Hospital Capacity Management Solutions Market Size, Growth by Product (Asset, Bed Management, Nurse Scheduling, Patient Flow Management), Component (Software, Integrated, Services), Delivery Mode (On-premise, Cloud), End User (Hospitals, ASC) & Region - Global Forecast to 2026

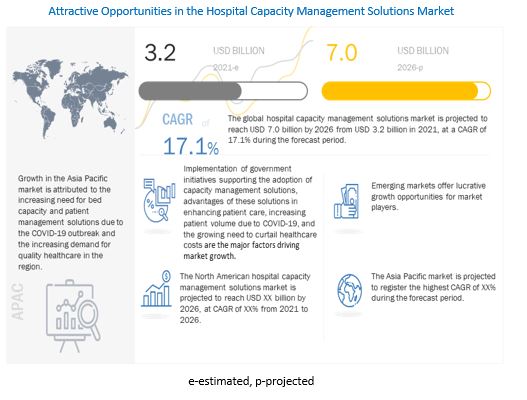

The global hospital capacity management solutions market in terms of revenue was estimated to be worth USD 3.2 billion in 2021 and is poised to reach USD 7.0 billion by 2026, growing at a CAGR of 17.1% from 2021 to 2026. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The growth in the market is mainly driven by factors such as the need for better capacity management in hospitals, need to curtail escalating healthcare costs, and the advantages of capacity management solutions in enhancing patient care and safety.

To know about the assumptions considered for the study, download the pdf brochure

Hospital Capacity Management Solutions Market Dynamics

Driver: Need to curtail healthcare costs

Governments and healthcare systems across the globe are focusing on controlling the rising healthcare costs by minimizing patient readmissions, medical errors, and administration costs with the effective utilization of capacity management software, such as workforce management and asset management. The successful adoption and implementation of these solutions are expected to save billions of dollars for healthcare systems worldwide. Delays and incorrect placement of patients in wrong beds can significantly increase healthcare costs. Thus, the adoption of hospital capacity management solutions helps reduce the overall healthcare costs.

Restraint: IT infrastructural constraints in developing countries

Cost issues are one of the major barriers to the adoption of HCIT solutions. The cost of setting up capacity management solutions is high. Maintenance and software update costs for capacity management systems can be higher than the cost of the software. Support and maintenance services, including software upgrades (as per changing user requirements), represent a recurring expenditure. Moreover, the lack of internal IT expertise in the healthcare industry necessitates training for end-users to maximize the efficiency of provider network management systems. This, in turn, increases the cost of ownership of these systems.

Opportunity: IoT-based healthcare capacity management

Advancements in information technology have provided the industry with an ever-expanding array of options like Internet of Things (IoT), which has generated significant growth opportunities for healthcare capacity management vendors. The healthcare-based IoT platform is integrated with smart sensors over a cloud-based network, which allows hospitals and other healthcare organizations to monitor cold storage and other aspects of their operations that must be maintained at specific conditions to ensure quality patient care. Through the implementation of IoT for asset monitoring and tracking of medical equipment, hospitals can access real-time data using smart sensors and devices and gain real-time visibility into the operational status. Also, IoT-based asset management aids in monitoring performance through a single dashboard, which tracks and analyzes various parameters for each asset. These advancements help in reducing healthcare costs and improving the overall quality of patient care.

Challenge: Issues related to data security and privacy

IoT-enabled devices that connect and share patient-generated data increase the number of potential vulnerabilities within a system. In most healthcare organizations, several IoT-enabled devices are deployed

on the same network. Networking technologies such as second-generation ultrasound, BLE, and RTLS also add an extra layer to already complex networks. These outside networks may or may not be as secure or protected as required. The information being transferred over these networks can be accessed by external parties, such as government agencies, data collectors, or hackers. This might not only interfere with the privacy of the concerned individual but may also pose a security threat to the individual as well as the organization.

By product segment, the asset management segment accounted for the largest share of the hospital capacity management solutions industry

Among the product segment, the asset management solutions segment of the hospital capacity management solutions market accounted for the largest market share. The large share of this segment is attributed to the increasing focus on the proper management and storage of healthcare equipment. Government incentives, penalties, and the necessity to reduce healthcare costs are also contributing to the growth of this market segment.

