Homogenizers Market by Type (Ultrasonic, Pressure, Mechanical), by Valve Technology (Single-valve Assembly, Two-valve Assembly), by Application (Food & Dairy, Cosmetics, Pharmaceuticals, Chemical Processing, Biotechnology), by Geography - Forecast to 2021

[319 Pages Report] The market for homogenizers is projected to grow from USD 1.53 Billion in 2016 to reach USD 1.94 Billion by 2021, at a CAGR of 4.92%. The report aims at estimating the market size and future growth potential of the homogenizers market across different segments such as type, valve technology, application, and region. Globally, competition in the homogenizers market is growing considerably owing to the increasing demand from various end user industries such as food & dairy, cosmetics, pharmaceutical, biotechnologies, and chemical industries. The base year considered for the study is 2015 and the market size is projected from 2016 to 2021.

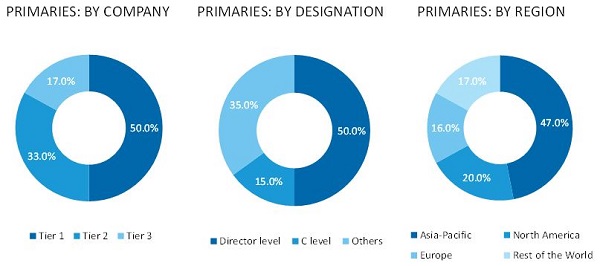

The research methodology used to estimate and forecast the market size included the top-down approach. The total market size of the homogenizers was calculated, and accordingly, the percentage was allotted to different sectors in each of the segments. This allotment and calculation was done on the basis of extensive primary interviews and secondary research. Primary research involved in this report includes extensive interviews with key people such as CEOs, VPs, directors, and executives. After arriving at the overall market size, the total market was split into several segments and subsegments. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary respondents is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The homogenizers value chain includes equipment manufacturers such as Krones AG (Germany), GEA Group (Germany), SPX Corporation (U.S.), Sonic Corporation (U.S.), Avestin Inc. (Canada), Bertoli s.r.l (Italy), FBF Italia s.r.l (Italy), Netzsch Group [Erich NETZSCH GmbH & Co. Holding KG] (Germany), PHD Technology International LLC (U.S.), Microfluidics International Corporation (U.S.), Ekato Holding GmbH (Germany), Alitec (Brazil), Simes SA (Argentina), Goma Engineering Pvt. Ltd. (India), Milkotek-Hommak (Turkey), BOS Homogenizers B.V. (The Netherlands), Silverson Machines Inc. (U.K.), and Frymakoruma GmbH (Germany). The homogenizer equipment manufactured by these companies are used by food & dairy, cosmetics, pharmaceutical, biotechnology, and chemical related companies such as Nestle S.A. (Switzerland), Novartis International AG (Switzerland), Pfizer Inc. (U.S.), and LOrιal S.A. (France).

Target Audience

- Raw material and manufacturing equipment suppliers

- Technology and equipment providers

- Intermediary suppliers

- Wholesalers

- Dealers

- Consumers

- Dairy products manufacturers/suppliers

- Cosmetic manufacturers

- Chemical processing industries

- Biotechnology industry

- Pharmaceutical industry

- Research institutes and organizations

- Government bodies, venture capitalists, and private equity firms

Scope of the Report

The research report segments homogenizers into the following submarkets:

Homogenizers market, by Type:

- Ultrasonic homogenizers

- Pressure homogenizers

- Mechanical homogenizers

Homogenizers market, by Valve Technology:

- Single-valve assembly

- Two-valve assembly

Homogenizers market, by Application:

- Food & dairy

- Cosmetics

- Pharmaceuticals

- Biotechnology

- Chemical processing

Homogenizers market, by Region:

- North America

- Northern Europe

- Western Europe

- Eastern Europe

- Asia-Pacific

- Middle East

- Africa

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the client-specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the market for different recycled product types

Geographic Analysis

- Further analysis of homogenizers market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five).

MarketsandMarkets projects that the market for homogenizers is projected to grow from USD 1.53 Billion in 2016 to USD 1.94 Billion by 2021, at a CAGR of 4.92%. The market for homogenizers is growing due to innovative developments in the industrial sectors and increasing demand from various end user industries such as food & dairy, cosmetics, pharmaceutical, biotechnologies, and chemical. Change in consumer lifestyles and growing consumption of novel food & beverage products are the important factors that led to the increase in the demand of homogenizers, especially in the emerging Asia-Pacific and Latin American regions.

The homogenizers market is segmented on the basis of type, valve technology, application, and region. On the basis of type, the ultrasonic homogenizers segment accounted for the largest market share, in terms of both volume and value. Ultrasonic homogenizers are widely used for emulsifying various cosmetics and consumer durable products, such as skin lotions, pharmaceutical ointments, lubricants, and fuels, owing to its capability of dispersing of powders in liquid.

Two valve assembly homogenizers are the most widely used valve technology among other technologies, especially in the dairy and cosmetics industries; this segment accounted for the largest share, in terms of both, volume and value. These are widely used for the products which require high processing and have high fat content such as dairy products, viscous products, cosmetics, and consumer products.

On the basis of application, the homogenizers market is segmented into food & dairy, cosmetics, pharmaceuticals, biotechnologies, and chemical. The food & dairy segment accounted for the largest market share in 2015. This growth is attributed to the increasing food & beverage industry which provides excellent opportunities to the market players to produce unique and innovative homogenized food & beverage products. Changing consumer lifestyle and growing consumption of food & beverage products will further drive the market.

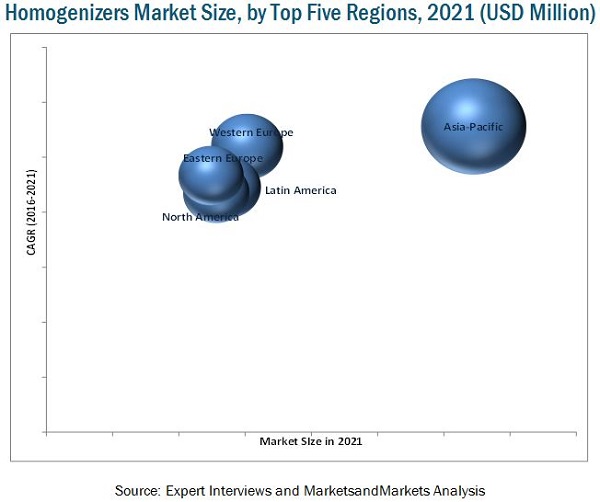

The global homogenizers market is segmented, region-wise, into North America, Northern Europe, Western Europe, Eastern Europe, Asia-Pacific, Middle East, Africa, and Latin America. The Asia-Pacific region held the largest share among all the regions in 2015. The rising economy and the rapid growth in the food & beverage and dairy sectors of the Asia-Pacific region have significantly impacted the growth of the homogenizers market.

Mergers & acquisitions accounted for 44% of the total strategic growth developments adopted by key players in the homogenizers market from 2011 to 2015. Companies adopted these strategies to increase their geographical reach and strengthen their product portfolios and were largely adopted by the leading homogenizers manufacturing companies. Krones AG (Germany), GEA Group (Germany), and Netzsch Group [Erich NETZSCH GmbH & Co. Holding KG] (Germany) are some of the leading homogenizers manufacturing companies that adopted these strategies. Companies aim to serve the market efficiently by investing in research & development activities and introducing new products to keep up with changing consumer wants and needs.

