High Voltage Equipment Market by Type (Power Transformers, Switchgear, Switches, Control, Reactive Power, Instrument Transformer, Relay Panel, Earthing Equipment, Battery Set), by Voltage & by Region - Global Forecast & Trends to 2020

[214 Pages Report] High voltage equipment becomes the integral part of the transmission and distribution network. Power transmission includes equipment such as transformers and reactive compensation, breaker, protection and control and communication equipment and others. Continuously growing energy demand will continue to be the central market driver for transmission equipment.

Market for high voltage equipment is projected to reach over USD 116 Billion by 2020, at a CAGR of 5.6% from 2015 to 2020. Increasing implementation of smart grid across major countries, replacement and upgrade of aging transmission infrastructure and new capacity additions of generation, including renewable, and transmission are the key market drivers of the high voltage equipment market.

Key markets for high voltage equipment include China, the U.S, India, Russia, U.K, and Japan, which together constitute more than 50% of the projected market in the next five years. China with its strong layout of transmission plans is the largest market with nearly 15% of the global cumulative market for the next 5 years.

The high voltage equipment market report analyzes the key equipment in power transmission including Switchgear, Switches, Power Transformer, Instrument Transformer, Reactive Power Equipment, Insulator, Control Equipment, Relay Panel, Carrier Cabinet, Communication Equipment, SCADA, and Earthing Material and Battery Set. The report also analyses the demand for high voltage equipment based on their application in Ultra High Voltage, Extra High Voltage, High Voltage Direct Current, High Voltage transmission networks worldwide. Further, market is segmented by key geographies, North America, South America, Asia-Pacific, Europe, the Middle East, and Africa as well as key countries including the U.S, Canada, China, India, Brazil, Japan, Russia, Saudi Arabia and others.

This report delivers an analysis of key companies and the recent developments related to the high voltage equipment. Industry trends are presented with the help of Porters Five Forces, market drivers, restraints, opportunities, and challenges have been discussed in detail. Leading players in such as, ABB Ltd. (Switzerland), Alstom (France), Crompton Greaves (India), and Toshiba Corporation (Japan) have been profiled to provide the scenario of competitiveness in the market for high voltage equipment. Major developments of the key players have been tracked and included in the report to present the market scenario.

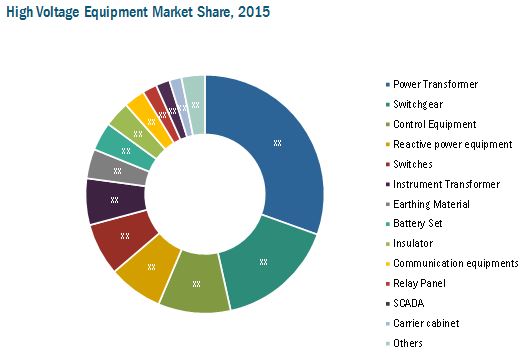

The above figure describes the market shares of various high voltage equipment. Transformer and switchgear equipment are the leading market segments. Rise in electricity demand with increasing transmission infrastructure additions are the key factors for the increasing demand of high voltage equipment. Other equipment includes DC distribution system, neutral grounding equipment, surge arrestors.

In this report market has been segmented by the following equipment -

On the basis of Equipment

- Switchgear

- Switches

- Power Transformer

- Instrument Transformer

- Reactive Power Equipment

- Insulator

- Control Equipment

- Relay Panel

- Carrier Cabinet

- Communication Equipment

- SCADA

- Earthing Material

- Battery Set

On the basis of voltage level

- UHV-Ultra high voltage ( 800 kV and Above)

- EHV (200 kV and above)

- HVDC (500 kV DC)

- HV ( 66 kV to 200 kV)

On the basis of Region

- North America

- South America

- Asia-Pacific

- Middle East

- Europe

- Africa

High voltage equipment typically include power transformer, switchgears, control equipment, communicating devices, insulators, and so on. Power transformers and instrument transformers are the devices used in transmission network of higher voltages for step-up and step-down application (400 kV, 200 kV, 110 kV, 66 kV, 33kV). Report also includes the segmentation based on equipment used for different voltage level such as Ultra High Voltage (UHV), Extra High Voltage (EHV), High Voltage Direct Current (HVDC), and High Voltage (HV).