By mode of delivery, the cloud-based solution segment is expected to be the fastest-growing segment of the hospital capacity management solutions industry during the forecast period

The cloud-based solution segment of the hospital capacity management solutions market is expected to be the fastest-growing segment during the forecast period. With technological advancements in place, healthcare organizations are adopting new technologies to enhance their operational and administrative processes.

By end-user, the hospitals segment is expected to account for the largest share of the hospital capacity management solutions industry

The government initiatives to enhance patient satisfaction and improve the quality of care, the growing patient volume, and the need to reduce the rising healthcare costs are the major factor driving the growth of hospitals segment of the hospital capacity management solutions market.

Asia-Pacific is the fastest-growing market for hospital capacity management solutions industry during the forecast period.

The Asia Pacific region of the hospital capacity management solutions market is projected to grow at the highest CAGR during the forecast period. The high growth in this regional market can be attributed to the increasing government initiatives for eHealth, growing medical tourism, increasing need for management solutions due to the COVID-19 outbreak, and the increasing demand for quality healthcare

The major players in this market are Cerner Corporation (US), McKesson Corporation (US), HealthStream (US), Stanley Healthcare (US), and Halma plc (US). Other prominent players in this market include Infosys (India), Teletracking Technologies, Inc. (US), NextGen Healthcare (US), Allscripts Healthcare Solutions, Inc. (US), Epic Systems Corporation (US), Sonitor Technologies (US), Koninklijke Philips N.V. (Netherlands), Neusoft Corporation (China), Infinitt Healthcare Co., Ltd. (South Korea), JVS Group (India), Infor Systems (US), Care Logistics (US), WellSky (US), Simul8 Corporation (US), and Alcidion Corporation (Australia).

Scope of the Hospital Capacity Management Solutions Industry

|

Report Metrics |

Details |

|

Market Revenue in 2021 |

USD 3.2 billion |

|

Projected Revenue by 2026 |

USD 7.0 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 17.1% |

|

Market Driver |

Need to curtail escalating healthcare costs |

|

Market Opportunity |

IoT-based healthcare capacity management |

The research report categorizes the global hospital capacity management solutions market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Asset Management

- Medical Equipment Management

- Bed Management

- Patient Flow Management Solutions

-

Workforce Management

- Nursing & Staff Scheduling Solutions

- Leave and Absence Management

- Quality Patient Care

By Component

-

Software

- Integrated

- Standalone

- Services

By Mode of delivery

- On-premise

- Cloud-based

By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Estonia

- Nordic Countries

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments of Hospital Capacity Management Solutions Industry

- In November 2020, HealthStream (US) had acquired Change Healthcare's Staff Scheduling Business helped the company enhance its position in the healthcare workforce scheduling market.

- In May 2020, STANLEY Healthcare (US) partnered with Cisco DNA Spaces (US) to integrate STANLEY Healthcare’s AeroScout RTLS platform with Cisco DNA Spaces to simplify the operations management of healthcare organizations.

- In April 2020, TeleTracking Technologies (US) launched COVID-19 Capacity and Census Dashboard that equips health systems with critical information like patient census, bed availability, patients in need of ventilation, and other aspects that are needed to prepare for and respond to the COVID-19 patient surge.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global hospital capacity management solutions market?

The global hospital capacity management solutions market boasts a total revenue value of USD 7.0 billion by 2026.

What is the estimated growth rate (CAGR) of the global hospital capacity management solutions market?

The global hospital capacity management solutions market has an estimated compound annual growth rate (CAGR) of 17.1% and a revenue size in the region of USD 3.2 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 MARKETS COVERED

FIGURE 1 HOSPITAL CAPACITY MANAGEMENT SOLUTIONS MARKET SEGMENTATION

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 LIMITATIONS

1.5 CURRENCY

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS FOR ASSET MANAGEMENT SOLUTIONS

FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 8 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 9 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT/LIMITATIONS

2.7 COVID-19 HEALTH ASSESSMENT

2.8 COVID-19 ECONOMIC ASSESSMENT

2.9 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 12 HOSPITAL CAPACITY MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 13 MARKET, BY COMPONENT, 2021 VS. 2026 (USD MILLION)

