US Healthcare Technology Management Market by Service (Maintenance & Repair, Integrated software platform, Quality & regulatory compliance, Labour management, Supply chain, Cyber security), Facility Type (Acute, Post Acute, Non Acute) - Global US Forecast to 2028

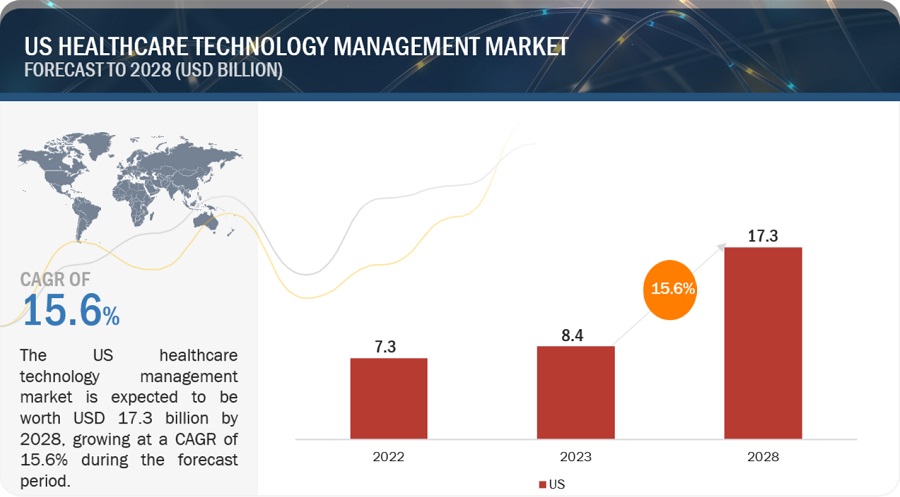

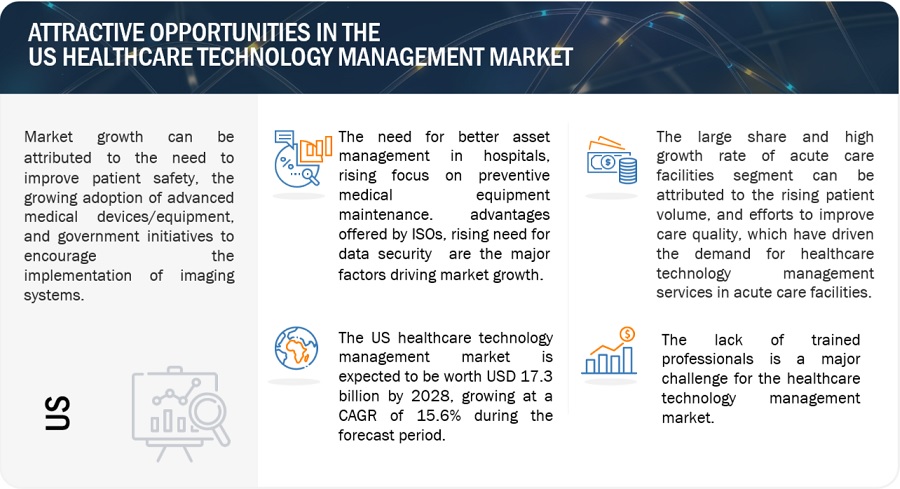

The global US healthcare technology management market, valued at US$7.3 billion in 2022, stood at US$8.4 billion in 2023 and is projected to advance at a resilient CAGR of 15.6% from 2023 to 2028, culminating in a forecasted valuation of US$17.3 billion by the end of the period. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. An increasing focus on preventative maintenance of medical equipment and the need for better asset management in hospitals are two factors driving market expansion. The advantages that ISOs provide and the growing demand for data security both promote this market's expansion. But over the projected period, a shortage of qualified technicians and clinical/biomedical engineers is anticipated to limit market growth.

