Glyphosate Market by Crop Type (Genetically Modified, Conventional), Form (Liquid, Dry), Application (Agricultural (Grains & Cereals, Oilseeds & Pulses, Fruits & Vegetables), Non Agricultural), and Region - Global Forecast to 2022

[141 pages report] The glyphosate market is projected to grow at a CAGR of 6.32% from 2016 to 2022, to reach USD 9.91 billion by 2022.

The years considered for the study are as follows:

- Base year 2015

- Estimated year 2016

- Projected year 2022

- Forecast period 2016 to 2022

The objectives of the report are as follows:

- To define, segment, and project the global market size of glyphosate on the basis of crop type, form, application, and region

- To project the size of the market and its submarkets, in terms of value and volume, with respect to five regions, namely, North America, Europe, Asia Pacific, South America, and Rest of the World (RoW)

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- Analyzing the demand-side factors based on the impact of macro and microeconomic factors on the market and shifts in demand patterns across different subsegments and regions.

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share.

- Secondary research was conducted to obtain the value of the global glyphosate market for regions such as North America, Europe, Asia Pacific, South America, and RoW.

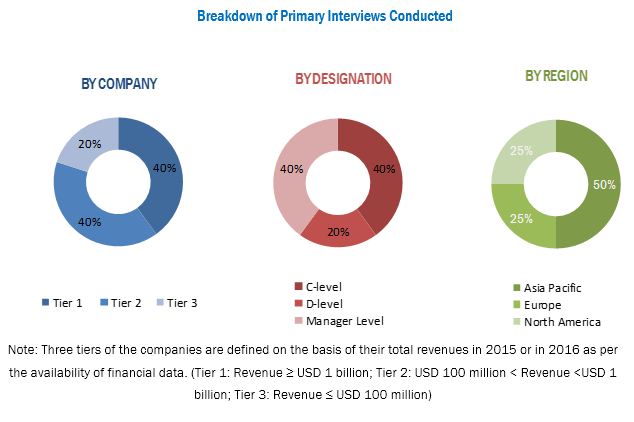

- Key players have been identified through secondary sources such as the Bloomberg Businessweek, Factiva and companies annual reports while their market share in the respective regions has been determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the global glyphosate market.

To know about the assumptions considered for the study, download the pdf brochure

Key participants in the supply chain of the glyphosate market are the product manufacturers, end use industries, and raw material suppliers. The key players that are profiled in the report include Monsanto (U.S.), Syngenta AG (Switzerland), Bayer AG (Germany), E.I. Du Pont De Nemours & Company (U.S.), The Dow chemical company (U.S.), Nufarm limited (Australia), Nantong Jiangshan Agrochemical & Chemical, Inc. (China), Adama Agricultural Solutions Ltd (Israel), UPL Limited (India), and Zhejiang Xinan Chemical Industrial Group Co., Ltd (China).

Target Audience

- Regulatory and research organizations

- Raw material suppliers and distributors

- Glyphosate traders, distributors, and dealers

- Biotechnology-based organizations

- Glyphosate manufacturers

- Research and consulting firms

- Manufacturers of chlorine, bromine, formic acid, and other feedstock chemicals

Scope of the Report

This research report categorizes the market based on crop type, form, application, and region.On the basis of crop type, the market for glyphosate has been segmented into:

- Genetically modified crops

- Conventional crops

On the basis of form, the market for glyphosate has been segmented into:

- Liquid

- Dry

On the basis of application, the market for glyphosate has been segmented into:

- Agricultural

- Grains & cereals

- Oilseeds & pulses

- Fruits & vegetables

- Others includes sugarcane, plantation crops, and pastures

- Non-agricultural

On the basis of region, the market for glyphosate has been segmented into:

- North America

- Europe

- Asia Pacific

- South America

- RoW (Africa and the Middle East)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs.The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Application Analysis

- Further breakdown of non-agricultural applications into lawn & garden, turf & ornamental grass, and aquatic application

Regional Analysis

- Further breakdown of the Rest of Europe market into Russia and Italy

- Further breakdown of the Rest of Asia Pacific market into Australia, New Zealand, and Vietnam

- Further breakdown of the RoW market into Paraguay, Uruguay, Chile, and Cuba

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Rapid commercialization of genetically engineered crops to increase the demand for glyphosate

Glyphosate is a broad spectrum systemic organophosphorus herbicide which is widely used for killing weeds and grasses. It is the most widely used non-selective herbicide which can be used for pre- and post-harvest weed control. The demand for glyphosate largely depends upon the production of genetically modified crops across countries, as these crops are glyphosate-resistant.

