Human Insulin Market By Drugs (Biologics, Biosimilars), Type (Short Acting, Long Acting, Premixed), Brands (Lantus, NovoRapid, Humalog), Delivery Devices (Pens, Pen Needles, Syringes), Applications (Type 1 Diabetes, Type 2 Diabetes) - Global Forecast to 2020

The global human insulin market size is projected to grow at a CAGR of 8.1%. Market growth can be attributed to factors such as growing diabetes patient population, increasing population exposure to key risk factors leading to diabetes, rising market demand for human insulin analogs, technological advancements in the field of human insulin delivery devices, and favorable medical reimbursements. However, stringent regulatory requirements for product approval are restraining the growth of market. In addition, high product manufacturing costs is posing significant challenges for market growth.

Objectives of the study are

- To define, describe, and forecast the global human insulin market on the basis of product, human insulin drugs type, human insulin drugs brand, delivery device, and application

- To provide detailed information regarding major factors influencing growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for leading market players

- To forecast the size of the market segments with respect to four main regions, namely, North America (U.S. and Canada), Europe (Germany, France, U.K., and Rest of Europe), Asia-Pacific (Japan, China, India, and Rest of Asia-Pacific), and the Rest of the World

- To strategically profile the key market players and comprehensively analyze their market shares and core competencies2

- To track and analyze competitive developments such as joint ventures; mergers and acquisitions; new product developments; and partnerships, agreements, and collaborations in the human insulin market

Research Methodology

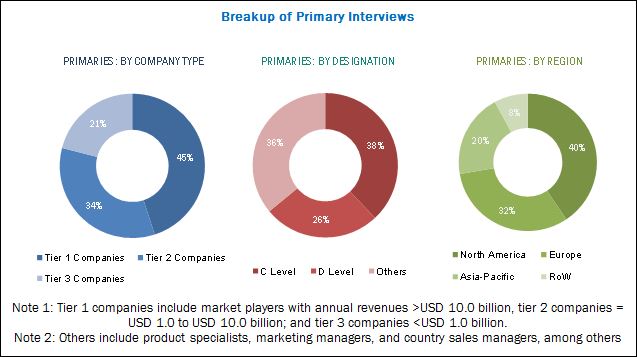

This research study involved the extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg Business, Factiva, and Avention) to identify and collect information useful for this technology-based, market-oriented, and commercial study of the global human insulin market. In-depth interviews were conducted with various primary respondents that mainly included key industry participants, subject-matter experts (SMEs), C & D level executives of key market players, and independent industry consultants, among others; to obtain and verify critical qualitative and quantitative information as well as to assess future market prospects of the global human insulin industry.

The secondary sources referred to for this research study include corporate filings (such as annual reports, SEC filings, investor presentations, and financial statements); research journals; press releases; as well as articles published by various trade, business, and professional associations.

To know about the assumptions considered for the study, download the pdf brochure

In 2014, Novo Nordisk A/S (Denmark) dominated the global human insulin market. Over the past three years, the company adopted product commercialization, geographic expansion, and awareness campaigns as key business strategies to maintain its position in the market. The other key players in this market include Sanofi (France), Eli Lilly and Company (U.S.), Biocon Ltd. (India), Julphar (U.A.E.), Ypsomed AG (Switzerland), Becton, Dickinson and Company (U.S.), Wockhardt Ltd. (India), B. Braun Meselgen AG (Switzerland), and Biodel Inc. (U.S.), among others.

Stakeholders

- Healthcare Service Providers (Including Hospitals, Clinics, and Medical Centers)

- Research Laboratories and Academic Institutes

- Product Sales and Distribution Companies

- Original Equipment Manufacturers (OEMs)

- Pharmaceutical and Biotechnology Companies

- Clinical Research Organizations (CROs)

- Research and Development Companies

- Market Research and Consulting Firms

- Non-government Organizations

Human Insulin Market Report Scope

This research report categorizes the human insulin market into the following segments and subsegments

