Aramid Fiber Market by Type (Para-Aramid Fiber, Meta-Aramid Fiber), Application (Security & Protection, Frictional Materials, Industrial Filtration, Optical Fibers, Rubber Reinforcement, Tire Reinforcement), Region - Global Forecast to 2028

Updated on : November 11, 2025

Aramid Fiber Market

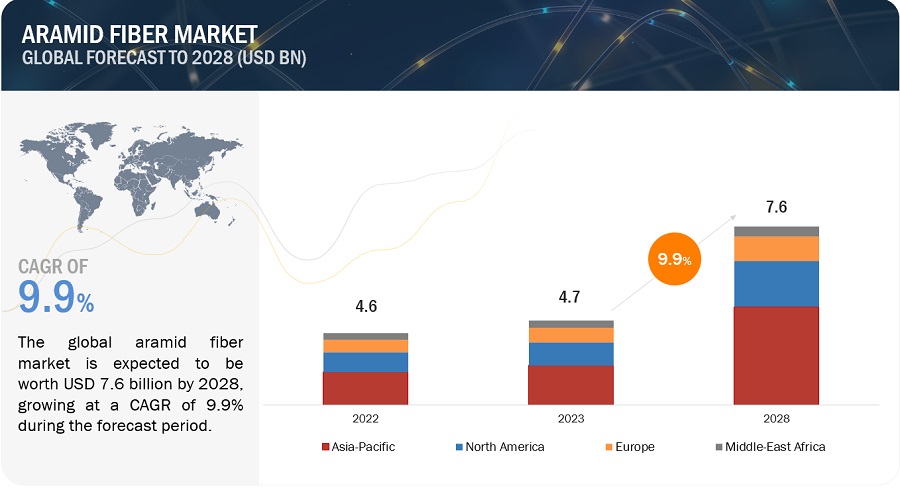

The global aramid fiber market was valued at USD 4.7 billion in 2023 and is projected to reach USD 7.6 billion by 2028, growing at 9.9% cagr from 2023 to 2028. The strong demand for lightweight and flexible materials is a pivotal driver in the aramid fiber market, particularly in the context of vehicle armor where it aids in weight reduction without compromising protective capabilities against specific threats. This factor significantly contributes to a positive market outlook. Furthermore, stringent regulations aimed at reducing carbon emissions have compelled many industry players to seek alternative materials that combine lightweight properties, strength, and fuel efficiency. This trend is further propelling the aramid fiber industry. Notably, aramid fiber's lightweight nature positions it as an optimal solution for achieving enhanced fuel efficiency in the aerospace and defense sectors. Consequently, the heightened demand for aramid fiber within the security and protection sector across various industries is a direct result of these compelling incentives.

Aramid Fiber Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in Aramid Fiber Market

Aramid Fiber Market Dynamics

Driver: Potential alternative for steel and asbestos

Aramid fibers are gaining popularity in the automotive industry, where they're replacing steel in components like gaskets and brake pads. This shift is driven by the fact that steel is much heavier than aramid fiber, adding weight to vehicles, which in turn reduces speed and increases fuel consumption. Additionally, aramid fibers outperform steel in terms of thermal and chemical resistance, making them a more suitable alternative. In the building and construction sector, aramid fibers are also taking the place of steel and asbestos in materials like ceiling and structural composites. Aramid fibers can withstand high temperatures and pressures without deteriorating and boast impressive strength, making them a safe substitute for asbestos. This substitution is especially relevant considering the health risks associated with asbestos, leading many countries to impose bans or restrictions on asbestos products due to a rising number of asbestos-related deaths.

Restraints: Non-biodegradable nature of aramid fibers

While aramid fibers possess valuable properties for numerous industrial applications, it's important to note that they pose environmental concerns. Aramid fibers are not easily biodegradable, leading to pollution issues when disposed of. This can result in significant landfill accumulation and clogging of drainage systems. Additionally, inhaling dust from cut aramid fibers can lead to respiratory problems, underscoring the importance of handling them with care.

Opportunities: Growing demand for homeland security

The security and protection sector represents a significant application area for aramid fibers. With escalating global conflicts, there's a heightened demand for enhanced safety measures, particularly for military personnel. This demand translates into increased requirements for advanced weaponry and personal protective equipment (PPE), subsequently driving growth in the aramid fiber market.

Challenges: High cost of production

Compared to traditional materials like steel or aluminum, the manufacturing process of aramid fibers is notably intricate, demanding significant capital investment in technology, machinery, and raw material supply. This complexity, combined with research and development expenses, presents a challenge to the growth of the aramid fiber market. Moreover, fluctuations in fuel prices exert a direct impact on aramid fiber production costs. Rising costs of raw materials, energy, fuel, and transportation further contribute to cost pressures. Nonetheless, advancements in manufacturing technologies specific to aramid fibers and the realization of economies of scale are anticipated to lead to cost reductions in end products over time.

