Aircraft Transparencies Market by Material (Glass, Acrylic, Polycarbonate), Application (Windows, Windshield, Canopies, Landing Lights & Wingtip lenses, Chin Bubbles, Cabin Interiors, Skylight), Aircraft Type, End-Use, and Region - Global Forecast to 2028

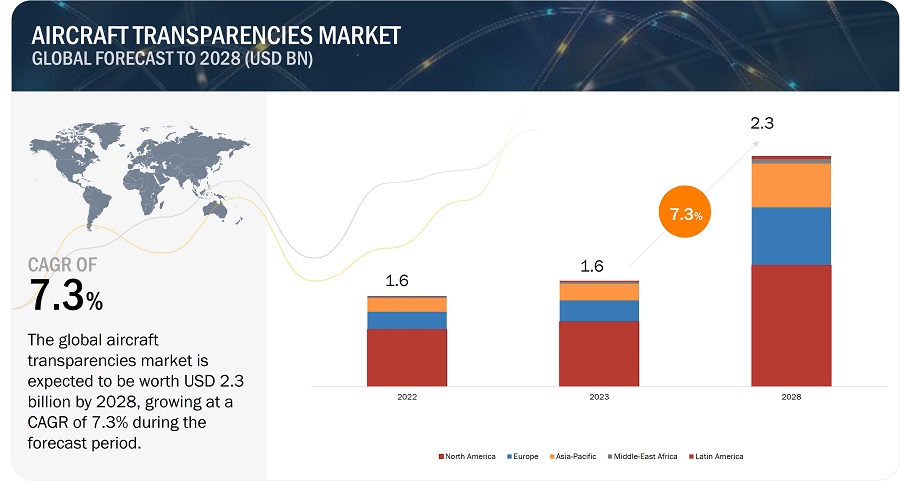

[215 Pages Report] The Global Aircraft Transparencies Market is estimated to be USD 1.6 billion in 2023 and expected to reach USD 2.3 billion by 2028 at a CAGR of 7.3% from 2023 to 2028.

The aircraft transparencies market refers to the industry involved in the manufacturing, supply, and maintenance of transparent components used in aircraft, including windshields, windows, canopies, and other transparency systems. These components are critical for providing visibility, structural integrity, and protection against external elements. The market for aircraft transparencies is driven by various factors. Firstly, the increasing air passenger traffic and the growth of the commercial aviation sector are major drivers. Airlines are continuously expanding their fleets and modernizing their aircraft to meet the rising demand for air travel, which boosts the demand for new transparencies.

Secondly, technological advancements play a significant role in the market. Lightweight polymers, advanced composites, and improved optical properties of transparencies contribute to enhanced performance, fuel efficiency, and safety. Advanced technologies like electrochromic windows that offer variable tinting and light control capabilities are also gaining popularity. Additionally, factors such as regulatory compliance, sustainability initiatives, and increasing focus on passenger comfort and experience further impact the aircraft transparencies industry. The market is highly competitive and includes major players such as PPG Industries Inc., Gentex Corporation, Lee Aerospace, GE Aviation, Safran Cabin, and Saint-Gobain S.A. These companies offer a range of products, including customized solutions and innovative transparency technologies.

Aircraft Transparencies Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft transparencies Market Dynamics

Driver: Modernization and technological advancements in aerospace industry

One of the major drivers in the aircraft transparencies market is the continuous modernization and technological advancement in the aerospace industry. The aerospace sector is constantly evolving to meet the demands of improved safety, efficiency, and passenger comfort. This drive for advancement has led to the development of innovative aircraft designs, materials, and technologies, including transparencies. Advancements in transparency materials, such as lightweight composites and advanced coatings, have enabled manufacturers to produce transparencies that are stronger, lighter, and more resistant to impact and environmental conditions. These technological advancements enhance the overall performance and safety of aircraft.

Moreover, modern aircraft designs often incorporate larger and more complex transparency systems, including curved windshields and panoramic windows, providing passengers with enhanced views and a more spacious cabin environment. These advancements not only improve the passenger experience but also contribute to the overall aesthetics and attractiveness of aircraft. Furthermore, the integration of advanced technologies into transparencies, such as anti-icing, anti-fogging, and augmented reality displays, enhances visibility, situational awareness, and operational efficiency.

Restraints: High cost of MRO services

The high cost of maintenance, repair, and overhaul (MRO) services acts as a restraint in the aircraft transparencies market. MRO services are essential for maintaining the performance and integrity of transparencies throughout their lifespan. However, the cost associated with these services, including inspection, repair, and replacement, can be significant. Factors such as specialized equipment, skilled labor, and regulatory compliance contribute to the high MRO expenses. This can pose challenges for airlines and operators, especially for older aircraft fleets, as they need to allocate substantial budgets for the maintenance of transparencies, impacting their overall operational costs and profitability.

Opportunities: Emergence of advanced air mobility

The emergence of new, advanced, and autonomous alternative modes of transportation and urban air mobility platforms is expected to boost the aircraft transparenices market. Urban air mobility platforms constitute air taxis, air ambulances, personal aerial vehicles, and others. Each of these urban platforms serves different purposes and will be designed and manufactured accordingly. One of the key purposes of this concept is to facilitate intracity transportation to reduce the stress on existing urban mobility solutions. Players such as Pipistrel d.o.o (Slovenia), Hyundai Motors (South Korea), Volocopter GmbH (Germany), and EHang (China) are also planning to develop autonomous aircraft for intracity transportation.

