Hybrid Fabric Market by Fiber (Glass/Carbon, Carbon/Uhmwpe, Glass/Aramid, Carbon/Aramid), Application Form (Composite and Non-Composite), End-use Industry (Automotive & Transportation, Aerospace & Defense, Wind Energy), Region - Global Forecast to 2024

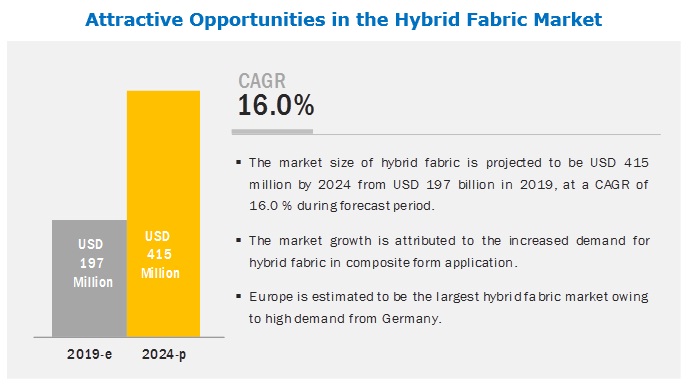

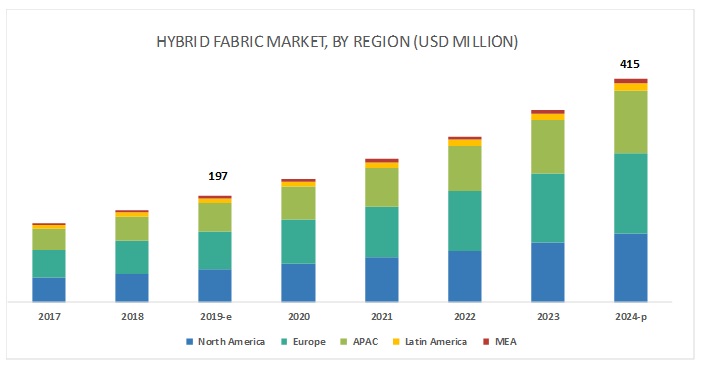

[126 Pages Report] The hybrid fabric market is projected to grow from USD 197 million in 2019 to USD 415 million by 2024, at a CAGR of 16.0% during the forecast period. The market is growing because of the high demand from the automotive & transportation, wind energy, and sports & recreational end-use industries. Hybrid fabric is preferred as it can reduce the weight of the product and is stronger than metallic parts. The market witnessed strong growth in the past few years owing to the growing use in the US, Germany, China, Brazil, and Japan.

By fiber type, glass/carbon fiber segment is expected to be the largest contributor in the hybrid fabric market during the forecast period.

The hybrid fabric market is segmented on the basis of fiber type into glass/carbon, carbon/UHMWPE, glass/aramid, carbon/aramid, and others. Glass/carbon hybrid fabric is the key type used in the automotive & transportation and wind energy industries. These are lightweight materials, which reduce the weight of vehicles and wind blades. The increasing demand from the automotive & transportation and wind energy end-use industries is expected to drive the market during the forecast period.

The composite application form is expected to be the leading segment of the hybrid fabric market during the forecast period.

In the composite form application, a resin is used as a matrix with carbon, glass, natural, and aramid hybrid fabric. Resins are widely used in the manufacturing of hybrid composites. For reinforcement material to be used in composites, these reinforcements should possess properties such as high modulus, high strength, high flexibility, high aspect ratio, and higher elasticity. Hybrid fabric is used extensively in the composite form to cater to the demands of various end-use industries such as aerospace & defense, automotive & transportation, wind energy, and others.

Europe is the major revenue generating region in the hybrid fabric market.

The region is experiencing maximum developments in the hybrid fabric market. Majority of the automotive and aerospace component manufacturers across the region are constantly involved in product innovations and development of hybrid fabric products in this region. The manufacturers across the region are adopting various growth strategies to strengthen their position in the market.

Key Market Players

The hybrid fabric market comprises major solution providers, such as Royal DSM N.V. (Netherlands), SGL Group (Germany), Gurit (Switzerland), Hexcel Corporation (US), Exel Composites (Finland), Solvay (Belgium), Textum Inc. (US), BGF Industries, Inc. (US), HACOTECH GmbH (Germany), and Arrow Technical Textiles Pvt. Ltd. (India). The study includes an in-depth competitive analysis of these key players in the hybrid fabric market, with their company profiles, recent developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This research report categorizes the hybrid fabric market based on fiber type, application form, end-use industry, and region.

