Healthcare Virtual Assistants Market by Product (Chatbots, Smart Speakers), User Interface (Automatic Speech Recognition, Text Based, Text-to-Speech Based), End User (Healthcare Providers, Patients, Healthcare Payers) - Global Forecast to 2024

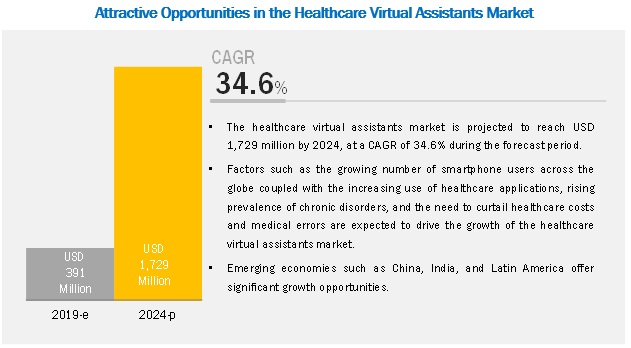

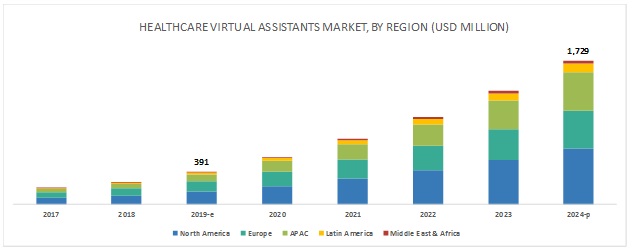

[159 Pages Report] The healthcare virtual assistants market is projected to reach USD 1,729 million by 2024 from USD 391 million in 2019, at a CAGR of 34.6%. Factors such as the growing number of smartphone users and the increasing use of healthcare applications, the growing demand for quality healthcare delivery, and the rising prevalence of chronic disorders are driving the growth of the healthcare virtual assistants market. The increasing focus on developing conversational virtual assistant tools and multi-language support in healthcare virtual assistant tools are also expected to provide growth opportunities for players in the market.

The automatic speech recognition segment is expected to grow at the highest CAGR during the forecast period

Based on user interface, the automatic speech recognition segment is expected to grow at the highest CAGR during the forecast period. The automatic speech recognition segment is expected to witness the highest CAGR due to its increasing use in smart speakers.

Smart speakers segment to witness the highest growth during the forecast period

On the basis of product, the smart speakers segment is expected to witness the highest growth during the forecast period. The growth in this segment can be attributed to the increasing consumer preference for technologically advanced products. Smart speakers are multifunctional, fast, varied, and reliable solutions. This not only saves time but also offers increased comfort and greater convenience.

The market in the APAC is expected to witness the highest CAGR during the forecast period

The healthcare virtual assistants market in the APAC is projected to grow at the highest CAGR during the forecast period. Growth in the Asia Pacific market is primarily driven by the rising aging population, high penetration of smartphones, technological advancements, the growing use of remote monitoring devices, and increasing healthcare costs.

Key Market Players

Prominent players in the healthcare virtual assistants market are Nuance Communications Inc. (US), Microsoft (US), Amazon (US), Infermedica (Poland), Sensly (US), eGain Corporation (US), Kognito Solutions LLC (US), Verint Systems Inc. (US), HealthTap Inc. (US), and Babylon Healthcare Services Ltd (UK).

Nuance is one of the leading players in the healthcare virtual assistants industry. The company offers solutions and services to more than 500,000 clinics and 10,000 healthcare facilities worldwide to improve patient care and support clinical workflow. The company operates in more than 70 countries across the Americas, Europe, and Asia with a remarkable presence in the US, Australia, Belgium, Brazil, Canada, Germany, Hungary, Israel, Japan, and the UK.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, user interface, end user, and region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and the Middle East & Africa |

|

Companies covered |

Nuance Communications Inc. (US), Microsoft (US), Amazon (US), Infermedica (Poland), Sensly (US), eGain Corporation (US), Kognito Solutions LLC (US), Verint Systems Inc. (US), HealthTap Inc. (US), and Babylon Healthcare Services Ltd (UK). |

The research report categorizes the market into the following segments and subsegments:

Healthcare Virtual Assistants Market, by Product

- Smart Speakers

- Chatbots

Healthcare Virtual Assistants Market, by User Interface

- Automatic Speech Recognition

- Text-based

- Text-to-speech

- Others

Healthcare Virtual Assistants Market, by End User

- Healthcare Providers

- Patients

- Healthcare Payers

- Other End Users

Healthcare Virtual Assistants Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments

- In 2018, Nuance launched Dragon Medical One, a universal cloud-based speech recognition platform in Canada to enable physicians to quickly and conveniently capture a patient’s complete story at the point of care.