Recent developments have targeted small aircraft with a short range of up to 50 km, with electric vertical take-off and landing (eVTOL). An increasing number of similar concepts are coming forward, led by established industry players and startups. For instance, Airbus (Netherlands) has been working on two electric AAM vehicles to offer short-hop flights across big cities. An innovative startup, Joby Aviation (US), developed a flying eVTOL taxi prototype that can carry five people for up to 150 miles on a single charge; it has also acquired Uber’s urban air mobility initiative. Such developments present a significant market for the use of transparenices.

Challenges: Legal and regulatory barriers

Legal and regulatory bodies pose a significant restraint on the aircraft transparencies market. The aviation industry is subject to stringent safety regulations, and any new or modified aircraft transparency must meet specific standards to ensure passenger safety. Compliance with regulations related to materials, structural integrity, optical clarity, and impact resistance adds complexity and cost to the development and certification processes. Changes in regulations or the introduction of new standards may require modifications to existing transparencies, leading to additional expenses for manufacturers. Therefore, legal and regulatory factors play a crucial role in shaping the aircraft transparencies market and can present challenges for industry players.

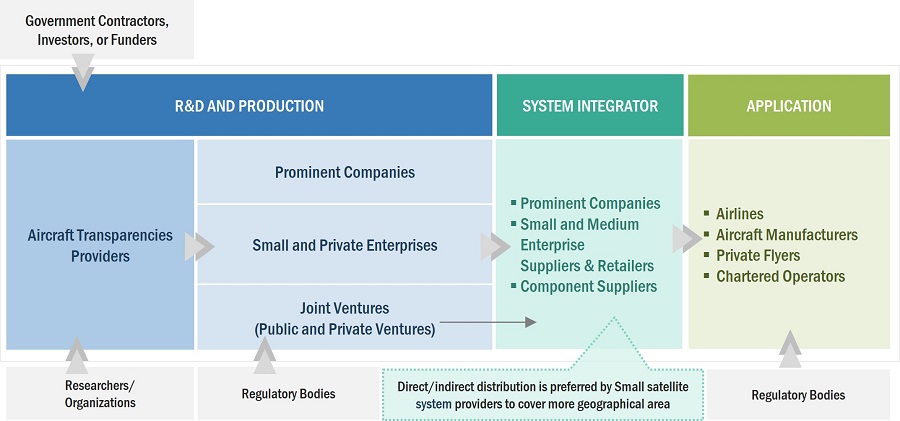

Aircraft Transparencies Market Ecosystem

The aircraft transparencies market ecosystem is comprised of various stakeholders and components that contribute to the overall functioning of the industry. This ecosystem includes aircraft manufacturers, suppliers of transparencies and materials, regulatory bodies, research organizations, and end-users such as airlines and defense organizations. Manufacturers design, produce, and certify transparencies, while suppliers provide raw materials and specialized components. Regulatory bodies ensure compliance with safety and performance standards. Research organizations drive innovation and advancements in transparency technologies. End-users play a vital role by specifying and purchasing transparencies for new aircraft or retrofitting existing ones. Collaboration and coordination among these stakeholders are essential for the smooth operation and growth of the aircraft transparencies market ecosystem. Prominent companies in this market include PPG Industries, Inc. (US), GKN Aerospace (UK), Saint-Gobain (France), General Electric Company (US), and Gentex Corporation (US) among others.

Based on Application, windows segment is estimated to account for the largest market share of the aircraft transparencies market.

Based on application, the windows segment is estimated to account for the largest market share. This can be attributed to several factors. Firstly, windows play a crucial role in the aesthetics, functionality, and passenger experience of an aircraft. The demand for larger windows, improved optical clarity, and enhanced safety features drives the growth of the windows segment. Secondly, advancements in window technologies, such as advanced coatings and smart glass, contribute to the segment's leadership position. Thirdly, retrofitting activities and the expansion of the business jet market further boost the demand for windows. These factors collectively make the windows segment the leader in the aircraft transparency market.

Based on end-use, the aftermarket segment are anticipated to dominate the market.

Based on end-use, the aftermarket segmented holds the largest market share. This can be attributed to several factors. Firstly, the aging aircraft fleet creates a significant demand for replacement and maintenance of transparencies. Secondly, retrofitting activities and upgrades in older aircraft necessitate the replacement of transparencies with newer, advanced options. Thirdly, regulatory requirements and safety standards may mandate the replacement of transparencies in existing aircraft. The aftermarket segment offers cost-effective solutions and a wide range of options, including refurbished, repaired, and certified transparencies. These factors contribute to the aftermarket segment's leadership position in the aircraft transparency market.

The polycarbonate segment of the aircraft transparencies market by material is projected to dominate the market.

The polycarbonate segment is expected to lead the aircraft transparency market. This can be attributed to the unique properties of polycarbonate, such as high impact resistance, lightweight nature, and excellent optical clarity. These characteristics make polycarbonate an ideal material for aircraft transparencies, including windshields, windows, and canopies. The increasing demand for lightweight and durable transparency solutions in the aviation industry, coupled with advancements in polycarbonate technology, contribute to the segment's leadership position in the aircraft transparency market.

The commercial aviation segment of the aircraft transparencies market by aircraft type is projected to dominate the market.

