HVAC Filters Market by Material (Fiberglass, Synthetic Polymer, Carbon, Metal), Technology (HEPA, Electrostatic Precipitator, Activated Carbon), End-use Industry (Building & Construction, Pharmaceutical, Food & Beverage) & Region - Global Forecast to 2026

HVAC Filters Market

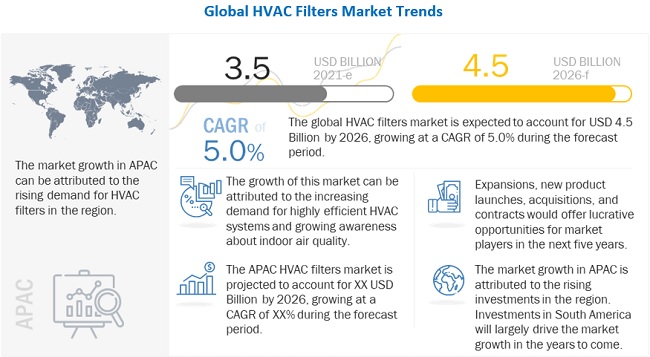

The global HVAC filters market was valued at USD 3.5 billion in 2021 and is projected to reach USD 4.5 billion by 2026, growing at a cagr 5.0% from 2021 to 2026. The driving factor for the market is increasing demand for HVAC systems, growing awareness about indoor air quality, and government regulations and policies for efficient filtration. Further, increasing investments in the construction sector and technological advancements in HVAC filters are expected to offer significant growth opportunities to manufacturers.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the HVAC Filters Market

The COVID-19 pandemic is causing widespread concern and economic hardship for consumers, businesses, and communities across the globe. Manufacturers are facing sudden challenges caused by the crisis, and HVAC system producers are no exception.

The primary transmission vector for the spread of COVID-19 is person-to-person. Social distancing is an important step in reducing the spread of COVID-19, but respiratory droplets can be transmitted through a building's HVAC system and infect others regardless of the implementation of social distancing measures.

In a recent survey conducted by Air Conditioning, Heating and Refrigeration (ACHR) Magazine that measured the effect of COVID-19 on the industry revealed that over 50% of respondents selected either "business is slowing down" or "the business has dropped off significantly."

The outbreak has got people calling into question the quality of the air they breathe at home, leading to an increase in interest in new air filters and UV air purifying products. In Southern parts of India, temperatures continue to rise as reaching the summer months. Customers do not seem to be putting off AC repairs, which is also contributing to an increased workload for residential HVAC firms.

Some commercial HVAC businesses have seen an uptick in service calls coming from "essential" buildings, such as healthcare facilities and grocery stores. Some stable businesses are taking advantage of the downtime by reaching out to commercial HVAC teams to service their HVAC units while their buildings are not occupied.

HVAC Filters Market Dynamics

Driver: Increasing demand for HVAC systems

According to the American Meteorological Society's State of the Climate, 2018 was recorded as the warmest year due to global warming. Climatic changes were visible in Europe and the Mediterranean Sea, the Middle East, New Zealand, parts of Asia, and regions surrounding oceans. The Society also forecasts that the global temperature will be 32.90 F more than the average temperature by 2020. Variation and changes in climatic conditions have led to the increase in demand for electrical cooling systems in summers and, simultaneously, for natural gas, heating oil, wood, and electrical heating systems in winters. Residential, commercial, and industrial buildings across the globe also use some form of heating, cooling, or climate control technologies to obtain thermal comfort and satisfactory levels of indoor air quality. Hence, with rising global temperatures and variation in climatic conditions, the demand for HVAC systems has increased, which is subsequently driving the HVAC filters market.

Restraint: Rising environmental concerns

According to the International Energy Agency, the sales of air conditioners (ACs) witnessed a growth of around 15% during 2017–2018. An increase in the sales of ACs will also lead to an increase in the air pollutants that are released during the functioning of the systems. ACs release hydrofluorocarbons (HFCs), which trap heat in the atmosphere, thus contributing to global warming. HVAC systems also consume around 32% of the total energy. The increased demand for and sales of ACs will consequently increase the amount of energy and power consumed during the operation. This will ultimately set pressure on fossil fuel reserves, as the majority of the power is generated through fossil fuel, such as coal. The use of highly efficient filters in HVAC systems also increases energy consumption to prevent pressure drops. To avoid the above situations, manufacturers of HVAC systems and filters are required to develop energy-efficient and low carbon-emitting systems, which will lead to the increased cost of HVAC systems and filters. Hence, rising environmental concerns due to the increased use of HVAC systems are hampering the growth of the HVAC filters market.

Opportunity: Technological advancement in HVAC filters

With the increased consumption of HVAC systems and filters, manufacturers adopt various technologies to produce highly efficient filters and systems. HVAC filters are now available with technologically advanced software systems. For instance, under the Filtrete brand, the 3M Company has developed a Bluetooth-enabled HVAC filter for residential buildings. The smart filter can provide its end-user with information related to airflow, pressure drop, life tracking, real-time indoor air quality reading, and replacement reminder, among others.