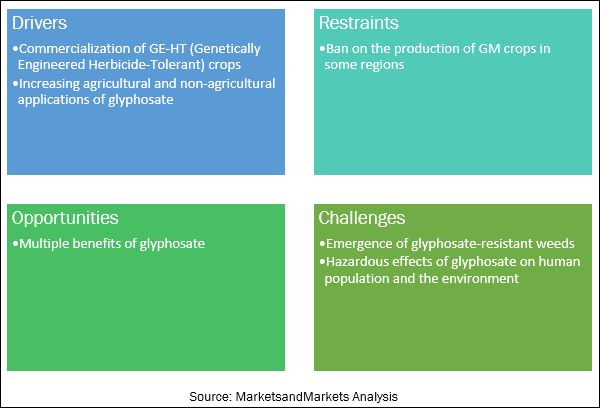

The global glyphosate market is projected to reach USD 9.91 billion by 2022, at a CAGR of 6.32% from 2016 to 2022. The key drivers for the markets growth are the commercialization of GE-HT (Genetically Engineered Herbicide-Tolerant) crops and increasing agricultural and non-agricultural applications of glyphosate.

Ban on the production of genetically modified crops in some regions acts as the major restraints for the market.

There are various controversies related to the use of genetically engineered crops, as the DNA of the crops is altered artificially. As stated by Dr. Mae-Wan Ho on Disabled-World.Com, Genetic modification is inherently dangerous, because it greatly expands the scope for horizontal gene transfer and recombination, precisely the processes that create new viruses and bacteria that cause disease epidemics, and trigger cancer in cells." These unsettled arguments can obstruct the production of GE-HT crops.

As the cultivation of GM crops is restricted by various countries, especially in Europe, this will have a direct effect on the use of glyphosate as a herbicide in this region as conventional crops may get affected by glyphosate, and any trace of glyphosate in food is not tolerated. The EFSA (European Food Safety Authority) has declared glyphosate unsafe to use, IARC (International Agency for Research on Cancer) has declared glyphosate a probable human carcinogenic by collecting data through its independent research.

The repetitive use of glyphosate on weeds results in a resisting mechanism toward glyphosate. There are currently 24 known weed species that are glyphosate-resistant; these include Palmer amaranth, Conyza bonariensis, Conyza Canadensis, Ryegrass, and Johnson grass.

To fight weed resistance and increase the effectiveness of glyphosate, high investments in research and innovation are required, which leads to an increase in the products cost. Active ingredients offering similar functionalities are facing competition due to cost efficiency and technological advancements. This emergence of glyphosate-resistant weeds has created a major challenge in glyphosate market.

Market Dynamics

Leading glyphosate manufacturers are developing innovative solutions for existing and new applications to drive the industry forward

Agriculture: Growing demand for efficient herbicides

Glyphosate is a post emergence, non-selective herbicide which kills and controls a variety of species of weeds and pests. Genetically engineered herbicide-tolerant crops now account for about 56% of global glyphosate use. One of the major reasons behind the rise in the usage of glyphosate includes steady expansion in the number of crops registered for use on glyphosate product labels.

The agricultural use of glyphosate is further classified into the following crops:

Grains & cereals:

Glyphosate has been used as an herbicide on grains and cereal crops such as wheat, rice, corn, barley, sorghum, oats, rye, triticale, buckwheat, fonio, quinoa, and other millets. Glyphosate can be used as a pre-harvest herbicide.

Oilseeds & pulses:

Across the world, farmers are using glyphosate as an herbicide on glyphosate-resistant (GR) crops, especially for soybeans.