FIGURE 14 MARKET, BY MODE OF DELIVERY, 2021 VS. 2026 (USD MILLION)

FIGURE 15 MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 16 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 GLOBAL MARKET OVERVIEW

FIGURE 17 OUTBREAK OF COVID-19 AND THE NEED TO CURTAIL THE INCREASING HEALTHCARE COSTS ARE DRIVING MARKET GROWTH

4.2 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 MARKET IN CHINA IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 REGIONAL MIX: MARKET (2019–2026)

FIGURE 19 ASIA PACIFIC TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD (2021–2026)

4.4 GLOBAL MARKET: DEVELOPED VS. DEVELOPING MARKETS, 2021 VS. 2026 (USD MILLION)

FIGURE 20 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING THE STUDY PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

TABLE 1 MARKET DYNAMICS: IMPACT ANALYSIS

5.2.1 MARKET DRIVERS

5.2.1.1 Need for better capacity management in hospitals

5.2.1.2 Need to curtail the increasing healthcare costs

5.2.1.3 Increasing patient volume due to the rising prevalence of chronic diseases and COVID-19

5.2.1.4 Management of regulatory compliance through the effective utilization of capacity management solutions

5.2.1.5 Healthcare consolidation in the US and Europe

5.2.2 MARKET RESTRAINTS

5.2.2.1 High cost of deployment

5.2.2.2 IT infrastructural constraints in developing countries

5.2.3 OPPORTUNITIES

5.2.3.1 IoT-based healthcare capacity management

5.2.3.2 Emerging economies

5.2.3.3 Growing competitiveness in the healthcare industry to drive asset optimization

5.2.4 CHALLENGES

5.2.4.1 Issues related to data security and privacy

5.2.4.2 Lack of trained healthcare IT professionals

5.3 COVID-19 IMPACT ANALYSIS ON THE GLOBAL MARKET

5.4 HOSPITAL CAPACITY MANAGEMENT SOLUTIONS: PRICING ANALYSIS

TABLE 2 AVERAGE SELLING PRICE OF HOSPITAL CAPACITY MANAGEMENT SOLUTIONS, BY REGION, 2020

5.5 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 DEGREE OF COMPETITION IS HIGH IN THE MARKET

TABLE 3 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6 ECOSYSTEM

FIGURE 22 ECOSYSTEM: GLOBAL MARKET

6 INDUSTRY INSIGHTS (Page No. - 66)

6.1 INTRODUCTION

6.2 TRENDS AMONG BIG TECH COMPANIES IN THE HEALTHCARE INDUSTRY

6.3 CHALLENGES FACED BY CUSTOMERS IN MANUAL CAPACITY MANAGEMENT IN HEALTHCARE SETTINGS

6.4 REGULATORY SCENARIO

6.4.1 INTRODUCTION

6.4.2 US

6.4.3 CANADA

6.4.4 EUROPE

6.4.4.1 Germany

6.4.4.2 France

6.4.4.3 UK

6.4.5 JAPAN

6.5 TECHNOLOGY ANALYSIS

7 HOSPITAL CAPACITY MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE (Page No. - 74)

7.1 INTRODUCTION

TABLE 4 GLOBAL MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

7.2 ASSET MANAGEMENT SOLUTIONS

TABLE 5 ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 6 ASSET MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.1 MEDICAL EQUIPMENT MANAGEMENT SOLUTIONS

7.2.1.1 Effective medical equipment tracking and management are key to providing quality healthcare

TABLE 7 MEDICAL EQUIPMENT MANAGEMENT SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 8 MEDICAL EQUIPMENT MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.2 BED MANAGEMENT SOLUTIONS

7.2.2.1 Demand for bed management solutions is expected to increase due to the increased patient volume in hospitals

TABLE 9 BED MANAGEMENT SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 10 BED MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 PATIENT FLOW MANAGEMENT SOLUTIONS

7.3.1 USE OF HYBRID RTLS TECHNOLOGY HELPS IN BETTER PATIENT FLOW MANAGEMENT

TABLE 11 PATIENT FLOW MANAGEMENT SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 12 PATIENT FLOW MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 WORKFORCE MANAGEMENT SOLUTIONS

