Epilepsy Monitoring Devices Market by Product (Conventional & Wearable Devices, Standard EEG, Video EEG, Ambulatory EEG, EMG, MEG, Deep Brain Stimulation Devices) End User (Hospitals, Neurology Centers, ASC, Home Care Settings) - Global Forecast to 2026

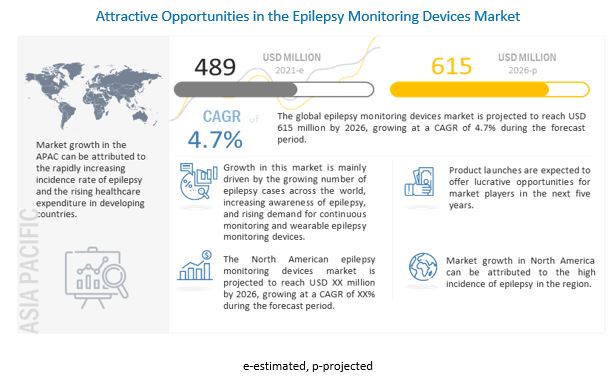

The global epilepsy monitoring devices market in terms of revenue was estimated to be worth $489 million in 2021 and is poised to reach $615 million by 2026, growing at a CAGR of 4.7% from 2021 to 2026. The growth in the market is mainly driven by the increasing incidence and prevalence of epilepsy, growing preference for ambulatory healthcare and increasing use of wearables, growing demand for continuous monitoring, and the rising awareness of neurodegenerative diseases, including epilepsy.

To know about the assumptions considered for the study, Request for Free Sample Report

Epilepsy monitoring devices Market Dynamics

Drivers: Increasing incidence and prevalence of epilepsy

According to the WHO, an estimated five million people around the world are diagnosed with epilepsy each year. In high-income countries, there are estimated to be 49 per 100,000 people diagnosed with epilepsy each year. In low- and middle-income countries, this figure can be as high as 139 per 100,000. This is likely due to the increased risk of endemic conditions such as malaria or neurocysticercosis, the higher incidence of road traffic injuries and birth-related injuries, variations in medical infrastructure, and the availability of preventive health programs and accessible care (in high-income countries).

Restraints: High cost of complex epilepsy monitoring procedures and devices

The high cost of epilepsy monitoring surgeries and devices is a major factor restraining the global epilepsy monitoring devices market, especially in developing countries with poor reimbursement policies. Brain monitoring devices are highly complex, and the procedures involving the use of these devices are generally expensive. For instance, the average cost of a standard EEG is ~USD 200–700; this procedure can cost as high as USD 3,000 for extended monitoring. Likewise, a single MEG system costs roughly USD 2.5–3 million. Due to the high price, healthcare facilities, even in countries that show wide adoption of high-tech medical equipment, find it difficult to procure MEG devices. Additionally, the maintenance cost and other associated indirect expenses increase the total cost of ownership of these devices, thereby limiting their adoption.

Opportunities: Increasing demand for non-invasive and minimally invasive devices

Invasive monitoring is a complex, painful, and risky process, as it involves direct intervention with sensitive brain tissue. Doctors and patients, therefore, show a high inclination toward the use of non-invasive or minimally invasive epilepsy monitoring devices

Several government initiatives are focused on the development of novel and innovative devices, such as the BRAIN initiative launched in the US in April 2013 for encouraging R&D related to the functioning of the brain. Advanced Research Projects Activity (IARPA) joined the BRAIN initiative for the development of non-invasive neural intervention devices for optimizing reasoning and problem-solving.

By product segment, the conventional devices segment accounted for the largest market share in 2020

Among the products segment, the conventional devices segment accounted for the largest market share in 2020. The large share of this segment is attributed to the rising awareness of neurodegenerative diseases including epilepsy.

In the conventional devices segment, monitoring devices contributed the largest share. The growth of this segment is driven by the increasing demand for continuous monitoring and minimally invasive and non-invasive devices.