Therefore, with technological advancements, the demand for smart filters will increase in several end-user industries, as these smart filters can help save maintenance costs and man-hours. Such development will provide growth opportunities for manufacturers of HVAC filters.

Challenges: Higher cost and maintenance of efficient HVAC filters

HVAC filters play an important role in the performance of HVAC systems. These filters can trap dust and pollen particles that pass through the systems. Depending upon their MERV ratings and dust collecting capabilities, these filters find applications in pharmaceutical production plants and food & beverage processing units. For instance, HEPA filters, capable of filtering every dust particle of 0.3µm, are mostly used in pharmaceutical and cleanroom applications. Such filters are, however, costly and can prevent airflow. HVAC systems with HEPA filters/efficient filters require more energy and power to maintain the airflow through filters. Higher the efficiency of HVAC filters, the higher the energy consumption of HVAC systems.

Most of the filters also require a replacement after the expiry of their shelf life or when the dust particles block the filter media. The cost of filters also depends on the price of raw materials used during filter media manufacturing. The price of synthetic polymer, for instance, depends on the price variation of crude oil.

“The HVAC filters market is projected to register a CAGR of 5% during the forecast period, in terms of value.”

The HVAC filters market size was USD 3.5 billion in 2021 and is projected to reach USD 4.5 billion by 2026. Increasing demand for HVAC systems, growing awareness about indoor air quality, and government regulations and policies for efficient filtration are the factors driving the market for HVAC filters. However, rising environmental concerns are expected to restrain this market. Increasing investments in the construction sector and technological advancements in HVAC filters are expected to offer significant growth opportunities to manufacturers.

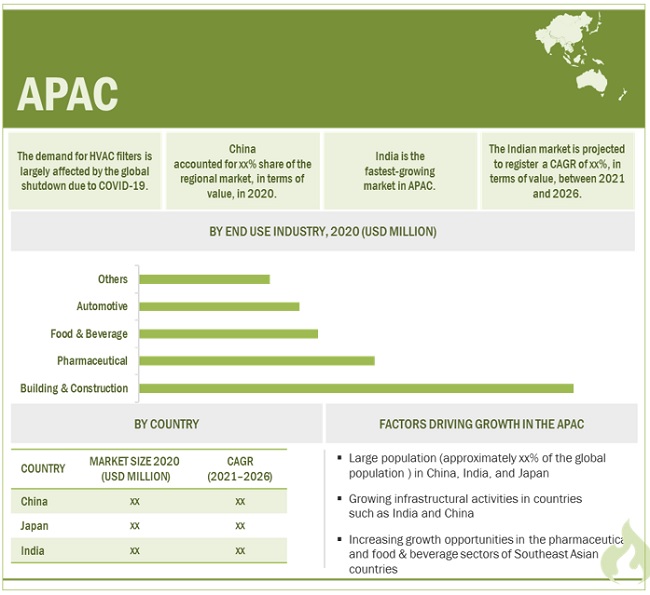

“APAC is the largest market for HVAC filters.”

APAC is the largest and fastest-growing market for HVAC filters. The region is witnessing high growth in the HVAC filters market due to large construction and infrastructure activities being carried out. The growth of the HVAC filters market is mainly attributed to the demand from China, India, and Southeast Asian countries. These bustling economies have a lot of potential customers. In terms of value, North America is expected to lead the HVAC filters market during the forecast period, owing to the rise in demand for highly efficient filters in the pharmaceutical and food & beverage industries in the region. However, due to the COVID-19 pandemic, the building & construction and automotive industries suffered huge losses due to the global lockdown.

To know about the assumptions considered for the study, download the pdf brochure

HVAC Filters Market Players

3M Company (US), Parker-Hannifin Corporation (US), Camfil AB (Sweden), Mann+Hummel (Germany), American Air Filter Company, Inc. (US), Donaldson Company, Inc. (US) among others, are the leading HVAC filters manufacturers, globally.

HVAC Filters Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 3.5 billion |

|

Revenue Forecast in 2026 |

USD 4.5 billion |

|

CAGR |

5.0% |

|

Market Size Available for Years |

2019-2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021-2026 |

|

Forecast Units |

Value (USD million) |

|

Segments Covered |

Material, Technology, End-Use Industry and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East, |

|

Companies Covered |

Some of the leading players operating in the HVAC filters market include 3M Company (US), Parker-Hannifin Corporation (US), Camfil AB (Sweden), Mann+Hummel (Germany), American Air Filter Company, Inc. (US), Donaldson Company, Inc. (US) |

This research report categorizes the HVAC filters market based on Material, Technology, End-Use Industry and region.

