Hybrid Cloud Market by Component, Service Type (Cloud Management and Orchestration, Disaster Recovery, and Hybrid Hosting), Service Model, Organization Size (SMEs and Large Enterprises), Vertical, and Region - Global Forecast to 2023

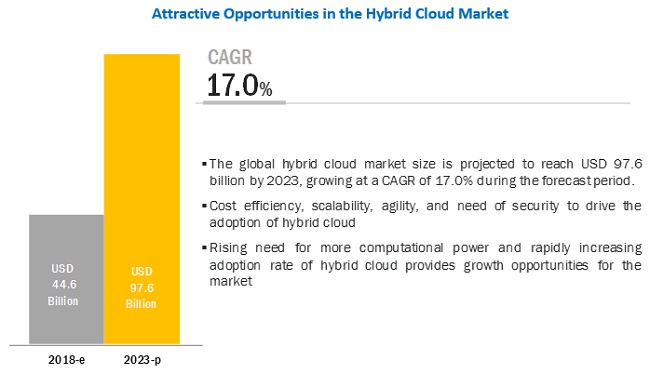

The Hybrid Cloud Market is projected to reach USD 97.6 billion by 2023, growing at a CAGR of 17.0% from USD 44.6 billion in 2018. Factors driving this growth include cost efficiency, scalability, agility, and security. Hybrid cloud enhances business-IT collaboration, improving agility, efficiency, and low-cost IT resource delivery.

COVID-19 Impact

Helped a global leader in cloud services and technology to identify and tap into a USD 20 million hybrid cloud market in North America and Europe

Client’s Problem Statement

Our client, a leading provider of cloud management and orchestration solutions and cloud services, required detailed analysis of hybrid cloud solutions and services and their adoption across North America and Europe. The client wanted information about the adoption of the hybrid cloud solution by key industry verticals such as BFSI, telecommunications & ITES, and healthcare & life sciences in the said geographies.

MnM Approach

MnM started by identifying a comprehensive list of current and upcoming hybrid cloud projects in the targeted geographies, which was provided for the said geographies. The revenue potential was identified based on the current market size, future growth potential, and the level of competitive intensity. A detailed competitive landscape for North America and Europe, along with the benchmarking of the key vendors were provided to the client.

Revenue Impact (RI)

Our analysis resulted in the client identifying and tapping into a USD 20 million hybrid cloud market for cloud management and orchestration providers in the region.

Selected Market Dynamics in Hybrid Cloud Market

Growing demand for agile, scalable, and cost-efficient computing

Enterprises are leveraging the hybrid cloud model to eliminate business challenges that are difficult to address with traditional IT infrastructure. Hybrid cloud is bridging the gap between IT and businesses by improving agility and efficiency as well as by rapidly delivering IT resources at a low cost. It empowers enterprises to extend their applications and infrastructure as required, and offers users high-speed performance and high availability. Hybrid cloud provides economies of scale while simultaneously delivering security to the sensitive information of businesses. As the availability of secure, scalable, and cost-effective resources can provide organizations with more opportunities to explore different operational avenues, it would drive the adoption of the hybrid cloud environment among organizations.

Lack of awareness about privacy and data protection

The lack of awareness about privacy and security issues has limited the adoption of the hybrid cloud. The low-level understanding of the security benefits delivered by the hybrid cloud is affecting its adoption rate among users. Sensitivity to privacy and data protection restricts enterprises to move their businesses to the cloud. The lack of clarity about the governance of cloud computing extends the restraints for hybrid cloud. Therefore, cloud processes need to be monitored continuously to minimize risks and improve the security features.

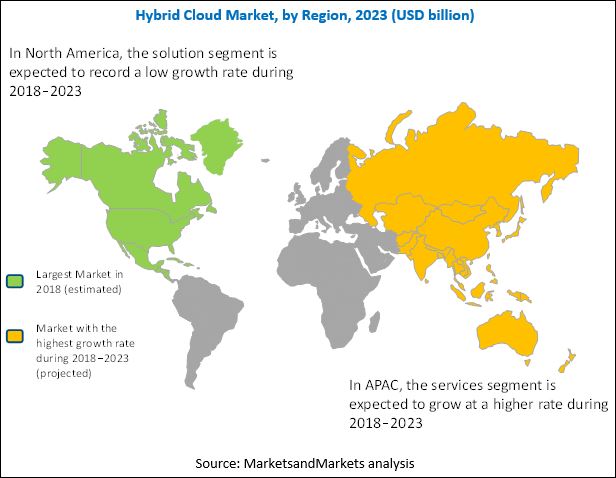

The hybrid cloud market has been segmented on the basis of components (solution and services), service types, service models, organization size, verticals, and regions. The services segment is expected to grow at a higher CAGR during the forecast period, and the solution segment is estimated to hold a larger market size in 2018 in the hybrid cloud market. The adoption of the hybrid cloud among enterprises has become a central part of the business process, due to the high flexibility, enhanced scalability, low cost, and secured deployment options, and is expected to grow in the coming years.

The hybrid hosting segment is estimated to hold the largest market size in 2018, as it offers numerous benefits, such as access through a single point of contact; sharing the network infrastructure; and monitoring, delivering, and managing hosting services. Organizations are enhancing their ability to integrate co-location, dedicated servers, and virtualized environments to construct a hybrid hosting environment.

