High Purity Methane Gas Market by Storage & Distribution and Transportation, Application (Chemical Synthesis, Heat Detection, R &D Laboratory, Transistors & Sensors, Power Electronic), End-Use Industry, Region - Global Forecast to 2025

Updated on : August 25, 2025

High Purity Methane Gas Market

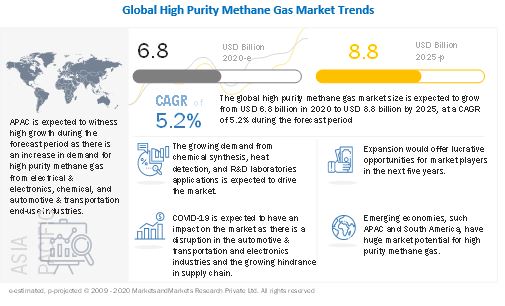

The high purity methane gas market was valued at USD 6.8 billion in 2020 and is projected to reach USD 8.8 billion by 2025, growing at 5.2% cagr from 2020 to 2025. The driving factors for the market is its growing demand from electrical & electronics industry.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact on the High Purity Methane Gas Market

The global High purity methane gas market includes major Tier I and II suppliers like as Osaka Gas (Japan), Sumitomo Seika (Japan), Linde Plc (Ireland), Air Liquide (France), and Matheson Tri-Gas Inc. (US). These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, and Rest of the World. COVID-19 has impacted their businesses as well.

These players have announced the suspension of production due to the lowered demand, supply chain bottlenecks, and to protect the safety of their employees in the US, France, Germany, Italy, and Spain during the COVID-19 pandemic. As a result, the demand for high purity methane gas is expected to decline in 2020. Manufacturers are likely to adjust production to prevent bottlenecks and plan production according to demand from tier 1 manufacturers.

High Purity Methane Gas Market Dynamics

Driver: Increasing demand from electronics industry

High purity gases are used in various electronic components such as silicon wafers, integrated circuits (IC), semiconductors, and solar cell products. High purity methane gas is a major feedstock for the production of graphene, which has extraordinary properties such as low optical absorption, high electrical conductivity, high charge mobility, flexibility, and bendability. Graphene consists of carbon atoms that are arranged in a honeycomb structure, and it is just one atom thick. These properties make graphene suitable for many applications such as solar cells, transistors. One of the most promising applications of graphene is its use as a transparent conductive electrode. The transparent conductive electrode should have high optical transparency and high electrical conductivity. Indium-tin-oxide (ITO) is commonly used as transparent conductive electrodes because of high optical transparency and high conductivity.

Also, graphene is used in the manufacturing of microchips or transistors, both essential elements in virtually all electronic devices. There are several companies that are already developing conductive ink, which is a type of ink that conducts electricity and is used to print circuits from graphene. The chemical vapor deposition (CVD is the most promising approach for producing graphene for large-scale electronic device applications because of its lower cost and higher efficiency.

Therefore, the growing use of graphene for electronic components and semiconductors, along with the increasing capacity of installed semiconductors, integrated circuits employed in various electronic equipment, and the development of new technologies, is driving the market for high purity methane gas.

Restraint: High cost of gas processing

Blending technology, cylinder preparation, laboratory analysis, and statistical quality control are required to produce high purity gases. As a result, high purity gases are much more expensive than industrial gases. EPA Protocol mixture having an analytical accuracy of 1% may cost as much as USD 1,500. As with any other specialized product, the end-cost of a particular specialty pure or gas mixture is largely determined by the degree of difficulty and complexity involved in its preparation.

The construction of a plant requires a huge investment. The post phases, such as maintenance and installation of technology, require considerable capital. There are also some uncounted costs related to repair. Also, there are some political and environmental challenges, such as the exploitation of natural gas reserves in different regions and the environmental risks associated with methanol when used as fuel, which are restraining the growth of the market.

Opportunity: Increasing demad for hydrogen as clean fuel in the transportation industry

Hydrogen derived from methane gas is considered a clean fuel that has tremendous potential in transportation applications. Hydrogen is the most abundant and lightest of the elements and is odorless and non-toxic. It has the highest energy content of common fuels by weight (nearly three times that of gasoline). Hydrogen is mainly derived from fossil energy using technologies such as steam methane reforming (SMR) of natural gas, followed by partial oxidation and auto thermal reforming (ATR). SMR is the most common method of producing commercial bulk hydrogen gas.