HVAC Filters Market, By Material

- Synthetic Polymer

- Fiberglass

- Carbon

- Metal

HVAC Filters Market, By Technology

- HEPA

- Electrostatic Precipitators

- Activated Carbon

- Others

HVAC Filters Market, By End-Use Industry

- Building & Construction

- Pharmaceutical

- Food & Beverage

- Automotive

- Others

HVAC Filters Market, By Region

- Asia Pacific

- North America

- Europe

- Middle East

- South America

Recent Developments

- In April 2018, 3M Company partnered with Amazon to integrate its Filtrete smart air filter with Amazon Dash Replenishment. This partnership is intended to increase the sales of its air filters on Amazon. The smart air filter, connected through Bluetooth, automatically orders the filter when a replacement is needed. The filter is paired with Bluetooth and Amazon Dash Replenishment, which estimates when to change the air filter and what size and type to purchase. This partnership has helped the company enhance its customers’ purchasing experience.

- In January 2018, the Filtrete brand of the 3M Company developed a Bluetooth-enabled HVAC filter for residential buildings. The filter contains a Bluetooth-enabled sensor that will provide the end-user with information related to airflow, pressure drop, life tracking, real-time indoor air quality reading, replacement reminder, and others. This development has helped the company create interest among end-users in the product.

- In April 2020, Parker Hannifin Corporation launched QuadSEAL 4, designed specifically for commercial HVAC applications. This product helps building owners earn points toward LEED green building certification. Its applications include hotels and entertainment complexes, food processing, microelectronics manufacturing, data centers, commercial office buildings, schools and universities, clean manufacturing facilities, hospitals and healthcare facilities, government institutions, and industrial manufacturing.

- In April 2020, Parker HVAC Filtration, a division of Parker Hannifin Corporation, has launched a new line of Micropleat high-efficiency filters designed for HVAC applications and featuring a media blend and a mini-pleat design. The filters provide high levels of particulate removal, dust-holding capacity, and efficiency, and others required in a high-purity air filter. Designed to trap microscopic particles and contaminants in the air stream, Micropleat filters meet both High-Efficiency Particulate Air (HEPA) and Ultra-Low Particulate Air (ULPA) minimum ratings of up to 99.97% at 0.3 microns and 99.999% at 0.12 microns, respectively.

Frequently Asked Questions (FAQ):

Does this report cover volume tables in addition to the value tables?

Yes

Which countries are considered in the European region?

The report includes the following European countries

- Germany

- UK

- France

- Spain

- Italy

What is the COVID-19 impact on the HVAC filters market?

Industry experts believe that COVID-19 would have a significant impact on HVAC filters market. There seems to be decrease in the demand for HVAC filters from end-use industries, during COVID-19.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 27)

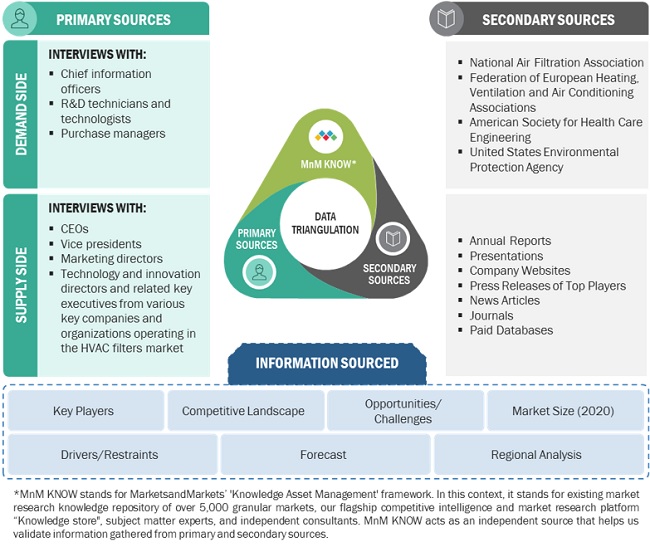

2.1 RESEARCH DATA

FIGURE 1 HVAC FILTERS MARKET: RESEARCH DESIGN

2.2 FORECAST NUMBER CALCULATION

2.3 MARKET ENGINEERING PROCESS

2.3.1 TOP-DOWN APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.4 ASSUMPTIONS

2.5 LIMITATIONS

2.6 RESEARCH DATA

2.6.1 SECONDARY DATA

2.6.1.1 Key data from secondary sources

2.6.2 PRIMARY DATA

2.6.2.1 Key data from primary sources

2.6.2.2 Breakdown of primary interviews

2.6.2.3 Key industry insights

2.7 DATA TRIANGULATION

3 EXECUTIVE SUMMARY (Page No. - 33)

FIGURE 4 SYNTHETIC POLYMER TO BE FASTEST-GROWING MATERIAL SEGMENT

FIGURE 5 HEPA TO ACCOUNT FOR LARGEST SHARE IN HVAC FILTERS MARKET

FIGURE 6 FOOD & BEVERAGE INDUSTRY TO BE IN FOREFRONT IN NEXT FIVE YEARS

FIGURE 7 ASIA PACIFIC TO LEAD HVAC FILTERS MARKET

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 ATTRACTIVE OPPORTUNITIES IN HVAC FILTERS MARKET

FIGURE 8 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 HVAC FILTERS MARKET, BY MATERIAL