The demand for soybeans has also been increasing as it is a rich source of protein to vegetarians. As the production of soybean increases, herbicide consumption is projected to increase. In recent years, rapid adoption of transgenic varieties, such as Roundup Ready or LibertyLink, has allowed for additional herbicide options for weed control in soybean. This is paving the way for increased herbicide consumption.

Fruits & vegetables:

Fruit production has been increasing continuously in recent years due to their growing demand. At the same time, the relevance of fruit-producing regions has changed in the Asia Pacific region with a diverse supply of fruits coming from this region.

The fruits & vegetables production system is getting more intense, with increased pressure on yield. Glyphosate usage is hence soaring in this segment. Also, the market for fruits & vegetables in the Asia Pacific region is projected to grow at the highest CAGR of 6.79% during the forecast period. The growing usage of glyphosate for deciduous fruits in Asia is projected to fuel its demand.

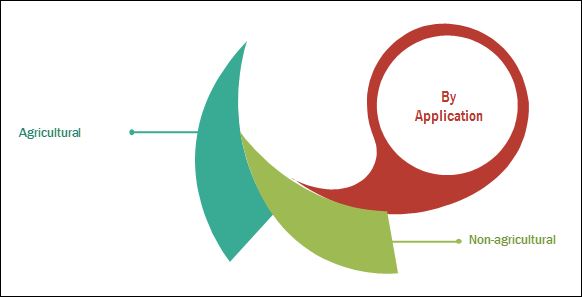

Glyphosate market, By Application

Non-agricultural: Aquatic weeds can be controlled using glyphosate

Non-agricultural applications of glyphosate include lawns & gardens, stadiums, railway tracks, and turfs & ornamentals. In the US, in 2007, glyphosate was the second-most widely used herbicide in the home & garden sector.

Glyphosate is used to control weeds, along roadsides, highways, railroads, forests, aqua systems, gardens, and lawns. For instance, coniferous forest management in Canada has extensively used herbicides, including glyphosate, for unwanted foliar and vegetative control. The agro-forestry and lumbering industries also use glyphosate. Aquatic weeds are also controlled using herbicides.

Key Questions

- The demand for glyphosate has been witnessing a steady growth; how are new technologies such as adjuvants that are coming in the market enhancing the effectiveness of glyphosate?

- What will be the prominent revenue-generating pockets for the market in the next five years?

- Most of the suppliers have opted mergers and acquisitions as the key strategies which could be observed from the recent developments. Where would it take the industry on a mid to long term basis?

- As the weed resistance increasing towards glyphosate, can there be any innovation to improve its efficacy?

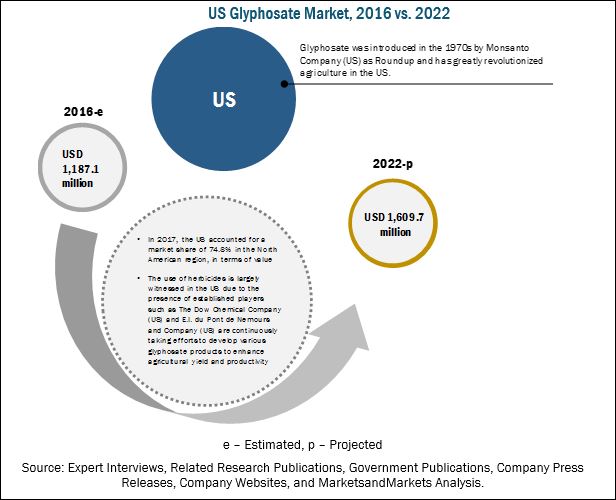

The glyphosate market is projected to grow at a CAGR of 6.32% from 2016 to 2022, to reach a projected value of USD 9.91 Billion by 2022. The market has become more diversified in recent years. Glyphosate, being a non-selective herbicide, is used for various varieties of weeds. Factors such as rapidly growing industrialization and urbanization, globally, has led to a decline in the total land available for cultivation and has increased the pressure on farmers to increase the yield of crops in the land available. This fueled the market growth of the glyphosate.