The Infrastructure-as-a-Service (IaaS) segment is expected to hold the largest market size during the forecast period. IaaS helps in transferring workloads from on-premises systems to the cloud during the peak demand. This advantage helps allocate resources for more important business processes. Organizations can enhance their performance, increase delivery speed, improve productivity, and provide flexible computing capabilities, both in the public and private cloud environments.

North America is estimated to hold the largest market size in 2018, whereas Asia Pacific (APAC) is projected to grow at the highest CAGR in the hybrid cloud market during the forecast period. Hybrid cloud deployment has become the most suitable solution for organizations across all regions. The major factors that would further drive the growth of the hybrid cloud market are the presence of a dynamic business environment, increasing adoption of multiple cloud services for cost savings, and an indispensable need to achieve better productivity and efficiency through centralized cloud governance.

The rising need for more computational power and rapidly increasing adoption rate of the hybrid cloud are expected to open new avenues for the hybrid cloud market.

Major players in the hybrid cloud market are IBM (US), Microsoft (US), Cisco Systems (US), AWS (US), Oracle (US), Google (US), VMware (US), Alibaba (China), Equinix (US), Rackspace (US), NetApp (US), Atos (US), Fujitsu (Japan), CenturyLink (Louisiana), HPE (US), DXC (US), RightScale (US), Micro Focus (US), NTT Communications (Japan), Dell EMC (US), Citrix (US), Pure Storage (US), Unitas Global (US), and Quest Software(US). These players have adopted various growth strategies, such as new product launches, mergers and acquisitions, partnerships, collaborations, and business expansions, to expand their footprint in the hybrid cloud market.

Scope of the Hybrid Cloud Market Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component, Service Type, Service Model, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM (US), Microsoft (US), Cisco Systems (US), AWS (US), Oracle (US), Google (US), VMware (US), Alibaba (China), Equinix (US), Rackspace (US), NetApp (US), Atos (US), Fujitsu (Japan), CenturyLink (Louisiana), HPE (US), DXC (US), RightScale (US), Micro Focus (US), NTT Communications (Japan), Dell EMC (US), Citrix (US), Pure Storage (US), Unitas Global (US), and Quest Software (US). |

The research report categorizes the hybrid cloud market based on component, service type, service model, organization size, vertical, and region.

By Component

- Solution

- Services

By Service Type

- Cloud management and orchestration

- Disaster recovery

- Hybrid hosting

By Service Model

- Infrastructure-as-a-Service

- Platform-as-a-Service

- Software-as-a-Service

By Organization Size

- Large enterprises

- Small and medium-sized enterprises

By Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Retail

- Media and entertainment

- Manufacturing

- Government

- Transportation

- Others (travel and hospitality, and education)

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Frequently Asked Questions (FAQ):

How big is the Hybrid Cloud Market?

What is growth rate of the Hybrid Cloud Market?

What are the top trends in Hybrid Cloud Market?

Who are the key players in Hybrid Cloud Market?

Who will be the leading hub for Hybrid Cloud Market?

What is scope of the Hybrid Cloud Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary

4 Premium Insights

4.1 Attractive Market Opportunities in the Hybrid Cloud Market

4.2 Market By Component

4.3 Market By Workloads

4.4 Market By Service Model

4.5 Market By Organization Size

4.6 Market By Vertical

4.7 Market Investment Scenario, 2019—2024

5 Hybrid Cloud Market - Startup Scenario

5.1 Startup Company Analysis By

5.1.1 Global Footprint

5.1.2 Revenue

5.1.3 Market Ranking/Share Interval

5.1.4 Venture Capital and Funding Scenario

6 Market Overview

6.1 Introduction

6.2 Market Dynamics

6.2.1 Drivers

6.2.1.1 Growing Demand for Agile, Scalable and Cost Effective Computing

6.2.1.2 Rising Need for Interoperability Standards Between Cloud Services and Existing Systems

6.2.1.3 Increasing Focus to Avoid Vendor Lock In

6.2.1.4 Growth in Digital Services and Their Applications

6.2.2 Restraints

6.2.2.1 Lack of Awarness About Piracy and Data Protection

6.2.2.2 Lack of Technical Expertise

6.2.3 Opportunities

6.2.3.1 Growing Demand for More Computational Power

6.2.3.2 Lack of Technical Expertise

6.2.4 Challenges

6.2.4.1 Secured Integration of Cloud and on Premise Application Workloads

6.2.4.2 Workload Complexities in Hybird Cloud Environment

6.3 Regulatory Landscape

6.3.1 Payment Card Industry Data Security Standard (PCI DSS)

6.3.2 Health Insurance Portability and Accountability Act (HIPAA)

6.3.3 Federal Information Security Management Act (FISMA)

6.3.4 Gramm–Leach–Bliley Act (GLBA)

6.3.6 Sarbanes–Oxley Act (SOX)

6.3.6 Federal Information Processing Standard (FIPS)

6.3.7 General Data Protection Regulation (GDPR)

6.3.8 Federal Risk and Authorization Management Program (FedRAMP)

6.4 Use Cases

6.4.1 IBM Implements Hybrid Cloud Deployemnt for Telecom Company

6.4.2 AWS Implements Hybrid Cloud Solution for Ge

6.4.3 Microsoft Deploys Business Intelligence Solution for Healthcare Provider

6.5 Impact of Disruptive Technologies

6.5.1 Analytics

6.5.2 IoT

6.5.3 AI/ML

7 Hybrid Cloud Market By Component

7.1 Introduction

7.2 Solution

7.2.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

7.2.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

7.3 Services

7.3.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

7.3.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

8 Hybrid Cloud Market By Services

8.1 Introduction

8.2 Professional Service

8.2.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

8.2.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

8.3 Managed Services

8.3.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

8.3.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

9 Hybrid Cloud Market By Service Type

9.1 Introduction

9.2 Cloud Management and Orchestration

9.2.1 Market Estimates And Forecasts, 2017 - 2024 (USD Million)

9.2.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

9.3 Disaster Recovery

9.3.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

9.3.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

9.4 Hybrid Hosting

9.4.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

9.4.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

10 Hybrid Cloud Market By Service Model

10.1 Introduction

10.2 Infrastructure as a Service

10.2.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

10.2.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

10.3 Platform as a Service

10.3.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

10.3.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

10.4 Software as a Service

10.4.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

10.4.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

11 Hybrid Cloud Market By Workloads

11.1 Introduction

11.2 Storage, Backup, and Disaster Recovery

11.2.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

11.2.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

11.3 Application Development and Testing

11.3.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

11.3.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

11.4 Database Management

11.4.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

11.4.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

11.5 Business Analytics

11.5.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

11.5.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

11.6 Integration and Orchestration

11.6.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

11.6.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

11.7 Customer Relationship Management

11.7.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

11.7.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

11.8 Enterprise Resource Management

11.8.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

11.8.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

11.11 Cloud Collaboration and Content Management

11.9.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

11.9.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

11.10 Others*

11.10.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

11.10.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

12 Hybrid Cloud Market By Organization Size

12.1 Introduction

12.2 Small and Medium-Sized Enterprises

12.2.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

12.2.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

12.3 Large Enterprises

12.3.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

12.3.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

13 Hybrid Cloud Market By Vertical

13.1 Introduction

13.2 Banking, Financial Services, and Insurance

13.2.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

13.2.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

13.3 IT and Telecommunications

13.3.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

