Aircraft Cabin Lighting Market by Light Type (Reading Lights, Ceiling & Wall, Signage, Floor Path Lighting, Lavatory Lights), Aircraft Type (Narrow Body, Wide Body, Very Large Aircraft), End-User (OEM and Aftermarket), & Region (2017-2022)

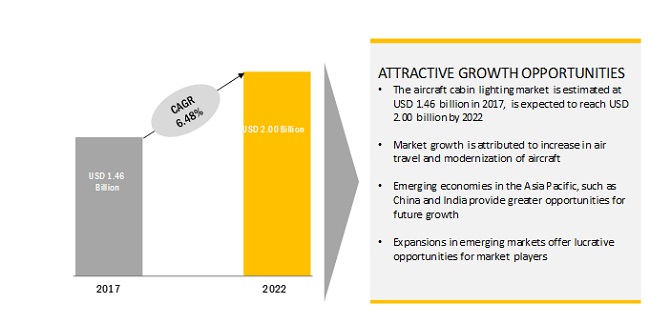

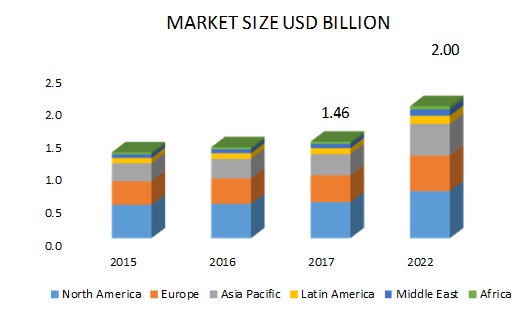

The aircraft cabin lighting market is projected to grow from an estimated USD 1.46 billion in 2017 to USD 2.00 billion by 2022, at a CAGR of 6.48% during the forecast period.

This growth can be attributed to factors, such as increased demand for interior light systems, as most of the airlines are upgrading their cabin interiors to increase efficiency and provide better service to passengers. However, the lack of profitable airlines in emerging economies is expected to restrain the growth of this market.

See how this study impacted revenues for other players in Aircraft Cabin Lighting Market

Clients Problem Statement

A leading supplier of innovative and desirable cabin interior design solutions wanted data and market intelligence about various light types specific to qualitative & quantitative analysis. The client also wanted market intelligence on light source cut across various aircraft classes at the regional level.

MnM Approach

MnM was engaged to conduct a study with the below-mentioned objectives, which were achieved to the satisfaction of the client.

Market sizing and forecast across various light types including reading lights, ceiling & wall lights, signage lights, floor path lighting strips, and lavatory lights was provided

Analysis of light source by different aircraft classes including business class, first-class, premium economy class, and economy class was provided

Key cabin lighting vendors were profiled, to provide a broader outlook for competitive benchmarking against similar solutions offered by competitors

Revenue Impact (RI)

Our analysis resulted in the client tap into a USD 250 million market, with a projected potential of USD 2 billion within three years of our recommendations.

Based on end user, the aftermarket segment is projected to account for the larger share of the aircraft cabin lighting market during the forecast period.

Based on end user, the aftermarket segment is estimated to account for the largest share of the aircraft cabin lighting market in 2017. The aftermarket phase is one of the crucial phases of the aircraft cabin lighting market, as post-delivery retrofit modification is done by the airlines. All major companies are focusing on aftermarket and Maintenance, Repair and Overhaul (MRO) services for cabin lighting.

Based on aircraft type, the wide body aircraft segment is projected to grow at the highest CAGR during the forecast period.

Based on aircraft type, the wide body aircraft segment is projected to grow at the highest CAGR during the forecast period. The growth of this market can be attributed to the demand for enhancing passenger experience in commercial aircraft and due to increase in deliveries and order of wide body aircraft by major airlines across the world.

North America is estimated to account for the largest share in the aircraft cabin lighting market in 2017 and Asia Pacific is projected to grow at the highest CAGR during the forecast period.

