Healthcare Provider Network Management Market by Component (Services, Internal, Outsourcing Services, Software), Delivery (On premise and Cloud), End User (Payer, Private, Public Health Insurers), Region (North America, Europe) - Global Forecasts to 2025

The global healthcare provider network management market in terms of revenue was estimated to be worth $2.9 billion in 2020 and is poised to reach $5.8 billion by 2025, growing at a CAGR of 14.9% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The growth of this market is driven by the implementation of stringent federal mandates in the US, the growing focus on improving the quality of care through the effective use of payer reporting requirements, the need to curtail escalating healthcare costs, and the in-house shortage of skilled personnel.

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare Provider Network Management Market Dynamics

Drivers: Implementation of stringent federal mandates in the US

The implementation of healthcare mandates like the Patient Protection and Affordable Care Act (PPACA), which includes Medical Loss Ratio (MLR) and Administrative Loss Ratio (ALR), has compelled payer organizations to effectively manage their provider networks to reduce operating costs while simultaneously improving benefit coverage and increasing customer satisfaction levels. PPACA aimed at providing insurance coverage to every US citizen by 2014. According to the Medical Expenditure Panel Survey, the share of uninsured adults aged 18 to 64 years, in the US, for the entire calendar year declined by 18.8% in 2013, 14.4% in 2014, 12.2% in 2017, and 13.0% at the time of the survey [i.e., the first nine months of 2018 (Source: CDC)]. In addition, under mandates like Medical Loss Ratio (MLR) health insurance, issuers need to spend 80% (individual and small group markets) to 85% (large group markets) on medical care and healthcare quality improvement; the remaining amount can be spent on administrative costs.

The implementation of stringent federal mandates, coupled with the expanding customer base (resulting in an increased workload) and rising need to cut down operational & administrative costs, has prompted payers to move towards provider network management.

Restrains: IT infrastructural constraints in developing countries

Cost issues are one of the major barriers to the adoption of HCIT solutions. The cost of a provider network management software is high. Maintenance and software update costs for provider network management systems can be higher than the cost of the software. Support and maintenance services, including software upgrades (as per changing user requirements), represent a recurring expenditure, amounting to almost 30% of the total cost of ownership. Moreover, the lack of internal IT expertise in the healthcare industry necessitates training for end users to maximize the efficiency of provider network management systems. This, in turn, increases the cost of ownership of these systems.

The evaluation of information systems in the healthcare sector is difficult. On the other hand, organizational impacts and benefits are often intangible, and their realization may take a longer time. Thus, the high cost of deployment and maintenance restricts smaller healthcare organizations from investing in provider network management solutions.

Opportunities: Advanced data analytics

Owing to the dynamic nature of the healthcare industry, payers face various challenges in maintaining provider networks and managing medical loss ratios. As a result, healthcare payers are increasingly focusing on employing highly advanced IT technologies such as data analytics. With a focus on managing medical loss ratios, it is critical for payers to use data analytics to retain current members and implement effective care management programs.

Payers can use analytics in clustering, optimization, unbiased predictive modeling and propensity-score shaping. Many payers have started using analytics tools, which make extensive use of data, enable statistical and quantitative analysis, and use predictive models to drive better fact-based decision-making. This improves performance in areas such as provider contracting.

Services segment to hold largest market share in 2020

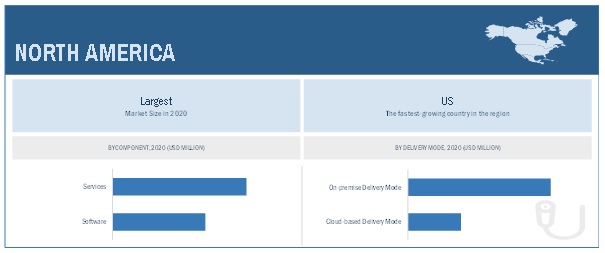

On the basis of component, the healthcare provider network management market is segmented into software and services. The services segment is expected to hold the largest share of the global healthcare provider network management market in 2020. This segment's large share can be attributed to the reduced costs of services in healthcare systems and improvements in claims auto adjudication rates, operational efficiencies, and provider relationships. The services segment is further categorised as internal and external services.