FIGURE 9 SYNTHETIC POLYMER TO BE LARGEST AND FASTEST-GROWING SEGMENT

4.3 HVAC FILTERS MARKET, BY TECHNOLOGY

FIGURE 10 HEPA SECTOR TO RECORD HIGHEST CAGR IN TERMS OF VOLUME

4.4 HVAC FILTERS MARKET, BY END-USE INDUSTRY

FIGURE 11 BUILDING & CONSTRUCTION TO ACCOUNT FOR LARGEST MARKET SHARE

4.5 HVAC FILTERS MARKET, BY REGION

FIGURE 12 ASIA PACIFIC TO BE AT GROWTH FOREFRONT IN HVAC FILTERS MARKET

4.6 HVAC FILTERS MARKET: MAJOR COUNTRIES

FIGURE 13 INDIA TO REGISTER HIGHEST CAGR IN MARKET

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HVAC FILTERS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for HVAC systems

TABLE 1 GLOBAL AIR CONDITIONER DEMAND, BY REGION (THOUSAND UNITS)

5.2.1.2 Growing awareness about indoor air quality

5.2.1.3 Government regulations and policies for efficient filtration

TABLE 2 MERV RATING CHART

5.2.2 RESTRAINTS

5.2.2.1 Rising environmental concerns

FIGURE 15 HVAC AND REFRIGERATION ENERGY CONSUMPTION

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing investments in construction sector

5.2.3.2 Technological advancement in HVAC filters

5.2.4 CHALLENGES

5.2.4.1 Higher cost and maintenance of efficient HVAC filters

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 16 PORTER'S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ENVIRONMENTAL FACTORS

5.5 COVID-19 IMPACT ON HVAC FILTERS MARKET

5.5.1 IMPACT OF COVID-19 ON HVAC INDUSTRY

5.5.1.1 Impact of COVID-19 on building & construction industry

5.5.1.2 Impact of COVID-19 on pharmaceutical industry

5.5.1.3 Impact of COVID-19 on food & beverage industry

5.5.1.4 Impact of COVID-19 on automotive industry

5.5.1.5 Impact of COVID-19 on various countries

6 HVAC FILTERS MARKET, BY SYSTEM (Page No. - 48)

6.1 INTRODUCTION

6.2 HEAT PUMPS

6.3 ROOFTOP UNITS

6.4 GEOTHERMAL HEAT PUMPS

6.5 PACKAGED AIR CONDITIONERS

6.6 SPLIT SYSTEM HVAC

6.7 DUCTLESS SYSTEMS

6.8 HYBRID HVAC SYSTEMS

7 HVAC FILTERS MARKET, BY MATERIAL (Page No. - 50)

7.1 INTRODUCTION

FIGURE 17 CARBON TO BE MOST DOMINANT SEGMENT OF HVAC FILTERS MARKET IN 2021

TABLE 3 HVAC FILTERS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 4 HVAC FILTERS MARKET SIZE, BY MATERIAL, 2019–2026 (THOUSAND UNITS)

7.2 SYNTHETIC POLYMER

7.2.1 HIGH EFFICIENCY, WASHABILITY, AND LONGEVITY TO INCREASE USES

7.3 FIBERGLASS

7.3.1 LOW COST, DIMENSIONAL STABILITY, DESIGN FLEXIBILITY, AND EXCELLENT ELECTRICAL PROPERTIES TO INCREASE DEMAND

7.4 CARBON

7.4.1 ABILITY TO ABSORB ODORS AND GASES TO FUEL THE DEMAND

7.5 METAL

7.5.1 EASY CLEANING AND REUSABILITY MAKE IT SUITABLE FOR HVAC SYSTEMS

8 HVAC FILTERS MARKET, BY TECHNOLOGY (Page No. - 54)

8.1 INTRODUCTION

FIGURE 18 HEPA SEGMENT TO BE LARGEST TECHNOLOGY THROUGH 2026

TABLE 5 HVAC FILTERS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 6 HVAC FILTERS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (THOUSAND UNITS)

8.2 HEPA

8.2.1 RISING DEMAND FOR HIGHLY EFFICIENT HVAC FILTERS IN PHARMACEUTICAL, FOOD & BEVERAGE, AND SEMICONDUCTOR INDUSTRIES

8.3 ELECTROSTATIC PRECIPITATOR

8.3.1 LOW-PRESSURE DROP AND WASHABLE PROPERTIES TO DRIVE DEMAND

8.4 ACTIVATED CARBON

8.4.1 INCREASING DEMAND FOR ODOR, GAS, AND TOXIC FUMES CONTROL FILTERS

8.5 OTHERS

9 HVAC FILTERS MARKET, BY END-USE INDUSTRY (Page No. - 58)

9.1 INTRODUCTION

FIGURE 19 BUILDING & CONSTRUCTION TO BE LARGEST END-USE INDUSTRY

TABLE 7 HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 8 HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