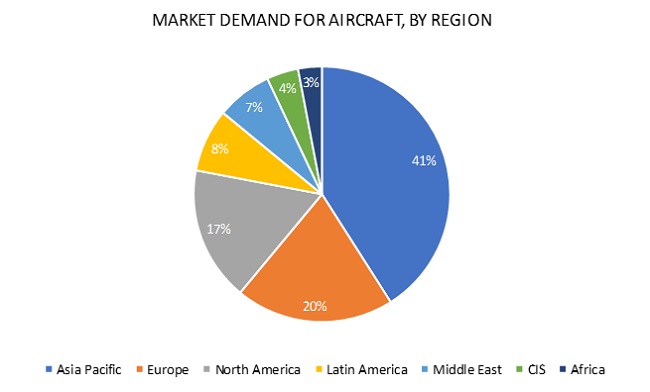

North America is estimated to account for the largest share in the aircraft cabin lighting market in 2017. Major aircraft manufacturers, such as Boeing (US), Lockheed Martin (US), Bombardier (Canada), Bell Helicopter (US), Sikorsky Aircraft (US), BAE Systems (UK), The Raytheon Company (US), and General Dynamics (US), among others, are based in this region, and thus generate high demand for aircraft cabin lights. North America is projected to lead the aircraft cabin lighting market during the forecast period, in terms of market share. The Asia Pacific aircraft cabin lighting market is projected to grow at the highest CAGR during the forecast period, owing to the presence of emerging aircraft manufacturers, such as COMAC (China) and Mitsubishi Aircraft (Japan), among others. The Asia Pacific market has witnessed strong growth in the past few years, mainly due to the rising air passenger traffic. The growth in air passenger traffic has resulted in the increased demand for aircraft cabin lights, and this trend is expected to continue over the next five years.

Rising Aircraft Demand:

Market Dynamics: Aircraft Cabin Lighting Market

Efficient alternatives to existing interior lights

Existing interior lights installed in aircraft have various drawbacks in terms of efficiency, reliability, durability, and weight. The advent of advanced LED lighting has helped eliminate these drawbacks, and the advantages of LED lights over conventional aircraft cabin lights are driving the retrofit market. The replacement of existing aircraft cabin lights with technologically advanced LED lights by airlines are leading to the growth of the aircraft cabin lighting market.

New aircraft interior lighting system technology

Aircraft and component manufacturers are undertaking efforts to develop new technologies that benefit both, the airlines and passengers, and make air travel more comfortable. For instance, in February 2017, Lufthansa introduced a new aircraft interior lighting technology developed for the Airbus 350-900. This new technology provides the capability of 24 lighting variants for the comfort of passengers, and their functions are based on the biorhythms of passengers on board. Lufthansa has equipped 10 aircraft with this technology and plans to equip its Boeing 747-800s with the same. Lufthansas aircraft bearing this lighting technology conducted its first flight from Munich, Germany to Delhi, India on February 10, 2017

Scope of the Report:

Aircraft Cabin Lighting Market, By End User

- OEM

- Aftermarket

Aircraft Cabin Lighting Market, By Light Type

- Reading Lights

- Ceiling & Wall Lights

- Signage Lights

- Floor Path Strips

- Lavatory Lights

Aircraft Cabin Lighting Market, By Aircraft Type

- Narrow Body Aircraft

- Wide Body Aircraft

- Very Large Aircraft

- Regional Transport Aircraft

- Business Jets

Aircraft Cabin Lighting Market, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Key Players in Aircraft Cabin Lighting Market

Major players operating in the aircraft cabin lighting market include Zodiac Aerospace (France), United Technologies (US), Diehl Stiftung (Germany), Rockwell Collins (US), Astronics (US), STG Aerospace (UK), Luminator Technology (US), and Honeywell (US). These key players offer various aircraft cabin light types including reading lights, ceiling lights, lavatory lights, signage lights, and wall lights. These companies have well-equipped manufacturing facilities and strong distribution networks across North America, Europe, and Asia Pacific.