The commercial aviation segment is expected to lead the aircraft transparency market. This can be attributed to factors such as the increasing air passenger traffic, growing demand for new aircraft, and fleet modernization efforts by airlines. The commercial aviation sector's focus on safety, regulatory compliance, and passenger experience drives the demand for advanced transparency solutions. Additionally, the commercial aviation segment benefits from technological advancements, sustainability initiatives, and the need for fuel efficiency, further solidifying its leadership position in the aircraft transparency market.

The Asia Pacific market is projected to lead the aircraft transparencies market.

The Asia Pacific region is expected to emerge as the leading segment in the aircraft transparencies market during the forecasted period. The region's rapid economic growth, increasing air travel, and the expansion of the aviation industry are driving the demand for new aircraft and retrofitting of existing fleets. Additionally, the presence of major aircraft manufacturers and suppliers in countries like China, India, and Japan further supports market growth in the region. The Asia Pacific region offers significant growth opportunities for aircraft transparencies, making it a key focus area for industry players.

Aircraft Transparencies Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Aircraft Transparencies Companies - Key Market Players

The Aircraft Transparencies Companies are dominated by a few globally established players such as Prominent companies include PPG Industries, Inc. (US), GKN Aerospace (UK), Saint-Gobain (France), General Electric Company (US), and Gentex Corporation (US) among others are some of the leading players operating in the aircraft transparencies market, are the key manufacturers that secured aircraft transparencies contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements of commercial, government and military users across the world.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2022 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Application, By End-Use, By Aircraft Type, By Material, and By Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Companies covered |

PPG Industries, Inc. (US), GKN Aerospace (UK), Saint-Gobain (France), General Electric Company (US), and Gentex Corporation (US), and among others. |

Aircraft Transparencies Market Highlights

The study categorizes the aircraft transparencies market based on Application, Aircraft Type, End-use, Material, and Region.

|

Segment |

Subsegment |

|

By Material |

|

|

By Application |

|

|

By End-use |

|

|

By Aircraft Tpe |

|

|

By Region |

|

Recent Developments

- In October 2020, PPG Industries announced that they had been selected by Dassault Aviation, a French aircraft manufacturer, to supply coatings for the Falcon 6X business jet. PPG Industries will provide exterior paint coatings and interior coatings for the aircraft.

- In February 2023, GKN Aerospace has launched an 80,000-square-foot expansion of its Chihuahua, Mexico facility to meet future demands for advanced, complex composite manufacturing and assembly for the business jet industry. The expansion is expected to be completed by December 2023.

- In October 2020, GKN Aerospace has acquired Permanova Lasersystem AB, a Swedish additive manufacturing system company, as part of its Engines business's journey to transform its supply chain and provide customers with more sustainable and advanced material solutions. Permanova Lasersystem AB, headquartered in Gothenburg, is a pioneer in advanced laser technology and cell integration, as well as a current supplier of laser welding and laser metal deposition systems to GKN Aerospace.

- In January 2020, Gentex announced that they had been selected by Boeing to supply the dimmable windows for Boeing's new 777X wide-body jet. Gentex's electronically dimmable windows allow passengers to control the amount of light that enters the cabin, improving comfort and reducing the need for traditional window shades.

Frequently Asked Questions (FAQ):

Which are the major companies in the aircraft transparencies market? What are their major strategies to strengthen their market presence?

Some of the key players in the aircraft transparencies market are PPG Industries, Inc. (US), GKN Aerospace (UK), Saint-Gobain (France), General Electric Company (US), and Gentex Corporation (US) among others, are the key manufacturers that secured aircraft transparencies system contracts in the last few years.

What are the drivers and opportunities for the aircraft transparencies market?

The primary driver of the aircraft transparency market is the increasing demand for new aircraft and the need to replace or upgrade existing transparencies. This is fueled by factors such as rising air passenger traffic, fleet modernization efforts, and the emphasis on safety and fuel efficiency. Additionally, advancements in materials and technology, including lightweight polymers and improved optical properties, create opportunities for enhanced transparency solutions. The aftermarket segment also presents an opportunity for growth, driven by the aging aircraft fleet and retrofitting activities. Overall, the aircraft transparency market offers significant potential for manufacturers and suppliers to meet the evolving demands of the aviation industry.

Which region is expected to grow at the highest rate in the next five years?

The market in Asia-Pacific region is projected to grow at the highest CAGR of from 2023 to 2028, showcasing strong demand from aircraft transparencies in the region. This growth can be attributed to factors such as increasing air passenger traffic, rising disposable incomes, expanding airline fleets, and the growing demand for new aircraft in the region. Additionally, the presence of emerging economies, advancements in aerospace manufacturing capabilities, and investments in infrastructure development contribute to the strong growth prospects of the Asia Pacific region in the aircraft transparency market.

Which type of aircraft transparencies is expected to significantly lead in the coming years?

The military aviation aircraft type is expected to exhibit the highest CAGR in the aircraft transparency market over the forecasted period from 2023 to 2028. This growth can be attributed to factors such as increasing defense spending, modernization programs, and the need to upgrade and replace aging military aircraft. The demand for specialized transparencies for military applications, including canopies and windshields, drives the growth of the military aviation aircraft type in the aircraft transparency market. Additionally, advancements in materials, technology, and increasing geopolitical tensions contribute to the strong growth prospects in the military aviation segment.