On the basis of crop type, the market was led by the genetically modified crops segment, followed by the conventional crops segment, in 2015. The GM crops segment leads the market owing to increasing production of genetically engineered crops such as soybean, cotton, and corn. Asian countries are expected to become major regional markets owing to changing farming practices, which are expected to contribute to the growth of the global market in the near future.

The global market, on the basis of form, is segmented into dry and liquid. The liquid from segment accounted for the largest market share in 2015. It offers cost efficiency, longer shelf life, and easy foliar application to the end users.

The glyphosate market, on the basis of application, is segmented into agricultural and r non-agricultural applications. The grains & cereals subsegment accounted for the largest market share in 2015, in agricultural application. The production of transgenic, glyphosate-tolerant crops, such as roundup ready crops, has led to the increased consumption of glyphosate. The glyphosate products offered controls grass growth and act as broadleaf weeds killer in glyphosate tolerant corn, soybeans, cotton, alfalfa, canola, and sugar beets, plus reduced tillage and fallow systems. Non-agricultural applications of glyphosate include lawns & gardens, stadiums, railway tracks, and turfs & ornamentals.

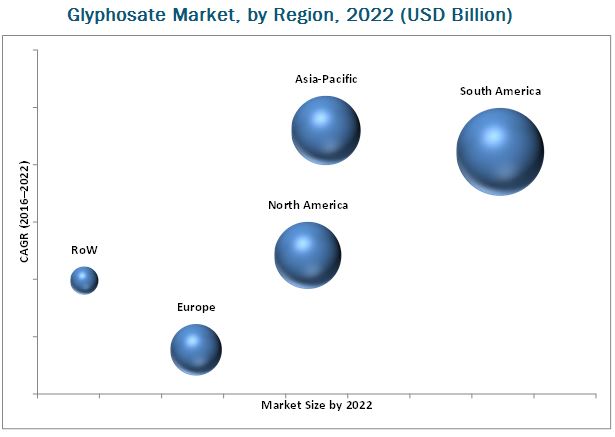

South America accounted for the largest market share for glyphosate market in 2015, owing to the increase in demand for glyphosate in countries such as Brazil and Argentina. However, Asia Pacific is projected to be the fastest-growing market during the forecast period, due to the high adoption of the upgraded crop protection technologies. Due to awareness related to the efficient use of glyphosate, Indian farmers are also adopting glyphosate as a crop protection tool.

The major restraining factor for the market is ban on the production of GM crops in some countries in Europe. Restriction on GM crops by various countries will have a direct effect on the use of glyphosate. Another challenge faced by glyphosate industry is the emergence of the glyphosate resistant weeds such as Palmer amaranth and Conyza bonariensis. Monsanto (U.S.), one of the prominent players in the market, focuses on developing new modified glyphosate products and technologies, in order to prevent growth of glyphosate resistant weeds and cater to the large customer base. Its core competencies are diverse product portfolios that include Roundup Ready PLUS and Roundup Custom (spray). Syngenta Ag is also one of the major players that offers various systemic herbicide products for weed control. In June 2016, Monsanto, Sumitomo Chemical (Japan), and Valent USA (U.S.) entered into a collaboration for providing crop protection solutions. In terms of new product development strategy, Monsanto has developed herbicide tolerance cotton product Bollgard II XtendFlex. It ultimately increases the yield for cotton growers. This product is pending for regulatory approval.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Periodization Considered for the Study

1.4 Currency

1.5 Units

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Market Share Estimation

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.3 Breakdown of Primaries

2.3 Macroindicator

2.3.1 Introduction

2.3.1.1 Decline in Arable Land

2.4 Market Size Estimation

2.5 Market Breakdown & Data Triangulation

2.5.1 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Investment Opportunitues for Glyphosate Producers