Global electricity demand has been growing, and in particular for Asia-Pacific, it is likely to grow at a faster rate. To meet this growing demand, there is being new and augmented capacity added which is needed to be evacuated by new and upgraded power transmission and distribution networks. Continuous infrastructure investments for power transmission and distribution equipment can be seen both in developed and developing regions. Compared to other assets, transmission investments are extremely risky and require long lead times for the planning process and stakeholder involvement. The demand for electricity worldwide is projected to grow at an annual rate of 2.4% for the period 2009 to 2035, rise in industrialization and urbanization are reasons boosting up the power demand. Also, to reduce transmission losses, efficient power delivery system with the reliable equipment is the key necessity. Rise in smart grid projects is also enhancing the need for up gradation of the existing network.

European countries have already initiated investment towards the smart grid technology market. This continuous rise in T&D expenditure is resulting in an increase in the high voltage equipment market. The market is expected to grow with a CAGR 5.44% from 2015 to 2020.

Continuous demand for electricity in highly populated countries such as India and China has improved the development of power T&D equipment. The length of the installed T&D lines over the next five years is likely to be the highest in Asia-Pacific among all regions. Moreover, the T&D expenditure in Asia-Pacific is also the highest. High voltage equipment is extensively used by utilities companies. North America and Europe currently have market for grid modernization and replacement of old installations. Along with the capacity enhancement trending world-wide, the investments in the offshore wind farms are expected to drive the market

The upcoming power generation sources will also increase the growth of new T&D lines which in turn will increase the requirements for the power sector equipment.

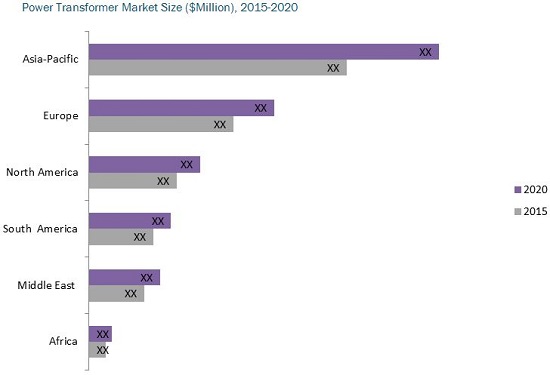

Currently, power transformers market holds the largest share in the high voltage equipment market. It is also predominantly large in Asia-Pacific then followed by markets in Europe and North America and others. Other important equipment for high voltage equipment market are switches, switchgear and protection equipment.

Table of Content

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.1.1 Increasing Electric Power Consumption

2.2.2 Power Transmission Infrastructure Development

2.3 Description of High Voltage Equipment Market

2.3.1 Electricity Generation

2.4 Market Size Estimation

2.5 Market Breakdown & Data Triangulation

2.6 Research Assumptions & Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 41)

4.1 Attractive Market Opportunities in the High Voltage Equipment Market

4.2 High Voltage Equipment Market Regional Scenario

4.3 High Voltage Equipment Market in Asia-Pacific

4.4 Europe Was the Second Largest High Voltage Equipment Market in 2014

4.5 High Voltage Equipment Market: Developed vs Developing Nations

4.6 Asia-Pacific High Voltage Equipment Market, By Voltage Level

4.7 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 48)

5.1 Introduction

5.2 High Voltage Market Segmentation

5.2.1 By Equipment

5.2.2 By Voltage

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Power Sector Reforms Including T&D Expansions & Renovation