13.3.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

13.4 Government and Public Sector

13.4.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

13.4.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

13.5 Retail and Consumer Goods

13.5.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

13.5.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

13.6 Manufacturing

13.6.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

13.6.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

13.7 Energy and Utilities

13.7.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

13.7.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

13.8 Media and Entertainment

13.8.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

13.8.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

13.9 Healthcare and Life Sciences

13.9.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

13.9.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

13.10 Others*

13.10.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

13.10.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

13.11 Connected/Parent Market

13.11.1 Cloud Infrastruture Services Market

13.11.2 Cloud Computing Market

14 Hybrid Cloud Market By Region

14.1 Introduction

14.2 North America

14.2.1 Market Estimates and Forecasts By Component, 2017 - 2024 (USD Million)

14.2.2 Market Estimates and Forecasts By Services, 2017 - 2024 (USD Million)

14.2.3 Market Estimates and Forecasts By Service Type, 2017 - 2024 (USD Million)

14.2.4 Market Estimates and Forecasts By Service Model, 2017 - 2024 (USD Million)

14.2.5 Market Estimates and Forecasts By Workloads, 2017 - 2024 (USD Million)

14.2.6 Market Estimates and Forecasts By Orgnaiztaion Type, 2017 - 2024 (USD Million)

14.2.7 Market Estimates and Forecasts By Vertical, 2017 - 2024 (USD Million)

14.2.8 Market Estimates and Forecasts, By Country, 2017 - 2024 (USD Million)

14.2.8.1 US

14.2.8.2 Canada

14.3 Europe

14.3.1 Market Estimates and Forecasts By Component, 2017 - 2024 (USD Million)

14.3.2 Market Estimates and Forecasts By Services, 2017 - 2024 (USD Million)

14.3.3 Market Estimates and Forecasts By Service Type, 2017 - 2024 (USD Million)

14.3.4 Market Estimates and Forecasts By Service Model, 2017 - 2024 (USD Million)

14.3.5 Market Estimates and Forecasts By Workloads, 2017 - 2024 (USD Million)

14.3.6 Market Estimates and Forecasts By Orgnaiztaion Type, 2017 - 2024 (USD Million)

14.3.7 Market Estimates and Forecasts By Vertical, 2017 - 2024 (USD Million)

14.3.8 Market Estimates and Forecasts, By Country, 2017 - 2024 (USD Million)

14.3.8.1 UK

14.3.8.2 Germany

14.3.8.3 France

14.3.8.4 Rest of Europe

14.4 Asia Pacific

14.4.1 Market Estimates and Forecasts By Component, 2017 - 2024 (USD Million)

14.4.2 Market Estimates and Forecasts By Services, 2017 - 2024 (USD Million)

14.4.3 Market Estimates and Forecasts By Service Type, 2017 - 2024 (USD Million)

14.4.4 Market Estimates and Forecasts By Service Model, 2017 - 2024 (USD Million)

14.4.5 Market Estimates and Forecasts By Workloads, 2017 - 2024 (USD Million)

14.4.6 Market Estimates and Forecasts By Orgnaiztaion Type, 2017 - 2024 (USD Million)

14.4.7 Market Estimates and Forecasts By Vertical, 2017 - 2024 (USD Million)

14.4.8 Market Estimates and Forecasts, By Country, 2017 - 2024 (USD Million)

14.4.8.1 China

14.4.8.2 Japan

14.4.8.3 Australia

14.4.8.4 Singapore

14.4.8.5 Rest of APAC

14.5 Latin America

14.5.1 Market Estimates and Forecasts By Component, 2017 - 2024 (USD Million)

14.5.2 Market Estimates and Forecasts By Services, 2017 - 2024 (USD Million)

14.5.3 Market Estimates and Forecasts By Service Type, 2017 - 2024 (USD Million)

14.5.4 Market Estimates and Forecasts By Service Model, 2017 - 2024 (USD Million)

14.5.5 Market Estimates and Forecasts By Workloads, 2017 - 2024 (USD Million)

14.5.6 Market Estimates and Forecasts By Orgnaiztaion Type, 2017 - 2024 (USD Million)

14.5.7 Market Estimates and Forecasts By Vertical, 2017 - 2024 (USD Million)

14.5.8 Market Estimates and Forecasts, By Country, 2017 - 2024 (USD Million)

14.5.8.1 Brazil

14.5.8.2 Mexico

14.5.8.3 Rest of Latin America

14.6 Middle East and Africa

14.6.1 Market Estimates and Forecasts By Component, 2017 - 2024 (USD Million)

14.6.2 Market Estimates and Forecasts By Services, 2017 - 2024 (USD Million)

14.6.3 Market Estimates and Forecasts By Service Type, 2017 - 2024 (USD Million)

14.6.4 Market Estimates and Forecasts By Service Model, 2017 - 2024 (USD Million)

14.6.5 Market Estimates and Forecasts By Workloads, 2017 - 2024 (USD Million)

14.6.6 Market Estimates and Forecasts By Orgnaiztaion Type, 2017 - 2024 (USD Million)

14.6.7 Market Estimates and Forecasts By Vertical, 2017 - 2024 (USD Million)

14.6.8 Market Estimates and Forecasts, By Country, 2017 - 2024 (USD Million)

14.6.8.1 Saudi Arabia

14.6.8.2 UAE

14.6.8.3 South Africa

14.6.8.4 Rest of Middle East and Africa

15 Competitive Landscape

15.1 Competitive Scenario

15.1.1 Introduction

15.1.2 Partnerships, Agreements, and Collaborations

15.1.3 New Product/Service Launches

15.1.4 Mergers and Acquisitions

15.1.5 Business Expansions

16 Company Profiles

16.1 Accenture

16.2.1 Business Overview

16.2.2 Company Snapshot

16.2.3 Financial Overview (Operating Income & R&D Expenditure)

16.2.4 Business Revenue Mix

16.2.5 Geographic Revenue Mix

16.2.6 Products Offered

16.2.7 Recent Development

16.2.7.1 New Product Launched/Product Updates

16.2.7.1 Merger & Acquisition/Joint Venture/ Partnership

16.2.8 SWOT Analysis

16.2.9 MnM View

16.2 Alibaba

18.2.1 Business Overview

16.2.2 Company Snapshot

16.2.3 Financial Overview (Operating Income & R&D Expenditure)

16.2.4 Business Revenue Mix

16.2.5 Geographic Revenue Mix