On the basis of fiber type, the hybrid fabric market has been segmented as follows:

- Glass/Carbon

- Carbon/UHMWPE

- Glass/Aramid

- Carbon/Aramid

- Others (aramid/diolen, carbon/polyethylene, carbon/zylon, carbon/flax, steel/glass, carbon/vectran, and glass/aramid/carbon)

On the basis of application form, the hybrid fabric market has been segmented as follows:

- Composite Form

- Non-composite Form

On the basis of end-use industry, the hybrid fabric market has been segmented as follows:

- Automotive & transportation

- Aerospace & Defense

- Wind Energy

- Sports & Recreational

- Consumer Goods

- Others (marine, building & construction, and electronics & electrical)

On the basis of region, the hybrid fabric market has been segmented as follows:

- North America

- Europe

- APAC

- Latin America

- MEA

Recent Developments

- In May 2018, Exel Composites (Finland) acquired Diversified Structural Composites (US). Diversified Structural Composites is a manufacturer of hybrid fabric. It also manufactures hybrid composites using a combination of glass and carbon hybrid fabric. The acquisition has helped Exel Composites strengthen its business in North America.

- In October 2016, Royal DSM N.V. developed a product named Dyneema Carbon hybrid composites. The new product offers improved performance in comparison to pure carbon fiber composites. It has been developed by the company to meet improved performance requirements such as the reduced weight of components, high improved impact resistance, and enhanced vibration dampening.

- In October 2017, Solvay (Belgium) developed a new hybrid composite material. The composite is made using a combination of fibers, namely, carbon and glass. The resin used is polyarylamide. The development has helped the company enhance its presence in the hybrid composites market.

Key Questions addressed by the report

- Which are the major fibers used in manufacturing hybrid fabric?

- Which is the major application form used in hybrid fabric manufacturing?

- Which is the largest and fastest-growing region for the market?

- Which is the dominating end-use industry for hybrid fabric?

- What are the major strategies adopted by leading companies?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Hybrid Fabric Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

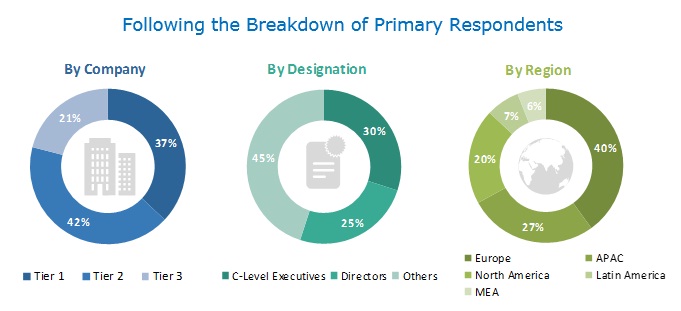

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Hybrid Fabric Market

4.2 Hybrid Fabric Market, By End-Use Industry

4.3 Hybrid Fabric Market, By End-Use Industry and Region

4.4 Hybrid Fabric Market, By Fiber Type

4.5 Hybrid Fabric Market, By Application Form

4.6 Hybrid Fabric Market, By Country

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Balance in Cost and Performance Characteristics