To know about the assumptions considered for the study, download the pdf brochure

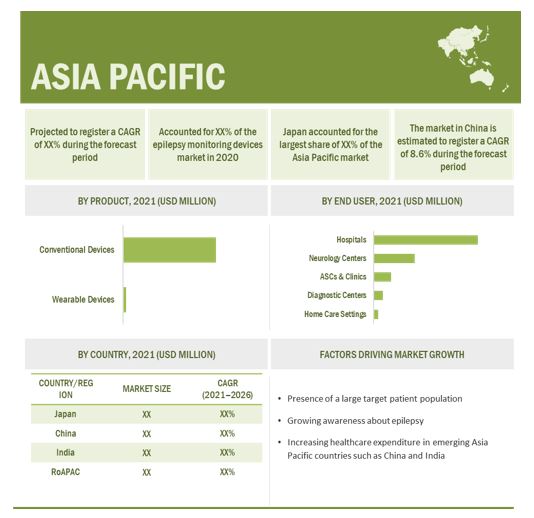

Asia-Pacific is the fastest-growing market for epilepsy monitoring devices market during the forecast period.

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period. The high growth in this regional market can be attributed to rising medical tourism, the implementation of new ICT guidelines in Japan, investments, and reforms to modernize China’s healthcare infrastructure, the presence of a large target patient population (coupled with the rapidly growing geriatric population, especially in Japan and China), growing awareness about epilepsy, and the increasing healthcare expenditure in emerging APAC countries such as China and India.

The major players in the global epilepsy monitoring devices market are Natus Medical, Inc. (US), Compumedics Limited (Australia), Empatica, Inc. (US), The Magstim Co. Ltd. (UK), Nihon Kohden Corporation (Japan), Medtronic Plc (Ireland), Masimo Corporation (US), Boston Scientific Corporation (US), Drägerwerk AG & Co. KGaA (Germany), mjn Neuroserveis S.L. (Spain), Abbott Laboratories, Inc. (US), LivAssured B.V. (Netherlands), BioSerenity (France), Aleva Neurotherapeutics (Switzerland), Medpage, Ltd. (UK), Neurosoft (Russia), Advanced Brain Monitoring (US), Lifelines Neuro Company, LLC (US), Mitsar Co., Ltd. (Russia), Rimed (US), Emotiv (US), CGX (A Cognionics Company) (US), Mindray Medical International Ltd. (China), Cadwell Industries, Inc. (US), NeuroWave Systems, Inc. (US), and MC10, Inc. (US).

Scope of the Epilepsy Monitoring Devices Market report

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, end-user and region |

|

Geographies covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Companies covered |

|

The research report categorizes the Epilepsy monitoring devices market into the following segments and subsegments:

By Product

- Wearable Devices

-

Conventional Devices

- Deep Brain Stimulation Devices

-

Montioring Devices

-

EEG Devices

- Standard EEG

- Video EEG

- Others/Ambulatory EEG

- EMG Devices

- MEG Devices

- Other Monitoring Devices

-

EEG Devices

By End User

- Hospitals

- Ambulatory Surgery Centers & Clinics

- Neurology Centres

- Diagnostic Centres

- Home Care Settings

By Region

-

North America

- US

- Canada

-

Europe

- France

- Germany

- UK

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Rest of the World

Recent Developments

- In February 2021, BioSerenity and Premier Inc. entered into an agreement where the former was to serve as Premier’s contracted provider and serve approximately 4,000 US hospitals and 175,000 other providers.

- In January 2021, Nihon Kohden launched disposable EEG electrodes to help prevent cross-contamination between patients and healthcare workers while maintaining high-quality EEG signals.

- In July 2020, Magstim acquired Philips’ subsidiary, EGI, adding high-density EEG solutions to its product portfolio. This acquisition helped the company close the loop for the development of a comprehensive system for non-invasive neuromodulation.

- In May 2020, Natus Medical announced a partnership with Holberg to develop and distribute the Autoscore algorithm. The algorithm helps automate electroencephalography (EEG) classifications and advance reporting efficiency.

Frequently Asked Questions (FAQs):

What is the size of Epilepsy Monitoring Devices Market?

The global epilepsy monitoring devices market in terms of revenue was estimated to be worth $489 million in 2021 and is poised to reach $615 million by 2026, growing at a CAGR of 4.7% from 2021 to 2026.

Why is Epilepsy Monitoring Devices Market Growing ?

The growth in the market is mainly driven by the increasing incidence and prevalence of epilepsy, growing preference for ambulatory healthcare and increasing use of wearables, growing demand for continuous monitoring, and the rising awareness of neurodegenerative diseases, including epilepsy.

