High-Frequency Transformer Market Size, Share & Industry Growth Analysis Report By Application (Power Supplies, Alternative Energy Inverters, Electronic Switching Devices, LED Lighting, Personal Electronics), Power Output, Vertical, and Region - Global Growth Driver and Industry Forecast to 2026

High-Frequency Transformer Market

High-Frequency Transformer Market and Top Companies

TDK Corporation

TDK Corporation is a leading manufacturer of electronic components with expertise in magnetic technology. The company operates through five business segments, namely, Passive Components, Magnetic Application Products, Sensor Application Products, Energy Application Products, and Others. The company offers high-frequency transformers under the shade of its Passive Components business segment. Some of the key products offered through this segment are transformers for IGBT/FET, transformers for BMS, current sense transformers for AC-DC converters, and pulse transformers. The operating frequency ranges of high-frequency transformers offered by TDK Corporation are between 50 KHz and 1 MHz. They are suitable for applications in the automotive and consumer electronics industries, as well as the medical and industrial sectors.

Murata Manufacturing Co. Ltd.

Murata Manufacturing Co. Ltd. is a global leader in the manufacturing, designing, and supply of leading-edge electronic components, advanced electronic materials, and multi-functional, high-density modules. The products offered by the company find applications in electronic devices used in our day-to-day lives, such as computers, cars, smartphones, and home appliances. The company’s products are also being used in different new applications, such as energy management systems and healthcare devices. It also specializes in the designing, manufacturing, and sale of electronic components and modules, including inductors, connectors, isolators, filters, resonators, buzzers, capacitors, sensors, power supply circuit modules, wireless communication modules, and quartz devices. The company operates through three segments, namely, Electronic Components, Modules, and Others. High-frequency transformers are offered through the Electronic Components segment under the matching devices product line. Its innovative and patented pdqb winding technology has enabled it to manufacture high-frequency transformers of 400 kW that can operate at frequencies as high as 50 KHz.

Delta Electronics Inc.

Delta Electronics Inc. is a global leader having a diversified portfolio related to power and thermal management solutions. It has a large presence in the Americas, Asia, EMEA, and Australia. Delta Electronics Inc. offers its products through four business segments, namely, Power Electronics, Automation, Infrastructure, and Others. Through its wide product portfolio, the company caters to multiple verticals, such as communications, medical, IT, renewable energy, and power. High-frequency transformers are offered through the Power Electronics segment. Under this segment, the company also offers a few other products such as compact size and low noise DC-DC and AC-DC switching power supply, DC-DC converters, battery chargers, industrial motor drives, and power adapters.

High-Frequency Transformer Market and Top End-User Industry

Industrial

With the continuous adoption of technologies in the industrial sector, the demand for small-sized electronic components with high-power densities is growing. Thus, the application of high-frequency transformers is increasing in various industrial applications. Industrial vertical consists of various industries such as building & factory automation, warehousing, process automation, and manufacturing. Some of the key application areas of high-frequency transformers in the industrial sector include AC-AC and DC-DC power supplies, test and measurement instruments, industrial inverters, LED lighting, industrial robots, power backup equipment, heavy machinery, motors, power tools, and automation and control systems. Many companies offer high-frequency transformers for industrial applications.

Automotive

The automotive vertical is one of the major end users of high-frequency transformers. Investments in electric vehicle charging infrastructure are consistently increasing across countries such as the US, Germany, France, and China. The on-board and off-board chargers of electric vehicles are equipped with high-frequency transformers. Besides, these transformers are widely used in different systems of non-electric vehicles. Sumida Corporation, a renowned company engaged in the manufacturing of high-frequency transformers, has developed various types of transformers, such as flyback transformers for electric compressors of car air conditioning systems, transformers for step down DC-DC converters & LEDs, and isolation pulse transformers for the battery management systems.

High-Frequency Transformers Market and Top Application

Power Supplies

Power supplies play a key role in all electronic devices, and the growing trend of component miniaturization is driving the demand for high-frequency transformers in both industrial and consumer markets. The high-frequency transformers operate between 20 kHz and 1 MHz; the higher the frequency, the smaller the transformer size. In this segment, the switched mode power supply (SMPS) high-frequency transformer has facilitated the development of a large number of topologies to meet the design requirements. Some of these are push-pull, buck, boost, and buck-boost flyback. High-frequency transformers are widely used in AC-DC and DC-DC power supply applications across industries.

Updated on : Oct 23, 2024

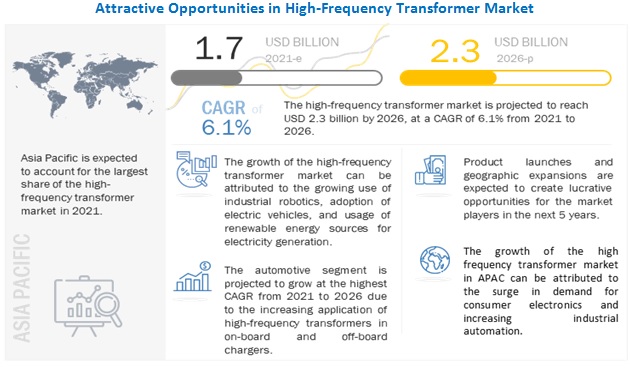

The global high-frequency transformer market size is expected to grow from USD 1.7 billion in 2021 to USD 2.3 billion by 2026, at a compound annual growth rate (CAGR) of 6.1%.

The key driving factor fueling the demand for high-frequency transformers is the growing adoption of advanced technologies such as IIoT, factory automation, 5G, and cloud computing in the consumer electronics, automotive, manufacturing, IT & telecommunications, and military & defense verticals.

The rising trend of miniaturization of electronics and small form factor components in the consumer electronics and automotive verticals are projected to drive the growth of the high-frequency transformer industry from 2021 to 2026. However, the increasing prices of raw materials and their cascading effect on the final prices of high-frequency transformers are expected to hamper their adoption rate in some industries or sectors.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on the High-Frequency Transformer Market

COVID-19 has severely impacted the global economy and all the industries throughout the globe. Governments of various countries have imposed lockdowns to contain the spread of the epidemic. The complete global lockdown in the initial stage of the pandemic in various countries severely impacted the livelihoods of people and quality of life. This has resulted into the disruptions in the supply chain across the globe. The economies across the world have declined as there is a major decline in the demand for products. The production across industries has been limited due to the pandemic resulting in the shortage of raw material. The decline in exports and the disruptions in the supply chain are the major factors contributed to the decline in production of high-frequency transformers to some extent. However, some verticals, such as healthcare and consumer electronics, witnessed healthy growth in this period. Likewise, the automotive, industrial, and many other verticals have made a strong comeback or started recovering after the upliftment of COVID-19-related restrictions globally.