5.2.2 Restraints

5.2.2.1 High Technology Cost Associated With the Manufacturing of Hybrid Fabric

5.2.3 Opportunities

5.2.3.1 Penetration of Hybrid Fabric in Newer Applications

5.2.3.2 Growing Demand From Emerging Markets

5.2.4 Challenges

5.2.4.1 Lack of Awareness Related to Hybrid Fabric

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview and Key Trends

5.4.1 Introduction

5.4.2 Trends and Forecast of GDP

5.4.3 Trends in Automotive & Transportation Industry

5.4.4 Trends in Aerospace & Defence Industry

5.4.5 Trends in Wind Energy Industry

6 Hybrid Fabric Market, By Fiber Type (Page No. - 45)

6.1 Introduction

6.2 Glass/Carbon Hybrid Fabric

6.2.1 The Affordability and Lightweight of Glass/ Carbon Hybrid Fabric Drive Its Demand

6.3 Carbon/Uhmwpe Hybrid Fabric

6.3.1 The Growing Automotive & Transportation Industry is Likely to Propel the Market

6.4 Glass/Aramid(Kevlar) Hybrid Fabric

6.4.1 Decreasing Raw Material Cost is Driving the Demand for Glass/Aramid(Kevlar) Hybrid Fabric

6.5 Carbon/Aramid(Kevlar) Hybrid Fabric

6.5.1 Carbon/Aramid(Kevlar) Hybrid Fabric Have High Abrasion Resistance, Which is Boosting Its Demand

6.6 Others

7 Hybrid Fabric Market, By Application Form (Page No. - 56)

7.1 Introduction

7.1.1 Composite Form

7.1.1.1 Composite is the Largest Application Form of Hybrid Fabric

7.1.2 Non-Composite Form

7.1.2.1 Non-Composite Form of Hybrid Fabric is Widely Used in the Consumer Goods Industry

8 Hybrid Fabric Market, By End-Use Industry (Page No. - 61)

8.1 Introduction

8.2 Automotive & Transportation

8.2.1 Automotive & Transportation is the Largest End-Use Industry of Hybrid Fabric

8.3 Aerospace & Defense

8.3.1 Hybrid Fabric is Widely Used in Ballistic Application

8.4 Wind Energy

8.4.1 Carbon/Glass Hybrid Fabric is Widely Used in the Wind Energy Industry

8.5 Sports & Recreational

8.5.1 The Optimal Properties of Hybrid Fabric Drive Its Demand in the Sports & Recreational Industry

8.6 Consumer Goods

8.6.1 Increasing Demand From the Clothing Sector is Propelling the Market in This Segment

8.7 Others

9 Hybrid Fabric Market, By Region (Page No. - 74)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 The US Dominates the Hybrid Fabric Market in North America

9.2.2 Canada

9.2.2.1 Balance in Cost and Performance Characteristics is Driving the Market

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany is the Largest Manufacturer of Hybrid Fabric in Europe

9.3.2 France

9.3.2.1 The Use of Hybrid Fabric in Various End-Use Industries is Triggering the Market

9.3.3 UK

9.3.3.1 The Growing Aircraft Component Manufacturers is Spurring the Demand for Hybrid Fabric

9.3.4 Italy

9.3.4.1 Italy has A Diversified Aerospace & Defense Industry

9.4 APAC

9.4.1 China

9.4.1.1 China is the Fastest-Growing Market for Hybrid Fabric at the Global Level

9.4.2 Japan

9.4.2.1 High Demand in Composite Form Application is Driving the Market in Japan

9.4.3 South Korea

9.4.3.1 Increasing Demand From Aerospace & Defense Industry is Witnessed in the Country

9.5 MEA

9.5.1 Uae

9.5.1.1 The Growing Demand for Fuel-Efficient and Lightweight Vehicles is Boosting the Market in Uae

9.5.2 Israel

9.5.2.1 Israel is the Fastest-Growing Hybrid Fabric Market in the MEA

9.5.3 South Africa

9.5.3.1 South Africa is A Prominent Hybrid Fabric Market

9.6 Latin America

9.6.1 Brazil

9.6.1.1 Brazil Dominates the Hybrid Fabric Market in Latin America Due to the Promising Wind Energy Industry in the Country

10 Competitive Landscape (Page No. - 95)

10.1 Introduction

10.2 Competitive Leadership Mapping, Hybrid Fabric Market

10.2.1 Terminology/Nomenclature

10.2.1.1 Visionary Leaders

10.2.1.2 Dynamic Differentiators

10.2.1.3 Emerging Companies

10.2.1.4 Innovators

10.2.2 Strength of Product Portfolio

10.2.3 Business Strategy Excellence

10.3 Competitive Scenario

10.3.1 New Product Development

10.3.2 Acquisition

11 Company Profiles (Page No. - 101)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Royal Dsm N.V

11.2 SGL Group

11.3 Gurit

11.4 Hexcel Corporation

11.5 Exel Composites Plc

11.6 Solvay

11.7 Textum Inc

11.8 BGF Industries, Inc.

11.9 Hacotech GmbH

11.10 Arrow Technical Textiles Pvt Ltd

11.11 Other Companies

11.11.1 Quantum Composites

11.11.2 C. Cramer, Weberei, GmbH & Co. Kg

11.11.3 Devold AMT

11.11.4 Colan Australia

11.11.5 Cit Composite Materials Italy

11.11.6 Quantumeta

11.11.7 RTP Company

11.11.8 G. Angeloni S.R.L.

11.11.9 Fothergill Group

11.11.10 Composite Fabrics of America (CFA)

11.11.11 Texiglass Textile Industry and Trade

11.11.12 Fiberpreg

11.11.13 Plastic Reinforcement Fabric Ltd

11.11.14 GRM Systems Ltd

11.11.15 Caar Reinforcements Ltd

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 120)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (72 Tables)

