Gluten Feed Market by Source (Wheat, Corn, Barley, Rye, Others), by Livestock (Swine, Poultry, Cattle, Aquaculture, Others), & Geography - Trends & Forecasts to 2019

Globally, there has been an increase in the demand for protein for animal feed. An increase in the average level of income, population rise, and urbanization are some of the drivers triggering the demand in the global gluten feed market.

This research report provides in-depth market insight into the global gluten feed industry. Gluten feed is especially popular with producers who are close enough to processing plants to make transportation cost-effective. It is also very palatable and complements low as well as high-quality feeds. This report takes into account the wide range of factors and their influence on the gluten feed market dynamics. The market drivers and restraints are explained in detail in the report, along with growth opportunities.

The global gluten feed market is expected to reach a value of $1,055.5 Million by 2019, at a CAGR of 5.4% from 2014 to 2019. The overall market size is estimated by segmenting the market into micro-markets, based on the share of each source, livestock, and geographical region. The market data is available from 2013 to 2019, with a forecasted CAGR from 2014 to 2019.

Various secondary sources such as encyclopedias, directories, and databases were used to identify and collect information for this extensive commercial study of the global market. The primary sources experts from related industries and suppliers were interviewed to obtain and verify critical information as well as to assess the future prospects of the gluten feed market.

The key players covered in this report include Ingredion Incorporated (U.S.), The Roquette Group (France), Archer Daniels Midland Company (ADM) (U.S.), Cargill Incorporated (U.S.), Tate & Lyle Plc. (U.K.), Bunge Ltd. (U.S.), Grain Processing Corporation (U.S.), Agrana Group (Austria), Commodity Specialists Company (U.S.), and Tereos Syral (France).

Gluten Feed Market Share (Value), by Type (2013)

Source: MarketsandMarkets Analysis

Scope of the Report

This research report categorizes the global gluten feed market on the basis of source, livestock, and geography; projecting revenue, and analyzing trends in each of the sub-markets:

By Source

- Wheat

- Corn

- Barley

- Rye

- Others

By Livestock

- Swine

- Poultry

- Cattle

- Aquaculture

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- RoW

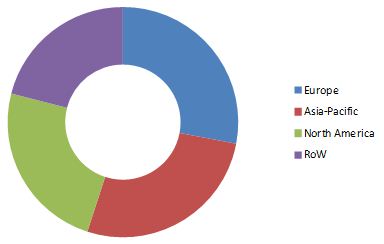

The European segment topped the revenue chart of the global gluten feed market, accounting for around 28% of the total market. The market for gluten feed is expected to grow at a CAGR of 5.4% by 2019, with the highest growth projected to be observed in the Asia-Pacific region.

Gluten Feed market Share (Value), by Geography, 2013

Source: MarketsandMarkets Analysis

The global market, in terms of value, was dominated by Europe in 2013. Aneconomic rise after the Euro crisis is the key driver that pushed the market forward in this region. The Asia-Pacific region is the second-largest market. North America ranks third, as it is the major exporter of corn gluten feed to other countries and regions.

Ingredion Incorporated (U.S), The RoquetteGroup(France), Archer Daniels Midland Company (ADM) (U.S), Cargill Incorporated (U.S.), Tate & Lyle Plc (U.K.), Bunge Ltd. (U.S.), Grain Processing Corporation (U.S.), Agrana Group (Austria), Commodity Specialists Company (U.S.), and TereosSyral (France) are some of the key players in the gluten feed market and their recent development strategies have been studied in detail in this report.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives

1.2 Report Description

1.3 Markets Covered

1.4 Research Methodology

1.4.1 Market Size Estimation

1.4.1.1 Market Breakdown & Data Triangulation

1.4.1.2 Assumptions Made for the Report

1.4.1.2.1 Periodization Considered for Gluten Feed Market

1.4.1.3 Key Data Taken From Secondary Sources

1.4.1.4 Key Data Taken From Primary Sources

2 Executive Summary (Page No. - 27)

3 Premium Insights (Page No. - 30)

3.1 Gluten Feed Market

3.2 Drivers & Restraints

3.3 Market By Geography

3.4 Market By Segment

3.5 Market By Geography

3.6 Market By Livestock

3.7 Market By Geography

3.8 Market By Source

4 Market Analysis (Page No. - 37)

4.1 Introduction

4.2 Market Dynamics

4.2.1 Market Drivers

4.2.1.1 Strong Demand for Gluten Feed in Developing Countries

4.2.1.2 Corn Gluten Feed - A Cost-Effective Substitute for Expensive Grain-Based Feed

4.2.2 Market Restraints

4.2.2.1 Sensitivity to Gluten

4.2.2.2 Availability of Local Feed Alternatives

4.2.3 Market Opportunities

4.2.3.1 Gluten Feed - A Potential Substitute for Fish Meal in Aquaculture Feed

4.2.4 Burning Issues

4.2.4.1 Change in Feed Safety Regulations in European Union Regarding Genetically-Modified Organisms in Gluten Feed Imports

4.2.4.2 Sulfur Toxicity - A Rising Concern for Feed Manufacturers

4.3 Porter’s Five forces

4.3.1 Bargaining Power of Suppliers

4.3.2 Bargaining Power of Buyers

4.3.3 Threat of New Entrants

4.3.4 Threat of Substitutes

4.3.5 Degree of Competition

5 Market Overview (Page No. - 47)

5.1 Introduction

5.2 History & Evolution

5.3 Market Statistics

5.3.1 Market Share Analysis

5.3.2 Sub-Markets

5.4 Complementary Market

5.4.1 Dried Distillers Grains With Solubles (DDGS)

5.5 Related Markets

5.5.1 Feed Binders

5.5.2 Feed Additives

6 Industry Analysis (Page No. - 56)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Raw Material

6.2.2 Storage &Cleaning

6.2.3 Steeping

6.2.4 Grinding &Germ Separation

6.2.5 Fiber Separation &Recovery

6.2.6 Gluten &Starch Separation

6.3 Supply Chain Analysis

6.3.1 Raw Material Suppliers

6.3.2 Manufacturers

6.3.3 Distributors

6.3.4 End-Users

7 Gluten Feed Market, By Source (Page No. - 62)

7.1 Introduction

7.2 Corn

7.3 Wheat

7.4 Barley

7.5 Rye

7.6 Others

8 Market By Livestock (Page No. - 75)

8.1 Introduction

8.2 Cattle

8.3 Swine

8.4 Poultry

8.5 Aquaculture

8.6 Others

9 Market By Geography (Page No. - 87)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Rest of North America

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 Italy

9.3.4 U.K.

9.3.5 Spain

9.3.6 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Thailand

9.4.5 Vietnam

9.4.6 Indonesia

9.4.7 Rest of Asia-Pacific

9.5 ROW

9.5.1 Brazil

9.5.2 Argentina

9.5.3 South Africa

9.5.4 Egypt

9.5.5 Others

10 Competitive Landscape (Page No. - 141)

10.1 Introduction

10.2 Expansion: the Most Preferred Strategic Approach

10.3 Cargill Inc. & Tereos Syral: Most Active Companies

11 Company Profiles (Page No. - 147)

(Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 Ingredion Incorporated

11.2 the Roquette Group

11.3 Archer Daniels Midland Company

11.4 Cargill Incorporated

11.5 Tate & Lyle Plc

11.6 Bunge Ltd.

11.7 Grain Processing Corporation

11.8 Agrana Group

11.9 Commodity Specialists Company

11.1 Tereos Syral

*Details on Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

List of Tables (88 Tables)

Table 1 Gluten Market Size Estimation

Table 2 Market Size, By Source, 2012–2019($Million)