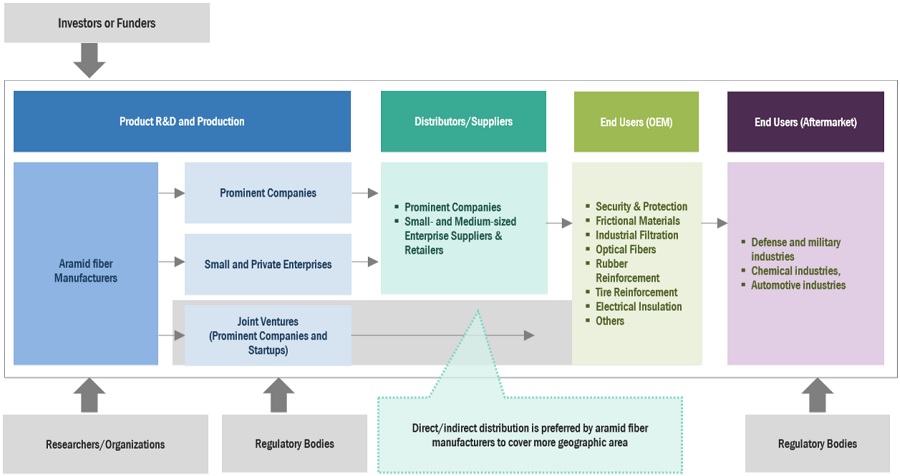

Aramid Fiber Market Ecosystem

Prominent companies in this market include well-established, financially stable aramid fiber manufacturers. These businesses have been in business for a while and have a extensive range of products, pioneering technologies, and strong international sales and marketing networks. Top companies in this market include Teijin Limited (Japan), DuPont de Numerous, Inc. (US), Yantai Tayho Advanced Materials Co., Ltd. (China), Hyosung Corporation (South Korea), Toray Industries, Inc. (Japan), Kolon Industries Inc. (South Korea), Huvis Corp. (South Korea), Kermel (France), China National Bluestar (Group) Co., Ltd. (China), and X-FIPER New Material Co., Ltd. (China).

Based on type, meta-aramid fiber is projected to be the fastest-growing market for aramid fiber, in terms of value, during the forecast period.

Meta-aramid fiber presents notable advantages over para-aramid fiber, notably in terms of superior thermal and chemical resistance, along with valuable dielectric properties. These attributes render it a preferred choice for applications ranging from fire-resistant clothing to electrical insulation. Furthermore, meta-aramid fiber exhibits versatility when combined with other high-performance fibers, resulting in enhanced overall properties. For instance, when blended with materials like wood and carbon, its strength can be significantly augmented. The burgeoning demand for meta-aramid fiber is predominantly propelled by its increasing necessity in protective clothing and electrical insulation applications, underlining its growing significance in these sectors.

Based on application, optical fibers is projected to be the fastest-growing segment for aramid fiber market, in terms of value, in 2022.

The optical fibers sector is experiencing rapid growth, primarily driven by the surging demand for robust and resilient optical fiber cables, particularly within the telecommunications industry. The escalating use of the Internet and telecommunication services has spurred the necessity for swifter connectivity and adaptable cable designs. Aramid fibers play a crucial role in reinforcing fiber optic cables due to their capacity to provide enhanced protection against mechanical strain, environmental moisture, saltwater, and temperature variations. Additionally, they contribute to prolonging the lifespan of these cables while concurrently reducing their overall weight. These factors collectively fuel the expansion of the aramid fiber market in the optical fibers application segment.

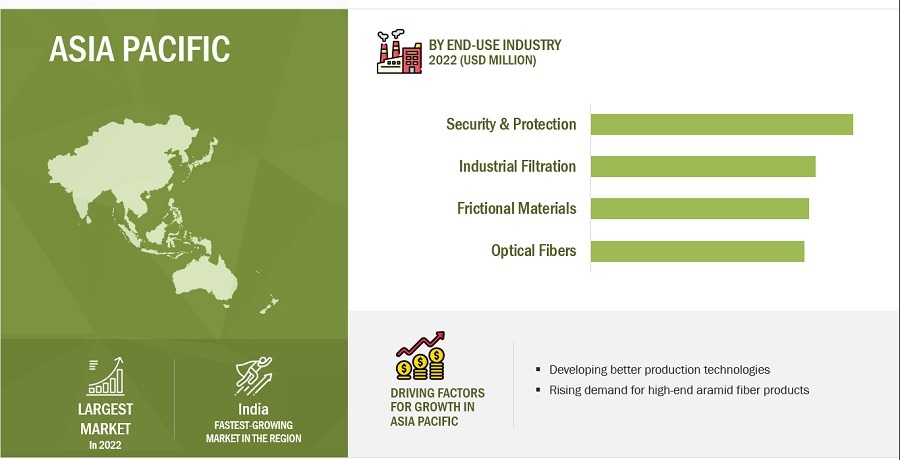

“Asia Pacific is projected to be the fastest growing region during the forecast period, in terms of value”

Asia Pacific region stands as a highly appealing global market for aramid fibers, with substantial growth prospects on the horizon. This attractiveness is underscored by the mounting demand observed across key sectors such as industry, construction, maritime, and automotive. The region's significant population growth, coupled with an improving standard of living, signifies the remarkable developments unfolding here. Crucially, factors like rising employment rates, increased disposable income among the populace, and growing foreign investments across various sectors of the economy further enhance Asia Pacific's allure as a vibrant and promising market for aramid fibers.

To know about the assumptions considered for the study, download the pdf brochure

Aramid Fiber Market Players

The key players profiled in the report include Teijin Limited (Japan), DuPont de Numerous, Inc. (US), Yantai Tayho Advanced Materials Co., Ltd. (China), Toray Industries, Inc. (Japan), and Kolon Industries Inc. (South Korea) among others, are the key manufacturers that holds major market share in the last few years. Major focus was given to the collaborations, partnerships and new product development due to the changing requirements of users across the world.