Recent Developments:

In April 2017, Rockwell Collins acquired B/E Aerospace for USD 8.6 billion. This acquisition strategy enabled Rockwell Collins to enhance its portfolio of cabin interior products, including seating units, food & beverage preparation units, storage equipment, lighting systems, and modular galley and lavatory systems.

In April 2017, STG Aerospace received a contract from China Eastern Airlines to retrofit 125 Boeing 737NG with saf-Tglo photoluminescent emergency floor path marking systems. This development strategy enabled the company to strengthen its foothold in the aircraft cabin lighting market

In July 2017, Diehl Aerosystems, a business segment of Diehl Stiftung & Co., invested approximately USD 11.98 million (10 million Euro) to establish a new logistics center at Laupheim, Germany. This development strategy enabled the company to widen its distribution network and enhance its customer base in the aircraft cabin lighting market

Key questions addressed by the report:

- What are the opportunities for aircraft cabin lighting manufacturers?

- How much growth is expected for aircraft cabin lighting in the various region?

- Who are the major current and potential competitors in the market, and what are their top priorities, strategies, and developments?

- What is the major end-user segment of the aircraft cabin lighting market?

Customizations available for the report:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the company. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

- Additional Level Segmentation

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Geographic Scope

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Aircrafts Cabin Lighting Market

4.2 Market Growth, By Aircraft Light Type

4.3 Market, By Aircraft Type

4.4 Market, By End use

4.5 Asia Pacific: Aircrafts Cabin Lighting Market By Aircraft Type and Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Aircraft Deliveries

