Hexane Market by Grade (Oil Extraction/Food, Pharmaceutical, and Industrial), Application (Oil Extraction, Pharmaceutical, Industrial Cleaning and Degreasing, Polymerization), and Region (North America, APAC, Europe, MEA, South America) - Global Forecast to 2027

Updated on : September 09, 2025

Hexane Market

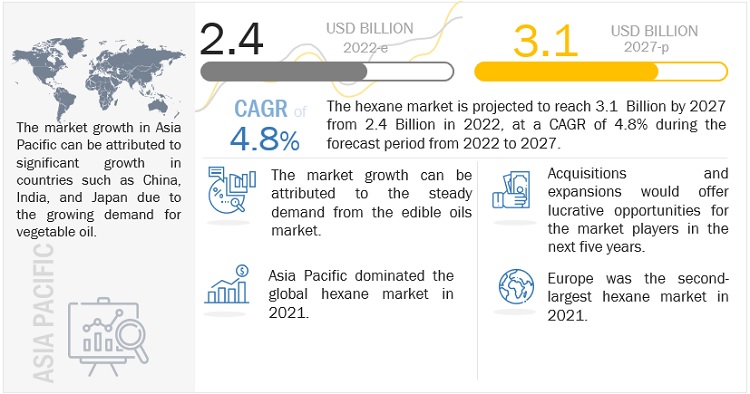

The hexane market was valued at USD 2.4 billion in 2022 and is projected to reach USD 3.1 billion by 2027, growing at 4.8% cagr from 2022 to 2027. Factors such as the increase in demand for the solvent in paints & coatings sector is increasing growth opportunities for the hexane market.

Hexane Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Hexane Market Dynamics

Driver: Steady demand from edible oils market

Hexane has a greater ability to extract oil when compared to other solvents, such as petroleum ether, and ethyl acetate. Therefore, it is mainly used in the extraction of edible oils from vegetables and seeds, including soybean, mustard seed, cottonseed, rape seed, flax, groundnut, corn germ, safflower seed, and palm. It helps extract the maximum possible quantity of oil, while also eliminating undesirable odour from oil. The solvent is recyclable and can be reused after oil extraction. Particularly, food-grade hexane is utilized in oil extraction, owing to its efficiency and safety. It has a low boiling point, and the solvent retains its liquid state in cool temperatures. Hexane extracts oil from fruits, and seeds, without disturbing their nutritional value. Thus, steady demand from edible oils market is expected to drive the hexane market.

Restraints: End-use industries shifting focus toward green solvents

Industries, particularly, conventional solvent manufacturers, are shifting their focus towards green solvents due to their biodegradability, non-toxic nature, and higher solvency than petroleum-derived solvents, for instance, hexane. Also, consumers across different end-use industries, such as food & beverages, pharmaceutical, cosmetics, and textile, prefer green solvents over petroleum-derived solvents. This is due to the stringent regulations being implemented by various countries across the globe pertaining to the use of hydrocarbons. Several tire manufacturing companies are focusing on the development of green tires, which offer improved performance and are sustainable. These tires also ensure the safety of vehicles. Bridgestone, Continental, and Goodyear, among others, are the major manufacturers of green tires. These factors are expected to restrain the growth of the hexane market.

Opportunity: Increase in demand for solvents in paints & coatings industry

As a solvent, hexane can dissolve various components, such as additives, pigments, that are used in the formulation of paints & coatings. Solvents assist in the regulation of paint viscosity and improve the quality of films. In paints, the product is highly used to avoid clumps or globs, and thereby provide the desired consistency. They also expedite the curing and drying process. Furthermore, the surging demand for paints due to the rapid growth across the construction industry and the mounting infrastructure development in China, India, the US, among other countries, are expected to further boost the adoption of solvents in the paints & coatings industry.

Challenge: Fluctuations in global crude oil prices

Crude oil is the most important energy resource for conducting economic activities, and the uncertainty in the evolution of crude oil prices has a significant effect on economic stability. Hydrocarbon solvents, such as hexane is a refined, processed, and purified products of crude oil. Therefore, the fluctuations in the price of crude oil will have a direct impact on the hexane manufacturers, creating a situation of uncertainty. Crude oil prices have constantly been fluctuating since the drop in 2014, and the declining trend continued until 2016. However, prices witnessed a rising trend in 2017 and 2018, which resulted in higher demand for production enhancement activities. The prices again dipped in 2019 and 2020, with a steady increase from January 2021 to March 2022.