4.2 Market Size for Glyphosate, By Region

4.3 South American Glyphosate Market, By Country and Crop Type

4.4 Market for Glyphosate, By Form, Value

4.5 Market for Glyphosate, By Application

4.6 Glyphosate Market Attractiveness

5 Market Overview (Page No. - 36)

5.1 Introduction

5.1.1 Market Insights

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Crop Type

5.3.2 By Form

5.3.3 By Application

5.3.4 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Commercialization of GE-HT (Genetically Engineered Herbicide-Tolerant) Crops

5.4.1.2 Increasing Agricultural and Non-Agricultural Applications of Glyphosate

5.4.2 Restraints

5.4.2.1 Ban on the Production of GM Crops in Some Regions

5.4.3 Opportunities

5.4.3.1 Multiple Benefits of Glyphosate

5.4.4 Challenges

5.4.4.1 Emergence of Glyphosate-Resistant Weeds

5.4.4.2 Hazardous Effects of Glyphosate on Human Population and Environment

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Global Glyphosate Market: Supply Chain Analysis

6.3 Global Glyphosate Market: Porters Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Bargaining Power of Suppliers

6.3.3 Bargaining Power of Buyers

6.3.4 Threat of Substitutes

6.3.5 Threat of New Entrants

6.4 Trade Data

6.5 Key Patents

7 Market for Glyphosate, By Crop Type (Page No. - 50)

7.1 Introduction

7.2 Genetically Modified Crops

7.3 Conventional Crops

8 Market for Glyphosate, By Application (Page No. - 56)

8.1 Introduction

8.2 Agricultural

8.2.1 Grains & Cereals

8.2.2 Oilseeds & Pulses

8.2.3 Fruits & Vegetables

8.2.4 Others

8.3 Non-Agricultural

9 Market for Glyphosate, By Form (Page No. - 65)

9.1 Introduction

9.2 Liquid

9.3 Dry

10 Market for Glyphosate, By Region (Page No. - 69)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Spain

10.3.4 Poland

10.3.5 U.K.

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 Thailand

10.4.5 Rest of Asia-Pacific

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South America

10.6 Rest of the World (RoW)

10.6.1 Africa

10.6.2 Middle East

11 Competitive Landscape (Page No. - 104)

11.1 Overview

11.2 Key Player Rankings

11.2.1 Major Market Players

11.2.2 Other Market Players

11.3 Competitive Situations & Trends

11.3.1 Collaborations & Acquisitions

11.3.2 Expansions

11.3.3 New Product Launches

11.3.4 Agreements

12 Company Profiles (Page No. - 111)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Monsanto Company

12.2 Syngenta AG

12.3 The DOW Chemical Company

12.4 E.I. Du Pont De Nemours and Company

12.5 Bayer AG

12.6 Nufarm Limited

12.7 Nantong Jiangshan Agrochemical & Chemical, Inc

12.8 Zhejiang Xinan Chemical Industrial Group Co.,Ltd

12.9 ADAMA Agricultural Solutions Ltd.

12.10 United Phosphorus Limited (UPL)

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 133)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (73 Tables)

Table 1 Key Patents in Glyphosate Market

Table 2 Market Size for Glyphosate, By Crop Type, 20142022 (USD Million)

Table 3 Market Size, By Crop Type, 20142022 (KT)

Table 4 Genetically Modified Crops Market Size, By Region, 20142022 (USD Million)

Table 5 Genetically Modified Crops Market Size, By Region, 20142022 (KT)

Table 6 Conventional Crops Market Size, By Region, 20142022 (USD Million)

Table 7 Conventional Crops Market Size, By Region, 20142022 (KT)

Table 8 Market Size for Glyphosate, By Application, 2014-2022 (USD Million)

Table 9 Market Size, By Application, 2014-2022 (KT)

Table 10 Agricultural Glyphosate Market Size, By Region, 2014-2022 (USD Million)

Table 11 Market Size for Glyphosate for Grains & Cereals, By Region, 2014-2022 (USD Million)

Table 12 Market Size for Oilseeds & Pulses, By Region, 2014-2022 (USD Million)

Table 13 Market Size for Glyphosate for Fruits & Vegetables, By Region, 2014-2022 (USD Million)

Table 14 Market Size for Other Crops, By Region, 2014-2022 (USD Million)