US Healthcare technology management Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

US Healthcare Technology Management Market Dynamics

Driver: Rising focus on preventive medical equipment maintenance

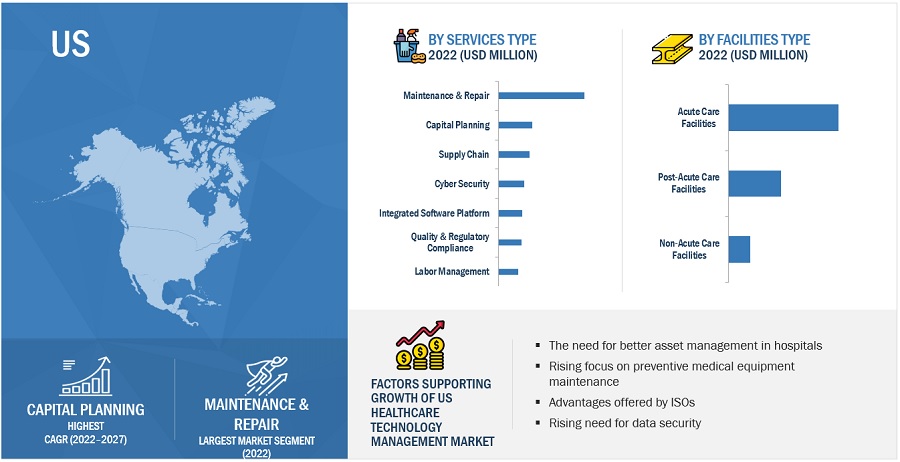

Healthcare providers are increasingly adopting preventive maintenance services to ensure the reliability of their medical equipment. This is important because medical equipment downtime can lead to patient safety incidents, lost revenue, and increased costs. Preventive maintenance services can help to identify and correct potential problems before they cause equipment downtime. This can help to improve patient safety, reduce costs, and increase the uptime of medical equipment.

The adoption of new medical technologies is also driving the growth of the US healthcare technology management services market. New medical technologies are often more complex and require more specialized maintenance. Healthcare providers need to partner with healthcare technology management service providers to ensure that they have the expertise to maintain these new technologies.

Restraint: Dearth Of Skilled Technicians and Clinical/Biomedical Engineers

The dearth of skilled technicians and clinical/biomedical engineers is a restraining factor for the US healthcare technology management market because these professionals are essential for the proper maintenance and operation of healthcare technology. Without them, healthcare facilities may experience equipment downtime, which can lead to patient safety risks and financial losses.

Here are some of the specific ways in which the dearth of skilled technicians and clinical/biomedical engineers can restrain the US healthcare technology management market:

- Increased equipment downtime:

- Reduced efficiency:

- Increased risk of errors:

The lack of trained professionals is a major challenge for the healthcare technology management market. This shortage of specialists is expected to create a supply-side crisis that would threaten patient access to quality care.

Opportunity: Increasing consolidation in the US healthcare industry

The growing trend of consolidation within the US healthcare industry presents a significant opportunity for the US healthcare technology management (HTM) market. As healthcare organizations merge and integrate, they seek streamlined operations and standardized technology solutions across their expanded networks. This demand for efficiency and uniformity creates a fertile ground for HTM companies to offer their expertise in optimizing, maintaining, and managing complex healthcare technology infrastructures. By providing comprehensive services that ensure seamless integration of technology systems, regulatory compliance, and data-driven insights, HTM firms can play a pivotal role in enabling consolidated healthcare systems to harness the benefits of scale while delivering high-quality patient care through advanced and well-maintained technological resources.

Challenge: Preference for multi-vendor contracts

Healthcare institutions that own advanced medical equipment modalities from different manufacturers prefer multi-vendor service contracts despite the availability of multi-vendor services from ISOs. Healthcare providers tend to opt for multi-vendor services offered by OEMs due to the following reasons:

- Availability of support services, including on-call support and 24x7 technical assistance

- Well-integrated global presence, connecting different types of maintenance services (such as remote monitoring, parts repair, and exchange) and onsite field maintenance technical support

- Strong technical knowledge regarding advanced maintenance services, such as remote monitoring services for high-end diagnostic imaging modalities (CT, MRI, gamma cameras, PET-CT, and angiography systems)

- A strong in-house team of biomedical engineers trained to service all major equipment brands

- Availability of inventory for the stock of pre-tested OEM spare parts

Multi-vendor service providers also provide healthcare providers with rental equipment to minimize financial losses associated with equipment downtime. Therefore, it becomes difficult for ISOs to gain a competitive edge.