5.2.1.2 Efficient Alternatives to Existing Interior Lights

5.2.2 Opportunities

5.2.2.1 Lightweight and Energy Efficient Lights

5.2.2.2 New Aircraft Interior Lighting System Technology

5.2.3 Challenges

5.2.3.1 Existing Backlog of Aircraft Deliveries

6 Industry Trends (Page No. - 38)

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Prominent Companies

6.2.2 Small and Medium Enterprises

6.2.3 End Users (Aircraft Manufacturers & Airline Companies)

6.3 Key Influencers

6.4 Emerging Trends

6.5 Porters Five Force Analysis

6.5.1 Threat of New Entrants

6.5.2 Threat of Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

7 Aircraft Cabin Lighting Market By End User (Page No. - 43)

7.1 Introduction

7.2 Original Equipment Manufacturer

7.3 Aftermarket

8 Aircraft Cabin Lighting Market By Light Type (Page No. - 47)

8.1 Introduction

8.2 Reading Lights

8.3 Ceiling & Wall Lights

8.4 Signage Lights

8.5 Floor Path Lighting Strips

8.6 Lavatory Lights

9 Aircraft Cabin Lighting Market By Aircraft Type (Page No. - 52)

9.1 Introduction

9.2 Narrow Body Aircraft

9.3 Wide Body Aircraft

9.4 Very Large Aircraft

9.5 Regional Transport Aircraft

9.6 Business Jets

10 Aircraft Cabin Lighting Market By Components (Page No. - 57)

10.1 Introduction

10.2 Light Source

10.3 Electronics & Sensors

10.4 Others

11 Aircraft Cabin Lighting Market By Class (Page No. - 61)

11.1 Introduction

11.2 Business Class

11.3 First Class

11.4 Premium Economy Class

11.5 Economy Class

12 Aircraft Cabin Lighting Market, By Exterior Lights (Page No. - 66)

12.1 Adjacent Market - Aircraft Lighting Market, By Exterior Lights

12.2 Emergency Lights

12.3 Position Lights

12.4 Wings & Engine Inspection Lights

12.5 Anti-Collision Lights

12.6 Landing Lights

12.7 Takeoff Lights

12.8 Runway Turnoff Lights

12.9 Cargo & Service Lights

12.1 Search Lights

13 Regional Analysis (Page No. - 98)

13.1 Introduction

13.2 North America

13.2.1 US

13.2.2 Canada

13.3 Europe

13.3.1 UK

13.3.2 Germany

13.3.3 France

13.3.4 Italy

13.3.5 Rest of Europe

13.4 Asia Pacific

13.4.1 China

13.4.2 Russia

13.4.3 Japan

13.4.4 India

13.4.5 Australia

13.4.6 Rest of Asia Pacific

13.5 Latin America

13.5.1 Brazil

13.5.2 Mexico

13.5.3 Rest of Latin America

13.6 Middle East

13.6.1 UAE

13.6.2 Saudi Arabia

13.6.3 Rest of the Middle East

13.7 Africa

13.7.1 South Africa

13.7.2 Egypt

13.7.3 Rest of Africa

14 Competitive Landscape (Page No. - 165)

14.1 Overview

14.2 Ranking of Players, 2016

14.3 Top Players in Key Region

14.4 Top 3 Developments in the Aircrafts Cabin Lighting Market

14.4.1 New Product Launches

14.4.2 Partnerships, Agreements, and Expansions

14.4.3 Contracts

14.4.4 Acquisitions

15 Company Profiles (Page No. - 174)

(Overview, Financial*, Products & Services, Strategy, and Developments)

15.1 Overview

15.2 Rockwell Collins

15.3 Zodiac Aerospace

15.4 Honeywell International

15.5 Diehl Stiftung

15.6 United Technologies

15.7 Cobham

15.8 Astronics

15.9 STG Aerospace

15.10 Luminator Technology

15.11 Precise Flight

15.12 Soderberg Manufacturing

15.13 Oxley

15.14 Heads Up Technologies

*Details Might Not be Captured in Case of Unlisted Companies

16 Appendix (Page No. - 213)

16.1 Discussion Guide

16.2 Knowledge Store: Marketsandmarkets Subscription Portal

16.3 Introducing Rt: Real-Time Market Intelligence

16.4 Available Customizations

16.5 Related Reports

16.6 Author Details

List of Tables (196 Tables)

Table 1 Aircraft Deliveries Forecast By Boeing Commercial Market Outlook

Table 2 Aircraft Deliveries Forecast By Airbus Global Market Forecast

Table 3 Aircraft Shipments By Gama General Aviation

Table 4 Aircraft Deliveries Forecast By Embraer Market Outlook

Table 5 Advantages of Led Lighting

Table 6 Top Emerging Trends in the Market

Table 7 Market Size, By End User, 2015-2022 (USD Million)

Table 8 Aircraft Cabin Lighting OEM Market Size, By Aircraft Type, 2015-2022 (USD Million)

Table 9 Aircraft Cabin Lighting OEM Aftermarket Size, By Aircraft Type, 2015-2022 (USD Million)

Table 10 Aircrafts Cabin Lighting Market, By Light Type, 2015-2022 (USD Million)

Table 11 Aircraft Reading Lights Market, By End User, 2015-2022 (USD Million)

Table 12 Aircraft Ceiling & Wall Lights Market, By End User, 2015-2022 (USD Million)

Table 13 Aircraft Signage Lights Market, By End User, 2015-2022 (USD Million)

Table 14 Aircraft Floor Path Lighting Strips Market, By End User, 2015-2022 (USD Million)

Table 15 Aircraft Lavatory Lights Market, By End User, 2015-2022 (USD Million)

Table 16 Market Size, By Aircraft Type, 2015-2022 (USD Million)

Table 17 Narrow Body Market, By Light Type, 2015-2022 (USD Million)

Table 18 Wide Body Market, By Light Type, 2015-2022 (USD Million)

Table 19 Very Large Market, By Light Type, 2015-2022 (USD Million)

Table 20 Regional Transport Aircrafts Cabin Lighting Market, By Light Type, 2015-2022 (USD Million)

Table 21 Business Jets Market, By Light Type, 2015-2022 (USD Million)