Based on grade, industrial segment is expected to grow at the highest CAGR during the forecast period, in terms of volume

The hexane market by grade is segmented into oil extraction/food grade, pharmaceutical, and industrial. The industrial grade is expected to grow at the highest CAGR during 2022 to 2027, owing to its usage in various industries such as oil and grease extraction, furniture, and printing industries. Also, the growth is aided by the increase in demand for textiles in emerging economies for industrial grade hexane.

Based on application, polymerization segment is expected to grow at the highest CAGR during the forecast period, in terms of volume

The hexane market, by application, is segmented into oil extraction, pharmaceutical, industrial cleaning & greasing, polymerization, and others. The polymerization segment is expected to grow at the highest CAGR during 2022 to 2027, owing to increase in demand for polymers. Hexane is used as a reaction medium for polymerization. This is expected to create opportunities for the growth of hexane market.

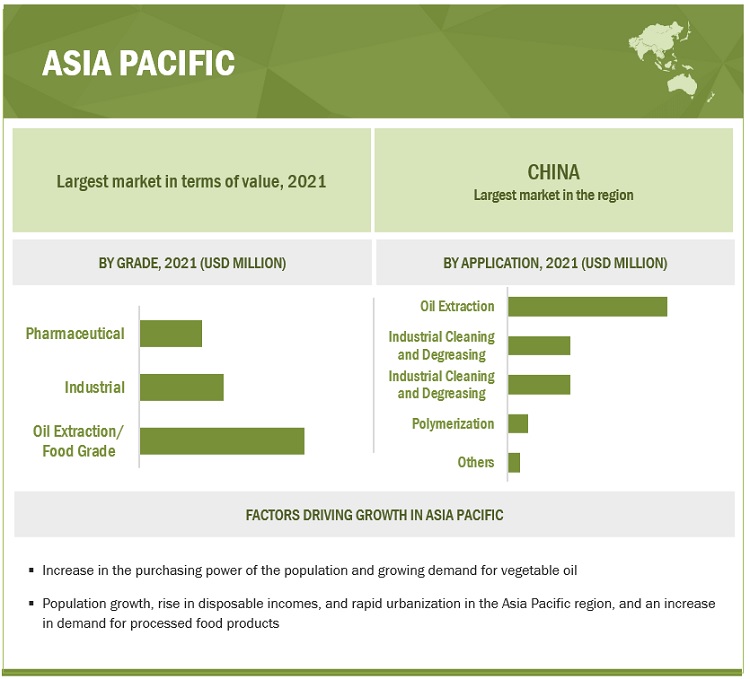

Asia Pacific is expected to be the largest hexane market during the forecast period, in terms of volume

Asia Pacific is the largest hexane market followed by North America, in terms of volume, during the forecast period of 2022 to 2027. The major economies of the Asia Pacific region contributing significantly to the growth of the hexane market are China, India, Japan, and South Korea. The region has emerged as an important consumer of hexane due to the increasing demand for vegetable oil, aided by rise in the standard of living of the people and disposable income. This further increases the growth of hexane market in Asia Pacific.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Hexane Market Players

Major companies in the hexane market include China Petroleum & Chemical Corporation (China), Shell plc (UK), Exxon Mobil Corporation (US), Rompetrol-Rafinare (Romania), Junyuan Petroleum Group (China), TotalEnergies (France), Phillips 66 Company (US), Indian Oil Corporation Ltd (India), Petróleo Brasileiro S.A. (Brazil), Bharat Petroleum Corporation Limited (India), Hindustan Petroleum Corporation Limited (India), Honeywell International Inc. (US), Sumitomo Chemical (Japan), among others. A total of 23 major players have been covered. These players have adopted product launches, acquisitions, and expansions as the major strategies to consolidate their position in the market.

Hexane Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million), Volume (Kiloton) |

|

Segments Covered |

Grade, Application, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include China Petroleum & Chemical Corporation (China), Shell plc (UK), Exxon Mobil Corporation (US), Rompetrol-Rafinare (Romania), Junyuan Petroleum Group (China), among others. |

This research report categorizes the hexane market based on grade, application, and region.

Based on grade, the hexane market has been segmented as follows:

- Oil Extraction/ Food Grade

- Industrial Grade

- Pharmaceutical Grade

Based on application, the hexane market has been segmented as follows:

- Oil Extraction

- Industrial Cleaning and Degreasing

- Pharmaceutical

- Polymerization

- Others

Based on region, the hexane market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Hexane Market Recent Developments

- In December 2021, Sumitomo Chemical decided to build new research facilities in Chiba and Osaka, and reorganize research laboratories in Osaka, Tsukuba, and Chiba, to accelerate the creation of next generation businesses.