TABLE 13 WORKFORCE MANAGEMENT SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 14 WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 15 WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.1 NURSING & STAFF SCHEDULING SOLUTIONS

7.4.1.1 Nursing & staff scheduling solutions segment accounted for the largest share of the workforce management solutions market

TABLE 16 NURSING & STAFF SCHEDULING SOLUTIONS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.2 LEAVE & ABSENCE MANAGEMENT SOLUTIONS

7.4.2.1 Leave & absence management solutions minimize the impact of staff absence on the operations of organizations

TABLE 17 LEAVE & ABSENCE MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 QUALITY PATIENT CARE SOLUTIONS

7.5.1 INCREASING FOCUS ON PATIENT-CENTRIC CARE TO DRIVE THE GROWTH OF THIS MARKET SEGMENT

TABLE 18 QUALITY PATIENT CARE SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 19 QUALITY PATIENT CARE SOLUTIONS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8 HOSPITAL CAPACITY MANAGEMENT SOLUTIONS MARKET, BY MODE OF DELIVERY (Page No. - 88)

8.1 INTRODUCTION

TABLE 20 MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

8.2 ON-PREMISE SOLUTIONS

8.2.1 ON-PREMISE SOLUTIONS SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE GLOBAL MARKET

TABLE 21 ON-PREMISE HOSPITAL CAPACITY MANAGEMENT SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 22 ON-PREMISE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 CLOUD-BASED SOLUTIONS

8.3.1 CLOUD-BASED SOLUTIONS SEGMENT TO WITNESS HIGHER GROWTH DURING THE FORECAST PERIOD

TABLE 23 CLOUD-BASED HOSPITAL CAPACITY MANAGEMENT SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 24 CLOUD-BASED MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9 HOSPITAL CAPACITY MANAGEMENT SOLUTIONS MARKET, BY COMPONENT (Page No. - 93)

9.1 INTRODUCTION

TABLE 25 MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

9.2 SOFTWARE

TABLE 26 HOSPITAL CAPACITY MANAGEMENT SOFTWARE OFFERED BY MAJOR PLAYERS

TABLE 27 HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 28 HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.1 INTEGRATED SOFTWARE

9.2.1.1 Integrated software segment to account for a larger share of the hospital capacity management software market

TABLE 29 INTEGRATED HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.2 STANDALONE SOFTWARE

9.2.2.1 Standalone software provides practical and easy-to-use tools for capacity management

TABLE 30 STANDALONE HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.3 SERVICES

9.3.1 FREQUENT NEED FOR UPGRADES AND IMPROVEMENTS IN SOFTWARE APPLICATIONS ARE THE MAJOR DRIVERS

TABLE 31 HOSPITAL CAPACITY MANAGEMENT SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

10 HOSPITAL CAPACITY MANAGEMENT SOLUTIONS MARKET, BY END USER (Page No. - 99)

10.1 INTRODUCTION

TABLE 32 MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2 HOSPITALS

10.2.1 LARGE PATIENT POOL DUE TO THE COVID-19 OUTBREAK IS DRIVING THE ADOPTION OF CAPACITY MANAGEMENT SOLUTIONS IN HOSPITALS

TABLE 33 MARKET FOR HOSPITALS, BY COUNTRY, 2019–2026 (USD MILLION)

10.3 AMBULATORY SURGICAL CENTERS

10.3.1 INCREASING PATIENT VOLUME IN AMBULATORY SURGICAL CENTERS TO DRIVE THE GROWTH OF THIS MARKET SEGMENT

TABLE 34 MARKET FOR AMBULATORY SURGICAL CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

10.4 OTHER END USERS

TABLE 35 MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

11 HOSPITAL CAPACITY MANAGEMENT SOLUTIONS MARKET, BY REGION (Page No. - 104)

11.1 INTRODUCTION

TABLE 36 MARKET, BY REGION, 2019–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 23 NORTH AMERICA: MARKET SNAPSHOT

TABLE 37 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

11.2.1 US

11.2.1.1 Presence of a large number of COVID-19 patients and the growing need to curtail soaring healthcare costs to drive market growth in the US