Table 3 Impact Analysis of Drivers

Table 4 Impact Analysis of Restraints

Table 5 Feedstocks, their Co-Products and Major Areas of Utilization

Table 6 Market Size By Source, 2012-2019, ($Million)

Table 7 Nutrient Composition of Corn Gluten Feed

Table 8 Top 5 Global Producers of Corn (Metric Tons), 2012

Table 9 Corn: Gluten Feed Market Size By Geography, 2012-2019, ($Million)

Table 10 Top 5 Global Producers of Wheat (Metric Tons), 2012

Table 11 Wheat: Market Size By Geography, 2012-2019, ($Million)

Table 12 Top 5 Global Producers of Barley (Metric Tons), 2012

Table 13 Barley: Market Size By Geography, 2012-2019, ($Million)

Table 14 Top 5 Global Producers of Rye (Metric Tons), 2012

Table 15 Rye: Market Size, By Geography, 2012-2019, ($Million)

Table 16 Others: Gluten Feed Market Size, By Geography, 2012-2019, ($Million)

Table 17 Global Livestock Feed Consumed (Million Metric Tons)

Table 18 Average Tonnage of Feed Consumed Per Region

Table 19 Feed Industry Market Size, By Country, 2014 (Mt)

Table 20 Gluten Feed Market Size, By Livestock, 2012-2019, ($Million)

Table 21 Global Livestock Feed Consumption, 2013

Table 22 Cattle: Gluten Feed Market Size, By Geography, 2012-2019, ($Million)

Table 23 Swine: Market Size, By Geography, 2012-2019, ($Million)

Table 24 Poultry: Market Size, By Geography, 2012-2019, ($Million)

Table 25 Aquaculture: Market Size, By Geography, 2012-2019, ($Million)

Table 26 Others: Market Size, By Geography, 2012-2019, ($Million)

Table 27 Market Size, By Geography, 2012-2019, ($Million)

Table 28 Average Feed Tonnage Production, By Geography, 2013

Table 29 North America: Market Size, By Country, 2012-2019, ($Million)

Table 30 U.S.: Market Size, By Source, 2012-2019, ($Million)

Table 31 U.S.: Market Size, By Livestock, 2012-2019, ($Million)

Table 32 Canada: Market Size, By Source, 2012-2019, ($Million)

Table 33 Canada: Market Size, By Livestock, 2012-2019, ($Million)

Table 34 Rest of North America: Market Size, By Source, 2012-2019, ($Million)

Table 35 Rest of North America: Market Size, By Livestock, 2012-2019, ($Million)

Table 36 Europe: Market Size, By Country, 2012-2019, ($Million)

Table 37 Germany: Market Size, By Source, 2012-2019, ($Million)

Table 38 Germany: Market Size, By Livestock, 2012-2019, ($Million)

Table 39 France: Market Size, By Source, 2012-2019, ($Million)

Table 40 France: Market Size, By Livestock, 2012-2019, ($Million)

Table 41 Italy: Market Size, By Source, 2012-2019, ($Million)

Table 42 Italy: Market Size, By Livestock, 2012-2019, ($Million)

Table 43 U.K.: Market Size, By Source, 2012-2019, ($Million)

Table 44 U.K.: Gluten Feed Market Size, By Livestock, 2012-2019, ($Million)

Table 45 Spain: Market Size, By Source, 2012-2019, ($Million)

Table 46 Spain: Market Size, By Livestock, 2012-2019, ($Million)

Table 47 Rest of Europe: Market Size, By Source, 2012-2019, ($Million)

Table 48 Rest of Europe: Market Size, By Livestock, 2012-2019, ($Million)

Table 49 Asia-Pacific: Market Size, By Country, 2012-2019, ($Million)

Table 50 Asia-Pacific: Top 5 Cereal Producers, By Country, 2011-2012 (Mt)

Table 51 China: Market Size, By Source, 2012-2019, ($Million)

Table 52 China: Market Size, By Livestock, 2012-2019, ($Million)

