Flight Management Systems (FMS) Market by Hardware (Control Display Unit, Visual Display Unit, Flight Management Computer), Aircraft Type (NBA, WBA, VLA, RTA), Fit (Line Fit, Retrofit) and Region - Global Forecast to 2021

The flight management systems market is projected to grow from USD 2.31 Billion in 2016 to USD 3.13 Billion by 2021, at a CAGR of 6.23% during the forecast period of 2016 to 2021. The market for market is driven by various factors, such as rise in aircraft orders globally, significant growth in airline industry worldwide, development of glass cockpits resulting in better operational efficiency, among others. This report covers the forecast of the flight management systems market and its dynamics over the next five years, while also recognizing market applications, evolving technologies, recent developments in the market, and high potential geographic regions and countries. The base year considered for the study is 2015 and the forecast period is from 2016 to 2021.

Objectives of the Study:

The report analyzes the market on the basis of fit (line fit and retrofit), hardware (visual display unit, control display unit, flight management computers), aircraft type (narrow body aircraft, wide body aircraft, very large aircraft, regional transport aircraft) and maps these segments and subsegments across major regions worldwide, namely, North America, Europe, Asia-Pacific, the Middle East, Latin America, and Africa.

The report provides in-depth market intelligence regarding market dynamics and major factors that influence the growth of the global flight management systems market (drivers, restraints, opportunities, and industry-specific challenges), along with analyzing micromarkets with respect to individual growth trends, future prospects, and their contribution to the overall flight market.

The report also covers competitive developments such as long-term contracts, joint ventures, mergers & acquisitions, new product launches and developments, and research & development activities in the global flight management systems market, in addition to the strategies adopted by key market players.

The flight management systems market is projected to grow from USD 2.31 Billion in 2016 to USD 3.13 Billion by 2021, at a CAGR of 6.23% during the forecast period. Various factors, such as demand for next generation flight management systems and advanced required navigation performance, development of glass cockpits resulting in better operational efficiency, significant growth in airline industry worldwide, and augmented fleet orders globally are expected to drive the flight management systems market. This market has witnessed a substantial growth in recent years.

The market is divided on the basis of fit, hardware, aircraft type, and geography. By fit, the flight management systems market has been segmented into line fit and retrofit. The line fit segment is estimated to have the largest market share in 2016. The growth of this segment is attributed to rise in aircraft orders as well as deliveries worldwide. The studied market has been segmented based on hardware into visual display unit, control display unit, and flight management computers. The flight management computers segment is expected to register the highest growth rate due to rise in the demand of technologically advanced, lightweight flight management systems. This research report categorizes the flight management systems market based on aircraft type into narrow body aircraft, wide body aircraft, very large body aircraft, and regional transport aircraft. The very large aircraft segment is expected to grow at the highest rate during the forecast period. The key factors fueling the growth of this segment include the need of long distance travel, rise in demand of higher capacity aircraft, and the rise in air travel worldwide.

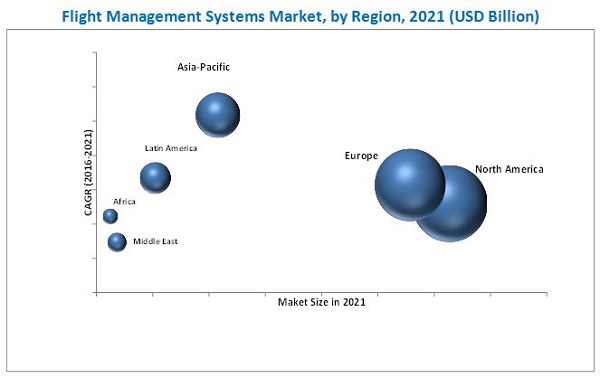

North America, Europe, Asia-Pacific, Middle East, Africa, and Latin America are considered in the geography segment. The North America and Europe flight management systems market held the largest market share in 2016 and are expected to dominate the global market during the forecast period. Asia-Pacific is the fastest-growing market due to the growth of the commercial low-cost carriers in the region. The rise in aircraft orders and deliveries as well the need for technologically advanced flight management systems are the key drivers for the growth of flight management systems market in this region.

