLOWING AGENT MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

- TABLE 243 EUROPE: BLOWING AGENT MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 244 EUROPE: BLOWING AGENT MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

- TABLE 245 EUROPE: BLOWING AGENT MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 246 EUROPE: BLOWING AGENT MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

- FIGURE 1 HYDRAZINE HYDRATE: MARKET SEGMENTATION

- FIGURE 2 HYDRAZINE HYDRATE MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE REVENUE OF COMPANIES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE): PRODUCTS SOLD

- FIGURE 6 HYDRAZINE HYDRATE MARKET: DATA TRIANGULATION

- FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 9 100% CONCENTRATION LEVEL TO BE FASTEST-GROWING SEGMENT DURING THE FORECAST PERIOD

- FIGURE 10 POLYMERIZATION & BLOWING AGENTS TO BE LEADING APPLICATION OF HYDRAZINE HYDRATE MARKET

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 12 MODERATE GROWTH IN HYDRAZINE HYDRATE MARKET DURING FORECAST PERIOD

- FIGURE 13 CHINA LED ASIA PACIFIC HYDRAZINE HYDRATE MARKET IN 2021

- FIGURE 14 ASIA PACIFIC TO BE LARGEST MARKET FOR HYDRAZINE HYDRATE MARKET DURING FORECAST PERIOD

- FIGURE 15 POLYMERIZATION AND BLOWING AGENTS ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 16 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 17 FACTORS GOVERNING HYDRAZINE HYDRATE MARKET

- FIGURE 18 HYDRAZINE HYDRATE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 20 HYDRAZINE HYDRATE MARKET: SUPPLY CHAIN

- FIGURE 21 HYDRAZINE HYDRATES MARKET: FUTURE REVENUE MIX

- FIGURE 22 HYDRAZINE HYDRATES MARKET: ECOSYSTEM

- FIGURE 23 HYDRAZINE HYDRATE IMPORT, BY KEY COUNTRY (2013–2021)

- FIGURE 24 HYDRAZINE HYDRATE EXPORT, BY KEY COUNTRIES (2013–2021)

- FIGURE 25 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS

- FIGURE 26 AVERAGE SELLING PRICE OF HYDRAZINE HYDRATE, BY REGION, 2020–2027

- FIGURE 27 PATENTS REGISTERED IN HYDRAZINE HYDRATE MARKET, 2011–2021

- FIGURE 28 PATENT PUBLICATION TRENDS, 2011–2021

- FIGURE 29 LEGAL STATUS OF PATENTS - HYDRAZINE HYDRATE MARKET

- FIGURE 30 MAXIMUM PATENTS FILED IN JURISDICTION OF US

- FIGURE 31 BRISTOL MYERS SQUIBB REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2011 AND 2021

- FIGURE 32 60%-85% CONCENTRATION LEVEL SEGMENT ACCOUNTED FOR LARGEST SHARE BETWEEN 2022 AND 2027

- FIGURE 33 POLYMERIZATION & BLOWING AGENTS TO BE LARGEST APPLICATION OF HYDRAZINE HYDRATE BETWEEN 2022–2027

- FIGURE 34 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN HYDRAZINE HYDRATE MARKET DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC: HYDRAZINE HYDRATE MARKET SNAPSHOT

- FIGURE 36 EUROPE: HYDRAZINE HYDRATE MARKET SNAPSHOT

- FIGURE 37 NORTH AMERICA: HYDRAZINE HYDRATE MARKET SNAPSHOT

- FIGURE 38 RANKING OF TOP FIVE PLAYERS IN HYDRAZINE HYDRATE MARKET, 2021

- FIGURE 39 ARKEMA S.A. LED HYDRAZINE HYDRATE MARKET IN 2021

- FIGURE 40 REVENUE ANALYSIS OF KEY COMPANIES (2017-2021)

- FIGURE 41 HYDRAZINE HYDRATE MARKET: COMPANY OVERALL FOOTPRINT

- FIGURE 42 COMPANY EVALUATION QUADRANT -HYDRAZINE HYDRATE MARKET (TIER 1)

- FIGURE 43 START-UPS/SMES EVALUATION QUADRANT FOR HYDRAZINE HYDRATE MARKET

- FIGURE 44 LANXESS AG: COMPANY SNAPSHOT

- FIGURE 45 ARKEMA S.A.: COMPANY SNAPSHOT

- FIGURE 46 LONZA GROUP AG: COMPANY SNAPSHOT

- FIGURE 47 WEIFANG YAXING CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 48 LGC SCIENCE GROUP HOLDINGS LIMITED: COMPANY SNAPSHOT

- FIGURE 49 NIPPON CARBIDE INDUSTRIES CO., INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size for hydrazine hydrate market. Intensive secondary research was done to gather information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

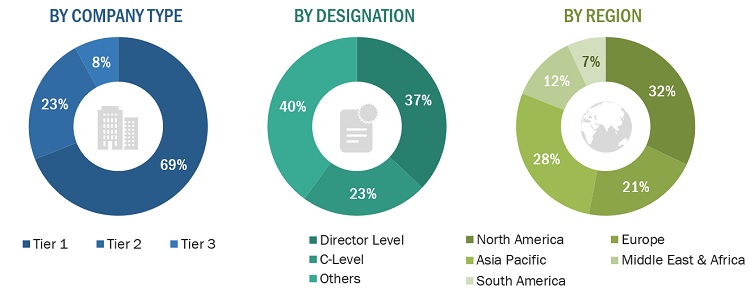

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The Hydrazine Hydrate Industry comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized from key opinion leaders in various applications for the hydrazine hydrate market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Arkema S.A. |

Global Strategy & Innovation Manager |

|

Lanxess AG |

Technical Sales Manager |

|

Lonza Group AG |

Senior Supervisor |

|

LGC Science Group Holdings Limited |

Production Supervisor |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the hydrazine hydrate market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Hydrazine Hydrate Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Hydrazine Hydrate Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into respective segments and subsegments. To realize the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the hydrazine hydrate industry.

Market Definition

The hydrazine hydrate market involves the manufacture and sale of hydrazine hydrate is primarily used as a reducing agent, a blowing agent, and a propellant in various industrial applications, including pharmaceuticals, agrochemicals, polymerization, and water treatment. It offers a high degree of selectivity and efficiency in drug synthesis, helps to improve the efficiency and stability of agrochemicals, improves the adhesion of coatings and paints to various substrates, and helps to remove toxic heavy metals and other pollutants in waste water. The industries and other end users who buy and use these goods in their industrial activities are included in the market, as well as hydrazine hydrate producers, distributors, and suppliers.

Key Stake Holders

- Hydrazine hydrae manufacturers

- Raw material manufacturers

- Government planning commissions and research organizations

- Industry associations

- End-use industries

- R&D institutions

Report Objectives

- To analyze and forecast the size of the hydrazine hydrate market in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the hydrazine hydrate market based on concentration level and application

- To forecast the size of the market segments for regions such as Asia Pacific, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hydrazine Hydrate Market