By Product

- Drugs

- Delivery Devices

Product Type

-

Insulin Analogs and Biosimilars

- Rapid-acting

- Long-acting

- Premixed

-

Human Insulin Biologics

- Short-acting

- Intermediate-acting

- Premixed

By Brand

-

Insulin Analogs and Biosimilars

- Lantus

- NovoRapid/Novolog

- Humalog

- Other Brands

-

Human Insulin Biologics

- Actrapid, Insulatard, and Mixtard

- Humulin

- Insuman

By Product Type

-

Pens

- Reusable

- Disposable

-

Pen Needles

- Standard

- Safety

- Syringes

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolios of the top five companies

Geographical Analysis

- Further breakdown of the Rest of Europe human insulin market size into Italy, Spain, Poland, and other countries

- Further breakdown of the Rest of Asia-Pacific human insulin market size into Australia, South Korea, Indonesia, and other countries

- Further breakdown of the RoW human insulin market size into the Middle East, Latin America, and Africa

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

By product, the human insulin market is classified into two major segments— drugs and delivery devices. Human insulin drugs segment is expected to account for the largest share of the global market, by product, in 2015. Its large share is propelled by factors such as increasing diabetic population across globe, growing R&D for drug discovery & development, rising proportion of aging population in developed countries, increasing market accessibility of generic human insulin products worldwide, and rising government initiatives to support the development and commercialization of effective biosimilars.

By product type, the human insulin delivery devices market is classified into three segments—pens, pen needles, and syringes. The pens segment is expected to account for the largest market share in 2015; it is poised to be the fastest-growing segment during the next five years. Its high growth can be attributed to growing market focus of pen manufacturers on emerging countries such as China, India, & Brazil; significant medical reimbursements offered for human insulin pens across mature markets such as the U.S. & Europe; and continuous pipeline development & product commercialization of innovative human insulin pens.

Geographically, the market is classified into four regions—North America, Europe, Asia-Pacific, and the Rest of the World. In 2015, North America is estimated to dominate the global human insulin market. The Asia-Pacific market is poised to grow the fastest, during the forecast period, owing to growing diabetes prevalence in APAC (coupled with large diabetic & pre-diabetic patient population), strengthening distribution networks of global product manufacturers in the region, evolving regulatory framework for marketing approvals & medical reimbursements, continued expansion of advanced medical facilities in emerging countries (such as China & India), and rising public awareness related to benefits offered by human insulin in diabetes treatment.

Geography expansion and product development are the key strategies adopted by major players to strengthen their positions in the global market. Moreover, strategies such as partnerships, agreements, collaborations, awareness campaigns, and research funding & grants were also adopted by a significant number of market players to strengthen their product portfolios and expand their distribution networks in the global human insulin market.

Sanofi (France), Novo Nordisk A/S (Denmark), Eli Lilly and Company (U.S.), Biocon Ltd. (India), Julphar (U.A.E.), Ypsomed AG (Switzerland), Becton, Dickinson and Company (U.S.), Wockhardt Ltd. (India), B. Braun Meselgen AG (Switzerland), and Biodel Inc. (U.S.) are few of the key players operating in the global human insulin market.

Frequently Asked Questions (FAQ):

What is the size of Human Insulin Market ?

The global Human Insulin Market size is growing at a CAGR of 8.1%

What are the major growth factors of Human Insulin Market ?

Market growth can be attributed to factors such as growing diabetes patient population, increasing population exposure to key risk factors leading to diabetes, rising market demand for human insulin analogs, technological advancements in the field of human insulin delivery devices, and favorable medical reimbursements. However, stringent regulatory requirements for product approval are restraining the growth of market. In addition, high product manufacturing costs is posing significant challenges for market growth.

Who all are the prominent players of Human Insulin Market ?

The other key players in this market include Sanofi (France), Eli Lilly and Company (U.S.), Biocon Ltd. (India), Julphar (U.A.E.), Ypsomed AG (Switzerland), Becton, Dickinson and Company (U.S.), Wockhardt Ltd. (India), B. Braun Meselgen AG (Switzerland), and Biodel Inc. (U.S.), among others. .