5.3.1.2 Smart Grid Rollouts

5.3.1.3 Growing Industrialization & Urbanization

5.3.1.4 Increased Investment in Renewable Energy Sources

5.3.2 Restraints

5.3.2.1 Competition From Local Players Offering Low-Quality & Cheap Products

5.3.2.2 Standardization of High Voltage Equipment Products

5.3.3 Opportunities

5.3.3.1 Proposed HVDC Transmission Methods for Long Distance Transmission

5.3.3.2 Grid Upgrades & Automations

5.3.4 Challenges

5.3.4.1 Cyber Security

5.3.4.2 Price Volatility of Raw Materials

6 Industry Trends (Page No. - 59)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Porters Five Forces Analysis

6.4.1 Threat of Substitutes

6.4.1.1 Availability of Substitutes

6.4.1.2 Technological Upgrades & Innovation in the Market

6.4.2 Threat of New Entrants

6.4.2.1 High Capital Investment

6.4.2.2 Dominance of Key Market Players

6.4.3 Bargaining Power of Buyers

6.4.3.1 Large Number of Suppliers

6.4.3.2 Price Competitiveness Between Suppliers

6.4.4 Bargaining Power of Suppliers

6.4.4.1 Low Product Variation

6.4.4.2 Increase in Equipment Demand in Transmission & Generation Sectors

6.4.5 Degree of Competition

7 High Voltage Equipment Market, By Voltage Level (Page No. - 68)

7.1 Introduction

7.2 UHV-800kv & Above

7.3 HVDC-500kv Voltage

7.4 EHV-200 to 800kv Voltage

7.5 HV-Up to 200kv Voltage

8 High Voltage Equipment Market, By Type (Page No. - 78)

8.1 Introduction

8.1 Switchgear

8.2 Switches

8.3 Power Transformer

8.4 Instrument Transformer

8.5 Reactive Power Equipment

8.6 Insulator

8.7 Control Equipment

8.8 Relay Panel

8.9 Carrier Cabinet

8.10 Communication Equipment

8.11 Scada

8.12 Earthing Material

8.13 Battery Set

8.14 Other Equipment

9 High Voltage Equipment Market, By Region (Page No. - 101)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 U.K.

9.3.2 Germany

9.3.3 France

9.3.4 Russia

9.3.5 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Australia

9.4.4 Japan

9.4.5 Rest of Asia-Pacific

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Middle East

9.6.1 Saudi Arabia

9.6.2 UAE

9.6.3 Kuwait

9.6.4 Qatar

9.6.5 Rest of Middle East

9.7 Africa

9.7.1 South Africa

9.7.2 Nigeria

9.7.3 Rest of Africa

10 Competitive Landscape (Page No. - 140)

10.1 Overview

10.2 Contracts & Agreements

10.3 Expansions

10.4 New Product Development

10.5 Joint Ventures

10.6 Mergers & Acquisitions

11 Company Profiles (Page No. - 151)

11.1 Introduction

11.2 General Electric Company

11.2.1 Business Overview

11.2.2 Products & Services

11.2.3 Developments, 2012-2014

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 Alstom SA

11.3.1 Business Overview

11.3.2 Products & Services

11.3.3 Developments, 2013-2015

11.4 Siemens AG

11.4.1 Business Overview

11.4.2 Products & Services

11.4.3 Developments, 2012-2014

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 ABB Ltd.

11.5.1 Business Overview

11.5.2 Products & Services

11.5.3 Developments, 2014-2015

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 Larsen & Toubro Limited

11.6.1 Business Overview

11.6.2 Product Portfolio ( Medium Voltage Only)

11.6.3 Developments, 20122014

11.6.4 MnM View

11.7 Mitsubishi Electric Corporation

11.7.1 Business Overview

11.7.2 Products and Services

11.7.3 Developments, 2013-2015

11.7.4 SWOT Analysis

11.7.5 MnM View

11.8 Hitachi Ltd.

11.8.1 Business Overview

11.8.2 Product & Services

11.8.3 Developments, 2013-2014

11.8.4 Hitachi Ltd :SWOT Analysis

11.8.5 MnM View

11.9 Crompton Greaves Ltd.

11.9.1 Business Overview

11.9.2 Product Portfolio

11.9.3 Crompton Greaves Ltd : SWOT Analysis

11.9.4 Developments, 2011-2014

11.10 Fuji Electric

11.10.1 Business Overview

11.11 Toshiba

11.12 NR Electric Co., Ltd.

11.12.1 Business Overview

11.12.2 Developments, 2012-2014

11.13 Tebian Electric Apparatus

11.13.1 Introduction

11.13.2 Product Portfolio

11.13.3 Developments, 2014

11.14 Bharat Heavy Electricals Limited

11.14.1 Business Overview

11.14.2 Product Portfolio

11.14.3 Developments, 2014

12 Appendix (Page No. - 200)

12.1 Insights of Industry Experts

12.2 Other Developments

12.3 Discussion Guide

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Related Reports

List of Tables (72 Tables)

Table 1 Renovation & Growing Industrialization are the Driving Factors for High Voltage Equipment