The cloud-based delivery mode segment is expected to register the highest CAGR during the forecast period

Based on delivery mode, the healthcare provider network management market is segmented into the on-premise delivery mode and cloud-based delivery mode. The on-premise delivery mode segment accounted for the largest share of the global healthcare provider network management market in 2019. On the other hand, the cloud-based delivery mode segment is expected to register the highest CAGR during the forecast period. Comparatively, lower capital expenses and operational costs incurred and better scalability, flexibility, and affordability are the major factors driving the cloud-based solutions market

Private payers accounted for the largest market share in 2019

Based on end users, the healthcare provider network management services market is segmented into private payers and public payers. The private payers' segment is expected to hold the the largest share of the global market in 2020. The large share of this end-user segment can be attributed to the rising competitiveness among private payers to enhance their capabilities and offerings.

To know about the assumptions considered for the study, download the pdf brochure

North America was the largest regional market for healthcare provider network management market in 2019.

The global healthcare provider network management market has been categorized on the basis of four major regional segments—North America, Europe, Asia Pacific, and the Rest of the World. North America was the largest regional segment of the overall market, followed by Europe. The large share of the market can be attributed to the growing health insurance coverage, the rising need to curtail healthcare costs in the US, and a strong government focus on Canada's healthcare IT solutions.

The market in the Asia Pacific, on the other hand, is anticipated to witness the highest growth owing to the factors such as the evolution of the healthcare ecosystem, growing burden on the healthcare industry, and increasing government initiatives for HCIT adoption in the region.

Healthcare Provider Network Management Market Key Players

Cognizant (US), Optum, Inc. (US), Ayasdi, Inc. (US), Change Healthcare (US), Genpact Limited (US), Infosys BPM Ltd. (India), are some of the leading players of the healthcare provider network management market.

Healthcare Provider Network Management Market Scope

|

Market size for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Component, By Delivery Model, By End User |

|

Geographies covered |

North America, Europe, Asia Pacific, ROW |

|

Companies covered |

The market players include Cognizant (US), Ayasdi, Inc. (US), Change Healthcare (US), Optum, Inc. (US), Genpact Limited (US), Infosys BPM Ltd. (India), Atos Syntel, Inc. (France), Mphasis, Ltd. (India), SKYGEN USA (US), Evolent Health, Inc. (US) (Total 20 companies) |

The study categorizes the healthcare provider network management market-based on component, delivery mode, and end user at the regional and global level.

By Component

- Services

- Software

By Delivery Mode

- On-premise Delivery Mode

- Cloud-based Delivery Mode

By End User

- Services

- Software

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- RoE

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In 2020, Change Healthcare acquired the PROMETHEUS Analytics unit, which enabled it to strengthen its solutions offerings

- In 2018, EXL acquired SCIO, a health analytics solution and services company serving various healthcare organizations, including providers, health plans, pharmacy benefit managers, employers, health service providers, and global life sciences companies. This acquisition broadened and accelerated EXL’s market-leading advanced analytics and healthcare capabilities.

- In 2018, Atos acquired Syntel, a leading global provider of integrated information technology and knowledge process services. With this acquisition, Atos strengthened its digital solutions portfolio business in the US and worldwide

- In 2019, Mphasis expanded its footprint in Hyderabad (India) with the inauguration of its new facility.

- In 2017, Cognizant expanded its Latin American operations with the opening of a new center in Sao Paulo, Brazil.

Frequently Asked Questions (FAQs):

What is the size of Healthcare Provider Network Management Market?

The global healthcare provider network management market boasts a total value of $2.9 billion in 2020 and is projected to register a growth rate of 14.9% to reach a value of $5.8 billion by 2025.

What are the major growth factors of Healthcare Provider Network Management Market?