9.2 BUILDING & CONSTRUCTION

9.2.1 INCREASING DEMAND FOR GREEN BUILDINGS AND AWARENESS ABOUT INDOOR AIR QUALITY

9.3 PHARMACEUTICAL

9.3.1 INCREASE IN DEMAND FOR HIGH-EFFICIENCY FILTERS FOR CRITICAL MANUFACTURING PROCESSES

9.4 FOOD & BEVERAGE

9.4.1 INCREASE IN DEMAND FOR IMPROVED AIR QUALITY IN FOOD PROCESSING PLANTS

9.5 AUTOMOTIVE

9.5.1 INCREASE IN VEHICULAR TRAFFIC AND AIR POLLUTION

9.6 OTHERS

10 HVAC FILTERS MARKET, BY REGION (Page No. - 62)

10.1 INTRODUCTION

FIGURE 20 INDIA TO BE FASTEST-GROWING HVAC FILTERS MARKET

TABLE 9 HVAC FILTERS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 10 HVAC FILTERS MARKET SIZE, BY REGION, 2019–2026 (THOUSAND UNITS)

10.2 APAC

FIGURE 21 APAC: HVAC FILTERS MARKET SNAPSHOT

TABLE 11 APAC: HVAC FILTERS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 12 APAC: HVAC FILTERS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNITS)

TABLE 13 APAC: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 14 APAC: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.2.1 CHINA

10.2.1.1 Rising green building construction activities boosting market growth

TABLE 15 CHINA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 16 CHINA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.2.2 JAPAN

10.2.2.1 Increase in demand for HVAC systems in various end-use industries

TABLE 17 JAPAN: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 18 JAPAN: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.2.3 INDIA

10.2.3.1 Increasing commercial construction activities

TABLE 19 INDIA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 20 INDIA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.2.4 INDONESIA

10.2.4.1 Increasing construction activities to drive the market

TABLE 21 INDONESIA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 22 INDONESIA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.2.5 SOUTH KOREA

10.2.5.1 Growing food & beverage industry to augment market growth

TABLE 23 SOUTH KOREA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 24 SOUTH KOREA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.2.6 AUSTRALIA

10.2.6.1 Rising demand for high-efficiency HVAC filters in food & beverage and pharmaceutical industries

TABLE 25 AUSTRALIA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 26 AUSTRALIA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.2.7 REST OF APAC

TABLE 27 REST OF APAC: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 28 REST OF APAC: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.3 NORTH AMERICA

TABLE 29 NORTH AMERICA: HVAC FILTERS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 30 NORTH AMERICA: HVAC FILTERS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNITS)

TABLE 31 NORTH AMERICA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 32 NORTH AMERICA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.3.1 US

10.3.1.1 Stringent regulations and technological advancements propelling market growth

TABLE 33 US: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 34 US: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.3.2 CANADA

10.3.2.1 Increase in demand for energy-efficient HVAC systems

TABLE 35 CANADA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 36 CANADA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.3.3 MEXICO

10.3.3.1 Increase in construction activities and pharmaceutical production

TABLE 37 MEXICO: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 38 MEXICO: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.4 EUROPE

TABLE 39 EUROPE: HVAC FILTERS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 40 EUROPE: HVAC FILTERS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNITS)

TABLE 41 EUROPE: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 42 EUROPE: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.4.1 GERMANY

10.4.1.1 Increase in pharmaceuticals production to drive the market

TABLE 43 GERMANY: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 44 GERMANY: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.4.2 UK

10.4.2.1 Growth in the building & construction industry

TABLE 45 UK: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 46 UK: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.4.3 FRANCE

10.4.3.1 Rise in demand from food & beverage end-use industry

TABLE 47 FRANCE: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 48 FRANCE: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.4.4 ITALY

10.4.4.1 Increase in sales of automotive vehicles supporting market growth

TABLE 49 ITALY: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 50 ITALY: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.4.5 SPAIN

10.4.5.1 Rapid industrialization contributing to the market

TABLE 51 SPAIN: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 52 SPAIN: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.4.6 RUSSIA

10.4.6.1 Rise in demand for air conditioners to support the market

TABLE 53 RUSSIA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 54 RUSSIA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.4.7 REST OF EUROPE

TABLE 55 REST OF EUROPE: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 56 REST OF EUROPE: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.5 MIDDLE EAST & AFRICA

TABLE 57 MIDDLE EAST & AFRICA: HVAC FILTERS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA: HVAC FILTERS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNITS)