Aramid Fiber Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Ton) and Value (USD Million/Billion) |

|

Segments covered |

Type, Application, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

Teijin Limited (Japan), DuPont de Numerous, Inc. (US), Yantai Tayho Advanced Materials Co., Ltd. (China), Hyosung Corporation (South Korea), Toray Industries, Inc. (Japan), Kolon Industries, Inc. (South Korea), Huvis Corp. (South Korea), Kermel (France), and China National Bluestar (Group) Co., Ltd. (China) |

This report categorizes the global aramid fiber market based on type, product form, end-use industry, and region.

On the basis of type, the aramid fiber market has been segmented as follows:

- Para-aramid fiber

- Meta-aramid fiber

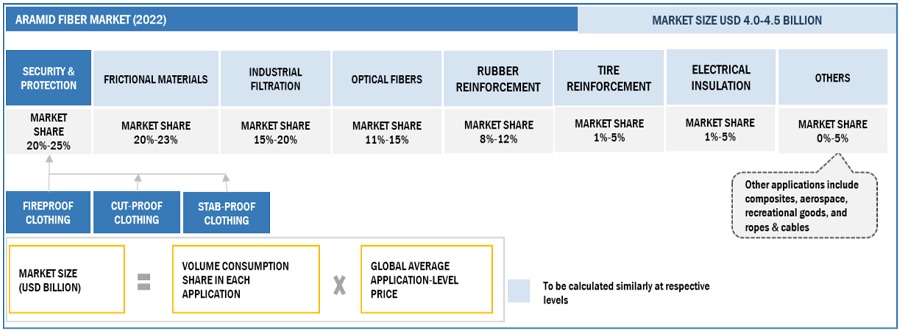

On the basis of applications, the aramid fiber market has been segmented as follows:

- Security & Protection

- Frictional Materials

- Industrial Filtration

- Optical Fibers

- Rubber Reinforcement

- Tire Reinforcement

- Electrical Insulation

- Others

On the basis of region, the aramid fiber market has been segmented as follows:

- Europe

- North America

- Asia Pacific

- Middle East & Arica

- South America

Recent Developments

- In 2021, Kolon Industries has invested USD 208.6 million to expand its annual production capacity for aramid, a vital raw material used in fifth-generation network cables and electric vehicles. This investment aims to double the current capacity from 7,500 metric tons to reach 15,000 metric tons by the year 2023.

- In 2020, Teijin Limited has innovated high-performance para-aramid fibers using environmentally friendly raw materials. These fibers find applications across a range of industries, including car tires, airfreight containers, and protective clothing.

- In 2020, DuPont unveiled an innovative product called DuPont Kevlar MicroCore. This unique, high-temperature-resistant superfine fiber material is designed for use in battery separators, specifically to cater to the increasing demand for safer and higher-performing lithium-ion batteries, particularly in the context of electric vehicles (EVs).

Frequently Asked Questions (FAQ):

What are the major developments impacting the market?

The chances for use aramid fiber in aerospace industry is expected to shift market trends.

Who are major players in aramid fiber market?

Teijin Limited (Japan), DuPont de Numerous, Inc. (US), Yantai Tayho Advanced Materials Co., Ltd. (China), Hyosung Corporation (South Korea), Toray Industries, Inc. (Japan), Kolon Industries Inc. (South Korea).

What is the major application of aramid fiber?

Security & protection is the major application for aramid fiber market during the forecast period.

What are the major factors restraining market growth during the forecast period?

High R&D cost and non biodegradability of aramid fibers

What are the various strategies key players are focusing within aramid fiber market?

Key players are majorly focused on new product launch and partnering with local or regional players within the market, in order to attract larger market share globally. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for lightweight materials in security & protection applications- Rising need for lightweight materials enabling significant emission reduction in vehicles- Potential substitute for steel and asbestosRESTRAINTS- High R&D costs- Non-biodegradable nature of aramid fibersOPPORTUNITIES- Rising need for homeland security- Growing aerospace & defense sector- Advancements in aramid fiber material manufacturing technologiesCHALLENGES- High cost of production- Availability of alternatives with similar properties

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIALSARAMID FIBER MANUFACTURERSDISTRIBUTION TO END-USE INDUSTRIES

-

6.2 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.3 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATIONAVERAGE SELLING PRICE TREND, BY REGION

-

6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSESREVENUE SHIFTS AND NEW REVENUE POCKETS FOR ARAMID FIBER MANUFACTURERS

-

6.5 ECOSYSTEM

-

6.6 CASE STUDIESCASE STUDY ON ARAMID FIBER FOR LIGHTWEIGHT PROTECTIVE RACING SUITSCASE STUDY ON ARAMID FIBER FOR FLAME-RESISTANT COMFORT WEAR

- 6.7 TECHNOLOGY ANALYSIS

-

6.8 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON ARAMID FIBER MARKETREGULATIONS RELATED TO ARAMID FIBER MARKETREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9 KEY CONFERENCES & EVENTS IN 2023–2024

-

6.10 TRADE DATAIMPORT SCENARIO OF ARAMID FIBERSEXPORT SCENARIO OF ARAMID FIBERS

-

6.11 PATENT ANALYSISAPPROACHDOCUMENT TYPELEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTS

- 7.1 INTRODUCTION

-

7.2 PARA-ARAMID FIBERRISING DEMAND FOR PROTECTIVE APPAREL TO DRIVE MARKET

-

7.3 META-ARAMID FIBERGROWING DEMAND FROM TELECOMMUNICATION AND AUTOMOTIVE INDUSTRIES TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 SECURITY & PROTECTIONSTRINGENT REGULATIONS ENFORCED BY GOVERNMENT AND OTHER AGENCIES IN DEVELOPED ECONOMIES TO DRIVE MARKET