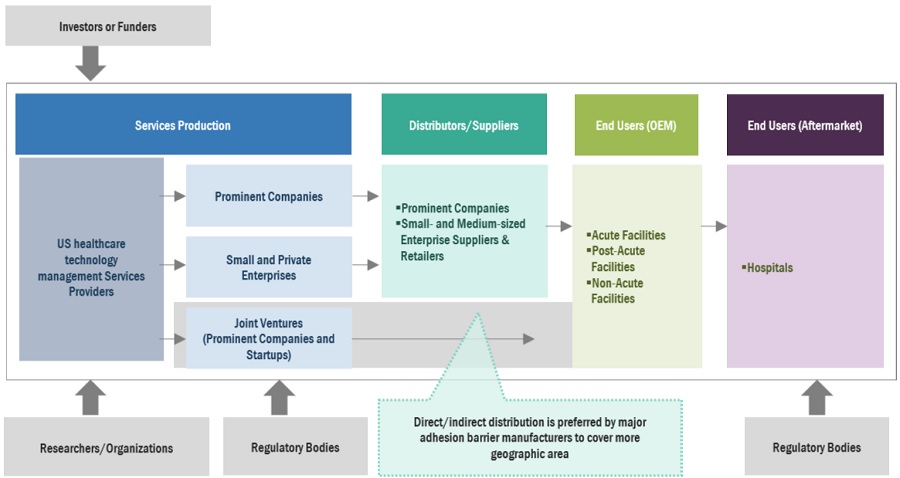

US Healthcare Technology Management Ecosystem

The maintenance & repair segment accounted for the largest share of the US healthcare technology management industry.

Based on the type of service, the US healthcare technology management market is segmented into cyber security, maintenance & repair, quality & regulatory compliance, integrated software platform, labor management, capital planning, and supply chain (procurement). The maintenance & repair segment accounted for the largest share of 35.9% of the market in 2022. factors impacting the growth of this market include a drive for better patient safety, the increasing use of innovative medical supplies and technologies across a range of healthcare facilities, and government initiatives that support the use of imaging systems.

Acute care facilities accounted for the largest share of the US healthcare technology management industry in 2022.

Based on facility types, the US healthcare technology management market is segmented into post-acute care, acute care, and non-acute care facilities. In 2022, acute care facilities accounted for the largest share of the market and are expected to grow at the highest CAGR during the forecast period. The significant market share and rapid growth of the acute care facilities segment can be largely attributed to elements like the general rise in patient volumes, the demand for better clinical asset management, and the need to raise patient care standards, all of which are driving up demand for healthcare technology management services.

Strategic Choices by Healthcare Organizations will drive the US healthcare technology management industry.

The US healthcare provider sector is constantly challenged by industry-wide improvements. Health organizations need to be strategic in their preference, implementation, and utilization of medical assets if their organisations are to maximise the clinical, financial, and operational return on investments. This has lead to various healthcare organizations to get associated with healthcare technology management firms for the overall asset management (quality & regulatory compliance, labor management, cybersecurity, supply chain, repair, and maintenance) of hospital facilities to improve organizational performance.

To know about the assumptions considered for the study, download the pdf brochure

Some major players in the US healthcare technology management market are GE Healthcare (US), TRIMEDX (US), Siemens Healthineers (Germany), Koninklijke Philips N.V. (Netherlands), Sodexo (France), Crothall Healthcare (US), Agility Inc (US), RENOVO Solutions (US), ABM Industries Incorporated (US), JANNX Medical System (US) and the InterMed Group (US).