There are certain factors prevailing in the market that hinder the growth of this industry. Factors such as uncertainty in economic conditions, heavy capital investment, and government regulations inhibit the growth of the market. Rising costs of power and energy required for the operation of homogenizer could be a major challenge.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 33)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Study Scope

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Stakeholders

1.5 Limitations

2 Research Methodology (Page No. - 37)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations of the Research Study

3 Executive Summary (Page No. - 45)

3.1 Introduction

3.1.1 Factors Driving the Homogenizers Market

3.2 Evolution of Homogenizers

3.3 Strategies Adopted By Leading Market Players From 2011 to 2015

4 Premium Insights (Page No. - 49)

4.1 Attractive Market Opportunities in the Homogenizers Market

4.2 Homogenizers Market Size, By Application (USD Million)

4.3 Asia- Pacific Homogenizers Market, By Country & Type

4.4 Country Wise Growth Rates From 2016 to 2021

4.5 Emerging Markets vs. Developed Markets

4.6 Homogenizers Market Size, By Valve Technology, 2015 (USD Million)

5 Market Overview (Page No. - 53)

5.1 Introduction

5.2 Evolution of Homogenizer Market

5.3 Homogenizer Market Segmentation

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Demand-Side Analysis

5.4.1.1.1 Increasing Demand for Novel Food & Beverage Products

5.4.1.1.2 Increasing Demand for Homogenizers Providing Extended Shelf Life of Food Products

5.4.1.1.3 Growing Demand for Ultrasonic Homogenizers

5.4.1.1.4 Increase in the Demand From End-User Industries

5.4.1.2 Supply-Side Drivers

5.4.1.2.1 Research & Development on Homogenizers and New Technologies By Homogenizer Manufacturers

5.4.2 Restraints

5.4.2.1 Demand-Side Restraints

5.4.2.1.1 Heavy Capital Investment to Install Homogenizers

5.4.3 Opportunities

5.4.3.1 Homogenizer Toll Processing Provides Huge Opportunity for the Market Growth

5.4.4 Challenges

5.4.4.1 Increasing Cost of Energy and Power

6 Industry Trends (Page No. - 66)

6.1 Introduction

6.2 Manufacturing Process of Homogenizers

6.3 Porters Five Forces Analysis: Homogenizers Market

6.3.1 Intensity of Competitive Rivalry

6.3.2 Bargaining Power of Buyers

6.3.3 Bargaining Power of Suppliers

6.3.4 Threat of Substitutes

6.3.5 Threat of New Entrants

7 Homogenizer Market, By Type (Page No. - 71)

7.1 Introduction

7.1.1 Homogenizers Market, By Type

7.1.1.1 Ultrasonic Homogenizers Segment Dominated the Homogenizers Market in 2015

7.2 Ultrasonic Homogenizers

7.2.1 Ultrasonic Homogenizers Market, By Application

7.2.1.1 Pharmaceuticals Segment Accounted for Second-Largest Share for Ultrasonic Homogenizers in 2015

7.3 Pressure Homogenizers

7.3.1 Pressure Homogenizers Market, By Type

7.3.1.1 High-Pressure Homogenizers Segment Dominated the Homogenizers Market in 2015

7.3.2 Pressure Homogenizers Market, By Application

7.3.2.1 Pharmaceuticals Segment is Projected to Grow at the Highest CAGR for Pressure Homogenizers Market From 2016 to 2021

7.3.3 High-Pressure Homogenizers

7.3.4 Mid-Pressure Homogenizers

7.3.5 Low-Pressure Homogenizers

7.4 Mechanical Homogenizers

7.4.1 Mechanical Homogenizers Market, By Type

7.4.1.1 Rotor-Stator Homogenizers Segment Dominated the Homogenizers Market in 2015

7.4.2 Mechanical Homogenizers Market, By Application

7.4.2.1 Food & Dairy Accounted for the Largest Market Share for Mechanical Homogenizers in 2015

7.4.3 Rotor-Stator Homogenizers

7.4.4 Blade Type Homogenizers

8 Homogenizers Market, By Valve Technology (Page No. - 81)

8.1 Introduction

8.2 Single-Valve Assembly

8.3 Two-Valve Assembly

8.3.1 Homogenizers Market, By Valve Technology

8.3.1.1 Two-Valve Assembly Segment Dominated the Valve Technology Market in 2015

9 Homogenizers Market, By Application (Page No. - 85)

9.1 Introduction

9.1.1 Market, By Application

9.1.1.1 Food & Dairy Segment Dominated the Homogenizers Application Globally

9.2 Food & Dairy

9.3 Cosmetics

9.4 Pharmaceutical

9.5 Biotechnology

9.6 Chemical Processing

10 Homogenizers Market, By Region (Page No. - 92)

10.1 Introduction

10.1.1 Market, By Region

10.1.1.1 Asia-Pacific Dominated the Market for Homogenizers in 2015

10.2 Asia-Pacific

10.2.1 Asia-Pacific: Homogenizers Market, By Country

10.2.1.1 China is Projected to Be the Fastest-Growing Market From 2016 to 2021

10.2.2 Asia-Pacific: Market, By Type

10.2.2.1 Pressure Homogenizers Segment is Projected to Grow at the Highest Rate From 2016 to 2021

10.2.3 Asia-Pacific: Pressure Homogenizers Market, By Type

10.2.3.1 Mid-Pressure Homogenizers Segment is Projected to Grow at the Highest Rate From 2016 to 2021

10.2.4 Asia-Pacific: Homogenizers Market, By Application

10.2.4.1 Food & Dairy Segment Dominated the Homogenizers Market in Asia-Pacific in 2015

10.2.5 Asia-Pacific: Homogenizers Market, By Valve Technology

10.2.5.1 Two-Valve Assembly Segment Dominated the Valve Technology Market in Asia-Pacific in 2015

10.2.6 China

10.2.6.1 China: Homogenizers Market, By Type

10.2.6.1.1 Pressure Homogenizers to Dominate the Homogenizers Market in China By 2021

10.2.6.2 China: Pressure Homogenizers Market, By Type

10.2.6.2.1 Mid-Pressure Homogenizers are Projected to Grow at the Highest Rate Through 2021

10.2.6.3 China: Homogenizers Market, By Application

10.2.6.3.1 the Pharmaceutical Application Accounted for the Second-Largest Share in China in 2015