Table 22 Market, By Component, 2015-2022 (USD Million)

Table 23 Market, By Class, 2015-2022 (USD Million)

Table 24 Market, By Exterior Lights, 2015-2022 (USD Million)

Table 25 Fixed Wing Exterior Lights Segment, By Subtype, 2015-2022 (USD Million)

Table 26 Rotary Wing Exterior Lights Segment, By Subtype, 2015-2022 (USD Million)

Table 27 Fixed Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 28 North America Fixed Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 29 US Fixed Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 30 Canada Fixed Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 31 Europe Fixed Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 32 Asia Pacific Fixed Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 33 China Fixed Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 34 Rest of Asia Pacific Fixed Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 35 Latin America Fixed Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 36 Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Million)

Table 37 North America Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 38 US Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 39 Canada Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 40 Europe Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Million)

Table 41 UK Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 42 France Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 43 Germany Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 44 Italy Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 45 Rest of Europe Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 46 Asia Pacific Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Million)

Table 47 China Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 48 India Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 49 Japan Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 50 Australia Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Million)

Table 51 Rest of Asia Pacific Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 52 Middle East Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 53 UAE Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 54 Saudi Arabia Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 55 Rest of Middle East Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Million)

Table 56 Rest of the World Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Million)

Table 57 Latin America Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 58 Africa Fixed Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 59 Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Million)

Table 60 North America Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Million)

Table 61 US Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 62 Canada Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 63 Europe Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 64 UK Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 65 France Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 66 Italy Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 67 Rest of Europe Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 68 Asia Pacific Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 69 China Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 70 Japan Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 71 India Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 72 Rest of Asia Pacific Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 73 Latin America Rotary Wing Aircraft Exterior Lights OEM Segment, By Subtype, 2015-2022 (USD Thousand)

Table 74 Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Million)

Table 75 North America Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 76 US Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 77 Canada Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 78 Europe Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 79 UK Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 80 France Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 81 Germany Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 82 Italy Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 83 Rest of Europe Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 84 Asia Pacific Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 85 China Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 86 India Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 87 Japan Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 88 Australia Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 89 Rest of Asia Pacific Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 90 Middle East Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 91 UAE Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 92 Saudi Arabia Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 93 Rest of Middle East Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 94 Rest of the World Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 95 Latin America Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 96 Africa Rotary Wing Aircraft Exterior Lights Aftermarket Segment, By Subtype, 2015-2022 (USD Thousand)

Table 97 Market, By Region, 2015-2022 (USD Million)

Table 98 North America Market, By End User, 20152022 (USD Million)

Table 99 North America Aircraft Cabin Lighting OEM Market, By Aircraft Type, 20152022 (USD Million)

Table 100 North America Aircraft Cabin Lighting OEM Market, By Light Type, 20152022 (USD Million)

Table 101 North America Aircraft Cabin Lighting OEM Market, By Class, 20152022 (USD Million)

Table 102 North America Market, By Aircraft Type, 20152022 (USD Million)

Table 103 North America Market, By Light Type, 20152022 (USD Million)

Table 104 North America Market, By Class, 20152022 (USD Million)

Table 105 North America Market, By Country, 2015-2022 (USD Million)

Table 106 US Market, By End User, 20152022 (USD Million)

Table 107 US Aircraft Cabin Lighting OEM Market, By Aircraft Type, 20152022 (USD Million)

Table 108 US OEM Market, By Light Type, 20152022 (USD Million)

Table 109 US Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 110 US Aftermarket, By Light Type, 20152022 (USD Million)

Table 111 Canada Market, By End User, 20152022 (USD Million)

Table 112 Canada OEM Market, By Aircraft Type, 20152022 (USD Million)

Table 113 Canada OEM Market, By Light Type, 20152022 (USD Million)

Table 114 Canada Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 115 Canada Aftermarket, By Light Type, 20152022 (USD Million)

Table 116 Europe Market, By End User, 20152022 (USD Million)

Table 117 Europe OEM Market, By Aircraft Type, 20152022 (USD Million)

Table 118 Europe OEM Market, By Light Type, 20152022 (USD Million)