16.2.6 Products Offered

16.2.7 Recent Development

16.2.7.1 New Product Launched/Product Updates

16.2.7.1 Merger & Acquisition/Joint Venture/ Partnership

16.2.8 SWOT Analysis

16.2.9 MnM View

16.3 Atos

16.2.1 Business Overview

16.2.2 Company Snapshot

16.2.3 Financial Overview (Operating Income & R&D Expenditure)

16.2.4 Business Revenue Mix

16.2.5 Geographic Revenue Mix

16.2.6 Products Offered

16.2.7 Recent Development

16.2.7.1 New Product Launched/Product Updates

16.2.7.1 Merger & Acquisition/Joint Venture/ Partnership

16.2.8 SWOT Analysis

16.2.9 MnM View

16.4 AWS

16.2.1 Business Overview

16.2.2 Company Snapshot

16.2.3 Financial Overview (Operating Income & R&D Expenditure)

16.2.4 Business Revenue Mix

16.2.5 Geographic Revenue Mix

16.2.6 Products Offered

16.2.7 Recent Development

16.2.7.1 New Product Launched/Product Updates

16.2.7.1 Merger & Acquisition/Joint Venture/ Partnership

16.2.8 SWOT Analysis

16.2.9 MnM View

16.5 Centurylink

16.2.1 Business Overview

16.2.2 Company Snapshot

16.2.3 Financial Overview (Operating Income & R&D Expenditure)

16.2.4 Business Revenue Mix

16.2.5 Geographic Revenue Mix

16.2.6 Products Offered

16.2.7 Recent Development

16.2.7.1 New Product Launched/Product Updates

16.2.7.1 Merger & Acquisition/Joint Venture/ Partnership

16.2.8 SWOT Analysis

16.2.9 MnM View

16.6 Citrix

16.7 Dell EMC

16.8 DXC

16.9 Fujitsu

16.10 Google

16.11 HPE

16.12 IBM

16.13 Micro Focus

16.14 Microsoft

16.15 Netapp

16.16 NTT Communications

16.17 Oracle

16.18 Pure Storage

16.19 Quest Software

16.20 Rackspace

16.21 Rightscale

16.22 Unitas Global

16.23 VMware

17 Appendix

17.1 Discussion Guide

17.2 Knowledge Store: Marketsandmarkets Subscription Portal

17.3 Introducing Rt: Real-Time Market Intelligence

17.4 Available Customization

17.5 Related Reports

17.6 Author Details

List of Tables (184 Tables)

Table 1 Hybrid Cloud Market: Assumptions

Table 2 Market Size By Component, 2017–2024 (USD Million)

Table 3 Solutions: Market Size By Type, 2017–2024 (USD Million)

Table 4 Service: Market Size By Type, 2017–2024 (USD Million)

Table 5 Professional Service: Market Size By Type, 2017–2024 (USD Million

Table 6 Managed Service: Market Size, By Type, 2017–2024 (USD Million

Table 7 Service Type: Market Size By Type, 2017–2024 (USD Million

Table 8 Cloud Management and Orchestration Market Size, By Region, 2017–2024 (USD Million)

Table 9 Disaster Recovery Market Size, By Region, 2017–2024 (USD Million)

Table 10 Hybrid Hosting Market Size, By Region, 2017–2024 (USD Million)

Table 11 Service Model: Hybrid Cloud Market Size, By Region, 2017–2024 (USD Million)

Table 12 Infrastructure-As-A-Service Market Size, By Region, 2017–2024 (USD Million)

Table 13 Platform-As-A-Service Market Size, By Region, 32017–2024 (USD Million)

Table 14 Software-As-A-Service Market Size, By Region, 2017–2024 (USD Million)

Table 15 Hybrid Cloud Market Size, By Deployment Type, 2017–2024 (USD Million)

Table 16 Workload: Market Size By Region, 2017–2024 (USD Million)

Table 17 Small and Medium-Sized Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 18 Hybrid Cloud Market Size, By End-User, 2017–2024 (USD Million)

Table 19 Service Providers: Market Size By Region, 2017–2024 (USD Million)

Table 20 Verticals: Hybrid Cloud Market Size, By Type, 2017–2024 (USD Million)

Table 21 Service Providers: Market Size By Region, 2017–2024 (USD Million)

Table 22 Telecom Service Provider Market Size, By Region, 2017–2024 (USD Million)

Table 23 Cloud Service Provider Market Size, By Region, 2017–2024 (USD Million)

Table 24 Managed Service Providers Market Size, By Region, 2017–2024 (USD Million)

Table 25 Others Market Size, By Region, 2017–2024 (USD Million)

Table 26 Verticals: Hybrid Cloud Market Size, By Region, 2017–2024 (USD Million)

Table 27 Banking, Financial Services, and Insurance Market Size, By Region, 2017–2024 (USD Million)

Table 28 It and ITSM Market Size, By Region, 2017–2024 (USD Million)

Table 29 Government Market Size, By Region, 2017–2024 (USD Million)

Table 30 Manufacturing Market Size, By Region, 2017–2024 (USD Million)

Table 31 Healthcare Market Size, By Region, 2017–2024 (USD Million)

Table 32 Retail Market Size, By Region, 2017–2024 (USD Million)

Table 33 Transportation and Logistics Market Size, By Region, 2017–2024 (USD Million)

Table 34 Others Market Size, By Region, 2017–2024 (USD Million)

Table 35 Connected Market -Cloud-Based ITSM Market Size and Growth, 2014–2021 (USD Billion)

Table 36 Connected Market -Market Size, By Solution, 2014–2021 (USD Million)

Table 37 Connected Market -Service Portfolio Management: Market Size, By Region, 2014–2021 (USD Million)

Table 38 Connected Market -Configuration and Change Management: Market Size, By Region, 2014–2021 (USD Million)

Table 39 Connected Market -Service Desk Software: Market Size, By Region, 2014–2021 (USD Million)

Table 40 Connected Market - Operations and Performance Management: Market Size, By Region, 2014–2021 (USD Million)

Table 41 Connected Market -Dashboard, Reporting, and Analytics: Market Size, By Region, 2014–2021 (USD Million)

Table 42 Connected Market -Cloud-Based ITSM Market Size, By Service, 2014–2021 (USD Million)

Table 43 Connected Market -Professional Services: Market Size, By Region, 2014–2021 (USD Million)

Table 44 Connected Market -Managed Services: Market Size, By Region, 2014–2021 (USD Million)

Table 45 Connected Market -Cloud-Based ITSM Market Size, By Organization Size, 2014–2021 (USD Million)

Table 46 Connected Market -Small and Medium Enterprises: Market Size, By Region, 2014–2021 (USD Million)

Table 47 Connected Market -Small and Medium Enterprises: Market Size, By Vertical, 2014–2021 (USD Million)