TABLE 45 US: KEY MACROINDICATORS

TABLE 46 US: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 47 US: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 48 US: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 49 US: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 50 US: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 51 US: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 52 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Implementation of digital health initiatives to propel market growth

TABLE 53 CANADA: KEY MACROINDICATORS

TABLE 54 CANADA: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 55 CANADA: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 56 CANADA: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 57 CANADA: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 58 CANADA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 59 CANADA: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3 EUROPE

TABLE 61 EUROPE: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 62 EUROPE: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 63 EUROPE: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 EUROPE: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 66 EUROPE: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Government initiatives focused on improving the adoption of HCIT to drive market growth

TABLE 69 GERMANY: KEY MACROINDICATORS

TABLE 70 GERMANY: HOSPITAL CAPACITY MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 71 GERMANY: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 GERMANY: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 73 GERMANY: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 74 GERMANY: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 75 GERMANY: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.2 UK

11.3.2.1 The UK is rapidly transforming its organizations into paperless environments, which would help boost the demand for hospital capacity management solutions

TABLE 77 UK: KEY MACROINDICATORS

TABLE 78 UK: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 79 UK: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 UK: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 UK: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 82 UK: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 83 UK: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Upcoming retirement of a large number of French doctors will draw attention to the need for effective patient management solutions

TABLE 85 FRANCE: KEY MACROINDICATORS

TABLE 86 FRANCE: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 87 FRANCE: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 FRANCE: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 89 FRANCE: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 90 FRANCE: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 91 FRANCE: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Growing focus on improving patient care to drive the global market in Italy

TABLE 93 ITALY: KEY MACROINDICATORS

TABLE 94 ITALY: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 95 ITALY: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 96 ITALY: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 ITALY: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 98 ITALY: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 99 ITALY: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 ITALY: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Growing need for optimization in healthcare workflows to drive market growth in Spain

TABLE 101 SPAIN: KEY MACROINDICATORS

TABLE 102 SPAIN: HOSPITAL CAPACITY MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 103 SPAIN: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 SPAIN: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 105 SPAIN: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 106 SPAIN: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 107 SPAIN: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 SPAIN: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.6 NORDIC COUNTRIES

11.3.6.1 Presence of a highly developed hospital infrastructure to contribute to market growth in Nordic countries

TABLE 109 NORDIC COUNTRIES: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 110 NORDIC COUNTRIES: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 NORDIC COUNTRIES: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 NORDIC COUNTRIES: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 113 NORDIC COUNTRIES: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 114 NORDIC COUNTRIES: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 NORDIC COUNTRIES: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.7 NETHERLANDS

11.3.7.1 High healthcare expenditure and high adoption of HCIT solutions are major factors driving market growth in the Netherlands

TABLE 116 NETHERLANDS: KEY MACROINDICATORS

TABLE 117 NETHERLANDS: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 118 NETHERLANDS: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 NETHERLANDS: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 NETHERLANDS: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 121 NETHERLANDS: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 122 NETHERLANDS: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 NETHERLANDS: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.8 ESTONIA

11.3.8.1 Shortage of hospital beds and high adoption of HCIT solutions to drive market growth in Estonia

TABLE 124 ESTONIA: KEY MACROINDICATORS

TABLE 125 ESTONIA: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 126 ESTONIA: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 ESTONIA: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 ESTONIA: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 129 ESTONIA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 130 ESTONIA: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 131 ESTONIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3.9 REST OF EUROPE

TABLE 132 REST OF EUROPE: HOSPITAL CAPACITY MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 133 REST OF EUROPE: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 REST OF EUROPE: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 REST OF EUROPE: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 136 REST OF EUROPE: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 137 REST OF EUROPE: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 138 REST OF EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 24 APAC: MARKET SNAPSHOT

TABLE 139 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 140 ASIA PACIFIC: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 ASIA PACIFIC: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 144 ASIA PACIFIC: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 Japan is the largest market for hospital capacity management solutions in APAC

TABLE 147 JAPAN: KEY MACROINDICATORS

TABLE 148 JAPAN: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 149 JAPAN: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 150 JAPAN: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 JAPAN: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 152 JAPAN: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 153 JAPAN: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Market in China to grow at the highest CAGR during the forecast period