Table 119 Europe OEM Market, By Class, 20152022 (USD Million)

Table 120 Europe Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 121 Europe Aftermarket, By Light Type, 20152022 (USD Million)

Table 122 Europe Aftermarket, By Class, 20152022 (USD Million)

Table 123 Europe Aircrafts Cabin Lighting Market, By Country, 2015-2022 (USD Million)

Table 124 UK Aircraft Cabin Lighting Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 125 UK Aftermarket, By Light Type, 20152022 (USD Million)

Table 126 Germany Aircraft Cabin Lighting Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 127 Germany Aftermarket, By Light Type, 20152022 (USD Million)

Table 128 France Market, By End User, 20152022 (USD Million)

Table 129 France OEM Market, By Aircraft Type, 20152022 (USD Million)

Table 130 France OEM Market, By Light Type, 20152022 (USD Million)

Table 131 France Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 132 France Aftermarket, By Light Type, 20152022 (USD Million)

Table 133 Italy Aircraft Cabin Lighting Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 134 Italy Aftermarket, By Light Type, 20152022 (USD Million)

Table 135 Rest of Europe Aircraft Cabin Lighting Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 136 Rest of Europe Aftermarket, By Light Type, 20152022 (USD Million)

Table 137 Asia Pacific Market, By End User, 20152022 (USD Million)

Table 138 Asia Pacific OEM Market, By Light Type, 20152022 (USD Million)

Table 139 Asia Pacific Aircraft Cabin Lighting OEM Market, By Class, 20152022 (USD Million)

Table 140 Asia Pacific Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 141 Asia Pacific Aftermarket, By Light Type, 20152022 (USD Million)

Table 142 Asia Pacific Aftermarket, By Class, 20152022 (USD Million)

Table 143 Asia Pacific Aircraft Cabin Lighting Market, By Country, 2015-2022 (USD Million)

Table 144 China Aircraft Cabin Lighting OEM Market, By Light Type, 20152022 (USD Million)

Table 145 China Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 146 China Aftermarket, By Light Type, 20152022 (USD Million)

Table 147 Russia OEM Market, By Light Type, 20152022 (USD Million)

Table 148 Russia Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 149 Russia Aftermarket, By Light Type, 20152022 (USD Million)

Table 150 Japan Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 151 Japan Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 152 Japan Aftermarket, By Light Type, 20152022 (USD Million)

Table 153 India Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 154 India Aircraft Cabin Lighting Aftermarket, By Light Type, 20152022 (USD Million)

Table 155 Australia Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 156 Australia Aftermarket, By Light Type, 20152022 (USD Million)

Table 157 Rest of Asia Pacific Aircraft Cabin Lighting Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 158 Rest of Asia Pacific Aftermarket, By Light Type, 20152022 (USD Million)

Table 159 Latin America Aircraft Cabin Lighting Market, By End Use, 20152022 (USD Million)

Table 160 Latin America OEM Market, By Aircraft Type, 20152022 (USD Million)

Table 161 Latin America OEM Market, By Light Type, 20152022 (USD Million)

Table 162 Latin America OEM Market, By Class, 20152022 (USD Million)

Table 163 Latin America Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 164 Latin America Aftermarket, By Light Type, 20152022 (USD Million)

Table 165 Latin America Aftermarket, By Class, 20152022 (USD Million)

Table 166 Latin America Market, By Country, 2015-2022 (USD Million)

Table 167 Brazil Market, By End Use, 20152022 (USD Million)

Table 168 Brazil Aircraft Cabin Lighting OEM Market, By Aircraft Type, 20152022 (USD Million)

Table 169 Brazil OEM Market, By Light Type, 20152022 (USD Million)

Table 170 Brazil Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 171 Brazil Aftermarket, By Light Type, 20152022 (USD Million)

Table 172 Mexico Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 173 Mexico Aftermarket, By Light Type, 20152022 (USD Million)

Table 174 Rest of Latin America Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 175 Rest of Latin America Aftermarket, By Light Type, 20152022 (USD Million)