Who all are the prominent players of Epilepsy Monitoring Devices Market?

The major players in the global epilepsy monitoring devices market are Natus Medical, Inc. (US), Compumedics Limited (Australia), Empatica, Inc. (US), The Magstim Co. Ltd. (UK), Nihon Kohden Corporation (Japan), Medtronic Plc (Ireland), Masimo Corporation (US), Boston Scientific Corporation (US), Drägerwerk AG & Co. KGaA (Germany), mjn Neuroserveis S.L. (Spain), Abbott Laboratories, Inc. (US), LivAssured B.V. (Netherlands), BioSerenity (France), Aleva Neurotherapeutics (Switzerland), Medpage, Ltd. (UK), Neurosoft (Russia), Advanced Brain Monitoring (US), Lifelines Neuro Company, LLC (US), Mitsar Co., Ltd. (Russia), Rimed (US), Emotiv (US), CGX (A Cognionics Company) (US), Mindray Medical International Ltd. (China), Cadwell Industries, Inc. (US), NeuroWave Systems, Inc. (US), and MC10, Inc. (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION & SCOPE

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKET SEGMENTATION

FIGURE 1 EPILEPSY MONITORING DEVICES INDUSTRY SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH APPROACH

2.2 RESEARCH METHODOLOGY DESIGN

FIGURE 2 EPILEPSY MONITORING DEVICES INDUSTRY : RESEARCH DESIGN

2.2.1 SECONDARY RESEARCH

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY RESEARCH

FIGURE 3 PRIMARY SOURCES

2.2.2.1 Key data from primary sources

2.2.2.2 Insights from primary experts

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION: EPILEPSY MONITORING DEVICES MARKET

FIGURE 6 MARKET SIZE ESTIMATION

FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 8 COMPANY REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 9 COMPANY REVENUE SHARE ANALYSIS ILLUSTRATION: EEG MARKET

FIGURE 10 TOP-DOWN APPROACH

FIGURE 11 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE EPILEPSY MONITORING DEVICES INDUSTRY (2021–2026)

FIGURE 12 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 13 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE ESTIMATION

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.7.2 SCOPE-RELATED LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: EPILEPSY MONITORING DEVICES MARKET

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 14 EPILEPSY MONITORING DEVICES MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 15 MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 16 GEOGRAPHICAL SNAPSHOT OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 EPILEPSY MONITORING DEVICES MARKET OVERVIEW

FIGURE 17 INCREASING INCIDENCE AND PREVALENCE OF EPILEPSY AND GROWING PREFERENCE FOR AMBULATORY HEALTHCARE AND HEALTH WEARABLES TO DRIVE MARKET GROWTH

4.2 EPILEPSY MONITORING DEVICES : GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 CHINA TO WITNESS THE HIGHEST GROWTH IN THE MARKET DURING THE FORECAST PERIOD

4.3 NORTH AMERICA: EPILEPSY MONITORING DEVICES INDUSTRY, BY PRODUCT AND COUNTRY (2020)

FIGURE 19 CONVENTIONAL DEVICES SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2020

4.4 REGIONAL MIX: EPILEPSY MONITORING DEVICES INDUSTRY (2021–2026)

FIGURE 20 APAC TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD (2021–2026)

4.5 EPILEPSY MONITORING DEVICES INDUSTRY : DEVELOPED VS. DEVELOPING MARKETS

FIGURE 21 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 EPILEPSY MONITORING DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing incidence and prevalence of epilepsy

FIGURE 23 US: RATE OF DEATH WITH EPILEPSY AS THE UNDERLYING CAUSE (2009–2019)

5.2.1.2 Rising awareness of neurodegenerative disorders, including epilepsy

5.2.1.3 Growing preference for ambulatory healthcare and increasing use of wearables

5.2.1.4 Growing demand for continuous monitoring

5.2.2 RESTRAINTS

5.2.2.1 High cost of complex epilepsy monitoring procedures and devices

5.2.2.2 Unfavorable reimbursement policies

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for non-invasive and minimally invasive devices

5.2.3.2 Expanding therapeutic applications of epilepsy monitoring devices

5.2.3.3 High epilepsy incidence and growing healthcare markets in emerging economies

FIGURE 24 NUMBER OF EPILEPSY CASES IN SELECT COUNTRIES (2016)