TABLE 155 CHINA: KEY MACROINDICATORS

TABLE 156 CHINA: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 157 CHINA: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 158 CHINA: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 159 CHINA: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 160 CHINA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 161 CHINA: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 162 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Increasing government initiatives to improve the healthcare system are driving the demand for hospital capacity management solutions

TABLE 163 INDIA: KEY MACROINDICATORS

TABLE 164 INDIA: HOSPITAL CAPACITY MANAGEMENT SOLUTIONS MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 165 INDIA: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 166 INDIA: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 167 INDIA: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 168 INDIA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 169 INDIA: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 INDIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4.4 REST OF ASIA PACIFIC

TABLE 171 REST OF ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 173 REST OF ASIA PACIFIC: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 174 REST OF ASIA PACIFIC: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 175 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 176 REST OF ASIA PACIFIC: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 177 REST OF ASIA PACIFIC: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.5 LATIN AMERICA

11.5.1 FAVORABLE GOVERNMENT INITIATIVES TO SUPPORT MARKET GROWTH

TABLE 178 LATIN AMERICA: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 179 LATIN AMERICA: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 180 LATIN AMERICA: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 183 LATIN AMERICA: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

11.6.1 HEALTHCARE INFRASTRUCTURE IMPROVEMENTS TO SUPPORT MARKET GROWTH

TABLE 185 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: ASSET MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: WORKFORCE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: HOSPITAL CAPACITY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 172)

12.1 INTRODUCTION

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 25 MARKET EVALUATION FRAMEWORK: PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS WERE THE MOST WIDELY ADOPTED STRATEGIES

12.3 REVENUE SHARE ANALYSIS OF LEADING MARKET PLAYERS

FIGURE 26 HOSPITAL CAPACITY MANAGEMENT SOLUTIONS MARKET: REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS

12.4 FOOTPRINT ANALYSIS OF THE TOP PLAYERS IN THE GLOBAL MARKET

TABLE 192 FOOTPRINT OF COMPANIES

TABLE 193 PRODUCT TYPE FOOTPRINT OF COMPANIES

TABLE 194 SOFTWARE TYPE FOOTPRINT OF COMPANIES

TABLE 195 REGIONAL FOOTPRINT OF COMPANIES

12.5 GLOBAL MARKET: R&D EXPENDITURE

FIGURE 27 R&D EXPENDITURE OF THE KEY PLAYERS IN THE GLOBAL MARKET

12.6 COMPANY EVALUATION MATRIX DEFINITION & METHODOLOGY

12.7 MARKET SHARE ANALYSIS

FIGURE 28 GLOBAL MARKET SHARE ANALYSIS, BY KEY PLAYER, 2020

12.8 COMPANY EVALUATION MATRIX

12.8.1 STARS

12.8.2 EMERGING LEADERS

12.8.3 PERVASIVE PLAYERS

12.8.4 PARTICIPANTS

FIGURE 29 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

12.9 COMPETITIVE SCENARIO

12.9.1 KEY DEVELOPMENTS IN THE GLOBAL MARKET

TABLE 196 DEALS (JANUARY 2017 TO APRIL 2021)

TABLE 197 PRODUCT LAUNCHES (JANUARY 2017 TO APRIL 2021)

13 COMPANY PROFILES (Page No. - 183)

13.1 KEY PLAYERS

(Business Overview, Products & Services, Key Insights, Recent Developments, MnM View)*

13.1.1 CERNER CORPORATION

TABLE 198 CERNER CORPORATION: BUSINESS OVERVIEW

FIGURE 30 CERNER CORPORATION: COMPANY SNAPSHOT (2020)

13.1.2 HEALTHSTREAM

TABLE 199 HEALTHSTREAM: BUSINESS OVERVIEW

FIGURE 31 HEALTHSTREAM: COMPANY SNAPSHOT (2020)

13.1.3 MCKESSON CORPORATION

TABLE 200 MCKESSON CORPORATION: BUSINESS OVERVIEW

FIGURE 32 MCKESSON CORPORATION: COMPANY SNAPSHOT (2020)