The use of hydrogen-operated fuel cells in the transportation industry eliminates the dependency on fossil fuels, which are continuously depleting and becoming expensive. Hydrogen can be produced from renewable energy sources, which can be used in fuel cell-based vehicles. Also, their quick-fueling capability makes hydrogen fuel cells a promising option for long-distance travel. In addition, hydrogen has a low-carbon footprint, which has the potential to facilitate significant reductions in energy-related CO2 emissions. Thus, the use of renewable feedstocks for hydrogen production is an attractive option from an environmental perspective.

With the development of hydrogen refilling infrastructure, the use of fuel cell transport vehicles, such as buses and cars, is slated to increase at a rapid pace. Companies such as Walmart and Coca-Cola are deploying material handling equipment powered by fuel cells. The demand will also increase as several governments plan to implement zero-emission transportation systems.

Challenges: Structural & regulatory restrictions

The Climate change will drive regulators to seek more precise causes and controls. Other concerns for worker safety have increased the number of detectors and increased awareness of calibration and bump-testing before the instruments are put to use. While the ever-tightening environmental regulations put pressure on industrial operations to reduce their environmental emissions, producers, and distributors of high purity gases are expanding their portfolios of certified or EPA protocol type mixes to support the monitoring required.

Methane is a powerful greenhouse gas emitted by human activities such as leakage from natural gas systems and the raising of livestock, as well as by natural sources such as wetlands. It has a direct influence on the climate and a number of indirect effects on human health, crop yields, and the quality and productivity of vegetation through its role as an important precursor to the formation of tropospheric ozone.

High Purity Methane Gas Market Ecosystem

The High purity methane gas market is projected to register a CAGR of 5.3% during the forecast period, in terms of value.

The global High purity methane gas market is estimated to be USD 6,874.5 million in 2020 and is projected to reach USD 8,885.5 million by 2025, at a CAGR of 5.3% from 2020 to 2025. The market is witnessing moderate growth, owing to increasing application, technological advancements, and growing demand for these high purity methane gas in the Asia Pacific and Europe. High purity methane gas are largely used in the electrical & electronics industry. In this industry, high-purity methane gas is used in fluorescent tubes for lighting purposes due to its low cost, high efficiency, and low striking voltage. The increasing use of high purity methane gas in electronics and chemical industries is driving the high purity methane gas market. Strict environmental and government regulations is the restraints for the High purity methane gas market.

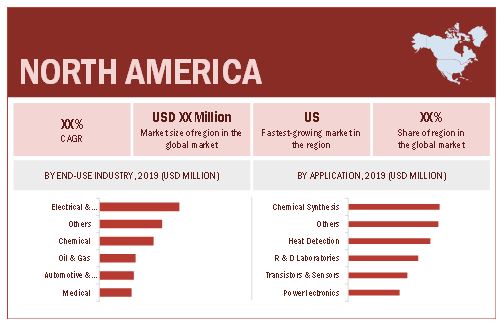

North America is the largest market for High Purity Methane Gas.

North America accounted for the largest share of the High purity methane gas market in 2020. Factors such as the rapidly increasing consumption of high purity methane gas in the electrical & electronics and chemical industries in countries such as US, Canada and Mexico have led to an increased demand for High purity methane gas in the North American region.

High Purity Methane Gas Market Players

High purity methane gas is a diversified and competitive market with a large number of global players and few regional and local players. Osaka Gas (Japan), Sumitomo Seika (Japan), Linde Plc (Ireland), Air Liquide (France), and Matheson Tri-Gas Inc. (US) are some of the key players in the market.

Recent Developments

- In October 2020, Linde Plc entered into a long-term agreement with Samsung Electronics (South Korea) to supply ultra-high purity industrial gases for its latest semiconductor facilities in Pyeongtaek, South Korea. Linde is currently the main supplier of industrial gases to Samsung's existing facilities in Pyeongtaek.

- In February 2020, Air Liquide S.A. and BASF SE (Germany) signed three long-term contracts in the Antwerp basin, Belgium. Air Liquide entered into a 15-year agreement to renew its air gas supply to existing installations and provide additional oxygen to a new ethylene oxide plant to be built by BASF. In addition, Air Liquide will purchase part of the methane fraction generated during the BASF production process and valorize it as a feedstock in its hydrogen production plants, contributing to a circular economy and reducing CO2 emissions of up to 15,000 tons per year on the Antwerp site.