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 27)

3.1 Introduction

3.2 Current Market Scenario

3.3 Future Outlook

3.4 Conclusion

4 Premium Insights (Page No. - 32)

4.1 Global Market (2015–2020)

4.2 Global Market Size, By Product (2015)

4.3 Global HI Drugs Market Size, By Product Type (2015-2020)

4.4 Global HI Drugs Market Size, By Brand (2014)

4.5 Global HI Delivery Devices Market Size, By Type (2015-2020)

4.6 Global Market Size, By Region (2015-2020)

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Evolution

5.4 Market Dynamics

5.4.1 Key Market Drivers

5.4.1.1 Growth in the Number of Diabetic Patients

5.4.1.2 Increasing Population Exposure to Key Risk Factors Leading to Diabetes

5.4.1.3 Rising Market Demand for HI Analogs

5.4.1.4 Technological Advancements in HI Delivery Devices

5.4.1.5 Favorable Medical Reimbursement Scenario in Developed Countries

5.4.2 Key Market Restraints

5.4.2.1 Stringent Regulatory Requirements for Product Approval

5.4.3 Key Market Opportunities

5.4.3.1 Emerging Markets

5.4.3.2 Expected Patent Expiry of Key HI Drugs

5.4.4 Key Market Challenge

5.4.4.1 High Product Manufacturing Costs

6 Industry Insights (Page No. - 48)

6.1 Introduction

6.2 Industry Trends

6.2.1 Growing Market Demand for HI Pens

6.2.2 Increasing Market Focus on the Pipeline Development of Novel Human Insulin Therapies

6.3 Pipeline Analysis

6.3.1 By Company

6.3.2 By Clinical Trial Phase

6.3.3 Porter’s Five Force Analysis

6.3.3.1 Threat From New Entrants

6.3.3.2 Threat From Substitutes

6.3.3.3 Bargaining Power of Buyers

6.3.3.4 Bargaining Power of Suppliers

6.3.3.5 Intensity of Competitive Rivalry

7 Global Human Insulin Market, By Product Type (Page No. - 55)

7.1 Introduction

7.2 HI Drugs

7.3 HI Delivery Devices

8 Global Human Insulin Drugs Market, By Type (Page No. - 60)

8.1 Introduction

8.2 Insulin Analogs and Biosimilars

8.2.1 Long-Acting Biosimilars

8.2.2 Rapid-Acting Biosimilars

8.2.3 Premixed Biosimilars

8.3 HI Biologics

8.3.1 Short-Acting Biologics

8.3.2 Intermediate-Acting Biologics

8.3.3 Premixed Biologics

9 Global Human Insulin Drugs Market, By Brand (Page No. - 69)

9.1 Introduction

9.2 HI Analogs and Biosimilars

9.2.1 Lantus

9.2.2 Novorapid and Novolog

9.2.3 Humalog

9.2.4 Other Brands

9.3 HI Biologics

9.3.1 Actrapid, Mixtard, and Insulatard

9.3.2 Humulin

9.3.3 Insuman

10 Global Human Insulin Market, By Delivery Devices (Page No. - 78)

10.1 Introduction

10.2 Syringes

10.3 Pens

10.3.1 Disposable Pens

10.3.2 Reusable Pens

10.4 Pen Needles

10.4.1 Standard Pen Needles

10.4.2 Safety Pen Needles

11 Global Human Insulin Market, By Application (Page No. - 85)

11.1 Introduction

11.2 Type I Diabetes

11.3 Type II Diabetes

12 Human Insulin Market, By Region (Page No. - 90)

12.1 Introduction

12.2 North America

12.2.1 U.S.

12.2.2 Canada

12.3 Europe

12.3.1 Germany

12.3.2 France

12.3.3 U.K.

12.3.4 Rest of Europe (RoE)

12.4 Asia-Pacific (APAC)

12.4.1 Japan

12.4.2 China

12.4.3 India

12.4.4 Rest of Asia-Pacific (RoAPAC)

12.5 Rest of the World (RoW)

13 Competitive Landscape (Page No. - 107)

13.1 Overview

13.2 Market Share Analysis

13.2.1 HI Drugs Market

13.2.2 HI Delivery Devices Market

13.3 Competitive Scenario

13.4 Recent Developments

13.4.1 Geographical Expansions

13.4.2 Agreements, Collaborations, and Partnerships

13.4.3 New Product Launches

13.4.4 Awareness Programs

13.4.5 Funding & Scholarships

13.4.6 Strategic Acquisitions

14 Company Profiles (Page No. - 119)

14.1 Introduction

14.1.1 Geographic Benchmarking