- In February 2021, GFS Chemicals, Inc. announced its new partnership with Hanna Instruments USA, Inc. With this approach, GFS expanded its customer base by product offerings, that include Karl Fischer titration solutions and other specialty solvents and reagents for applications like peroxide value, acid number, and more.

- In January 2021, Indian Oil Corporation Ltd announced the plans for more than 400 USD thousand expansion project at its Chennai refinery. The refinery produced highest quantity of food grade hexane in 2020-21.

Frequently Asked Questions (FAQ):

What is the current size of the global hexane market?

The hexane market is projected to reach USD 3.1 Billion by 2027 from USD 2.4 Billion in 2022, at a CAGR of 4.8%, during the forecast period.

Who are the leading players in the global hexane market?

Some of the key players operating in the hexane market are China Petroleum & Chemical Corporation (China), Shell plc (UK), Exxon Mobil Corporation (US), Rompetrol-Rafinare (Romania), Junyuan Petroleum Group (China), TotalEnergies (France), Phillips 66 Company (US), Indian Oil Corporation Ltd (India), Petróleo Brasileiro S.A. (Brazil), Bharat Petroleum Corporation Limited (India), Hindustan Petroleum Corporation Limited (India), Honeywell International Inc. (US), Sumitomo Chemical (Japan), among others.

Which is the largest segment, by grade, in the global hexane market?

Oil extraction/food grade is the largest segment in the global hexane market, by value. Food grade hexane is majorly used as solvent in the solvent extraction units for vegetable oil.

Which is the largest segment, by application, in the global hexane market?

Oil extraction, by application, is the largest segment in the global hexane market. The growth in demand of vegetable oil is expected to drive the market for hexane.

Which is the largest region in the global hexane market?

Asia Pacific, by region, is the largest hexane market. The major economies of the Asia Pacific region contributing significantly to the growth of the hexane market are China, India, Japan, and South Korea.

What factors are driving the demand for hexane in the United States, especially in the food processing industry?

In the United States, the demand for hexane is largely driven by its use in the food processing industry, specifically for edible oil extraction from seeds and vegetables. Hexane’s effectiveness as a solvent, combined with its high yield and cost efficiency, makes it the preferred choice for extracting oils from soybeans, corn, and other seeds. This demand is also influenced by the rising consumption of plant-based foods and oils. However, due to health and environmental concerns, there is increased scrutiny and regulatory oversight from agencies like the FDA and EPA, pushing some companies to seek hexane alternatives or adopt stricter safety measures.

How is the UK addressing environmental concerns related to hexane usage in industrial applications?

In the United Kingdom, environmental concerns regarding hexane emissions and toxicity are shaping its market landscape. The UK has stringent regulations on volatile organic compounds (VOCs), and hexane, being a VOC, is subject to strict controls. This has led industries, particularly in food processing and pharmaceuticals, to explore more sustainable and eco-friendly alternatives where possible. Additionally, companies that continue to use hexane are investing in technologies to reduce emissions and improve containment to comply with UK and EU environmental standards, aligning with the country’s broader goals to reduce industrial pollutants and enhance air quality.

What factors are driving the growth of the hexane market in the US?

The growth of the hexane market in the United States is primarily driven by increased demand for edible oil extraction and its extensive use as an industrial solvent in various sectors, including pharmaceuticals and cosmetics. The rising consumption of packaged food products, coupled with a growing need for high-quality cooking oils, is significantly contributing to market expansion. Additionally, innovations in extraction technologies and the increasing application of hexane in adhesives and sealants further enhance its market potential. The US hexane market is projected to reach approximately $462.9 million by 2024, growing at a CAGR of 3.6% through 2034.

How is the UK hexane market expected to evolve in the coming years?