- In March 2017, Sumitomo Seika Chemicals and Xergi (Denmark) collaborated to develop and promote a biogas plant engineering business in Japan. Biogas, which consists mainly of methane, is produced by methane fermentation in an anaerobic digestion process involving wet organic biomass materials. It can be utilized in a gas engine cogeneration system for heat and electricity production.

Frequently Asked Questions (FAQ):

Does this report cover volume tables in addition to the value tables?

Yes, volume tables are provided for each segment except offering.

Which countries are considered in the European region?

The report includes the following European countries

- Germany

- U.K.

- Italy

- Russia

- France

- Rest of Europe

What is the COVID-19 impact on the high purity methane gas market?

Industry experts believe that COVID-19 would have a impact on high purity methane gas market, Since the manufacturing of certain chemicals, fuel, and electricity is classified under critical infrastructure and as essential goods and services, companies operating in the high purity methane gas market sustained their manufacturing of methane gas during the pandemic. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 HIGH PURITY METHANE GAS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION APPROACH

2.2.1 ESTIMATION OF HIGH PURITY METHANE GAS MARKET SIZE BASED ON MARKET SHARE ANALYSIS

FIGURE 1 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 2 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.3 MARKET SIZE ESTIMATION

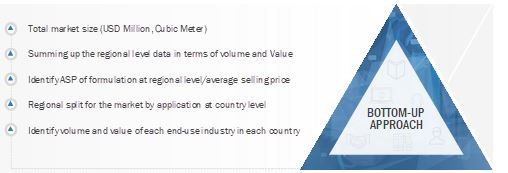

2.3.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

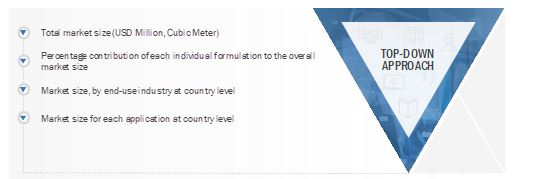

2.3.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 3 HIGH PURITY METHANE GAS MARKET: DATA TRIANGULATION

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 4 CYLINDERS DOMINATED THE HIGH PURITY METHANE GAS MARKET IN 2019

FIGURE 5 CHEMICAL SYNTHESIS WAS THE LARGEST APPLICATION OF HIGH PURITY METHANE GAS IN 2019

FIGURE 6 ELECTRICAL & ELECTRONICS END-USE INDUSTRY TO REGISTER HIGHEST GROWTH

FIGURE 7 NORTH AMERICA LED THE HIGH PURITY METHANE GAS MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 ATTRACTIVE OPPORTUNITIES IN HIGH PURITY METHANE GAS MARKET

FIGURE 8 GROWING USAGE OF HIGH PURITY METHANE GAS IN END-USE APPLICATIONS TO DRIVE THE MARKET

4.2 HIGH PURITY METHANE GAS MARKET, BY REGION

FIGURE 9 NORTH AMERICA TO BE THE LARGEST MARKET BETWEEN 2020 AND 2025

4.3 NORTH AMERICA: HIGH PURITY METHANE GAS MARKET, BY COUNTRY AND END-USE INDUSTRY, 2019

FIGURE 10 US AND ELECTRICAL & ELECTRONICS SEGMENT ACCOUNTED FOR LARGEST SHARES

4.4 HIGH PURITY METHANE GAS MARKET, BY MAJOR COUNTRIES

FIGURE 11 CHINA TO BE THE FASTEST-GROWING MARKET BETWEEN 2020 AND 2025

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HIGH PURITY METHANE GAS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand from the electronics industry

5.2.1.2 Growing demand from chemical synthesis applications

5.2.2 RESTRAINTS

5.2.2.1 High cost of gas processing

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for hydrogen as a clean fuel in the transportation industry

5.2.4 CHALLENGES

5.2.4.1 Structural and regulatory restrictions

TABLE 1 THE STANDARDS BY COMPRESSED GAS ASSOCIATION:

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 13 PORTER’S FIVE FORCES ANALYSIS OF HIGH PURITY METHANE GAS MARKET

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 RIVALRY AMONG EXISTING PLAYERS