-

8.3 FRICTIONAL MATERIALSADVANCEMENTS IN TECHNOLOGY IN TRANSPORTATION INDUSTRY TO DRIVE MARKET

-

8.4 INDUSTRIAL FILTRATIONDEMAND FOR HIGH-TEMPERATURE GAS FILTRATION TO DRIVE MARKET

-

8.5 OPTICAL FIBERSRISE IN INVESTMENTS IN TELECOMMUNICATION TO DRIVE MARKET

-

8.6 RUBBER REINFORCEMENTINCREASING DEMAND FOR THERMAL STABILITY FROM AUTOMOTIVE AND INDUSTRIAL SECTORS TO DRIVE MARKET

-

8.7 TIRE REINFORCEMENTDEMAND FOR HEAVY-DUTY VEHICLES AND EFFICIENT TIRES TO DRIVE MARKET

-

8.8 ELECTRICAL INSULATIONDEMAND FOR INSULATION IN EXTREME CONDITIONS TO DRIVE MARKET

-

8.9 OTHERSCOMPOSITESAEROSPACERECREATIONAL GOODSROPES & CABLES

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICRECESSION IMPACTASIA PACIFIC ARAMID FIBER MARKET, BY TYPEASIA PACIFIC ARAMID FIBER MARKET, BY APPLICATIONASIA PACIFIC ARAMID FIBER MARKET, BY COUNTRY- China- Japan- India- South Korea

-

9.3 NORTH AMERICARECESSION IMPACTNORTH AMERICA ARAMID FIBER MARKET, BY TYPENORTH AMERICA ARAMID FIBER MARKET, BY APPLICATIONNORTH AMERICA ARAMID FIBER MARKET, BY COUNTRY- US- Canada- Mexico

-

9.4 EUROPERECESSION IMPACT ON EUROPEEUROPE ARAMID FIBER MARKET, BY TYPEEUROPE ARAMID FIBER MARKET, BY APPLICATIONEUROPE ARAMID FIBER MARKET, BY COUNTRY- Germany- UK- France- Spain

-

9.5 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICASOUTH AMERICA ARAMID FIBER MARKET, BY TYPESOUTH AMERICA ARAMID FIBER MARKET, BY APPLICATIONSOUTH AMERICA ARAMID FIBER MARKET, BY COUNTRY- Brazil

-

9.6 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA ARAMID FIBER MARKET, BY TYPEMIDDLE EAST & AFRICA ARAMID FIBER MARKET, BY APPLICATIONMIDDLE EAST & AFRICA ARAMID FIBER MARKET, BY COUNTRY- Saudi Arabia- UAE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 RANKING OF KEY MARKET PLAYERS, 2022

-

10.4 MARKET SHARE ANALYSISDUPONT DE NEMOURS, INC.TEIJIN LIMITEDKOLON INDUSTRIES, INC.YANTAI TAYHO ADVANCED MATERIALS CO., LTD.TORAY INDUSTRIES, INC.

- 10.5 REVENUE ANALYSIS OF TOP FIVE PLAYERS

-

10.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

10.7 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

10.8 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 MAJOR PLAYERSTEIJIN LIMITED- Business overview- Products offered- Recent developments- MnM viewDUPONT DE NEMOURS, INC.- Business overview- Products offered- Recent developments- MnM viewYANTAI TAYHO ADVANCED MATERIALS CO., LTD.- Business overview- Products offered- Recent developments- MnM viewHYOSUNG CORPORATION- Business overview- Products offered- Recent developments- MNM viewTORAY INDUSTRIES, INC.- Business overview- Products offered- Recent developments- MnM viewKOLON INDUSTRIES, INC.- Business overview- Products offered- Recent developments- MnM viewHUVIS CORP.- Business overview- Products offeredKERMEL- Business overview- Kermel: Business overview- Products offeredCHINA NATIONAL BLUESTAR (GROUP) CO., LTD.- Business overview- Products offeredX-FIPER NEW MATERIAL CO., LTD- Business overview- Products offered

-

11.2 OTHER KEY MARKET PLAYERSTAEKWANG INDUSTRIAL CO., LTD.ARAMID HPM LLCSHANGHAI J&S NEW MATERIALS CO., LTDYF INTERNATIONAL BVLYDALL, INC.SUZHOU ZHAODA SPECIALLY FIBER TECHNICAL CO., LTDSHENMA INDUSTRIAL CO., LTD.SINOPEC YIZHENG CHEMICAL FIBER CO., LTD.ZHANGJIAGANG GANGYING INDUSTRY CO., LTDVEPLAS ADVANCED TECHNOLOGIES GROUPPRO-SYSTEMS S.P.A.WUXI GDE TECHNOLOGY CO., LTDBARNET INTELLIGENT MATERIALSZHEJIANG SURETEX COMPOSITE CO., LTDHEBEI SILICON VALLEY CHEMICAL CO., LTD.