In the United Kingdom, the hexane market is anticipated to grow due to increasing applications in food processing and extraction industries. The demand for hexane as a solvent in edible oil extraction is particularly noteworthy, driven by rising health consciousness among consumers regarding refined oils. Furthermore, regulatory support for sustainable practices is likely to promote the use of hexane in various applications, including cosmetics and pharmaceuticals. The UK market is expected to witness steady growth, aligning with broader trends towards efficiency and sustainability in industrial processes.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Steady demand from edible oils market- Strong demand from growing markets in Asia PacificRESTRAINTS- Shifting focus of end-use industries toward green solventsOPPORTUNITIES- Increase in demand for solvents in paints & coatings industryCHALLENGES- Handling issues related to hexane due to its high flammability and toxicity- Fluctuations in global crude oil prices

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 MANUFACTURING PROCESSINTRODUCTIONSYNTHESIS

-

5.7 POLICIES AND REGULATIONSREACH: REGISTRATION, EVALUATION, AUTHORISATION, AND RESTRICTION OF CHEMICALS REGULATION- Dossier evaluation statusCLP: CLASSIFICATION, LABELING, AND PACKAGINGATMOSPHERIC STANDARDSFDA REGULATIONS

- 5.8 CASE STUDY ANALYSIS

- 5.9 TRADE DATA

- 5.10 PRICING ANALYSIS

- 6.1 INTRODUCTION

-

6.2 N-HEXANEUSAGE OF N-HEXANE IN SEVERAL APPLICATIONS TO DRIVE DEMAND

-

6.3 ISOHEXANERISING DEMAND FOR ADHESIVES IN GROWING ECONOMIES TO SUPPORT MARKET

-

6.4 NEOHEXANEUSE OF NEOHEXANE IN GLUES AND PAINTS TO DRIVE DEMAND

- 7.1 INTRODUCTION

-

7.2 OIL EXTRACTION/FOOD GRADEHIGH DEMAND FOR VEGETABLE OIL TO DRIVE DEMAND

-

7.3 PHARMACEUTICAL GRADERISE IN CHRONIC DISEASES TO DRIVE MARKET

-

7.4 INDUSTRIAL GRADEUSAGE ACROSS VARIOUS INDUSTRIES TO DRIVE DEMAND

- 8.1 INTRODUCTION

-

8.2 OIL EXTRACTIONRISING DEMAND FOR VEGETABLE OIL TO DRIVE SEGMENT

-

8.3 PHARMACEUTICALRISE IN CHRONIC DISEASES TO DRIVE MARKET

-

8.4 INDUSTRIAL CLEANING & DEGREASINGGROWING DEMAND FOR TEXTILE, FOOTWEAR, AND LEATHER PRODUCTS TO BOOST MARKET

-

8.5 POLYMERIZATIONGROWING DEMAND FOR POLYMERS TO ENHANCE DEMAND FOR HEXANE

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Rise in consumption of vegetable oil to drive demandCANADA- Strong chemical industry to boost marketMEXICO- Rise in demand for processed food and paints & coatings to propel demand

-

9.3 ASIA PACIFICCHINA- China accounts for largest market in Asia PacificINDIA- Growth in paints & coatings industry to drive marketJAPAN- Large construction sector: major consumers of hexaneSOUTH KOREA- Growth of food and pharmaceutical sectorsREST OF ASIA PACIFIC

-

9.4 EUROPEGERMANY- Germany accounted for largest market share of hexane in EuropeUK- Increase in production of commercial vehicles to drive marketFRANCE- Growth in construction and pharmaceutical sectors to drive marketREST OF EUROPE

-

9.5 MIDDLE EAST & AFRICASAUDI ARABIA- Growth in construction and pharmaceutical sectors to create opportunities for market playersREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICABRAZIL- Largest market in South AmericaREST OF SOUTH AMERICA

- 10.1 INTRODUCTION

- 10.2 REVENUE ANALYSIS

-

10.3 MARKET SHARE ANALYSIS, 2021SHELL PLCCHINA PETROLEUM & CHEMICAL CORPORATIONEXXON MOBIL CORPORATIONROMPETROL-RAFINAREJUNYUAN PETROLEUM GROUP