Table 1 Hybrid Fabric Market Size, 2017–2024

Table 2 Trends and Forecast of GDP, 2017–2023 (USD Billion)

Table 3 Automotive & Transportation Production, Million Units (2013–2017)

Table 4 Number of New Airplane Deliveries, By Region

Table 5 Hybrid Fabric Market Size, By Fiber Type, 2017–2024 (USD Thousand)

Table 6 Hybrid Fabric Market Size, By Fiber Type, 2017–2024 (Ton)

Table 7 Glass/Carbon Hybrid Fabric Market Size, By Region, 2017–2024 (USD Thousand)

Table 8 Glass/Carbon Hybrid Fabric Market Size, By Region, 2017–2024 (Ton)

Table 9 Carbon/Uhmwpe Hybrid Fabric Market Size, By Region, 2017–2024 (USD Thousand)

Table 10 Carbon/Uhmwpe Hybrid Fabric Market Size, By Region, 2017–2024 (Ton)

Table 11 Glass/Aramid(Kevlar) Hybrid Fabric Market Size, By Region, 2017–2024 (USD Thousand)

Table 12 Glass/Aramid(Kevlar) Hybrid Fabric Market Size, By Region, 2017–2024 (Ton)

Table 13 Carbon/Aramid(Kevlar) Hybrid Fabric Market Size, By Region, 2017–2024 (USD Thousand)

Table 14 Carbon/Aramid(Kevlar) Hybrid Fabric Market Size, By Region, 2017–2024 (Ton)

Table 15 Other Hybrid Fabric Market Size, By Region, 2017–2024 (USD Thousand)

Table 16 Other Hybrid Fabric Market Size, By Region, 2017–2024 (Ton)

Table 17 Hybrid Fabric Market Size, By Application Form, 2017–2024 (USD Thousand)

Table 18 Hybrid Fabric Market Size, By Application Form, 2017–2024 (Ton)

Table 19 Hybrid Fabric Market Size in Composite Form, By Region, 2017–2024 (USD Thousand)

Table 20 Hybrid Fabric Market Size in Composite Form, By Region, 2017–2024 (Ton)

Table 21 Hybrid Fabric Market Size in Non-Composite Form, By Region, 2017–2024 (USD Thousand)

Table 22 Hybrid Fabric Market Size in Non-Composite Form, By Region, 2017–2024 (Ton)

Table 23 Hybrid Fabric Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 24 Hybrid Fabric Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 25 Hybrid Fabric Market Size in Automotive & Transportation, By Region, 2017–2024 (USD Thousand)

Table 26 Hybrid Fabric Market Size in Automotive & Transportation, By Region, 2017–2024 (Ton)

Table 27 Hybrid Fabric Market Size in Aerospace & Defense, By Region, 2017–2024 (USD Thousand)

Table 28 Hybrid Fabric Market Size in Aerospace & Defense, By Region, 2017–2024 (Ton)

Table 29 Hybrid Fabric Market Size in Wind Energy, By Region, 2017–2024 (USD Thousand)

Table 30 Hybrid Fabric Market Size in Wind Energy, By Region, 2017–2024 (Ton)

Table 31 Hybrid Fabric Market Size in Sports & Recreational, By Region, 2018–2024 (USD Thousand)

Table 32 Hybrid Fabric Market Size in Sports & Recreational, By Region, 2017–2024 (Ton)

Table 33 Hybrid Fabric Market Size in Consumer Goods, By Region, 2017–2024 (USD Thousand)

Table 34 Hybrid Fabric Market Size in Consumer Goods, By Region, 2017–2024 (Ton)

Table 35 Hybrid Fabric Market Size in Other End-Use Industries, By Region, 2017–2024 (USD Thousand)

Table 36 Hybrid Fabric Market Size in Other End-Use Industries, By Region, 2017–2024 (Ton)