High-Frequency Transformer Market Dynamics

DRIVERS: Positive growth outlook of automotive industry and growth in adoption of electric vehicles

High-frequency transformers find applications in various systems, such as electric compressors, DC-DC converters, LED lighting, battery management systems, inverters, electric vehicle charging systems, and on-board chargers, of automobiles (both gas and electric) manufactured today.

The growing trend of component miniaturization and the need for high performance and reliability are the major reasons for the rising adoption of high-frequency transformers in the automotive industry. Moreover, the positive growth outlook of the global automotive industry based on trends such as connected vehicles, IoT, autonomous control, electric and hybrid vehicles, and alternative fuel vehicles is expected to create immense growth opportunities for the high-frequency transformer market.

RESTRAINTS: Increasing prices of raw material used in the manufacturing of high-frequency transformers

The key raw materials used in the manufacturing of high-frequency transformers include copper, iron, and ferrite, which feature high electrical conductivity. Copper is used to make foils and wires of high-frequency transformers, and it forms one of the key components of the transformer design.

Similarly, ferrite forms the transformer’s core in the overall design. Any fluctuation or increase in the prices of these materials can result in an increase in the final costs of high-frequency transformers. As per the data by Trading Economics, in the past 10 years, the price of copper globally has witnessed fluctuations in the range of USD 2/Lbs to more than USD 4.5/Lbs. In mid-2021, it has reached its highest level of USD 4.7/Lbs. Thus, the increasing prices of raw materials and their cascading effect on the final prices of high-frequency transformers are expected to hamper their adoption rate in some industries or sectors.

OPPORTUNITIES: Rising Trend of automation and adoption of advanced technologies in industrial sector

With the growing adoption of various technologies in the industrial sector for advanced control and automation, the demand for high-frequency transformers is also expected to rise at a significant pace. High-frequency transformers find applications in motor drives, inverters, robotics, battery chargers, UPS, and other industrial equipment.

The industrial robotics industry has been growing at an impressive rate in the past few years, with robots being used for applications such as machine tending, welding, cutting, grinding, soldering, and assembly. Automotive and electronics are the two major end-user industries of industrial robots, such as stand-alone robots, collaborative robots, and mobile robots. The increasing penetration of automation technologies and robotics into the industrial sector is expected to create lucrative opportunities for the players offering high-frequency transformers during the forecast period.

CHALLENGES: Trade-off between small form factor and skin and proximity effects

Technological advancements in electronic systems and equipment, coupled with the rising trend of component miniaturization, are fueling the demand for high-frequency transformers that are small, lightweight, and exhibit high-power density.

However, the development of small size and lightweight high-frequency transformers also has design challenges. Some of these challenges include losses from skin effects and proximity effects in high-frequency transformers. Losses due to skin effects are caused by the property of high-frequency currents that flow on the conductor’s surface. Proximity effects, also called eddy current losses, cause an excessive level of resistance within the transformer’s wire and result in power losses. Besides, they also create heat dissipation issues. Hence, selecting high-quality raw materials and components (Litz wires) for minimizing skin and proximity effects is a crucial requirement for manufacturers nowadays.

“Industrial vertical to dominate the high-frequency transformer market in 2021”

Industrial vertical is expected to dominate the high-frequency transformer market in 2021. With the growing adoption of technologies such as IIoT and artificial intelligence in the manufacturing sector and rapid industrialization, the demand for high-frequency transformers is increasing at a substantial rate. The industrial vertical holds the largest share of the global high-frequency transformer market, and the forecasts depict that it will grow at a healthy rate in the future, which is expected to fuel the demand for high-frequency transformers.

“Power supplies to hold the largest share of high-frequency transformer market from 2021 to 2026”

The power supplies segment is expected to hold the largest share of the high-frequency transformer market from 2021 to 2026. The growing demand for switch-mode power supply (SMPS) high-frequency transformers due to their high efficiency in power management RF circuits and power sourcing applications is expected to drive the growth of this segment.

To know about the assumptions considered for the study, download the pdf brochure

“High- frequency transformer market in APAC to grow at the highest CAGR”

The market in APAC is expected to grow at the highest CAGR from 2021 to 2026. The region is one of the most prominent markets for high-frequency transformers due to the presence of some of the fastest-growing economies and high investments in the industrial sector. China is the largest manufacturing hub in the world owing to which the demand for high-frequency transformers is high in the country. Similarly, the companies in the healthcare industry in Japan are highly focused on the adoption of automation and robotics to increase the overall production efficiency and competitiveness. This factor is expected to boost the demand for high-frequency transformers in Japan. India is one of the fastest-developing countries in the APAC region, attributed to the increasing government-led investments in initiatives such as Make in India. All these factors are anticipated to drive the demand for high-frequency transformers in India.

Top High-Frequency Transformer Companies - Key Market Players

TDK Corporation (Japan), Murata Manufacturing Co. Ltd. (Japan), Delta Electronics Inc. (Taiwan), Vishay Intertechnology, Inc. (US), and Würth Elektronik GmbH & Co. KG (Germany) are a few high-frequency transformer companies.

Scope of the Report

|

Report Metric |

Details |

| Estimated Market Size | USD 1.7 billion in 2021 |

| Projected Market Size | USD 2.3 billion by 2026 |

| Growth Rate | CAGR of 6.1%. |

|

Market Size Available for Years |

2017–2026 |

|

Base Year |

2020 |

|

Forecast Period |

2021–2026 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Power Output, Application, and Vertical |

|

Geographic Regions Covered |

North America, APAC, Europe, and RoW |

|

Companies Covered |

Major Players: Murata Manufacturing Co. Ltd. (Japan), TDK Corporation (Japan), Delta Electronics Inc. (Taiwan), Vishay Intertechnology, Inc.(US), Würth Elektronik GmbH & Co. KG (Germany), and Others- total 30 players have been covered. |

This research report categorizes the high-frequency transformer market by power output, application, vertical, and region.

By Power Output:

- Up to 50W

- 51- 100W

- 101- 400W

- 401W and Above

By Application:

- Power Supplies

- Alternative Energy Inverters

- Electronic Switching Devices

- LED Lighting

- Plasma Generation

- Personal Electronics

- Others

By Vertical:

- Industrial

- Automotive

- Military & Defense

- RF & Telecommunications

- Consumer Electronics

- Transmission & Distribution

- Healthcare

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments in High-Frequency Transformer Industry

- In September 2019, Murata Manufacturing Co., Ltd. launched a new high-power, high-frequency transformer with the help of its innovative and patented pdqb winding technology. The transformer can operate at frequencies as high as 50kHz.