-

10.4 COMPANY EVALUATION MATRIXSTAR PLAYERSEMERGING LEADERSPERVASIVEPARTICIPANTS

- 10.5 COMPETITIVE SCENARIO

-

11.1 CHINA PETROLEUM & CHEMICAL CORPORATIONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

11.2 SHELL PLCBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

11.3 EXXON MOBIL CORPORATIONBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

11.4 ROMPETROL-RAFINAREBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

11.5 JUNYUAN PETROLEUM GROUPBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

11.6 TOTALENERGIESBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS

-

11.7 PHILLIPS 66 COMPANYBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

11.8 INDIAN OIL CORPORATION LTDBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENT

-

11.9 PETRÓLEO BRASILEIRO S.A.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

11.10 BHARAT PETROLEUM CORPORATION LIMITEDBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

11.11 HINDUSTAN PETROLEUM CORPORATION LIMITEDBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

11.12 HONEYWELL INTERNATIONAL INC.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENT

-

11.13 SUMITOMO CHEMICALBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENT

-

11.14 THAI OIL PUBLIC COMPANY LIMITEDBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENT

-

11.15 SHENYANG HUIFENG PETROCHEMICAL CO., LTDBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

11.16 TOKYO CHEMICAL INDUSTRY CO., LTD.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

11.17 ARHAM PETROCHEM PRIVATE LIMITEDBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENT

-

11.18 HYDRITE CHEMICALBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENT

-

11.19 GFS CHEMICALS, INC.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS

-

11.20 NOAH CHEMICALSBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

11.21 LIAONING YUFENG CHEMICAL CO., LTD.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

11.22 SPECTRUM CHEMICALBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

11.23 MERCK KGAABUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 HEXANE MARKET, BY GRADE: INCLUSIONS & EXCLUSIONS

- TABLE 2 HEXANE MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

- TABLE 3 HEXANE MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

- TABLE 4 HEXANE MARKET, 2022–2027

- TABLE 5 HEXANE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 HEXANE MARKET: ECOSYSTEM

- TABLE 7 MAIN APPLICATIONS OF HEXANE IN EXTRACTION OF FOOD PRODUCTS AND INGREDIENTS

- TABLE 8 DOSSIER EVALUATION STATUS OF N-HEXANE

- TABLE 9 EXPORT DATA (2021)

- TABLE 10 IMPORT DATA (2021)

- TABLE 11 HEXANE MARKET SIZE, BY GRADE, 2018–2020 (USD MILLION)

- TABLE 12 HEXANE MARKET SIZE, BY GRADE, 2021–2027 (USD MILLION)

- TABLE 13 HEXANE MARKET SIZE, BY GRADE, 2018–2020 (KILOTON)

- TABLE 14 HEXANE MARKET SIZE, BY GRADE, 2021–2027 (KILOTON)

- TABLE 15 HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 16 HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 17 HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 18 HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 19 OIL EXTRACTION: HEXANE MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

- TABLE 20 OIL EXTRACTION: HEXANE MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 21 OIL EXTRACTION: HEXANE MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

- TABLE 22 OIL EXTRACTION: HEXANE MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 23 PHARMACEUTICAL: HEXANE MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

- TABLE 24 PHARMACEUTICAL: HEXANE MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 25 PHARMACEUTICAL: HEXANE MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

- TABLE 26 PHARMACEUTICAL: HEXANE MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 27 INDUSTRIAL CLEANING & DEGREASING: HEXANE MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

- TABLE 28 INDUSTRIAL CLEANING & DEGREASING: HEXANE MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 29 INDUSTRIAL CLEANING & DEGREASING: HEXANE MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

- TABLE 30 INDUSTRIAL CLEANING & DEGREASING: HEXANE MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 31 POLYMERIZATION: HEXANE MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

- TABLE 32 POLYMERIZATION: HEXANE MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 33 POLYMERIZATION: HEXANE MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

- TABLE 34 POLYMERIZATION: HEXANE MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 35 OTHER APPLICATIONS: HEXANE MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

- TABLE 36 OTHER APPLICATIONS: HEXANE MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 37 OTHER APPLICATIONS: HEXANE MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

- TABLE 38 OTHER APPLICATIONS: HEXANE MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 39 HEXANE MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

- TABLE 40 HEXANE MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 41 HEXANE MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

- TABLE 42 HEXANE MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

- TABLE 43 NORTH AMERICA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 44 NORTH AMERICA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 45 NORTH AMERICA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 46 NORTH AMERICA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 47 NORTH AMERICA: HEXANE MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 48 NORTH AMERICA: HEXANE MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: HEXANE MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

- TABLE 50 NORTH AMERICA: HEXANE MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 51 US: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 52 US: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 53 US: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 54 US: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 55 CANADA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 56 CANADA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 57 CANADA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 58 CANADA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 59 MEXICO: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 60 MEXICO: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 61 MEXICO: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 62 MEXICO: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 63 ASIA PACIFIC: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 64 ASIA PACIFIC: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 65 ASIA PACIFIC: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 66 ASIA PACIFIC: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 67 ASIA PACIFIC: HEXANE MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 68 ASIA PACIFIC: HEXANE MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 69 ASIA PACIFIC: HEXANE MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