Table 37 Hybrid Fabric Market Size, By Region, 2017–2024 (USD Thousand)

Table 38 Hybrid Fabric Market Size, By Region, 2017–2024 (Ton)

Table 39 North America: Hybrid Fabric Market Size, By Country, 2017–2024 (USD Thousand)

Table 40 North America: Hybrid Fabric Market Size, By Country, 2017–2024 (Ton)

Table 41 North America: Hybrid Fabric Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 42 North America: Hybrid Fabric Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 43 North America: Hybrid Fabric Market Size, By Fiber Type, 2017–2024 (USD Thousand)

Table 44 North America: Hybrid Fabric Market Size, By Fiber Type, 2017–2024 (Ton)

Table 45 Europe: Hybrid Fabric Market Size, By Country, 2017–2024 (USD Thousand)

Table 46 Europe: Hybrid Fabric Market Size, By Country, 2017–2024 (Ton)

Table 47 Europe: Hybrid Fabric Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 48 Europe: Hybrid Fabric Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 49 Europe: Hybrid Fabric Market Size, By Fiber Type, 2017–2024 (USD Thousand)

Table 50 Europe: Hybrid Fabric Market Size, By Fiber Type, 2017–2024 (Ton)

Table 51 APAC: Hybrid Fabric Market Size, By Country, 2017–2024 (USD Thousand)

Table 52 APAC: Hybrid Fabric Market Size, By Country, 2017–2024 (Ton)

Table 53 APAC: Hybrid Fabric Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 54 APAC: Hybrid Fabric Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 55 APAC: Hybrid Fabric Market Size, By Fiber Type, 2017–2024 (USD Thousand)

Table 56 APAC: Hybrid Fabric Market Size, By Fiber Type, 2017–2024 (Ton)

Table 57 China: New Wind Energy Installations, 2011–2017 (Mw)

Table 58 MEA: Hybrid Fabric Market Size, By Country, 2017–2024 (USD Thousand)

Table 59 MEA: Hybrid Fabric Market Size, By Country, 2017–2024 (Ton)

Table 60 MEA: Hybrid Fabric Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 61 MEA: Hybrid Fabric Market Size, By End-Use Industry, 2017–2024 (Ton)

Table 62 MEA: Hybrid Fabric Market Size, By Fiber Type, 2017–2024 (USD Thousand)

Table 63 MEA: Hybrid Fabric Market Size, By Fiber Type, 2017–2024 (Ton)

Table 64 Latin America: Hybrid Fabric Market Size, By Country, 2017–2024 (USD Thousand)

Table 65 Latin America: Hybrid Fabric Market Size, By Country, 2017–2024 (Ton)

Table 66 Latin America: Hybrid Fabric Market Size, By End-Use Industry,2017–2024 (USD Thousand)

Table 67 Latin America: Hybrid Fabric Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 68 Latin America: Hybrid Fabric Market Size, By Fiber Type, 2017–2024 (USD Thousand)

Table 69 Latin America: Hybrid Fabric Market Size, By Fiber Type, 2016–2023 (Ton)

Table 70 Brazil: New Wind Energy Installations, 2011–2017 (Mw)

Table 71 New Product Development, 2016–2018

Table 72 Acquisition, 2016–2018

List of Figures (54 Figures)

Figure 1 Hybrid Fabric Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Hybrid Fabric Market: Data Triangulation

Figure 5 Glass/Carbon Fiber Hybrid Fabric to Account for the Largest Market Share in 2018

Figure 6 Composite Was the Dominant Form in the Hybrid Fabric Market in 2018

Figure 7 Automotive & Transportation Industry to Drive the Global Hybrid Fabric Market

Figure 8 Germany to Register the Highest Cagr

Figure 9 APAC to Register the Highest Cagr Between 2019 and 2024

Figure 10 Increasing Demand From End-Use Industries is Driving the Market

Figure 11 Automotive & Transportation to Be the Largest End-Use Industry of the Hybrid Fabric

Figure 12 Europe Accounted for the Largest Market Share in 2018

Figure 13 Glass/Carbon to Be the Largest Fiber Type

Figure 14 Composite to Be the Larger Application Form of Hybrid Fabric

Figure 15 Germany to Be the Fastest-Growing Hybrid Fabric Market

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the Hybrid Fabric Market

Figure 17 Hybrid Fabric Market: Porter’s Five Forces Analysis

Figure 18 Trends and Forecast of GDP, 2017–2023 (USD Billion)