The growth of this market is driven by the implementation of stringent federal mandates in the US, the growing focus on improving the quality of care through the effective use of payer reporting requirements, the need to curtail escalating healthcare costs, and the in-house shortage of skilled personnel.

Who all are the prominent players of Healthcare Provider Network Management Market?

Cognizant (US), Optum, Inc. (US), Ayasdi, Inc. (US), Change Healthcare (US), Genpact Limited (US), Infosys BPM Ltd. (India), are some of the leading players of the healthcare provider network management market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.5.1 SCOPE-RELATED LIMITATIONS

1.5.2 METHODOLOGY-RELATED LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

2.2 RESEARCH METHODOLOGY STEPS

FIGURE 1 RESEARCH METHODOLOGY: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET

FIGURE 2 RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Secondary sources

2.2.2 PRIMARY DATA

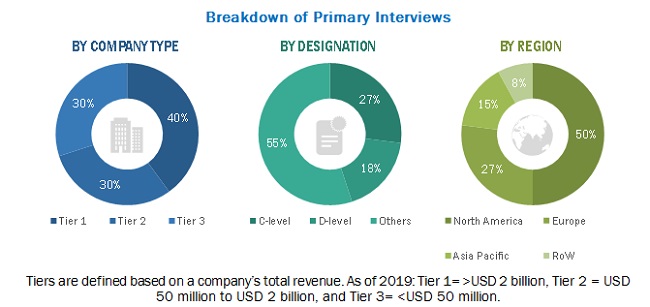

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2.2.1 Key data from primary sources

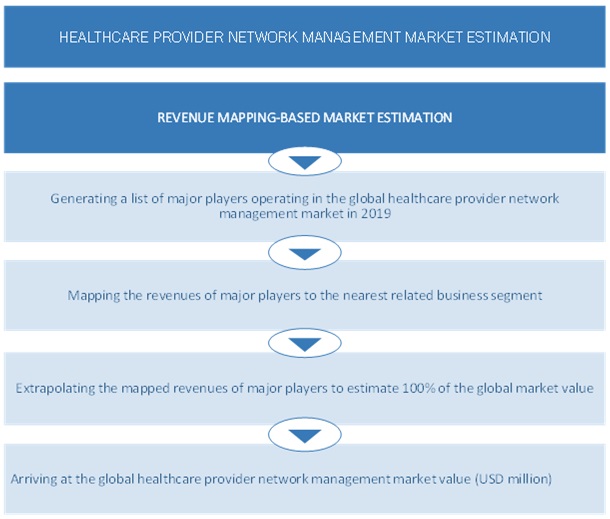

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach one: Revenue mapping-based estimation

FIGURE 4 ESTIMATION OF THE HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET: REVENUE MAPPING-BASED ESTIMATION

2.3.1.2 Approach two: Buyer adoption-based approach

FIGURE 5 MARKET SIZE ESTIMATION: BUYER ADOPTION-BASED

FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 7 REVENUE-BASED MARKET SIZE ESTIMATION: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET

2.3.2 TOP-DOWN APPROACH

FIGURE 8 PENETRATION RATE-BASED MARKET ESTIMATION

2.4 MARKET DATA ESTIMATION AND TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.5 ASSUMPTIONS FOR THE STUDY

2.5.1 COVID-19-SPECIFIC ASSUMPTIONS

2.6 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 10 HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT, 2020 VS. 2025 (USD MILLION)

FIGURE 11 HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE, 2020 VS. 2025 (USD MILLION)

FIGURE 12 HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 13 GEOGRAPHICAL SNAPSHOT OF THE HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 HEALTHCARE PROVIDER NETWORK MANAGEMENT: MARKET OVERVIEW

FIGURE 14 THE ASIA PACIFIC REGION IS PROJECTED TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

4.2 NORTH AMERICA HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT & COUNTRY (2019)

FIGURE 15 THE US ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET IN 2019

4.3 HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE (2020-2025)

FIGURE 16 ON-PREMISE DELIVERY MODE SEGMENT TO DOMINATE THE HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET DURING THE FORECAST PERIOD