- TABLE 70 ASIA PACIFIC: HEXANE MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 71 CHINA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 72 CHINA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 73 CHINA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 74 CHINA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 75 INDIA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 76 INDIA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 77 INDIA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 78 INDIA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 79 JAPAN: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 80 JAPAN: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 81 JAPAN: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 82 JAPAN: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 83 SOUTH KOREA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 84 SOUTH KOREA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 85 SOUTH KOREA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 86 SOUTH KOREA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 87 REST OF ASIA PACIFIC: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 88 REST OF ASIA PACIFIC: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 89 REST OF ASIA PACIFIC: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 90 REST OF ASIA PACIFIC: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 91 EUROPE: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 92 EUROPE: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 93 EUROPE: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 94 EUROPE: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 95 EUROPE: HEXANE MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 96 EUROPE: HEXANE MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 97 EUROPE: HEXANE MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

- TABLE 98 EUROPE: HEXANE MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 99 GERMANY: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 100 GERMANY: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 101 GERMANY: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 102 GERMANY: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 103 UK: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 104 UK: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 105 UK: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 106 UK: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 107 FRANCE: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 108 FRANCE: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 109 FRANCE: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 110 FRANCE: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 111 REST OF EUROPE: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 112 REST OF EUROPE: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 113 REST OF EUROPE: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 114 REST OF EUROPE: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 115 MIDDLE EAST & AFRICA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 118 MIDDLE EAST & AFRICA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 119 MIDDLE EAST & AFRICA: HEXANE MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

- TABLE 120 MIDDLE EAST & AFRICA: HEXANE MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 121 SOUTH AMERICA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

- TABLE 122 SOUTH AMERICA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 123 SOUTH AMERICA: HEXANE MARKET SIZE, BY APPLICATION, 2018–2020 (KILOTON)

- TABLE 124 SOUTH AMERICA: HEXANE MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

- TABLE 125 SOUTH AMERICA: HEXANE MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

- TABLE 126 SOUTH AMERICA: HEXANE MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 127 OVERVIEW OF KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 128 HEXANE MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 129 HEXANE MARKET: GRADE FOOTPRINT

- TABLE 130 HEXANE MARKET: APPLICATION FOOTPRINT

- TABLE 131 HEXANE MARKET: REGION FOOTPRINT

- TABLE 132 HEXANE MARKET: DEALS, 2019–2022

- TABLE 133 HEXANE MARKET: OTHER DEVELOPMENTS, 2019–2022

- TABLE 134 CHINA PETROLEUM & CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 135 CHINA PETROLEUM & CHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 136 SHELL PLC: COMPANY OVERVIEW

- TABLE 137 SHELL PLC: PRODUCTS OFFERED

- TABLE 138 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- TABLE 139 EXXON MOBIL CORPORATION: PRODUCTS OFFERED

- TABLE 140 ROMPETROL-RAFINARE: COMPANY OVERVIEW

- TABLE 141 ROMPETROL-RAFINARE: PRODUCTS OFFERED

- TABLE 142 JUNYUAN PETROLEUM GROUP: COMPANY OVERVIEW

- TABLE 143 JUNYUAN PETROLEUM GROUP: PRODUCTS OFFERED

- TABLE 144 TOTALENERGIES: COMPANY OVERVIEW

- TABLE 145 TOTALENERGIES: PRODUCTS OFFERED

- TABLE 146 TOTALENERGIES: PRODUCT LAUNCH

- TABLE 147 PHILLIPS 66 COMPANY: COMPANY OVERVIEW

- TABLE 148 PHILLIPS 66 COMPANY: PRODUCTS OFFERED

- TABLE 149 INDIAN OIL CORPORATION LTD: COMPANY OVERVIEW

- TABLE 150 INDIAN OIL CORPORATION LTD: PRODUCTS OFFERED

- TABLE 151 INDIAN OIL CORPORATION LTD: OTHERS

- TABLE 152 PETRÓLEO BRASILEIRO S.A.: COMPANY OVERVIEW

- TABLE 153 PETRÓLEO BRASILEIRO S.A.: PRODUCTS OFFERED

- TABLE 154 BHARAT PETROLEUM CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 155 BHARAT PETROLEUM CORPORATION LIMITED: PRODUCTS OFFERED

- TABLE 156 HINDUSTAN PETROLEUM CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 157 HINDUSTAN PETROLEUM CORPORATION LIMITED: PRODUCTS OFFERED

- TABLE 158 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 159 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 160 HONEYWELL INTERNATIONAL INC.: OTHERS