Scope of the US Healthcare Technology Management Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$8.4 billion |

|

Projected Revenue by 2028 |

$17.3 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 15.6% |

|

Market Driver |

Rising focus on preventive medical equipment maintenance |

|

Market Opportunity |

Increasing consolidation in the US healthcare industry |

The study categorizes the US healthcare technology management market to forecast revenue and analyze trends in each of the following submarkets:

By Type Of Service

- Maintenance & Repair

- Capital Planning

- Integrated Software Platform

- Labor Management

- Supply Chain (Procurement)

- Cyber Security

- Quality & Regulatory Compliance

By Facility Type

- Acute care facility

- Acute Hospitals

- Childrens Hospitals

- Academic Medical Center

- Military Treatment Facility

- Ambulatory Surgery Center

- Post Acute Care Facility

- Long-term acute facility

- Skilled Nursing Facility

- Other

- Non-Acute Care Facility

- Physicians Offices & Clinics

- Other Non-Acute Facilities

Recent Developments of US Healthcare Technology Management Industry

- In 2023, RENOVO Solutions (US) partnered with Censinet (US). The partnership will work toward reducing the cybersecurity risk of medical devices and healthcare Internet-of-Things (IoT). Renovo will offer Censinet RiskOps, the cloud-based risk exchange that enables total automation of third-party risk management through RENOVOSecure.

- In 2022, Orale (US) launched Oracle Fusion Cloud Enterprise Performance Management (EPM) solution that allows healthcare organizations to quickly model scenarios, optimize resources, determine future demand, and make better financial, workforce, and patient care decisions.

- In 2022, Siemens Healthineers (Germany) launched Technology Optimization. Technology Optimization Partnerships are a strategic approach to multivendor service that leverages connected solutions to help hospitals and health systems make data-driven decisions, enhance financial performance, and improve equipment utilization across the enterprise.

- In 2021, Sodexo (France) launched a unique global brand, “Sodexo Live,” to unify and leverage all of the Group’s expertise across the world in sectors of sports events and hospitality.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the US healthcare technology management market between 2023 and 2028?

The US healthcare technology management market is expected to grow from USD 8.4 billion in 2023 to USD 17.3 billion by 2028, at a CAGR of 15.6%, driven by factors such as the rising focus on preventative maintenance of medical equipment and the demand for efficient asset management in healthcare facilities.

What are the key factors driving the US healthcare technology management market?

The major factors driving the market include the increased adoption of preventative maintenance services, the growing complexity of new medical technologies, and the need for better data security and asset management in healthcare facilities.

What are the challenges facing the US healthcare technology management market?

The market faces challenges such as a shortage of skilled technicians and clinical/biomedical engineers, which impacts the ability of healthcare facilities to efficiently maintain and repair medical equipment.

What opportunities are available in the US healthcare technology management market?

Opportunities in the market include the increasing consolidation of healthcare organizations, which is creating demand for streamlined and standardized technology management solutions across larger networks.

What are the key services provided by healthcare technology management companies?

Key services include maintenance and repair, capital planning, cybersecurity, quality and regulatory compliance, labor management, and supply chain (procurement) services.

Which facility type holds the largest share in the US healthcare technology management market?

Acute care facilities accounted for the largest share of the market in 2022, driven by the increasing use of advanced medical technologies and the growing need for efficient clinical asset management.

How does the shortage of skilled technicians affect the US healthcare technology management market?

The shortage of skilled technicians and biomedical engineers results in increased equipment downtime, reduced efficiency, and higher risks of errors, which can lead to financial losses and compromise patient safety.

What impact does the growing focus on preventive maintenance have on the market?

The increasing adoption of preventive maintenance services is driving market growth by helping healthcare providers reduce equipment downtime, enhance patient safety, and cut operational costs.

Which companies are key players in the US healthcare technology management market?

Key players in the market include GE Healthcare, TRIMEDX, Siemens Healthineers, Koninklijke Philips N.V., Sodexo, and Crothall Healthcare, among others.

What role does consolidation play in the US healthcare technology management market?