- 12.1 INTRODUCTION

- 12.2 LIMITATION

-

12.3 ARMOR MATERIALS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

12.4 ARMOR MATERIALS MARKET, BY REGIONNORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST & AFRICASOUTH AMERICA

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 ARAMID FIBER MARKET: RISK ASSESSMENT

- TABLE 2 ARAMID FIBER MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020–2028 (USD BILLION)

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 6 AVERAGE SELLING PRICE TREND OF KEY PLAYERS (USD/KG), BY APPLICATION

- TABLE 7 AVERAGE SELLING PRICE TREND OF ARAMID FIBER, BY REGION (USD/KG)

- TABLE 8 ARAMID FIBER MARKET: ECOSYSTEM

- TABLE 9 ARAMID FIBER MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 10 ARAMID FIBER IMPORTS, BY REGION, 2013–2022 (USD MILLION)

- TABLE 11 ARAMID FIBER EXPORTS, BY REGION, 2013–2022 (USD MILLION)

- TABLE 12 TOP 10 PATENT OWNERS (US) IN LAST 11 YEARS

- TABLE 13 ARAMID FIBER MARKET, BY TYPE, 2017–2021 (TON)

- TABLE 14 ARAMID FIBER MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 15 ARAMID FIBER MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 16 ARAMID FIBER MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 17 PARA-ARAMID FIBER MARKET, BY REGION, 2017–2021 (TON)

- TABLE 18 PARA-ARAMID FIBER MARKET, BY REGION, 2022–2028 (TON)

- TABLE 19 PARA-ARAMID FIBER MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 20 PARA-ARAMID FIBER MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 21 PARA-ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 22 PARA-ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 23 PARA-ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 24 PARA-ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 25 META-ARAMID FIBER MARKET, BY REGION, 2017–2021 (TON)

- TABLE 26 META-ARAMID FIBER MARKET, BY REGION, 2022–2028 (TON)

- TABLE 27 META-ARAMID FIBER MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 28 META-ARAMID FIBER MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 29 ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 30 ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 31 ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 32 ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 33 ARAMID FIBER MARKET IN SECURITY & PROTECTION, BY REGION, 2017–2021 (TON)

- TABLE 34 ARAMID FIBER MARKET IN SECURITY & PROTECTION, BY REGION, 2022–2028 (TON)

- TABLE 35 ARAMID FIBER MARKET IN SECURITY & PROTECTION, BY REGION, 2017–2021 (USD MILLION)

- TABLE 36 ARAMID FIBER MARKET IN SECURITY & PROTECTION, BY REGION, 2022–2028 (USD MILLION)

- TABLE 37 ARAMID FIBER MARKET IN FRICTIONAL MATERIALS, BY REGION, 2017–2021 (TON)

- TABLE 38 ARAMID FIBER MARKET IN FRICTIONAL MATERIALS, BY REGION, 2022–2028 (TON)

- TABLE 39 ARAMID FIBER MARKET IN FRICTIONAL MATERIALS, BY REGION, 2017–2021 (USD MILLION)

- TABLE 40 ARAMID FIBER MARKET IN FRICTIONAL MATERIALS, BY REGION, 2022–2028 (USD MILLION)

- TABLE 41 ARAMID FIBER MARKET IN INDUSTRIAL FILTRATION, BY REGION, 2017–2021 (TON)

- TABLE 42 ARAMID FIBER MARKET IN INDUSTRIAL FILTRATION, BY REGION, 2022–2028 (TON)

- TABLE 43 ARAMID FIBER MARKET IN INDUSTRIAL FILTRATION, BY REGION, 2017–2021 (USD MILLION)

- TABLE 44 ARAMID FIBER MARKET IN INDUSTRIAL FILTRATION, BY REGION, 2022–2028 (USD MILLION)

- TABLE 45 ARAMID FIBER MARKET IN OPTICAL FIBERS, BY REGION, 2017–2021 (TON)

- TABLE 46 ARAMID FIBER MARKET IN OPTICAL FIBERS, BY REGION, 2022–2028 (TON)

- TABLE 47 ARAMID FIBER MARKET IN OPTICAL FIBERS, BY REGION, 2017–2021 (USD MILLION)

- TABLE 48 ARAMID FIBER MARKET IN OPTICAL FIBERS, BY REGION, 2022–2028 (USD MILLION)

- TABLE 49 ARAMID FIBER MARKET IN RUBBER REINFORCEMENT, BY REGION, 2017–2021 (TON)

- TABLE 50 ARAMID FIBER MARKET IN RUBBER REINFORCEMENT, BY REGION, 2022–2028 (TON)

- TABLE 51 ARAMID FIBER MARKET IN RUBBER REINFORCEMENT, BY REGION, 2017–2021 (USD MILLION)

- TABLE 52 ARAMID FIBER MARKET IN RUBBER REINFORCEMENT, BY REGION, 2022–2028 (USD MILLION)

- TABLE 53 ARAMID FIBER MARKET IN TIRE REINFORCEMENT, BY REGION, 2017–2021 (TON)

- TABLE 54 ARAMID FIBER MARKET IN TIRE REINFORCEMENT, BY REGION, 2022–2028 (TON)

- TABLE 55 ARAMID FIBER MARKET IN TIRE REINFORCEMENT, BY REGION, 2017–2021 (USD MILLION)

- TABLE 56 ARAMID FIBER MARKET IN TIRE REINFORCEMENT, BY REGION, 2022–2028 (USD MILLION)

- TABLE 57 ARAMID FIBER MARKET IN ELECTRICAL INSULATION, BY REGION, 2017–2021 (TON)

- TABLE 58 ARAMID FIBER MARKET IN ELECTRICAL INSULATION, BY REGION, 2022–2028 (TON)

- TABLE 59 ARAMID FIBER MARKET IN ELECTRICAL INSULATION, BY REGION, 2017–2021 (USD MILLION)

- TABLE 60 ARAMID FIBER MARKET IN ELECTRICAL INSULATION, BY REGION, 2022–2028 (USD MILLION)

- TABLE 61 ARAMID FIBER MARKET IN OTHER APPLICATIONS, BY REGION, 2017–2021 (TON)