Table 48 Connected Market -Large Enterprises: Market Size, By Region, 2014–2021 (USD Million)

Table 49 Connected Market -Large Enterprises: Market Size, By Vertical, 2014–2021 (USD Million)

Table 50 Connected Market -Cloud-Based ITSM Market Size, By Vertical, 2014–2021 (USD Million)

Table 51 Connected Market -Banking, Financial Services, and Insurance: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 52 Connected Market -Banking, Financial Services, and Insurance: Market Size, By Region, 2014–2021 (USD Million)

Table 53 Connected Market -Telecom and IT: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 54 Connected Market -Telecom and IT: Market Size, By Region, 2014–2021 (USD Million)

Table 55 Connected Market -Healthcare and Life Sciences: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 56 Connected Market -Healthcare and Life Sciences: Market Size, By Region, 2014–2021 (USD Million)

Table 57 Connected Market -Retail and CPG: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 58 Connected Market -Retail and CPG: Cloud-Based ITSM Market Size, By Region, 2014–2021 (USD Million)

Table 59 Connected Market -Government and Public Sector: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 60 Connected Market -Government and Public Sector: Market Size, By Region, 2014–2021 (USD Million)

Table 61 Connected Market -Energy and Utilities: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 62 Connected Market -Energy and Utilities: Market Size, By Region, 2014–2021 (USD Million)

Table 63 Travel and Hospitality: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 64 Connected Market -Travel and Hospitality: Market Size, By Region, 2014–2021 (USD Million)

Table 65 Connected Market -Manufacturing: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 66 Connected Market -Manufacturing: Market Size, By Region, 2014–2021 (USD Million)

Table 67 Connected Market -Education: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 68 Connected Market -Education: Market Size, By Region, 2014–2021 (USD Million)

Table 69 Connected Market -Others: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 70 Connected Market -Others: Market Size, By Region, 2014–2021 (USD Million)

Table 71 Connected Market -Cloud-Based Itsm Market Size, By Region, 2014–2021 (USD Million)

Table 72 Connected Market -AIOPS Platform Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 73 Connected Market -AI Investment, 2016 (USD Billion)

Table 74 Connected Market -Enterprise use Cases, By Vertical

Table 75 Connected Market -AIOPS Platform Market Size, By Component, 2016–2023 (USD Million)

Table 76 Connected Market -Platform: Market Size, By Region, 2016–2023 (USD Million)

Table 77 Connected Market -Services: Market Size, By Region, 2016–2023 (USD Million)

Table 78 Connected Market -AIOPS Platform Market Size, By Service, 2016–2023 (USD Million)

Table 79 Connected Market - Implementation Services: Market Size, By Region, 2016–2023 (USD Million)

Table 80 Connected Market - License and Maintenance Services: Market Size, By Region, 2016–2023 (USD Million)

Table 81 Connected Market -Training and Education Services: AIOPS Platform Market Size, By Region, 2016–2023 (USD Million)

Table 82 Connected Market -Consulting Services: Market Size, By Region, 2016–2023 (USD Million)

Table 83 Connected Market -Managed Services: Market Size, By Region, 2016–2023 (USD Million)

Table 84 Connected Market -AIOPS Platform Market Size, By Application, 2016–2023 (USD Million)

Table 85 Connected Market -Real-Time Analytics: Market Size, By Region, 2016–2023 (USD Million)

Table 86 Connected Market -Application Performance Management: Market Size, By Region, 2016–2023 (USD Million)

Table 87 Connected Market -Infrastructure Management: AIOPS Platform Market Size, By Region, 2016–2023 (USD Million)

Table 88 Connected Market -Network and Security Management: Market Size, By Region, 2016–2023 (USD Million)

Table 89 Connected Market -Others: Market Size, By Region, 2016–2023 (USD Million)

Table 90 Connected Market -AIOPS Platform Market Size, By Organization Size, 2016–2023 (USD Million)

Table 91 Connected Market -Small and Medium-Sized Enterprises: Market Size, By Region, 2016–2023 (USD Million)

Table 92 Connected Market -Large Enterprises: Market Size, By Region, 2016–2023 (USD Million)

Table 93 Connected Market -AIOPS Platform Market Size, By Deployment, 2016–2023 (USD Million)

Table 94 Connected Market -On-Premises: Market Size, By Region, 2016–2023 (USD Million)

Table 95 Connected Market -Cloud: Market Size, By Region, 2016–2023 (USD Million)

Table 96 Connected Market -AIOPS Platform Market Size, By Vertical, 2016–2023 (USD Million)

Table 97 Connected Market -Banking, Financial Services, and Insurance: Market Size, By Region, 2016–2023 (USD Million)

Table 98 Connected Market -Healthcare and Life-Sciences: Market Size, By Region, 2016–2023 (USD Million)

Table 99 Connected Market -Retail and Consumer Goods: Market Size, By Region, 2016–2023 (USD Million)

Table 100 Connected Market -IT and Telecom: AIOPS Platform Market Size, By Region, 2016–2023 (USD Million)

Table 101 Connected Market -Government: Market Size, By Region, 2016–2023 (USD Million)

Table 102 Connected Market -Manufacturing: Market Size, By Region, 2016–2023 (USD Million)