- In February 2021, TDK Corporation has launched the EPCOS E10 EM series, which is a new range of insulated SMT transformers suitable for various DC-DC converter topologies and gate driver circuits in industrial electronics and e-mobility. Their compact design helps to meet the clearance and creepage requirements according to the IEC-60664-1 standard.

- In May 2020, Delta Electronics Inc. announced the acquisition of Trihedral Engineering, a Canada-based company leading in the development of SCADA and IIoT software. This acquisition has strengthened the industrial automation and system integration business of the company.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the high-frequency transformer market during 2021-2026?

The global high-frequency transformer market is expected to record a CAGR of 6.1% from 2021–2026.

Does this report include the impact of COVID-19 on the high-frequency transformer market?

Yes, the report includes the impact of COVID-19 on the high-frequency transformer market. It illustrates the post- COVID-19 market scenario.

What are the driving factors for the high-frequency transformers?

Positive growth outlook of automotive industry and growth in adoption of electric vehicles.

Which are the significant players operating in the high-frequency transformer market?

TDK Corporation (Japan), Murata Manufacturing Co. Ltd. (Japan), Delta Electronics Inc. (Taiwan), Vishay Intertechnology, Inc. (US), and Würth Elektronik GmbH & Co. KG (Germany) are some of the major companies operating in the high-frequency transformer market.

Which region will lead the high-frequency transformer market in the future?

APAC is expected to lead the high-frequency transformer market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 HIGH-FREQUENCY TRANSFORMER MARKET: SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 HIGH-FREQUENCY TRANSFORMER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis (demand side)

FIGURE 3 HIGH-FREQUENCY TRANSFORMER MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by using top-down analysis (supply side)

FIGURE 4 HIGH-FREQUENCY TRANSFORMER MARKET: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY FOR HIGH-FREQUENCY TRANSFORMER MARKET USING SUPPLY SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 46)

TABLE 2 HIGH-FREQUENCY TRANSFORMER MARKET, 2017–2020 (USD MILLION)

TABLE 3 HIGH-FREQUENCY TRANSFORMER MARKET, 2021–2026 (USD MILLION)

FIGURE 7 IMPACT OF COVID-19 ON HIGH-FREQUENCY TRANSFORMER MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

TABLE 4 PESSIMISTIC SCENARIO (POST-COVID-19): HIGH-FREQUENCY TRANSFORMER MARKET, 2021–2026 (USD MILLION)

3.3 OPTIMISTIC SCENARIO

TABLE 5 OPTIMISTIC SCENARIO (POST-COVID-19): HIGH-FREQUENCY TRANSFORMER MARKET, 2021–2026 (USD MILLION)

FIGURE 8 POWER SUPPLIES SEGMENT TO LEAD HIGH-FREQUENCY TRANSFORMER MARKET FROM 2021 TO 2026

FIGURE 9 AUTOMOTIVE VERTICAL TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

FIGURE 10 ASIA PACIFIC (APAC) TO HOLD LARGEST SHARE OF HIGH-FREQUENCY TRANSFORMER MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR HIGH-FREQUENCY TRANSFORMER MARKET

FIGURE 11 INCREASING FOCUS ON INDUSTRIAL AUTOMATION AND GROWING ADOPTION OF ELECTRIC VEHICLES TO FUEL GROWTH OF HIGH-FREQUENCY TRANSFORMER MARKET DURING FORECAST PERIOD

4.2 HIGH-FREQUENCY TRANSFORMER MARKET, BY APPLICATION

FIGURE 12 POWER SUPPLIES SEGMENT TO HOLD LARGEST SHARE OF HIGH-FREQUENCY TRANSFORMER MARKET FROM 2021 TO 2026

4.3 HIGH-FREQUENCY TRANSFORMER MARKET IN NORTH AMERICA, BY VERTICAL AND COUNTRY

FIGURE 13 INDUSTRIAL VERTICAL AND US TO HOLD LARGEST SHARES OF NORTH AMERICAN HIGH-FREQUENCY TRANSFORMER MARKET IN 2026

4.4 HIGH-FREQUENCY TRANSFORMER MARKET, BY VERTICAL

FIGURE 14 INDUSTRIAL VERTICAL TO HOLD LARGEST SHARE OF HIGH-FREQUENCY TRANSFORMER MARKET IN 2026

4.5 HIGH-FREQUENCY TRANSFORMER MARKET, BY COUNTRY

FIGURE 15 CHINA HIGH-FREQUENCY TRANSFORMER MARKET TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 HIGH-FREQUENCY TRANSFORMER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Positive growth outlook of automotive industry and growth in adoption of electric vehicles

FIGURE 17 GLOBAL PLUG-IN VEHICLE SALES, 2017–2021

5.2.1.2 Expanding renewable energy industry

FIGURE 18 GLOBAL AVERAGE ANNUAL NET RENEWABLE CAPACITY ADDITIONS (GW), 2011–2022

5.2.1.3 Growing demand for consumer electronics and household appliances

FIGURE 19 HIGH-FREQUENCY TRANSFORMER MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Increasing prices of raw materials used in manufacturing of high-frequency transformers

FIGURE 20 HIGH-FREQUENCY TRANSFORMER MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Rising trend of automation and adoption of advanced technologies in industrial sector

5.2.3.2 Growing demand for customized high-frequency transformers in critical industries

FIGURE 21 HIGH-FREQUENCY TRANSFORMER MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Trade-off between small form factor and skin and proximity effects

FIGURE 22 HIGH-FREQUENCY TRANSFORMER MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN: HIGH-FREQUENCY TRANSFORMER MARKET

5.4 ECOSYSTEM ANALYSIS

FIGURE 24 HIGH-FREQUENCY TRANSFORMER MARKET: ECOSYSTEM ANALYSIS

TABLE 6 HIGH-FREQUENCY TRANSFORMER MARKET ECOSYSTEM: KEY PLAYERS

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN HIGH-FREQUENCY TRANSFORMER MARKET

FIGURE 25 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN HIGH-FREQUENCY TRANSFORMER MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 HIGH-FREQUENCY TRANSFORMER MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 INTENSITY OF COMPETITIVE RIVALRY

5.6.2 BARGAINING POWER OF SUPPLIERS

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 THREAT OF SUBSTITUTES

5.6.5 THREAT OF NEW ENTRANTS

5.7 CASE STUDY ANALYSIS

TABLE 8 USE OF HIGH-FREQUENCY TRANSFORMERS IN CRITICAL INDUSTRIES

TABLE 9 USE OF CUSTOM HIGH-FREQUENCY TRANSFORMERS IN AEROSPACE INDUSTRY

5.8 TECHNOLOGY ANALYSIS

5.8.1 IOT AND INDUSTRIAL IOT

5.8.2 LITZ WIRE

5.9 PRICING ANALYSIS

TABLE 10 PRICING OF HIGH-FREQUENCY TRANSFORMERS

5.10 TRADE ANALYSIS

5.10.1 IMPORT SCENARIO OF INDUCTORS

FIGURE 26 IMPORT DATA FOR INDUCTORS, BY KEY COUNTRY, 2016−2020 (USD MILLION)