- TABLE 161 SUMITOMO CHEMICAL: COMPANY OVERVIEW

- TABLE 162 SUMITOMO CHEMICAL: PRODUCTS OFFERED

- TABLE 163 SUMITOMO CHEMICAL: OTHERS

- TABLE 164 THAI OIL PUBLIC COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 165 THAI OIL PUBLIC COMPANY LIMITED: PRODUCTS OFFERED

- TABLE 166 THAI OIL PUBLIC COMPANY LIMITED: DEALS

- TABLE 167 SHENYANG HUIFENG PETROCHEMICAL CO., LTD: COMPANY OVERVIEW

- TABLE 168 SHENYANG HUIFENG PETROCHEMICAL CO., LTD: PRODUCTS OFFERED

- TABLE 169 TOKYO CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 170 TOKYO CHEMICAL INDUSTRY CO., LTD.: PRODUCTS OFFERED

- TABLE 171 ARHAM PETROCHEM PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 172 ARHAM PETROCHEM PRIVATE LIMITED: PRODUCTS OFFERED

- TABLE 173 ARHAM PETROCHEM PRIVATE LIMITED: DEALS

- TABLE 174 HYDRITE CHEMICAL: COMPANY OVERVIEW

- TABLE 175 HYDRITE CHEMICAL: PRODUCTS OFFERED

- TABLE 176 HYDRITE CHEMICAL: OTHERS

- TABLE 177 GFS CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 178 GFS CHEMICALS, INC.: PRODUCTS OFFERED

- TABLE 179 GFS CHEMICALS, INC.: DEALS

- TABLE 180 NOAH CHEMICALS: COMPANY OVERVIEW

- TABLE 181 NOAH CHEMICALS: PRODUCTS OFFERED

- TABLE 182 LIAONING YUFENG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 183 LIAONING YUFENG CHEMICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 184 SPECTRUM CHEMICAL: COMPANY OVERVIEW

- TABLE 185 SPECTRUM CHEMICAL: PRODUCTS OFFERED

- TABLE 186 MERCK KGAA: COMPANY OVERVIEW

- TABLE 187 MERCK KGAA: PRODUCTS OFFERED

- FIGURE 1 HEXANE: MARKET SEGMENTATION

- FIGURE 2 HEXANE MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MAIN MATRIX CONSIDERED FOR CONSTRUCTING AND ASSESSING DEMAND FOR HEXANE

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 HEXANE MARKET: DATA TRIANGULATION

- FIGURE 8 OIL EXTRACTION/FOOD GRADE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 OIL EXTRACTION APPLICATION TO LEAD HEXANE MARKET

- FIGURE 10 ASIA PACIFIC DOMINATED HEXANE MARKET

- FIGURE 11 MARKET TO WITNESS MODERATE GROWTH BETWEEN 2022 AND 2027

- FIGURE 12 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN HEXANE MARKET

- FIGURE 13 INDUSTRIAL GRADE TO GROW FASTEST IN HEXANE MARKET

- FIGURE 14 POLYMERIZATION SEGMENT TO WITNESS HIGHEST CAGR

- FIGURE 15 CHINA TO GROW AT HIGHEST CAGR IN HEXANE MARKET

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HEXANE MARKET

- FIGURE 17 OIL SEED PRODUCTION, 2018-2030

- FIGURE 18 VEGETABLE OIL PRODUCTION, 2018-2030

- FIGURE 19 CRUDE OIL PRICES: JANUARY 2019–OCTOBER 2022 (USD/BARREL)

- FIGURE 20 HEXANE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 ECOSYSTEM MAP OF HEXANE MARKET

- FIGURE 22 HEXANE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 PRODUCTION PROCESS

- FIGURE 24 HEXANE MARKET: PRICING ANALYSIS

- FIGURE 25 OIL EXTRACTION/FOOD GRADE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 26 OIL EXTRACTION TO LARGEST SEGMENT UNTIL 2027