FIGURE 25 GLOBAL ANNUAL HEALTHCARE EXPENDITURE: DEVELOPED VS. DEVELOPING ECONOMIES (1995 VS. 2012 VS. 2022)

5.2.4 CHALLENGES

5.2.4.1 Shortage of trained professionals

5.2.4.2 Issues related to product approval and commercialization

5.3 IMPACT OF COVID-19 ON THE EPILEPSY MONITORING DEVICES MARKET

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 DEGREE OF COMPETITION IS HIGH IN THE MARKET

TABLE 3 EPILEPSY MONITORING DEVICES INDUSTRY: PORTER’S FIVE FORCES ANALYSIS

5.5 REGULATORY ANALYSIS

TABLE 4 KEY REGULATIONS & STANDARDS GOVERNING MEDICAL DEVICES

5.6 ECOSYSTEM ANALYSIS

FIGURE 27 ECOSYSTEM ANALYSIS

5.7 PATENT ANALYSIS

5.7.1 PATENT PUBLICATION TRENDS

FIGURE 28 PATENT PUBLICATION TRENDS (JANUARY 2011–SEPTEMBER 2021)

5.7.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 29 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR EPILEPSY MONITORING DEVICE PATENTS (JANUARY 2011–SEPTEMBER 2021)

FIGURE 30 TOP APPLICANT COUNTRIES/REGIONS FOR EPILEPSY MONITORING DEVICE PATENTS (JANUARY 2011–SEPTEMBER 2021)

6 EPILEPSY MONITORING DEVICES MARKET, BY PRODUCT (Page No. - 66)

6.1 INTRODUCTION

TABLE 5 MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

6.2 CONVENTIONAL DEVICES

TABLE 6 COMPANIES PROVIDING CONVENTIONAL EPILEPSY MONITORING DEVICES

TABLE 7 CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 8 CONVENTIONAL DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.1 MONITORING DEVICES

TABLE 9 MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 10 MONITORING DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.1.1 EEG devices

TABLE 11 EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 12 EEG DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.1.1.1 Standard EEG devices

6.2.1.1.1.1 Standard EEG devices accounted for the largest share of the EEG devices market

TABLE 13 COMPANIES PROVIDING STANDARD EEG DEVICES

TABLE 14 STANDARD EEG DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.1.1.2 Video EEG devices

6.2.1.1.2.1 Video EEG enables healthcare professionals to observe a patient during a seizure event and compare the visuals to the EEG results for better treatment planning

TABLE 15 COMPANIES PROVIDING VIDEO EEG DEVICES

TABLE 16 VIDEO EEG DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.1.1.3 Other/Ambulatory EEG devices

6.2.1.1.3.1 Ambulatory EEG is more cost-effective and convenient in comparison with routine EEG

TABLE 17 COMPANIES PROVIDING AMBULATORY EEG DEVICES

TABLE 18 OTHER/AMBULATORY EEG DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.1.2 EMG devices

6.2.1.2.1 High demand for EMG devices is mainly due to the increasing prevalence of neuromuscular diseases

TABLE 19 COMPANIES PROVIDING EMG DEVICES

TABLE 20 EMG DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.1.3 MEG devices

6.2.1.3.1 MEG devices are more technologically advanced than other monitoring devices as they can simultaneously measure data from several points on the surface of the head

TABLE 21 COMPANIES PROVIDING MEG DEVICES

TABLE 22 MEG DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.1.4 Other monitoring devices

TABLE 23 COMPANIES PROVIDING OTHER MONITORING DEVICES

TABLE 24 OTHER MONITORING DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.2 DEEP BRAIN STIMULATION DEVICES

6.2.2.1 Successful DBS allows people to potentially reduce their medications and improve their quality of life

TABLE 25 DEEP BRAIN STIMULATION DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3 WEARABLE DEVICES

6.3.1 HIGH PREFERENCE FOR WEARABLE DEVICES DUE TO EASE OF USE IS A KEY FACTOR DRIVING MARKET GROWTH

TABLE 26 COMPANIES PROVIDING WEARABLE EPILEPSY MONITORING DEVICES

TABLE 27 WEARABLE DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7 EPILEPSY MONITORING DEVICES MARKET, BY END USER (Page No. - 82)