5.10.2 EXPORT SCENARIO OF INDUCTORS

FIGURE 27 EXPORT DATA FOR INDUCTORS, BY KEY COUNTRY, 2016−2020 (USD MILLION)

5.11 PATENT ANALYSIS

FIGURE 28 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 29 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2020

TABLE 11 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

TABLE 12 LIST OF FEW PATENTS IN HIGH-FREQUENCY TRANSFORMER MARKET, 2019–2020

5.12 MARKET REGULATIONS AND STANDARDS

TABLE 13 REGULATIONS AND STANDARDS FOR BATTERIES

6 HIGH-FREQUENCY TRANSFORMER MARKET, BY POWER OUTPUT (Page No. - 75)

6.1 INTRODUCTION

TABLE 14 HIGH-FREQUENCY TRANSFORMER MARKET, BY POWER OUTPUT, 2017–2020 (USD MILLION)

TABLE 15 HIGH-FREQUENCY TRANSFORMER MARKET, BY POWER OUTPUT, 2021–2026 (USD MILLION)

6.2 UP TO 50 W

6.3 51–10O W

6.4 101–400 W

6.5 401 W AND ABOVE

7 HIGH-FREQUENCY TRANSFORMER MARKET, BY APPLICATION (Page No. - 77)

7.1 INTRODUCTION

FIGURE 30 HIGH-FREQUENCY TRANSFORMER MARKET, BY APPLICATION

FIGURE 31 POWER SUPPLIES SEGMENT TO HOLD LARGEST SHARE OF HIGH-FREQUENCY TRANSFORMER MARKET FROM 2021 TO 2026

TABLE 16 HIGH-FREQUENCY TRANSFORMER MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 17 HIGH-FREQUENCY TRANSFORMER MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

7.2 POWER SUPPLIES

7.2.1 GROWING DEMAND FOR SWITCHED MODE POWER SUPPLY (SMPS) TRANSFORMERS IN SEVERAL VERTICALS TO DRIVE MARKET GROWTH

TABLE 18 HIGH-FREQUENCY TRANSFORMER MARKET FOR POWER SUPPLIES, BY VERTICAL 2017–2020 (USD MILLION)

TABLE 19 HIGH-FREQUENCY TRANSFORMER MARKET FOR POWER SUPPLIES, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 20 HIGH-FREQUENCY TRANSFORMER MARKET FOR POWER SUPPLIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 HIGH-FREQUENCY TRANSFORMER MARKET FOR POWER SUPPLIES, BY REGION, 2021–2026 (USD MILLION)

7.3 ALTERNATIVE ENERGY INVERTERS

7.3.1 INCREASING DEMAND FOR SOLAR AND WIND INVERTERS TO DRIVE GROWTH OF HIGH-FREQUENCY TRANSFORMER MARKET

TABLE 22 HIGH-FREQUENCY TRANSFORMER MARKET FOR ALTERNATIVE ENERGY INVERTERS, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 23 HIGH-FREQUENCY TRANSFORMER MARKET FOR ALTERNATIVE ENERGY INVERTERS, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 24 HIGH-FREQUENCY TRANSFORMER MARKET FOR ALTERNATIVE ENERGY INVERTERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 HIGH-FREQUENCY TRANSFORMER MARKET FOR ALTERNATIVE ENERGY INVERTERS, BY REGION, 2021–2026 (USD MILLION)

7.4 ELECTRONIC SWITCHING DEVICES

7.4.1 GROWING MARKET FOR ELECTRONIC SWITCHING DEVICES TO FUEL DEMAND FOR HIGH-FREQUENCY TRANSFORMERS

TABLE 26 HIGH-FREQUENCY TRANSFORMER MARKET FOR ELECTRONIC SWITCHING DEVICES, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 27 HIGH-FREQUENCY TRANSFORMER MARKET FOR ELECTRONIC SWITCHING DEVICES, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 28 HIGH-FREQUENCY TRANSFORMER MARKET FOR ELECTRONIC SWITCHING DEVICES, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 HIGH-FREQUENCY TRANSFORMER MARKET FOR ELECTRONIC SWITCHING DEVICES, BY REGION, 2021–2026 (USD MILLION)

7.5 LED LIGHTING

7.5.1 GROWING DEMAND FOR LED LIGHTS DUE TO THEIR HIGHER POWER EFFICIENCY TO DRIVE MARKET GROWTH

TABLE 30 HIGH-FREQUENCY TRANSFORMER MARKET FOR LED LIGHTING, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 31 HIGH-FREQUENCY TRANSFORMER MARKET FOR LED LIGHTING, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 32 HIGH-FREQUENCY TRANSFORMER MARKET FOR LED LIGHTING, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 HIGH-FREQUENCY TRANSFORMER MARKET FOR LED LIGHTING, BY REGION, 2021–2026 (USD MILLION)

7.6 PLASMA GENERATION

7.6.1 GROWING ADOPTION OF PLASMA GENERATION TECHNOLOGY IN MEDICAL SECTOR TO DRIVE GROWTH OF HIGH-FREQUENCY TRANSFORMER MARKET

TABLE 34 HIGH-FREQUENCY TRANSFORMER MARKET FOR PLASMA GENERATION, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 35 HIGH-FREQUENCY TRANSFORMER MARKET FOR PLASMA GENERATION, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 36 HIGH-FREQUENCY TRANSFORMER MARKET FOR PLASMA GENERATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 HIGH-FREQUENCY TRANSFORMER MARKET FOR PLASMA GENERATION, BY REGION, 2021–2026 (USD MILLION)

7.7 PERSONAL ELECTRONICS

7.7.1 RISING PENETRATION OF HIGH-FREQUENCY TRANSFORMERS IN ELECTRONICS INDUSTRY TO DRIVE MARKET GROWTH

TABLE 38 HIGH-FREQUENCY TRANSFORMER MARKET FOR PERSONAL ELECTRONICS, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 39 HIGH-FREQUENCY TRANSFORMER MARKET FOR PERSONAL ELECTRONICS, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 40 HIGH-FREQUENCY TRANSFORMER MARKET FOR PERSONAL ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 HIGH-FREQUENCY TRANSFORMER MARKET FOR PERSONAL ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