14.1.2 Strategic Benchmarking

14.1.2.1 Capacity Building

14.1.2.2 Product Development and Commercialization

14.2 B. Braun Melsungen AG

14.2.1 Business Overview

14.2.2 Product Portfolio

14.2.3 Recent Developments

14.3 Becton, Dickinson and Company

14.3.1 Business Overview

14.3.2 Product Portfolio

14.3.3 Recent Developments

14.4 Biocon Limited

14.4.1 Business Overview

14.4.2 Product Portfolio

14.4.3 MnM View

14.5 Biodel Inc.

14.5.1 Business Overview

14.5.2 Product Portfolio

14.5.3 Recent Developments

14.6 ELI Lilly and Company

14.6.1 Business Overview

14.6.2 Product Portfolio

14.6.3 Recent Developments

14.6.4 MnM View

14.7 Julphar (Also Known as Gulf Pharmaceutical Industries)

14.7.1 Business Overview

14.7.2 Product Portfolio

14.7.3 MnM View

14.8 NOVO Nordisk A/S

14.8.1 Business Overview

14.8.2 Product Portfolio

14.8.3 Recent Developments

14.8.4 MnM View

14.9 Sanofi

14.9.1 Business Overview

14.9.2 Product Portfolio

14.9.3 Recent Developments

14.9.4 MnM View

14.10 Wockhardt Limited

14.10.1 Business Overview

14.10.2 Product Portfolio

14.10.3 Recent Developments

14.11 Ypsomed AG

14.11.1 Business Overview

14.11.2 Product Portfolio

14.11.3 Recent Developments

15 Appendix (Page No. - 152)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

List of Tables (75 Tables)

Table 1 Key HI Drugs: Year of Patent Expiry

Table 2 Key HI Therapies Under Pipeline Development & Commercialization: 2005-2015

Table 3 HI Pipeline: Major Companies Involved

Table 4 HI Pipeline: Stages of Clinical Trial

Table 5 Global Market Size, By Product Type, 2013–2020 (USD Million)

Table 6 Drugs Market Size, By Region, 2013–2020 (USD Million)

Table 7 Delivery Devices Market Size, By Region, 2013–2020 (USD Million)

Table 8 Global Drugs Market Size, By Type, 2013–2020 (USD Million)

Table 9 Global Insulin Analogs and Biosimilars Market Size, By Type, 2013–2020 (USD Million)

Table 10 Insulin Analogs and Biosimilars Market Size, By Region, 2013–2020 (USD Million)

Table 11 Long-Acting Insulin Analogs and Biosimilars Market Size, By Region, 2013–2020 (USD Million)

Table 12 Rapid-Acting Insulin Analogs and Biosimilars Market Size, By Region, 2013–2020 (USD Million)

Table 13 Premixed Insulin Analogs and Biosimilars Market Size, By Region, 2013–2020 (USD Million)

Table 14 Global Biologics Market Size, By Type, 2013–2020 (USD Million)

Table 15 Biologics Market Size, By Region, 2013–2020 (USD Million)

Table 16 Short-Acting HI Biologics Market Size, By Region, 2013–2020 (USD Million)

Table 17 Intermediate-Acting HI Biologics Market Size, By Region, 2013–2020 (USD Million)

Table 18 Premixed HI Biologics Market Size, By Region, 2013–2020 (USD Million)

Table 19 Global HI Drugs Market Size, By Product Type, 2013–2020 (USD Million)

Table 20 Global Insulin Analogs and Biosimilars Market Size, By Brand, 2013–2020 (USD Million)

Table 21 Insulin Analogs and Biosimilars Market Size, By Region, 2013–2020 (USD Million)

Table 22 Insulin Analogs and Biosimilars Market Size for Lantus, By Region, 2013–2020 (USD Million)

Table 23 Insulin Analogs and Biosimilars Market Size for Novorapid and Novolog, By Region, 2013–2020 (USD Million)

Table 24 Insulin Analogs and Biosimilars Market Size for Humalog, By Region, 2013–2020 (USD Million)

Table 25 Insulin Analogs and Biosimilars Market Size for Other Brands, By Region, 2013–2020 (USD Million)

Table 26 Global HI Biologics Market Size, By Brand, 2013–2020 (USD Million)

Table 27 HI Biologics Market Size, By Region, 2013–2020 (USD Million)