- In 2018, Verint Systems and UCB, a biopharmaceutical company, introduced April, UCB’s PD Coach app that is equipped with a patented & conversational virtual health assistant.

- In 2018, eGain integrated eGain Solve with Amazon Connect, which enables connected and convenient customer experience across all touch points.

- In 2017, HealthTap opened an Asia Pacific hub office in Hamilton, New Zealand to connect New Zealanders with hospital clinicians and healthcare professionals from smartphones, tablets, and personal computers at home or on-the-go.

Critical Questions the Report Answers

- Where will all these developments take the industry in the mid to long term?

- What are the major end users of healthcare virtual assistants?

- What are the user interface areas of healthcare virtual assistants?

- Which are the major healthcare virtual assistant products?

- What is the global scenario of healthcare virtual assistants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Limitations

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Approach

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 27)

4 Market Overview (Page No. - 31)

4.1 Introduction

4.2 Market Dynamics

4.2.1 Market Drivers

4.2.1.1 Growing Smartphone Users and Increasing Use of Healthcare Applications

4.2.1.2 Need to Curtail Growing Healthcare Costs and Medical Errors

4.2.1.3 Growing Demand for Quality Healthcare Delivery

4.2.1.4 Rising Prevalence of Chronic Disorders

4.2.2 Market Restraints

4.2.2.1 Lack of Structured Data in the Healthcare Industry

4.2.2.2 Concerns Regarding Data Privacy

4.2.3 Market Opportunities

4.2.3.1 Increasing Focus on Developing Conversational Virtual Assistant Tools

4.2.3.2 Multi-Language Support in Healthcare Virtual Assistant Tools

4.2.4 Market Challenges

4.2.4.1 Issues Related to Connectivity Range and Compatibility

4.2.4.2 Dearth of Skilled Personnel and Uncertain Regulatory Framework for Medical Software

5 Industry Insights (Page No. - 36)

5.1 Introduction

5.2 Start-Up Scenario

5.3 Use Cases

5.3.1 Nuance Communications

5.3.2 True Image Interactive

5.3.3 Cincinnati Children’s Hospital Medical Center

5.3.4 Boston Children’s Hospital

5.3.5 Public Health England

6 Healthcare Virtual Assistants Market, By Product (Page No. - 39)

6.1 Introduction

6.2 Smart Speakers

6.2.1 Smart Speakers to Witness the Highest Growth in the Healthcare Virtual Assistants Market During the Forecast Period

6.3 Chatbots

6.3.1 Healthcare Chatbots Act as A Connecting Link Between Patients and Clinicians, Helping Them to Communicate and Share Information for Diagnosis and Treatment Purposes

7 Healthcare Virtual Assistants Market, By User Interface (Page No. - 46)

7.1 Introduction

7.2 Automatic Speech Recognition

7.2.1 Speech Recognition Software Can Enhance Workflow, Reduce Record Errors, and Improve Communication

7.3 Text-Based

7.3.1 Text-Based Messaging Services are Cost-Effective, Quick, Independent, and Popular Among End Users

7.4 Text-To-Speech

7.4.1 Text-To-Speech User Interfaces are Commonly Used to Receive Instructions While Performing A Task

7.5 Others

8 Healthcare Virtual Assistants Market, By End User (Page No. - 54)

8.1 Introduction

8.2 Healthcare Providers

8.2.1 Virtual Assistant Tools are Used to Predict and Prevent Readmissions and Improve Operations Among Healthcare Providers

8.3 Healthcare Payers

8.3.1 Virtual Assistant Tools are A Secure Way for Payers to Automate Many Necessary Yet Time-Consuming Processes

8.4 Patients

8.4.1 Smartphone Applications to Drive the Adoption of Virtual Assistant Tools Among Patients

8.5 Other End Users

9 Healthcare Virtual Assistants Market, By Region (Page No. - 63)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 The US is the Largest Market for Healthcare Virtual Assistants Globally

9.2.2 Canada

9.2.2.1 Drive to Promote Remote Patient Monitoring and Homecare Have Supported the Adoption of HCIT Technologies

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany Holds the Largest Share in the European Market for Healthcare Virtual Assistants

9.3.2 UK

9.3.2.1 Mobile Apps and Wearable Devices Have Been Widely Adopted in the UK

9.3.3 France

9.3.3.1 France’s Healthcare System is Largely Government-Financed

9.3.4 Italy

9.3.4.1 An Aging Population and Rising Healthcare Costs Have Driven the Adoption of Virtual Assistants in Italy

9.3.5 Spain

9.3.5.1 Approximately 90% of Spain’s Population Can Access the Internet

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.1.1 Utilization of Advanced HCIT Solutions has Risen to Improve Care Quality in Japan