- TABLE 62 ARAMID FIBER MARKET IN OTHER APPLICATIONS, BY REGION, 2022–2028 (TON)

- TABLE 63 ARAMID FIBER MARKET IN OTHER APPLICATIONS, BY REGION, 2017–2021 (USD MILLION)

- TABLE 64 ARAMID FIBER MARKET IN OTHER APPLICATIONS, BY REGION, 2022–2028 (USD MILLION)

- TABLE 65 ARAMID FIBER MARKET, BY REGION, 2017–2021 (TON)

- TABLE 66 ARAMID FIBER MARKET, BY REGION, 2022–2028 (TON)

- TABLE 67 ARAMID FIBER MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 68 ARAMID FIBER MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 69 ASIA PACIFIC: ARAMID FIBER MARKET, BY TYPE, 2017–2021 (TON)

- TABLE 70 ASIA PACIFIC: ARAMID FIBER MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 71 ASIA PACIFIC: ARAMID FIBER MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 72 ASIA PACIFIC: ARAMID FIBER MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 74 ASIA PACIFIC: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 75 ASIA PACIFIC: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 76 ASIA PACIFIC: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: ARAMID FIBER MARKET, BY COUNTRY, 2017–2021 (TON)

- TABLE 78 ASIA PACIFIC: ARAMID FIBER MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 79 ASIA PACIFIC: ARAMID FIBER MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 80 ASIA PACIFIC: ARAMID FIBER MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 81 CHINA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 82 CHINA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 83 CHINA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 84 CHINA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 85 JAPAN: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 86 JAPAN: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 87 JAPAN: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 88 JAPAN: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 89 INDIA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 90 INDIA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 91 INDIA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 92 INDIA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 93 SOUTH KOREA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 94 SOUTH KOREA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 95 SOUTH KOREA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 96 SOUTH KOREA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: ARAMID FIBER MARKET, BY TYPE, 2017–2021 (TON)

- TABLE 98 NORTH AMERICA: ARAMID FIBER MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 99 NORTH AMERICA: ARAMID FIBER MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 100 NORTH AMERICA: ARAMID FIBER MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 102 NORTH AMERICA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 103 NORTH AMERICA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 104 NORTH AMERICA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: ARAMID FIBER MARKET, BY COUNTRY, 2017–2021 (TON)

- TABLE 106 NORTH AMERICA: ARAMID FIBER MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 107 NORTH AMERICA: ARAMID FIBER MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: ARAMID FIBER MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 109 US: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 110 US: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 111 US: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 112 US: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 113 CANADA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 114 CANADA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 115 CANADA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 116 CANADA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 117 MEXICO: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 118 MEXICO: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 119 MEXICO: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 120 MEXICO: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 121 EUROPE: ARAMID FIBER MARKET, BY TYPE, 2017–2021 (TON)

- TABLE 122 EUROPE: ARAMID FIBER MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 123 EUROPE: ARAMID FIBER MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 124 EUROPE: ARAMID FIBER MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 125 EUROPE: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 126 EUROPE: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 127 EUROPE: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 128 EUROPE: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 129 EUROPE: ARAMID FIBER MARKET, BY COUNTRY, 2017–2021 (TON)

- TABLE 130 EUROPE: ARAMID FIBER MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 131 EUROPE: ARAMID FIBER MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 132 EUROPE: ARAMID FIBER MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 133 GERMANY: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 134 GERMANY: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 135 GERMANY: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 136 GERMANY: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 137 UK: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 138 UK: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 139 UK: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 140 UK: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 141 FRANCE: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 142 FRANCE: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 143 FRANCE: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 144 FRANCE: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 145 SPAIN: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 146 SPAIN: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 147 SPAIN: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 148 SPAIN: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 149 SOUTH AMERICA: ARAMID FIBER MARKET, BY TYPE, 2017–2021 (TON)

- TABLE 150 SOUTH AMERICA: ARAMID FIBER MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 151 SOUTH AMERICA: ARAMID FIBER MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 152 SOUTH AMERICA: ARAMID FIBER MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 153 SOUTH AMERICA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 154 SOUTH AMERICA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 155 SOUTH AMERICA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 156 SOUTH AMERICA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 157 SOUTH AMERICA: ARAMID FIBER MARKET, BY COUNTRY, 2017–2021 (TON)

- TABLE 158 SOUTH AMERICA: ARAMID FIBER MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 159 SOUTH AMERICA: ARAMID FIBER MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 160 SOUTH AMERICA: ARAMID FIBER MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 161 BRAZIL: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 162 BRAZIL: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 163 BRAZIL: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 164 BRAZIL: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET, BY TYPE, 2017–2021 (TON)

- TABLE 166 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 167 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 170 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 171 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET, BY COUNTRY, 2017–2021 (TON)

- TABLE 174 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 175 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: ARAMID FIBER MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 177 SAUDI ARABIA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 178 SAUDI ARABIA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 179 SAUDI ARABIA: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 180 SAUDI ARABIA: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 181 UAE: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (TON)

- TABLE 182 UAE: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (TON)

- TABLE 183 UAE: ARAMID FIBER MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 184 UAE: ARAMID FIBER MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 185 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS OF ARAMID FIBER

- TABLE 186 ARAMID FIBER MARKET: DEGREE OF COMPETITION

- TABLE 187 ARAMID FIBER MARKET: TYPE FOOTPRINT

- TABLE 188 ARAMID FIBER MARKET: APPLICATION FOOTPRINT

- TABLE 189 ARAMID FIBER MARKET: COMPANY REGION FOOTPRINT

- TABLE 190 ARAMID FIBER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 191 ARAMID FIBER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 192 ARAMID FIBER MARKET: PRODUCT LAUNCHES, (2019–2023)