Table 28 HI Biologics Market Size for Actrapid, Mixtard, and Insulatard, By Region, 2013–2020 (USD Million)

Table 29 HI Biologics Market Size for Humulin, By Region, 2013–2020 (USD Million)

Table 30 HI Biologics Market Size for Insuman, By Region, 2013–2020 (USD Million)

Table 31 Global Market Size, By Delivery Device, 2013–2020 (USD Million)

Table 32 HI Syringes Market Size, By Region, 2013–2020 (USD Million)

Table 33 Global HI Pens Market Size, By Product Type, 2013–2020 (USD Million)

Table 34 HI Pens Market Size, By Region, 2013–2020 (USD Million)

Table 35 Disposable HI Pens Market Size, By Region, 2013–2020 (USD Million)

Table 36 Reusable HI Pens Market Size, By Region, 2013–2020 (USD Million)

Table 37 Global HI Pen Needles Market Size, By Product Type, 2013–2020 (USD Million)

Table 38 HI Pen Needles Market Size, By Region, 2013–2020 (USD Million)

Table 39 HI Standard Pen Needles Market Size, By Region, 2013–2020 (USD Million)

Table 40 HI Safety Pen Needles Market Size, By Region, 2013–2020 (USD Million)

Table 41 Global Market Size, By Application, 2013–2020 (USD Million)

Table 42 HI Application Market Size for Type I Diabetes, By Region, 2013–2020 (USD Million)

Table 43 HI Application Market Size for Type Ii Diabetes, By Region, 2013–2020 (USD Million)

Table 44 Market Size, By Region, 2013–2020 (USD Million)

Table 45 North America: Market Size, By Country, 2013–2020 (USD Million)

Table 46 U.S.: Market Size, By Product, 2013–2020 (USD Million)

Table 47 U.S.: Market Size , By Application, 2013–2020 (USD Million)

Table 48 Canada: Market Size, By Product, 2013–2020 (USD Million)

Table 49 Canada: Human Insulin Market Size , By Application, 2013–2020 (USD Million)

Table 50 Europe: Human Insulin Market Size, By Country, 2013–2020 (USD Million)

Table 51 Germany: Human Insulin Market Size, By Product, 2013–2020 (USD Million)

Table 52 Germany: Human Insulin Market Size , By Application, 2013–2020 (USD Million)

Table 53 France: Human Insulin Market Size, By Product, 2013–2020 (USD Million)

Table 54 France: Human Insulin Market Size , By Application, 2013–2020 (USD Million)

Table 55 U.K.: Human Insulin Market Size, By Product, 2013–2020 (USD Million)

Table 56 U.K.: Human Insulin Market Size , By Application, 2013–2020 (USD Million)

Table 57 RoE: Human Insulin Market Size, By Product, 2013–2020 (USD Million)

Table 58 RoE: Human Insulin Market Size , By Application, 2013–2020 (USD Million)

Table 59 APAC: Human Insulin Market Size, By Country, 2013–2020 (USD Million)

Table 60 Japan: Human Insulin Market Size, By Product, 2013–2020 (USD Million)

Table 61 Japan: Human Insulin Market Size , By Application, 2013–2020 (USD Million)

Table 62 China: Human Insulin Market Size, By Product, 2013–2020 (USD Million)

Table 63 China: Human Insulin Market Size , By Application, 2013–2020 (USD Million)

Table 64 India: Human Insulin Market Size, By Product, 2013–2020 (USD Million)

Table 65 India: Human Insulin Market Size , By Application, 2013–2020 (USD Million)

Table 66 RoAPAC: Human Insulin Market Size, By Product, 2013–2020 (USD Million)

Table 67 RoAPAC: Human Insulin Market Size , By Application, 2013–2020 (USD Million)

Table 68 RoW: Human Insulin Market Size, By Product, 2013–2020 (USD Million)

Table 69 RoW: Human Insulin Market Size , By Application, 2013–2020 (USD Million)

Table 70 Geographical Expansions, 2012–2015

Table 71 Agreements, Collaborations, and Partnerships, 2012–2015

Table 72 New Product Launches and Product Approvals, 2012–2015

Table 73 Awareness Programs, 2012–2015

Table 74 Funding & Scholarships, 2012–2015

Table 75 Strategic Acquisitions, 2012–2015

List of Figures (53 Figures)