7.8 OTHERS

TABLE 42 HIGH-FREQUENCY TRANSFORMER MARKET FOR OTHERS, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 43 HIGH-FREQUENCY TRANSFORMER MARKET FOR OTHERS, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 44 HIGH-FREQUENCY TRANSFORMER MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 HIGH-FREQUENCY TRANSFORMER MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

8 HIGH-FREQUENCY TRANSFORMER MARKET, BY VERTICAL (Page No. - 93)

8.1 INTRODUCTION

FIGURE 32 HIGH-FREQUENCY TRANSFORMER MARKET, BY VERTICAL

FIGURE 33 AUTOMOTIVE TO BE FASTEST-GROWING SEGMENT IN HIGH-FREQUENCY TRANSFORMER MARKET FROM 2021 TO 2026

TABLE 46 HIGH-FREQUENCY TRANSFORMER MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 47 HIGH-FREQUENCY TRANSFORMER MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

8.2 INDUSTRIAL

8.2.1 GROWING DEMAND FOR INDUSTRIAL ROBOTS TO FUEL GROWTH OF HIGH-FREQUENCY TRANSFORMER MARKET

8.2.2 IMPACT OF COVID-19

TABLE 48 HIGH-FREQUENCY TRANSFORMER MARKET FOR INDUSTRIAL VERTICAL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 49 HIGH-FREQUENCY TRANSFORMER MARKET FOR INDUSTRIAL INDUSTRY VERTICAL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 50 HIGH-FREQUENCY TRANSFORMER MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 HIGH-FREQUENCY TRANSFORMER MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2021–2026 (USD MILLION)

8.3 AUTOMOTIVE

8.3.1 INCREASING APPLICATION OF HIGH-FREQUENCY TRANSFORMERS IN ON-BOARD CHARGERS OF ELECTRIC VEHICLES TO DRIVE MARKET GROWTH

8.3.2 IMPACT OF COVID-19

TABLE 52 HIGH-FREQUENCY TRANSFORMER MARKET FOR AUTOMOTIVE VERTICAL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 53 HIGH-FREQUENCY TRANSFORMER MARKET FOR AUTOMOTIVE VERTICAL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 54 HIGH-FREQUENCY TRANSFORMER MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 HIGH-FREQUENCY TRANSFORMER MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2021–2026 (USD MILLION)

8.4 MILITARY & DEFENSE

8.4.1 INCREASING DEMAND FOR HIGH-PERFORMANCE EQUIPMENT IN MILITARY & DEFENSE VERTICAL TO BOOST MARKET GROWTH

8.4.2 IMPACT OF COVID-19

TABLE 56 HIGH-FREQUENCY TRANSFORMER MARKET FOR MILITARY & DEFENSE VERTICAL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 57 HIGH-FREQUENCY TRANSFORMER MARKET FOR MILITARY & DEFENSE VERTICAL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 58 HIGH-FREQUENCY TRANSFORMER MARKET FOR MILITARY & DEFENSE VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 HIGH-FREQUENCY TRANSFORMER MARKET FOR MILITARY & DEFENSE VERTICAL, BY REGION, 2021–2026 (USD MILLION)

8.5 RF & TELECOMMUNICATIONS

8.5.1 EXPANDING TELECOMMUNICATIONS INDUSTRY AND INCREASING DEPLOYMENT OF 5G TO FUEL DEMAND FOR HIGH-FREQUENCY TRANSFORMERS

8.5.2 IMPACT OF COVID-19

TABLE 60 HIGH-FREQUENCY TRANSFORMER MARKET FOR RF & TELECOMMUNICATIONS VERTICAL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 61 HIGH-FREQUENCY TRANSFORMER MARKET FOR RF & TELECOMMUNICATIONS VERTICAL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 62 HIGH-FREQUENCY TRANSFORMER MARKET FOR RF & TELECOMMUNICATIONS VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 HIGH-FREQUENCY TRANSFORMER MARKET FOR RF & TELECOMMUNICATIONS VERTICAL, BY REGION, 2021–2026 (USD MILLION)

8.6 CONSUMER ELECTRONICS

8.6.1 RISING TREND OF COMPONENT MINIATURIZATION IN CONSUMER ELECTRONICS INDUSTRY TO FUEL GROWTH OF HIGH-FREQUENCY TRANSFORMER MARKET

8.6.2 IMPACT OF COVID-19

TABLE 64 HIGH-FREQUENCY TRANSFORMER MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 65 HIGH-FREQUENCY TRANSFORMER MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 66 HIGH-FREQUENCY TRANSFORMER MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 67 HIGH-FREQUENCY TRANSFORMER MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2021–2026 (USD MILLION)

8.7 TRANSMISSION & DISTRIBUTION

8.7.1 GROWING ADOPTION OF RENEWABLE ENERGY IN TRANSMISSION & DISTRIBUTION VERTICAL TO DRIVE GROWTH OF HIGH-FREQUENCY TRANSFORMER MARKET

8.7.2 IMPACT OF COVID-19

TABLE 68 HIGH-FREQUENCY TRANSFORMER MARKET FOR TRANSMISSION & DISTRIBUTION VERTICAL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 69 HIGH-FREQUENCY TRANSFORMER MARKET FOR TRANSMISSION & DISTRIBUTION VERTICAL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 70 HIGH-FREQUENCY TRANSFORMER MARKET FOR TRANSMISSION & DISTRIBUTION VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 HIGH-FREQUENCY TRANSFORMER MARKET FOR TRANSMISSION & DISTRIBUTION VERTICAL, BY REGION, 2021–2026 (USD MILLION)

8.8 HEALTHCARE

8.8.1 RISING DEMAND FOR DIGITAL TOOLS AND SERVICES AND DEPLOYMENT OF NEW EQUIPMENT TO FUEL MARKET GROWTH

8.8.2 IMPACT OF COVID-19

TABLE 72 HIGH-FREQUENCY TRANSFORMER MARKET FOR HEALTHCARE VERTICAL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 73 HIGH-FREQUENCY TRANSFORMER MARKET FOR HEALTHCARE VERTICAL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 74 HIGH-FREQUENCY TRANSFORMER MARKET FOR HEALTHCARE VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 HIGH-FREQUENCY TRANSFORMER MARKET FOR HEALTHCARE VERTICAL, BY REGION, 2021–2026 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 111)

9.1 INTRODUCTION

FIGURE 34 HIGH-FREQUENCY TRANSFORMER MARKET, BY GEOGRAPHY

TABLE 76 HIGH-FREQUENCY TRANSFORMER MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 77 HIGH-FREQUENCY TRANSFORMER MARKET, BY REGION, 2021–2026 (USD MILLION)