The consolidation of healthcare organizations is driving demand for standardized technology management solutions, as integrated healthcare systems require efficient management and optimization of complex technology infrastructures to enhance operational efficiency and patient care.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing need for clinical asset management in hospitals- Advantages offered by ISOs- Growing focus on preventive medical equipment maintenance- Rising need to curb cybersecurity risksRESTRAINTS- Shortage of skilled techniciansOPPORTUNITIES- Expansion of healthcare facilitiesCHALLENGES- Preference for multi-vendor contracts

-

5.3 INDUSTRY TRENDSCLOUD-BASED IT SOLUTIONS

-

5.4 REGULATORY ANALYSISISO STANDARDS- ISO 9001:2015- ISO 13485:2016US

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM MAPPING

-

5.8 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 PATENT ANALYSISPATENT PUBLICATION TRENDSTOP PATENT APPLICANTS

-

5.10 TECHNOLOGY ANALYSISMACHINE LEARNINGARTIFICIAL INTELLIGENCEINTERNET OF THINGSBLOCKCHAINBIG DATA

- 5.11 PRICING ANALYSIS

-

5.12 KEY CONFERENCES AND EVENTSUS HEALTHCARE TECHNOLOGY MARKET: KEY CONFERENCES AND EVENTS (2023−2024)

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSKEY STAKEHOLDERS IN BUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 MAINTENANCE & REPAIR SERVICESRECURRING REQUIREMENT FOR PREVENTIVE MAINTENANCE TO DRIVE MARKET

-

6.3 CAPITAL PLANNING SERVICESRISING NEED FOR CAPITAL BUDGETING AND INVENTORY ANALYTICS TO PROPEL MARKET

-

6.4 INTEGRATED SOFTWARE PLATFORMSIMPLIFICATION OF HEALTHCARE ASSETS DUE TO INCLUSION OF CMMS TO DRIVE MARKET

-

6.5 QUALITY & REGULATORY COMPLIANCESTRINGENT REGULATORY COMPLIANCE FOR HEALTHCARE INDUSTRY TO FUEL MARKET

-

6.6 LABOR MANAGEMENTPROVISION OF STREAMLINED OPERATIONS FOR OPTIMAL PRODUCTIVITY TO SUPPORT MARKET GROWTH

-

6.7 SUPPLY CHAIN SERVICESABILITY TO TRACK EQUIPMENT IN REAL-TIME TO FUEL MARKET

-

6.8 CYBERSECURITY SERVICESRISING NEED TO MITIGATE DATA SECURITY RISKS TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 ACUTE CARE FACILITIESACUTE HOSPITALS- Rising patient volume due to increasing incidence of chronic diseases to drive marketPEDIATRIC HOSPITALS- Increasing efforts to improve child care to propel marketACADEMIC MEDICAL CENTERS- Advanced research facilities equipped for student training to propel marketMILITARY TREATMENT FACILITIES- Federal government initiatives for quality care to drive marketAMBULATORY SURGERY CENTERS- Low costs and convenience offered by ASCs to propel market

-

7.3 POST-ACUTE CARE FACILITIESLONG-TERM ACUTE CARE FACILITIES- Provision of specialized care for senior individuals to drive marketSKILLED NURSING FACILITIES- Patient requirement for long-term therapeutic care to support market growthOTHER POST-ACUTE CARE FACILITIES

-

7.4 NON-ACUTE CARE FACILITIESCLINICS- Growing adoption of digitized workflows to propel marketOTHER NON-ACUTE CARE FACILITIES

- 8.1 OVERVIEW

- 8.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 8.3 REVENUE SHARE ANALYSIS OF KEY PLAYERS

- 8.4 R&D EXPENDITURE OF KEY PLAYERS

- 8.5 MARKET RANKING

-

8.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 8.7 COMPETITIVE BENCHMARKING

-

8.8 COMPETITIVE SITUATIONS AND TRENDSSERVICE LAUNCHESDEALSOTHER DEVELOPMENTS

-

9.1 KEY PLAYERSGE HEALTHCARE- Business overview- Services offered- Recent developments- MnM viewSIEMENS HEALTHINEERS- Business overview- Services offered- Recent developments- MnM viewKONINKLIJKE PHILIPS N.V.- Business overview- Services offered- Recent developments- MnM viewTRIMEDX- Business overview- Services offered- Recent developmentsAGILITI, INC.- Business overview- Services offered- Recent developmentsCROTHALL HEALTHCARE (SUBSIDIARY OF COMPASS GROUP)- Business overview- Services offered- Recent developmentsSODEXO- Business overview- Services offered- Recent developmentsABM INDUSTRIES INCORPORATED- Business overview- Services offeredRENOVO SOLUTIONS- Business overview- Services offered- Recent developmentsINTERMED GROUP, INC.- Business overview- Services offered- Recent developmentsJANNX MEDICAL SYSTEMS- Business overview- Services offeredORACLE- Business overview- Services offered- Recent developments