Table 2 Competition From Local Players is Restraining the Growth of the High Voltage Equipment Market

Table 3 HVDC Transmission in Developing Countries Offer Growth Opportunities to the High Voltage Equipment Market

Table 4 Price Volatility for Raw Material is the Biggest Challenge of the High Voltage Equipment Market

Table 5 High Voltage Equipment Market Size, By Voltage Level, 2013-2020 (USD Billion)

Table 6 UHV-800kv & Above Market Size, By Region, 20132020 (USD Billion)

Table 7 HVDC-500kv Voltage Market Size, By Region, 20132020 (USD Billion)

Table 8 EHV-200 to 800kv Market Size, By Region, 20132020 (USD Billion)

Table 9 HV-Up to 200kv Voltage Market Size, By Region, 20132020 (USD Billion)

Table 10 High Voltage Equipment Market Size, By Equipment, 20132020 (USD Million)

Table 11 Switchgear Market Size, By Region, 20132020 (USD Million)

Table 12 Switches Market Size, By Region, 20132020 (USD Million)

Table 13 Power Transformer Market Size, By Region, 20132020 (USD Million)

Table 14 Instrument Transformer Market Size, By Region, 20132020 (USD Million)

Table 15 Reactive Power Equipment Market Size, By Region, 20132020 (USD Million)

Table 16 Insulator Market Size, By Region, 20132020 (USD Million)

Table 17 Control Equipment Market Size, By Region, 20132020 (USD Million)

Table 18 Relay Panel Market Size, By Region, 20132020 (USD Million)

Table 19 Carrier Cabinet Market Size, By Region, 20132020 (USD Million)

Table 20 Communication Equipment Market Size, By Region, 20132020 (USD Million)

Table 21 Scada Market Size, By Region, 20132020 (USD Million)

Table 22 Earthing Material Market Size, By Region, 20132020 (USD Million)

Table 23 Battery Set Market Size, By Region, 20132020 (USD Million)

Table 24 Other Equipment Market Size, By Region, 20132020 (USD Million)

Table 25 High Voltage Equipment Market Size, By Region, 2013-2020 (USD Billion)

Table 26 North America: High Voltage Equipment Market Size, By Country, 2013-2020 (USD Billion)

Table 27 North America: High Voltage Equipment Market Size, By Voltage Level, 2013-2020 (USD Billion)

Table 28 North America: High Voltage Equipment Market Size, By Equipment, 2013-2020 (USD Million)

Table 29 U.S.: High Voltage Equipment Market Size, By Voltage , 2013-2020 (USD Billion)

Table 30 Canada: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 31 Mexico: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 32 Europe: High Voltage Equipment Market Size, By Country, 2013-2020 (USD Billion)

Table 33 Europe: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 34 Europe: High Voltage Equipment Market Size, By Equipment, 2013-2020 (USD Million)

Table 35 U.K.: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 36 Germany: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 37 France: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 38 Russia: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 39 Rest of Europe: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 40 Asia-Pacific: High Voltage Equipment Market Size, By Country, 2013-2020 (USD Billion)

Table 41 Asia-Pacific: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 42 Asia-Pacific: High Voltage Equipment Market Size, By Equipment, 2013-2020 (USD Million)

Table 43 China: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 44 India: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 45 Australia: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 46 Japan: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 47 Rest of Asia-Pacific: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 48 South America: High Voltage Equipment Market Size, By Country, 2013-2020 (USD Billion)

Table 49 South America: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 50 South America: High Voltage Equipment Market Size, By Equipment, 2013-2020 (USD Million)

Table 51 Brazil: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 52 Argentina: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 53 Rest of South America: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 54 Middle East: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 55 Middle East: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 56 Middle East: High Voltage Equipment Market Size, By Equipment, 2013-2020 (USD Million)

Table 57 Saudi Arabia: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 58 UAE: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 59 Kuwait: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 60 Qatar: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 61 Rest of Middle East: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 62 Africa: High Voltage Equipment Market Size, By Country, 2013-2020 (USD Billion)

Table 63 Africa: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 64 Africa: High Voltage Equipment Market Size, By Equipment, 2013-2020 (USD Million)

Table 65 South Africa: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 66 Nigeria: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 67 Rest of Africa: High Voltage Equipment Market Size, By Voltage, 2013-2020 (USD Billion)