FIGURE 35 GEOGRAPHIC SNAPSHOT: HIGH-FREQUENCY TRANSFORMER MARKET

9.2 NORTH AMERICA

9.2.1 IMPACT OF COVID-19 ON NORTH AMERICAN MARKET

FIGURE 36 SNAPSHOT: NORTH AMERICAN HIGH-FREQUENCY TRANSFORMER MARKET

FIGURE 37 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN HIGH-FREQUENCY TRANSFORMER MARKET DURING FORECAST PERIOD

TABLE 78 HIGH-FREQUENCY TRANSFORMER MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 79 HIGH-FREQUENCY TRANSFORMER MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 80 HIGH-FREQUENCY TRANSFORMER MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 81 HIGH-FREQUENCY TRANSFORMER MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 82 HIGH-FREQUENCY TRANSFORMER MARKET IN NORTH AMERICA, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 83 HIGH-FREQUENCY TRANSFORMER MARKET IN NORTH AMERICA, BY VERTICAL, 2021–2026 (USD MILLION)

9.2.2 US

9.2.2.1 Continuous innovation in automotive industry to drive market growth

9.2.3 CANADA

9.2.3.1 Emerging trends in manufacturing sector to fuel demand for high-frequency transformers in Canada

9.2.4 MEXICO

9.2.4.1 High demand for healthcare devices to drive market growth

9.3 EUROPE

9.3.1 IMPACT OF COVID-19 ON EUROPEAN MARKET

FIGURE 38 SNAPSHOT: EUROPEAN HIGH-FREQUENCY TRANSFORMER MARKET

FIGURE 39 GERMANY TO ACCOUNT FOR LARGEST SHARE OF EUROPEAN HIGH-FREQUENCY TRANSFORMER MARKET DURING FORECAST PERIOD

TABLE 84 HIGH-FREQUENCY TRANSFORMER MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 85 HIGH-FREQUENCY TRANSFORMER MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 86 HIGH-FREQUENCY TRANSFORMER MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 87 HIGH-FREQUENCY TRANSFORMER MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 88 HIGH-FREQUENCY TRANSFORMER MARKET IN EUROPE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 89 HIGH-FREQUENCY TRANSFORMER MARKET IN EUROPE, BY VERTICAL, 2021–2026 (USD MILLION)

9.3.2 UK

9.3.2.1 Expansion of various verticals to drive market growth in UK

9.3.3 GERMANY

9.3.3.1 Expanding automotive industry to drive growth of German high-frequency transformer market

9.3.4 FRANCE

9.3.4.1 Increasing focus on growth of industrial and healthcare verticals to create growth opportunities for high-frequency transformer market

9.3.5 ITALY

9.3.5.1 Growing adoption of robotics and automation to fuel growth of high-frequency transformer market

9.3.6 REST OF EUROPE

9.4 APAC

9.4.1 IMPACT OF COVID-19 ON APAC MARKET

FIGURE 40 SNAPSHOT: APAC HIGH-FREQUENCY TRANSFORMER MARKET

FIGURE 41 CHINA TO ACCOUNT FOR LARGEST SHARE OF APAC HIGH-FREQUENCY TRANSFORMER MARKET DURING FORECAST PERIOD

TABLE 90 HIGH-FREQUENCY TRANSFORMER MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 91 HIGH-FREQUENCY TRANSFORMER MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 92 HIGH-FREQUENCY TRANSFORMER MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 93 HIGH-FREQUENCY TRANSFORMER MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 94 HIGH-FREQUENCY TRANSFORMER MARKET IN APAC, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 95 HIGH-FREQUENCY TRANSFORMER MARKET IN APAC, BY VERTICAL, 2021–2026 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Expanding healthcare vertical to fuel demand for high-frequency transformers in Japan

9.4.3 CHINA

9.4.3.1 Growing adoption of automation technologies in manufacturing sector to drive market growth

9.4.4 SOUTH KOREA

9.4.4.1 Rapid adoption of advanced technologies in various verticals to drive growth of high-frequency transformer market

9.4.5 INDIA

9.4.5.1 Increasing investments and favorable government initiatives related to manufacturing industry to fuel demand for high-frequency transformers

9.4.6 REST OF APAC

9.5 REST OF THE WORLD (ROW)

9.5.1 IMPACT OF COVID-19 ON ROW MARKET

FIGURE 42 SOUTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF ROW HIGH-FREQUENCY TRANSFORMER MARKET DURING FORECAST PERIOD

TABLE 96 HIGH-FREQUENCY TRANSFORMER MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 97 HIGH-FREQUENCY TRANSFORMER MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 98 HIGH-FREQUENCY TRANSFORMER MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 99 HIGH-FREQUENCY TRANSFORMER MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 100 HIGH-FREQUENCY TRANSFORMER MARKET IN ROW, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 101 HIGH-FREQUENCY TRANSFORMER MARKET IN ROW, BY VERTICAL, 2021–2026 (USD MILLION)

9.5.2 SOUTH AMERICA

9.5.2.1 Growth of renewable energy vertical in South America to fuel demand for high-frequency transformers

9.5.3 MIDDLE EAST & AFRICA

9.5.3.1 Expanding transmission & distribution vertical to drive growth of high-frequency transformer market

10 COMPETITIVE LANDSCAPE (Page No. - 137)

10.1 INTRODUCTION

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 102 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN HIGH-FREQUENCY TRANSFORMER MARKET

10.3 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 43 HIGH-FREQUENCY TRANSFORMER MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2016–2020

10.4 MARKET SHARE ANALYSIS, 2020

TABLE 103 HIGH-FREQUENCY TRANSFORMER MARKET: MARKET SHARE ANALYSIS (2020)

10.5 COMPANY EVALUATION QUADRANT, 2020

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 44 HIGH-FREQUENCY TRANSFORMER MARKET: COMPANY EVALUATION QUADRANT, 2020

10.6 SMALL AND MEDIUM ENTERPRISES (SMES) EVALUATION QUADRANT, 2020

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 45 HIGH-FREQUENCY TRANSFORMER MARKET (GLOBAL), SME EVALUATION QUADRANT, 2020