10.2.7 Japan

10.2.7.1 Japan: Homogenizers Market, By Type

10.2.7.1.1 Ultrasonic Homogenizers to Dominate the Market in Japan By 2021

10.2.7.2 Japan: Pressure Homogenizers Market, By Type

10.2.7.2.1 Mid-Pressure Homogenizers are Projected to Grow at the Highest Rate Through 2021

10.2.7.3 Japan: Market Size, By Application

10.2.7.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in Japan in 2015

10.2.8 India

10.2.8.1 India: Homogenizers Market, By Type

10.2.8.1.1 Pressure Homogenizers to Grow at the Highest Rate By 2021

10.2.8.2 India: Pressure Homogenizers Market, By Type

10.2.8.2.1 Mid-Pressure Homogenizers Dominated the Indian Market in 2015

10.2.8.3 India: Homogenizers Market, By Application

10.2.8.3.1 Food & Dairy Application Accounted for the Largest Share in India in 2015

10.2.9 Australia

10.2.9.1 Australia: Homogenizers Market, By Type

10.2.9.1.1 Pressure Homogenizers to Grow at the Highest Rate By 2021

10.2.9.2 Australia: Pressure Homogenizers Market, By Type

10.2.9.2.1 High-Pressure Homogenizers Dominated the Australian Market in 2015

10.2.9.3 Australia: Homogenizers Market Size, By Application

10.2.9.3.1 Food & Dairy Application Accounted for the Largest Share in Australia in 2015

10.2.10 New Zealand

10.2.10.1 New Zealand: Homogenizers Market, By Type

10.2.10.1.1 Pressure Homogenizers to Grow at the Highest Rate By 2021

10.2.10.2 New Zealand: Pressure Homogenizers Market, By Type

10.2.10.2.1 High-Pressure Homogenizers Dominated New Zealands Market in 2015

10.2.10.3 New Zealand: Homogenizers Market Size, By Application

10.2.10.3.1 Pharmaceutical Application is Projected to Grow at the Highest Rate By 2021

10.2.11 Southeast Asia

10.2.11.1 Southeast Asia: Homogenizers Market, By Type

10.2.11.1.1 Pressure Homogenizers to Grow at the Highest Rate By 2021

10.2.11.2 Southeast Asia: Pressure Homogenizers Market, By Type

10.2.11.2.1 High-Pressure Homogenizers Projected to Grow at the Highest CAGR By 2021

10.2.11.3 Southeast Asia: Homogenizers Market, By Application

10.2.11.3.1 Pharmaceutical Application is Projected to Grow at the Highest Rate By 2021

10.2.12 Rest of Asia-Pacific

10.2.12.1 Rest of Asia-Pacific: Homogenizers Market, By Type

10.2.12.1.1 Pressure Homogenizers to Grow at the Highest Rate By 2021

10.2.12.2 Rest of Asia-Pacific: Pressure Homogenizers Market, By Type

10.2.12.2.1 High-Pressure Homogenizers Projected to Grow at the Highest CAGR By 2021

10.2.12.3 Rest of Asia-Pacific: Homogenizers Market, By Application

10.2.12.3.1 Pharmaceutical Application is Projected to Grow at the Highest Rate By 2021

10.3 Western Europe

10.3.1 Western Europe: Homogenizers Market, By Country

10.3.1.1 France is Projected to Be the Fastest-Growing Market By 2021

10.3.2 Western Europe: Homogenizers Market, By Type

10.3.2.1 Pressure Homogenizers Segment to Grow at the Highest Rate By 2021

10.3.3 Western Europe: Pressure Homogenizers Market, By Type

10.3.3.1 Mid-Pressure Homogenizers Segment Projected to Grow at the Highest Rate By 2021

10.3.4 Western Europe: Homogenizers Market, By Application

10.3.4.1 Food & Dairy Segment Dominated in Western Europe

10.3.5 Western Europe: Homogenizers Market, By Valve Technology

10.3.5.1 Two-Valve Assembly Segment Dominated the Valve Technology Market in Western Europe

10.3.6 Germany

10.3.6.1 Germany: Homogenizers Market, By Type

10.3.6.1.1 Ultrasonic Homogenizers Segment to Dominate the in Germany By 2021

10.3.6.2 Germany: Pressure Homogenizers Market, By Type

10.3.6.2.1 High-Pressure Segment Projected to Grow at the Highest Rate By 2021

10.3.6.3 Germany: Homogenizers Market, By Application

10.3.6.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in Germany in 2015

10.3.7 France

10.3.7.1 France: Homogenizers Market, By Type

10.3.7.1.1 Ultrasonic Homogenizers Segment to Dominate the Homogenizers Market in France By 2021

10.3.7.2 France: Pressure Homogenizers Market, By Type

10.3.7.2.1 Mid-Pressure Homogenizers Segment Projected to Grow at the Highest Rate By 2021

10.3.7.3 France: Homogenizers Market, By Application

10.3.7.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in France in 2015

10.3.8 Spain

10.3.8.1 Spain: Homogenizers Market, By Type

10.3.8.1.1 Ultrasonic Homogenizers Segment to Dominate Market in Spain By 2021

10.3.8.2 Spain: Pressure Homogenizers Market, By Type

10.3.8.2.1 Mid-Pressure Homogenizers Segment Projected to Grow at the Highest Rate By 2021

10.3.8.3 Spain: Homogenizers Market, By Application

10.3.8.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in Spain in 2015

10.3.9 Benelux

10.3.9.1 Benelux: Homogenizers Market, By Type

10.3.9.1.1 Ultrasonic Homogenizers Segment to Dominate the Market in Benelux By 2021

10.3.9.2 Benelux: Pressure Homogenizers Market, By Type

10.3.9.2.1 High-Pressure Segment Projected to Grow at the Highest Rate By 2021

10.3.9.3 Benelux: Homogenizers Market, By Application

10.3.9.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in Benelux in 2015

10.3.10 Switzerland

10.3.10.1 Switzerland: Homogenizers Market, By Type

10.3.10.1.1 Ultrasonic Homogenizers Segment to Dominate the Market in Switzerland By 2021

10.3.10.2 Switzerland: Pressure Homogenizers Market, By Type

10.3.10.2.1 High-Pressure Homogenizers Segment Projected to Grow at the Highest Rate By 2021

10.3.10.3 Switzerland: Homogenizers Market, By Application

10.3.10.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in Switzerland in 2015