Table 15 Market Size for Glyphosate for Non-Agricultural Applications, By Region, 2014-2022 (USD Million)

Table 16 Market Size for Glyphosate, By Form, 20142022 (USD Million)

Table 17 Liquid Glyphosate Market Size, By Region, 20142022 (USD Million)

Table 18 Dry Glyphosate Market Size, By Region, 2014-2022 (USD Million)

Table 19 Market Size for Glyphosate, By Region, 20142022 (USD Million)

Table 20 Market Size, By Region, 20142022 (KT)

Table 21 North America: Market Size for Glyphosate, By Country, 20142022 (USD Million)

Table 22 North America: Market Size, By Country, 20142022 (KT)

Table 23 North America Glyphosate Market Size, By Crop Type, 20142022 (USD Million)

Table 24 North America: Market Size, By Crop Type, 20142022 (KT)

Table 25 North America: Market Size for Glyphosate, By Form, 20142022 (USD Million)

Table 26 North America Market Size, By Application, 20142022 (USD Million)

Table 27 U.S.: Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 28 Canada: Market Size, By Application, 20142022 (USD Million)

Table 29 Mexico: Market Size, By Application, 20142022 (USD Million)

Table 30 Europe:Market Size for Glyphosate, By Country, 20142022 (USD Million)

Table 31 Europe: Market Size, By Country, 20142022 (KT)

Table 32 Europe: Market Size for Glyphosate, By Crop Type, 20142022 (USD Million)

Table 33 Europe: Market Size, By Crop Type, 20142022 (KT)

Table 34 Europe: Market Size for Glyphosate, By Form, 20142022 (USD Million)

Table 35 Europe: Market Size, By Application 20142022 (USD Million)

Table 36 Germany: Glyphosate Market Size, By Application, 20142022 (USD Million)

Table 37 France: Market Size, By Application, 20142022 (USD Million)

Table 38 Spain: Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 39 Poland: Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 40 U.K.: Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 41 Rest of Europe:Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 42 Asia-Pacific: Market Size for Glyphosate, By Country, 20142022 (USD Million)

Table 43 Asia-Pacific: Market Size for Glyphosate, By Country, 20142022 (KT)

Table 44 Asia-Pacific: Market Size, By Crop Type, 2014-2022 (USD Million)

Table 45 Asia-Pacific: Glyphosate Market Size, By Crop Type, 2014-2022 (KT)

Table 46 Asia-Pacific: Market Size, By Form, 2014-2022 (USD Million)

Table 47 Asia-Pacific: Market Size for Glyphosate, By Application, 2014-2022 (USD Million)

Table 48 China: Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 49 India: Market Size, By Application, 20142022 (USD Million)

Table 50 Japan: Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 51 Thailand: Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 52 Rest of Asia-Pacific: Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 53 South America: Market Size for Glyphosate, By Country, 20142022 (USD Million)

Table 54 South America: Market Size, By Country, 20142022 (KT)

Table 55 South America Glyphosate Market, By Crop Type, 20142022 (USD Million)

Table 56 South America: Market, By Crop Type, 20142022 (KT)

Table 57 South America: Glyphosate Market, By Form, 2014-2022 (USD Million)

Table 58 South America: Market, By Application, 20142022 (USD Million)

Table 59 Brazil: Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 60 Argentina: Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 61 Rest of South America: Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 62 RoW: Glyphosate Market Size, By Region, 20142022 (USD Million)

Table 63 RoW: Market Size for Glyphosate, By Region, 20142022 (KT)

Table 64 RoW: Market, By Crop Type, 20142022 (USD Million)

Table 65 RoW: Glyphosate Market, By Crop Type, 20142022 (KT)

Table 66 RoW: Glyphosate Market, By Form, 20142022 (USD Million)

Table 67 RoW: Market, By Application, 20142022 (USD Million)

Table 68 Africa: Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 69 Middle East: Market Size for Glyphosate, By Application, 20142022 (USD Million)

Table 70 Collaboration & Acquisitions

Table 71 Expansions

Table 72 New Product Launches

Table 73 Agreements

List of Figures (55 Figures)

Figure 1 Market Segmentation

Figure 2 Glyphosate Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Global Per Capita Arable Land, 20052013

Figure 5 Potential Total Corn & Soybean Losses in Field (By Value) Due to Weeds in the U.S.