Some of the factors, such as limited navigation database capacity, vulnerability of FMS to cyberattacks, and technical complexities in the functioning of advanced FMS limit the growth of this market. The various types of flight management systems offered by different companies in the flight management systems market have been listed in this report. The recent developments section of the report contains latest and important developments by companies in the market between 2014 and 2016.

The major players in the flight management systems market are Honeywell International Inc. (U.S.), Thales Group (France), General Electric Company (U.S.), Leonardo-Finmeccanica S.p.A (Italy), Rockwell Collins (U.S.), Esterline Technologies (U.S.), Garmin Ltd. (Switzerland), Universal Avionics Systems (U.S.), Lufthansa Systems (Germany), Jeppesen Sanderson, Inc. (U.S.), and Navtech, Inc. (Canada). The strategy of contracts accounted for a major share of the total growth strategies adopted by the leading players in the market. For instance, Jeppesen Sanderson, Inc. received a contract worth USD 1.8 Million from the U.S. Naval Air Systems Command for flight management system (FMS) navigation database software subscriptions compatible with the E-2D Advanced Hawkeye aircraft. This strategy has helped the companies to maintain their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

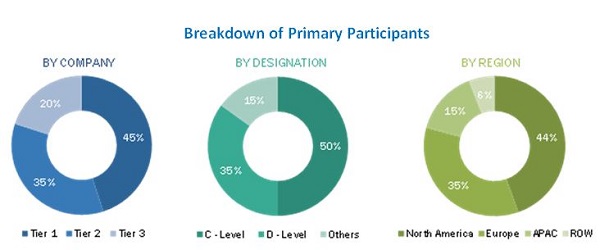

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Rising Demand for Aircraft

2.2.2.2 Increasing Dependency on Flight Management System

2.2.2.3 Growth in FMS Retrofit Market

2.2.3 Supply-Side Indicators

2.2.3.1 Increased Supply of Avionics Systems Will Eventually Increase the Supply of FMS

2.2.3.2 Technological Advancements in FMS

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 39)

4 Premium Insights (Page No. - 45)

4.1 Attractive Market Opportunities in the Flight Management Systems Market

4.2 Global Flight Management Systems Market Share

4.3 North America to Account for the Largest Market Share in 2016

4.4 Flight Management Systems Market: By Aircraft Type

4.5 Market: By Hardware

4.6 Market: By Fit

5 Market Overview (Page No. - 50)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Hardware

5.3.2 By Aircraft Type

5.3.3 By Fit

5.3.4 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Demand for Next Generation Flight Management System (NG-FMS) and Advanced Required Navigation Performance (RNP)