Which application of aircraft transparencies is expected to significantly lead in the coming years?

The windows segment is expected to dominate the aircraft transparencies market during the forecasted period. Factors such as increasing aircraft deliveries, rising air passenger traffic, and the demand for lightweight and durable materials contribute to the growth of the windows segment. Additionally, advancements in technologies like anti-icing, anti-fogging, and enhanced optical clarity further enhance the market prospects for windows in the aircraft transparencies industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Modernization and technological advancements in aerospace industry- Adoption of aircraft transparencies to increase aircraft performance, efficiency, and safety- Rise in aircraft renewals and deliveries- Large fleets of commercial and military aircraft- Increasing use of UAVs and hybrid VTOLsRESTRAINTS- High cost of MRO servicesOPPORTUNITIES- Emergence of advanced air mobility- Reduction in material costsCHALLENGES- Legal and regulatory barriers

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS FOR AIRCRAFT TRANSPARENCIES MANUFACTURERS

- 5.4 TRADE ANALYSIS

-

5.5 CASE STUDY ANALYSISWINDSHIELDSCANOPIESWINDOWS

- 5.6 PRICING ANALYSIS

-

5.7 ECOSYSTEM MAPPINGPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.8 VALUE CHAIN ANALYSIS

-

5.9 TECHNOLOGY ANALYSISCOATINGS FOR AIRCRAFT TRANSPARENCIES- Indium Tin Oxide (ITO)- Polyurethane- Gold- Bismuth Oxide

-

5.10 AIRCRAFT TRANSPARENCIES MARKET: PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.11 RECESSION IMPACT ANALYSIS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 VOLUME DATA

- 5.14 KEY CONFERENCES AND EVENTS IN 2023

- 5.15 REGULATORY LANDSCAPE

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

-

6.3 TECHNOLOGY ANALYSISELECTRONICALLY DIMMABLE AIRCRAFT WINDOWSWINDOWLESS AIRCRAFTAIRCRAFT GLAZINGPANORAMIC WINDOWSTRANSPARENCY COATING

-

6.4 IMPACT OF MEGATRENDSIMPLEMENTATION OF INDUSTRY 4.0GLOBALIZATION OF SUPPLY CHAIN FOR AIRCRAFT TRANSPARENCIES MANUFACTURING

-

6.5 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 GLASSDEMAND FOR SMART GLASS IN AIRCRAFT WINDOWS AND WINDSHIELDS

-

7.3 ACRYLICAMONG PUREST PLASTICS USED IN AIRCRAFT PARTS

-

7.4 POLYCARBONATELIGHTWEIGHT AND HIGH-PERFORMANCE PLASTIC

- 8.1 INTRODUCTION

-

8.2 COMMERCIAL AVIATIONNARROW BODY AIRCRAFT (NBA)- Airbus ramping up production of NBAWIDE BODY AIRCRAFT (WBA)- To be fastest-growing segment of commercial aviationREGIONAL TRANSPORT AIRCRAFT (RTA)- US and India to drive demandCOMMERCIAL HELICOPTERS- Used to conduct missions, including emergency medical service missions

-

8.3 MILITARY AVIATIONFIGHTER AIRCRAFT- Growing concerns over border tensions to boost fighter aircraft procurementTRANSPORT AIRCRAFT- To grow at slower rate than military aviation aircraftMILITARY HELICOPTERS- Increasing use in medical evacuation, parachute drop, and search and rescueSPECIAL MISSION AIRCRAFT- Growing defense spending and territorial disputes

-

8.4 BUSINESS & GENERAL AVIATIONBUSINESS JETS- Rise in demand for private/corporate jetsGENERAL AVIATION- Increasing use of lightweight materials

-

8.5 ADVANCED AIR MOBILITYAIR TAXIS- Need for on-demand urban transportationAIR SHUTTLES AND AIR METROS- Require electric motors for take-off and propulsionPERSONAL AERIAL VEHICLES- Used for point-to-point pick-up and drop servicesAIR AMBULANCES AND MEDICAL EMERGENCY VEHICLES- Serve medical emergency services

- 9.1 INTRODUCTION

-

9.2 WINDOWSASIA PACIFIC, NORTH AMERICA, AND EUROPE TO LEAD MARKET

-

9.3 WINDSHIELDSLIGHTWEIGHT ACRYLIC MATERIALS WIDELY USED IN AIRCRAFT WINDSHIELDS

-

9.4 CANOPIESADVANCEMENTS IN MATERIALS SUCH AS MONOLITHIC POLYCARBONATE

-

9.5 LANDING LIGHTS & WINGTIP LENSESGROWING CONCERNS OVER PILOT & PASSENGER SAFETY

-

9.6 CHIN BUBBLESPRIMARILY USED FOR HELICOPTER DOORS

-

9.7 CABIN INTERIORS (SEPARATORS)INVOLVE USE OF COMPOSITES AND REAL THIN GLASS

-

9.8 SKYLIGHTSCOMPOSITE & LIGHTWEIGHT MATERIALS IN SKYLIGHTS PROVIDE DURABILITY

- 10.1 INTRODUCTION

-

10.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)LINE-FIT OPTIONS TO REDUCE TIME CONSUMED IN INSTALLING AIRCRAFT TRANSPARENCIES