10.7 HIGH-FREQUENCY TRANSFORMER MARKET: COMPANY FOOTPRINT

TABLE 104 COMPANY FOOTPRINT

TABLE 105 APPLICATION: COMPANY FOOTPRINT

TABLE 106 VERTICAL: COMPANY FOOTPRINT

TABLE 107 REGIONAL: COMPANY FOOTPRINT

10.8 COMPETITIVE SITUATIONS AND TRENDS

10.8.1 HIGH-FREQUENCY TRANSFORMER MARKET: PRODUCT LAUNCHES

10.8.2 HIGH-FREQUENCY TRANSFORMER MARKET: DEALS

11 COMPANY PROFILES (Page No. - 153)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 MURATA MANUFACTURING CO. LTD.

TABLE 108 MURATA MANUFACTURING CO. LTD.: BUSINESS OVERVIEW

FIGURE 46 MURATA MANUFACTURING CO. LTD.: COMPANY SNAPSHOT

TABLE 109 MURATA MANUFACTURING CO., LTD.: PRODUCT OFFERING

TABLE 110 MURATA MANUFACTURING CO., LTD: PRODUCT LAUNCHES

11.1.2 TDK CORPORATION

TABLE 111 TDK CORPORATION: BUSINESS OVERVIEW

FIGURE 47 TDK CORPORATION: COMPANY SNAPSHOT

TABLE 112 TDK CORPORATION: PRODUCT OFFERING

TABLE 113 TDK CORPORATION: PRODUCT LAUNCHES

TABLE 114 TDK CORPORATION: DEALS

11.1.3 DELTA ELECTRONICS INC.

TABLE 115 DELTA ELECTRONICS INC.: BUSINESS OVERVIEW

FIGURE 48 DELTA ELECTRONICS INC.: COMPANY SNAPSHOT

TABLE 116 DELTA ELECTRONICS INC.: PRODUCT OFFERING

TABLE 117 DELTA ELECTRONICS INC.: DEALS

11.1.4 VISHAY INTERTECHNOLOGY, INC.

TABLE 118 VISHAY INTERTECHNOLOGY, INC.: BUSINESS OVERVIEW

FIGURE 49 VISHAY INTERTECHNOLOGY, INC.: COMPANY SNAPSHOT

TABLE 119 VISHAY INTERTECHNOLOGY, INC.: PRODUCT OFFERING

11.1.5 WÜRTH ELEKTRONIK GMBH & CO. KG

TABLE 120 WÜRTH ELEKTRONIK GMBH & CO. KG: BUSINESS OVERVIEW

FIGURE 50 WÜRTH ELEKTRONIK GMBH & CO. KG: COMPANY SNAPSHOT

TABLE 121 WÜRTH ELEKTRONIK GMBH & CO. KG: PRODUCT OFFERING

TABLE 122 WÜRTH ELEKTRONIK GMBH & CO. KG: PRODUCT LAUNCHES

11.1.6 TT ELECTRONICS

TABLE 123 TT ELECTRONICS: BUSINESS OVERVIEW

FIGURE 51 TT ELECTRONICS: COMPANY SNAPSHOT

TABLE 124 TT ELECTRONICS: PRODUCT OFFERING

TABLE 125 TT ELECTRONICS: DEALS

11.1.7 BEL FUSE INC.

TABLE 126 BEL FUSE INC.: BUSINESS OVERVIEW

FIGURE 52 BEL FUSE INC.: COMPANY SNAPSHOT

TABLE 127 BEL FUSE INC.: PRODUCT OFFERING

TABLE 128 BEL FUSE INC.: PRODUCT LAUNCHES

11.1.8 SAMSUNG ELECTRO-MECHANICS

TABLE 129 SAMSUNG ELECTRO-MECHANICS: BUSINESS OVERVIEW

FIGURE 53 SAMSUNG ELECTRO-MECHANICS: COMPANY SNAPSHOT

TABLE 130 SAMSUNG ELECTRO-MECHANICS: PRODUCT OFFERING

11.1.9 PANASONIC CORPORATION

TABLE 131 PANASONIC CORPORATION: BUSINESS OVERVIEW

FIGURE 54 PANASONIC CORPORATION: COMPANY SNAPSHOT

TABLE 132 PANASONIC CORPORATION: PRODUCT OFFERING

11.1.10 TAIYO YUDEN CO., LTD.

TABLE 133 TAIYO YUDEN CO., LTD.: BUSINESS OVERVIEW

FIGURE 55 TAIYO YUDEN CO., LTD.: COMPANY SNAPSHOT

TABLE 134 TAIYO YUDEN CO., LTD.: PRODUCT OFFERING

11.2 OTHER PLAYERS

11.2.1 SUMIDA CORPORATION

TABLE 135 SUMIDA CORPORATION.: COMPANY OVERVIEW

11.2.2 TABUCHI ELECTRIC CO., LTD.

TABLE 136 TABUCHI ELECTRIC CO., LTD.: COMPANY OVERVIEW

11.2.3 BOURNS, INC.

TABLE 137 BOURNS, INC.: COMPANY OVERVIEW

11.2.4 FALCO ELECTRONICS

TABLE 138 FALCO ELECTRONICS: COMPANY OVERVIEW

11.2.5 COILCRAFT INC.

TABLE 139 COILCRAFT INC.: COMPANY OVERVIEW

11.2.6 ABC TAIWAN ELECTRONICS CORP.

TABLE 140 ABC TAIWAN ELECTRONICS CORP.: COMPANY OVERVIEW

11.2.7 GCI TECHNOLOGIES

TABLE 141 GCI TECHNOLOGIES: COMPANY OVERVIEW

11.2.8 CTM MAGNETICS

TABLE 142 CTM MAGNETICS: COMPANY OVERVIEW

11.2.9 PULSE ELECTRONICS

TABLE 143 PULSE ELECTRONICS: COMPANY OVERVIEW

11.2.10 AGILE MAGNETICS, INC.

TABLE 144 AGILE MAGNETICS, INC.: COMPANY OVERVIEW

11.2.11 KUK WIJDEVEN

TABLE 145 KUK WIJDEVEN: COMPANY OVERVIEW

11.2.12 YUAN DEAN SCIENTIFIC CO., LTD.

TABLE 146 YUAN DEAN SCIENTIFIC CO., LTD.: COMPANY OVERVIEW

11.2.13 COILMASTER ELECTRONICS CO., LTD.

TABLE 147 COILMASTER ELECTRONICS CO., LTD.: COMPANY OVERVIEW

11.2.14 ABLE COIL & ELECTRONICS COMPANY, INC.

TABLE 148 ABLE COIL & ELECTRONICS COMPANY, INC.: COMPANY OVERVIEW

11.2.15 GT ELECTRONIC INDIA PVT. LTD.

TABLE 149 GT ELECTRONIC INDIA PVT. LTD.: COMPANY OVERVIEW

11.2.16 L/C MAGNETICS

TABLE 150 L/C MAGNETICS: COMPANY OVERVIEW

11.2.17 ICE COMPONENTS, INC.

TABLE 151 ICE COMPONENTS, INC.: COMPANY OVERVIEW

11.2.18 MARQUE MAGNETICS

TABLE 152 MARQUE MAGNETICS: COMPANY OVERVIEW

11.2.19 GEI INC.

TABLE 153 GEI INC.: COMPANY OVERVIEW

11.2.20 AVX CORPORATION

TABLE 154 AVX CORPORATION: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 201)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 SMART APPLIANCES MARKET, BY REGION