5.4.1.2 Development of Glass Cockpits Resulting in Better Operational Efficiency

5.4.1.3 Significant Growth in Airline Industry Worldwide

5.4.1.4 Augmented Fleet Orders Globally

5.4.2 Restraints

5.4.2.1 Vulnerability of FMS to Cyber-Attacks

5.4.2.2 Stringent Safety Regulations

5.4.3 Opportunities

5.4.3.1 Ageing Aircraft: Growth in Retrofit Market

5.4.3.2 Improved Technology for Heavy Data Storage and Operational Efficiency

5.4.3.3 Need for Advanced Navigation and Surveillance Technologies

5.4.4 Challenges

5.4.4.1 Technical Complexity of FMS System

6 Industry Trends (Page No. - 62)

6.1 Introduction

6.2 Innovation and Patent Registration

6.3 Emerging Technology Trends in FMS

6.3.1 Interoperability With Future FMS: Next Generation Flight Management System (NG-FMS)

6.3.2 Performance-Based Navigation (PBN)

6.3.3 Wide Area Augmentation System/Localizer Performance With Vertical Guidance (WAAS/LPV)

6.3.4 Adaptive 4D Trajectory Concept

6.3.5 Electronic Flight Instrument System (EFIS)

7 Flight Management Systems Market, By Fit (Page No. - 66)

7.1 Introduction

7.2 Line Fit

7.3 Retrofit

8 Flight Management Systems Market, By Aircraft Type (Page No. - 70)

8.1 Introduction

8.2 Narrow Body Aircraft

8.3 Wide Body Aircraft

8.4 Very Large Aircraft

8.5 Regional Transport Aircraft

9 Flight Management Systems Market, By Hardware (Page No. - 76)

9.1 Introduction

9.2 Visual Display Unit (VDU)

9.3 Control Display Unit (CDU)

9.4 Flight Management Computers (FMC)

10 Regional Analysis (Page No. - 81)

10.1 Introduction

10.2 North America

10.2.1 By Aircraft Type

10.2.2 By Hardware

10.2.3 By Fit

10.2.4 By Country

10.2.4.1 U.S.

10.2.4.1.1 By Aircraft Type

10.2.4.1.2 By Hardware

10.2.4.2 Canada

10.2.4.2.1 By Aircraft Type

10.2.4.2.2 By Hardware

10.3 Europe

10.3.1 By Aircraft Type

10.3.2 By Hardware

10.3.3 By Fit

10.3.4 By Country

10.3.4.1 U.K.

10.3.4.1.1 By Aircraft Type

10.3.4.1.2 By Hardware

10.3.4.2 France

10.3.4.2.1 By Aircraft Type

10.3.4.2.2 By Hardware

10.3.4.3 Germany

10.3.4.3.1 By Aircraft Type

10.3.4.3.2 By Hardware

10.3.4.4 Italy

10.3.4.4.1 By Aircraft Type

10.3.4.4.2 By Hardware

10.3.4.5 Rest of Europe

10.3.4.5.1 By Aircraft Type

10.3.4.5.2 By Hardware

10.4 Africa

10.4.1 By Aircraft Type

10.4.2 By Hardware

10.4.3 By Fit

10.4.4 By Country

10.4.4.1 South Africa

10.4.4.1.1 By Aircraft Type

10.4.4.1.2 By Hardware

10.4.4.2 Rest of Africa

10.4.4.2.1 By Aircraft Type

10.4.4.2.2 By Hardware

10.5 Asia-Pacific

10.5.1 By Aircraft Type

10.5.2 By Hardware

10.5.3 By Fit

10.5.4 By Country

10.5.4.1 China

10.5.4.2 By Aircraft Type

10.5.4.3 By Hardware

10.5.5 India

10.5.5.1 By Aircraft Type

10.5.5.2 By Hardware

10.5.6 Japan

10.5.6.1 By Aircraft Type

10.5.6.2 By Hardware

10.5.7 Singapore

10.5.7.1 By Aircraft Type

10.5.7.2 By Hardware

10.5.8 Rest of Asia-Pacific

10.5.8.1 By Aircraft Type

10.5.8.2 By Hardware

10.6 Latin America

10.6.1 By Aircraft Type

10.6.2 By Hardware

10.6.3 By Fit

10.6.4 By Country

10.6.5 Brazil

10.6.5.1 By Aircraft Type

10.6.5.2 By Hardware

10.6.6 Rest of Latin America

10.6.6.1 By Aircraft Type

10.6.6.2 By Hardware

10.7 The Middle East

10.7.1 By Aircraft Type

10.7.2 By Hardware

10.7.3 By Fit

10.7.4 By Country

10.7.5 UAE

10.7.5.1 By Aircraft Type

10.7.5.2 By Hardware

10.7.6 Qatar

10.7.6.1 By Aircraft Type

10.7.6.2 By Hardware

10.7.7 Rest of the Middle East

10.7.7.1 By Aircraft Type

10.7.7.2 By Hardware

11 Competitive Landscape (Page No. - 139)

11.1 Introduction

11.2 Key Player Analysis

11.3 Brand Analysis

11.4 Competitive Situation and Trends

11.5 Contracts

11.6 New Product Launches

11.7 Acquisitions, Agreements, Collaborations, and Partnership

12 Company Profiles (Page No. - 154)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

12.1 Introduction

12.2 Honeywell International Inc.

12.3 Thales Group

12.4 General Electric Company

12.5 Rockwell Collins

12.6 Esterline Technologies Corporation

12.7 Garmin Ltd.

12.8 Universal Avionics Systems Corporation

12.9 Jeppesen Sanderson, Inc.

12.10 Navtech, Inc.

12.11 Lufthansa Systems GmbH & Co. Kg

12.12 Leonardo-Finmeccanica Spa

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 185)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customization