TABLE 59 MIDDLE EAST & AFRICA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.5.1 SAUDI ARABIA

10.5.1.1 Increasing automotive vehicle sales to propel the market

TABLE 61 SAUDI ARABIA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 62 SAUDI ARABIA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.5.2 EGYPT

10.5.2.1 Government investments in manufacturing industries to improve air quality

TABLE 63 EGYPT: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 64 EGYPT: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.5.3 UAE

10.5.3.1 Rise in automotive vehicle sales to drive the market

TABLE 65 UAE: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 66 UAE: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 67 REST OF MIDDLE EAST & AFRICA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 68 REST OF MIDDLE EAST & AFRICA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.6 SOUTH AMERICA

TABLE 69 SOUTH AMERICA: HVAC FILTERS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 70 SOUTH AMERICA: HVAC FILTERS MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND UNITS)

TABLE 71 SOUTH AMERICA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 72 SOUTH AMERICA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.6.1 BRAZIL

10.6.1.1 Increase in demand for pharmaceutical products and automotive vehicles propelling market

TABLE 73 BRAZIL: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 74 BRAZIL: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.6.2 ARGENTINA

10.6.2.1 High demand for food & beverage products

TABLE 75 ARGENTINA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 76 ARGENTINA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

10.6.3 REST OF SOUTH AMERICA

TABLE 77 REST OF SOUTH AMERICA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 78 REST OF SOUTH AMERICA: HVAC FILTERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND UNITS)

11 COMPETITIVE LANDSCAPE (Page No. - 95)

11.1 INTRODUCTION

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 STAR

11.2.2 EMERGING LEADERS

11.2.3 PERVASIVE

11.2.4 EMERGING COMPANIES

FIGURE 22 HVAC FILTERS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

11.3 STRENGTH OF PRODUCT PORTFOLIO

11.4 BUSINESS STRATEGY EXCELLENCE

11.5 MARKET SHARE OF KEY PLAYERS IN HVAC FILTERS MARKET, 2020

12 COMPANY PROFILES (Page No. - 100)

12.1 3M COMPANY

(Business overview, Products offered, Recent developments, SWOT analysis, Winning imperatives, Current focus and strategies, Threat from competition, and Right to win)*