10.4 Latin America

10.4.1 Latin America: Homogenizers Market, By Country

10.4.1.1 Argentina is Projected to Be the Fastest-Growing Market By 2021

10.4.2 Latin America: Market, By Type

10.4.2.1 Ultrasonic Homogenizers to Grow at the Highest Rate By 2021

10.4.3 Latin America: Pressure Homogenizers Market, By Type

10.4.3.1 High-Pressure Homogenizers are Projected to Grow at the Highest Rate By 2021

10.4.4 Latin America: Homogenizers Market, By Application

10.4.4.1 Food & Dairy Dominated the Latin American Market, By Application

10.4.5 Latin America: Homogenizers Market, By Valve Technology

10.4.5.1 Two-Valve Assembly Segment Dominated the Market in Latin America

10.4.6 Argentina

10.4.6.1 Argentina: Homogenizers Market, By Type

10.4.6.1.1 Ultrasonic Homogenizers to Dominate the Market in Argentina By 2021

10.4.6.2 Argentina: Pressure Homogenizers Market, By Type

10.4.6.2.1 Mid-Pressure Homogenizers are Projected to Grow at the Highest Rate By 2021

10.4.6.3 Argentina: Homogenizers Market, By Application

10.4.6.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in Argentina in 2015

10.4.7 Brazil

10.4.7.1 Brazil: Homogenizers Market, By Type

10.4.7.1.1 Pressure Homogenizers to Grow at the Highest Rate By 2021

10.4.7.2 Brazil: Pressure Homogenizers Market, By Type

10.4.7.2.1 High-Pressure Homogenizers Dominated the Brazilian Market in 2015

10.4.7.3 Brazil: Homogenizers Market, By Application

10.4.7.3.1 Food & Dairy Application Accounted for the Largest Share in Brazil in 2015

10.4.8 Mexico

10.4.8.1 Mexico: Homogenizers Market, By Type

10.4.8.1.1 Ultrasonic Homogenizers to Grow at the Highest Rate By 2021

10.4.8.2 Mexico: Pressure Homogenizers Market, By Type

10.4.8.2.1 High-Pressure Homogenizers Dominated the Mexican Market in 2015

10.4.8.3 Mexico: Homogenizers Market, By Application

10.4.8.3.1 Pharmaceutical Application is Projected to Grow at the Highest Rate By 2021

10.4.9 Colombia

10.4.9.1 Colombia: Homogenizers Market, By Type

10.4.9.1.1 Pressure Homogenizers to Grow at the Highest Rate By 2021

10.4.9.2 Colombia: Pressure Homogenizers Market, By Type

10.4.9.2.1 High-Pressure Homogenizers Projected to Grow at the Highest CAGR By 2021

10.4.9.3 Colombia: Homogenizers Market, By Application

10.4.9.3.1 Pharmaceutical Application is Projected to Grow at the Highest Rate By 2021

10.4.10 Rest of Latin America

10.4.10.1 Rest of Latin America: Homogenizers Market, By Type

10.4.10.1.1 Ultrasonic Homogenizers Dominated the Market, By Type, in 2015

10.4.10.2 Rest of Latin America: Pressure Homogenizers Market, By Type

10.4.10.2.1 Mid-Pressure Homogenizers Projected to Grow at the Second-Highest Rate By 2021

10.4.10.3 Rest of Latin America: Homogenizers Market, By Application

10.4.10.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in 2015

10.5 North America

10.5.1 North America: Homogenizers Market, By Country

10.5.1.1 U.S. is Projected to Be the Fastest-Growing Market From 2016 to 2021

10.5.2 North America: Homogenizers Market, By Type

10.5.2.1 Ultrasonic Homogenizers Segment is Projected to Grow at the Highest Rate From 2016 to 2021

10.5.3 North America: Pressure Homogenizers Market, By Type

10.5.3.1 High-Pressure Homogenizers Segment is Projected to Grow at the Highest Rate From 2016 to 2021

10.5.4 North America: Homogenizers Market, By Application

10.5.4.1 Food & Dairy Segment Dominated the Homogenizers Market in North America in 2015

10.5.5 North America: Homogenizers Market, By Valve Technology

10.5.5.1 Two-Valve Assembly Segment Dominated the Valve Technology Market in North America in 2015

10.5.6 U.S.

10.5.6.1 U.S.: Homogenizers Market, By Type

10.5.6.1.1 Ultrasonic Homogenizers Segment is Projected to Dominate the Homogenizers Market in the U.S. in 2021

10.5.6.2 U.S.: Pressure Homogenizers Market, By Type

10.5.6.2.1 High-Pressure Homogenizers Segment is Projected to Grow at the Highest Rate From 2016 to 2021

10.5.6.3 U.S.: Homogenizers Market, By Application

10.5.6.3.1 Pharmaceuticals Segment Accounted for the Second-Largest Share in the U.S. in 2015

10.5.7 Canada

10.5.7.1 Canada: Homogenizers Market, By Type

10.5.7.1.1 Ultrasonic Homogenizers Segment is Projected to Grow at the Highest Rate From 2016 to 2021

10.5.7.2 Canada: Pressure Homogenizers Market, By Type

10.5.7.2.1 High-Pressure Homogenizers Segment Dominated the Canadian Homogenizers Market in 2015

10.5.7.3 Canada: Market, By Application

10.5.7.3.1 Food & Dairy Segment Accounted for the Largest Share in Canada in 2015

10.6 Eastern Europe

10.6.1 Eastern Europe: Homogenizers Market, By Country

10.6.1.1 Russia is Projected to Be the Fastest-Growing Market By 2021

10.6.2 Eastern Europe: Homogenizers Market, By Type

10.6.2.1 Pressure Homogenizers Segment to Grow at the Highest Rate By 2021

10.6.3 Eastern Europe: Pressure Homogenizers Market, By Type

10.6.3.1 High-Pressure Homogenizers Segment is Projected to Grow at the Highest Rate By 2021

10.6.4 Eastern Europe: Homogenizers Market, By Application

10.6.4.1 Food & Dairy Dominated the Application Segment in Eastern Europe in 2015

10.6.5 Eastern Europe: Homogenizers Market, By Valve Technology

10.6.5.1 Two-Valve Assembly Segment Dominated, By Valve Technology, in Eastern Europe

10.6.6 Russia

10.6.6.1 Russia: Homogenizers Market, By Type

10.6.6.1.1 Ultrasonic Homogenizers Segment to Dominate the Market in Russia By 2021

10.6.6.2 Russia: Pressure Homogenizers Market, By Type

10.6.6.2.1 Mid-Pressure Homogenizers Segment is Projected to Grow at the Highest Rate By 2021

10.6.6.3 Russia: Market, By Application

10.6.6.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in Russia in 2015

10.6.7 Poland

10.6.7.1 Poland: Homogenizers Market, By Type

10.6.7.1.1 Ultrasonic Homogenizers Segment to Dominate the Market in Poland By 2021

10.6.7.2 Poland: Pressure Homogenizers Market, By Type

10.6.7.2.1 High-Pressure Homogenizers Segment is Projected to Grow at the Highest Rate By 2021

10.6.7.3 Poland: Homogenizers Market, By Application

10.6.7.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in Poland in 2015

10.6.8 Rest of Eastern Europe

10.6.8.1 Rest of Eastern Europe: Homogenizers Market, By Type

10.6.8.1.1 Ultrasonic Homogenizers Segment to Dominate the Homogenizers Market By 2021

10.6.8.2 Rest of Eastern Europe: Pressure Homogenizers Market, By Type

10.6.8.2.1 High-Pressure Homogenizers Segment is Projected to Grow at the Highest Rate By 2021

10.6.8.3 Rest of Eastern Europe: Homogenizers Market, By Application

10.6.8.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in 2015

10.7 Northern Europe

10.7.1 Northern Europe: Homogenizers Market, By Country

10.7.1.1 U.K. is Projected to Be the Fastest-Growing Market From 2016 to 2021

10.7.2 Northern Europe: Homogenizers Market, By Type

10.7.2.1 Pressure Homogenizers Segment is Projected to Grow at the Highest Rate From 2016 to 2021

10.7.3 Northern Europe: Pressure Homogenizers Market, By Type

10.7.3.1 Mid-Pressure Homogenizers Segment is Projected to Grow at the Highest Rate From 2016 to 2021

10.7.4 Northern Europe: Homogenizers Market, By Application

10.7.4.1 Pharmaceuticals Segment is Projected to Grow at the Highest Rate in Northern Europe From 2016 to 2021

10.7.5 Northern Europe: Homogenizers Market, By Valve Technology

10.7.5.1 Two-Valve Assembly Segment Dominated the Valve Technology Market in Northern Europe

10.7.6 Sweden

10.7.6.1 Sweden: Homogenizers Market, By Type

10.7.6.1.1 Pressure Homogenizers Segment is Projected to Dominate the Homogenizers Market in Sweden in 2021

10.7.6.2 Sweden: Pressure Homogenizers Market, By Type

10.7.6.2.1 Mid-Pressure Homogenizers Segment is Projected to Grow at the Highest Rate From 2016 to 2021

10.7.6.3 Sweden: Homogenizers Market, By Application

10.7.6.3.1 Pharmaceuticals Segment Accounted for the Second-Largest Share in Sweden in 2015

10.7.7 U.K.

10.7.7.1 U.K.: Homogenizers Market, By Type

10.7.7.1.1 Pressure Homogenizers Segment is Projected to Dominate the Homogenizers Market in the U.K. in 2021

10.7.7.2 U.K.: Pressure Homogenizers Market, By Type