13.5 Related Reports

List of Tables (83 Tables)

Table 1 Honeywell International Inc.: Comparison Chart of Conventional FMS With Next Generation Flight Management System (NG-FMS)

Table 2 Regional Growth in Airline Industry: 2015 vs 2016

Table 3 Boeing: Aircraft Delivery Forecast Comparison By Region, 2014 vs 2034

Table 4 Cyber-Attacks in the Aviation Industry: 2006-2013

Table 5 Innovation & Patent Registrations, (2000-2016)

Table 6 Flight Management Systems Market Size, By Fit, 2014-2021 (USD Million)

Table 7 Flight Management Systems Market Size for Line Fit, By Region, 2014- 2021 (USD Million)

Table 8 Flight Management Systems Market Size for Retrofit, By Region, 2014 – 2021 (USD Million)

Table 9 Market Size, By Aircraft Type, 2014 – 2021 (USD Million)

Table 10 Market Size for Narrow Body Aircraft, By Region, 2014– 2021 (USD Million)

Table 11 Flight Management Systems Market Size for Wide Body Aircraft, By Region, 2014 – 2021 (USD Million)

Table 12 Market Size for Very Large Aircraft, By Region, 2014 – 2021 (USD Million)

Table 13 Flight Management Systems Market Size for Regional Transport Aircraft, By Region, 2014 – 2021 (USD Million)

Table 14 Market Size, By Hardware, 2014-2021 (USD Million)

Table 15 Visual Display Unit Market Size, By Region, 2014-2021 (USD Million)

Table 16 Control Display Unit Market Size, By Region, 2014-2021 (USD Million)

Table 17 Flight Management Computers Market Size, By Region, 2014-2021 (USD Million)

Table 18 Flight Management System Market Size, By Region, 2014–2021 (USD Million)

Table 19 North America: Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 20 North America: Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 21 North America: Flight Management System Market Size, By Fit, 2014-2021 (USD Million)

Table 22 North America: Flight Management System Market Size, By Country, 2014-2021 (USD Million)

Table 23 U.S.: Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 24 U.S.: Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 25 Canada: Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 26 Canada: Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 27 Europe: Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 28 Europe: Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 29 Europe: Flight Management System Market Size, By Fit, 2014-2021 (USD Million)

Table 30 Europe: Flight Management System Market Size, By Country, 2014-2021 (USD Million)

Table 31 U.K.: Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 32 U.K.: Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 33 France: Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 34 France: Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 35 Germany: Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 36 Germany: Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 37 Italy: Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 38 Italy: Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 39 RoE: Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 40 RoE: Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 41 Africa: Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 42 Africa: Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 43 Africa: Flight Management System Market Size, By Fit, 2014-2021 (USD Million)

Table 44 Africa: Flight Management System Market Size, By Country, 2014-2021 (USD Million)

Table 45 South Africa: Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 46 South Africa: Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 47 Rest of Africa: Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 48 Rest of Africa: Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 49 Asia-Pacific Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 50 Asia-Pacific Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 51 Asia-Pacific: Flight Management System Market Size, By Fit, 2014-2021 (USD Million)

Table 52 Asia-Pacific Flight Management System Market Size, By Country, 2014-2021 (USD Million)

Table 53 China: Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 54 China: Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 55 India Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 56 India Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 57 Japan Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 58 Japan Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 59 Singapore Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 60 Singapore Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 61 Rest of Asia-Pacific Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 62 Rest of Asia-Pacific Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 63 Latin America Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 64 Latin America Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 65 Latin America Flight Management System Market Size, By Fit, 2014-2021 (USD Million)

Table 66 Latin America Flight Management System Market Size, By Country, 2014-2021 (USD Million)

Table 67 Brazil Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 68 Brazil Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 69 Rest of Latin America Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 70 Rest of Latin America Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 71 Middle East Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 72 Middle East Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 73 Middle East Flight Management System Market Size, By Fit, 2014-2021 (USD Million)