TABLE 79 3M COMPANY: BUSINESS OVERVIEW

FIGURE 23 3M COMPANY: COMPANY SNAPSHOT

FIGURE 24 3M COMPANY: SWOT ANALYSIS

12.2 PARKER-HANNIFIN CORPORATION

TABLE 80 PARKER-HANNIFIN CORPORATION: BUSINESS OVERVIEW

FIGURE 25 PARKER-HANNIFIN CORPORATION: COMPANY SNAPSHOT

FIGURE 26 PARKER-HANNIFIN CORPORATION: SWOT ANALYSIS

12.3 CAMFIL AB

TABLE 81 CAMFIL AB: BUSINESS OVERVIEW

FIGURE 27 CAMFIL AB: COMPANY SNAPSHOT

FIGURE 28 CAMFIL AB: SWOT ANALYSIS

12.4 MANN+HUMMEL

TABLE 82 MANN+HUMMEL: BUSINESS OVERVIEW

FIGURE 29 MANN+HUMMEL: COMPANY SNAPSHOT

FIGURE 30 MANN+HUMMEL: SWOT ANALYSIS

12.5 AMERICAN AIR FILTER COMPANY, INC.

TABLE 83 AMERICAN AIR FILTER COMPANY, INC.: BUSINESS OVERVIEW

FIGURE 31 AMERICAN AIR FILTER COMPANY, INC.: SWOT ANALYSIS

12.6 DONALDSON COMPANY, INC.

TABLE 84 DONALDSON COMPANY, INC.: BUSINESS OVERVIEW

FIGURE 32 DONALDSON COMPANY, INC.: COMPANY SNAPSHOT

FIGURE 33 DONALDSON COMPANY, INC.: SWOT ANALYSIS

12.7 AHLSTROM-MUNKSJÖ

TABLE 85 AHLSTROM-MUNKSJÖ: BUSINESS OVERVIEW

FIGURE 34 AHLSTROM-MUNKSJÖ: COMPANY SNAPSHOT

FIGURE 35 AHLSTROM-MUNKSJÖ: SWOT ANALYSIS

12.8 FILTRATION GROUP CORPORATION

TABLE 86 FILTRATION GROUP CORPORATION: BUSINESS OVERVIEW

FIGURE 36 FILTRATION GROUP CORPORATION: SWOT ANALYSIS

12.9 FREUDENBERG GROUP

TABLE 87 FREUDENBERG GROUP: BUSINESS OVERVIEW

FIGURE 37 FREUDENBERG GROUP: COMPANY SNAPSHOT

FIGURE 38 FREUDENBERG GROUP: SWOT ANALYSIS

12.10 SOGEFI GROUP

TABLE 88 SOGEFI GROUP: BUSINESS OVERVIEW

FIGURE 39 SOGEFI GROUP: COMPANY SNAPSHOT

FIGURE 40 SOGEFI GROUP: SWOT ANALYSIS

12.11 GVS GROUP

TABLE 89 GVS GROUP: BUSINESS OVERVIEW

FIGURE 41 GVS GROUP: COMPANY SNAPSHOT

FIGURE 42 GVS GROUP: SWOT ANALYSIS

12.12 SPECTRUM FILTRATION PVT. LTD.

TABLE 90 SPECTRUM FILTRATION PVT. LTD.: BUSINESS OVERVIEW

FIGURE 43 SPECTRUM FILTRATION PVT. LTD.: SWOT ANALYSIS

12.13 EMIRATES INDUSTRIAL FILTERS LLC

TABLE 91 EMIRATES INDUSTRIAL FILTERS LLC: BUSINESS OVERVIEW

FIGURE 44 EMIRATES INDUSTRIAL FILTERS LLC: SWOT ANALYSIS

12.14 KOCH FILTER

TABLE 92 KOCH FILTER: BUSINESS OVERVIEW

FIGURE 45 KOCH FILTER: SWOT ANALYSIS

12.15 SANDLER AG

TABLE 93 SANDLER AG: BUSINESS OVERVIEW

FIGURE 46 SANDLER AG.: SWOT ANALYSIS

12.16 TROY FILTERS LTD.

TABLE 94 TROY FILTERS LTD.: BUSINESS OVERVIEW

12.17 DHA FILTER

TABLE 95 DHA FILTER: BUSINESS OVERVIEW

12.18 GENERAL FILTER HAVAK

TABLE 96 GENERAL FILTER HAVAK: BUSINESS OVERVIEW

12.19 JOHNS MANVILLE

TABLE 97 JOHNS MANVILLE: BUSINESS OVERVIEW

12.20 HOLLINGSWORTH & VOSE

TABLE 98 HOLLINGSWORTH & VOSE: BUSINESS OVERVIEW

12.21 OTHER PLAYERS

12.21.1 AIR FILTERS, INC.

12.21.2 TEX-AIR FILTERS

12.21.3 A-J MANUFACTURING

12.21.4 FILT AIR LTD.

12.21.5 AIRSAN CORPORATION

*Details on Business overview, Products offered, Recent developments, SWOT analysis, Winning imperatives, Current focus and strategies, Threat from competition, and Right to win not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 149)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The global HVAC filters market is estimated to be USD 3.5 billion in 2021 and is projected to reach USD 4.5 billion by 2026, at a CAGR of 5.0% from 2021 to 2026. The driving factor for the HVAC filters market is increasing demand for HVAC systems, growing awareness about indoor air quality, and government regulations and policies for efficient filtration. Further, increasing investments in the construction sector and technological advancements in HVAC filters are expected to offer significant growth opportunities to manufacturers.

Secondary Research

Secondary data includes company information acquired from annual reports, press releases, and investor presentations; white papers; and articles from recognized authors. In the market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), both top-down and bottom-up approaches were extensively used, along with several data triangulation methods to obtain, verify, and validate the market revenue arrived at. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

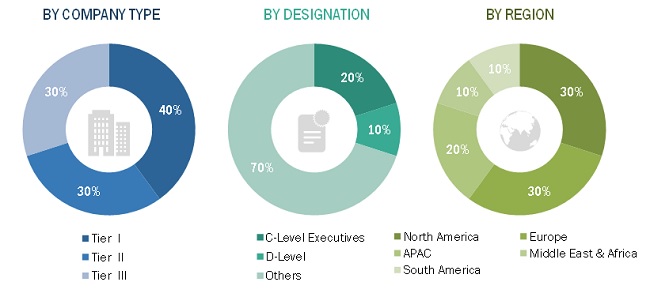

Primary Research

In the primary research process, experts from the supply and demand sides were interviewed to obtain qualitative and quantitative information and validate the data through secondary research. Primary sources from the supply-side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the HVAC filters market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

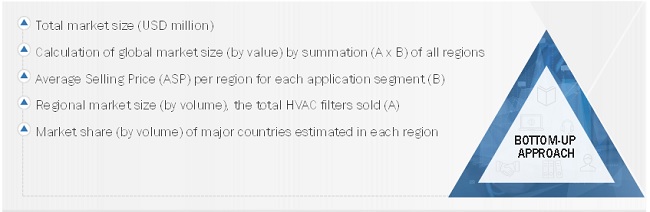

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the HVAC filters market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry and markets were identified through extensive secondary research.

The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

HVAC Filters Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

HVAC Filters Market: Top-Down Approach

Data Triangulation

After arriving at the total market size, the overall market was split into several segments. The data triangulation procedure was employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments. The data was triangulated by studying various factors and trends from the demand and supply sides. It was then verified through primary interviews. Hence, there were three sources for every data: primary source, secondary source, and MNM KNOW. The data were assumed to be correct when the values arrived at from the three points matched.