10.7.7.2.1 Mid-Pressure Homogenizers Segment is Projected to Grow at the Highest Rate From 2016 to 2021

10.7.7.3 U.K.: Homogenizers Market, By Application

10.7.7.3.1 Pharmaceuticals Segment Accounted for the Second-Largest Share in the U.K. in 2015

10.7.8 Denmark

10.7.8.1 Denmark: Homogenizers Market, By Type

10.7.8.1.1 Pressure Homogenizers Segment is Projected to Dominate the Homogenizers Market in Denmark in 2021

10.7.8.2 Denmark: Pressure Homogenizers Market, By Type

10.7.8.2.1 High-Pressure Homogenizers Segment is Projected to Grow at the Highest Rate From 2016 to 2021

10.7.8.3 Denmark: Homogenizers Market, By Application

10.7.8.3.1 Pharmaceuticals Segment Accounted for the Second-Largest Share in Denmark in 2015

10.7.9 Finland

10.7.9.1 Finland: Homogenizers Market, By Type

10.7.9.1.1 Pressure Homogenizers Segment is Projected to Dominate the Homogenizers Market in Finland By 2021

10.7.9.2 Finland: Pressure Homogenizers Market, By Type

10.7.9.2.1 High-Pressure Homogenizers Segment is Projected to Grow at the Highest Rate From 2016 to 2021

10.7.9.3 Finland: Homogenizers Market, By Application

10.7.9.3.1 Pharmaceuticals Segment Accounted for the Second-Largest Share in Finland in 2015

10.7.10 Norway

10.7.10.1 Norway: Homogenizers Market, By Type

10.7.10.1.1 Pressure Homogenizers Segment is Projected to Dominate the Homogenizers Market in Norway in 2021

10.7.10.2 Norway: Pressure Homogenizers Market, By Type

10.7.10.2.1 Mid-Pressure Homogenizers Segment is Projected to Grow at the Highest Rate From 2016 to 2021

10.7.10.3 Norway: Homogenizers Market, By Application

10.7.10.3.1 Pharmaceuticals Segment Accounted for the Second-Largest Share in Norway in 2015

10.8 Middle East

10.8.1 Middle East: Homogenizers Market, By Country

10.8.1.1 Saudi Arabia is Projected to Be the Fastest-Growing Market By 2021

10.8.2 Middle East: Homogenizers Market, By Type

10.8.2.1 Pressure Homogenizers to Grow at the Highest Rate Through 2021

10.8.3 Middle East: Pressure Homogenizers Market, By Type

10.8.3.1 High-Pressure Homogenizers are Projected to Grow at the Highest Rate Through 2021

10.8.4 Middle East: Homogenizers Market, By Application

10.8.4.1 Food & Dairy Application Dominated the Application Segment in the Middle East

10.8.5 Middle East: Market, By Valve Technology

10.8.5.1 Two Valve Assembly Segment Dominated the Valve Technology Market in the Middle East

10.8.6 Iran

10.8.6.1 Iran: Homogenizers Market, By Type

10.8.6.1.1 Pressure Homogenizers to Grow at the Highest Rate Through 2021

10.8.6.2 Iran: Pressure Homogenizers Market, By Type

10.8.6.2.1 High-Pressure Homogenizers Dominated the Iranian Homogenizers Market in 2015

10.8.6.3 Iran: Homogenizers Market, By Application

10.8.6.3.1 Food & Dairy Application Accounted for the Largest Share in Iran in 2015

10.8.7 UAE

10.8.7.1 UAE: Homogenizers Market, By Type

10.8.7.1.1 Pressure Homogenizers to Grow at the Highest Rate Through 2021

10.8.7.2 UAE: Pressure Homogenizers Market, By Type

10.8.7.2.1 High-Pressure Homogenizers Dominated the Market in UAE in 2015

10.8.7.3 UAE: Homogenizers Market, By Application

10.8.7.3.1 Food & Dairy Application Accounted for the Largest Share in UAE in 2015

10.8.8 Saudi Arabia

10.8.8.1 Saudi Arabia: Homogenizers Market, By Type

10.8.8.1.1 Ultrasonic Homogenizers Dominated the Saudi Arabian Homogenizers Market in 2015

10.8.8.2 Saudi Arabia: Pressure Homogenizers Market, By Type

10.8.8.2.1 High-Pressure Homogenizers Dominated the Saudi Arabian Market in 2015

10.8.8.3 Saudi Arabia: Homogenizers Market, By Application

10.8.8.3.1 Pharmaceutical Application is Projected to Grow at the Highest Rate Through 2021

10.8.9 Rest of the Middle East

10.8.9.1 Rest of the Middle East: Homogenizers Market, By Type

10.8.9.1.1 Pressure Homogenizers to Grow at the Highest Rate Through 2021

10.8.9.2 Rest of the Middle East: Pressure Homogenizers Market, By Type

10.8.9.2.1 High-Pressure Homogenizers Dominated the Market in 2015

10.8.9.3 Rest of the Middle East: Homogenizers Market, By Application

10.8.9.3.1 Pharmaceutical Application is Projected to Grow at the Highest Rate Through 2021

10.9 Africa

10.9.1 Africa: Homogenizers Market, By Country

10.9.1.1 Angola is Projected to Be the Fastest-Growing Market By 2021

10.9.2 Africa: Homogenizers Market, By Type

10.9.2.1 Pressure Homogenizers to Grow at the Highest Rate By 2021

10.9.3 Africa: Pressure Homogenizers Market, By Type

10.9.3.1 High-Pressure Homogenizers are Projected to Grow at the Highest Rate By 2021

10.9.4 Africa: Homogenizers Market, By Application

10.9.4.1 Food & Dairy Application Dominated the Application Segment in Africa

10.9.5 Africa: Homogenizers Market, By Valve Technology

10.9.5.1 Two Valve Assembly Segment Dominated the Valve Technology Market in Africa

10.9.6 South Africa

10.9.6.1 South Africa: Homogenizers Market, By Type

10.9.6.1.1 Ultrasonic Homogenizers to Dominate the Market in South Africa By 2021

10.9.6.2 South Africa: Pressure Homogenizers Market, By Type

10.9.6.2.1 High-Pressure Homogenizers are Projected to Grow at the Highest Rate By 2021

10.9.6.3 South Africa: Homogenizers Market, By Application

10.9.6.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in South Africa in 2015

10.9.7 Nigeria

10.9.7.1 Nigeria: Homogenizers Market, By Type

10.9.7.1.1 Ultrasonic Homogenizers to Dominate the Homogenizers Market in Nigeria By 2021

10.9.7.2 Nigeria: Pressure Homogenizers Market, By Type

10.9.7.2.1 High-Pressure Homogenizers are Projected to Grow at the Highest Rate By 2021

10.9.7.3 Nigeria: Homogenizers Market, By Application

10.9.7.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in Nigeria in 2015

10.9.8 Angola

10.9.8.1 Angola: Homogenizers Market, By Type

10.9.8.1.1 Ultrasonic Homogenizers to Dominate the Homogenizers Market in Angola By 2021

10.9.8.2 Angola: Pressure Homogenizers Market, By Type

10.9.8.2.1 High-Pressure Homogenizers are Projected to Grow at the Highest Rate By 2021

10.9.8.3 Angola: Homogenizers Market, By Application

10.9.8.3.1 Cosmetic Application Accounted for the Second-Largest Share in Angola in 2015

10.9.9 Rest of Africa

10.9.9.1 Rest of Africa: Homogenizers Market, By Type

10.9.9.1.1 Ultrasonic Homogenizers to Dominate the Homogenizers Market in Rest of Africa By 2021

10.9.9.2 Rest of Africa: Pressure Homogenizers Market, By Type

10.9.9.2.1 High-Pressure Homogenizers are Projected to Grow at the Highest Rate By 2021

10.9.9.3 Rest of Africa: Homogenizers Market, By Application

10.9.9.3.1 Pharmaceutical Application Accounted for the Second-Largest Share in Rest of Africa in 2015

11 Competitive Landscape (Page No. - 256)

11.1 Overview

11.2 Competitive Situations & Trends

11.3 Key Growth Strategies, 20112016

11.3.1 Mergers & Acquisitions

11.3.2 New Product Launches

11.3.3 Agreements, Collaborations, and Joint Ventures

11.3.4 Expansions & Investments

12 Company Profiles (Page No. - 262)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Krones AG

12.3 GEA Group

12.4 SPX Corporation

12.5 Sonic Corporation

12.6 Avestin Inc.

12.7 Bertoli SRL

12.8 FBF Italia SRL

12.9 Netzsch Group [Erich Netzsch Gmbh & Co. Holding Kg]

12.10 Phd Technology International Llc

12.11 Microfluidics International Corporation

12.12 Ekato Holding Gmbh

12.13 Alitec

12.14 Simes SA

12.15 Goma Engineering Pvt. Ltd.

12.16 Milkotek-Hommak

12.17 BOS Homogenisers B.V.

12.18 Silverson Machines Inc.

12.19 Frymakoruma Gmbh

12.20 Shanghai Donghua High Pressure Homogenizer Factory

12.21 Shanghai Jinzhu Machinery Equipment Co., Ltd.

12.22 Shanghai Precise Packaging Co., Ltd.

12.23 Shanghai Samro Homogenizer Co., Ltd.

12.24 Yixing Yiqing Machinery Co., Ltd.

12.25 Changzhou Chaoli Homogenizing Pump Factory

12.26 Shanghai Jimei Food Machinery Co., Ltd.

12.27 Wenzhou Gaoya Light Industry Machinery Co., Ltd.

12.28 Shanghai Jiadi Machinery Co., Ltd.

12.29 Nanjing Xianou Instruments Manufacture Co., Ltd.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 311)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Company Developments