Table 53 Japan: Market Size, By Source, 2012-2019, ($Million)

Table 54 Japan: Market Size, By Livestock, 2012-2019, ($Million)

Table 55 India: Market Size, By Source, 2012-2019, ($Million)

Table 56 India: Market Size, By Livestock, 2012-2019, ($Million)

Table 57 Thailand: Market Size, By Source, 2012-2019, ($Million)

Table 58 Thailand: Market Size, By Livestock, 2012-2019, ($Million)

Table 59 Vietnam: Market Size, By Source, 2012-2019, ($Million)

Table 60 Vietnam: Market Size, By Livestock, 2012-2019, ($Million)

Table 61 Indonesia: Market Size, By Source, 2012-2019, ($Million)

Table 62 Indonesia: Market Size, By Livestock, 2012-2019, ($Million)

Table 63 Rest of Asia-Pacific: Market Size, By Source, 2012-2019, ($Million)

Table 64 Rest of Asia-Pacific: Gluten Feed Market Size, By Livestock, 2012-2019, ($Million)

Table 65 ROW: Market Size, By Country, 2012-2019, ($Million)

Table 66 Brazil: Market Size, By Source, 2012-2019, ($Million)

Table 67 Brazil: Market Size, By Livestock, 2012-2019, ($Million)

Table 68 Argentina: Market Size, By Source, 2012-2019, ($Million)

Table 69 Argentina: Market Size, By Livestock, 2012-2019, ($Million)

Table 70 South Africa: Market Size, By Source, 2012-2019, ($Million)

Table 71 South Africa: Market Size, By Livestock, 2012-2019, ($Million)

Table 72 Egypt: Market Size, By Source, 2012-2019, ($Million)

Table 73 Egypt: Market Size, By Livestock, 2012-2019, ($Million)

Table 74 Others in ROW: Gluten Feed Market Size, By Source, 2012-2019, ($Million)

Table 75 Others in ROW: Market Size, By Livestock, 2012-2019, ($Million)

Table 76 Mergers & Acquisitions, 2011-2014

Table 77 New Product Launch, 2011-2014

Table 78 Expansions, 2010-2013

Table 79 Joint Venture, 2011-2014

Table 80 Ingredion Incorporated: Products & their Description

Table 81 Roquette: Products & their Description

Table 82 Archer Daniel Midland: Products & Their Description

Table 83 Cargill Inc.: Products & Their Description

Table 84 Tate & Lyle Plc: Products & Their Description

Table 85 Grain Processing Corporation: Products & Their Description

Table 86 Agrana: Products & Their Description

Table 87 Commodity Specialists Company: Products & Their Description

Table 88 Tereos Syral: Products & Their Description

List of Figures (18 Figures)

Figure 1 Market Segmentation

Figure 2 Market Size Estimation Methodology

Figure 3 Market: Drivers Vs. Restraints

Figure 4 Market, By Country 2013 ($Million)

Figure 5 Market Size, By Segment 2013 ($Million)

Figure 6 Cattle: Market Size, By Geography 2013-2019 ($Million)

Figure 7 U.S.: Market Size, By Livestock 2014-2019 ($Million)

Figure 8 Europe: Corn Feed Market Size, By Country 2014 ($Million)

Figure 9 China: Market Size, By Source, 2014-2019 ($Million)

Figure 10 Porter’s Five forces Analysis

Figure 11 Evolution of Gluten Feed

Figure 12 Market Share, By Company, 2013

Figure 13 Market Share (Value), By Geography, 2013

Figure 14 Market Share (Value), By Source, 2013

Figure 15 Value Chain Analysis of Market

Figure 16 Feed Industry Market Size, By Country (Top 5), 2013, (Metric Tons)

Figure 17 Gluten Feed Market Development Share, By Growth Strategy, 2009-2014

Figure 18 Market Development Share, By Company, 2011-2014

Growth opportunities and latent adjacency in Gluten Feed Market