Report Objectives

- To define, describe, and forecast the market size for heating, ventilation, and air conditioning (HVAC) filters, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To estimate and forecast the HVAC filters market size on the basis of material, technology, end-use industry, and region

- To analyze and forecast the HVAC filters market on the basis of major regions—Asia Pacific (APAC), Europe, North America, South America, and Middle East & Africa

- To analyze opportunities in the market for stakeholders and present a competitive landscape of the market leaders

- To analyze recent developments in the market, such as investments & expansions and mergers & acquisitions

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations:

- With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

- The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in HVAC Filters Market

The HVAC Filters Market report gives a holistic view of the market talking about macro data, competitive landscape, potential growth opportunities as well as market sizing by following segmentations:

1. Material (Fiberglass, Synthetic Polymer, Carbon, Metal), 2. Technology (HEPA, Electrostatic Precipitator, Activated Carbon), 3. End-use Industry (Building & Construction, Pharmaceutical, Food & Beverage), 4. Region (North America, Europe, Asia-Pacific, MEA, South America)

The HVAC Filters Industry report will provide you with the market size in USD Million and Thousand Units for the HVAC Filters Market segmented by Material, Technology and End User Industry. The data is further segmented and provided for North America, South America ,Europe, Middle East & Africa, APAC and also for the major countries in these regions along with competitive landscape and company profiles for 25 companies. The forecast is Provided till 2024.

HVAC Filters Market report does provide the market size in USD Million and Thousand Units for the US market along with the major countries ( 18) in the report. Data can be compared on Global, Regional and country level market size.

Similar reports on Filtration market are as below:

* Liquid Filtration Market by Fabric Material (Polymer, Cotton, and Metal), Filter Media (Woven, Nonwoven, and Mesh), End-User (Municipal Treatment, Food & Beverage, Metal & Mining, Chemical, and Pharmaceutical), Region - Global Forecast to 2024

* Industrial Filters Market by Type (Liquid and Air Filter Media), End-use Industry (Food & Beverage, Metal & Mining, Chemical, Pharmaceutical, and Power Generation), and Region (APAC, Europe, North America, MEA, and SA) - Global Forecast to 2023

* Fabric Filters Market by Type (Liquid and Air Filter Media), End-use Industry (Food & Beverage, Metal & Mining, Chemical, Pharmaceutical, Power Generation), Region (APAC, Europe, North America, MEA, and South America) - Global Forecast to 2024

*Automotive Filters Market by Type (Air, Fuel, Oil, Cabin, Coolant, Brake Dust, Oil Separator, Transmission, Steering, Dryer Cartridge, EMI/EMC, Coolant Air Particle), Air & Cabin Filter Media, Fuel & Vehicle Type, Aftermarket - Global Forecast to 2025

* Pharmaceutical Filtration Market by Product (Membrane Filters, Single-Use Systems), Technique (Microfiltration, Ultrafiltration), Application (Final Product Processing, Raw material), Scale of Operation (Manufacturing, Pilot, R&D) - Global Forecast to 2021

* Pharmaceutical Membrane Filtration Market by Product (Filter, Systems), Technique (Microfiltration, Ultrafiltration), Material (PES, PVDF, PTFE, PCTE), Application (Final Product (Sterile), Raw Material (Bioburden), Cell Separation, Air) - Global Forecast to 2024

* Membrane Filtration Market by Type (RO, UF, MF, NF), Application (Water, Dairy, Drinks & Concentrates, Wine & Beer), Module Design (Spiral, Tubular, Plate & Frame), Membrane Material (Polymeric & Ceramic), and Region - Global Forecast to 2025

* Depth Filtration Market by Media Type (Diatomaceous Earth, Activated Carbon, Cellulose), Product (Filter Cartridge, Capsule Filter), Application (Final Product Processing (Small Molecules, Biologics), Cell clarification) - Global Forecast to 2022

* Tangential Flow Filtration Market by Product (TFF System, Membrane Filter), Application (Bioprocess, Viral Vector Purification), Technique (Ultrafiltration, Microfiltration), Material Type (PES/PS Membrane), Region - Global Forecast to 2024

* Hollow Fiber Filtration Market by Technique (Microfiltration, Ultrafiltration), Material (Polymer, Ceramic), Application (Harvest & Clarification, Concentration, Perfusion), End User (Pharmaceutical Manufacturer, CRO, CMO) - Global Forecast to 2023

* Virus Filtration Market by Product (Kits & Reagents, Systems, Services), Application (Biologics (Vaccine & Therapeutics, Blood, Tissues, Stem Cells), Devices, Air, Water Purification), End User (Biopharmaceutical, CROs, Research) - Global Forecast to 2020