Table 103 Connected Market -Media and Entertainment: Market Size, By Region, 2016–2023 (USD Million)

Table 104 Connected Market -Others: Market Size, By Region, 2016–2023 (USD Million)

Table 105 Connected Market -AIOPS Platform Market Size, By Region, 2016–2023 (USD Million)

Table 106 Hybrid Cloud Market Size, By Region, 2017–2024 (USD Million)

Table 107 North America: Hybrid Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 108 North America: Market Size By Solution, 2017–2024 (USD Million)

Table 109 North America: Market Size By Standalone Network Management Solution, 2017–2024 (USD Million)

Table 110 North America: Market Size By Service, 2017–2024 (USD Million)

Table 111 North America: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 112 North America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 113 North America: Market Size By End-User, 2017–2024 (USD Million)

Table 114 North America: Market Size By Vertical, 2017–2024 (USD Million)

Table 115 North America: Market Size By Country, 2017–2024 (USD Million)

Table 116 Hybrid Cloud Market Size, By Region, 2017–2024 (USD Million)

Table 117 United States: Hybrid Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 118 United States: Market Size By Solution, 2017–2024 (USD Million)

Table 119 United States: Market Size By Standalone Network Management Solution, 2017–2024 (USD Million)

Table 120 United States: Market Size By Service, 2017–2024 (USD Million)

Table 121 United States: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 122 United States: Market Size By Organization Size, 2017–2024 (USD Million)

Table 123 United States: Market Size By End-User, 2017–2024 (USD Million)

Table 124 United States: Market Size By Vertical, 2017–2024 (USD Million)

Table 125 Europe: Hybrid Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 126 Europe: Market Size By Solution, 2017–2024 (USD Million)

Table 127 Europe: Market Size By Standalone Network Management Solution, 2017–2024 (USD Million)

Table 128 Europe: Market Size By Service, 2017–2024 (USD Million)

Table 129 Europe: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 130 Europe: Market Size By Organization Size, 2017–2024 (USD Million)

Table 131 Europe: Market Size By End-User, 2017–2024 (USD Million)

Table 132 Europe: Market Size By Vertical, 2017–2024 (USD Million)

Table 133 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 134 United Kingdom: Hybrid Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 135 United Kingdom: Market Size By Solution, 2017–2024 (USD Million)

Table 136 United Kingdom: Market Size By Standalone Network Management Solution, 2017–2024 (USD Million)

Table 137 United Kingdom: Market Size By Service, 2017–2024 (USD Million)

Table 138 United Kingdom: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 139 United Kingdom: Market Size By Organization Size, 2017–2024 (USD Million)

Table 140 United Kingdom: Market Size By End-User, 2017–2024 (USD Million)

Table 141 United Kingdom: Market Size By Vertical, 2017–2024 (USD Million)

Table 142 United Kingdom: Market Size By Country, 2017–2024 (USD Million)

Table 143 Asia Pacific: Hybrid Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 144 Asia Pacific: Market Size By Solution, 2017–2024 (USD Million)

Table 145 Asia Pacific: Market Size By Standalone Network Management Solution, 2017–2024 (USD Million)

Table 146 Asia Pacific: Market Size By Service, 2017–2024(USD Million)

Table 147 Asia Pacific: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 148 Asia Pacific: Market Size By Organization Size, 2017–2024 (USD Million)

Table 149 Asia Pacific: Market Size By End-User, 2017–2024 (USD Million)

Table 150 Asia Pacific: Market Size By Vertical, 2017–2024 (USD Million)

Table 151 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 152 China: Hybrid Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 153 China: Market Size By Solution, 2017–2024 (USD Million)

Table 154 China: Market Size By Standalone Network Management Solution, 2017–2024 (USD Million)

Table 155 China: Market Size By Service, 2017–2024(USD Million)

Table 156 China: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 157 China: Market Size By Organization Size, 2017–2024 (USD Million)

Table 158 China: Market Size By End-User, 2017–2024 (USD Million)

Table 159 China: Market Size By Vertical, 2017–2024 (USD Million)

Table 160 China: Market Size By Country, 2017–2024 (USD Million)

Table 161 Middle East and Africa: Hybrid Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 162 Middle East and Africa: Market Size By Solution, 2017–2024 (USD Million)

Table 163 Middle East and Africa: Market Size By Standalone Network Management Solution, 2017–2024 (USD Million)

Table 164 Middle East and Africa: Market Size By Service, 2017–2024 (USD Million)

Table 165 Middle East and Africa: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 166 Middle East and Africa: Market Size By Organization Size, 2017–2024 (USD Million)

Table 167 Middle East and Africa: Market Size By End-User, 2017–2024 (USD Million)

Table 168 Middle East and Africa: Market Size By Vertical, 2017–2024 (USD Million)

Table 169 Latin America: Hybrid Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 170 Latin America: Market Size By Solution, 2017–2024 (USD Million)

Table 171 Latin America: Market Size By Standalone Network Management Solution, 2017–2024 (USD Million)

Table 172 Latin America: Market Size By Service, 2017–2024 (USD Million)

Table 173 Latin America: Market Size By Deployment Type, 2017–2024 (USD Million)