5.4 VALUE CHAIN ANALYSIS

FIGURE 14 RAW MATERIAL SUPPLIERS AND MANUFACTURERS ADD MAJOR VALUE TO HIGH PURITY METHANE GAS

5.4.1 IMPACT OF COVID-19 ON SUPPLY CHAIN

TABLE 2 IMPACT OF COVID 19 ON SUPPLY CHAIN

5.5 TRADE ANALYSIS

TABLE 3 NATURAL GAS (GASEOUS STATE) EXPORT DATA, 2018 (USD BILLION)

TABLE 4 NATURAL GAS (GASEOUS STATE) IMPORT DATA, 2018 (USD BILLION)

5.6 MARKET MAP

5.7 PRICING ANALYSIS

FIGURE 15 AVERAGE SELLING PRICE (2018-2025)

5.8 TECHNOLOGY ANALYSIS

5.9 PATENT ANALYSIS

FIGURE 16 PATENTS REGISTERED IN LAST 5 YEARS

FIGURE 17 PUBLICATION TRENDS

FIGURE 18 JURISDICTION GRANT

FIGURE 19 TOP APPLICANTS OF PATENT

5.10 POLICY & REGULATIONS

5.10.1 ENVIRONMENTAL PROTECTION AGENCY

5.10.2 EUROPEAN UNION

5.10.3 TRANSPORT AND STORAGE REGULATIONS

TABLE 5 REGULATIONS ON TRANSPORTATION AND STORAGE OF GAS CYLINDERS

5.11 MACROECONOMIC INDICATORS

5.11.1 TRENDS AND FORECAST OF GDP

TABLE 6 TRENDS AND FORECAST OF GDP, BY KEY COUNTRIES, 2016-2023 (USD MILLION)

5.11.2 PRODUCTION STATISTICS OF AUTOMOTIVE INDUSTRY, 2019

TABLE 7 PRODUCTION STATISTICS OF AUTOMOBILES 2019 (UNITS)

6 HIGH PURITY METHANE GAS MARKET, BY STORAGE & DISTRIBUTION AND TRANSPORTATION (Page No. - 57)

6.1 INTRODUCTION

FIGURE 20 CYLINDERS DOMINATED THE HIGH PURITY METHANE GAS MARKET IN 2019

TABLE 8 HIGH PURITY METHANE GAS MARKET SIZE, BY STORAGE & DISTRIBUTION AND TRANSPORTATION, 2018–2025 (USD MILLION)

TABLE 9 HIGH PURITY METHANE GAS MARKET SIZE, BY STORAGE & DISTRIBUTION AND TRANSPORTATION, 2018–2025 (CUBIC METER)

6.2 CYLINDERS

6.2.1 NORTH AMERICA DOMINATES IN THIS SEGMENT

TABLE 10 CYLINDERS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 CYLINDERS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

6.3 BOTTLES

6.3.1 INCREASED DEMAND FROM RESEARCH & DEVELOPMENT SECTOR TO BOOST THE MARKET

TABLE 12 BOTTLES: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 BOTTLES: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

6.4 OTHER TRANSPORTABLE

TABLE 14 OTHER TRANSPORTABLE: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 OTHER TRANSPORTABLE: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

7 HIGH PURITY METHANE GAS MARKET, BY APPLICATION (Page No. - 62)

7.1 INTRODUCTION

FIGURE 21 CHEMICAL SYNTHESIS APPLICATION TO LEAD THE HIGH PURITY METHANE GAS MARKET DURING THE FORECAST PERIOD

TABLE 16 HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 17 HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

7.2 CHEMICAL SYNTHESIS

7.2.1 RISING DEMAND FOR METHANE IN HYDROGEN PRODUCTION TO BOOST THE MARKET

TABLE 18 CHEMICAL SYNTHESIS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 CHEMICAL SYNTHESIS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER) THE MARKET

7.3 HEAT DETECTION

7.3.1 INCREASED DEMAND FROM ENERGY AND MEDICAL SECTORS TO BOOST THE MARKET

TABLE 20 HEAT DETECTION: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 HEAT DETECTION: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

7.4 R&D LABORATORIES

7.4.1 ONGOING R&D ACTIVITIES IN VARIOUS APPLICATIONS TO PROPEL THE MARKET

TABLE 22 R&D LABORATORIES: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 R&D LABORATORIES: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