13.3.1 Mergers & Acquisitions

13.4 Knowledge Store: Marketsandmarkets Subscription Portal

13.5 Introducing RT: Real-Time Market Intelligence

13.6 Available Customizations

13.6.1 Geographic Analysis

13.6.2 Company Information

13.7 Related Reports

List of Tables (321 Tables)

Table 1 Increasing Demand for Novel Food & Beverage Products are the Key Drivers of the Market

Table 2 R&D on Homogenizers and Introduction of New Technologies By Manufacturers

Table 3 Leading Homogenizers Manufacturers That are Focusing on Technology Advancements

Table 4 Heavy Capital Investment to Install Homogenizers May Restrain Market Growth

Table 5 Homogenizer Toll Processing Provides Huge Opportunity for the Market Growth

Table 6 Increasing Cost of Energy and Power Could Be A Challenge

Table 7 Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 8 Market Size, By Type, 20142021 (Units)

Table 9 Ultrasonic Homogenizers Market Size, By Application,20142021 (USD Million)

Table 10 Ultrasonic Homogenizers Market Size, By Application, 20142021 (Units)

Table 11 Pressure Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 12 Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 13 Pressure Homogenizers Market Size, By Application,20142021 (USD Million)

Table 14 Pressure Homogenizers Market Size, By Application, 20142021 (Units)

Table 15 Mechanical Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 16 Mechanical Homogenizers Market Size, By Type, 20142021 (Units)

Table 17 Mechanical Homogenizers Market Size, By Application,20142021 (USD Million)

Table 18 Mechanical Homogenizers Market Size, By Application, 20142021 (Units)

Table 19 Homogenizers Market Size, By Valve Technology,20142021 (USD Million)

Table 20 Market Size, By Valve Technology, 20142021 (Units)

Table 21 Market Size, By Application, 20142021 (USD Million)

Table 22 Market Size, By Application, 20142021 (Units)

Table 23 Market Size, By Region, 20142021 (USD Million)

Table 24 Market Size, By Region, 20142021 (Units)

Table 25 Asia-Pacific: Homogenizers Market Size, By Country,20142021 (USD Million)

Table 26 Asia-Pacific: Homogenizers Market Size, By Country, 20142021 (Units)

Table 27 Asia-Pacific: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 28 Asia-Pacific: Homogenizers Market Size, By Type, 20142021 (Units)

Table 29 Asia-Pacific: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 30 Asia-Pacific: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 31 Asia-Pacific: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 32 Asia-Pacific: Homogenizers Market Size, By Application, 20142021 (Units)

Table 33 Asia-Pacific: Homogenizers Market Size, By Valve Technology,20142021 (USD Million)

Table 34 Asia-Pacific: Homogenizers Market Size, By Valve Technology,20142021 (Units)

Table 35 China: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 36 China: Homogenizers Market Size, By Type, 20142021 (Units)

Table 37 China: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 38 China: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 39 China: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 40 China: Homogenizers Market Size, By Application, 20142021 (Units)

Table 41 Japan: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 42 Japan: Homogenizers Market Size, By Type, 20142021 (Units)

Table 43 Japan: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 44 Japan: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 45 Japan: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 46 Japan: Homogenizers Market Size, By Application, 20142021 (Units)

Table 47 India: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 48 India: Homogenizers Market Size, By Type, 20142021 (Units)

Table 49 India: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 50 India: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 51 India: Homogenizers Market Size, By Application, 20142021 (USD Million)

Table 52 India: Homogenizers Market Size, By Application, 20142021 (Units)

Table 53 Australia: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 54 Australia: Homogenizers Market Size, By Type, 20142021 (Units)

Table 55 Australia: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 56 Australia: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 57 Australia: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 58 Australia: Market Size, By Application, 20142021 (Units)

Table 59 New Zealand: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 60 New Zealand: Homogenizers Market Size, By Type, 20142021 (Units)

Table 61 New Zealand: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 62 New Zealand: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 63 New Zealand: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 64 New Zealand: Homogenizers Market Size, By Application,20142021 (Units)

Table 65 Southeast Asia: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 66 Southeast Asia: Homogenizers Market Size, By Type, 20142021 (Units)

Table 67 Southeast Asia: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 68 Southeast Asia: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 69 Southeast Asia: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 70 Southeast Asia: Homogenizers Market Size, By Application,20142021 (Units)

Table 71 Rest of Asia-Pacific: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 72 Rest of Asia-Pacific: Homogenizers Market Size, By Type,20142021 (Units)

Table 73 Rest of Asia-Pacific: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 74 Rest of Asia-Pacific: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 75 Rest of Asia-Pacific: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 76 Rest of Asia-Pacific: Homogenizers Market Size, By Application,20142021 (Units)

Table 77 Western Europe: Homogenizers Market Size, By Country,20142021 (USD Million)

Table 78 Western Europe: Homogenizers Market Size, By Country,20142021 (Units)

Table 79 Western Europe: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 80 Western Europe: Homogenizers Market Size, By Type, 20142021 (Units)

Table 81 Western Europe: Homogenizers Market Size, By Pressure Homogenizers, 20142021 (USD Million)

Table 82 Western Europe: Pressure Homogenizers Market Size, By, 20142021 (Units)

Table 83 Western Europe: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 84 Western Europe: Homogenizers Market Size, By Application,20142021 (Units)

Table 85 Western Europe: Homogenizers Market Size, By Valve Technology,20142021 (USD Million)

Table 86 Western Europe: Homogenizers Market Size, By Valve Technology,20142021 (Units)

Table 87 Germany: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 88 Germany: Homogenizers Market Size, By Type, 20142021 (Units)

Table 89 Germany: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 90 Germany: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 91 Germany: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 92 Germany: Homogenizers Market Size, By Application, 20142021 (Units)

Table 93 France: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 94 France: Homogenizers Market Size, By Type, 20142021 (Units)

Table 95 France: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 96 France: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 97 France: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 98 France: Homogenizers Market Size, By Application, 20142021 (Units)

Table 99 Spain: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 100 Spain: Homogenizers Market Size, By Type, 20142021 (Units)

Table 101 Spain: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 102 Spain: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 103 Spain: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 104 Spain: Homogenizers Market Size, By Application, 20142021 (Units)

Table 105 Benelux: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 106 Benelux: Homogenizers Market Size, By Type, 20142021 (Units)

Table 107 Benelux: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 108 Benelux: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 109 Benelux: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 110 Benelux: Homogenizers Market Size, By Application, 20142021 (Units)

Table 111 Switzerland: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 112 Switzerland: Homogenizers Market Size, By Type, 20142021 (Units)

Table 113 Switzerland: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 114 Switzerland: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 115 Switzerland: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 116 Switzerland: Homogenizers Market Size, By Application,20142021 (Units)

Table 117 Latin America: Homogenizers Market Size, By Country,20142021 (USD Million)

Table 118 Latin America: Homogenizers Market Size, By Country, 20142021 (Units)

Table 119 Latin America: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 120 Latin America: Homogenizers Market Size, By Type, 20142021 (Units)

Table 121 Latin America: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 122 Latin America: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 123 Latin America: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 124 Latin America: Homogenizers Market Size, By Application,20142021 (Units)

Table 125 Latin America: Homogenizers Market Size, By Valve Technology,20142021 (USD Million)

Table 126 Latin America: Homogenizers Market Size, By Valve Technology,20142021 (Units)

Table 127 Argentina: Food & Beverage Processing Market, 20122015 (USD Million)

Table 128 Argentina: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 129 Argentina: Homogenizers Market Size, By Type, 20142021 (Units)