7.1 INTRODUCTION

TABLE 28 MARKET, BY END USER, 2019–2026 (USD MILLION)

7.2 HOSPITALS

7.2.1 HOSPITALS CAN INVEST IN EXPENSIVE AND SOPHISTICATED TECHNOLOGIES, OWING TO WHICH THE ADOPTION OF EPILEPSY MONITORING DEVICES IS HIGHER AMONG HOSPITALS

TABLE 29 MARKET FOR HOSPITALS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 NEUROLOGY CENTERS

7.3.1 HIGH PREFERENCE FOR THE DIAGNOSIS AND TREATMENT OF BRAIN DISORDERS AT NEUROLOGY CENTERS IS A MAJOR FACTOR DRIVING MARKET GROWTH

TABLE 30 MARKET FOR NEUROLOGY CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 AMBULATORY SURGERY CENTERS & CLINICS

7.4.1 PATIENTS ARE INCREASINGLY OPTING FOR AMBULATORY SURGERY CENTERS & CLINICS AS A MORE CONVENIENT ALTERNATIVE TO HOSPITAL-BASED OUTPATIENT PROCEDURES

TABLE 31 MARKET FOR AMBULATORY SURGERY CENTERS & CLINICS, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 DIAGNOSTIC CENTERS

7.5.1 DIAGNOSTIC CENTERS OFFER DIAGNOSIS AND TREATMENT OPTIONS FOR VARIOUS NEUROLOGICAL CONDITIONS—A KEY FACTOR DRIVING MARKET GROWTH

TABLE 32 MARKET FOR DIAGNOSTIC CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

7.6 HOME CARE SETTINGS

7.6.1 GROWING NEED FOR LONG-TERM HOME CARE TO DRIVE MARKET GROWTH

TABLE 33 MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2019–2026 (USD MILLION)

8 EPILEPSY MONITORING DEVICES MARKET, BY REGION (Page No. - 89)

8.1 INTRODUCTION

TABLE 34 MARKET, BY REGION, 2019–2026 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

TABLE 35 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

8.2.1 US

8.2.1.1 The US dominates the North American epilepsy monitoring devices market

TABLE 41 US: EPILEPSY MONITORING DEVICES INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 42 US: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 43 US: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 44 US: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 45 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Growing number of hospitals and surgical centers to drive the demand for epilepsy monitoring devices in Canada

TABLE 46 CANADA: EPILEPSY MONITORING DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 47 CANADA: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 48 CANADA: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 49 CANADA: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 50 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

8.3 EUROPE

TABLE 51 EUROPE: EPILEPSY MONITORING DEVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 52 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 53 EUROPE: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 54 EUROPE: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 55 EUROPE: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 56 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 High burden of Alzheimer’s in the country will support market growth

TABLE 57 GERMANY: EPILEPSY MONITORING DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 58 GERMANY: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 GERMANY: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 GERMANY: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 61 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

8.3.2 UK

8.3.2.1 Increasing investments by public and private sectors to drive the growth of the epilepsy monitoring devices market in the UK

TABLE 62 UK: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 63 UK: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 UK: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 65 UK: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

8.3.3 FRANCE

8.3.3.1 Increasing geriatric population to drive market growth in France

TABLE 67 FRANCE: EPILEPSY MONITORING DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 68 FRANCE: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 69 FRANCE: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 FRANCE: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

8.3.4 REST OF EUROPE

TABLE 72 ROE: EPILEPSY MONITORING DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 73 ROE: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 ROE: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 ROE: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 ROE: MARKET, BY END USER, 2019–2026 (USD MILLION)

8.4 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: EPILEPSY MONITORING DEVICES MARKET SNAPSHOT

TABLE 77 APAC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 78 APAC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 79 APAC: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 APAC: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 APAC: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 82 APAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

8.4.1 JAPAN

8.4.1.1 Incidence of epilepsy in Japan is expected to increase due to the large geriatric population

TABLE 83 JAPAN: EPILEPSY MONITORING DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 84 JAPAN: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 85 JAPAN: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 JAPAN: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

8.4.2 CHINA

8.4.2.1 China to register the highest growth in the epilepsy monitoring devices market during the forecast period

TABLE 88 CHINA: EPILEPSY MONITORING DEVICES INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 89 CHINA: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 90 CHINA: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 CHINA: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