9.4.2 China

9.4.2.1 Rising Geriatric Population and A Spike in Internet and Smartphone Use Indicate High Growth Opportunities

9.4.3 India

9.4.3.1 The Indian Market is Among the Fastest Growing in APAC

9.4.4 Rest of Asia Pacific

9.5 Latin America

9.5.1 The Growing Number of Smartphone Users and Increasing Reliance on Telemedicine has Helped Support Market Growth

9.6 Middle East & Africa

9.6.1 A Number of Middle Eastern Countries are Investing in the Modernization of Their Healthcare Systems

10 Competitive Landscape (Page No. - 108)

10.1 Overview

10.2 Healthcare Virtual Assistants Market, Competitive Leadership Mapping, 2018

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Dynamic Differentiators

10.2.4 Emerging Companies

10.3 Market Ranking Analysis

10.4 Competitive Situation and Trends

10.4.1 New Product Launches

10.4.2 Agreements, Partnerships, and Collaborations

10.4.3 Expansions

10.4.4 Acquisitions

10.4.5 Other Developments

11 Company Profiles (Page No. - 119)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Nuance Communications, Inc.

11.2 Amazon

11.3 Verint Systems Inc.

11.4 Infermedica

11.5 Sensely, Inc.

11.6 Microsoft Corporation

11.7 CSS Corporation

11.8 Egain Corporation

11.9 Kognito Solutions, LLC

11.10 Healthtap, Inc.

11.11 Babylon Healthcare Services Limited

11.12 ADA Digital Health

11.13 Other Company Profiles

11.13.1 Medrespond LLC.

11.13.2 Floatbot.AI

11.13.3 Kore.AI, Inc.

11.13.4 Datalog.AI

11.13.5 True Image Interactive, Inc.

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 152)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (85 Tables)

Table 1 Market Dynamics: Impact Analysis

Table 2 Start-Up Companies and Investor Scenario

Table 3 Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 4 Key Products Available in the Market

Table 5 Healthcare Virtual Assistant Smart Speakers Market, By Country, 2017–2024 (USD Million)

Table 6 Key Products Available in the Market

Table 7 Healthcare Virtual Assistant Chatbots Market, By Country, 2017–2024 (USD Million)

Table 8 Healthcare Virtual Assistants Market, By User Interface, 2017-2024 (USD Million)

Table 9 Healthcare Virtual Assistants Market for Automatic Speech Recognition, By Country, 2017-2024 (USD Million)

Table 10 Healthcare Virtual Assistants Market for Text-Based User Interfaces, By Country, 2017-2024 (USD Million)

Table 11 Healthcare Virtual Assistants Market for Text-To-Speech User Interfaces, By Country, 2017-2024 (USD Million)

Table 12 Healthcare Virtual Assistants Market for Other User Interface, By Country, 2017-2024 (USD Million)

Table 13 Healthcare Virtual Assistants Market, By End User, 2017-2024 (USD Million)

Table 14 Healthcare Virtual Assistants Market for Healthcare Providers, By Country, 2017-2024 (USD Million)

Table 15 Healthcare Virtual Assistants Market for Healthcare Payers, By Country, 2017-2024 (USD Million)

Table 16 Healthcare Virtual Assistants Market for Patients, By Country, 2017-2024 (USD Million)

Table 17 Healthcare Virtual Assistants Market for Other End Users, By Country, 2017-2024 (USD Million)

Table 18 Healthcare Virtual Assistants Market, By Region, 2017–2024 (USD Million)

Table 19 North America: Healthcare Virtual Assistants Market, By Country, 2017–2024 (USD Million)

Table 20 North America: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 21 North America: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 22 North America: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 23 US: Macroeconomic Indicators

Table 24 US: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 25 US: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 26 US: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 27 Canada: Macroeconomic Indicators

Table 28 Canada: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 29 Canada: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 30 Canada: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 31 Europe: Healthcare Virtual Assistants Market, By Country, 2017–2024 (USD Million)

Table 32 Europe: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 33 Europe: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 34 Europe: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 35 Germany: Macroeconomic Indicators

Table 36 Germany: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 37 Germany: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 38 Germany: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 39 UK: Macroeconomic Indicators

Table 40 UK: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 41 UK: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 42 UK: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 43 France: Macroeconomic Indicators

Table 44 France: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 45 France: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 46 France: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 47 Italy: Macroeconomic Indicators