7.5 TRANSISTORS & SENSORS

7.5.1 HIGH DEMAND FOR GRAPHENE FROM ELECTRONICS INDUSTRY TO BOOST THE MARKET

TABLE 24 TRANSISTORS & SENSORS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 TRANSISTORS & SENSORS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

7.6 POWER ELECTRONICS

7.6.1 HIGH DEMAND FOR METHANE AS A FUEL TO SPUR MARKET GROWTH

TABLE 26 POWER ELECTRONICS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 POWER ELECTRONICS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

7.7 OTHERS

TABLE 28 OTHER APPLICATIONS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 OTHER APPLICATIONS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

8 HIGH PURITY METHANE GAS MARKET, BY END-USE INDUSTRY (Page No. - 71)

8.1 INTRODUCTION

FIGURE 22 ELECTRICAL & ELECTRONICS INDUSTRY TO LEAD THE HIGH PURITY METHANE GAS MARKET DURING THE FORECAST PERIOD

TABLE 30 HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 31 HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

8.2 AUTOMOTIVE & TRANSPORTATION

8.2.1 INCREASING USE OF METHANE AS A FUEL IN AUTOMOBILES TO DRIVE DEMAND

TABLE 32 AUTOMOTIVE & TRANSPORTATION: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 AUTOMOTIVE & TRANSPORTATION: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

8.3 OIL & GAS

8.3.1 MARKET WITNESSING MODERATE GROWTH IN THIS SEGMENT

TABLE 34 OIL & GAS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 OIL & GAS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

8.4 CHEMICAL

8.4.1 GROWING DEMAND FOR CHEMICALS FROM VARIOUS INDUSTRIES TO SUPPORT MARKET GROWTH

TABLE 36 CHEMICAL: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 37 CHEMICAL: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

8.5 ELECTRICAL & ELECTRONICS

8.5.1 GROWTH IN SMART TECHNOLOGIES TO DRIVE THE MARKET

TABLE 38 ELECTRICAL & ELECTRONICS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 39 ELECTRICAL & ELECTRONICS: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

8.6 MEDICAL

8.6.1 GROWING HEALTHCARE SERVICES TO BOOST THE MARKET

TABLE 40 MEDICAL: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 41 MEDICAL: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

8.7 OTHERS

TABLE 42 OTHER END-USE INDUSTRIES: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 43 OTHER END-USE INDUSTRIES: HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

9 HIGH PURITY METHANE GAS MARKET, BY REGION (Page No. - 79)

9.1 INTRODUCTION

FIGURE 23 APAC TO RECORD FASTEST GROWTH DURING THE FORECAST PERIOD

TABLE 44 HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 45 HIGH PURITY METHANE GAS MARKET SIZE, BY REGION, 2018–2025 (CUBIC METER)

9.2 NORTH AMERICA

9.2.1 IMPACT OF COVID-19 ON NORTH AMERICA

FIGURE 24 NORTH AMERICA: HIGH PURITY METHANE GAS MARKET SNAPSHOT

TABLE 46 NORTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 NORTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY COUNTRY, 2018–2025 (CUBIC METER)

TABLE 48 NORTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY STORAGE & DISTRIBUTION AND TRANSPORTATION, 2018–2025 (USD MILLION)

TABLE 49 NORTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY STORAGE & DISTRIBUTION AND TRANSPORTATION, 2018–2025 (CUBIC METER)

TABLE 50 NORTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 51 NORTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 52 NORTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 53 NORTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.2.2 US

9.2.2.1 Growing clean energy demand to drive the market

TABLE 54 US: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 55 US: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 56 US: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 57 US: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.2.3 CANADA

9.2.3.1 High demand from the chemical industry to drive the market in the country

TABLE 58 CANADA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 59 CANADA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 60 CANADA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 61 CANADA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.2.4 MEXICO

9.2.4.1 Growing demand from chemical applications boosting the market

TABLE 62 MEXICO: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 63 MEXICO: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 64 MEXICO: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 65 MEXICO: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.3 EUROPE

9.3.1 IMPACT OF COVID-19 ON EUROPE

FIGURE 25 EUROPE: HIGH PURITY METHANE GAS MARKET SNAPSHOT

TABLE 66 EUROPE: HIGH PURITY METHANE GAS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 67 EUROPE: HIGH PURITY METHANE GAS MARKET SIZE, BY COUNTRY, 2018–2025 (CUBIC METER)