Figure 6 Market Size Estimation: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Market Breakdown & Data Triangulation

Figure 9 Genetically Modified Crops Segment to Dominate the Market, By Crop Type, in Terms of Value By 2022

Figure 10 Dry Form of Glyphosate to Register the Highest CAGR in Terms of Value Between 2016 & 2022

Figure 11 Agricultural Application Segment to Dominate the Global Market During the Forecast Period

Figure 12 Asian Countries to Be the Fastest-Growing in the Global Market, in Terms of Value (2016-2022)

Figure 13 Attractive Growth Opportunities in the Market for Manufacturers

Figure 14 Glyphosate Market: Asia-Pacific is Projected to Grow at the Highest Rate Between 2016 and 2022

Figure 15 Brazil Held the Largest Share in the South American Glyphosate Market in 2015

Figure 16 Dry Glyphosate Segment to Grow at A Higher CAGR From 2016 to 2022, in Terms of Value

Figure 17 Agricultural Application Dominated the Market Across All Regions in 2015

Figure 18 Asia-Pacific Glyphosate Market to Grow at the Highest CAGR From 2016 to 2022

Figure 19 Milestones in the History of Glyphosate Discovery, Commercialization, and Regulation

Figure 20 Milestones in Glyphosate Use and Impacts

Figure 21 Market for Glyphosate, By Crop Type

Figure 22 Market for Glyphosate, By Form

Figure 23 Market for Glyphosate, By Application

Figure 24 Market, By Region

Figure 25 Glyphosate Market: Drivers, Restraints, Opportunities, and Challenges

Figure 26 Global Glyphosate Market: Supply Chain Analysis

Figure 27 Global Glyphosate Market: Porters Five Forces Analysis

Figure 28 Global Herbicide Export Data

Figure 29 Global Herbicide Import Data

Figure 30 Genetically Modified Crops Segment is Projected to Dominate the Market Through 2022

Figure 31 Global Glyphosate Market, By Application

Figure 32 Agricultural Application of Glyphosate to Lead the Market During the Forecast Period

Figure 33 Liquid Glyphosate Segment Dominated the Market in 2015 (USD Million)

Figure 34 South America is Expected to Dominate the Global Market By 2022

Figure 35 Regional Snapshot: Asia-Pacific to Be the Most Attractive Market for Glyphosate, 20162022

Figure 36 Asia-Pacific Glyphosate Market: A Snapshot

Figure 37 South American Glyphosate Market: A Snapshot

Figure 38 Collaborations & Aquisitions and Expansions : Leading Approaches of Key Companies, 20112016

Figure 39 Expanding Revenue Base Through Collaborations & Aqusitions, 20142016

Figure 40 Collaborations & Acquisitions : the Key Strategy, 20112016

Figure 41 Monsanto Compnay: Company Snapshot

Figure 42 Monsanto Company: SWOT Analysis

Figure 43 Syngenta AG: Business Overview

Figure 44 Syngenta AG: SWOT Analysis

Figure 45 The DOW Chemical Company: Business Overview

Figure 46 The DOW Chemical Company: SWOT Analysis

Figure 47 E.I. Du Pont De Nemours and Company: Business Overview

Figure 48 E.I. Du Pont De Nemours and Company: SWOT Analysis

Figure 49 Bayer AG: Company Snapshot

Figure 50 Bayer AG : SWOT Analysis

Figure 51 Nufarm Limited: Business Overview

Figure 52 Nantong Jiangshan Agrochemical & Chemical, Inc: Company Snapshot

Figure 53 Zhejiang Xinan Chemical Industrial Group Co., Ltd: Company Snapshot

Figure 54 ADAMA Agricultural Solutions Ltd.: Company Snapshot

Figure 55 UPL : Company Snapshot

Growth opportunities and latent adjacency in Glyphosate Market