- TABLE 193 ARAMID FIBER MARKET: DEALS, (2019–2023)

- TABLE 194 ARAMID FIBER MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS, (2019–2023)

- TABLE 195 TEIJIN LIMITED: COMPANY OVERVIEW

- TABLE 196 TEIJIN LIMITED: PRODUCT LAUNCHES

- TABLE 197 TEIJIN LIMITED: DEALS

- TABLE 198 TEIJIN LIMITED: OTHER DEVELOPMENTS

- TABLE 199 DUPONT DE NEMOURS, INC: COMPANY OVERVIEW

- TABLE 200 DUPONT DE NEMOURS, INC.: PRODUCT LAUNCHES

- TABLE 201 DUPONT DE NEMOURS, INC.: DEALS

- TABLE 202 YANTAI TAYHO ADVANCED MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 203 YANTAI TAYHO ADVANCED MATERIALS CO., LTD.: OTHER DEVELOPMENTS

- TABLE 204 HYOSUNG CORPORATION: COMPANY OVERVIEW

- TABLE 205 HYOSUNG CORPORATION: OTHER DEVELOPMENTS

- TABLE 206 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 207 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 208 TORAY INDUSTRIES, INC.: DEALS

- TABLE 209 KOLON INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 210 KOLON INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 211 HUVIS CORP.: COMPANY OVERVIEW

- TABLE 212 CHINA BLUESTAR (GROUP) CO., LTD.: COMPANY OVERVIEW

- TABLE 213 X-FIPER NEW MATERIAL CO., LTD: COMPANY OVERVIEW

- TABLE 214 TAEKWANG INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 215 ARAMID HPM LLC: COMPANY OVERVIEW

- TABLE 216 SHANGHAI J&S NEW MATERIALS CO., LTD: COMPANY OVERVIEW

- TABLE 217 YF INTERNATIONAL BV: COMPANY OVERVIEW

- TABLE 218 LYDALL, INC.: COMPANY OVERVIEW

- TABLE 219 SUZHOU ZHAODA SPECIALLY FIBER TECHNICAL CO., LTD: COMPANY OVERVIEW

- TABLE 220 SHENMA INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 221 SINOPEC YIZHENG CHEMICAL FIBER CO., LTD.: COMPANY OVERVIEW

- TABLE 222 ZHANGJIAGANG GANGYING INDUSTRY CO., LTD: COMPANY OVERVIEW

- TABLE 223 VEPLAS ADVANCED TECHNOLOGIES GROUP: COMPANY OVERVIEW

- TABLE 224 PRO-SYSTEMS S.P.A.: COMPANY OVERVIEW

- TABLE 225 WUXI GDE TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 226 BARNET INTELLIGENT MATERIALS: COMPANY OVERVIEW

- TABLE 227 ZHEJIANG SURETEX COMPOSITE CO., LTD: COMPANY OVERVIEW

- TABLE 228 HEBEI SILICON VALLEY CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 229 ARMOR MATERIALS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 230 ARMOR MATERIALS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 231 ARMOR MATERIALS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 232 ARMOR MATERIALS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 233 NORTH AMERICA: ARM0R MATERIALS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 234 NORTH AMERICA: ARM0R MATERIALS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 235 NORTH AMERICA: ARM0R MATERIALS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 236 NORTH AMERICA: ARM0R MATERIALS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 237 EUROPE: ARMOR MATERIALS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 238 EUROPE: ARMOR MATERIALS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 239 EUROPE: ARMOR MATERIALS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 240 EUROPE: ARMOR MATERIALS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 241 ASIA PACIFIC: ARMOR MATERIALS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 242 ASIA PACIFIC: ARMOR MATERIALS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 243 ASIA PACIFIC: ARMOR MATERIALS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 244 ASIA PACIFIC: ARMOR MATERIALS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 245 MIDDLE EAST & AFRICA: ARMOR MATERIALS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: ARMOR MATERIALS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: ARMOR MATERIALS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 248 MIDDLE EAST & AFRICA: ARMOR MATERIALS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 249 SOUTH AMERICA: ARMOR MATERIALS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 250 SOUTH AMERICA: ARMOR MATERIALS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 251 SOUTH AMERICA: ARMOR MATERIALS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 252 SOUTH AMERICA: ARMOR MATERIALS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- FIGURE 1 ARAMID FIBER MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) COLLECTIVE SHARE OF MAJOR PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE)– COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – TOP-DOWN

- FIGURE 6 ARAMID FIBER MARKET: DATA TRIANGULATION

- FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 9 OPTICAL FIBERS SEGMENT TO WITNESS HIGHEST CAGR IN ARAMID FIBER MARKET DURING FORECAST PERIOD

- FIGURE 10 PARA-ARAMID FIBER SEGMENT TO DOMINATE ARAMID FIBER MARKET DURING FORECAST PERIOD

- FIGURE 11 EUROPE ACCOUNTED FOR LARGEST SHARE OF ARAMID FIBER MARKET IN 2022

- FIGURE 12 EUROPE TO LEAD ARAMID FIBER MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 CHINA AND SECURITY & PROTECTION APPLICATION LED ARAMID FIBER MARKET IN ASIA PACIFIC IN 2022