TABLE 68 EUROPE: HIGH PURITY METHANE GAS MARKET SIZE, BY STORAGE & DISTRIBUTION AND TRANSPORTATION, 2018–2025 (USD MILLION)

TABLE 69 EUROPE: HIGH PURITY METHANE GAS MARKET SIZE, BY STORAGE & DISTRIBUTION AND TRANSPORTATION, 2018–2025 (CUBIC METER)

TABLE 70 EUROPE: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 71 EUROPE: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 72 EUROPE: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 73 EUROPE: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.3.2 GERMANY

9.3.2.1 Presence of leading chemical manufacturers in the country to drive the market

TABLE 74 GERMANY: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 75 GERMANY: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 76 GERMANY: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 77 GERMANY: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.3.3 FRANCE

9.3.3.1 Rising number of biomethane projects to fuel the market

TABLE 78 FRANCE: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 79 FRANCE: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 80 FRANCE: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 81 FRANCE: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.3.4 RUSSIA

9.3.4.1 Oil & gas industry to boost demand

TABLE 82 RUSSIA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 83 RUSSIA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 84 RUSSIA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 85 RUSSIA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.3.5 ITALY

9.3.5.1 Demand from the energy sector to support market growth

TABLE 86 ITALY: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 87 ITALY: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 88 ITALY: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 89 ITALY: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.3.6 UK

9.3.6.1 Growth of chemical industry fueling the market

TABLE 90 UK: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 91 UK: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 92 UK: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 93 UK: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.3.7 REST OF EUROPE

TABLE 94 REST OF EUROPE: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 95 REST OF EUROPE: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 96 REST OF EUROPE: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 97 REST OF EUROPE: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.4 APAC

9.4.1 IMPACT OF COVID-19 ON APAC

FIGURE 26 APAC: HIGH PURITY METHANE GAS MARKET SNAPSHOT

TABLE 98 APAC: HIGH PURITY METHANE GAS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 99 APAC: HIGH PURITY METHANE GAS MARKET SIZE, BY COUNTRY, 2018–2025 (CUBIC METER)

TABLE 100 APAC: HIGH PURITY METHANE GAS MARKET SIZE, BY STORAGE & DISTRIBUTION AND TRANSPORTATION, 2018–2025 (USD MILLION)

TABLE 101 APAC: HIGH PURITY METHANE GAS MARKET SIZE, BY STORAGE & DISTRIBUTION AND TRANSPORTATION, 2018–2025 (CUBIC METER)

TABLE 102 APAC: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 103 APAC: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 104 APAC: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 105 APAC: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.4.2 CHINA

9.4.2.1 Growing electronics and chemical sectors to drive the market

TABLE 106 CHINA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 107 CHINA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 108 CHINA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 109 CHINA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.4.3 JAPAN

9.4.3.1 High demand from the electronics industry to drive the market in the country

TABLE 110 JAPAN: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 111 JAPAN: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 112 JAPAN: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 113 JAPAN: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.4.4 INDIA

9.4.4.1 Significant development of oil & gas industry to drive the market

TABLE 114 INDIA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 115 INDIA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 116 INDIA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 117 INDIA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.4.5 SOUTH KOREA

9.4.5.1 Increasing government interventions to boost the market growth

TABLE 118 SOUTH KOREA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 119 SOUTH KOREA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 120 SOUTH KOREA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 121 SOUTH KOREA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.4.6 AUSTRALIA

9.4.6.1 Growth of the chemical industry fueling the market

TABLE 122 AUSTRALIA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 123 AUSTRALIA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 124 AUSTRALIA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 125 AUSTRALIA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.4.7 REST OF APAC

TABLE 126 REST OF APAC: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 127 REST OF APAC: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 128 REST OF APAC: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 129 REST OF APAC: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.5 MIDDLE EAST & AFRICA

9.5.1 IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA

TABLE 130 MIDDLE EAST & AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY COUNTRY, 2018–2025 (CUBIC METER)

TABLE 132 MIDDLE EAST & AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY STORAGE & DISTRIBUTION AND TRANSPORTATION, 2018–2025 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY STORAGE & DISTRIBUTION AND TRANSPORTATION, 2018–2025 (CUBIC METER)