12.3.1 INTRODUCTION

FIGURE 56 GEOGRAPHIC SNAPSHOT - DEVELOPING COUNTRIES ARE EMERGING AS NEW HOTSPOTS

TABLE 155 SMART APPLIANCES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 156 SMART APPLIANCES MARKET, BY REGION, 2021–2026 (USD MILLION)

12.3.2 NORTH AMERICA

FIGURE 57 SNAPSHOT: SMART APPLIANCES MARKET IN NORTH AMERICA

12.3.2.1 Smart appliances market in North America: COVID-19 impact

FIGURE 58 IMPACT OF COVID-19 ON SMART APPLIANCES MARKET IN NORTH AMERICA

TABLE 157 POST-COVID-19: SMART APPLIANCES MARKET IN NORTH AMERICA, 2017–2026 (USD MILLION)

TABLE 158 SMART APPLIANCES MARKET IN NORTH AMERICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 159 SMART APPLIANCES MARKET IN NORTH AMERICA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 160 SMART APPLIANCES MARKET IN NORTH AMERICA, BY END USER, 2017–2020 (USD MILLION)

TABLE 161 SMART APPLIANCES MARKET IN NORTH AMERICA, BY END USER, 2021–2026 (USD MILLION)

TABLE 162 SMART APPLIANCES MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 163 SMART APPLIANCES MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.2.2 US

12.3.2.2.1 US to be largest market for smart appliances during forecast period

12.3.2.3 Canada

12.3.2.3.1 Investment in R&D activities will boost market growth in Canada

12.3.2.4 Mexico

12.3.2.4.1 Trade agreement with US will catalyze market growth in Mexico

12.3.3 EUROPE

FIGURE 59 SNAPSHOT: SMART APPLIANCES MARKET IN EUROPE

TABLE 164 SMART APPLIANCES MARKET IN EUROPE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 165 SMART APPLIANCES MARKET IN EUROPE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 166 SMART APPLIANCES MARKET IN EUROPE, BY END USER, 2017–2020 (USD MILLION)

TABLE 167 SMART APPLIANCES MARKET IN EUROPE, BY END USER, 2021–2026 (USD MILLION)

TABLE 168 SMART APPLIANCES MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 169 SMART APPLIANCES MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.3.1 UK

12.3.3.1.1 Government initiatives to encourage adoption of energy-efficient products will drive demand for smart appliances in UK

12.3.3.2 Germany

12.3.3.2.1 Presence of smart appliance manufacturing units of large companies will support market growth in Germany

12.3.3.3 France

12.3.3.3.1 Adoption of smart home appliances augments market growth in France

12.3.3.4 Italy

12.3.3.4.1 High focus on manufacturing industry strengthens smart appliances market in Italy

12.3.3.5 Rest of Europe

12.3.4 ASIA PACIFIC

FIGURE 60 SNAPSHOT: SMART APPLIANCES MARKET IN APAC

12.3.4.1 Smart appliances market in APAC: COVID-19 impact

FIGURE 61 IMPACT OF COVID-19 ON SMART APPLIANCES MARKET IN APAC

TABLE 170 POST-COVID-19: SMART APPLIANCES MARKET IN APAC, 2017–2026 (USD MILLION)

TABLE 171 SMART APPLIANCES MARKET IN APAC, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 172 SMART APPLIANCES MARKET IN APAC, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 173 SMART APPLIANCES MARKET IN APAC, BY END USER, 2017–2020 (USD MILLION)

TABLE 174 SMART APPLIANCES MARKET IN APAC, BY END USER, 2021–2026 (USD MILLION)

TABLE 175 SMART APPLIANCES MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 176 SMART APPLIANCES MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.4.2 China

12.3.4.2.1 China to account for largest size of APAC smart appliances market during forecast period

12.3.4.3 Japan

12.3.4.3.1 Trade agreements will boost smart appliances market growth in Japan

12.3.4.4 South Korea

12.3.4.4.1 Presence of leading smart appliance-manufacturing companies will underpin market growth in South Korea

12.3.4.5 India

12.3.4.5.1 Rising electronics manufacturing to augment smart appliances market growth in India

12.3.4.6 Rest of APAC

12.3.5 REST OF WORLD (ROW)

TABLE 177 SMART APPLIANCES MARKET IN ROW, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 178 SMART APPLIANCES MARKET IN ROW, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 179 SMART APPLIANCES MARKET IN ROW, BY END USER, 2017–2020 (USD MILLION)

TABLE 180 SMART APPLIANCES MARKET IN ROW, BY END USER, 2021–2026 (USD MILLION)

TABLE 181 SMART APPLIANCES MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 182 SMART APPLIANCES MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

12.3.5.1 South America

12.3.5.1.1 High demand from Brazil drives market growth in South America

12.3.5.2 Middle East & Africa

12.3.5.2.1 High demand from residential segment drives smart appliances market in Middle East & Africa

13 APPENDIX (Page No. - 222)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

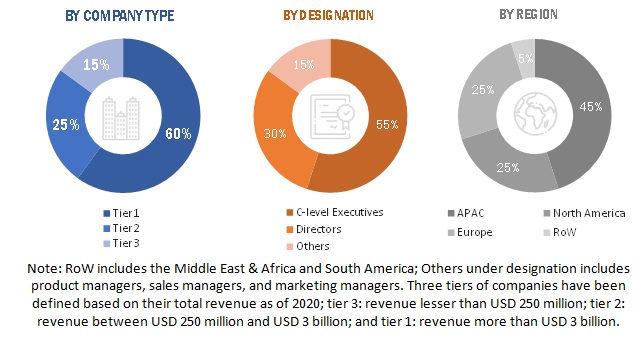

The study involved four major activities in estimating the current size of the high-frequency transformer market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the high-frequency transformer market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

The impact and implication of COVID-19 on various industry, as well as high-frequency transformers, have also been discussed in this section. Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred high-frequency transformer component suppliers, manufacturers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts (with a key focus on the impact of COVID-19), such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from high-frequency transformer providers, such as TDK Corporation (Japan), Murata Manufacturing Co. Ltd. (Japan), Delta Electronics Inc. (Taiwan), Vishay Intertechnology, Inc. (US), and Würth Elektronik GmbH & Co. KG (Germany); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the high-frequency transformer market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global High-Frequency Transformer Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe and forecast the high-frequency transformer market, in terms of power output, application, and vertical.

- To describe and forecast the market, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of high-frequency transformers.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the high-frequency transformer market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the high-frequency transformers.

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders.

- To analyze competitive strategies, such as product launches, expansions, mergers and acquisitions, adopted by key market players in the high-frequency transformer market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in High-Frequency Transformer Market