- 10.1 DISCUSSION GUIDE

- 10.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 10.3 CUSTOMIZATION OPTIONS

- 10.4 RELATED REPORTS

- 10.5 AUTHOR DETAILS

- TABLE 1 SERVICE TYPE

- TABLE 2 INCLUSIONS AND EXCLUSIONS

- TABLE 3 STANDARD CURRENCY CONVERSION RATES

- TABLE 4 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: AVERAGE SELLING PRICE OF SERVICES OFFERED BY KEY PLAYERS

- TABLE 7 US HEALTHCARE TECHNOLOGY MANAGEMENT: BUYING CRITERIA FOR SERVICE TYPE

- TABLE 8 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 9 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET, BY FACILITY TYPE, 2021–2028 (USD MILLION)

- TABLE 10 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET FOR ACUTE CARE FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 11 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET FOR POST-ACUTE CARE FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 12 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET FOR NON-ACUTE CARE FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 13 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: SERVICE TYPE PORTFOLIO ANALYSIS

- TABLE 14 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: FACILITY TYPE PORTFOLIO ANALYSIS

- TABLE 15 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: COMPANY PORTFOLIO ANALYSIS

- TABLE 16 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: SERVICE LAUNCHES (JANUARY 2020–JULY 2023)

- TABLE 17 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: DEALS (JANUARY 2020–JULY 2023)

- TABLE 18 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: OTHER DEVELOPMENTS (JANUARY 2020–JULY 2023)

- TABLE 19 GE HEALTHCARE: BUSINESS OVERVIEW

- TABLE 20 SIEMENS HEALTHINEERS: BUSINESS OVERVIEW

- TABLE 21 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- TABLE 22 TRIMEDX: BUSINESS OVERVIEW

- TABLE 23 AGILITI, INC.: BUSINESS OVERVIEW

- TABLE 24 CROTHALL HEALTHCARE: BUSINESS OVERVIEW

- TABLE 25 SODEXO: BUSINESS OVERVIEW

- TABLE 26 ABM INDUSTRIES INCORPORATED: BUSINESS OVERVIEW

- TABLE 27 RENOVO SOLUTIONS: BUSINESS OVERVIEW

- TABLE 28 INTERMED GROUP, INC.: BUSINESS OVERVIEW

- TABLE 29 JANNX MEDICAL SYSTEMS: BUSINESS OVERVIEW

- TABLE 30 ORACLE: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

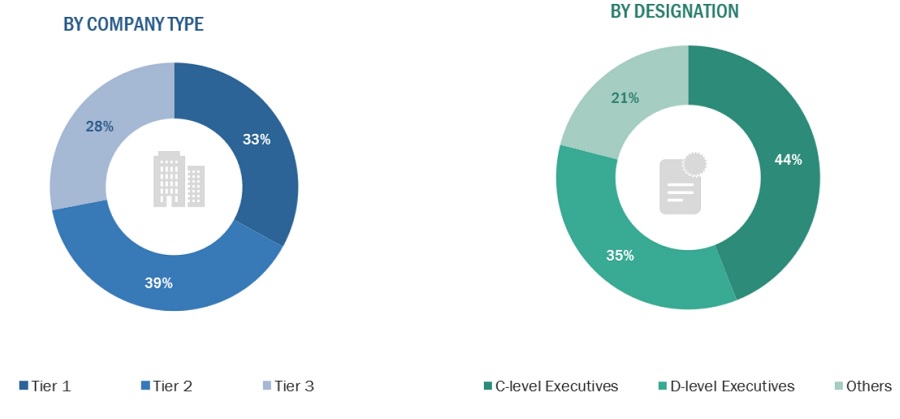

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE AND DESIGNATION

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY FACILITY TYPE AND DESIGNATION

- FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2022)

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 BOTTOM UP APPROACH

- FIGURE 9 US HEALTHCARE TECHNOLOGY MARKET: IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 11 KEY INSIGHTS FROM PRIMARY EXPERTS

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET, BY SERVICE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET, BY FACILITY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 INCREASING NEED FOR CLINICAL ASSET MANAGEMENT TO DRIVE MARKET

- FIGURE 16 ACUTE CARE FACILITIES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 MAINTENANCE & REPAIR SERVICES SEGMENT IN ACUTE CARE FACILITIES ACCOUNTED FOR LARGEST MARKET SHARE FOR 2022

- FIGURE 18 HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: ECOSYSTEM MAP

- FIGURE 22 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: US PATENT PUBLICATION TRENDS (2015–2023)

- FIGURE 23 TOP APPLICANTS FOR US HEALTHCARE TECHNOLOGY MANAGEMENT PATENTS (2015–2023)

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SERVICE TYPE

- FIGURE 25 KEY BUYING CRITERIA FOR HEALTHCARE TECHNOLOGY MANAGEMENT SERVICES

- FIGURE 26 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: REVENUE SHARE ANALYSIS OF KEY PLAYERS (2018−2022)

- FIGURE 27 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: R&D EXPENDITURE OF KEY PLAYERS (2021 VS. 2022)

- FIGURE 28 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: RANKING FOR MULTI-VENDOR OEMS (2022)

- FIGURE 29 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: RANKING ANALYSIS FOR ISOS (2022)

- FIGURE 30 US HEALTHCARE TECHNOLOGY MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 31 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

- FIGURE 32 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2022)

- FIGURE 33 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 34 AGILITI, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 35 COMPASS GROUP: COMPANY SNAPSHOT (2022)

- FIGURE 36 SODEXO: COMPANY SNAPSHOT (2022)

- FIGURE 37 ABM INDUSTRIES INCORPORATED: COMPANY SNAPSHOT (2022)

- FIGURE 38 ORACLE: COMPANY SNAPSHOT (2022)

The study involved four major activities in estimating the current size of the US Healthcare Technology management market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering US Healthcare Technology Management and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the US Healthcare Technology Management Market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the US Healthcare Technology management market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across the US. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from US Healthcare Technology Management manufacturers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side and customer/end users who are using US Healthcare Technology Management were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of US Healthcare Technology Management and the future outlook of their business, which will affect the overall market.

Breakdown of Primary Interviews: Supply-Side Participants, By Company Type and Designation

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1=>USD 1 billion, Tier 2 USD 500 million to USD 1 billion, Tier 3=<USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the US Healthcare Technology Management Market includes the following details.

The market sizing of the market was undertaken from the US side.

The size of the US Healthcare Technology Management Market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall US Healthcare Technology Management Market was obtained from secondary data and validated by primary participants to arrive at the total US Healthcare Technology Management Market. Primary participants further validated the numbers.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the US healthcare technology management market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated from the sale of healthcare technology management by leading players has been determined through primary and secondary research.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies were ascertained based on a detailed analysis of their respective product offerings and geographic reach/strength (direct or through distributors or suppliers.

Top Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom-Up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Healthcare technology management (HTM), on a broad level, refers to professionals (clinical or biomedical engineers) or firms that specialize in providing healthcare technology management services to the healthcare provider or healthcare facilities in areas such as capital planning, cybersecurity, quality & compliance, and maintenance & repair, among others.

Key Stakeholders

- Senior Management

- Doctors/surgeons

- Finance/Procurement Department

Report Objectives

- To define, describe, and forecast the US healthcare technology management market based on the type of service and facility type

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall US healthcare technology management market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically analyze the market structure and profile the key players in the US healthcare technology management market and comprehensively analyze their core competencies2

- To track and analyze competitive developments such as product launches, acquisitions, partnerships, agreements, and collaborations in the US healthcare technology management market during the forecast period

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in US Healthcare Technology Management Market