-

10.3 AFTERMARKETINCREASING AIRCRAFT FLEET SIZE WITH MORE PASSENGER-FRIENDLY FEATURES

-

11.1 INTRODUCTIONREGIONAL RECESSION IMPACT ANALYSIS

-

11.2 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Presence of leading OEMs and MRO providersCANADA- Aircraft modernization programs

-

11.3 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Growing number of aging fleetsINDIA- Improving capabilities of domestic aerospace industryJAPAN- Increasing in-house development of aircraftAUSTRALIA- Growth in air traffic and new aircraft deliveriesINDONESIA- Burgeoning middle-class population with high demand for travelSINGAPORE- Thriving UAM ecosystemSOUTH KOREA- Launch of UAM services by 2025REST OF ASIA PACIFIC

-

11.4 EUROPEPESTLE ANALYSISFRANCE- Heavy investments in aerospace industryGERMANY- Growing investments in air travel and connectivityUK- Consistent increase in number of passengers arriving and departing at airport terminalsITALY- High demand for civil and corporate helicoptersSPAIN- Strategic investment plans with EU and AirbusRUSSIA- Increase in defense spendingREST OF EUROPE

-

11.5 MIDDLE EAST & AFRICAPESTLE ANALYSISISRAEL- Increased expenditure on R&D of UAVs for military and commercial applicationsUAE- Widescale adoption of advanced air mobility platform for commercial applicationsSAUDI ARABIA- Aviation sector modernization programsSOUTH AFRICA- Development of airport infrastructure

-

11.6 LATIN AMERICAPESTLE ANALYSISBRAZIL- Presence of OEMs and growth opportunities for airlinesMEXICO- Manufacturing hub for aerospace industry

- 12.1 INTRODUCTION

-

12.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022COMPANIES ADOPTED PRODUCT LAUNCHES AS KEY GROWTH STRATEGY FROM 2019 TO 2022

- 12.3 MARKET RANKING ANALYSIS FOR TOP 5 PLAYERS, 2022

- 12.4 COMPETITIVE BENCHMARKING

-

12.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.6 START-UP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.7 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKRECENT DEVELOPMENTS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSPPG INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGKN AEROSPACE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAINT-GOBAIN- Business overview- Products/Solutions/Services offered- MnM viewGENERAL ELECTRIC COMPANY- Business overview- Products/Solutions/Services offered- MnM viewGENTEX CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBELL TEXTRON INC.- Business overview- Products/Solutions/Services offered- Recent developmentsLEE AEROSPACE- Business overview- Products/Solutions/Services offered- Recent developmentsTHE NORDAM GROUP LLC- Business overview- Products/Solutions/Services offeredLLAMAS PLASTICS INC.- Business overview- Products/Solutions/Services offeredSPARTECH- Business overview- Products/Solutions/Services offeredMECAPLEX LTD.- Business overview- Products/Solutions/Services offeredCONTROL LOGISTICS INC.- Business overview- Products/Solutions/Services offeredPLEXIWEISS GMBH- Business overview- Products/Solutions/Services offeredAEROPAIR LTD.- Business overview- Products/Solutions/Services offeredTECH-TOOL PLASTICS, INC.- Business overview- Products/Solutions/Services offeredCEE BAILEY’S AIRCRAFT PLASTICS- Business overview- Products/Solutions/Services offeredTHE WAG AERO GROUP- Business overview- Products/Solutions/Services offeredLP AERO PLASTICS INC.- Business overview- Products/Solutions/Services offeredAVIATIONGLASS & TECHNOLOGY B.V.- Business overview- Products/Solutions/Services offered

-

13.3 OTHER PLAYERSMICRO-SURFACE FINISHING PRODUCTS, INC.- Business overview- Products/Solutions/Services offeredPACIFIC AERO TECH, LLC- Business overview- Products/Solutions/Services offeredSOUNDAIR AVIATION- Business overview- Products/Solutions/Services offeredMAGNETIC MRO AS- Business overview- Products/Solutions/Services offeredDESSER AEROSPACE- Business overview- Products/Solutions/Services offeredDART AEROSPACE- Business overview- Products/Solutions/Services offered

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 AIRCRAFT TRANSPARENCIES MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 3 REGIONAL OUTLOOK ON GROWTH OF AIR TRAFFIC, FLEET, AND AIRCRAFT DELIVERIES

- TABLE 4 IMPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, USD MILLION (2017–2021)

- TABLE 5 EXPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, USD MILLION (2017–2021)

- TABLE 6 AVERAGE SELLING PRICE RANGE: OEM AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION (2022)

- TABLE 7 AVERAGE SELLING PRICE RANGE: AFTERMARKET AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION (2022)

- TABLE 8 AIRCRAFT TRANSPARENCIES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 9 AIRCRAFT TRANSPARENCIES MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AIRCRAFT TRANSPARENCIES (%)

- TABLE 11 KEY BUYING CRITERIA FOR AIRCRAFT TRANSPARENCIES

- TABLE 12 AIRCRAFT TRANSPARENCIES OEM MARKET, BY AIRCRAFT TYPE (UNITS)

- TABLE 13 AIRCRAFT TRANSPARENCIES AFTERMARKET, BY AIRCRAFT TYPE (UNITS)

- TABLE 14 AIRCRAFT TRANSPARENCIES MARKET: KEY CONFERENCES AND EVENTS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 AIRCRAFT TRANSPARENCIES MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 20 AIRCRAFT TRANSPARENCIES MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 21 AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 22 AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 23 AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 24 AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 25 AIRCRAFT TRANSPARENCIES MARKET, BY END-USE, 2019–2022 (USD MILLION)