Table 74 Middle East Flight Management System Market Size, By Country, 2014-2021 (USD Million)

Table 75 UAE Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 76 UAE Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 77 Qatar Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 78 Qatar Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 79 Rest of the Middle East Flight Management System Market Size, By Aircraft Type, 2014-2021 (USD Million)

Table 80 Rest of Middle East Flight Management System Market Size, By Hardware, 2014-2021 (USD Million)

Table 81 Contracts, January 2013-May 2016

Table 82 New Product Launches, July 2014-June 2016

Table 83 Acquisitions, Agreements, Collaborations, and Partnership, February 2014 - June 2016

List of Figures (89 Tables)

Figure 1 Flight Management Systems Market: Markets Covered

Figure 2 Study Years

Figure 3 Flight Management Systems Market Stakeholders

Figure 4 Research Flow

Figure 5 Research Design: Flight Management Systems Market

Figure 6 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 7 Aircraft Deliveries, By Aircraft Type, 2014-2020

Figure 8 Decline in Number of Accidents Due to Implementation of FMS in Commercial Aircraft ,1995-2015

Figure 9 Retrofit Makret Share and Growth, By Region ,2012-2013

Figure 10 Market Size Estimation Methodology: Bottom-Up Approach

Figure 11 Market Size Estimation Methodology: Top-Down Approach

Figure 12 Data Triangulation

Figure 13 Assumptions of the Research Study

Figure 14 Asia-Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 15 FMS Market, By Aircraft Type: Market for Vla to Grow at the Fastest Rate During the Forecast Period

Figure 16 FMS Market Snapshot (2016 vs 2021): Market for Flight Management Computer is Estimated to Grow at the Fastest Rate During the Forecast Period

Figure 17 FMS Market, By Fit: Line Fit Segment Estimated to Grow Fastest During the Forecast Period

Figure 18 Contracts Was the Key Growth Strategy in 2015

Figure 19 Attractive Market Opportunities in the Flight Management Systems Market, 2016-2021

Figure 20 Asia-Pacific is Estimated to Grow at the Highest CAGR During the Forecast Period

Figure 21 North America to Account for the Largest Share in the Flight Management Systems Market in 2016

Figure 22 Narrow Body Aircraft (NBA) is Estimated to Lead the Flight Management Systems Market During the Forecast Period

Figure 23 Visual Display Unit (VDU) Market is Estimated to Lead the Flight Management Systems Market During the Forecast Period

Figure 24 Line Fit Market is Estimated to Lead the Flight Management Systems Market During the Forecast Period

Figure 25 Air Navigation Tools are an Integral Part of Flight Management Systems

Figure 26 Flight Management Systems Market, By Hardware

Figure 27 Market, By Aircraft Type

Figure 28 Flight Management Systems Market, By Fit

Figure 29 Market, By Region

Figure 30 Demand for Advanced and Fuel Efficient Technologies for Next Generation Aircraft to Drive the FMS Market

Figure 31 U.S.: Threats Caused By Insufficient Pilot Knowledge and System Complexity (2013)

Figure 32 Flight Management Systems Market, By Fit, 2016 – 2021 (USD Million)

Figure 33 Aircraft Types

Figure 34 Market, By Aircraft Type, 2016–2021 (USD Million)

Figure 35 Visual Display Unit (VDU) Expected to Lead the Global FMS Market During the Forecast Period

Figure 36 North America Market Snapshot: Demand is Expected to Be Driven By the Increase in Passenger Traffic

Figure 37 North America: Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 38 North America: Flight Management System Market Size, By Fit, 2016-2021 (USD Million)

Figure 39 U.S.: Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 40 Canada: Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 41 Europe Market Snapshot: Demand is Expected to Be Driven By the Aircraft Modernization Programs in the Region

Figure 42 Europe: Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 43 Europe: Flight Management System Market, By Fit, 2016-2021 (USD Million)

Figure 44 U.K.: Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 45 France: Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 46 Germany: Flight Management System Market, By Hardware, 2016--2021 (USD Million)