13.1.4 INFOSYS LIMITED

TABLE 201 INFOSYS LIMITED: BUSINESS OVERVIEW

FIGURE 33 INFOSYS LIMITED: COMPANY SNAPSHOT (2020)

13.1.5 STANLEY BLACK & DECKER, INC. (STANLEY HEALTHCARE)

TABLE 202 STANLEY BLACK & DECKER, INC.: BUSINESS OVERVIEW

FIGURE 34 STANLEY BLACK & DECKER, INC.: COMPANY SNAPSHOT (2020)

13.1.6 TELETRACKING TECHNOLOGIES, INC.

TABLE 203 TELETRACKING TECHNOLOGIES, INC.: BUSINESS OVERVIEW

13.1.7 NEXTGEN HEALTHCARE

TABLE 204 NEXTGEN HEALTHCARE: BUSINESS OVERVIEW

FIGURE 35 NEXTGEN HEALTHCARE: COMPANY SNAPSHOT (2020)

13.1.8 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

TABLE 205 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: BUSINESS OVERVIEW

FIGURE 36 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY SNAPSHOT (2020)

13.1.9 EPIC SYSTEMS CORPORATION

TABLE 206 EPIC SYSTEMS CORPORATION: BUSINESS OVERVIEW

13.1.10 HALMA PLC

TABLE 207 HALMA PLC: BUSINESS OVERVIEW

FIGURE 37 HALMA PLC: COMPANY SNAPSHOT (2020)

13.1.11 SAP SE

TABLE 208 SAP SE: BUSINESS OVERVIEW

FIGURE 38 SAP SE: COMPANY SNAPSHOT (2020)

13.2 OTHER PLAYERS

13.2.1 SONITOR TECHNOLOGIES

TABLE 209 SONITOR TECHNOLOGIES: BUSINESS OVERVIEW

13.2.2 KONINKLIJKE PHILIPS N.V.

TABLE 210 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

FIGURE 39 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2020)

13.2.3 NEUSOFT CORPORATION

TABLE 211 NEUSOFT CORPORATION: BUSINESS OVERVIEW

13.2.4 INFINITT HEALTHCARE CO., LTD.

TABLE 212 INFINITT HEALTHCARE CO., LTD.: BUSINESS OVERVIEW

FIGURE 40 INFINITT HEALTHCARE CO., LTD.: COMPANY SNAPSHOT (2020)

13.2.5 JVS GROUP

TABLE 213 JVS GROUP: BUSINESS OVERVIEW

13.2.6 INFOR SYSTEMS

13.2.7 CARE LOGISTICS

13.2.8 WELLSKY

13.2.9 SIMUL8 CORPORATION

13.2.10 ALCIDION CORPORATION

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 221)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

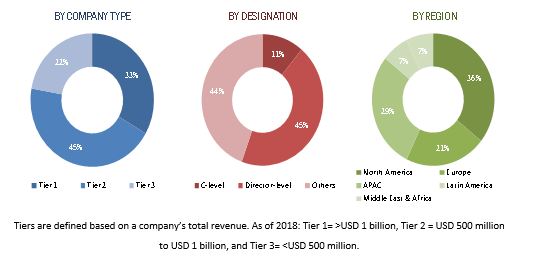

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the hospital capacity management solutions market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the global market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the hospital capacity management solutions market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach to calculate the revenue of different players in the global market

The size of the global hospital capacity management solutions market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the global hospital capacity management solutions market by product, component, mode of delivery, end-user, and region

- To provide detailed information about the significant factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the global market in five major regions along with their respective key countries (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa)

- To profile the key players in the global market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as product launches, expansions, and R&D activities of the leading players in the global market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Asia-Pacific market into South Korea, Australia, and other Southeast Asian countries

- Further breakdown of the European market into Russia and Switzerland.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hospital Capacity Management Solutions Market

What are the recent developments in the global Hospital Capacity Management Solutions Market?

In what way, the Covid-19 is impacting the global Hospital Capacity Management Solutions Market?

Can you share more elaborated information on the global leading players of the Hospital Capacity Management Solutions Market as well as growth strategies adopted by them?