Table 130 Argentina: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 131 Argentina: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 132 Argentina: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 133 Argentina: Homogenizers Market Size, By Application, 20142021 (Units)

Table 134 Brazil: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 135 Brazil: Homogenizers Market Size, By Type, 20142021 (Units)

Table 136 Brazil: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 137 Brazil: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 138 Brazil: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 139 Brazil: Homogenizers Market Size, By Application, 20142021 (Units)

Table 140 Mexico: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 141 Mexico: Homogenizers Market Size, By Type, 20142021 (Units)

Table 142 Mexico: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 143 Mexico: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 144 Mexico: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 145 Mexico: Homogenizers Market Size, By Application, 20142021 (Units)

Table 146 Food Processing & Beverage Industry in Colombia,20122014 (USD Million)

Table 147 Colombia: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 148 Colombia: Homogenizers Market Size, By Type, 20142021 (Units)

Table 149 Colombia: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 150 Colombia: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 151 Colombia: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 152 Colombia: Homogenizers Market Size, By Application, 20142021 (Units)

Table 153 Rest of Latin America: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 154 Rest of Latin America: Homogenizers Market Size, By Type,20142021 (Units)

Table 155 Rest of Latin America: Pressure Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 156 Rest of Latin America: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 157 Rest of Latin America: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 158 Rest of Latin America: Homogenizers Market Size, By Application,20142021 (Units)

Table 159 North America: Homogenizers Market Size, By Country,20142021 (USD Million)

Table 160 North America: Homogenizers Market Size, By Country,20142021 (Units)

Table 161 North America: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 162 North America: Homogenizers Market Size, By Type, 20142021 (Units)

Table 163 North America: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 164 North America: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 165 North America: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 166 North America: Homogenizers Market Size, By Application,20142021 (Units)

Table 167 North America: Homogenizers Market Size, By Valve Technology,20142021 (USD Million)

Table 168 North America: Homogenizers Market Size, By Valve Technology,20142021 (Units)

Table 169 U.S.: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 170 U.S.: Homogenizers Market Size, By Type, 20142021 (Units)

Table 171 U.S.: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 172 U.S.: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 173 U.S.: Homogenizers Market Size, By Application, 20142021 (USD Million)

Table 174 U.S.: Homogenizers Market Size, By Application, 20142021 (Units)

Table 175 Canada: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 176 Canada: Market Size, By Type, 20142021 (Units)

Table 177 Canada: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 178 Canada: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 179 Canada: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 180 Canada: Homogenizers Market Size, By Application, 20142021 (Units)

Table 181 Eastern Europe: Homogenizers Market Size, By Country,20142021 (USD Million)

Table 182 Eastern Europe: Homogenizers Market Size, By Country,20142021 (Units)

Table 183 Eastern Europe: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 184 Eastern Europe: Homogenizers Market Size, By Type, 20142021 (Units)

Table 185 Eastern Europe: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 186 Eastern Europe: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 187 Eastern Europe: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 188 Eastern Europe: Homogenizers Market Size, By Application,20142021 (Units)

Table 189 Eastern Europe: Homogenizers Market Size, By Valve Technology,20142021 (USD Million)

Table 190 Eastern Europe: Homogenizers Market Size, By Valve Technology,20142021 (Units)

Table 191 Russia: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 192 Russia: Homogenizers Market Size, By Type, 20142021 (Units)

Table 193 Russia: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 194 Russia: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 195 Russia: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 196 Russia: Homogenizers Market Size, By Application, 20142021 (Units)

Table 197 Poland: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 198 Poland: Homogenizers Market Size, By Type, 20142021 (Units)

Table 199 Poland: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 200 Poland: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 201 Poland: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 202 Poland: Homogenizers Market Size, By Application, 20142021 (Units)

Table 203 Rest of Eastern Europe: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 204 Rest of Eastern Europe: Homogenizers Market Size, By Type,20142021 (Units)

Table 205 Rest of Eastern Europe: Pressure Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 206 Rest of Eastern Europe: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 207 Rest of Eastern Europe: Homogenizers Market Size, By Application, 20142021 (USD Million)

Table 208 Rest of Eastern Europe: Homogenizers Market Size, By Application, 20142021 (Units)

Table 209 Northern Europe: Homogenizers Market Size, By Country,20142021 (USD Million)

Table 210 Northern Europe: Homogenizers Market Size, By Country,20142021 (Units)

Table 211 Northern Europe: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 212 Northern Europe: Homogenizers Market Size, By Type, 20142021 (Units)

Table 213 Northern Europe: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 214 Northern Europe: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 215 Northern Europe: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 216 Northern Europe: Homogenizers Market Size, By Application,20142021 (Units)

Table 217 Northern Europe: Homogenizers Market Size, By Valve Technology, 20142021 (USD Million)

Table 218 Northern Europe: Homogenizers Market Size, By Valve Technology, 20142021 (Units)

Table 219 Sweden: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 220 Sweden: Homogenizers Market Size, By Type, 20142021 (Units)

Table 221 Sweden: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 222 Sweden: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 223 Sweden: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 224 Sweden: Market Size, By Application, 20142021 (Units)

Table 225 U.K.: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 226 U.K.: Homogenizers Market Size, By Type, 20142021 (Units)

Table 227 U.K.: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 228 U.K.: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 229 U.K.: Homogenizers Market Size, By Application, 20142021 (USD Million)

Table 230 U.K.: Homogenizers Market Size, By Application, 20142021 (Units)

Table 231 Denmark: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 232 Denmark: Homogenizers Market Size, By Type, 20142021 (Units)

Table 233 Denmark: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 234 Denmark: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 235 Denmark: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 236 Denmark: Homogenizers Market Size, By Application, 20142021 (Units)

Table 237 Finland: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 238 Finland: Homogenizers Market Size, By Type, 20142021 (Units)

Table 239 Finland: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 240 Finland: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 241 Finland: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 242 Finland: Homogenizers Market Size, By Application, 20142021 (Units)

Table 243 Norway: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 244 Norway: Homogenizers Market Size, By Type, 20142021 (Units)

Table 245 Norway: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 246 Norway: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 247 Norway: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 248 Norway: Homogenizers Market Size, By Application, 20142021 (Units)

Table 249 Middle East: Homogenizers Market Size, By Country,20142021 (USD Million)

Table 250 Middle East: Homogenizers Market Size, By Country, 20142021 (Units)

Table 251 Middle East: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 252 Middle East: Homogenizers Market Size, By Type, 20142021 (Units)

Table 253 Middle East: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 254 Middle East: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 255 Middle East: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 256 Middle East: Homogenizers Market Size, By Application,20142021 (Units)

Table 257 Middle East: Homogenizers Market Size, By Valve Technology,20142021 (USD Million)

Table 258 Middle East: Homogenizers Market Size, By Valve Technology,20142021 (Units)

Table 259 Iran: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 260 Iran: Homogenizers Market Size, By Type, 20142021 (Units)

Table 261 Iran: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 262 Iran: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 263 Iran: Homogenizers Market Size, By Application, 20142021 (USD Million)

Table 264 Iran: Homogenizers Market Size, By Application, 20142021 (Units)

Table 265 UAE: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 266 UAE: Homogenizers Market Size, By Type, 20142021 (Units)

Table 267 UAE: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 268 UAE: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 269 UAE: Homogenizers Market Size, By Application, 20142021 (USD Million)

Table 270 UAE: Homogenizers Market Size, By Application, 20142021 (Units)

Table 271 Saudi Arabia: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 272 Saudi Arabia: Homogenizers Market Size, By Type, 20142021 (Units)

Table 273 Saudi Arabia: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 274 Saudi Arabia: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 275 Saudi Arabia: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 276 Saudi Arabia: Homogenizers Market Size, By Application,20142021 (Units)

Table 277 Rest of the Middle East: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 278 Rest of the Middle East: Homogenizers Market Size, By Type,20142021 (Units)