Table 176 Middle East Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 177 Middle East Aftermarket, By Light Type, 20152022 (USD Million)

Table 178 Middle East Aftermarket, By Class, 20152022 (USD Million)

Table 179 Middle East Market, By Country, 2015-2022 (USD Million)

Table 180 UAE Aircraft Cabin Lighting Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 181 UAE Aftermarket, By Light Type, 20152022 (USD Million)

Table 182 Saudi Arabia Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 183 Saudi Arabia Aftermarket, By Light Type, 20152022 (USD Million)

Table 184 Rest of the Middle East Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 185 Rest of the Middle East Aftermarket, By Light Type, 20152022 (USD Million)

Table 186 Africa Aircraft Cabin Lighting Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 187 Africa Aftermarket, By Light Type, 20152022 (USD Million)

Table 188 Africa Aftermarket, By Class, 20152022 (USD Million)

Table 189 Africa Industry, By Country, 2015-2022 (USD Million)

Table 190 South Africa Aircraft Cabin Lighting Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 191 South Africa Aftermarket, By Light Type, 20152022 (USD Million)

Table 192 Egypt Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 193 Egypt Aftermarket, By Light Type, 20152022 (USD Million)

Table 194 Rest of Africa Aircraft Cabin Lighting Aftermarket, By Aircraft Type, 20152022 (USD Million)

Table 195 Rest of Africa Aftermarket, By Light Type, 20152022 (USD Million)

Table 196 Leading Companies Across Various Regions in the Lighting Market

List of Figures (38 Figures)

Figure 1 Aircraft Cabin Lighting Market Segmentation

Figure 2 Market: Research Flow

Figure 3 Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Aircraft Cabin Lighting Market, By Light Type, 2017-2022 (USD Million)

Figure 9 Aircraft Lighting Market Size, By Aircraft Type, 2017-2022 (USD Million)

Figure 10 Aircraft Lighting Market Size, By End Use, 2017-2022 (USD Million)

Figure 11 Geographic Analysis: Market, 2017

Figure 12 Increase in Air Travel Expected to Drive Market Growth From 2017 to 2022

Figure 13 Ceiling and Wall Lights Estimated to Account for the Largest Market Share in 2017

Figure 14 Wide Body Aircraft Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 15 Aftermarket Estimated to Lead the Market in 2017

Figure 16 China Estimated to Account for the Largest Share of the Asia Pacific Market in 2017

Figure 17 Aircraft Cabin Lighting: Market Dynamics

Figure 18 Market Demand for Aircraft, By Region

Figure 19 Increase in Aircraft Demand, By Type (2016-2022)

Figure 20 Supply Chain: Direct Distribution is the Most Preferred Strategy of Prominent Aircraft Cabin Lighting Manufacturers

Figure 21 Porters Five Forces Analysis: Aircraft Cabin Lighting Market

Figure 22 Market Size, By End User, 2017-2022 (USD Million)

Figure 23 Market Size, By Light Type, 2017-2022 (USD Million)

Figure 24 Market, By Aircraft Type, 2017-2022 (USD Million)

Figure 25 The Asia Pacific Market is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 26 North America Market Snapshot

Figure 27 Europe Market Snapshot

Figure 28 Asia Pacific Market Snapshot

Figure 29 Companies Adopted Contracts as the Key Growth Strategy Between 2015 and 2017

Figure 30 Top 3 Players in the Aircraft Cabin Lighting Market, 2016

Figure 31 Regional Revenue Mix of Top 5 Market Players

Figure 32 Rockwell Collins: Company Snapshot

Figure 33 Zodiac Aerospace: Company Snapshot

Figure 34 Honeywell International: Company Snapshot

Figure 35 Diehl Stiftung: Company Snapshot

Figure 36 United Technologies: Company Snapshot

Figure 37 Cobham: Company Snapshot

Figure 38 Astronics: Company Snapshot

Growth opportunities and latent adjacency in Aircraft Cabin Lighting Market