Figure 1 Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Assumptions for the Research Study

Figure 6 Human Insulin Market Share: Key Market Players (2014)

Figure 7 Future Trends: HI Drugs Market, By Type (2015–2020)

Figure 8 Future Trends: Human Insulin Market Size, By Brand (2015–2020)

Figure 9 Future Trends: HI Delivery Devices Market Size, By Type (2015–2020)

Figure 10 Future Trends: Human Insulin Market Share, By Region (2015–2020)

Figure 11 Attractive Growth Opportunities in the Human Insulin Market

Figure 12 North America is Expected to Dominate HI Drugs Market in 2015

Figure 13 Insulin Analogs & Biosimilars Segment is Expected to Grow the Fastest During Forecast Period

Figure 14 Lantus Was the Best Selling Insulin Brand Across All the Key Geographies in 2014

Figure 15 Insulin Pens to Lead the Overall Growth in HI Delivery Devices Market Till 2020

Figure 16 Asia-Pacific is Poised to Be the Fastest Growing Region in Human Insulin Market Till 2020

Figure 17 Market Evolution of HI Products

Figure 18 Human Insulin Market: Drivers, Restraints, Opportunities, & Challenges

Figure 19 Growth in Diabetic Patient Population Across Key Who Regions (2000–2030)

Figure 20 Proportion of Geriatric Population, By Country (2012 vs 2020)

Figure 21 Global Trend in Government Healthcare Expenditure: Developed vs Developing Countries (2010–2012)

Figure 22 Porter’s Five Forces Analysis (2014): Increasing Number of New Product Manufacturers Increases Market Competition

Figure 23 Drugs to Cover the Largest Market Share of Human Insulin Market Till 2020

Figure 24 U.S. & Europe Lead, Globally, in Terms of the Number of Ongoing Human Insulin-Based Clinical Studies (2015)

Figure 25 Insulin Analogs and Biosimilars Market: Future Trends (2013-2020)

Figure 26 North America to Lead the Premixed Insulin Analogs Market Till 20202

Figure 27 APAC to Grow the Fastest in Human Insulin Biologics Market During the Forecast Period

Figure 28 Lantus to Lead the Insulin Analogs & Biosmilar Market Sales in 2014

Figure 29 Actrapd to Cover the Largest Market Share of Human Insulin Biologics Market in 2015

Figure 30 Insulin Pens Segment is Poised to Grow the Fastest Till 2020

Figure 31 Safety Needles Segment is Expected to Sitness Fastest Market Growth During the Forecast Period

Figure 32 Type 2 Diabetes Application is Poised to Be the Fastest Growing Human Insulin Market Segment During the Study Period

Figure 33 India Will Have Highest Diabetes Population in 2030

Figure 34 Market Trends: North American Human Insulin Market (2015-2020)

Figure 35 Market Trends: European Human Insulin Market (2015-2020)

Figure 36 Market Trends: Asia-Pacific Human Insulin Market (2015-2020)

Figure 37 Leading Players Adopted the Strategy of Geographic Expansions to Strengthen Their Market Positioning During 2012 to 2015

Figure 38 Global Human Insulin Market Share, By Key Player (2014)

Figure 39 Global HI Drugs Market Ranking, By Key Player (2014)

Figure 40 Global HI Delivery Devices Market Ranking, By Key Player (2014)

Figure 41 Continuous Geographic Expansion is Stimulating Market Competition for Capacity Building Among Key Players

Figure 42 Geographic Revenue Mix of the Top 5 Market Players* (2014)

Figure 43 Leading Companies are Focusing on Capacity Building to Strengthen Their Product Development & Manufacturing Base

Figure 44 Leading HI Manufacturers are Focusing on Product Commercialization to Strengthen Their Market Position

Figure 45 B. Braun Melsungen AG: Company Snapshot

Figure 46 Becton, Dickinson and Company: Company Snapshot

Figure 47 Biocon Limited: Company Snapshot

Figure 48 ELI Lilly and Company: Company Snapshot

Figure 49 Julphar: Company Snapshot

Figure 50 NOVO Nordisk A/S: Company Snapshot

Figure 51 Sanofi: Company Snapshot

Figure 52 Wockhardt Limited: Company Snapshot

Figure 53 Ypsomed AG: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Human Insulin Market