- TABLE 26 AIRCRAFT TRANSPARENCIES MARKET, BY END-USE, 2023–2028 (USD MILLION)

- TABLE 27 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 28 AIRCRAFT TRANSPARENCIES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 AIRCRAFT TRANSPARENCIES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 31 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 36 US: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 37 US: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 38 US: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 39 US: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 40 CANADA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 41 CANADA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 42 CANADA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 43 CANADA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 44 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 45 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 47 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 49 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 CHINA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 51 CHINA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 52 CHINA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 53 CHINA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 54 INDIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 55 INDIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 56 INDIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 57 INDIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 58 JAPAN: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 59 JAPAN: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 60 JAPAN: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 61 JAPAN: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 62 AUSTRALIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 63 AUSTRALIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 64 AUSTRALIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 65 AUSTRALIA AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 66 INDONESIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 67 INDONESIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 68 INDONESIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 69 INDONESIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 70 SINGAPORE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 71 SINGAPORE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 72 SINGAPORE: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 73 SINGAPORE: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 74 SOUTH KOREA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 75 SOUTH KOREA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 76 SOUTH KOREA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 77 SOUTH KOREA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 78 REST OF ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 79 REST OF ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 80 REST OF ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 81 REST OF ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 85 EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: AIRCRAFT TRANSPARENCIES MARKET BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 87 EUROPE: AIRCRAFT TRANSPARENCIES MARKET BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 88 FRANCE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 89 FRANCE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 90 FRANCE: AIRCRAFT TRANSPARENCIES MARKET BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 91 FRANCE: AIRCRAFT TRANSPARENCIES MARKET BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 92 GERMANY: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 93 GERMANY: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 94 GERMANY: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 95 GERMANY: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 UK: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 97 UK: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 98 UK: AIRCRAFT TRANSPARENCIES MARKET BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 99 UK: AIRCRAFT TRANSPARENCIES MARKET BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 100 ITALY: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 101 ITALY: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 102 ITALY: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 103 ITALY: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 SPAIN: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 105 SPAIN: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 106 SPAIN: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 107 SPAIN: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 RUSSIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 109 RUSSIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 110 RUSSIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 111 RUSSIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 112 REST OF EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 113 REST OF EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 114 REST OF EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 115 REST OF EUROPE: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 ISRAEL: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 123 ISRAEL: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 124 ISRAEL: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 125 ISRAEL: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 126 UAE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 127 UAE: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 128 UAE: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 129 UAE: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 SAUDI ARABIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 131 SAUDI ARABIA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 132 SAUDI ARABIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 133 SAUDI ARABIA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 134 SOUTH AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 135 SOUTH AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 136 SOUTH AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 137 SOUTH AFRICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 138 LATIN AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 139 LATIN AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 140 LATIN AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 141 LATIN AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 142 LATIN AMERICA: AIRCRAFT TRANSPARENCIES SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 143 LATIN AMERICA: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 144 BRAZIL: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 145 BRAZIL: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 146 BRAZIL: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 147 BRAZIL: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 148 MEXICO: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 149 MEXICO: AIRCRAFT TRANSPARENCIES MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 150 MEXICO: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 151 MEXICO: AIRCRAFT TRANSPARENCIES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 152 AIRCRAFT TRANSPARENCIES MARKET: DEGREE OF COMPETITION

- TABLE 153 COMPANY PRODUCT FOOTPRINT

- TABLE 154 COMPANY APPLICATION FOOTPRINT

- TABLE 155 COMPANY AIRCRAFT TYPE FOOTPRINT

- TABLE 156 COMPANY REGION FOOTPRINT

- TABLE 157 AIRCRAFT TRANSPARENCIES MARKET: DEALS, JANUARY 2019–DECEMBER 2023

- TABLE 158 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 159 PPG INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 PPG INDUSTRIES, INC.: DEALS

- TABLE 161 GKN AEROSPACE: COMPANY OVERVIEW

- TABLE 162 GKN AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 GKN AEROSPACE: OTHERS

- TABLE 164 GKN AEROSPACE: DEALS

- TABLE 165 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 166 SAINT-GOBAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 GENERAL ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 168 GENERAL ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 GENTEX CORPORATION: COMPANY OVERVIEW

- TABLE 170 GENTEX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 GENTEX CORPORATION: DEALS

- TABLE 172 BELL TEXTRON INC.: COMPANY OVERVIEW

- TABLE 173 BELL TEXTRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 BELL TEXTRON INC.: DEALS

- TABLE 175 LEE AEROSPACE: COMPANY OVERVIEW

- TABLE 176 LEE AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 LEE AEROSPACE: DEALS

- TABLE 178 THE NORDAM GROUP LLC: COMPANY OVERVIEW

- TABLE 179 THE NORDAM GROUP LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 LLAMAS PLASTICS INC.: COMPANY OVERVIEW