Figure 19 Automotive & Transportation Production in Key Countries, Million Units (2016 vs. 2017)

Figure 20 New Airplane Deliveries, By Region, 2018–2037

Figure 21 Wind Energy Installed CAPACity, Mw (2016–2017)

Figure 22 Glass/Carbon Fiber Type to Lead the Hybrid Fabric Market

Figure 23 Europe to Be the Largest Glass/Carbon Hybrid Fabric Market

Figure 24 APAC to Be the Fastest-Growing Carbon/Uhmwpe Hybrid Fabric Market

Figure 25 North America to Be the Fastest-Growing Glass/Aramid Hybrid Fabric Market

Figure 26 APAC to Be the Fastest-Growing Carbon/Aramid Hybrid Fabric Market

Figure 27 APAC to Be the Fastest-Growing Other Hybrid Fabric Market

Figure 28 Composite Application Form to Dominate the Hybrid Fabric Market

Figure 29 Europe to Be the Largest Market in Composite Application Form

Figure 30 Europe to Be the Largest Market in the Non-Composite Application Form

Figure 31 Hybrid Fabric Market to Register the Highest Growth in the Automotive & Transportation Industry

Figure 32 Europe to Be the Largest Hybrid Fabric Market in theAutomotive & Transportation Industry

Figure 33 North America to Be the Second-Largest Market in the Aerospace & Defense Industry

Figure 34 APAC to Be the Largest Hybrid Fabric Market in the Wind Energy Industry

Figure 35 APAC to Be the Largest Hybrid Fabric Market in the Sports & Recreational Industry

Figure 36 North America to Be the Fastest-Growing Hybrid Fabric Market in the Consumer Goods Industry

Figure 37 Europe to Be the Largest Hybrid Fabric Market in Other End-Use Industries

Figure 38 Germany to Be the Fastest-Growing Hybrid Fabric Market

Figure 39 North America: Hybrid Fabric Market Snapshot

Figure 40 Europe: Hybrid Fabric Market Snapshot

Figure 41 APAC: Hybrid Fabric Market Snapshot

Figure 42 Companies Adopted Acquisition as the Key Growth Strategy Between 2016 and 2018

Figure 43 Hybrid Fabric (Global) Competitive Leadership Mapping, 2018

Figure 44 Royal Dsm N.V.: Company Snapshot

Figure 45 Royal Dsm N.V.: SWOT Analysis

Figure 46 SGL Group: Company Snapshot

Figure 47 SGL Group: SWOT Analysis

Figure 48 Gurit: Company Snapshot

Figure 49 Gurit: SWOT Analysis

Figure 50 Hexcel Corporation: Company Snapshot

Figure 51 Hexcel Corporation: SWOT Analysis

Figure 52 Exel Composites Plc: Company Snapshot

Figure 53 Exel Composites Plc: SWOT Analysis

Figure 54 Solvay: Company Snapshot

The study involved four major activities to estimate the current market size for hybrid fabric. The exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The hybrid fabric market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the automotive & transportation, aerospace & defense, marine, wind energy, sports & recreational, and consumer goods end-use industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the hybrid fabric market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data were triangulated by studying various factors and trends from both the demand and supply sides, in the automotive & transportation, aerospace & defense, wind energy, sports & recreational, and consumer goods end-use industries.

Report Objectives

- To define, describe, and forecast the hybrid fabric market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To identify and estimate the hybrid fabric market on the basis of fiber type, application form, and end-use industry

- To analyze significant regional trends in the Asia Pacific (APAC), North America, Europe, Latin America, and the Middle East & Africa (MEA) along with specific trends in their major countries

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the market opportunities and provide a competitive landscape for stakeholders and market leaders

- To analyze recent developments, such as new product development and acquisition in the hybrid fabric market

- To strategically profile key market players and analyze their core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of European hybrid fabric market into Russia, Norway, and Denmark.

- Further breakdown of Rest of Latin American market into Argentina, Chile, and Cuba.

- Further breakdown of Rest of APAC market into Chile, Indonesia, Nepal, the Philippines, and others.

- Further breakdown of Rest of MEA into Qatar, Bahrain, Kuwait, Egypt, Libya, and Sudan.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Hybrid Fabric Market