TABLE 134 MIDDLE EAST & AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 135 MIDDLE EAST & AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 136 MIDDLE EAST & AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.5.2 SAUDI ARABIA

9.5.2.1 Need to reduce sulfur content in petrochemical products to drive the market

TABLE 138 SAUDI ARABIA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 139 SAUDI ARABIA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 140 SAUDI ARABIA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 141 SAUDI ARABIA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.5.3 UAE

9.5.3.1 Oil & gas industry to boost the market

TABLE 142 UAE: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 143 UAE: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 144 UAE: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 145 UAE: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.5.4 SOUTH AFRICA

9.5.4.1 Demand for clean fuel to govern the growth of the market

TABLE 146 SOUTH AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 147 SOUTH AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 148 SOUTH AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 149 SOUTH AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 150 REST OF MIDDLE EAST & AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 151 REST OF MIDDLE EAST & AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 152 REST OF MIDDLE EAST & AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 153 REST OF MIDDLE EAST & AFRICA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.6 SOUTH AMERICA

9.6.1 IMPACT OF COVID-19 ON SOUTH AMERICA

TABLE 154 SOUTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 155 SOUTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY COUNTRY, 2018–2025 (CUBIC METER)

TABLE 156 SOUTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY STORAGE & DISTRIBUTION AND TRANSPORTATION, 2018–2025 (USD MILLION)

TABLE 157 SOUTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY STORAGE & DISTRIBUTION AND TRANSPORTATION, 2018–2025 (CUBIC METER)

TABLE 158 SOUTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 159 SOUTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 160 SOUTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 161 SOUTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.6.2 BRAZIL

9.6.2.1 Growing energy sector to drive the market

TABLE 162 BRAZIL: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 163 BRAZIL: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 164 BRAZIL: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 165 BRAZIL: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.6.3 ARGENTINA

9.6.3.1 Increasing oil & gas production to drive the market in the country

TABLE 166 ARGENTINA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 167 ARGENTINA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 168 ARGENTINA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 169 ARGENTINA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

9.6.4 REST OF SOUTH AMERICA

TABLE 170 REST OF SOUTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 171 REST OF SOUTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY APPLICATION, 2018–2025 (CUBIC METER)

TABLE 172 REST OF SOUTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 173 REST OF SOUTH AMERICA: HIGH PURITY METHANE GAS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (CUBIC METER)

10 COMPETITIVE LANDSCAPE (Page No. - 137)

10.1 OVERVIEW

FIGURE 27 COMPANIES ADOPTED MERGER & ACQUISITION AND PARTNERSHIP & COLLABORATION AS THE KEY GROWTH STRATEGIES BETWEEN 2017 AND 2020

10.2 MARKET RANKING OF KEY PLAYERS

FIGURE 28 RANKING OF KEY PLAYERS IN HIGH PURITY METHANE GAS MARKET, 2020

10.3 MARKET SHARE ANALYSIS

FIGURE 29 SHARE OF KEY PLAYERS IN HIGH PURITY METHANE GAS MARKET, 2020

10.4 MARKET EVALUATION FRAMEWORK

TABLE 174 MARKET EVALUATION FRAMEWORK

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STAR

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE

10.5.4 EMERGING COMPANIES

FIGURE 30 COMPETITIVE LEADERSHIP MAPPING: HIGH PURITY METHANE GAS MARKET, 2020

10.6 SME MATRIX, 2019

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 DYNAMIC COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 31 SME MATRIX: HIGH PURITY METHANE GAS MARKET, 2020

10.7 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 32 PRODUCT PORTFOLIO ANALYSIS IN HIGH PURITY METHANE GAS MARKET

10.8 COMPETITIVE SCENARIO

10.8.1 PARTNERSHIP & COLLABORATION

TABLE 175 PARTNERSHIP & COLLABORATION, 2017–2020

10.8.2 AGREEMENT & CONTRACT

TABLE 176 AGREEMENT & CONTRACT, 2020

10.8.3 MERGER & ACQUISITION

TABLE 177 MERGER & ACQUISITION, 2018

10.8.4 EXPANSION

TABLE 178 EXPANSION, 2019

10.8.5 JOINT VENTURE

TABLE 179 JOINT VENTURE, 2019

11 COMPANY PROFILES (Page No. - 147)

(Business overview, Products offered, Recent developments, SWOT analysis, Winning imperatives, Current Focus and Strategies & Right to win)*