4.4 GEOGRAPHICAL SNAPSHOT OF THE HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET

FIGURE 17 ASIA PACIFIC MARKET TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Implementation of stringent federal mandates in the US

5.2.1.2 Growing focus on improving the quality of care through the effective use of payer reporting requirements

5.2.1.3 Need to curtail escalating healthcare costs

5.2.1.4 In-house shortage of skilled personnel

5.2.2 RESTRAINTS

5.2.2.1 IT infrastructural constraints in developing countries

5.2.2.2 Unforeseen costs associated with outsourcing services

5.2.3 OPPORTUNITIES

5.2.3.1 Advanced data analytics

5.2.4 CHALLENGES

5.2.4.1 Reluctance of users to migrate from legacy systems

5.3 COVID-19 IMPACT

5.4 VALUE CHAIN ANALYSIS

FIGURE 19 HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET: VALUE CHAIN

5.5 ECOSYSTEM

FIGURE 20 HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET: ECOSYSTEM

6 HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT (Page No. - 46)

6.1 INTRODUCTION

TABLE 2 GLOBAL HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

6.2 PROVIDER NETWORK MANAGEMENT SERVICES

6.2.1 THE SERVICES SEGMENT IS EXPECTED TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

TABLE 3 GLOBAL HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 4 GLOBAL HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 5 NORTH AMERICA: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 6 EUROPE: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

6.3 PROVIDER NETWORK MANAGEMENT SOFTWARE

6.3.1 RISING HEALTHCARE COSTS IS THE KEY DRIVER FOR THE ADOPTION OF PROVIDER NETWORK MANAGEMENT SOFTWARE

TABLE 7 GLOBAL HEALTHCARE PROVIDER NETWORK MANAGEMENT SOFTWARE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 8 NORTH AMERICA: HEALTHCARE PROVIDER NETWORK MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 9 EUROPE: HEALTHCARE PROVIDER NETWORK MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

7 HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE (Page No. - 52)

7.1 INTRODUCTION

TABLE 10 GLOBAL HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE, 2018-2025 (USD MILLION)

7.2 ON-PREMISE DELIVERY MODE

7.2.1 THE ON-PREMISE DELIVERY MODE SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2019

TABLE 11 HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET FOR ON-PREMISE DELIVERY MODE, BY REGION, 2018-2025 (USD MILLION)

TABLE 12 NORTH AMERICA: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET FOR ON-PREMISE DELIVERY MODE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 13 EUROPE: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET FOR ON-PREMISE DELIVERY MODE, BY COUNTRY, 2018-2025 (USD MILLION)

7.3 CLOUD-BASED DELIVERY MODE

7.3.1 THE CLOUD-BASED DELIVERY MODE SEGMENT IS EXPECTED TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 14 HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET FOR CLOUD-BASED DELIVERY MODE, BY REGION, 2018-2025 (USD MILLION)

TABLE 15 NORTH AMERICA: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET FOR CLOUD-BASED DELIVERY MODE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 16 EUROPE: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET FOR CLOUD-BASED DELIVERY MODE, BY COUNTRY, 2018-2025 (USD MILLION)

8 HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY END USER (Page No. - 57)

8.1 INTRODUCTION

TABLE 17 GLOBAL HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY END USER, 2018-2025 (USD MILLION)

8.2 PRIVATE PAYERS

8.2.1 THE PRIVATE PAYERS' SEGMENT IS EXPECTED TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

TABLE 18 HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET FOR PRIVATE PAYERS, BY REGION, 2018-2025 (USD MILLION)

8.3 PUBLIC PAYERS

8.3.1 INCREASING GOVERNMENT INITIATIVES TO IMPROVE HEALTHCARE COVERAGE IS DRIVING THE GROWTH OF THIS SEGMENT

TABLE 19 HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET FOR PUBLIC PAYERS, BY REGION, 2018-2025 (USD MILLION)