Table 279 Rest of the Middle East: Pressure Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 280 Rest of the Middle East: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 281 Rest of the Middle East: Homogenizers Market Size, By Application, 20142021 (USD Million)

Table 282 Rest of the Middle East: Homogenizers Market Size, By Application, 20142021 (Units)

Table 283 Africa: Homogenizers Market Size, By Country, 20142021 (USD Million)

Table 284 Africa: Homogenizers Market Size, By Country, 20142021 (Units)

Table 285 Africa: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 286 Africa: Homogenizers Market Size, By Type, 20142021 (Units)

Table 287 Africa: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 288 Africa: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 289 Africa: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 290 Africa: Homogenizers Market Size, By Application, 20142021 (Units)

Table 291 Africa: Homogenizers Market Size, By Valve Technology,20142021 (USD Million)

Table 292 Africa: Homogenizers Market Size, By Valve Technology,20142021 (Units)

Table 293 South Africa: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 294 South Africa: Homogenizers Market Size, By Type, 20142021 (Units)

Table 295 South Africa: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 296 South Africa: Homogenizers Market Size, By Type, 20142021 (Units)

Table 297 South Africa: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 298 South Africa: Homogenizers Market Size, By Application,20142021 (Units)

Table 299 Nigeria: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 300 Nigeria: Homogenizers Market Size, By Type, 20142021 (Units)

Table 301 Nigeria: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 302 Nigeria: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 303 Nigeria: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 304 Nigeria: Market Size, By Application, 20142021 (Units)

Table 305 Angola: Homogenizers Market Size, By Type, 20142021 (USD Million)

Table 306 Angola: Homogenizers Market Size, By Type, 20142021 (Units)

Table 307 Angola: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 308 Angola: Pressure Homogenizers Market Size, By Type, 20142021 (Units)

Table 309 Angola: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 310 Angola: Homogenizers Market Size, By Application, 20142021 (Units)

Table 311 Rest of Africa: Homogenizers Market Size, By Type,20142021 (USD Million)

Table 312 Rest of Africa: Homogenizers Market Size, By Type, 20142021 (Units)

Table 313 Rest of Africa: Pressure Homogenizers Market Size, By Type,20142021 (USD Million)

Table 314 Rest of Africa: Pressure Homogenizers Market Size, By Type,20142021 (Units)

Table 315 Rest of Africa: Homogenizers Market Size, By Application,20142021 (USD Million)

Table 316 Rest of Africa: Homogenizers Market Size, By Application,20142021 (Units)

Table 317 Key Strategies Adopted By Market Players to Achieve Growth in the Homogenizers Market

Table 318 Mergers & Acquisitions, 2015

Table 319 New Product Launches, 2015

Table 320 Agreements, Collaborations, and Joint Ventures, 20132015

Table 321 Expansions & Investments, 20132014

List of Figures (68 Figures)

Figure 1 Homogenizers Market

Figure 2 Homogenizers Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation& Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Limitations of the Research Study

Figure 8 Homogenizers Market Size, By Type, 2016 vs. 2021(USD Million)

Figure 9 Asia-Pacific is Projected to Be the Fastest-Growing Region in the Homogenizers Market

Figure 10 Food & Dairy is Projected to Be the Leading Application Segment in the Homogenizers Market, in Terms of Value, By 2021

Figure 11 Leading Market Players Adopted Mergers & Acquisitions as the Key Strategy From 2011 to 2015

Figure 12 Emerging Economies Offer Attractive Opportunities in Homogenizers Market

Figure 13 Food & Dairy Segment Occupied the Largest Share Among All Applications of Homogenizers in 2015

Figure 14 Ultrasonics Segment Captured the Largest Share in the Asia-Pacific Region in 2015

Figure 15 U.S. Projected to Be the Fastest-Growing Country Market for Homogenizers Through 2021

Figure 16 Emerging Markets to Grow Faster Than Developed Markets Between 2016 & 2021

Figure 17 Two Valve Technology to Be the Fastest-Growing Segment for Homogenizers Through 2021

Figure 18 First Homogenizer Was Developed in 1899 for the Processing of Raw Milk

Figure 19 Homogenizer Market Segmentation

Figure 20 Increasing Demand for Novel Food & Beverage Products is the Key Driver of the Market

Figure 21 Global Consumption of Butter, 20122020

Figure 22 Global Consumption of Cheese, 20122020

Figure 23 Global Consumption of Whole Milk Powder, 20122020

Figure 24 Global Consumption for Skim Milk Powder, 20122020

Figure 25 Annual Growth of the Global Cosmetics Market, 20082014

Figure 26 Global Cosmetics Market Share, Region, 2014

Figure 27 Revenue Generated By Pharmaceutical & Medicines in the U.S.

Figure 28 Processing: From Reception to Final Packaging for Homogenizers Market

Figure 29 Porters Five Forces Analysis Homogenizers Market

Figure 30 Homogenizers Market Size, By Type, 2016 vs. 2021 (USD Million)

Figure 31 Two-Valve Assembly to Dominate the Valve Technology Market Through 2021

Figure 32 Food & Dairy Application Dominated the Homogenizers Market in Terms of Value in 2015

Figure 33 Milk & Dairy Products Aggregate Annual Consumption Growth Rate, By Key Region & Economy, 19922030

Figure 34 Top Five Global Cosmetics Companies Sales, 2013 vs. 2014 (USD Billion)

Figure 35 Geographical Snapshot: Homogenizers Market Growth Rate (20162021)

Figure 36 U.S. & Indian Markets Projected to Grow at the Highest Rate During the Forecast Period

Figure 37 Asia-Pacific: Market Snapshot

Figure 38 Cosmetics Retail Sales Growth in China (Year-On-Year Growth)

Figure 39 Japan: Pharmaceutical Market Size, 2013 vs. 2018 (USD Billion)

Figure 40 Milk Production in India, 2011-2015

Figure 41 Revenue of Indian Pharmaceutical Industry, 2005-2020 (USD Billion)

Figure 42 Australian Dairy Export, 2015-2016 (Thousand Tons)

Figure 43 New Zealands Exports of Goods & Services in 2014 (USD Billion)

Figure 44 Western Europe: Market Snapshot

Figure 45 German Food & Beverage Industry, 2013

Figure 46 Latin America: Market Snapshot

Figure 47 Argentina: Food Processing Equipment Import Market Share, 2013

Figure 48 Brazilian Food Processing Industry, 20092014 (USD Billion)

Figure 49 North America: Market Snapshot

Figure 50 Russia: the Fastest-Growing Market in Eastern Europe

Figure 51 European Union Chemical Trade Surplus With Russia, 2014 (USD Billion)

Figure 52 Russia: Butter and Cheese Imports, 2013 (USD Billion)

Figure 53 Northern Europe: Market Snapshot

Figure 54 Value of the Cosmetics Market in the U.K., 2013 vs. 2014

Figure 55 Growing Manufacturing Industries in Saudi Arabia

Figure 56 Companies Adopted Mergers & Acquisitions as Their Key Growth Strategy Over the Last Five Years (20112016)

Figure 57 Growth Comparison of Key Players in the Homogenizers Market,20122014

Figure 58 Mergers & Acquisitions: the Key Strategy, 20112016

Figure 59 Geographic Revenue Mix of Key Players in the Homogenizers Market

Figure 60 Krones AG: Company Snapshot

Figure 61 SWOT Analysis: Krones AG (Germany)

Figure 62 Krones AG: Net Income, 2011-2014

Figure 63 GEA Group: Company Snapshot

Figure 64 SWOT Analysis: GEA Group

Figure 65 GEA Group: Net Income, 2011-2014

Figure 66 SPX Corporation: Company Snapshot

Figure 67 SWOT Analysis: SPX Corporation

Figure 68 SPX Corporation: Net Income, 2011-2014

Growth opportunities and latent adjacency in Homogenizers Market