- TABLE 181 LLAMAS PLASTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 SPARTECH: COMPANY OVERVIEW

- TABLE 183 SPARTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 MECAPLEX LTD.: COMPANY OVERVIEW

- TABLE 185 MECAPLEX LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 CONTROL LOGISTICS INC.: COMPANY OVERVIEW

- TABLE 187 CONTROL LOGISTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 PLEXIWEISS GMBH: COMPANY OVERVIEW

- TABLE 189 PLEXIWEISS GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 AEROPAIR LTD.: COMPANY OVERVIEW

- TABLE 191 AEROPAIR LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 TECH-TOOL PLASTICS, INC.: COMPANY OVERVIEW

- TABLE 193 TECH-TOOL PLASTICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 CEE BAILEY’S AIRCRAFT PLASTICS: COMPANY OVERVIEW

- TABLE 195 CEE BAILEY’S AIRCRAFT PLASTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 THE WAG AERO GROUP: COMPANY OVERVIEW

- TABLE 197 THE WAG AERO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 LP AERO PLASTICS INC.: COMPANY OVERVIEW

- TABLE 199 LP AERO PLASTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 AVIATIONGLASS & TECHNOLOGY B.V.: COMPANY OVERVIEW

- TABLE 201 AVIATIONGLASS & TECHNOLOGY B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 MICRO-SURFACE FINISHING PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 203 MICRO-SURFACE FINISHING PRODUCTS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 PACIFIC AERO TECH, LLC: COMPANY OVERVIEW

- TABLE 205 PACIFIC AERO TECH, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 SOUNDAIR AVIATION: COMPANY OVERVIEW

- TABLE 207 SOUNDAIR AVIATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 MAGNETIC MRO AS: COMPANY OVERVIEW

- TABLE 209 MAGNETIC MRO AS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 DESSER AEROSPACE: COMPANY OVERVIEW

- TABLE 211 DESSER AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 DART AEROSPACE: COMPANY OVERVIEW

- TABLE 213 DART AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 AIRCRAFT TRANSPARENCIES MARKET: RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 MAJOR AIRCRAFT MANUFACTURERS’ QUARTERLY REVENUE, 2022–2023

- FIGURE 7 PARAMETRIC ASSUMPTIONS FOR MARKET FORECAST

- FIGURE 8 POLYCARBONATE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 9 WINDOWS SEGMENT TO BE LARGEST APPLICATION OF AIRCRAFT TRANSPARENCIES IN 2023

- FIGURE 10 AFTERMARKET END-USE SEGMENT TO ACCOUNT FOR LARGER SHARE OF AIRCRAFT TRANSPARENCIES MARKET IN 2023

- FIGURE 11 AIRCRAFT TRANSPARENCIES MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 TECHNOLOGICAL ADVANCEMENTS IN AEROSPACE INDUSTRY TO DRIVE MARKET

- FIGURE 13 MILITARY AVIATION SEGMENT TO LEAD MARKET

- FIGURE 14 OEM SEGMENT TO LEAD MARKET

- FIGURE 15 AIRCRAFT TRANSPARENCIES MARKET IN FRANCE TO REGISTER HIGHEST CAGR

- FIGURE 16 AIRCRAFT TRANSPARENCIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 REVENUE SHIFTS IN AIRCRAFT TRANSPARENCIES MARKET

- FIGURE 18 AIRCRAFT TRANSPARENCIES MARKET: ECOSYSTEM MAPPING

- FIGURE 19 AIRCRAFT TRANSPARENCIES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 AIRCRAFT TRANSPARENCIES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 22 FACTORS IMPACTING AIRCRAFT TRANSPARENCIES MARKET IN 2022-2023

- FIGURE 23 PROBABLE SCENARIO OF IMPACT ON AIRCRAFT TRANSPARENCIES MARKET

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT TRANSPARENCIES

- FIGURE 25 KEY BUYING CRITERIA FOR AIRCRAFT TRANSPARENCIES

- FIGURE 26 AIRCRAFT TRANSPARENCIES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 POLYCARBONATE TO BE LARGEST MATERIAL SEGMENT DURING FORECAST PERIOD

- FIGURE 28 COMMERCIAL AVIATION SEGMENT TO LEAD DURING FORECAST PERIOD

- FIGURE 29 WINDOWS SEGMENT TO LEAD AIRCRAFT TRANSPARENCIES MARKET DURING FORECAST PERIOD

- FIGURE 30 AFTERMARKET SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 31 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN AIRCRAFT TRANSPARENCIES MARKET IN 2023

- FIGURE 32 NORTH AMERICA: AIRCRAFT TRANSPARENCIES MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: AIRCRAFT TRANSPARENCIES MARKET SNAPSHOT

- FIGURE 34 EUROPE: AIRCRAFT TRANSPARENCIES MARKET SNAPSHOT

- FIGURE 35 SHARE OF TOP PLAYERS IN AIRCRAFT TRANSPARENCIES MARKET, 2022

- FIGURE 36 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2022

- FIGURE 37 AIRCRAFT TRANSPARENCIES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 38 AIRCRAFT TRANSPARENCIES MARKET: COMPETITIVE LEADERSHIP MAPPING OF START-UPS/SMES, 2022

- FIGURE 39 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 40 SAINT-GOBAIN: COMPANY SNAPSHOT