8.4.3 INDIA

8.4.3.1 Improving healthcare infrastructure in the country will support the growth of the epilepsy monitoring devices market

TABLE 93 INDIA: EPILEPSY MONITORING DEVICES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 94 INDIA: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 INDIA: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 96 INDIA: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 INDIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

8.4.4 REST OF ASIA PACIFIC

TABLE 98 ROAPAC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 99 ROAPAC: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 ROAPAC: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 ROAPAC: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 102 ROAPAC: EPILEPSY MONITORING DEVICES MARKET, BY END USER, 2019–2026 (USD MILLION)

8.5 REST OF THE WORLD

TABLE 103 ROW: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 104 ROW: CONVENTIONAL DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 105 ROW: MONITORING DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 106 ROW: EEG DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 ROW: MARKET, BY END USER, 2019–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 122)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

9.2.1 OVERVIEW OF THE STRATEGIES ADOPTED BY PLAYERS IN THE EPILEPSY MONITORING DEVICES INDUSTRY

9.3 COMPETITIVE BENCHMARKING

TABLE 108 FOOTPRINT OF COMPANIES IN THE EPILEPSY MONITORING DEVICES MARKET

TABLE 109 COMPANY END-USER FOOTPRINT (25 COMPANIES)

TABLE 110 COMPANY REGIONAL FOOTPRINT (26 COMPANIES)

9.4 COMPETITIVE LEADERSHIP MAPPING

9.4.1 STARS

9.4.2 EMERGING LEADERS

9.4.3 PERVASIVE PLAYERS

9.4.4 PARTICIPANTS

FIGURE 33 MARKET: COMPETITIVE LEADERSHIP MAPPING (2020)

9.5 COMPETITIVE LEADERSHIP MAPPING FOR OTHER COMPANIES

9.5.1 PROGRESSIVE COMPANIES

9.5.2 DYNAMIC COMPANIES

9.5.3 STARTING BLOCKS

9.5.4 RESPONSIVE COMPANIES

FIGURE 34 EPILEPSY MONITORING DEVICES MARKET: COMPETITIVE LEADERSHIP MAPPING FOR OTHER COMPANIES (2020)

9.6 MARKET SHARE ANALYSIS

FIGURE 35 EPILEPSY MONITORING DEVICES MARKET SHARE, BY KEY PLAYER, 2020

TABLE 111 EPILEPSY MONITORING DEVICES MARKET: DEGREE OF COMPETITION

9.7 COMPETITIVE SCENARIO

TABLE 112 PRODUCT LAUNCHES & APPROVALS, 2018–2021

10 COMPANY PROFILES (Page No. - 136)

10.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

10.1.1 NATUS MEDICAL, INC.

TABLE 114 NATUS MEDICAL, INC.: BUSINESS OVERVIEW

FIGURE 36 NATUS MEDICAL, INC.: COMPANY SNAPSHOT (2020)

10.1.2 COMPUMEDICS LIMITED

TABLE 115 COMPUMEDICS LIMITED: BUSINESS OVERVIEW

FIGURE 37 COMPUMEDICS LIMITED: COMPANY SNAPSHOT (2020)

10.1.3 NIHON KOHDEN CORPORATION

TABLE 116 NIHON KOHDEN CORPORATION: BUSINESS OVERVIEW

FIGURE 38 NIHON KOHDEN CORPORATION: COMPANY SNAPSHOT (2020)

10.1.4 THE MAGSTIM CO. LTD.

TABLE 117 THE MAGSTIM CO. LTD.: BUSINESS OVERVIEW

10.1.5 MEDTRONIC PLC

TABLE 118 MEDTRONIC PLC: BUSINESS OVERVIEW

FIGURE 39 MEDTRONIC PLC: COMPANY SNAPSHOT (2020)

10.1.6 EMPATICA, INC.

TABLE 119 EMPATICA, INC.: BUSINESS OVERVIEW

10.1.7 MASIMO CORPORATION

TABLE 120 MASIMO CORPORATION: BUSINESS OVERVIEW

FIGURE 40 MASIMO CORPORATION: COMPANY SNAPSHOT (2020)

10.1.8 BOSTON SCIENTIFIC CORPORATION

TABLE 121 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

FIGURE 41 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2020)