- FIGURE 27 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 28 NORTH AMERICA: HEXANE MARKET SNAPSHOT

- FIGURE 29 ASIA PACIFIC: HEXANE MARKET SNAPSHOT

- FIGURE 30 EUROPE: HEXANE MARKET SNAPSHOT

- FIGURE 31 REVENUE ANALYSIS OF KEY COMPANIES IN LAST FIVE YEARS

- FIGURE 32 HEXANE MARKET SHARE ANALYSIS

- FIGURE 33 HEXANE: COMPANY EVALUATION MATRIX, 2021

- FIGURE 34 CHINA PETROLEUM & CHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 35 SHELL PLC: COMPANY SNAPSHOT

- FIGURE 36 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- FIGURE 37 ROMPETROL-RAFINARE: COMPANY SNAPSHOT

- FIGURE 38 TOTALENERGIES: COMPANY SNAPSHOT

- FIGURE 39 PHILLIPS 66 COMPANY: COMPANY SNAPSHOT

- FIGURE 40 INDIAN OIL CORPORATION LTD: COMPANY SNAPSHOT

- FIGURE 41 PETRÓLEO BRASILEIRO S.A.: COMPANY SNAPSHOT

- FIGURE 42 BHARAT PETROLEUM CORPORATION LIMITED: COMPANY SNAPSHOT

- FIGURE 43 HINDUSTAN PETROLEUM CORPORATION LIMITED: COMPANY SNAPSHOT

- FIGURE 44 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 45 SUMITOMO CHEMICAL: COMPANY SNAPSHOT

- FIGURE 46 THAI OIL PUBLIC COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 47 MERCK KGAA: COMPANY SNAPSHOT

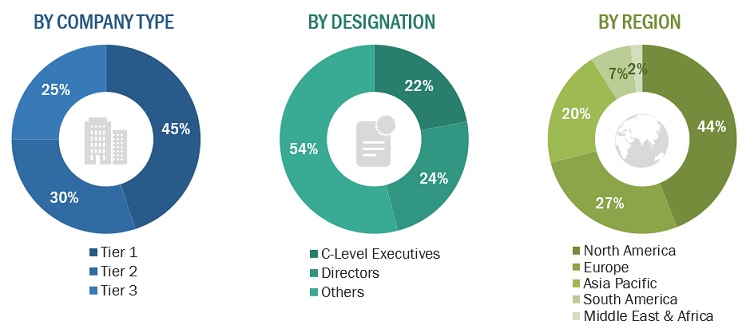

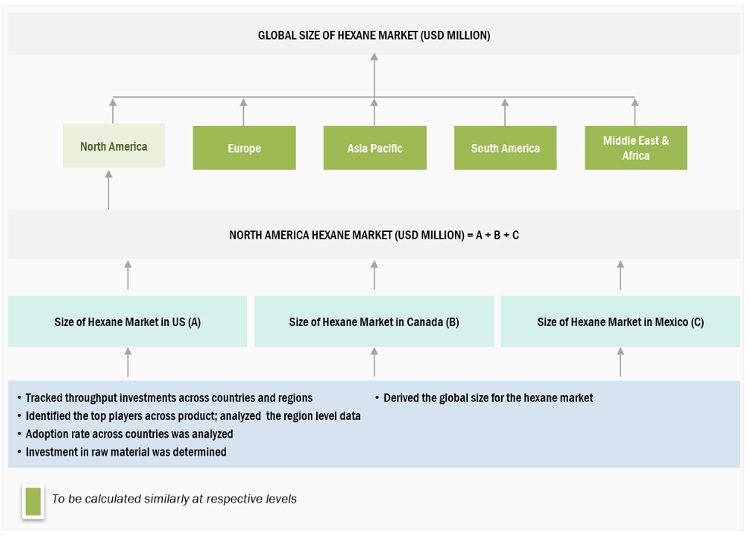

The study involved four major activities in estimating the current size of the hexane market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the hexane value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports; press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors, gold- and silver-standard websites, hexane manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The hexane market comprises several stakeholders, such as raw material suppliers, processors, end-use industries, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of hexane manufacturers, importers/exporters, and manufacturers engaged in the production of various products. The supply side is characterized by key technology providers for hexane, end-users, researchers, and service providers.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of manufacturing companies. The primary sources from the supply side included research institutions involved in R&D activities to introduce new technologies, key opinion leaders, distributors, and hexane manufacturing companies.

Breakdown of the Primary Interviews

Notes: Other designations include sales managers, engineers, and regional managers.

Tier 1 company—revenue >USD 5 billion, tier 2 company—revenue between USD 1 billion and USD 5 billion, and tier 3 company—revenue <USD 1 billion

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the hexane market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the hexane market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Hexane Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To analyze and forecast the size of the hexane market in terms of value and volume

- To define, describe, and forecast the market size by grade, application, and region

- To forecast the market size with respect to five main regions, namely, Asia Pacific, Europe, North America, Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as acquisitions, partnerships, and expansions in the hexane market

Competitive Intelligence

- To identify and profile the key players in the hexane market

- To determine the top players offering various products in the hexane market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hexane Market