11.1 OSAKA GAS

FIGURE 33 OSAKA GAS: COMPANY SNAPSHOT

FIGURE 34 OSAKA GAS: SWOT ANALYSIS

11.2 SUMITOMO SEIKA

FIGURE 35 SUMITOMO SEIKA: COMPANY SNAPSHOT

FIGURE 36 SUMITOMO SEIKA: SWOT ANALYSIS

11.3 LINDE PLC

FIGURE 37 LINDE PLC: COMPANY SNAPSHOT

FIGURE 38 LINDE PLC: SWOT ANALYSIS

11.4 AIR LIQUIDE

FIGURE 39 AIR LIQUIDE: COMPANY SNAPSHOT

FIGURE 40 AIR LIQUIDE: SWOT ANALYSIS

11.5 MATHESON TRI-GAS, INC.

11.6 MESSER GROUP

11.7 MIDDLESEX GASES & TECHNOLOGIES

11.8 BHURUKA GASES

11.9 AGT INTERNATIONAL

11.10 ADVANCED SPECIALTY GASES

*Details on Business overview, Products offered, Recent developments, SWOT analysis, Winning imperatives, Current Focus and Strategies & Right to win might not be captured in case of unlisted companies.

11.11 OTHER COMPANY PROFILES

11.11.1 QINGDAO GUIDA SPECIAL GAS CO., LTD

11.11.2 CRYOCARB

11.11.3 SCIENTIFIC GAS AUSTRALIA

11.11.4 CHENGDU TAIYU INDUSTRIAL GASES CO., LTD.

11.11.5 AMERICAN WELDING & GAS

11.11.6 GAS INNOVATION

11.11.7 AXCEL GASES

11.11.8 ELECTRONIC FLUOROCARBONS, LLC

11.11.9 TAIYO NIPPON SANSO INDIA

11.11.10 CHEMIX GASES

11.11.11 WUHAN NEWRADAR SPECIAL GAS CO. LTD

12 APPENDIX (Page No. - 169)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

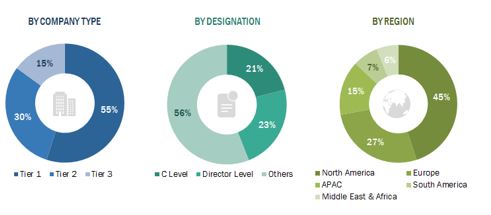

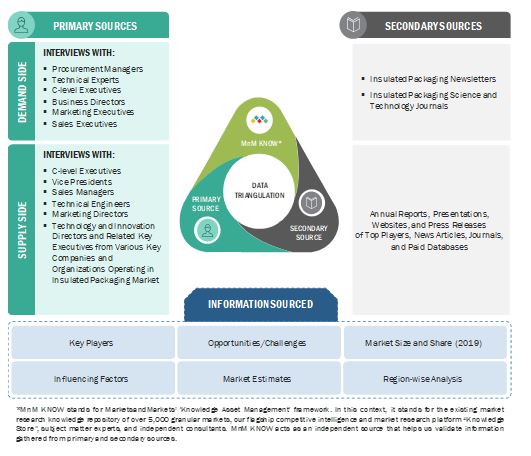

The study involved four major activities in estimating the size of the High Purity Methane Gas Market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals were used. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases.

Primary Research

The high Purity Methane Gas market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Developments in the high Purity Methane Gas market characterize the demand side. Market consolidation activities undertaken by manufacturers characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the high Purity Methane Gas market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

High purity methane gas: Bottom-Up Approach

High purity methane gas: Top-Down Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the high Purity Methane Gas market.

Report Objectives

- To define, describe, and forecast the high purity methane gas market in terms of value and volume

- To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, and challenges

- To analyze and forecast the market size based on storage & distribution and transportable, applications and end-use industry.

- To forecast the market size of five main regions, namely, North America, Europe, Asia Pacific (APAC), South America and Middle East and Africa (MEA) (along with the key countries in each region)

- To strategically analyze the micromarkets1 with respect to individual growth trends, growth prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To analyze the competitive developments, such as expansion, mergers & acquisitions, joint venture, and agreement & contracts in the high purity methane gas market

- To strategically profile the key players and comprehensively analyze their core competencies2

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in High Purity Methane Gas Market