10.1.9 ABBOTT LABORATORIES, INC.

TABLE 122 ABBOTT LABORATORIES, INC.: BUSINESS OVERVIEW

FIGURE 42 ABBOTT LABORATORIES, INC.: COMPANY SNAPSHOT (2020)

10.1.10 ALEVA NEUROTHERAPEUTICS S.A.

TABLE 123 ALEVA NEUROTHERAPEUTICS S.A.: BUSINESS OVERVIEW

10.1.11 DRÄGERWERK AG & CO. KGAA

TABLE 124 DRÄGERWERK AG & CO. KGAA: BUSINESS OVERVIEW

FIGURE 43 DRÄGERWERK AG & CO. KGAA: COMPANY SNAPSHOT (2020)

10.1.12 MEDPAGE LTD.

TABLE 125 MEDPAGE LTD.: BUSINESS OVERVIEW

10.1.13 LIVASSURED B.V.

TABLE 126 LIVASSURED B.V.: BUSINESS OVERVIEW

10.1.14 MJN NEUROSERVEIS, S.L.

TABLE 127 MJN NEUROSERVEIS, S.L.: BUSINESS OVERVIEW

10.1.15 BIOSERENITY

TABLE 128 BIOSERENITY: BUSINESS OVERVIEW

10.1.16 NEUROSOFT

TABLE 129 NEUROSOFT: BUSINESS OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

10.2 OTHER PLAYERS

10.2.1 ADVANCED BRAIN MONITORING, INC.

TABLE 130 ADVANCED BRAIN MONITORING, INC.: BUSINESS OVERVIEW

10.2.2 LIFELINES NEURO COMPANY, LLC

10.2.3 MITSAR CO., LTD.

10.2.4 RIMED

10.2.5 EMOTIV

10.2.6 CGX (A COGNIONICS COMPANY)

10.2.7 MINDRAY MEDICAL INTERNATIONAL LIMITED

10.2.8 CADWELL INDUSTRIES, INC.

10.2.9 NEUROWAVE SYSTEMS, INC.

10.2.10 MC10, INC.

11 APPENDIX (Page No. - 179)

11.1 INSIGHTS FROM INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

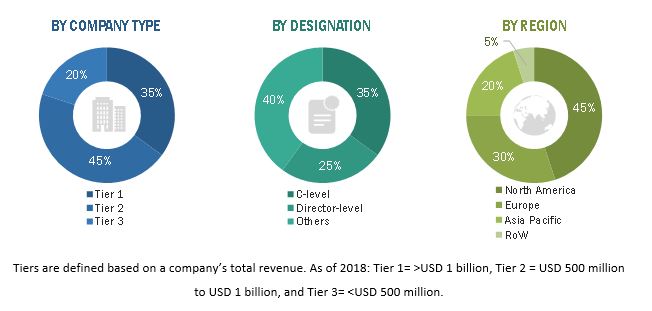

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the epilepsy monitoring devices market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the Epilepsy monitoring devices market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Epilepsy Monitoring Devices Market Size Estimation

The total size of the epilepsy monitoring devices market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach to calculate the revenue of different players in the epilepsy monitoring devices market

The size of the global epilepsy monitoring devices market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global epilepsy monitoring devices market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the epilepsy monitoring devices market based on product, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall epilepsy monitoring devices market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players in the market and comprehensively analyze their market shares and core competencies

- To forecast the size of the market segments with respect to four main regions, namely, North America, the Asia Pacific, Europe, and the Rest of the World (RoW)

- To track and analyze competitive developments such as new product launches, agreements, collaborations, and expansions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific epilepsy monitoring devices market into South Korea, Australia, New Zealand, and other countries

- Further breakdown of the Rest of Europe epilepsy monitoring devices market into Italy, Spain, Belgium, Russia, the Netherlands, Switzerland, and other countries

- Further breakdown of the Rest of the World epilepsy monitoring devices market into the Middle East & Africa and Latin America

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Epilepsy Monitoring Devices Market

What are the recent developments impacting the growth of Epilepsy Monitoring Devices Market?

How technologically advanced devices shaping the future of Epilepsy Monitoring Devices Market?

What is the adoption pattern for Epilepsy Monitoring Devices across major healthcare markets?