9 HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY REGION (Page No. - 60)

9.1 INTRODUCTION

TABLE 20 HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY REGION, 2018-2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 21 NORTH AMERICA TO GROW AT A CAGR OF 14.0% DURING THE FORECAST PERIOD

TABLE 21 NORTH AMERICA: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 22 NORTH AMERICA: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

TABLE 23 NORTH AMERICA: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 24 NORTH AMERICA: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 25 NORTH AMERICA: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY END USER, 2018-2025 (USD MILLION)

9.2.1 US

9.2.1.1 Increase in health insurance coverage

9.2.1.2 Rising need to curtail escalating healthcare costs

TABLE 26 US: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

TABLE 27 US: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 28 US: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 29 US: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY END USER, 2018-2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Strong government focus on healthcare IT solutions

9.2.2.2 The rising need to improve the quality of healthcare in Canada

TABLE 30 CANADA: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

TABLE 31 CANADA: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 32 CANADA: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 33 CANADA: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY END USER, 2018-2025 (USD MILLION)

9.3 EUROPE

FIGURE 22 EUROPE: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET OVERVIEW

TABLE 34 EUROPE: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 35 EUROPE: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

TABLE 36 EUROPE: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 37 EUROPE: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 38 EUROPE: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY END USER, 2018-2025 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Government initiatives to modernize the healthcare system in Germany drives the market growth

TABLE 39 GERMANY: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

TABLE 40 GERMANY: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 41 GERMANY: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 42 GERMANY: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY END USER, 2018-2025 (USD MILLION)

9.3.2 UK

9.3.2.1 UK is projected to grow with the highest CAGR during the forecast period

TABLE 43 UK: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

TABLE 44 UK: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 45 UK: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 46 UK: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY END USER, 2018-2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Digital insurance startups in France to support market growth for HPNM solutions

TABLE 47 FRANCE: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

TABLE 48 FRANCE: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 49 FRANCE: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 50 FRANCE: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY END USER, 2018-2025 (USD MILLION)

9.3.4 REST OF EUROPE

TABLE 51 ROE: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

TABLE 52 ROE: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 53 ROE: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 54 ROE: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY END USER, 2018-2025 (USD MILLION)

9.4 ASIA PACIFIC

TABLE 55 APAC: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

TABLE 56 APAC: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 57 APAC: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 58 APAC: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET, BY END USER, 2018-2025 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 59 ROW: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

TABLE 60 ROW: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET, BY DELIVERY MODE, 2018-2025 (USD MILLION)

TABLE 61 ROW: HEALTHCARE PROVIDER NETWORK MANAGEMENT SERVICES MARKET SIZE, BY END USER, 2018-2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 83)

10.1 OVERVIEW

FIGURE 23 KEY PLAYERS ADOPTED ORGANIC AND INORGANIC GROWTH STRATEGIES BETWEEN 2017 AND 2020

FIGURE 24 MARKET EVOLUTION FRAMEWORK

10.2 COMPETITIVE SCENARIO

10.2.1 ACQUISITIONS

10.2.2 AGREEMENTS, PARTNERSHIPS, AND COLLABORATIONS

10.2.3 PRODUCT AND SERVICE LAUNCHES

10.2.4 EXPANSIONS

11 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 87)

11.1 COMPANY EVALUATION MATRIX: DEFINITIONS AND METHODOLOGY

11.1.1 STARS

11.1.2 EMERGING LEADERS

11.1.3 PERVASIVE PLAYERS

11.1.4 PARTICIPANTS

FIGURE 25 MNM VENDOR DIVE COMPARISON MATRIX: HEALTHCARE PROVIDER NETWORK MANAGEMENT MARKET

11.2 COMPANY PROFILES

(Business overview, Products offered, Recent developments, MNM view)*

11.2.1 COGNIZANT

FIGURE 26 COGNIZANT: COMPANY SNAPSHOT (2019)