- FIGURE 41 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

- FIGURE 42 GENTEX CORPORATION: COMPANY SNAPSHOT

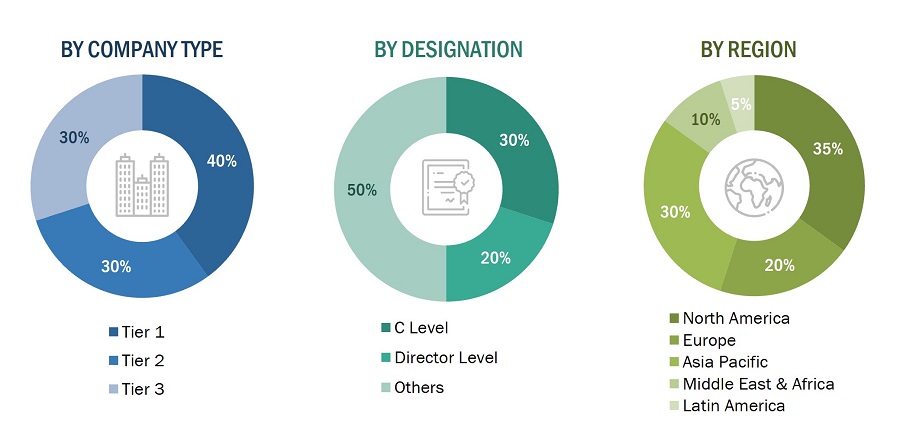

The study involved four major activities in estimating the current size of the aircraft transparencies market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The ranking analysis of companies in the aircraft transparencies market was carried out using secondary data from paid and unpaid sources, as well as by analyzing the product portfolios and service offerings of key companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. These included government sources, such as the International Air Transport Association (IATA), Federal Aviation Administration (FAA), and General Aviation Manufacturers Association (GAMA); corporate filings, such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles by recognized authors, directories, and databases.

Primary Research

Extensive primary research was conducted after obtaining information regarding the aircraft transparencies market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from aircraft transparencies vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using aircraft transparencies were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of aircraft transparencies and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

Aircraft Transparencies Manufacturers |

Mro |

|

PPG Industries, Inc. |

Pacific Aero Tech, LLC |

|

GKN Aerospace |

Soundair Aviation |

|

Mecaplex Ltd. |

Magnetic MRO |

|

Lee Aerospace |

Desser Aerospace |

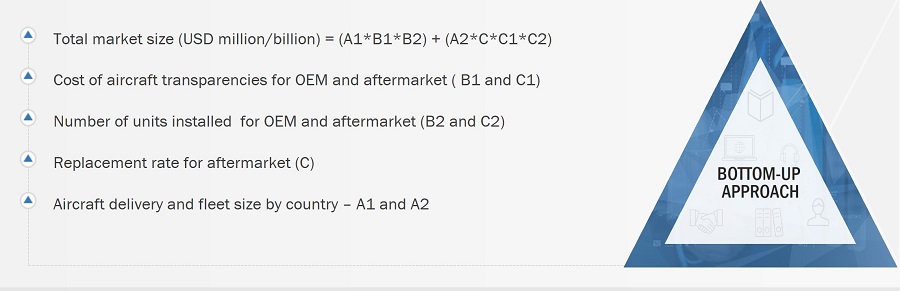

Market Size Estimation

The research methodology used to estimate the size of the aircraft transparencies market includes the following details.

- The top-down and bottom-up approaches were used to estimate and validate the size of the aircraft transparencies market. The research methodology used to estimate the market size includes the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Global aircraft transparencies market size: Bottom-Up Approach

The aircraft transparencies market, by application and aircraft type, was used as a primary segment for estimating and projecting the global market size from 2023 to 2028.

The market size was calculated by adding the mass subsegments mentioned below, and the different methodologies adopted for each to arrive at the market numbers are delineated below:

- Aircraft transparencies Market = Volume * Average selling price of the aircraft transparencies

Global aircraft transparencies market Size: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) acquired through percentage splits from secondary and primary research. The size of the immediate parent market was used to implement the top-down approach and calculate specific market segments. The bottom-up approach was also implemented to validate the revenues obtained for various market segments.

- Companies manufacturing aircraft transparenciess and their subsystems are included in the report.

- The total revenue of these companies was identified through their annual reports and other authentic sources. In cases where annual reports were unavailable, the company revenue was estimated based on the number of employees, sources such as Factiva, ZoomInfo, press releases, and any publicly available data.

- Company revenue was calculated based on their operating segments.

- All publicly available company contracts related to aircraft transparenciess were mapped and summed up.

Based on these parameters (contracts, agreements, partnerships, joint ventures, product matrix, secondary research), the share of aircraft transparenciess in each segment was estimated

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the aircraft transparencies market based on application, aircraft type, end-use, material, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aircraft transparencies market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies.

Market Definition

Aircraft transparencies include aircraft windshields, windows, canopies, landing lights and wingtip lenses, chin bubbles, and cabin interiors. This market also includes materials required to manufacture aircraft transparencies as well as coating materials that protect and enhance the capability of transparencies to withstand extreme conditions.

Modern engineering and architecture require transparency materials that offer high levels of safety and high-performance mechanical properties. These properties include ballistic resistance, wind loads, explosions, and physical attack resistance.

Market Stakeholders

- Raw Material Suppliers

- Aircraft Transparencies Manufacturers

- Technology Support Providers

- Distributors

- Maintenance, Repair, and Overhaul (MRO) Companies

- System Integrators

- Government Agencies

- Investors and Financial Community Professionals

- Research Organizations

- Component Suppliers

- Technologists

- R&D Staff

Available Customizations

MarketsAndMarkets offers the following customizations for this market report:

- Additional country-level analysis of the aircraft transparencies market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the aircraft transparencies market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Transparencies Market