- FIGURE 15 SECURITY & PROTECTION APPLICATION LED ARAMID FIBER MARKET

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 17 OVERVIEW OF FACTORS GOVERNING ARAMID FIBER MARKET

- FIGURE 18 ARAMID FIBER MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 ARAMID FIBER MARKET: SUPPLY CHAIN

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 21 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 22 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- FIGURE 23 AVERAGE SELLING PRICE TREND OF ARAMID FIBER, BY REGION (USD/KG)

- FIGURE 24 REVENUE SHIFT FOR ARAMID FIBER MARKET

- FIGURE 25 ARAMID FIBER MARKET: ECOSYSTEM

- FIGURE 26 ARAMID FIBER IMPORTS, BY KEY COUNTRIES, 2013–2022

- FIGURE 27 ARAMID FIBER EXPORTS, BY KEY COUNTRIES, 2013–2022

- FIGURE 28 PATENTS REGISTERED FOR ARAMID FIBER, 2012–2022

- FIGURE 29 PATENT PUBLICATION TRENDS FOR ARAMID FIBER, 2012–2022

- FIGURE 30 LEGAL STATUS OF PATENTS FILED FOR ARAMID FIBER

- FIGURE 31 MAXIMUM PATENTS FILED BY COMPANIES IN US

- FIGURE 32 THE BOEING COMPANY REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2012 AND 2022

- FIGURE 33 META-ARAMID FIBER TO GROW AT HIGHER CAGR BETWEEN 2023 AND 2028

- FIGURE 34 OPTICAL FIBERS SEGMENT TO REGISTER HIGHEST CAGR IN ARAMID FIBER MARKET DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN ARAMID FIBER MARKET BETWEEN 2023 AND 2028

- FIGURE 36 ASIA PACIFIC: ARAMID FIBER MARKET SNAPSHOT

- FIGURE 37 NORTH AMERICA: ARAMID FIBER MARKET SNAPSHOT

- FIGURE 38 EUROPE: ARAMID FIBER MARKET SNAPSHOT

- FIGURE 39 RANKING OF TOP FIVE PLAYERS IN ARAMID FIBER MARKET, 2022

- FIGURE 40 DUPONT DE NEMOURS, INC.: LEADING PLAYER IN ARAMID FIBER MARKET

- FIGURE 41 REVENUE ANALYSIS OF KEY COMPANIES FOR LAST FIVE YEARS

- FIGURE 42 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- FIGURE 43 ARAMID FIBER MARKET: COMPANY PRODUCT FOOTPRINT

- FIGURE 44 START-UP/SME EVALUATION MATRIX FOR

- FIGURE 45 TEIJIN LIMITED: COMPANY SNAPSHOT

- FIGURE 46 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

- FIGURE 47 HYOSONG CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 49 KOLON INDUSTRIES, INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size for aramid fiber market. Intensive secondary research was done to gather information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

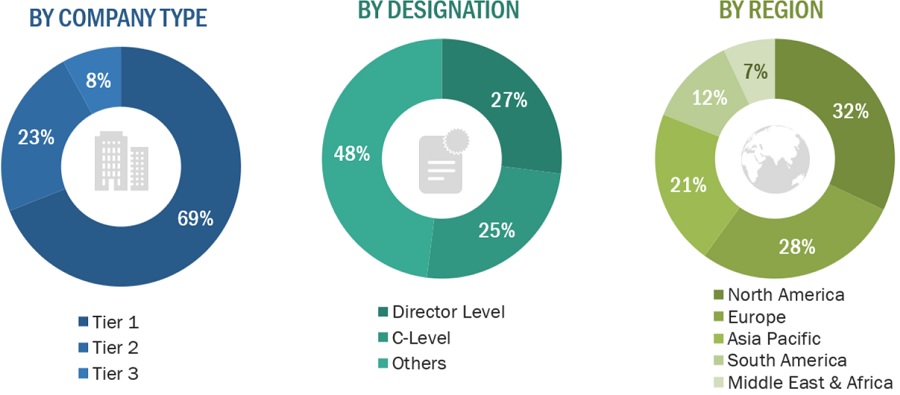

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The aramid fiber market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized from key opinion leaders in various applications for the aramid fiber industry. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

DuPont de Numerous, Inc. |

Global Strategy & Innovation Manager |

|

Teijin Limited |

Technical Sales Manager |

|

Kolon Industries, Inc. |

Senior Supervisor |

|

Yantai Tayho Advanced Materials Co.,Ltd. |

Production Supervisor |

|

Toray Industries, Inc. |

Production Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aramid fiber market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Aramid Fiber Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Aramid Fiber Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into respective segments and subsegments. To realize the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the aramid fiber industry.

Market Definition

According to the Encyclopedic Dictionary of Polymers, aramid fibers belong to a family of high-strength, high-modulus fibers derived from aramid resin. These fibers consist of long-chain synthetic polyamides with exceptionally strong tensile properties, making them a popular choice for advanced composite products that necessitate both strength and lightness. The primary sectors benefiting from aramid fibers include military & defense and automotive industries. Aramid fibers are available in various forms, such as roving, continuous filament yarns, spun yarns, pulp, and woven fabrics, offering versatility for diverse industrial applicationss.

Key Stake Holders

- Aramid fiber manufacturers

- Raw material manufacturers

- Government planning commissions and research organizations

- Industry associations

- End-use industries

- R&D institutions

Report Objectives

- To analyze and forecast the size of the aramid fiber market in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the aramid fiber market based on type, and application

- To forecast the size of the market segments for regions such as Asia Pacific, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aramid Fiber Market