11.2.2 CHANGE HEALTHCARE

FIGURE 27 CHANGE HEALTHCARE: COMPANY SNAPSHOT

11.2.3 OPTUM, INC. (A PART OF UNITEDHEALTH GROUP)

FIGURE 28 UNITEDHEALTH GROUP: COMPANY SNAPSHOT

11.2.4 AYASDI, INC.

11.2.5 GENPACT LIMITED

FIGURE 29 GENPACT LIMITED: COMPANY SNAPSHOT

11.2.6 INFOSYS BPM, LTD.

FIGURE 30 INFOSYS: COMPANY SNAPSHOT

11.2.7 ATOS SYNTEL INC. (A SUBSIDIARY OF ATOS SE)

FIGURE 31 ATOS SE: COMPANY SNAPSHOT (2019)

11.2.8 MPHASIS LIMITED

FIGURE 32 MPHASIS LIMITED: COMPANY SNAPSHOT

11.2.9 SKYGEN USA, LLC.

11.2.10 EVOLENT HEALTH, INC.

FIGURE 33 EVOLENT HEALTH: COMPANY SNAPSHOT (2019)

11.2.11 OSP LABS

11.2.12 HGS LTD.

FIGURE 34 HGS LTD.: COMPANY SNAPSHOT (2019)

11.2.13 VIRTUSA CORP.

FIGURE 35 VIRTUSA CORP.: COMPANY SNAPSHOT (2020)

11.2.14 EXL

FIGURE 36 EXL: COMPANY SNAPSHOT (2019)

11.2.15 VEE TECHNOLOGIES

11.2.16 SYMPLR

11.2.17 APPIAN

11.2.18 VIRSYS12, LLC. (A SALESFORCE COMPANY)

11.2.19 INOVALON

11.2.20 WIPRO LIMITED

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 116)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved the four major activities in estimating the size of the healthcare provider network management market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include Healthcare Information and Management Systems Society (HIMSS), National Association of Software and Service Companies (NASSCOM), American Health Information Management Association (AHIMA), European Federation for Medical Informatics (EFMI), American Association of Healthcare Administrative Management (AAHAM), American Medical Informatics Association (AMIA), Agency for Healthcare Research and Quality (AHRQ), Institute for Health Technology Transformation (iHT2), International Association of Health Policy (IAHP), Institute of Population and Public Health (IPPH), Public Health Agency of Canada, Centers for Medicare & Medicaid Services (CMS), World Health Organization (WHO), Organisation for Economic Co-operation and Development (OECD), Company Websites, Expert Interviews, Investor Presentations, Annual Reports, Press Releases, and MarketsandMarkets Analysis

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the healthcare provider network management market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives; preferred suppliers, manufacturers, distributors; and standards and certification organizations from companies and organizations related to all industry’s value chain segments. Primary research was conducted with primary respondents, such as key industry participants, subject-matter experts (SMEs), C-level executives, and industry consultants to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Healthcare Provider Network Management Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of the utilization/adoption/penetration trends, by component, delivery mode, end user, and region).

Revenue mapping-based estimation

All major players offering various healthcare provider network management solutions were identified at the global/regional level. Revenue mapping was done for major players, which was extrapolated to arrive at the global market value of each software and services segment. In addition, the healthcare provider network management market was split into various segments and subsegments at the regional and/or country-level based on:

- Mapping players at the regional and/or country level

- Detailed primary research to gather quantitative information related to the segments and subsegments at the regional and/or country level

- Detailed secondary research to gauge prevailing market trends at the regional and/or country level

- Base Year Calculation: Revenue mapping was done for the major players (together accounting for 50–55% of the global market) for FY 2019, which was extrapolated to arrive at the global market value of each segment and subsegment as per the above-mentioned steps

Global Market Size: Provider based approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global healthcare provider network management market based on component, delivery mode, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)2

- To profile the key market players and comprehensively analyze their product portfolios, market positions, and core competencies3

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, acquisitions, and R&D activities in the healthcare provider network management market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the healthcare provider network management market into specific regions/countries in APAC and the Rest of the World

- Profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Provider Network Management Market