Figure 47 Italy: Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 48 RoE: Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 49 Africa Market Snapshot: Demand is Expected to Be Driven By the Significant Growth in the Aviation Industry

Figure 50 Africa: Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 51 South Africa: Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 52 Rest of Africa: Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 53 Asia-Pacific Snapshot: India has the Highest Growth Potential During the Forecast Period

Figure 54 Asia-Pacific Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 55 Asia-Pacific Flight Management System Market, By Fit, 2016-2021 (USD Million)

Figure 56 China Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 57 India Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 58 Japan Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 59 Singapore Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 60 Rest of Asia-Pacific Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 61 Latin America Snapshot: Brazil has the Highest Growth Potential During the Forecast Period

Figure 62 Latin America Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 63 Latin America Flight Management System Market, By Fit, 2016-2021 (USD Million)

Figure 64 Brazil Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 65 Rest of Latin America Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 66 The Middle East Snapshot: UAE has the Highest Growth Potential During the Forecast Period

Figure 67 The Middle East Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 68 The Middle East Flight Management System Market, By Fit, 2016-2021 (USD Million)

Figure 69 UAE Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 70 Qatar Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 71 Rest of the Middle East Flight Management System Market, By Hardware, 2016-2021 (USD Million)

Figure 72 Companies Adopted Contracts as the Key Growth Strategy From January 2014 to June 2016

Figure 73 Honeywell International Inc. Dominated the Flight Management Systems Market in 2015

Figure 74 Brand Analysis: Flight Management Systems

Figure 75 Flight Management Systems Market Witnessed Significant Growth From January 2013 to June 2016

Figure 76 Securing Contracts Was the Major Growth Strategy in Flight Management Systems Market During 2014-2016

Figure 77 Geographic Revenue Mix of Top 4 Market Players

Figure 78 Honeywell International Inc.: Company Snapshot

Figure 79 Honeywell Internationalinc.:SWOT Analysis

Figure 80 Thales Group : Company Snapshot

Figure 81 Thales Group : SWOT Analysis

Figure 82 General Electric Company : Company Snapshot

Figure 83 General Electric Company : SWOT Analysis

Figure 84 Rockwell Collins : Company Snapshot

Figure 85 Rockwell Collins : SWOT Analysis

Figure 86 Esterline Technologies Corporation : Company Snapshot

Figure 87 Esterline Technologies Corporation : SWOT Analysis

Figure 88 Garmin Ltd. : Company Snapshot

Figure 89 Leonardo-Finmeccanica Spa: Company Snapshot=

Research Methodology:

The research methodology used to estimate and forecast the flight management systems market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the market from the revenue of the key market players. After arriving at the overall market size, the total market was split into several segments and subsegments which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives, among others. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The flight management systems market ecosystem comprises of software/hardware/ service and solution providers, manufacturers, distributors, and end users. Some of the key players of the market include Honeywell International Inc. (U.S.), Thales Group (France), General Electric Company (U.S.), Leonardo-Finmeccanica S.p.A (Italy), Rockwell Collins (U.S.), Esterline Technologies (U.S.), Garmin Ltd. (Switzerland), Universal Avionics Systems (U.S.), Lufthansa Systems (Germany), Jeppesen Sanderson, Inc. (U.S.), and Navtech, Inc. (Canada). These players are adopting various strategies, such as agreements and partnerships, new product developments, contracts, and expansion to strengthen their positions in the flight management systems market. They are also focusing on the development of new products with higher precision and reduced weight, by investing considerable amount of their revenue into R&D.

Target Audience

- Software/Hardware/Service and Solution Providers

- Technology Support Providers

- Flight Management Systems Manufacturers

- Subcomponent Manufacturers

Scope of the Report

By Fit

- Line Fit

- Retrofit

By Aircraft Type

- Narrow Body Aircraft

- Wide Body Aircraft

- Very Large Aircraft

- Regional Transport Aircraft

By Hardware

- Visual Display Unit (VDU)

- Control Display Unit (CDU)

- Flight Management Computers (FMC)

By Region

- North America

- Europe

- Asia-Pacific

- Middle East

- Latin America

- Africa

Available customization

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Flight Management Systems (FMS) Market