Table 174 Latin America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 175 Latin America: Market Size By End-User, 2017–2024 (USD Million)

Table 176 Latin America: Market Size By Vertical, 2017–2024 (USD Million)

Table 177 Partnership and Agreements, 2017-2018

Table 178 New Product/Service Launches and Product Enhancements, 2018

Table 179 Acquisitions, 2017– 2018

Table 180 Business Expansions, 2016–2018

Table 181 Startup Scenario: Global Footprint, 2019

Table 182 Startup Scenario: Revenue, 2019

Table 183 Startup Scenario: Market Ranking/Share Interval, 2019

Table 184 Startup Scenario: Venture Capital/Funding, 2019

List of Figures (52 Figures)

Figure 1 Hybrid Cloud Market Segmentation

Figure 2 Regional Scope

Figure 3 Market Research Design

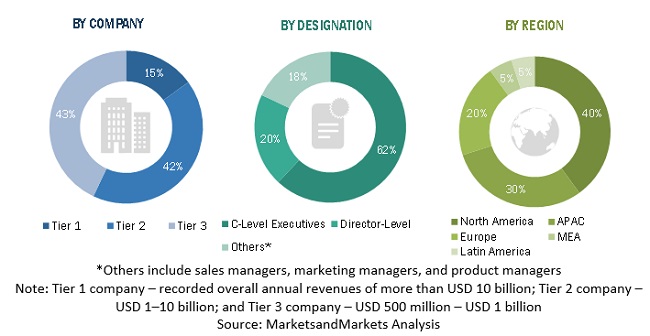

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Hybrid Cloud Market: Assumptions

Figure 9 Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Figure 10 Top 3 Segments With the Largest Market Shares in the Market

Figure 11 Market: Regional Snapshot

Figure 12 Growing Demand for Agile, Scalable, and Cost-Efficient Computation is Expected to Drive the Global Hybrid Cloud Market Growth

Figure 13 Solution Segment is Estimated to Have the Larger Market Size in 2018

Figure 14 Banking, Financial Services, and Insurance Vertical and North America are Estimated to Have the Largest Market Shares in 2018

Figure 15 Asia Pacific is Expected to Emerge as the Best Market for Investments for the Next 5 Years

Figure 16 Hybrid Cloud Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Solution Segment is Estimated to Have the Larger Market Size in 2018

Figure 18 Professional Services Segment is Estimated to Have the Larger Market Size in 2018

Figure 19 Support and Maintenance Segment is Estimated to Have the Larger Market Size in 2018

Figure 20 Hybrid Hosting Segment is Estimated to Have the Largest Market Size in 2018

Figure 21 Infrastructure-As-A-Service Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 22 Large Enterprises Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 23 Banking, Financial Services, and Insurance Vertical is Estimated to Have the Largest Market Size in 2018

Figure 24 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 25 North America: Hybrid Cloud Market Snapshot

Figure 26 Asia Pacific: Market Snapshot

Figure 27 Key Developments By the Leading Players in the Hybrid Cloud Market During 2016–2018

Figure 28 Geographic Revenue Mix of the Top Market Players

Figure 29 IBM: Company Snapshot

Figure 30 IBM: SWOT Analysis

Figure 31 Microsoft: Company Snapshot

Figure 32 Microsoft: SWOT Analysis

Figure 33 Cisco Systems: Company Snapshot

Figure 34 Cisco Systems: SWOT Analysis

Figure 35 AWS: Company Snapshot

Figure 36 AWS: SWOT Analysis

Figure 37 Oracle: Company Snapshot

Figure 38 Oracle: SWOT Analysis

Figure 39 Google: Company Snapshot

Figure 40 VMware: Company Snapshot

Figure 41 Alibaba: Company Snapshot

Figure 42 Equinix: Company Snapshot

Figure 43 Netapp: Company Snapshot

Figure 44 ATOS: Company Snapshot

Figure 45 Fujitsu: Company Snapshot

Figure 46 Centurylink: Company Snapshot

Figure 47 HPE: Company Snapshot

Figure 48 DXC: Company Snapshot

Figure 49 Micro Focus: Company Snapshot

Figure 50 Dell EMC: Company Snapshot

Figure 51 Citrix: Company Snapshot

Figure 52 Pure Storage: Company Snapshot

The study consists of 4 major activities to estimate the current market size of the hybrid cloud market. An extensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the hybrid cloud market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek, have been referred to for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors, gold standard and silver standard websites, Research and Development (R&D) organizations, regulatory bodies, and databases.

Primary research

Various primary sources from both the supply and demand sides of the hybrid cloud market were interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors of hybrid cloud solutions, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the profile breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Hybrid Cloud Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the hybrid cloud market. The methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using the study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the size of the hybrid cloud market by application area, modality, offering, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the hybrid cloud market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the hybrid cloud market

- To analyze opportunities in the market for stakeholders by identifying the high growth segments of the hybrid cloud ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches, such as product launches, acquisitions, contracts, agreements, and partnerships, in the hybrid cloud market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American hybrid cloud market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA hybrid cloud market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Hybrid Cloud Market

Understanding the Hybrid Cloud Advisory & Professional Services

Interested in hybrid cloud market

Understanding the market of hybrid cloud predictions

Interested in virtual data center market