Table 48 Italy: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 49 Italy: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 50 Italy: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 51 Spain: Macroeconomic Indicators

Table 52 Spain: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 53 Spain: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 54 Spain: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 55 RoE: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 56 RoE: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 57 RoE: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 58 APAC: Healthcare Virtual Assistants Market, By Country, 2017–2024 (USD Million)

Table 59 APAC: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 60 APAC: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 61 APAC: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 62 Japan: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 63 Japan: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 64 Japan: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 65 China: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 66 China: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 67 China: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 68 India: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 69 India: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 70 India: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 71 RoAPAC: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 72 RoAPAC: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 73 RoAPAC: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 74 Latin America: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 75 Latin America: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 76 Latin America: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 77 Middle East & Africa: Healthcare Virtual Assistants Market, By Product, 2017–2024 (USD Million)

Table 78 Middle East & Africa: Healthcare Virtual Assistants Market, By User Interface, 2017–2024 (USD Million)

Table 79 Middle East & Africa: Healthcare Virtual Assistants Market, By End User, 2017–2024 (USD Million)

Table 80 Growth Strategy Matrix, 2016–2019

Table 81 New Product Launches, 2018

Table 82 Agreements, Partnerships, and Joint Ventures, 2018

Table 83 Expansions, 2017-2018

Table 84 Acquisitions, 2016-2018

Table 85 Other Developments, 2017-2018

List of Figures (27 Figures)

Figure 1 Healthcare Virtual Assistants Market Segmentation

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Healthcare Virtual Assistants Market, By Product, 2019 vs 2024 (USD Million)

Figure 8 Healthcare Virtual Assistants Market, By User Interface, 2019 vs 2024 (USD Million)

Figure 9 Healthcare Virtual Assistants Market, By End User, 2019 vs 2024 (USD Million)

Figure 10 Geographical Snapshot of the Healthcare Virtual Assistants Market

Figure 11 Smart Speakers Segment Will Continue to Dominate the Healthcare Virtual Assistants Market During the Forecast Period

Figure 12 Automatic Speech Recognition Continue to Dominate the Healthcare Virtual Assistants Market During the Forecast Period

Figure 13 Healthcare Providers Continue to Dominate the Healthcare Virtual Assistants Market During the Forecast Period

Figure 14 Number of Hospitals, By Country/Region (2015)

Figure 15 Healthcare Virtual Assistants Market: Geographic Snapshot

Figure 16 North America: Healthcare Virtual Assistants Market Snapshot

Figure 17 Europe: Healthcare Virtual Assistants Market Snapshot

Figure 18 APAC: Healthcare Virtual Assistants Market Snapshot

Figure 19 New Product Launches—Key Growth Strategies Adopted By Market Players Between 2016 & 2019

Figure 20 Competitive Leadership Mapping

Figure 21 Ranking of the Key Players in the Healthcare Virtual Assistants Market, 2018

Figure 22 Battle for Market Share: Acquisitions Was the Key Strategy Adopted By Prominent Players

Figure 23 Nuance Communication: Company Snapshot

Figure 24 Amazon: Company Snapshot

Figure 25 Verint Systems Inc.: Company Snapshot

Figure 26 Microsoft: Company Snapshot

Figure 27 Egain Corporation: Company Snapshot

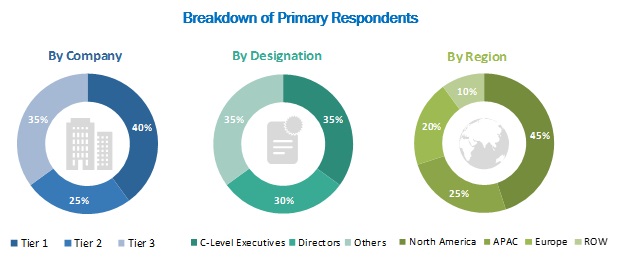

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the healthcare virtual assistants market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, industry experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Industry experts from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, technology and innovation directors of companies manufacturing healthcare virtual assistant products, key opinion leaders, and suppliers and distributors; whereas, industry experts from the demand side include researchers, biotechnologists, R&D heads, and related key personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by product, user interface, end user, and region).

Data Triangulation

After arriving at the market size, the total healthcare virtual assistants market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the healthcare virtual assistants market by product, user interface, end user, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the healthcare virtual assistants market in five main regions (along with major countries)—North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To profile the key players in the healthcare virtual assistants market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as mergers and acquisitions; new product/technology launches; expansions; collaborations and agreements; and R&D activities of the leading players in the healthcare virtual assistants market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the Latin American healthcare virtual assistants market into Brazil, Mexico, and Rest of Latin America

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Virtual Assistants Market