Table 68 Contracts & Agreements, 2011-2014

Table 69 Expansions, 2014-2015

Table 70 New Product Development, 2013-2014

Table 71 Joint Ventures, 2013-2014

Table 72 Mergers and Acquisitions, 2011-2014

List of Figures (53 Figures)

Figure 1 High Voltage Equipment Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 3 World Energy Consumption, 2010-2025, (Quadrillion BTU)

Figure 4 World Electricity Generation, 2008-2013, Regional Share

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 T&D Network Expansions Driving the High Voltage Equipment Market

Figure 8 Power Transformers Led the Market in 2014

Figure 9 High Voltage Equipment Market Size, 20152020

Figure 10 Asia-Pacific Accounted for the Largest Share in the High Voltage Equipment Market in 2014

Figure 11 High Voltage Equipment Market Share, By Voltage, 2014

Figure 12 Asia-Pacific & Europe are Expected to Dominate the Global High Voltage Equipment Market During the Forecast Period

Figure 13 Increase in Energy Demand From Emerging Economies to Create Growth Opportunities in the High Voltage Equipment Market

Figure 14 Asia-Pacific is Expected to Account for A Major Share of the High Voltage Equipment Market During the Forecast Period

Figure 15 China Held the Maximum Share in the Asia-Pacific High Voltage Equipment Market

Figure 16 Asia-Pacific Accounted for the Largest Share in the High Voltage Equipment Market in 2014

Figure 17 Developing Economies to Grow Faster Than the Developed Ones

Figure 18 EHV Transmission Equipment has A Promising Future in Emerging Economies of the Region From 2015 to 2020

Figure 19 The African Market is Expected to Enter the Exponential Growth Phase in Coming Years

Figure 20 High Voltage Equipment Market, By Equipment

Figure 21 High Voltage Equipment Market: By Voltage

Figure 22 High Voltage Equipment Market: By Region

Figure 23 Industrialization & Replacement of Old Infrastructure are Driving the Market

Figure 24 High Voltage Equipment Market: Value Chain Analysis

Figure 25 High Voltage Equipment Market: Supply Chain Analysis

Figure 26 High Voltage Equipment Market: Porters Five Forces Analysis

Figure 27 High Voltage Equipment Market Size, By Voltage Level, 2015-2020 (USD Billion)

Figure 28 High Voltage Equipment Market Size, By Equipment (2015-2020)

Figure 29 Power Transformer Market Size, By Region, 2014 & 2020 (USD Million)

Figure 30 Insulators Market Share, By Region, 2015 & 2020

Figure 31 Regional Snapshot: Rapid Growth Markets are Emerging as New Hot Spots

Figure 32 Regional Snapshot: Emerging Technologies of Europe Provide Attractive Market Opportunities

Figure 33 Regional Snapshot: Emerging Economies of Asia-Pacific Provide Attractive Market Opportunities

Figure 34 Companies Adopted Expansions and Contracts & Agreements to Gain Traction in the Market

Figure 35 Battle for Market Share: Contracts and Expansions are the Key Strategies, 2011-2014

Figure 36 Market Evaluation Framework: A Significant Number of Expansions and Contracts & Agreements has Fuelled Growth and Innovation From 2011 to 2014

Figure 37 Geographic Revenue Mix of the Top 4 Market Players

Figure 38 General Electric Company : Company Snapshot

Figure 39 General Electric Company : SWOT Analysis

Figure 40 Alstom SA: Company Snapshot

Figure 41 Siemens AG: Company Snapshot

Figure 42 Siemens AG: SWOT Analysis

Figure 43 ABB Ltd.: Company Snapshot

Figure 44 ABB Ltd.: SWOT Analysis

Figure 45 Larsen & Toubro Limited: Company Snapshot

Figure 46 Mitsubishi Electric Corporation: Company Snapshot

Figure 47 Hitachi Ltd.: Company Snapshot

Figure 48 Crompton Greaves Limited : Company Snapshot

Figure 49 Fuji Electric: Business Overview

Figure 50 Toshiba: Business Overview

Figure 51 NR Electric Co., Ltd.: Business Overview

Figure 52 Tbea: Business Overview

Figure 53 Bharat Heavy Electricals Limited: Business Overview

Growth opportunities and latent adjacency in High Voltage Equipment Market